Академический Документы

Профессиональный Документы

Культура Документы

Cash Flow Hedge Title

Загружено:

MichBadilloCalanogИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cash Flow Hedge Title

Загружено:

MichBadilloCalanogАвторское право:

Доступные форматы

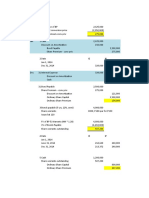

Cash Flow Hedge

(1) Cash flow hedge of a forecasted purchase transaction

Dec 15, 2014 Dec 31, 2014 Jan 15, 2015

Spot rate 40 50 60

Forward rate 45 55 60

Hedged item Hedging instrument

Dec 15, 2014 No entry No entry

Dec 31, 2014 No entry Forward contract (asset) 10K

Accum OCI-Gain 10K

Jan 15, 2015 Inventory 60K Forward contract (asset) 5K

Cash 60K Accum OCI-Gain 5K

(change in FV)

Cash 15K

Forward contract (asset) 15K

(net settlement)

Notes *Inventory & cash payment are based *If forward rate increased, increase in

on the spot rate on the actual Accum OCI

transaction date *If forward rate decreased, decrease

*The gain in OCI will remain in OCI in Accum OCI

until it is sold. Once it is sold, there *On the actual transaction date, net

will be a reclassification of OCI to P/L cash settlement should be equal to the

as a reduction to CGS. (If there is a forward rate on Dec 15, 2014.

loss in OCI, then addition to CGS).

(2) Cash flow hedge of a forecasted sale transaction – present value

Hedged item Hedging instrument

Notes *AR is based on the spot rate on the *PV = 1 on settlement date

actual transaction date *If forward rate increased, decrease in

* Sales is based on the spot rate on Accum OCI

the actual transaction date, but it *If forwad rate decreased, increase in

should be adjusted to reflect the gain Accum OCI

or loss in reclassifying OCI to P/L

If OCI-gain, addition to Sales

If OCI-loss, reduction to Sales

Net effect on sales: Sales will be

based on the spot rate on the

date it entered into a forward

contract

Вам также может понравиться

- Fair Value Hedge of An Unrecognized Firm Commitment: NotesДокумент3 страницыFair Value Hedge of An Unrecognized Firm Commitment: NotesAyessa Missy UvasОценок пока нет

- ACCT 4250 - Assignment 3Документ14 страницACCT 4250 - Assignment 3Thao TranОценок пока нет

- MAT Smart Notes - Yash KhandelwalДокумент7 страницMAT Smart Notes - Yash Khandelwalfamnas RahmanОценок пока нет

- Intercompany FAT - FMT ProcessДокумент17 страницIntercompany FAT - FMT ProcessDebjit RoyОценок пока нет

- AFAR Last Minute by HerculesДокумент8 страницAFAR Last Minute by Herculesjanjan3256Оценок пока нет

- Intermediate Accounting 1 - Chapter 15, Financial Assets at Fair ValueДокумент8 страницIntermediate Accounting 1 - Chapter 15, Financial Assets at Fair ValueAndrei FajardoОценок пока нет

- Initial Measurement: by Default: FVPLДокумент7 страницInitial Measurement: by Default: FVPLRemОценок пока нет

- Ias 21Документ1 страницаIas 21Dawar Hussain (WT)Оценок пока нет

- CA Intermediate Solutions for Accounting Nov 2022 ExamДокумент31 страницаCA Intermediate Solutions for Accounting Nov 2022 ExamSUMANTO BARMANОценок пока нет

- Financial Instruments Testing WP Pro FormaДокумент7 страницFinancial Instruments Testing WP Pro FormaMaria Fatima AlambraОценок пока нет

- 62e49cfs (Module3)Документ12 страниц62e49cfs (Module3)kumaranil_1983Оценок пока нет

- IFRS 3 Business CombinationДокумент5 страницIFRS 3 Business CombinationImraz IqbalОценок пока нет

- Statement of Cash FlowsДокумент7 страницStatement of Cash FlowsZance JordaanОценок пока нет

- Financial Accounting & AnalysisДокумент2 страницыFinancial Accounting & AnalysisTangerine Ila TomarОценок пока нет

- Financial ManagementДокумент8 страницFinancial ManagementBebark AkramОценок пока нет

- 5500 Sample PDFДокумент3 страницы5500 Sample PDFMwangi JosphatОценок пока нет

- Basic 6 Treasury AccountingДокумент25 страницBasic 6 Treasury AccountingShailjaОценок пока нет

- DEPARTMENTAL ACCOUNTSДокумент17 страницDEPARTMENTAL ACCOUNTSAyush AcharyaОценок пока нет

- Uninvoiced Receipt Accruals Report for Halifax International AirportДокумент1 страницаUninvoiced Receipt Accruals Report for Halifax International AirportranvijayОценок пока нет

- Investment in Debt SecuritiesДокумент29 страницInvestment in Debt SecuritiesDjunah ArellanoОценок пока нет

- Notes for L3Документ11 страницNotes for L3yuyin.gohyyОценок пока нет

- Financial Accounting Formulas and NotesДокумент10 страницFinancial Accounting Formulas and NotesAntonio LinОценок пока нет

- X Company Financial ReportsДокумент21 страницаX Company Financial ReportsChristian Gerard Eleria ØSCОценок пока нет

- IAS 21 - Foreign Currency TransactionsДокумент1 страницаIAS 21 - Foreign Currency TransactionsDawar Hussain (WT)Оценок пока нет

- Advanced Accounting Quiz 9 - Installment Sales (Part 2 of 2)Документ6 страницAdvanced Accounting Quiz 9 - Installment Sales (Part 2 of 2)guardian saintsОценок пока нет

- Topic - Explaining The Concept of Cash Flow Statement (Operating, Investing and Financing Activities)Документ15 страницTopic - Explaining The Concept of Cash Flow Statement (Operating, Investing and Financing Activities)Sakshi koulОценок пока нет

- Entity Data and Reporting InformationДокумент105 страницEntity Data and Reporting InformationAmin AriantoОценок пока нет

- Cheating Sheet - AccountsДокумент4 страницыCheating Sheet - AccountsTrishul enterprisesОценок пока нет

- Taxation TablesДокумент17 страницTaxation TablesVeneela ReddyОценок пока нет

- Uninvoiced Receipt Accruals ReportДокумент5 страницUninvoiced Receipt Accruals ReportranvijayОценок пока нет

- Bill/I NV O/D IN: Cred It Note Req Credit NoteДокумент2 страницыBill/I NV O/D IN: Cred It Note Req Credit Notekanth arОценок пока нет

- Non Financial Liabilities Provision and Contingencies.v2Документ44 страницыNon Financial Liabilities Provision and Contingencies.v2Angelica Mingaracal RosarioОценок пока нет

- Summary Accounting For Investment in EquityДокумент36 страницSummary Accounting For Investment in EquityJoana TrinidadОценок пока нет

- FAR SampleДокумент3 страницыFAR SampleAt Least Know This CPAОценок пока нет

- Financial Reporting: © The Institute of Chartered Accountants of IndiaДокумент7 страницFinancial Reporting: © The Institute of Chartered Accountants of IndiaRITZ BROWNОценок пока нет

- COMM1140 Ratio ListДокумент2 страницыCOMM1140 Ratio Listyifeiwang2006Оценок пока нет

- Discounted Cashflow Valuation: Basis For ApproachДокумент39 страницDiscounted Cashflow Valuation: Basis For ApproachShivОценок пока нет

- Trial BalanceДокумент6 страницTrial BalanceLefulesele MasiaОценок пока нет

- Cash Flow Statement Cashflows From Operations Cash Receipts From CustomersДокумент16 страницCash Flow Statement Cashflows From Operations Cash Receipts From CustomersAfruza Akter MunniОценок пока нет

- ACCT 4200 Project Solution - Final Posting 2022Документ14 страницACCT 4200 Project Solution - Final Posting 2022Jaspal SinghОценок пока нет

- PRINCIPLES OF ACCOUNTING FORMATДокумент4 страницыPRINCIPLES OF ACCOUNTING FORMATSumithaОценок пока нет

- Cashflow ExampleДокумент6 страницCashflow ExamplecoolyouhiОценок пока нет

- H.10 Regular Way Purchase or Sale of Financial AssetsДокумент8 страницH.10 Regular Way Purchase or Sale of Financial Assetschen.abellar.swuОценок пока нет

- FDNACCT Unit 4 - Part 3 - Merchandising Transactions - Class Ex - Examples - Answer KeyДокумент2 страницыFDNACCT Unit 4 - Part 3 - Merchandising Transactions - Class Ex - Examples - Answer Keyrabinoadrian24Оценок пока нет

- 01Receipt and Cost AccountingДокумент47 страниц01Receipt and Cost Accountingsujit nayakОценок пока нет

- Advanced Financial Accounting QuizДокумент53 страницыAdvanced Financial Accounting Quizanon nimusОценок пока нет

- T4 - Cash Flow StatementДокумент26 страницT4 - Cash Flow StatementJhonatan Perez VillanuevaОценок пока нет

- Bank ValuationДокумент34 страницыBank ValuationwathanaОценок пока нет

- Computation of NAVДокумент33 страницыComputation of NAVMannu SolankiОценок пока нет

- CAPITAL GAINS REVISION (Part 2)Документ31 страницаCAPITAL GAINS REVISION (Part 2)Mana SharmaОценок пока нет

- Usermanual LC FinДокумент17 страницUsermanual LC FinShahnawaz BaigОценок пока нет

- Particulars Dr. Cr. Amount (RS.) Amount (RS.) : © The Institute of Chartered Accountants of IndiaДокумент9 страницParticulars Dr. Cr. Amount (RS.) Amount (RS.) : © The Institute of Chartered Accountants of Indiaomkar sawantОценок пока нет

- Ratio Analysis For CAДокумент7 страницRatio Analysis For CAShahid MahmudОценок пока нет

- Fs - Evilla, E. (Vertam Farms Opc) 2020Документ44 страницыFs - Evilla, E. (Vertam Farms Opc) 2020Ma Teresa B. Cerezo100% (2)

- Session 6 - Trial BalanceДокумент26 страницSession 6 - Trial BalanceanandakumarОценок пока нет

- ACCT 4200 Project Solution - Final Posting 2022Документ15 страницACCT 4200 Project Solution - Final Posting 2022Jaspal SinghОценок пока нет

- Capsule Corporation Excel-2Документ449 страницCapsule Corporation Excel-2Nicola ZucchettiОценок пока нет

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)От EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Рейтинг: 3.5 из 5 звезд3.5/5 (17)

- Variance ReviewerДокумент3 страницыVariance ReviewerMichBadilloCalanogОценок пока нет

- AgencyДокумент2 страницыAgencyMichBadilloCalanogОценок пока нет

- Question # 1 Answer ONLY 1-14, 1-15 & 1-16 (3 Items Only)Документ6 страницQuestion # 1 Answer ONLY 1-14, 1-15 & 1-16 (3 Items Only)MichBadilloCalanogОценок пока нет

- Variance ReviewerДокумент3 страницыVariance ReviewerMichBadilloCalanogОценок пока нет

- Pledge, Mortgage, and AntichresisДокумент5 страницPledge, Mortgage, and AntichresisMichBadilloCalanog100% (1)

- Analysis of bond issue and amortization scheduleДокумент9 страницAnalysis of bond issue and amortization scheduleMichBadilloCalanogОценок пока нет

- ContractsДокумент8 страницContractsCharrie Grace PabloОценок пока нет

- Retail InventoryДокумент2 страницыRetail InventoryMichBadilloCalanogОценок пока нет

- IFRS For Revenue Recognition F10Документ52 страницыIFRS For Revenue Recognition F10MichBadilloCalanogОценок пока нет

- Specific Express Powers of A Corporation Under The Corporation CodeДокумент5 страницSpecific Express Powers of A Corporation Under The Corporation CodeMichBadilloCalanogОценок пока нет

- Audit of IntagiblesДокумент2 страницыAudit of IntagiblesMichBadilloCalanogОценок пока нет

- Reversing Entries How To Reverse Entries When To ReverseДокумент1 страницаReversing Entries How To Reverse Entries When To ReverseMichBadilloCalanogОценок пока нет

- Audit of ReceivablesДокумент4 страницыAudit of ReceivablesMichBadilloCalanogОценок пока нет

- Audit of IntagiblesДокумент2 страницыAudit of IntagiblesMichBadilloCalanogОценок пока нет

- FormulaДокумент13 страницFormulaMichBadilloCalanogОценок пока нет

- Specific Express Powers of A Corporation Under The Corporation CodeДокумент5 страницSpecific Express Powers of A Corporation Under The Corporation CodeMichBadilloCalanogОценок пока нет

- Audit of LiabilitiesДокумент7 страницAudit of LiabilitiesMichBadilloCalanogОценок пока нет

- Reversing EntriesДокумент1 страницаReversing EntriesMichBadilloCalanogОценок пока нет

- Reversing EntriesДокумент1 страницаReversing EntriesMichBadilloCalanogОценок пока нет

- Additional ProbsДокумент1 страницаAdditional ProbsMichBadilloCalanogОценок пока нет

- ObligationsДокумент5 страницObligationsMichBadilloCalanogОценок пока нет

- Reversing EntriesДокумент1 страницаReversing EntriesMichBadilloCalanogОценок пока нет

- TudyДокумент3 страницыTudyMichBadilloCalanogОценок пока нет

- PlaylistДокумент1 страницаPlaylistMichBadilloCalanogОценок пока нет

- ch01Документ22 страницыch01MichBadilloCalanogОценок пока нет

- ACTBAS2 ReviewerДокумент4 страницыACTBAS2 ReviewerLauren Gabrielle AranetaОценок пока нет

- RA 1425 (SB 438 and HB 5561)Документ2 страницыRA 1425 (SB 438 and HB 5561)Xymon BassigОценок пока нет

- The Basics Of The Long Ratio BackspreadДокумент3 страницыThe Basics Of The Long Ratio BackspreadSpringbok747Оценок пока нет

- Niftybees Covered CallДокумент15 страницNiftybees Covered CallSweety DasОценок пока нет

- Compare Funded Trading Accounts Programs PDFДокумент2 страницыCompare Funded Trading Accounts Programs PDFAmine HousniОценок пока нет

- Blades Inc. Case (Options) PDFДокумент2 страницыBlades Inc. Case (Options) PDFmazazОценок пока нет

- All AFM Technical Articles 2021Документ139 страницAll AFM Technical Articles 2021Ashfaq Ul Haq OniОценок пока нет

- Optimal Hedging ComДокумент37 страницOptimal Hedging ComfljlpfwОценок пока нет

- ITM ITM ITM ITM ITM: #Value! #Value! #Value! #Value! #Value! #Value! #Value! #Value! #Value! #Value!Документ4 страницыITM ITM ITM ITM ITM: #Value! #Value! #Value! #Value! #Value! #Value! #Value! #Value! #Value! #Value!Mayank GuptaОценок пока нет

- KAS Vertical SpreadsДокумент34 страницыKAS Vertical SpreadsPriyanashi Jain100% (3)

- Finance 101 Insead Lec 2Документ18 страницFinance 101 Insead Lec 2Dwijesh RajwadeОценок пока нет

- CME Wash Trades CFTC Comment ListДокумент9 страницCME Wash Trades CFTC Comment ListSteve QuinlivanОценок пока нет

- STAT0013 Introductory SlidesДокумент126 страницSTAT0013 Introductory SlidesMusa AsadОценок пока нет

- NISM Currency Derivatives Certification Sample QuestionsДокумент13 страницNISM Currency Derivatives Certification Sample QuestionsMahesh Rampalli100% (1)

- DerivaGem Options Calculator SoftwareДокумент10 страницDerivaGem Options Calculator SoftwareNatalia TorresОценок пока нет

- Chapter 5 9eДокумент80 страницChapter 5 9eRahil VermaОценок пока нет

- Module 1 - Derivatives Concepts & ETD - Student VersionДокумент2 страницыModule 1 - Derivatives Concepts & ETD - Student VersionNothingToKnowОценок пока нет

- Risk Management Applications of Option StrategiesДокумент15 страницRisk Management Applications of Option StrategiesJaco GreeffОценок пока нет

- Ultimate Options Trading GuideДокумент49 страницUltimate Options Trading GuideMatthew England58% (12)

- A Beginner's Guide To Credit Default Swaps (Part 4) - Rich NewmanДокумент6 страницA Beginner's Guide To Credit Default Swaps (Part 4) - Rich NewmanOUSSAMA NASRОценок пока нет

- Test Bank Financial InstrumentДокумент13 страницTest Bank Financial InstrumentMasi100% (1)

- Lecture - 5 - Hedging Risks. The Use of Financial Derivatives and InsuranceДокумент25 страницLecture - 5 - Hedging Risks. The Use of Financial Derivatives and InsuranceJaylan A ElwailyОценок пока нет

- P1.T3. Financial Markets & Products Robert Mcdonald, Derivatives Markets, 3Rd Edition Bionic Turtle FRM Study Notes Reading 20Документ18 страницP1.T3. Financial Markets & Products Robert Mcdonald, Derivatives Markets, 3Rd Edition Bionic Turtle FRM Study Notes Reading 20Garima GulatiОценок пока нет

- CHP 3 MCQДокумент4 страницыCHP 3 MCQfenaОценок пока нет

- Chapter 1: INTRODUCTION 1.1: Background of The Study:: Equity and DerivativesДокумент128 страницChapter 1: INTRODUCTION 1.1: Background of The Study:: Equity and DerivativesRavi ChokshiОценок пока нет

- Chapter 1 - Practice QuestionsДокумент3 страницыChapter 1 - Practice QuestionsSiddhant AggarwalОценок пока нет

- Practice CFA Institute 7Документ1 страницаPractice CFA Institute 7Dao My HanhОценок пока нет

- Replicating Options With Positions in Stock and CashДокумент10 страницReplicating Options With Positions in Stock and CashleptokurtosisОценок пока нет

- Report on Study of Commodity Derivatives MarketДокумент84 страницыReport on Study of Commodity Derivatives MarketTasmay EnterprisesОценок пока нет

- Broker HandbookДокумент84 страницыBroker Handbookdfisher1118100% (2)

- What Lies Beneath All TrendsДокумент20 страницWhat Lies Beneath All Trendsocean219100% (1)

- Chapter 20: Options Markets: Introduction: Problem SetsДокумент19 страницChapter 20: Options Markets: Introduction: Problem SetsAuliah SuhaeriОценок пока нет