Академический Документы

Профессиональный Документы

Культура Документы

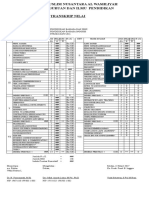

HL 3 November 2017 (Asli)

Загружено:

Puput0 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров2 страницыHL

Авторское право

© © All Rights Reserved

Доступные форматы

DOC, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документHL

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров2 страницыHL 3 November 2017 (Asli)

Загружено:

PuputHL

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

India is now world’s most expensive market based on price-to-earnings ratio

MUMBAI, Nov. 2 (Economic Times Bureau)

Indian stocks soared to record highs on Wednesday, aided by a fresh bout of foreign portfolio

inflows that drove the rupee up to a six-week high. The Nifty closed above 10,400 for the first

time, led by strong rallies in large lenders including SBI and ICICI Bank. The jump in India’s

position in the World Bank’s Ease of Doing Business (EODB) ranking by 30 places lifted

investor sentiment and drove the rupee higher. Investors believed that the jump in EODB

rankings would increase foreign direct investment into the country.

Oil prices rose to their highest since mid-2015 on expectations that major oil producers will

maintain their output cuts. The BSE Sensex rose 387.14 points, or 1.17%, to end at 33,600.27

while the Nifty gained 105.20 points, or 1.02%, to close at 10,440.50.

Bharti Airtel was the biggest gainer on the indices, advancing 8.2% after the company posted

strong second quarter results. With this, India has now become the world’s most expensive

market based on price-to-earnings ratio. The Sensex’s P/E ratio on a trailing basis is 24.53 times

compared with 19.67 for the Dow Jones, 23.32 for the UK and 17.04 times for the Shanghai

composite.

The rupee gained 15 paise, or about 0.23%, to close at 64.60 a dollar, its highest level since

September 20.Currency market dealers said the spike could have been higher but for the

intervention by the Reserve Bank of India.

Foreign portfolio investors net bought shares worth Rs 1,038 crore on Monday, while their

domestic counterparts sold shares worth Rs 668 crore. Since early August, foreigners have

predominantly sold Indian stocks, which have been absorbed by domestic mutual funds and

insurance companies. While it may be too early to conclude that their selling trend has reversed,

brokers said a sustained rebound in the rupee could lead to fresh inflows.

“It’s a market driven by liquidity,” said Nilesh Shah, managing director, Kotak Asset

Management. “Money is flowing into equities because other asset classes are not looking

attractive and there are hopes of economic and earnings growth.”

Fund managers said cautious traders, who had created bearish bets when the market hit all-

time highs earlier this week, were forced to square up on Wednesday, providing further fillip to

benchmark indices. The gains in the broader market were relatively measured with the mid-cap

index rising 0.35% and the small-cap index moving up 0.65%.

Asian shares hit a 10-year high on Wednesday, while US markets rose on Tuesday night on

expectations of tax rate cuts by the Donald Trump administration. Oil extended its winning run

on Wednesday with Brent crude futures rising to $61.49 per barrel, off the day’s high of $61.70,

the highest since July 2015. In October, oil prices posted their fourth straight month of gains.

Rising crude oil prices are usually positive for sentiment in emerging market equities. For

India, which is a net importer of crude, higher prices is not good news. “Higher oil prices are

tantamount to a negative terms-of-trade shock that weakens growth, pushes up inflation and

deteriorates the twin deficits,” said Nomura’s economist Sonal Varma in a note to clients.

German Unemployment Extends Decline as Economy Powers Ahead

BERLIN, Nov. 2 (Bloomberg)

German unemployment declined in October as companies added workers to meet surging

demand, underpinning already strong growth momentum in Europe’s largest economy. The

number of people out of work fell by a seasonally adjusted 11,000 to 2.495 million, the Federal

Labor Agency in Nuremberg said on Thursday. That beat the median estimate in a Bloomberg

survey for a drop of 10,000. The jobless rate held at record low of 5.6 percent.

Germany is heading for its best growth performance in six years, with consumption

benefiting from a strengthening labor market and companies more optimistic than ever that the

global recovery will fuel demand. The most recent Purchasing Managers’ Index showed job

creation in manufacturing was among the fastest in the survey’s history.

The Institute for Employment Research predicts unemployment will decrease by some

60,000 people in 2018, Scheele told reporters in Nuremberg. In October, joblessness fell by

about 7,000 in west Germany and by 4,000 in the eastern part of the country.

The number of people in low-wage jobs remains close to an all-time high, and trade unions

are focusing on the quality of work in addition to negotiating higher wages, Brzeski wrote in a

note to clients.

Sluggish wage growth -- not just in Germany but also in the 19-nation euro area -- is one

reason why the European Central Bank is advocating prudence in scaling back ultra-

expansionary monetary stimulus.

Policy makers decided last week to extend asset purchases through September at half the

current monthly pace to fuel inflation, which remains far below the institution’s goal even as the

economy is headed for its best annual performance in a decade.

The Bundesbank predicts that the German economy may have maintained its growth pace of

the first half of the year in the third quarter. First data will be published on Nov. 14. Economists

in a separate survey project an expansion of 0.5 percent.

Вам также может понравиться

- CurrencyWatch-Jan09 12Документ4 страницыCurrencyWatch-Jan09 12akubadiaОценок пока нет

- Sensex Up 60% in 2009 As FII Inflow Crosses Rs 25000 CroreДокумент6 страницSensex Up 60% in 2009 As FII Inflow Crosses Rs 25000 CroreRajesh ModiОценок пока нет

- India's Recovery From RecessionДокумент2 страницыIndia's Recovery From RecessionkrishnammdОценок пока нет

- Ficc Times HTML HTML: The Key Events of Last WeekДокумент6 страницFicc Times HTML HTML: The Key Events of Last WeekMelissa MillerОценок пока нет

- Bombay News - Oct 13, 2008 - Markets Recover 40 Percent of Last Week's LossesДокумент2 страницыBombay News - Oct 13, 2008 - Markets Recover 40 Percent of Last Week's LossesJagannadhamОценок пока нет

- Interest Rate: Wholesale Inflation Drops On Back of Softer Oil PricesДокумент9 страницInterest Rate: Wholesale Inflation Drops On Back of Softer Oil PricesRoshni BhatiaОценок пока нет

- Economic Report - 03 October 2012Документ6 страницEconomic Report - 03 October 2012Angel BrokingОценок пока нет

- AndhraVilas - Oct 13, 2008 - Markets Recover 40 Percent of Last Week's LossesДокумент3 страницыAndhraVilas - Oct 13, 2008 - Markets Recover 40 Percent of Last Week's LossesJagannadhamОценок пока нет

- Weekly financial guide covering markets, economy and stocksДокумент5 страницWeekly financial guide covering markets, economy and stocksManish Kumar GuptaОценок пока нет

- HDFC Q3 net up 12% on loan growthДокумент2 страницыHDFC Q3 net up 12% on loan growthVikash Chander KhatkarОценок пока нет

- Monthly Report October 2012 Highlights Key DevelopmentsДокумент48 страницMonthly Report October 2012 Highlights Key DevelopmentsGauriGanОценок пока нет

- Boloji - Oct 13, 2008 - Markets Recover 40 Percent of Last Week's LossesДокумент2 страницыBoloji - Oct 13, 2008 - Markets Recover 40 Percent of Last Week's LossesJagannadhamОценок пока нет

- China manufacturing activity continues rebound in SeptemberДокумент2 страницыChina manufacturing activity continues rebound in SeptemberPuputОценок пока нет

- Egypt CrisisДокумент1 страницаEgypt CrisisMitali AgrawalОценок пока нет

- Viewpoint:: Short Covering - Sellers Remorse Expected To Drive Stocks HigherДокумент4 страницыViewpoint:: Short Covering - Sellers Remorse Expected To Drive Stocks HigherGauriGanОценок пока нет

- Commodities-Mostly Up On European Optimism, US DataДокумент5 страницCommodities-Mostly Up On European Optimism, US DataUmesh ShanmugamОценок пока нет

- Euro Holdings at Three-Year Low level-IMF: Currencies-The US Dollar Index Slides On Last Trading Day of 2011Документ3 страницыEuro Holdings at Three-Year Low level-IMF: Currencies-The US Dollar Index Slides On Last Trading Day of 2011akubadiaОценок пока нет

- Sample 1 SNAPSHOT-Vietnam Dong, Gold and Interbank Rates-Oct 1-0243 GMTДокумент5 страницSample 1 SNAPSHOT-Vietnam Dong, Gold and Interbank Rates-Oct 1-0243 GMTkedarkОценок пока нет

- Ficc Times HTML HTML: The Week Gone by and The Week AheadДокумент7 страницFicc Times HTML HTML: The Week Gone by and The Week AheadBindiya CardozОценок пока нет

- FICC Times 12 July 2013Документ6 страницFICC Times 12 July 2013Melissa MillerОценок пока нет

- Overheating: Niranjan Rajadhyaksha's Previous ColumnsДокумент5 страницOverheating: Niranjan Rajadhyaksha's Previous ColumnsVaibhav KarthikОценок пока нет

- Blues Here Again: SlowdownДокумент1 страницаBlues Here Again: SlowdownAditya EthapeОценок пока нет

- 11.12morning NewsДокумент2 страницы11.12morning NewsrajavenkateshsundaraneediОценок пока нет

- Falling Factory Activity Adds To Rupee's WoesДокумент1 страницаFalling Factory Activity Adds To Rupee's Woesthanhtam3819Оценок пока нет

- India To Offer 68 Blocks in 10th Round of Nelp: BusinessДокумент1 страницаIndia To Offer 68 Blocks in 10th Round of Nelp: BusinessvinayvpalekarОценок пока нет

- Pocket News For The Week 50Документ2 страницыPocket News For The Week 50Vikash Chander KhatkarОценок пока нет

- News 25janДокумент5 страницNews 25janPuneet Kumar UpadhyayОценок пока нет

- China's August Inflation Eases As Economy RecoversДокумент2 страницыChina's August Inflation Eases As Economy RecoversDzz Zeet OonnОценок пока нет

- HSBC India Manufacturing PMI™: HSBC Purchasing Managers' Index™ Press ReleaseДокумент3 страницыHSBC India Manufacturing PMI™: HSBC Purchasing Managers' Index™ Press ReleaseRonitsinghthakur SinghОценок пока нет

- J Street Volume 290Документ10 страницJ Street Volume 290JhaveritradeОценок пока нет

- J Street Volume 289Документ10 страницJ Street Volume 289JhaveritradeОценок пока нет

- Commodity World 23-3-2012Документ2 страницыCommodity World 23-3-2012balinishantОценок пока нет

- Bank of England MustДокумент4 страницыBank of England MustAli ShadanОценок пока нет

- India Opens Stock Market To Foreign InvestorsДокумент4 страницыIndia Opens Stock Market To Foreign InvestorsSharad SrivastavaОценок пока нет

- Research Paper On Equity MarketДокумент7 страницResearch Paper On Equity Marketkkxtkqund100% (1)

- Market During The Week: Eekly EwsletterДокумент5 страницMarket During The Week: Eekly EwsletteranushresearchОценок пока нет

- Euro Strengthens PDFДокумент3 страницыEuro Strengthens PDFhjkl22Оценок пока нет

- IMF says India to grow faster than China in 2016Документ2 страницыIMF says India to grow faster than China in 2016Vikash Chander KhatkarОценок пока нет

- Agen Judi Poker Online, Agen Judi Domino Online Indonesia TerpercayaДокумент2 страницыAgen Judi Poker Online, Agen Judi Domino Online Indonesia TerpercayaIndriHerisRaya100% (1)

- Make More - Oct 2011Документ8 страницMake More - Oct 2011vidithrt143Оценок пока нет

- Financial Articles: MembersДокумент6 страницFinancial Articles: MembersSwapnil ChavanОценок пока нет

- The World Economy... - 06/04/2010Документ2 страницыThe World Economy... - 06/04/2010Rhb InvestОценок пока нет

- Chinese Market Crash 2015: Behind the Dramatic Rise and FallДокумент3 страницыChinese Market Crash 2015: Behind the Dramatic Rise and FallRonak KamdarОценок пока нет

- Indian Equity Market Outperforms Despite Challenges in FY19Документ22 страницыIndian Equity Market Outperforms Despite Challenges in FY19AkashОценок пока нет

- Indian Stock Market Overview: Types, Participants and Recent TrendsДокумент7 страницIndian Stock Market Overview: Types, Participants and Recent TrendsdebashreepalОценок пока нет

- BTTest PDFДокумент33 страницыBTTest PDFZuraimie IsmailОценок пока нет

- Tracking The World Economy.... - 01/10/2010Документ3 страницыTracking The World Economy.... - 01/10/2010Rhb InvestОценок пока нет

- JSTREET Volume 322Документ10 страницJSTREET Volume 322JhaveritradeОценок пока нет

- EIC Project Report On Pharmaceutical IndustryДокумент52 страницыEIC Project Report On Pharmaceutical IndustrykalpeshsОценок пока нет

- Ficc Times HTML HTML: The Week Gone by and The Week AheadДокумент6 страницFicc Times HTML HTML: The Week Gone by and The Week Aheadr_squareОценок пока нет

- Stocks Rally With Crude Before Payrolls As China Nerves SubsideДокумент2 страницыStocks Rally With Crude Before Payrolls As China Nerves SubsidePuputОценок пока нет

- Level of Prices: Price Inflation Occurs and Is Revealed in A Rise in GeneralДокумент6 страницLevel of Prices: Price Inflation Occurs and Is Revealed in A Rise in GeneralfruitfulluftОценок пока нет

- DatacfДокумент2 страницыDatacfhemanggorОценок пока нет

- Two Circles - Oct 24, 2008 - Indian Equities Markets Suffer Worst Ever LossesДокумент4 страницыTwo Circles - Oct 24, 2008 - Indian Equities Markets Suffer Worst Ever LossesJagannadhamОценок пока нет

- Market Research Oct 28 - Nov 1Документ2 страницыMarket Research Oct 28 - Nov 1FEPFinanceClubОценок пока нет

- DN 10page (18-18)Документ1 страницаDN 10page (18-18)Robert OkandaОценок пока нет

- Daily 29.10.2013Документ1 страницаDaily 29.10.2013FEPFinanceClubОценок пока нет

- Rama Krishna Vadlamudi, HYDERABAD July 11, 2011: What Investors IgnoredДокумент4 страницыRama Krishna Vadlamudi, HYDERABAD July 11, 2011: What Investors IgnoredRamaKrishna Vadlamudi, CFAОценок пока нет

- Kunci Gitar Chord Lirik Ed Sheeran - PerfectДокумент2 страницыKunci Gitar Chord Lirik Ed Sheeran - PerfectPuputОценок пока нет

- Grammar and Punctuation RulesДокумент2 страницыGrammar and Punctuation RulesPuputОценок пока нет

- MODULE 1INTRODUCING LITERATURE Kak HalimahДокумент76 страницMODULE 1INTRODUCING LITERATURE Kak HalimahPuputОценок пока нет

- Translate of News PaperДокумент2 страницыTranslate of News PaperPuputОценок пока нет

- Over 100 Questions English 3 in 1 (Primary 1)Документ8 страницOver 100 Questions English 3 in 1 (Primary 1)PuputОценок пока нет

- Full CaseДокумент6 страницFull CasePuputОценок пока нет

- Little MixДокумент15 страницLittle MixPuputОценок пока нет

- Practice Oral & Listening Comprehention 2Документ10 страницPractice Oral & Listening Comprehention 2PuputОценок пока нет

- EPB Comprehension Revision 1Документ7 страницEPB Comprehension Revision 1PuputОценок пока нет

- Mexico To File WTO Complaint Over US Tariffs: MinistryДокумент1 страницаMexico To File WTO Complaint Over US Tariffs: MinistryPuputОценок пока нет

- B. InggrisДокумент3 страницыB. InggrisPuputОценок пока нет

- FisikДокумент1 страницаFisikPuputОценок пока нет

- BBC - Learning English - Vocabulary NotebookДокумент12 страницBBC - Learning English - Vocabulary NotebookLauraRosanoОценок пока нет

- Formal Informal EnglishДокумент8 страницFormal Informal EnglishTeofilo AlvarezОценок пока нет

- Bahan Berita 6 OktoberДокумент2 страницыBahan Berita 6 OktoberPuputОценок пока нет

- Lang MediaДокумент12 страницLang MediaLoredana ȚicleteОценок пока нет

- Bahan Berita 12 OktoberДокумент2 страницыBahan Berita 12 OktoberPuputОценок пока нет

- QuizzesДокумент8 страницQuizzesgojianОценок пока нет

- Euro Zone Sentiment Rises in October, Inflation Expectations DropДокумент2 страницыEuro Zone Sentiment Rises in October, Inflation Expectations DropPuputОценок пока нет

- Bahan Berita 15 OktoberДокумент2 страницыBahan Berita 15 OktoberPuputОценок пока нет

- Bahan Berita 5 OktoberДокумент2 страницыBahan Berita 5 OktoberPuputОценок пока нет

- Bahan Berita 12 OktoberДокумент2 страницыBahan Berita 12 OktoberPuputОценок пока нет

- Translate of News PaperДокумент2 страницыTranslate of News PaperPuputОценок пока нет

- ECB Stimulus Pressure Rises as Euro Area Inflation Turns NegativeДокумент2 страницыECB Stimulus Pressure Rises as Euro Area Inflation Turns NegativePuputОценок пока нет

- Fed awaited evidence global slowdown not derailing US economyДокумент2 страницыFed awaited evidence global slowdown not derailing US economyPuputОценок пока нет

- Improving Vocabulary Using Word Games TechniqueДокумент9 страницImproving Vocabulary Using Word Games TechniquePuputОценок пока нет

- Stocks Rally With Crude Before Payrolls As China Nerves SubsideДокумент2 страницыStocks Rally With Crude Before Payrolls As China Nerves SubsidePuputОценок пока нет

- Full CaseДокумент6 страницFull CasePuputОценок пока нет

- d-494 - Wed - 20 DEC 2017Документ8 страницd-494 - Wed - 20 DEC 2017PuputОценок пока нет

- Risk and Rates of Return: Multiple Choice: ConceptualДокумент79 страницRisk and Rates of Return: Multiple Choice: ConceptualKatherine Cabading InocandoОценок пока нет

- Essentials of a Contract - Formation, Validity, Performance & DischargeДокумент25 страницEssentials of a Contract - Formation, Validity, Performance & Dischargesjkushwaha21100% (1)

- FRM 2015 Part 1 Practice ExamДокумент47 страницFRM 2015 Part 1 Practice ExamVitor SalgadoОценок пока нет

- Module 10 PAS 33Документ4 страницыModule 10 PAS 33Jan JanОценок пока нет

- Example For Chapter 2 (FABM2)Документ10 страницExample For Chapter 2 (FABM2)Althea BañaciaОценок пока нет

- 1.25 Suku Bunga, Diskonto, Imbalan (Persen Per Tahun)Документ2 страницы1.25 Suku Bunga, Diskonto, Imbalan (Persen Per Tahun)Izzuddin AbdurrahmanОценок пока нет

- Region I - TIP DAR ProgramДокумент761 страницаRegion I - TIP DAR ProgramDavid ThomasОценок пока нет

- BASO Presentation PDFДокумент25 страницBASO Presentation PDFGEOEXPLOREMINPERU MINERÍA Y GEOLOGIAОценок пока нет

- QUIZДокумент15 страницQUIZCarlo ConsuegraОценок пока нет

- MAS Annual Report 2010 - 2011Документ119 страницMAS Annual Report 2010 - 2011Ayako S. WatanabeОценок пока нет

- Hersey K Delynn PayStubДокумент1 страницаHersey K Delynn PayStubSharon JonesОценок пока нет

- Banking - HL - CBA 0979 - GOROKAN (01 Jan 23 - 28 Feb 23)Документ5 страницBanking - HL - CBA 0979 - GOROKAN (01 Jan 23 - 28 Feb 23)Adrianne JulianОценок пока нет

- NMIMS MUMBAI NAVI MUMBAI Student Activity Sponsorship and Exp - POLICYДокумент5 страницNMIMS MUMBAI NAVI MUMBAI Student Activity Sponsorship and Exp - POLICYRushil ShahОценок пока нет

- Time Risk by Terry RossioДокумент60 страницTime Risk by Terry RossioMatt WallaceОценок пока нет

- Solution Manual For Designing and Managing The Supply Chain 3rd Edition by David Simchi LeviДокумент5 страницSolution Manual For Designing and Managing The Supply Chain 3rd Edition by David Simchi LeviRamswaroop Khichar100% (1)

- Application For Provident Benefits Claim (HQP-PFF-040, V02.1) PDFДокумент2 страницыApplication For Provident Benefits Claim (HQP-PFF-040, V02.1) PDFPhilip Floro0% (1)

- Referral PolicyДокумент2 страницыReferral PolicyDipikaОценок пока нет

- Taxmann - Budget Highlights 2022-2023Документ42 страницыTaxmann - Budget Highlights 2022-2023Jinang JainОценок пока нет

- Free Accounting Firm Business PlanДокумент1 страницаFree Accounting Firm Business PlansolomonОценок пока нет

- Annual ReportДокумент15 страницAnnual ReportDibakar DasОценок пока нет

- BCOMQPOCT18Документ383 страницыBCOMQPOCT18SHRIKANT C. DUDHALОценок пока нет

- CH 09Документ22 страницыCH 09Yooo100% (1)

- Research ProposalДокумент49 страницResearch ProposalAmanuel HawiОценок пока нет

- Federal ReserveДокумент21 страницаFederal ReserveMsKhan0078Оценок пока нет

- 6,1 Manajemen Modal Kerja PDFДокумент14 страниц6,1 Manajemen Modal Kerja PDFIronaYurieОценок пока нет

- Sinhgad Institute of Management - Research TopicsДокумент17 страницSinhgad Institute of Management - Research TopicsAnmol LimpaleОценок пока нет

- LIC Jeevan Anand Plan PPT Nitin 359Документ11 страницLIC Jeevan Anand Plan PPT Nitin 359Nitin ShindeОценок пока нет

- FBL Annual Report 2019Документ130 страницFBL Annual Report 2019Fuaad DodooОценок пока нет

- Monthly One Liners - April 2021Документ29 страницMonthly One Liners - April 2021ramОценок пока нет

- When Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfОт EverandWhen Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfРейтинг: 5 из 5 звезд5/5 (36)

- Workin' Our Way Home: The Incredible True Story of a Homeless Ex-Con and a Grieving Millionaire Thrown Together to Save Each OtherОт EverandWorkin' Our Way Home: The Incredible True Story of a Homeless Ex-Con and a Grieving Millionaire Thrown Together to Save Each OtherОценок пока нет

- Radiographic Testing: Theory, Formulas, Terminology, and Interviews Q&AОт EverandRadiographic Testing: Theory, Formulas, Terminology, and Interviews Q&AОценок пока нет

- Hillbilly Elegy: A Memoir of a Family and Culture in CrisisОт EverandHillbilly Elegy: A Memoir of a Family and Culture in CrisisРейтинг: 4 из 5 звезд4/5 (4276)

- Heartland: A Memoir of Working Hard and Being Broke in the Richest Country on EarthОт EverandHeartland: A Memoir of Working Hard and Being Broke in the Richest Country on EarthРейтинг: 4 из 5 звезд4/5 (269)

- Outliers by Malcolm Gladwell - Book Summary: The Story of SuccessОт EverandOutliers by Malcolm Gladwell - Book Summary: The Story of SuccessРейтинг: 4.5 из 5 звезд4.5/5 (17)

- High-Risers: Cabrini-Green and the Fate of American Public HousingОт EverandHigh-Risers: Cabrini-Green and the Fate of American Public HousingОценок пока нет

- Poor Economics: A Radical Rethinking of the Way to Fight Global PovertyОт EverandPoor Economics: A Radical Rethinking of the Way to Fight Global PovertyРейтинг: 4.5 из 5 звезд4.5/5 (263)

- The NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersОт EverandThe NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersОценок пока нет

- Fucked at Birth: Recalibrating the American Dream for the 2020sОт EverandFucked at Birth: Recalibrating the American Dream for the 2020sРейтинг: 4 из 5 звезд4/5 (172)

- Nickel and Dimed: On (Not) Getting By in AmericaОт EverandNickel and Dimed: On (Not) Getting By in AmericaРейтинг: 4 из 5 звезд4/5 (186)

- 2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)От Everand2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)Оценок пока нет

- EMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeОт EverandEMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeРейтинг: 3.5 из 5 звезд3.5/5 (3)

- The PMP Project Management Professional Certification Exam Study Guide PMBOK Seventh 7th Edition: The Complete Exam Prep With Practice Tests and Insider Tips & Tricks | Achieve a 98% Pass Rate on Your First AttemptОт EverandThe PMP Project Management Professional Certification Exam Study Guide PMBOK Seventh 7th Edition: The Complete Exam Prep With Practice Tests and Insider Tips & Tricks | Achieve a 98% Pass Rate on Your First AttemptОценок пока нет

- Not a Crime to Be Poor: The Criminalization of Poverty in AmericaОт EverandNot a Crime to Be Poor: The Criminalization of Poverty in AmericaРейтинг: 4.5 из 5 звезд4.5/5 (37)

- Improve Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersОт EverandImprove Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersРейтинг: 4 из 5 звезд4/5 (14)

- Charity Detox: What Charity Would Look Like If We Cared About ResultsОт EverandCharity Detox: What Charity Would Look Like If We Cared About ResultsРейтинг: 4 из 5 звезд4/5 (9)

- EMT (Emergency Medical Technician) Crash Course Book + OnlineОт EverandEMT (Emergency Medical Technician) Crash Course Book + OnlineРейтинг: 4.5 из 5 звезд4.5/5 (4)

- The Great Displacement: Climate Change and the Next American MigrationОт EverandThe Great Displacement: Climate Change and the Next American MigrationРейтинг: 4.5 из 5 звезд4.5/5 (32)

- Nursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASОт EverandNursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASОценок пока нет

- The Injustice of Place: Uncovering the Legacy of Poverty in AmericaОт EverandThe Injustice of Place: Uncovering the Legacy of Poverty in AmericaРейтинг: 4.5 из 5 звезд4.5/5 (2)