Академический Документы

Профессиональный Документы

Культура Документы

EIF Soultion

Загружено:

MahaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

EIF Soultion

Загружено:

MahaАвторское право:

Доступные форматы

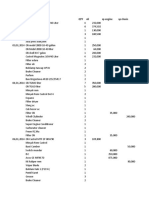

Essential of Islamic Finance Assignment -1

Maliha Ahmed (3123)

MBA (M)

Submitted to: Mr. Farhan Mehboob

Date: 25. 09. 10

Topic: “Recent history of interest based banking”

Ans (a): Quranic Verses

The verses from Quran I would like to mention and explain about the dishonesty on interest based banking

system are from Surah e Baqra; ayaat # 275, 276 and 278.

According to my understanding it is stated that the money you have, should be rolling state that is it

should be in motion like if we give our money to somebody for business and he is getting profit from his

business and the profit he is getting from his business he is sharing some with us. This is what our banks

do. They invest our money somewhere and then pay us interest monthly on the bases of profit and loss.

I have also understood form the ayaats that those who stop and save their money from being invested and

give them to somebody with certain conditions of time and date to return it to them and if they are unable

to do so they will then become the owner of the poor man’s property.

It is stated that those who do such deeds are the followers of satin. They are evil who make profit when

someone is in his bad days of life.

Ans (b): Authentic Hadith.

(Sahih al-Bukhari, Volume 5, Book 58, Number 159.)

From Abu Burdah ibn Abi Musa: I came to Madinah and met 'Abdallah ibn Salam who said, "You live in a

country where riba is rampant; hence if anyone owes you something and presents you with a load of hay,

do not accept it for it is riba.

Explanation: A lender should not accept any excess (even in the form of gift) as part of or with the

repayment of the principal. It does not say anything about the borrower not to pay anything extra. Yet, this

hadith disallows the lenders from accepting anything extra in case of loans.

Ans (c): Da’ef Hadith.

(Sahih al-Bukhari, Volume 3, Book 41, Number 579)

Narrated Jabir bin Abdullah:

I went to the Prophet while he was in the Mosque. After the Prophet told me to pray two Rakat, he repaid

me the debt he owed me and gave me an extra amount.

Explanation: Every loan that attracts a benefit/advantage is riba. Without getting into the issue of

authenticity of any such narration, advocates of Islamic finance and banking commonly use such hadith. If

that is so, then there is no room for differentiating between loans with “stipulated” excess or voluntarily

paid extra. Citing the hadith “All loans with a benefit to the lender is riba” to justify that any loans with an

extra is prohibited, but then limiting it only to the loans with “stipulated” excess prohibited, to reconcile

the hadith that allow voluntary extra payments.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Are Consumer Perceptions of Brand Affected by Materialism?: History of Textile Industry in IndiaДокумент4 страницыAre Consumer Perceptions of Brand Affected by Materialism?: History of Textile Industry in IndiaMahaОценок пока нет

- Change N StressДокумент29 страницChange N StressMahaОценок пока нет

- Organizational Behaviour, Case StudyДокумент2 страницыOrganizational Behaviour, Case StudyMaha82% (33)

- Full SSGC ReportДокумент29 страницFull SSGC ReportMaha0% (1)

- ConflictДокумент14 страницConflictMaha100% (1)

- Final Project ReportДокумент200 страницFinal Project ReportMaha100% (1)

- Safeguard PresentationДокумент27 страницSafeguard PresentationMaha100% (3)

- Answer 2Документ4 страницыAnswer 2MahaОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Guardplc Certified Function Blocks - Basic Suite: Catalog Number 1753-CfbbasicДокумент110 страницGuardplc Certified Function Blocks - Basic Suite: Catalog Number 1753-CfbbasicTarun BharadwajОценок пока нет

- Memento Mori: March/April 2020Документ109 страницMemento Mori: March/April 2020ICCFA StaffОценок пока нет

- 10 Appendix RS Means Assemblies Cost EstimationДокумент12 страниц10 Appendix RS Means Assemblies Cost Estimationshahbazi.amir15Оценок пока нет

- Method Statement of Static Equipment ErectionДокумент20 страницMethod Statement of Static Equipment Erectionsarsan nedumkuzhi mani100% (4)

- User-Centered Website Development: A Human-Computer Interaction ApproachДокумент24 страницыUser-Centered Website Development: A Human-Computer Interaction ApproachKulis KreuznachОценок пока нет

- Pyramix V9.1 User Manual PDFДокумент770 страницPyramix V9.1 User Manual PDFhhyjОценок пока нет

- Libros de ConcretoДокумент11 страницLibros de ConcretoOSCAR GABRIEL MOSCOL JIBAJAОценок пока нет

- Telangana Budget 2014-2015 Full TextДокумент28 страницTelangana Budget 2014-2015 Full TextRavi Krishna MettaОценок пока нет

- WM3000U - WM3000 I: Measuring Bridges For Voltage Transformers and Current TransformersДокумент4 страницыWM3000U - WM3000 I: Measuring Bridges For Voltage Transformers and Current TransformersEdgar JimenezОценок пока нет

- Factory Hygiene ProcedureДокумент5 страницFactory Hygiene ProcedureGsr MurthyОценок пока нет

- Gigahertz company background and store locationsДокумент1 страницаGigahertz company background and store locationsjay BearОценок пока нет

- Shri Siddheshwar Co-Operative BankДокумент11 страницShri Siddheshwar Co-Operative BankPrabhu Mandewali50% (2)

- Intermediate Accounting Testbank 2Документ419 страницIntermediate Accounting Testbank 2SOPHIA97% (30)

- CaseHistoriesOnTheApplication of Vacuum PreloadingДокумент25 страницCaseHistoriesOnTheApplication of Vacuum PreloadingvaishnaviОценок пока нет

- A Research About The Canteen SatisfactioДокумент50 страницA Research About The Canteen SatisfactioJakeny Pearl Sibugan VaronaОценок пока нет

- 1 N 2Документ327 страниц1 N 2Muhammad MunifОценок пока нет

- OPIM101 4 UpdatedДокумент61 страницаOPIM101 4 UpdatedJia YiОценок пока нет

- Camera MatchingДокумент10 страницCamera MatchingcleristonmarquesОценок пока нет

- Hollow lateral extrusion process for tubular billetsДокумент7 страницHollow lateral extrusion process for tubular billetsjoaopedrosousaОценок пока нет

- SQL-Problems Solutions PDFДокумент11 страницSQL-Problems Solutions PDFManpreet Singh100% (1)

- UNIT: 01 Housekeeping SupervisionДокумент91 страницаUNIT: 01 Housekeeping SupervisionRamkumar RamkumarОценок пока нет

- Management Reporter Integration Guide For Microsoft Dynamics® SLДокумент22 страницыManagement Reporter Integration Guide For Microsoft Dynamics® SLobad2011Оценок пока нет

- The Essence of Success - Earl NightingaleДокумент2 страницыThe Essence of Success - Earl NightingaleDegrace Ns40% (15)

- Tita-111 2Документ1 страницаTita-111 2Gheorghita DuracОценок пока нет

- Business PlanДокумент9 страницBusiness PlanRico DejesusОценок пока нет

- LeasingДокумент2 страницыLeasingfollow_da_great100% (2)

- Market Participants in Securities MarketДокумент11 страницMarket Participants in Securities MarketSandra PhilipОценок пока нет

- (Jf613e) CVT Renault-Nissan PDFДокумент4 страницы(Jf613e) CVT Renault-Nissan PDFJhoanny RodríguezОценок пока нет

- Axtraxng™: Networked Access Control Management Software V27.XДокумент2 страницыAxtraxng™: Networked Access Control Management Software V27.XChiluvuri VarmaОценок пока нет

- Managing operations service problemsДокумент2 страницыManaging operations service problemsJoel Christian Mascariña0% (1)