Академический Документы

Профессиональный Документы

Культура Документы

Personal Assignment Accounting for Manager

Загружено:

Atoy SomarИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Personal Assignment Accounting for Manager

Загружено:

Atoy SomarАвторское право:

Доступные форматы

PERSONAL ASSIGNMENT

ACCOUNTING FOR MANAGER

Disusun Oleh:

Marcelo Caetano Araujo

1600004181

BINUS UNIVERCITY JAKARTA

BINUS GRADUATE PROGRAM ONLINE

BINUS BUSINESS SCHOOL

2018

Prepared By : Marcelo Caetano Araujo/160004181

Personal Assignment 2018

Lecturer: Toto Rusmanto

Wolf Creek Golf Inc. was organized on July 1, 2014. Quarterly financial statements

are prepared. The trial balance and adjusted trial balance on September 30 are shown here.

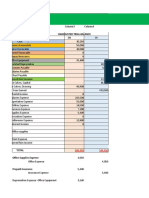

WOLF CREEK GOLF INC.

Trial Balance

September 30, 2014

Unadjusted Adjusted

Dr. Cr. Dr. Cr.

Cash $ 6,700 $ 6,700

Accounts Receivable 400 1,000

Supplies 1,200 180

Prepaid Rent 1,800 900

Equipment 15,000 15,000

Accumulated Depreciation—Equipment $ 350

Notes Payable $ 5,000 5,000

Accounts Payable 1,070 1,070

Salaries and Wages Payable 600

Interest Payable 50

Unearned Rent Revenue 1,000 800

Common Stock 14,000 14,000

Retained Earnings 0 0

Dividends 600 600

Service Revenue 14,100 14,700

Rent Revenue 700 900

Salaries and Wages Expense 8,800 9,400

Rent Expense 900 1,800

Depreciation Expense 350

Supplies Expense 1,020

Utilities Expense 470 470

Interest Expense 50

$35,870 $35,870 $37,470 $37,470

Instructions

a) Journalize the adjusting entries that were made.

b) Prepare an income statement and a retained earnings statement for the 3 months ending

c) September 30 and a classified balance sheet at

September 30. (c) Identify which accounts should be

closed on September 30.

d) If the note bears interest at 12%, how many months has it been outstanding?

Jawaban :

1. Journalize the adjusting entries that were made

Jurnal penyusuaian untuk 30 September 2014 untuk WOLF CREEK GOLF INC

a. Accounts Receivable $. 600.00

Service Revenue $. 600,00

b. Supplies $. 1,020.00

Suplies Expense $. 1,020.00

c. Prepaid Rent $. 900.00

Rent Expense $. 900.00

d. Depreciation Expense $. 350.00

Prepared By : Marcelo Caetano Araujo/160004181

Accumulated Depreciation—Equipment $. 350.00

e. Salaries and Wages Expense $. 600.00

Salaries and Wages Payable $. 600.00

f. Interest Expense $. 50.00

Interest Payable $. 50.00

g. Rent Revenue $. 200.00

Unearned Rent Revenue $. 200.00

h. Service Revenue $. 600.00

Service Expense $. 600.00

i. Rent Expense $. 1100.00

Rent Revenue $. 1100.00

j. Salaries and Wages Expense $. 600.00

Salaries and Wages Payable $. 600.00

k. Depreciation Expense $. 350.00

Depreciation Payable $. 350.00

l. Interest Expense $. 50.00

Interest Revenue $. 50.00

2. Prepare an income statement and a retained earnings statement for the 3 months ending

Income statement for 3 months ending is = $. 37,470.00 - $. 35,870.00 = $. 1,600 x 3 = $. 4,800.00

3. September 30 and a classified balance sheet at September 30. (c) Identify which accounts should be

closed on September 30.

Accounts yang akan tutup pada 30 September 2014 adalah sebagai berikut:

a. Accounts Receivable

b. Equipment

c. Common Stock

4. If the note bears interest at 12%, how many months has it been outstanding?

Jika nota tersebut dikenakan bunga sebesar 12%, maka dibutuhkan 8.33 bulan (12% x $.5,000.00=$.

600,00), jadi $. 5,000.00 / $. 600.00 = 8,33 Bulan

Prepared By : Marcelo Caetano Araujo/160004181

Вам также может понравиться

- Financial Accounting - Tugas 1Документ6 страницFinancial Accounting - Tugas 1Alfiyan100% (1)

- TUGAS AKUNTANSI DASAR PERTEMUAN 5 RICO ANANTA RANEX SAPUTRA NewДокумент8 страницTUGAS AKUNTANSI DASAR PERTEMUAN 5 RICO ANANTA RANEX SAPUTRA Newrico anantaОценок пока нет

- Chapter 4Документ35 страницChapter 4Mohammad Mostafa MostafaОценок пока нет

- Accounting AssignmentДокумент2 страницыAccounting Assignmentjannatulnisha78Оценок пока нет

- 4 Completing The Accounting Cycle PartДокумент1 страница4 Completing The Accounting Cycle PartTalionОценок пока нет

- Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRДокумент3 страницыTrial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRMaharani SinuratОценок пока нет

- AFR Session 4 ExercisesДокумент10 страницAFR Session 4 ExercisesSherif KhalifaОценок пока нет

- Accounting Homework AdjustmentsДокумент5 страницAccounting Homework AdjustmentsHasan NajiОценок пока нет

- BBB - Assignment FARДокумент23 страницыBBB - Assignment FARcha618717Оценок пока нет

- Watson Answering Service Balance SheetДокумент3 страницыWatson Answering Service Balance SheetDesy manurungОценок пока нет

- Take Home Quiz 3Документ3 страницыTake Home Quiz 3Sergio NicolasОценок пока нет

- Problem 3Документ6 страницProblem 3Idolprince DeveraОценок пока нет

- 10531lecture 6Документ14 страниц10531lecture 6Najia Salman100% (1)

- A. Hercules Poirot, P.I., Sa Worksheet For The Quarter Ended March 31, 2017 Account Titles Trial Balance Adjustmnets Adjusted Trial BalanceДокумент5 страницA. Hercules Poirot, P.I., Sa Worksheet For The Quarter Ended March 31, 2017 Account Titles Trial Balance Adjustmnets Adjusted Trial BalancevaldaОценок пока нет

- Sample WorksheetДокумент4 страницыSample WorksheetSam Rae LimОценок пока нет

- PA-HW Chap3 + 4Документ8 страницPA-HW Chap3 + 4Hà Anh ĐỗОценок пока нет

- Demonstration Problem - Chapter 4 - Internet Consulting ServicesДокумент9 страницDemonstration Problem - Chapter 4 - Internet Consulting ServicesTooba HashmiОценок пока нет

- Poa Week 7 Lecture - Problem No 4.4aДокумент13 страницPoa Week 7 Lecture - Problem No 4.4aSaad Khan67% (3)

- Fa1 Quiz4 ProblemДокумент1 страницаFa1 Quiz4 ProblemSix Paths ItachiОценок пока нет

- Watson Answering ServiceДокумент3 страницыWatson Answering Servicemohitgaba1967% (6)

- Assignment 9 FARДокумент23 страницыAssignment 9 FARcha618717Оценок пока нет

- Discussion Forum 4.4B SolutionsДокумент5 страницDiscussion Forum 4.4B SolutionsSidra UmairОценок пока нет

- Trial - Intro To Accounting Ch. 2 (12th Ed)Документ5 страницTrial - Intro To Accounting Ch. 2 (12th Ed)Bambang HasmaraningtyasОценок пока нет

- Trial - Intro To Accounting Ch. 2 (12th Ed)Документ5 страницTrial - Intro To Accounting Ch. 2 (12th Ed)Bambang HasmaraningtyasОценок пока нет

- Intro To Accounting Ch. 2Документ5 страницIntro To Accounting Ch. 2Bambang HasmaraningtyasОценок пока нет

- Hercules Poirpt PDFДокумент4 страницыHercules Poirpt PDFsy yusuf73% (11)

- Homework 4題目Документ2 страницыHomework 4題目劉百祥Оценок пока нет

- 7 SynthesisДокумент5 страниц7 SynthesisCristine Jane Granaderos OppusОценок пока нет

- Unearned Rent Income Adjustment Trial BalanceДокумент4 страницыUnearned Rent Income Adjustment Trial BalanceRaymon Villapando BardinasОценок пока нет

- WORKSHEET (Lembar Jawaban)Документ2 страницыWORKSHEET (Lembar Jawaban)I Gede Wahyu krisna DarmaОценок пока нет

- Group Assignment Account SEM1Документ7 страницGroup Assignment Account SEM1NUR LIEYANA BINTI MOHD SHUKOR MoeОценок пока нет

- Ex 2Документ13 страницEx 2Phuong Vu HongОценок пока нет

- 2009-11-02 095434 Julies Maid Cleaning ServiceДокумент17 страниц2009-11-02 095434 Julies Maid Cleaning ServiceabenazerОценок пока нет

- Maquoketa River Resort Adjusted Trial BalanceДокумент11 страницMaquoketa River Resort Adjusted Trial Balancemohitgaba19Оценок пока нет

- Pangan, WorksheetДокумент2 страницыPangan, WorksheetJane NoboraОценок пока нет

- Campus PizzeriaДокумент12 страницCampus PizzeriaSHIVAM SRIVASTAVAОценок пока нет

- Last Name, Given Name, Middle NameДокумент3 страницыLast Name, Given Name, Middle NameDe chavez, John carlo R.Оценок пока нет

- Activity 1 Finman 1Документ6 страницActivity 1 Finman 1lykaОценок пока нет

- Allan & WallyДокумент10 страницAllan & WallyLaura OliviaОценок пока нет

- E34Документ9 страницE34Nguyen Nguyen KhoiОценок пока нет

- Akuntansi 2Документ5 страницAkuntansi 22310102052.refatОценок пока нет

- Module - WorksheetДокумент2 страницыModule - WorksheetKae Abegail GarciaОценок пока нет

- 2204 - Financial StatementsДокумент4 страницы2204 - Financial StatementsKasey Mae AsoyОценок пока нет

- AccountingДокумент14 страницAccountingRizwana MehwishОценок пока нет

- Class ExerciseДокумент14 страницClass ExerciseAbdul Basit MalikОценок пока нет

- Adjusting Entries Problems 2022 DahonogДокумент2 страницыAdjusting Entries Problems 2022 DahonogBaltazar JustinianoОценок пока нет

- Balance Sheet and Income Statement for Maria's BusinessДокумент1 страницаBalance Sheet and Income Statement for Maria's BusinessStorm ShadowОценок пока нет

- 4.3.2.5 Elaborate - Determining AdjustmentsДокумент4 страницы4.3.2.5 Elaborate - Determining AdjustmentsMa Fe Tabasa0% (1)

- Class Exercise Session 5 and 6Документ8 страницClass Exercise Session 5 and 6Sumeet KumarОценок пока нет

- Latihan Soal AkuntansiДокумент5 страницLatihan Soal Akuntansiabe cedeОценок пока нет

- mgt101 Questions With AnswersДокумент11 страницmgt101 Questions With AnswersKinza LaiqatОценок пока нет

- ABM Fundamentals of AccountingДокумент3 страницыABM Fundamentals of AccountingtsukiОценок пока нет

- Prac PaДокумент20 страницPrac PaTrương Mỹ HạnhОценок пока нет

- Trial BalanceДокумент4 страницыTrial BalanceRonnie Lloyd JavierОценок пока нет

- Sample Problem For Last MeetingДокумент11 страницSample Problem For Last MeetingLylanie Alcoran AnibОценок пока нет

- At 4Документ4 страницыAt 4Thùy NguyễnОценок пока нет

- Jawaban Pengantar Akuntansi KiesooДокумент13 страницJawaban Pengantar Akuntansi KiesooRazer FanaОценок пока нет

- Answare P1Документ10 страницAnsware P1Atoy Somar0% (1)

- IT Strategies Planning in Pandemi COVID 19 in Hight School in Timor LesteДокумент14 страницIT Strategies Planning in Pandemi COVID 19 in Hight School in Timor LesteAtoy SomarОценок пока нет

- Solution Manual To Lectures On Corporate Finance Second EditionДокумент80 страницSolution Manual To Lectures On Corporate Finance Second Editionwaleedtanvir100% (2)

- SWOT PresentationДокумент7 страницSWOT PresentationAtoy SomarОценок пока нет

- Jawaban PA 4 NGДокумент7 страницJawaban PA 4 NGAtoy SomarОценок пока нет

- The Answare of PA 2, Session 3 By: Antonio Soares Martins/1801625204Документ5 страницThe Answare of PA 2, Session 3 By: Antonio Soares Martins/1801625204Atoy SomarОценок пока нет

- The Answare of PA 2, Session 3 By: Antonio Soares Martins/1801625204Документ5 страницThe Answare of PA 2, Session 3 By: Antonio Soares Martins/1801625204Atoy SomarОценок пока нет

- The Answare of PA 2, Session 3 By: Antonio Soares Martins/1801625204Документ5 страницThe Answare of PA 2, Session 3 By: Antonio Soares Martins/1801625204Atoy SomarОценок пока нет

- Trust Oil and Gas UC Network DesignДокумент5 страницTrust Oil and Gas UC Network DesignAtoy SomarОценок пока нет

- Trust Oil and Gas UC Network DesignДокумент5 страницTrust Oil and Gas UC Network DesignAtoy SomarОценок пока нет

- Trust Oil and Gas UC Network DesignДокумент5 страницTrust Oil and Gas UC Network DesignAtoy SomarОценок пока нет

- Homeroom Guidance - Activity For Module 1Документ3 страницыHomeroom Guidance - Activity For Module 1Iceberg Lettuce0% (1)

- Compatibility Testing: Week 5Документ33 страницыCompatibility Testing: Week 5Bridgette100% (1)

- GRADE 8 English Lesson on Indian LiteratureДокумент3 страницыGRADE 8 English Lesson on Indian LiteratureErold TarvinaОценок пока нет

- The Big Banana by Roberto QuesadaДокумент257 страницThe Big Banana by Roberto QuesadaArte Público Press100% (2)

- Ass. No.1 in P.E.Документ8 страницAss. No.1 in P.E.Jessa GОценок пока нет

- Restructuring ScenariosДокумент57 страницRestructuring ScenariosEmir KarabegovićОценок пока нет

- The Rescue FindingsДокумент8 страницThe Rescue FindingsBini Tugma Bini Tugma100% (1)

- Sawmill Safety 3-Trim SawsДокумент51 страницаSawmill Safety 3-Trim SawsramptgdОценок пока нет

- Mce Igcse Chemistry PPT c08Документ57 страницMce Igcse Chemistry PPT c08Shabanito GamingОценок пока нет

- ExpressionismДокумент16 страницExpressionismRubab ChaudharyОценок пока нет

- 2015 Masonry Codes and Specifications Compilation, MCAA StoreДокумент1 страница2015 Masonry Codes and Specifications Compilation, MCAA StoreMuhammad MurtazaОценок пока нет

- Modulo InglesДокумент8 страницModulo InglesJames Mosquera GarciaОценок пока нет

- Short EssayДокумент3 страницыShort EssayBlue PuppyОценок пока нет

- Theory of Karma ExplainedДокумент42 страницыTheory of Karma ExplainedAKASH100% (1)

- All Over AgainДокумент583 страницыAll Over AgainJamie Kris MendozaОценок пока нет

- MMS-TRG-OP-02F3 Narrative ReportДокумент14 страницMMS-TRG-OP-02F3 Narrative ReportCh Ma100% (1)

- Madagascar's Unique Wildlife in DangerДокумент2 страницыMadagascar's Unique Wildlife in DangerfranciscogarridoОценок пока нет

- Concepts of Cavity Prep PDFДокумент92 страницыConcepts of Cavity Prep PDFChaithra Shree0% (1)

- Periodic - Properties - Part 2 - by - AKansha - Karnwal - 1702453072953Документ68 страницPeriodic - Properties - Part 2 - by - AKansha - Karnwal - 1702453072953Saktipratik MishraОценок пока нет

- Drainage Pipe Unit Price AnalysisДокумент9 страницDrainage Pipe Unit Price Analysis朱叶凡Оценок пока нет

- Ko vs. Atty. Uy-LampasaДокумент1 страницаKo vs. Atty. Uy-LampasaMaria Janelle RosarioОценок пока нет

- Diss - DLL QTR.1 - Week 3Документ4 страницыDiss - DLL QTR.1 - Week 3michael r. cantorОценок пока нет

- Ramesh Dargond Shine Commerce Classes NotesДокумент11 страницRamesh Dargond Shine Commerce Classes NotesRajath KumarОценок пока нет

- OutletsДокумент226 страницOutletsPraveen Kumar Saini100% (1)

- 5.1 Physical Farming Constraints in Southern CaliforniaДокумент1 страница5.1 Physical Farming Constraints in Southern CaliforniaTom ChiuОценок пока нет

- History of Filipino Mural (Filipino Americans: A Glorious History, A Golden Legacy)Документ9 страницHistory of Filipino Mural (Filipino Americans: A Glorious History, A Golden Legacy)Eliseo Art Arambulo SilvaОценок пока нет

- E.Coli Coliforms Chromogenic Medium: CAT Nº: 1340Документ2 страницыE.Coli Coliforms Chromogenic Medium: CAT Nº: 1340Juan Manuel Ramos ReyesОценок пока нет

- January: DiplomaДокумент24 страницыJanuary: DiplomagwzglОценок пока нет

- Silent SpringДокумент28 страницSilent Springjmac1212Оценок пока нет

- Apexocardiograma Precizari PracticeДокумент12 страницApexocardiograma Precizari PracticeDaniel VelciuОценок пока нет