Академический Документы

Профессиональный Документы

Культура Документы

FEB 2018: Air Transport Monthly Monitor: RPK LF ASK FTK ASK

Загружено:

Reanaldy Ibrahim Masudi PutraОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

FEB 2018: Air Transport Monthly Monitor: RPK LF ASK FTK ASK

Загружено:

Reanaldy Ibrahim Masudi PutraАвторское право:

Доступные форматы

FEB 2018: Air Transport Monthly Monitor

World Results and Analyses for DEC 2017. Total scheduled services (domestic and international).

Air Transport Bureau

http://www.icao.int/sustainability/Pages/Air-Traffic-Monitor.aspx

LF 2014-2015

LF 2013-2014 E-mail: ecd@icao.int

GLOBAL KEY FIGURES DEC 2017

JUN OUTLOOK* - JAN 2018 JUL

( (versus DEC 2016) (versus JAN 2017)

RPK +6.2% ASK +5.8% FTK +5.7% LF: 80.7% +0.1 pt ASK +6.0% * Source OAG

PASSENGER TRAFFIC CAPACITY

Revenue Passenger-Kilometres - RPK Available Seat-Kilometres - ASK

World passenger traffic grew by +6.2% YoY in December 2017, -1.8 percentage points Capacity worldwide increased by +5.8% YoY in December 2017, -0.5

lower from the growth in the previous month. This was the third slowest rate after the percentage points lower than the growth in the previous month (+6.3%).

distorted growth in February comparing to the leap year 2016 and disrupted traffic in In response to the same level of passenger traffic demand, the expansion of

September due to hurricanes. All regions posted a deceleration in growth. The fastest capacity is expected to be at +6.0% in January 2018.

growing region continued to be Asia/Pacific while the slowest growing regions were

Africa and the Middle East. Domestic traffic demand in India and China remained

strong and both grew double-digitally.

800 12% 900 10%

RPK RPK YoY ASK ASK YoY

700 800

9.6% 10.7% 10% 8.0%

700 8%

600 8.0% 7.1%

ASK (billion)

YoY growth

RPK (billion)

600

YoY growth

8% 6.5%

500 6.1% 6.1% 6.1% 6.3% 6.2% 6.3%

7.7% 7.8% 500 5.8% 6.0%

400 6.8% 7.2% 7.2% 6% 6%

6.8% 400

5.7% 6.2%

300 4.8% 300 5.3%

4%

200 200 4%

2% 100

100

0 2.7% 2%

0 0%

Jan-17

Jul-17

Jan-18

Oct-17

Jun-17

Dec-17

May-17

Mar-17

Feb-17

Aug-17

Apr-17

Sep-17

Nov-17

Mar-17

Feb-17

May-17

Sep-17

Jan-17

Apr-17

Nov-17

Dec-17

Jul-17

Aug-17

Oct-17

Jun-17

(Source: ICAO, IATA, OAG) (Source: ICAO, IATA, OAG)

International Traffic vs. Tourist Arrivals Load Factor - LF

International passenger traffic grew by +6.0% YoY in December 2017, -2.1 The passenger Load Factor reached 80.7% in December 2017, +0.5

percentage points lower from the growth in the previous month. All regions percentage points higher than the LF recorded in the previous month.

decelerated in growth, except for Latin America/Caribbean which recorded the

The December LF was slightly higher than the rate in the same period in 2016.

second highest growth after Asia/Pacific.

The growth of international tourist arrivals* followed a similar monthly trend.

16% 14.9% international RPK 87% LF 2016-2017

international tourist arrivals* LF 2015-2016

14% 85% 84.7% 84.5%

12.5%

12%

YoY growth

10% 9.3% 8.6%

83% 82.0% 81.9% 81.6%

7.6% 7.4% 7.9% 8.1% 80.8% 80.2% 80.7%

8% 6.7% 7.3% 81% 80.4% 80.1%

80.2%

LF

6.4% 6.0% 79.5%

6% 7.1% 7.5% 80.6%

5.8% 6.2% 7.0% 6.5%

5.7% 6.2% 79%

4% 4.5% 5.2%

2% 3.5% 77%

2.2%

0% 75%

Jul-17

Jan-17

Jun-17

Apr-17

Oct-17

Dec-17

Feb-17

Mar-17

May-17

Nov-17

Aug-17

Sep-17

Feb

Mar

Jun

May

Jul

Sep

Oct

Nov

Apr

Aug

Jan

Dec

*UNWTO Definition (Source: IATA, UNWTO) (Source: IATA)

FREIGHT TRAFFIC

16%

FTK 14.0%

Freight Tonne-Kilometres - FTK 12.7% 12.1%

12%

World freight traffic grew by +5.7% YoY in December 2017, -3.1 percentage

YoY growth

11.0% 11.4% 8.8%

points lower from the growth in the previous month. This slowdown was partly 8% 9.2%

8.4% 8.5%

due to the comparison with the strong traffic rebound observed in December

6.9%

2016. The YTD growth of 2017 overall reached at +9.5%, a significant 5.9% 5.7%

4%

improvement from the +3.8% registered in 2016. Africa continued to record the

fastest growth, supported by the strengthening in trade between Africa and

0%

Asia/Pacific. Latin America/Caribbean and Europe experienced the slowest

May-17

Mar-17

Jan-17

Apr-17

Jun-17

Jul-17

Oct-17

Dec-17

Feb-17

Sep-17

Nov-17

Aug-17

growth among all regions.

Freight traffic growth outpaced the freight capacity expansion. As a result, the (Source: IATA)

freight load factor exceeded its YTD rate by over +1.3 percentage points.

ACRONYMS: ACI: Airports Council International; ASK: Available Seat-Kilometres; IATA: International Air Transport Association; FTK: Freight Tonne-Kilometres; LF: Passenger Load Factor;

OAG: Official Airline Guide; RPK: Revenue Passenger-Kilometres; UNWTO: World Tourism Organization; YoY: Year-on-year; YTD: Year-to-date.

FEB 2018: Air Transport Monthly Monitor

World Results and Analyses for DEC 2017. Total scheduled services (domestic and international).

Air Transport Bureau

E-mail: ecd@icao.int

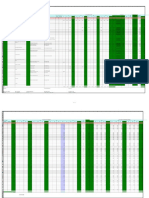

TOP 15 AIRPORTS (Ranked by aircraft departures, passengers and volume of freight)

DEC 2017: +3.8%, +4.3%, and +4.5% YoY in terms of aircraft departures, passengers and freight for the Top 15 DEC 17

Airports Departures YoY Airports Passengers* YoY Airports Freight** YoY

(ranking by number of departures) (ranking by number of passengers) (ranking by tonnes of freight)

Atlanta GA, US (ATL) 34,714 -4.3% Beijing, CN (PEK) 4,059,843 3.7% Hong Kong, CN (HKG) 462,000 6.2%

Chicago IL, US (ORD) 33,097 -0.1% Atlanta GA, US (ATL) 4,024,995 -4.4% Memphis TN, US (MEM) 375,692 0.6%

Los Angeles CA, US (LAX) 29,537 -1.2% Dubai, AE (DXB) 3,927,329 1.9% Shanghai, CN (PVG) 326,054 1.7%

Dallas/Fort Worth TX, US (DFW) 27,515 -0.2% Los Angeles CA, US (LAX) 3,548,967 3.3% Louisville KY, US (SDF) 274,776 5.5%

Beijing, CN (PEK) 25,826 0.8% Tokyo, JP (HND) 3,313,273 1.0% Incheon, KR (ICN) 249,849 6.3%

Denver CO, US (DEN) 23,516 -1.1% Hong Kong, CN (HKG) 3,202,500 4.2% Anchorage AK, US (ANC) 245,846 7.1%

Charlotte NC, US (CLT) 22,982 1.1% London, GB (LHR) 3,169,152 2.8% Dubai, AE (DXB) 229,019 -0.5%

Shanghai, CN (PVG) 21,131 3.9% Chicago IL, US (ORD) 3,041,561 3.9% Taipei, CN (TPE) 206,581 4.9%

New York NY, US (LGA) 20,938 39.9% New Delhi, IN (DEL) 2,973,595 15.3% Tokyo, JP (NRT) 202,867 5.2%

Newark NJ, US (EWR) 20,280 9.4% Singapore, SG (SIN) 2,931,000 3.3% Miami FL, US (MIA) 194,293 6.1%

Jakarta, ID (CGK) 20,175 8.8% Jakarta, ID (CGK) 2,915,265 4.9% Paris, FR (CDG) 191,000 6.7%

New Delhi, IN (DEL) 20,125 13.7% Shanghai, CN (PVG) 2,914,086 8.8% Singapore, SG (SIN) 188,700 6.4%

Guangzhou, CN (CAN) 20,080 5.3% Guangzhou, CN (CAN) 2,858,102 10.0% Beijing, CN (PEK) 187,369 0.3%

San Francisco CA, US (SFO) 19,841 8.2% Kuala Lumpur, MY (KUL) 2,814,585 5.2% Los Angeles CA, US (LAX) 179,720 5.2%

Houston TX, US (IAH) 19,476 -1.2% Bangkok, TH (BKK) 2,812,382 9.3% Chicago IL, US (ORD) 177,750 10.8%

............................................................................................................................. ................................................................................................................................ ................................................................................................................................ .................................................................................. .................

Note: Total scheduled and non-scheduled services (Source: ACI)

In terms of aircraft departures, the Top 15 airports In terms of passengers, the Top 15 airports reported a In terms of freight, the Top 15 airports reported a

reported an increase of +3.8% YoY. Decline was growth of +4.3% YoY. Atlanta was the only airport growth of +4.5% YoY. All the Top 15 airports recorded

observed in North America with six major airports experiencing a decrease in passenger traffic due to the an increase, except for Dubai with a decline of -0.5%.

posting decrease. Atlanta ranked 1st, however, power outage caused flight disruption. Beijing ranked Hong Kong remained at 1st with a solid increase of

posted a decline of -4.3% due to the power outage over Atlanta became 1st albeit with a moderate growth +6.2%. The strongest growth was recorded by

at the airport. New York LaGuardia recorded a of +3.7%. The strongest increase was recorded by New Chicago (+10.8%), continually supported by the

for the Top 15

**

Delhi (+15.3%), followed by Guangzhou (+10.0%). expansion of new cargo facility.

substantial increase+4.8%

by +39.9%.

TOP 15 AIRLINE GROUPS (Ranked by RPK) DEC 17

RPK (billion) % Share

DEC 2017: +5.4% YoY in terms of RPK for the Top 15 YoY of World

Cumulative

- 5 10 15 20 25 30 35 % Share

Total

In terms of RPK, the Top 15 airline groups accounted for 47.8% of world total RPK in December American1 29.9 2.4% 4.9% 4.9%

2017, and grew by +5.4% YoY. This growth was -0.8 percentage points lower than the world average United 29.1 2.7% 4.8% 9.7%

on scheduled services. All the Top 15 airline groups posted YoY increases, with the exception of Delta 26.9 -0.4% 4.4% 14.2%

Emirates 1 26.4 3.1% 4.4% 18.5%

Delta and Qatar Airways. AF-KLM 21.6 3.4% 3.6% 22.1%

China Southern 20.1 13.9% 3.3% 25.4%

American ranked 1st and rose by +2.4%. United retained the 2nd place with a growth of +2.7%. IAG2 19.4 6.1% 3.2% 28.6%

Delta reported a slight decrease of -0.4% in traffic mainly due to the dip in international traffic and Lufthansa Group 3 18.9 15.9% 3.1% 31.8%

flight disruption at Atlanta. Southwest ranked 1 position down to 10th and grew by +2.6%. Air China 17.4 10.6% 2.9% 34.6%

Southwest 17.2 2.6% 2.8% 37.5%

Emirates remained at 4th with a moderate YoY growth of +3.1%. Qatar Airways ranked 3 positions China Eastern 15.4 9.5% 2.5% 40.0%

Qatar Airways1 12.4

up to 12th due to its relatively higher traffic volume in December albeit with a -1.4% decline YoY. -1.4% 2.0% 42.0%

Singapore Airlines Group 11.9 5.1% 2.0% 44.0%

AF-KLM and IAG remained at 5th and 7th with a growth of +3.4% and +6.1%, respectively. Ryanair 1 11.4 3.3% 1.9% 45.9%

Turkish Airlines 11.2 16.3% 1.9% 47.8%

Lufthansa ranked 8th and recorded the second highest growth within the Top 15 by +15.9%, owing

to the surge in traffic of the group's Point-to-Point airlines. Turkish Airlines recorded the strongest Top 15 Total RPKs 289 billion 5.4% 47.8%

growth by +16.3% and ranked 15th. World Total RPKs 606 billion 6.2% 100.0%

Major airlines in Asia/Pacific posted solid growth with both China Southern and Air China grew (Source: ICAO, airlines' websites)

double-digitally. China Southern improved 2 positions and ranked over IAG at 6th. Singapore Note: Total scheduled and non-scheduled services

Airlines as well improved 1 position to 13th and up +5.1%.

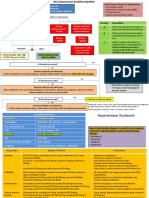

CAPACITY BY REGION (ICAO Statistical Regions) Three regions, Africa, Latin

America/Caribbean, and North

DEC 2017: +5.8% YoY in terms of World ASK

America, accelerated capacity

% Share of Capacity by Region +4.4% YoY expansion in December 2017.

+6.2% YTD

5.6% 2.6% +4.2% YoY Worldwide capacity increased by

Asia/Pacific

+4.1% YTD +5.8% YoY. Asia/Pacific continued to

Europe

+8.3% YoY record the fastest capacity expansion,

11.1%

North America

+8.4% YTD albeit at a slightly slower pace

34.0%

+5.7% YoY compared to the previous month. The

23.1% Middle East +2.6% YoY +6.5% YTD

23.6% +5.0% YoY +2.9% YTD

Middle East experienced the biggest

Latin America/Caribbean +5.5% YTD slowdown in capacity growth.

World:

Africa The world capacity expanded by +6.4%

+5.8% YoY

(Source: ICAO, IATA, OAG) +6.4% YTD in 2017 overall compared to 2016.

Note: Total scheduled services

* Embarked Passengers ** Loaded and Unloaded Freight inTonnes 1. ICAO estimates 2. British Airways, Iberia, and Vueling 3. Lufthansa Airlines, Eurowings, SWISS, Austrian Airlines, Brussels Airlines, Sun Express, and Lufthansa Cargo

ACRONYMS: ACI: Airports Council International; ASK: Available Seat-Kilometres; IATA: International Air Transport Association; FTK: Freight Tonne-Kilometres; LF: Passenger Load Factor;

OAG: Official Airline Guide; RPK: Revenue Passenger-Kilometres; UNWTO: World Tourism Organization; YoY: Year-on-year; YTD: Year-to-date.

Вам также может понравиться

- CS LII 25-26-240617 Current Statistics 1 2 and 3Документ3 страницыCS LII 25-26-240617 Current Statistics 1 2 and 3Sky DriveОценок пока нет

- CS LII 41 141017 CurrentStatisticsДокумент3 страницыCS LII 41 141017 CurrentStatisticsparvatikarmukundОценок пока нет

- Bulletin - CPI December 2019Документ10 страницBulletin - CPI December 2019kingsleyОценок пока нет

- Annex-II Quarter ReviewДокумент1 страницаAnnex-II Quarter ReviewxahidlalaОценок пока нет

- Uttar Pradesh Budget Analysis 2019-20Документ6 страницUttar Pradesh Budget Analysis 2019-20AdОценок пока нет

- Pmar 2018Документ15 страницPmar 2018Ninad PathakОценок пока нет

- Quarterly Construction Cost Review Q4 2018 Hong Kong and China - 001Документ17 страницQuarterly Construction Cost Review Q4 2018 Hong Kong and China - 001Pietrus NimbusОценок пока нет

- Economic ProfileДокумент5 страницEconomic ProfileTAWHID ARMANОценок пока нет

- Economic ProfileДокумент5 страницEconomic ProfileTAWHID ARMANОценок пока нет

- Economic and Educational Profile of KuwaitДокумент5 страницEconomic and Educational Profile of KuwaitTAWHID ARMANОценок пока нет

- Ohio State Highway Patrol: Statistical Analysis UnitДокумент4 страницыOhio State Highway Patrol: Statistical Analysis UnitJosh RichardsonОценок пока нет

- Department of Education: Fy 2018 Physical Plan / Financial Obligation / Monthly Disbursement ProgramДокумент21 страницаDepartment of Education: Fy 2018 Physical Plan / Financial Obligation / Monthly Disbursement ProgramChristine De San JoseОценок пока нет

- Newsl Flash08 Summer 2010 PerfДокумент6 страницNewsl Flash08 Summer 2010 Perfapi-31568155Оценок пока нет

- Jet Q2 2017 ResultДокумент128 страницJet Q2 2017 ResulttheredcornerОценок пока нет

- Table 2 Table 2Документ15 страницTable 2 Table 2PalakshVismayОценок пока нет

- q1 2017 ResultsДокумент28 страницq1 2017 ResultsMarcelo P. LimaОценок пока нет

- NI Composite Economic Index Q3 2017Документ14 страницNI Composite Economic Index Q3 2017Bianca ElenaОценок пока нет

- TDRIДокумент26 страницTDRIChatis HerabutОценок пока нет

- Rajasthan Tourism StatisticsДокумент8 страницRajasthan Tourism StatisticsAnjali VyasОценок пока нет

- R16 - 2015 - Online Article - Material Matters - Accelerators - NPCAДокумент3 страницыR16 - 2015 - Online Article - Material Matters - Accelerators - NPCAshekhar2307Оценок пока нет

- 2018 - 02 - 20 Short - Country-Presentation - InvestRomaniaДокумент22 страницы2018 - 02 - 20 Short - Country-Presentation - InvestRomaniaJonian MollaОценок пока нет

- MOLS Ecoscpe 3 Jan 2019Документ8 страницMOLS Ecoscpe 3 Jan 2019rchawdhry123Оценок пока нет

- Osun 2022Документ9 страницOsun 2022Ady IbikunleОценок пока нет

- Air Passenger Monthly Analysis - Mar 2020Документ4 страницыAir Passenger Monthly Analysis - Mar 2020Satrio AditomoОценок пока нет

- ACI Airport Worldwide Traffic Report - Oct15Документ33 страницыACI Airport Worldwide Traffic Report - Oct15freeflyairОценок пока нет

- Statistics - PSDAДокумент5 страницStatistics - PSDADivisha AgarwalОценок пока нет

- NAFA Stock June 2017Документ1 страницаNAFA Stock June 2017jeb38293Оценок пока нет

- Trade and PaymentsДокумент22 страницыTrade and PaymentsPideОценок пока нет

- MW 1709Документ27 страницMW 1709api-125614979Оценок пока нет

- Economic Review 2017-18 (E) Upto June (EDITED) - For Merge DesktopДокумент12 страницEconomic Review 2017-18 (E) Upto June (EDITED) - For Merge DesktopAmin Al RajhiОценок пока нет

- Diesel Progress - November 2022-8Документ2 страницыDiesel Progress - November 2022-8Matias121212Оценок пока нет

- PT Mag Statue of Unity Sep 2018Документ23 страницыPT Mag Statue of Unity Sep 2018Yogesh GopalОценок пока нет

- Marketing Research Project AirbnbДокумент12 страницMarketing Research Project AirbnbAnonymous QqlYPax1WLОценок пока нет

- Pakistan Total Imports: Main MenuДокумент35 страницPakistan Total Imports: Main MenuSAMI UR REHMANОценок пока нет

- Kantar Worldpanel FMCG Monitor Dec 2018 enДокумент9 страницKantar Worldpanel FMCG Monitor Dec 2018 enAnh Nguyen TranОценок пока нет

- ITIDA - Egypt Destination of Choice 2018Документ28 страницITIDA - Egypt Destination of Choice 2018AKОценок пока нет

- Accident Scorecard 2017Документ30 страницAccident Scorecard 2017Rainer AktionismusОценок пока нет

- NBP Stock Fund (NSF) : MONTHLY REPORT (MUFAP's Recommended Format) December 2020 Unit Price (31/12/2020) : Rs.15.2704Документ1 страницаNBP Stock Fund (NSF) : MONTHLY REPORT (MUFAP's Recommended Format) December 2020 Unit Price (31/12/2020) : Rs.15.2704Kiran SheikhОценок пока нет

- Covid Recovery Pulse: September 17, 2021Документ7 страницCovid Recovery Pulse: September 17, 2021Porus Saranjit SinghОценок пока нет

- Travel & Tourism: Economic Impact 2017 South AfricaДокумент24 страницыTravel & Tourism: Economic Impact 2017 South AfricakishoreОценок пока нет

- Industry Report Card April 2018Документ16 страницIndustry Report Card April 2018didwaniasОценок пока нет

- Covid Recovery Pulse: October 14, 2021Документ7 страницCovid Recovery Pulse: October 14, 2021Dilip KumarОценок пока нет

- Macroscope: Nov18 Trade Result Could Trigger (Another) Front-Loaded Rate HikeДокумент5 страницMacroscope: Nov18 Trade Result Could Trigger (Another) Front-Loaded Rate HikeKurnia NindyoОценок пока нет

- Indonesia Auto: OverweightДокумент7 страницIndonesia Auto: Overweightalvin maulana.pОценок пока нет

- Payment Systems Statistic For First Half of 2019 (BOG Data)Документ3 страницыPayment Systems Statistic For First Half of 2019 (BOG Data)ABC News GhanaОценок пока нет

- Marred by Regulatory Scrutiny: Qiwi PLCДокумент4 страницыMarred by Regulatory Scrutiny: Qiwi PLCRalph SuarezОценок пока нет

- COA-RO9 APP CSE 2023 FormДокумент30 страницCOA-RO9 APP CSE 2023 FormKlienberg Ferenal CancinoОценок пока нет

- Aviation 20170117 Mosl Mu PG006Документ6 страницAviation 20170117 Mosl Mu PG006Madhuchanda DeyОценок пока нет

- NBP Sarmaya Izafa Fund (Nsif) : MONTHLY REPORT (MUFAP's Recommended Format) April 2020 Unit Price (30/04/2020) : Rs.15.6356Документ1 страницаNBP Sarmaya Izafa Fund (Nsif) : MONTHLY REPORT (MUFAP's Recommended Format) April 2020 Unit Price (30/04/2020) : Rs.15.6356HIRA -Оценок пока нет

- Up Dated Up To March, 2018Документ10 страницUp Dated Up To March, 2018Kalpesh BhagneОценок пока нет

- III Report May 2022 EnglishДокумент44 страницыIII Report May 2022 Englishfrancisco CalderonОценок пока нет

- DHL Ocean Freight Market Update Mar2018Документ22 страницыDHL Ocean Freight Market Update Mar2018soumyarm942Оценок пока нет

- Mental Wellness Market by RegionДокумент1 страницаMental Wellness Market by RegionPrachi PandeyОценок пока нет

- 13 Transport and CommunicationДокумент26 страниц13 Transport and CommunicationHammad ShahzadОценок пока нет

- State Budget Analysis KA 2020-21 FinalДокумент7 страницState Budget Analysis KA 2020-21 Finalmohdahmed12345Оценок пока нет

- DHL Ocean Freight Market Update Sept2017Документ18 страницDHL Ocean Freight Market Update Sept2017soumyarm942Оценок пока нет

- Pakistan Forecast - Unemployment Rate (1983 - 2019) (Data & Charts)Документ1 страницаPakistan Forecast - Unemployment Rate (1983 - 2019) (Data & Charts)Aleem RasoolОценок пока нет

- Analyst Presentation Q2 2017 FinalДокумент13 страницAnalyst Presentation Q2 2017 FinalRamakanth GiriОценок пока нет

- Budget Briefs: Swachh Bharat Mission - Gramin (SBM-G)Документ10 страницBudget Briefs: Swachh Bharat Mission - Gramin (SBM-G)Sonmani ChoudharyОценок пока нет

- Dot To Dot DinoДокумент1 страницаDot To Dot DinoReanaldy Ibrahim Masudi PutraОценок пока нет

- Kimed 1 Ed 2 IsiДокумент13 страницKimed 1 Ed 2 IsiReanaldy Ibrahim Masudi PutraОценок пока нет

- Skmei 1389 WatchДокумент1 страницаSkmei 1389 WatchReanaldy Ibrahim Masudi PutraОценок пока нет

- AbstractДокумент1 страницаAbstractReanaldy Ibrahim Masudi PutraОценок пока нет

- 30 2141 PDFДокумент5 страниц30 2141 PDFReanaldy Ibrahim Masudi PutraОценок пока нет

- Existence of Bioactive Flavonoids in Rhizomes and Plant Cell Cultures of Boesenbergia Rotunda (L.) Mansf. KulturpflДокумент6 страницExistence of Bioactive Flavonoids in Rhizomes and Plant Cell Cultures of Boesenbergia Rotunda (L.) Mansf. KulturpflReanaldy Ibrahim Masudi PutraОценок пока нет

- WAAA (Sultan Hasanuddin) : General InfoДокумент14 страницWAAA (Sultan Hasanuddin) : General InfoReanaldy Ibrahim Masudi PutraОценок пока нет

- RJTT PDFДокумент34 страницыRJTT PDFReanaldy Ibrahim Masudi PutraОценок пока нет

- Exit DoorДокумент1 страницаExit DoorReanaldy Ibrahim Masudi PutraОценок пока нет

- 03-Jamu Madura 2Документ8 страниц03-Jamu Madura 2Uang Merah CepeanОценок пока нет

- 1744 8150 2 PBДокумент8 страниц1744 8150 2 PBReanaldy Ibrahim Masudi PutraОценок пока нет

- Evaluation of Antidiabetic Properties of Momordica Charantia in Streptozotocin Induced Diabetic Rats Using Metabolomics ApproachДокумент9 страницEvaluation of Antidiabetic Properties of Momordica Charantia in Streptozotocin Induced Diabetic Rats Using Metabolomics ApproachReanaldy Ibrahim Masudi PutraОценок пока нет

- WaddДокумент29 страницWaddReanaldy Ibrahim Masudi PutraОценок пока нет

- Warr PDFДокумент6 страницWarr PDFReanaldy Ibrahim Masudi PutraОценок пока нет

- JNC8 HTNДокумент2 страницыJNC8 HTNTaradifaNurInsi0% (1)

- VTBS WiiiДокумент3 страницыVTBS WiiiReanaldy Ibrahim Masudi PutraОценок пока нет

- 37 PDFДокумент12 страниц37 PDFReanaldy Ibrahim Masudi PutraОценок пока нет

- Alternative Conceptions of Chemical Bonding: Kim Chwee Daniel, Tan Ngoh Khang, Goh Lian Sai, Chia Hong Kwen, BooДокумент11 страницAlternative Conceptions of Chemical Bonding: Kim Chwee Daniel, Tan Ngoh Khang, Goh Lian Sai, Chia Hong Kwen, BooBalqis Nilnaizar RamadhanОценок пока нет

- Ramada Training ReportДокумент41 страницаRamada Training ReportKailash Joshi100% (2)

- Tourist Experience Expectations Question PDFДокумент12 страницTourist Experience Expectations Question PDFAbdulla KhodjaevОценок пока нет

- Ryokan Origins and History PDFДокумент1 страницаRyokan Origins and History PDFinsightsxОценок пока нет

- AnnavaramДокумент3 страницыAnnavaramJay Jayavarapu0% (1)

- Understanding The Core Attractiveness of Performing Arts Heritage To International TouristsДокумент20 страницUnderstanding The Core Attractiveness of Performing Arts Heritage To International TouristsaakashravinthОценок пока нет

- Aquarium Restaurant in Brasov RomaniaДокумент7 страницAquarium Restaurant in Brasov RomaniaAndrei BularcaОценок пока нет

- Submitted By: K. Mani Grace Reg No: Y8TT20016Документ108 страницSubmitted By: K. Mani Grace Reg No: Y8TT20016prem kumar100% (1)

- Welcome To RomaniaДокумент13 страницWelcome To RomaniaLeo MarianОценок пока нет

- Branding Asian Tourist DestinationsДокумент7 страницBranding Asian Tourist DestinationsAmit AntaniОценок пока нет

- Handout 2 Unit1 Getting AcquaintedДокумент2 страницыHandout 2 Unit1 Getting AcquaintedAdrian FigueroaОценок пока нет

- Ethic CodeДокумент3 страницыEthic CodeJayen Mareemootoo100% (1)

- Class Iv Social Ii Term Question BankДокумент3 страницыClass Iv Social Ii Term Question BankSanghamitra Biswa DudulОценок пока нет

- Bremen Touriflyer GBДокумент8 страницBremen Touriflyer GBRobert MihajlovskiОценок пока нет

- Evidence My Dream Vacation 3Документ5 страницEvidence My Dream Vacation 3Poma Mises62% (45)

- Tourism and The City:: Positive or A Negative ImpactsДокумент9 страницTourism and The City:: Positive or A Negative ImpactsDhruti ShahОценок пока нет

- Plan Luxor 2000 - 001Документ170 страницPlan Luxor 2000 - 001TeSoTrasОценок пока нет

- Thesis Synopsis 2Документ3 страницыThesis Synopsis 2anam asgharОценок пока нет

- BBA 1ST SEM Bachelor of Business Administration - Tourism and TravelДокумент11 страницBBA 1ST SEM Bachelor of Business Administration - Tourism and TravelAakash SinghОценок пока нет

- Unit 10 Ecotourism Lesson 3 ReadingДокумент17 страницUnit 10 Ecotourism Lesson 3 ReadingDuong Vu Thai100% (1)

- Budapest Card 2010Документ116 страницBudapest Card 2010Mădălina PăunescuОценок пока нет

- India Flight TicketДокумент2 страницыIndia Flight TicketKrishna KrishОценок пока нет

- Module in Philippine Tourism Geography and CultureДокумент30 страницModule in Philippine Tourism Geography and CultureChristine Musa de Mesa100% (1)

- NZ1-13793971-Cook Islands Building CodeДокумент40 страницNZ1-13793971-Cook Islands Building CodeSiddharth KumaranОценок пока нет

- Untitled Bingo: B I N GДокумент9 страницUntitled Bingo: B I N GFayna Pallares Freyer VОценок пока нет

- CHAPTER 1 - Introduction To Philippines and Its RegionsДокумент34 страницыCHAPTER 1 - Introduction To Philippines and Its RegionsBaby-Lyn D. Ravago100% (2)

- Describe A Historic Place. 3. Historical Place 4. Describe A Holiday. 6. Describe Your HouseДокумент6 страницDescribe A Historic Place. 3. Historical Place 4. Describe A Holiday. 6. Describe Your HouseTrần Thất BảoОценок пока нет

- NilapakanДокумент30 страницNilapakanjmОценок пока нет

- Do Roman Catholics KnOw About The Great Pyramids of China?Документ11 страницDo Roman Catholics KnOw About The Great Pyramids of China?.Оценок пока нет

- Task 2 - Places To VisitДокумент10 страницTask 2 - Places To Visitapi-653929682Оценок пока нет

- Module 3 - Eco Tourism and Eco TouristДокумент4 страницыModule 3 - Eco Tourism and Eco TouristChrysmae AcedoОценок пока нет