Академический Документы

Профессиональный Документы

Культура Документы

Land Titles Page 2 3 Test

Загружено:

Fe Portabes0 оценок0% нашли этот документ полезным (0 голосов)

20 просмотров3 страницыLand Titles

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документLand Titles

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

20 просмотров3 страницыLand Titles Page 2 3 Test

Загружено:

Fe PortabesLand Titles

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

THREE MAIN PRINCIPLES C.

The insurance principle may however purchase condominiums, buildings, and

A. The mirror principle This principle provides that, if through human enter into a long term land lease.

The basis of this principle is that the register frailty (in the Registry), the mirror fails to give an K&C assists foreigners, non-Philippine nationals,

of title is a mirror which reflects accurately and absolutely correct reflection of the title and a flaw Filipinos, OFW, Balikbayans and corporations

completely the current facts that are material to title. appears, purchasing and acquiring real property in the

With certain inevitable exceptions (ie exceptions to Philippines and can provide relevant information on

indefeasibility) the title is free from all adverse anyone who thereby suffers loss must be put Philippine laws and regulations regarding property

burdens, rights and qualifications unless they are in the same position, so far as money can do purchase and acquisition, review general contracts,

mentioned in the register.3 The “mirror” ideal, that the it, as if the reflection were a true one.5 asset protection contracts, deeds of sale, taxes and

register should reflect all facts and matters relevant to handle entire estate planning. In addition, K&C can

the title to a parcel of land has not been fulfilled in any The insurance principle also involves a introduce you to local real estate brokers to assist you

Torrens jurisdiction. curative process. Since it is the State rather than the in finding the property you are looking for in the

One is the mirror principle, which means the parties which effects the transaction, registration Philippines.

register correctly mirrors the information on the “sometimes confers a better title than the transferor

property's title; if the property is sold, the mirror possessed” so that a purchaser can “acquire an Foreign Ownership of Land in the Philippines

principle ensures that the only information that is indefeasible right, notwithstanding the infirmity of his Ownership of land in the Philippines is highly-

changed in the register is the landowner's name. author’s title”. Thus the insurance principle, properly regulated with land ownership reserved for persons

understood and fully carried out, involves far more or entities considered Philippine nationals or Filipino

B. The curtain principle than that the owner’s title is guaranteed by the State. citizens. For this purpose, a corporation owned 60%

The principle requires that the register is the sole It means: by Filipino citizens is treated as a Philippine national.

source of information for intending purchasers. As the Foreigners interested in acquiring land or real

Privy Council has put it, the main object of the Act: not only that registration will be carried on property through aggressive ownership structures

literally as an insurance undertaking but also must consider the provisions of the Philippines' Anti-

is to save persons dealing with registered that it is the privilege of the Registrar, or the Dummy Law to determine how to proceed. A major

proprietors from the trouble and expense of Commissioner, or other responsible officer, restriction in the law is the restriction on the number

going behind the register, in order to on bringing land under the Act, to cure the of alien members on the Board of Directors of a

investigate the history of their author’s title, title of known defects so far as he possibly landholding company which is limited to 40% alien

and to satisfy themselves of its validity.4 can. It implies that the whole business of participation. Another concern is the possible

registration ought to be conducted with such forfeiture of the property if the provisions of the law

The curtain principle is usually expressed in an economy of public manpower, public time is breached.

individual Torrens statutes in terms that no notice of and public money that the saving which is Exceptions to the restriction on foreigners

trusts is to be entered in the register book, thereby achieved far outweighs any payment of acquisition of land in the Philippines are the

implying that they are of no concern to a disponee and compensation for errors or omissions which following:

it is everywhere expressly stipulated that a purchaser may become necessary from time to time. Acquisition before the 1935 constitution

is not to be affected by notice of any trust. This does insurance principle, which financially protects the Acquisition through hereditary succession if

not mean that a fiduciary is allowed to escape from his landowner against loss should the registrar make any the foreigner is a legal or natural heir

obligations for, after registration, he holds the land mistakes in the proper registration of the property. Purchase of not more than 40% interest in a

upon the trusts and for the purposes for which the condominium project

same is applicable by law although these equities are Philippines Land Ownership and Acquisition Purchase by a former natural-born Filipino

behind the impenetrable curtain of the register book. In general, only Filipino citizens and corporations or citizen subject to the limitations prescribed

curtain principle, the certificate of title serves partnerships with least 60% of the shares are owned by law. (natural born Filipinos who acquired

as the main proof of ownership, eradicating the need by Filipinos are entitled to own or acquire land in the foreign citizenship is entitled to own up to

for lengthy documentation Philippines. Foreigners or non-Philippine nationals 1,000 sq.m. of residential land, and 1 hectare

of agricultural or farm land)

Filipinos who are married to aliens who If holding a title as an individual, a typical situation Those who are not BI registered and

retain their Filipino citizenship, unless by would be that a foreigner married to a Filipino citizen overseas should file the petition at the

their act or omission they have renounced would hold title in the Filipino spouse's name. The nearest embassy or consulate.

their Filipino citizenship foreign spouse's name cannot be on the Title but can Requirements:

be on the contract to buy the property. In the event Birth certificate authenticated my the

Foreigner Ownership as a Philippine Corporation of death of the Filipino spouse, the foreign spouse is Philippines National Statistics Office (NSO)

Foreign nationals or corporations may completely allowed a reasonable amount of time to dispose of Accomplish and submit a “Petition for Dual

own a condominium or townhouse in the Philippines. the property and collect the proceeds or the property Citizenship and Issuance of Identification

To take ownership of a private land, residential house will pass to any Filipino heirs and or relatives. Certificate (IC) pursuant to RA 9225” to a

and lot, and commercial building and lot foreigners Philippine embassy, consulate or the Bureau

may set up a Philippine corporation in the Philippines. Former Natural-born Philippine Citizen now of Immigration

This means that the corporation owning the land has Naturalized American Citizen Pay a $50.00 processing fee, schedule and

less than or up to 40% foreign equity and it is formed Any natural-born Philippine citizen who has lost his take an "Oath of Allegiance" before a

by 5-15 natural persons of legal age as incorporators, Philippine citizenship may still own private land in the consular officer

majority of whom are Philippine residents. Philippines up to a maximum area of 5,000 square The Bureau of Immigration in Manila

meters in the case of rural land. In the case of married receives the petition from the embassy or

Foreigners Leasing Of Philippine Real Estate Property couples, the total area that both couples are allowed consular office. The BI issues and sends an

Leasing land in the Philippines on a long term basis is to purchase should not exceed the maximum area Identification Certificate of citizenship to the

an option for foreigners or foreign corporations with mentioned above. embassy or consular office.

more than 40 percent foreign equity. Under the If a former Filipino who is now a naturalized citizen of

Investor's Lease Act of the Philippines a foreign Filipinos & Former Filipino Citizens (Balikbayans) & a foreign country does not want to avail of the Dual

national and or corporation may enter into a lease OFW Citizen Law in the Philippines, he or she can still

agreement with Filipino landowners for an initial Former natural-born Filipinos who are now acquire land based on BP (Batas Pambansa) 185 & RA

period of up to 50 years renewable once for an naturalized citizens of another country can buy and (Republic Act) 8179 but limited to the following:

additional 25 years. register, under their own name, land in the

Philippines but limited in land area. However, those For Residential Use

Foreigners owning Houses in the Philippines who avail of the Dual Citizenship Law in the (BP 185 - enacted in March 1982):

Foreigners owning a house or building in the Philippines can buy as much as any other Filipino Up to 1,000 square meters of residential land

Philippines is legal as long as the foreigner does not citizen. Under Republic Act 9225 (Philippines Dual Up to one (1) hectare of agricultural of farm

own the land on which the house is build. Citizenship Law of 2003), former Filipinos who land

became naturalized citizens of foreign countries are For Business/Commercial Use (RA 8179 - amended

Foreigners owning Condominiums & Townhouses in deemed not to have lost their Philippine citizenship, the Foreign Investment act of 1991):

the Philippines thus enabling them to enjoy all the rights and Up to 5,000 square meters of urban land

The Condominium Act of the Philippines, R.A. 4726, privileges of a Filipino regarding land ownership in the Up to three (3) hectares of rural land

expressly allows foreigners to acquire condominium Philippines. Real Estate Transaction Costs in the Philippines

units and shares in condominium corporations up to Purchases from Individuals:

not more than 40% of the total and outstanding Steps to Gain Dual Citizenship:

Philippines Capital gains tax - 6% of actual

capital stock of a Filipino owned or controlled If you are in the Philippines, file a "Petition sale price. This is paid by the seller but in

condominium corporation. However, there are a very for Dual Citizenship and Issuance of some cases it might be expected that the

few single-detached homes or Townhouses in the Identification Certificate (IC) pursuant to RA buyer pays. This percentage could differ if

Philippines with condominium titles. Most 9225” at the Bureau of Immigration (BI) and the property assessed is being used by a

condominiums are high rise buildings. for the cancellation of your alien certificate business or is a title- owned by a

of registration.

Foreigners Married to a Filipino Citizen

corporation, in this case the percentage is

7.5%

Philippines Document stamp tax - 1.5% of

the actual sale price. This is paid by wither

the buyer or the seller upon agreement.

Normally however, it is the buyer who

shoulders the cost.

Philippines Transfer tax - 0.5% of the actual

sale price

Philippines Registration fee - 0.25% of the

actual sale price

Purchases from Developers:

Philippines Capital gains tax - 10% of actual

sale price. This value might be expressed as

part of the sale price

Philippines Document stamp tax - 1.5% of

the actual sale price

Philippines Transfer tax - 0.5% of the actual

sale price

Philippines Registration fee - 0.25% of the

actual sale price

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Human Rights NmemonicДокумент1 страницаHuman Rights NmemonicFe PortabesОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Lord, Overflow Us With Your LoveДокумент3 страницыLord, Overflow Us With Your LoveFe PortabesОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- St. Mary's College Tagum City Holy Rosary Leaders (Every Saturday)Документ1 страницаSt. Mary's College Tagum City Holy Rosary Leaders (Every Saturday)Fe PortabesОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Bar Q & A On PropertyДокумент8 страницBar Q & A On PropertyFe Portabes100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- CommitteesДокумент3 страницыCommitteesFe PortabesОценок пока нет

- CompetitionДокумент1 страницаCompetitionFe PortabesОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Name: Cristy M. Boquel Teacher: Mrs. Dahab Course and Year: Fourth Year BSBA Subject: FM 8Документ1 страницаName: Cristy M. Boquel Teacher: Mrs. Dahab Course and Year: Fourth Year BSBA Subject: FM 8Fe PortabesОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Announcement For IntramsДокумент4 страницыAnnouncement For IntramsFe PortabesОценок пока нет

- Sta - Cruz Davao Del Dur, Philippines: Submitted By: Mary Cris T. Kuizon Bsed 3Документ1 страницаSta - Cruz Davao Del Dur, Philippines: Submitted By: Mary Cris T. Kuizon Bsed 3Fe PortabesОценок пока нет

- MissionДокумент1 страницаMissionFe PortabesОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- To All Participants of Musical Drama For Mother Ignacia: What?Документ3 страницыTo All Participants of Musical Drama For Mother Ignacia: What?Fe PortabesОценок пока нет

- Letter For MayorДокумент1 страницаLetter For MayorFe PortabesОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- September 12Документ1 страницаSeptember 12Fe PortabesОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Academic Club: Room Assignment Math & Science Club Filipiniana Club English Club Jpia JBA PicesДокумент3 страницыAcademic Club: Room Assignment Math & Science Club Filipiniana Club English Club Jpia JBA PicesFe PortabesОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- 11 November 2008. AnnouncementДокумент1 страница11 November 2008. AnnouncementFe PortabesОценок пока нет

- Awards Com. MTGДокумент2 страницыAwards Com. MTGFe PortabesОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Letter Student's AmbassadorДокумент2 страницыLetter Student's AmbassadorFe PortabesОценок пока нет

- Appointment of The Different YLO Advisers & Club ModeratorsДокумент1 страницаAppointment of The Different YLO Advisers & Club ModeratorsFe PortabesОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

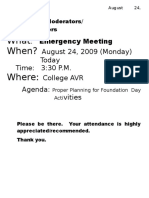

- August 24Документ2 страницыAugust 24Fe PortabesОценок пока нет

- Major Events: Basketball MenДокумент5 страницMajor Events: Basketball MenFe PortabesОценок пока нет

- School Chapel 2012Документ3 страницыSchool Chapel 2012Fe PortabesОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Attention!: To All College StudentsДокумент3 страницыAttention!: To All College StudentsFe PortabesОценок пока нет

- Introduction MIWS MassДокумент1 страницаIntroduction MIWS MassFe PortabesОценок пока нет

- NikaДокумент1 страницаNikaFe PortabesОценок пока нет

- Dacs Liquidation LabelДокумент1 страницаDacs Liquidation LabelFe PortabesОценок пока нет

- Introductio 2Документ2 страницыIntroductio 2Fe PortabesОценок пока нет

- List of Students 201Документ65 страницList of Students 201Fe PortabesОценок пока нет

- Prayer For The Beatification of Venerable Ignacia Del Espiritu SantoДокумент1 страницаPrayer For The Beatification of Venerable Ignacia Del Espiritu SantoFe PortabesОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- HM/TM Programs Family DayДокумент15 страницHM/TM Programs Family DayFe PortabesОценок пока нет

- 09-09-2017 Dacs Osas Committee & Sports Coordinators Kindly Proceed To The President'S Board Room Thanks!Документ1 страница09-09-2017 Dacs Osas Committee & Sports Coordinators Kindly Proceed To The President'S Board Room Thanks!Fe PortabesОценок пока нет

- EEOC V Scott MedicalДокумент14 страницEEOC V Scott MedicalHoward FriedmanОценок пока нет

- Remrev I - People v. Valdez - MoralejoДокумент2 страницыRemrev I - People v. Valdez - MoralejojmmoralejoОценок пока нет

- AcceptanceДокумент5 страницAcceptanceOngwang KonyakОценок пока нет

- Part 4 Case 2 Digest Torres vs. LimjapДокумент1 страницаPart 4 Case 2 Digest Torres vs. Limjapemmaniago08100% (1)

- Maquiling v. COMELECДокумент11 страницMaquiling v. COMELECKarla BeeОценок пока нет

- The Reason I'd Like To Pursue A Legal Career: Alburbar Maria PR-11Документ11 страницThe Reason I'd Like To Pursue A Legal Career: Alburbar Maria PR-11ЮрійОценок пока нет

- God Bless! Law On ObligationsДокумент10 страницGod Bless! Law On ObligationsMa. Kristine Laurice AmancioОценок пока нет

- Albert V University Publishing Co - DigestДокумент3 страницыAlbert V University Publishing Co - DigestBelle MaturanОценок пока нет

- de Borja v. Tan PDFДокумент3 страницыde Borja v. Tan PDFd-fbuser-49417072Оценок пока нет

- NEC System Integrated V Ralph CrisologoДокумент2 страницыNEC System Integrated V Ralph CrisologoDawn Marie Angeli BacurnayОценок пока нет

- Case NoДокумент2 страницыCase NoJasmin BayaniОценок пока нет

- Swift 1st Amended Complaint 20may2011Документ54 страницыSwift 1st Amended Complaint 20may2011WDET 101.9 FMОценок пока нет

- Bombay High Court Reports 1868 72Документ770 страницBombay High Court Reports 1868 72AdityaMehtaОценок пока нет

- University of The Philippines College of Law: Msi 2DДокумент3 страницыUniversity of The Philippines College of Law: Msi 2DMaria AnalynОценок пока нет

- 31) Tupaz IV v. CA and BPIДокумент2 страницы31) Tupaz IV v. CA and BPIRain HofileñaОценок пока нет

- Nature, Form and Kinds of AgencyДокумент64 страницыNature, Form and Kinds of AgencyLizglen Lisbos Gliponeo60% (5)

- Sps. Lumbres vs. Sps. Tablada, GR 165831, February 23, 2007Документ5 страницSps. Lumbres vs. Sps. Tablada, GR 165831, February 23, 2007FranzMordenoОценок пока нет

- De Guzman Vs de Dios A.C. No. 4943, January 26, 2001Документ4 страницыDe Guzman Vs de Dios A.C. No. 4943, January 26, 2001Lianne Gaille Relova PayteОценок пока нет

- Municipal Trial Court: Page 1 of 2Документ2 страницыMunicipal Trial Court: Page 1 of 2unjustvexationОценок пока нет

- Rule 8 CasesДокумент8 страницRule 8 CasesgesalmariearnozaОценок пока нет

- TRUSTS BakayanaДокумент4 страницыTRUSTS BakayanaDekweriz100% (1)

- Dacasin V DacasinДокумент9 страницDacasin V DacasinAbi GieОценок пока нет

- Seven GiftsДокумент79 страницSeven GiftscdcrossroaderОценок пока нет

- 24 - Bill of Particulars - Memorandum of Law and Brief in Support ofДокумент56 страниц24 - Bill of Particulars - Memorandum of Law and Brief in Support ofterryhinds0% (1)

- Barredo vs. Garcia and Almario 73 Phil., 607, July 08, 1942Документ36 страницBarredo vs. Garcia and Almario 73 Phil., 607, July 08, 1942Arjay Yared OniaОценок пока нет

- People Vs EtensoДокумент1 страницаPeople Vs Etensomfspongebob67% (3)

- Presentation ON Functions of Bar Council of India: by Neha Sachdeva Ritika Wahi Priya SarojДокумент19 страницPresentation ON Functions of Bar Council of India: by Neha Sachdeva Ritika Wahi Priya SarojNeha SachdevaОценок пока нет

- 3-1intro To Phil Courts and Cases.1Документ180 страниц3-1intro To Phil Courts and Cases.1Neil Francel D. MangilimanОценок пока нет

- Persons and Family RelationsДокумент124 страницыPersons and Family RelationsNgan TuyОценок пока нет

- Report - Administrative LawДокумент16 страницReport - Administrative LawDarlen Daileg SantianezОценок пока нет

- Legal Writing in Plain English: A Text with ExercisesОт EverandLegal Writing in Plain English: A Text with ExercisesРейтинг: 3 из 5 звезд3/5 (2)

- Essential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsОт EverandEssential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsРейтинг: 3 из 5 звезд3/5 (2)

- Solve Your Money Troubles: Strategies to Get Out of Debt and Stay That WayОт EverandSolve Your Money Troubles: Strategies to Get Out of Debt and Stay That WayРейтинг: 4 из 5 звезд4/5 (8)