Академический Документы

Профессиональный Документы

Культура Документы

Variance Reviewer

Загружено:

MichBadilloCalanogАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Variance Reviewer

Загружено:

MichBadilloCalanogАвторское право:

Доступные форматы

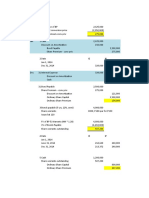

Costing

Standard Cost Normal Cost Actual Cost

Direct Materials Standard Actual Actual

Direct Labor Standard Actual Actual

Overhead Standard Budgeted Actual

Budgeted

= Budgeted Sales + Ending inventory – Beginning inventory

Production

(in units) (in units) (in units)

(in units)

Standard quantity of

= (Unit quantity standard)(Actual output)

materials allowed (SQ)

Standard quantity

= (Unit labor standard)(Actual output)

hours allowed (SH)

= Actual Cost – Planned Cost

Total Budget Variance

(AP x AQ) – (SP x SQ)

Unfavorable variance: occurs when AP or AQ > SP or SQ

Favorable variance: occurs when AP or AQ < SP or SQ

Price Variance

=(AP x AQ) – (SP x AQ)

=(AP – SP) x AQ

Total Budget Variance

=(AP x AQ) – (SP x SQ)

Usage Variance

=(SP x AQ) – (SP x SQ)

=(AQ – SQ) x SP

AP = Actual Price AQ = Actual Quantity

SP = Standard Price SQ = Standard Quantity

Total labor variance = Labor rate variance + Labor Efficiency Variance

Price Variance

=(AR x AH) – (SR x AH)

=(AR – SR) x AH

Total Labor Variance

=(AR x AH) – (SR x SH)

Usage Variance

=(SR x AH) – (SR x SH)

=(AH – SH) x SR

AR = Actual Rate AH = Actual Hours

SR = Standard Rate SH = Standard Hours

Flexible Budgeting

Actual Variable Overhead = Actual VOH

(VOH) Rate Actual Hours

VOH Spending Variance

=(AVOR x AH) – (SVOR x AH)

=(AVOR – SVOR) x AH

Total Variable Overhead

(VOH) Variance

=(AVOR x AH) – (SVOR x SH)

VOH Efficiency Variance

=(SVOR x AH) – (SVOR x SH)

=(AH – SH) x SVOR

Standard Fixed Overhead = Budgeted FOH costs

(FOH) Rate Practical Capacity

FOH Spending Variance

=Actual FOH – Budgeted FOH

(AFOH) (BFOH)

Total Fixed Overhead

Variance

=Actual FOH – Applied FOH

FOH Volume Variance

=Budgeted FOH–Applied FOH

(BFOH) (SH x SFOR)

Вам также может понравиться

- Question # 1 Answer ONLY 1-14, 1-15 & 1-16 (3 Items Only)Документ6 страницQuestion # 1 Answer ONLY 1-14, 1-15 & 1-16 (3 Items Only)MichBadilloCalanogОценок пока нет

- Audit of IntagiblesДокумент2 страницыAudit of IntagiblesMichBadilloCalanogОценок пока нет

- Variance ReviewerДокумент3 страницыVariance ReviewerMichBadilloCalanogОценок пока нет

- Retail InventoryДокумент2 страницыRetail InventoryMichBadilloCalanogОценок пока нет

- Audit of ReceivablesДокумент4 страницыAudit of ReceivablesMichBadilloCalanogОценок пока нет

- ContractsДокумент8 страницContractsCharrie Grace PabloОценок пока нет

- IFRS For Revenue Recognition F10Документ52 страницыIFRS For Revenue Recognition F10MichBadilloCalanogОценок пока нет

- Audit of LiabilitiesДокумент9 страницAudit of LiabilitiesMichBadilloCalanogОценок пока нет

- Specific Express Powers of A Corporation Under The Corporation CodeДокумент5 страницSpecific Express Powers of A Corporation Under The Corporation CodeMichBadilloCalanogОценок пока нет

- Cash Flow HedgeДокумент1 страницаCash Flow HedgeMichBadilloCalanogОценок пока нет

- FormulaДокумент13 страницFormulaMichBadilloCalanogОценок пока нет

- Audit of IntagiblesДокумент2 страницыAudit of IntagiblesMichBadilloCalanogОценок пока нет

- Specific Express Powers of A Corporation Under The Corporation CodeДокумент5 страницSpecific Express Powers of A Corporation Under The Corporation CodeMichBadilloCalanogОценок пока нет

- AgencyДокумент2 страницыAgencyMichBadilloCalanogОценок пока нет

- Reversing EntriesДокумент1 страницаReversing EntriesMichBadilloCalanogОценок пока нет

- Reversing EntriesДокумент1 страницаReversing EntriesMichBadilloCalanogОценок пока нет

- Reversing Entries How To Reverse Entries When To ReverseДокумент1 страницаReversing Entries How To Reverse Entries When To ReverseMichBadilloCalanogОценок пока нет

- Pledge, Mortgage, and AntichresisДокумент5 страницPledge, Mortgage, and AntichresisMichBadilloCalanog100% (1)

- ObligationsДокумент5 страницObligationsMichBadilloCalanogОценок пока нет

- Reversing EntriesДокумент1 страницаReversing EntriesMichBadilloCalanogОценок пока нет

- TudyДокумент3 страницыTudyMichBadilloCalanogОценок пока нет

- Audit of LiabilitiesДокумент7 страницAudit of LiabilitiesMichBadilloCalanogОценок пока нет

- Additional ProbsДокумент1 страницаAdditional ProbsMichBadilloCalanogОценок пока нет

- ch01Документ22 страницыch01MichBadilloCalanogОценок пока нет

- ACTBAS2 ReviewerДокумент4 страницыACTBAS2 ReviewerLauren Gabrielle AranetaОценок пока нет

- PlaylistДокумент1 страницаPlaylistMichBadilloCalanogОценок пока нет

- RA 1425 (SB 438 and HB 5561)Документ2 страницыRA 1425 (SB 438 and HB 5561)Xymon BassigОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Suzlon Energy Limited: Investor Presentation Q2, FY 2022-23Документ25 страницSuzlon Energy Limited: Investor Presentation Q2, FY 2022-23Sathish JustinОценок пока нет

- BBPM2203 Bi PDFДокумент236 страницBBPM2203 Bi PDFHaziq ZulkeflyОценок пока нет

- When To Use FmglflextДокумент2 страницыWhen To Use FmglflextPrivilege MudzingeОценок пока нет

- Services Strategies: Presented byДокумент21 страницаServices Strategies: Presented byhumanhonest100% (1)

- 2024 Retail Exhibition PlanДокумент1 страница2024 Retail Exhibition PlanIna JooОценок пока нет

- Circular Business ModelsДокумент44 страницыCircular Business ModelsHiểu MinhОценок пока нет

- S1-17-Ba ZC411 Mbazc411-L1Документ26 страницS1-17-Ba ZC411 Mbazc411-L1Ashutosh SinghОценок пока нет

- Economic Model of Consumer BehaviourДокумент8 страницEconomic Model of Consumer Behaviourmanojverma231988Оценок пока нет

- Section 1Документ5 страницSection 1MariamHatemОценок пока нет

- Thesis Paper On Marketing ManagementДокумент5 страницThesis Paper On Marketing ManagementMichele Thomas100% (2)

- E N T R E P R E Ne U R S H I P-Midterm: Lesson: Market SegmentationДокумент10 страницE N T R E P R E Ne U R S H I P-Midterm: Lesson: Market SegmentationKristina PabloОценок пока нет

- You Can Negotiate Anything by Herb Cohen - Book Summary: Why This Book MattersДокумент3 страницыYou Can Negotiate Anything by Herb Cohen - Book Summary: Why This Book MattersshahzebОценок пока нет

- Test Bank Chapter12Документ24 страницыTest Bank Chapter12Jessa Mae Muñoz100% (2)

- Citibank CaseДокумент11 страницCitibank CaseAbhinaba Ghose100% (1)

- Job Description - Sr. Sales and Application Engineer - OemetaДокумент2 страницыJob Description - Sr. Sales and Application Engineer - OemetaArymak1987Оценок пока нет

- ENGG 405 - Module 6Документ7 страницENGG 405 - Module 6Desi Margaret ElauriaОценок пока нет

- 5 Product StrategyДокумент40 страниц5 Product StrategyAnirban Kundu50% (2)

- SIM Audit 421 Problem Week 4-5Документ33 страницыSIM Audit 421 Problem Week 4-5Kristelle MarieОценок пока нет

- Accounting A Level Notes 9706Документ45 страницAccounting A Level Notes 9706shabanaОценок пока нет

- Spring 042Документ3 страницыSpring 042mehdiОценок пока нет

- Financial Profit & Loss KPI Dashboard: Open Index Income StatementДокумент30 страницFinancial Profit & Loss KPI Dashboard: Open Index Income StatementMohannad100% (2)

- TcsДокумент49 страницTcsAshishОценок пока нет

- F8-06 DocumentationДокумент20 страницF8-06 DocumentationReever RiverОценок пока нет

- M.A 2-Full Accounting InformationДокумент45 страницM.A 2-Full Accounting InformationShallОценок пока нет

- Capital MaintenanceДокумент5 страницCapital MaintenancePj SornОценок пока нет

- Perfect CompetitionДокумент24 страницыPerfect Competitionzishanmallick0% (1)

- Chapter 15 - Direct Marketing and Other MediaДокумент16 страницChapter 15 - Direct Marketing and Other MediaStatistics ABMОценок пока нет

- Gold ETFДокумент11 страницGold ETFPravin ChoughuleОценок пока нет

- Strategy AeropostaleДокумент57 страницStrategy Aeropostalezeeshan25% (4)

- Square Relentless Pursuit of More Elegant Payment Experience Memo Executive SummaryДокумент6 страницSquare Relentless Pursuit of More Elegant Payment Experience Memo Executive Summarymutoro fredОценок пока нет