Академический Документы

Профессиональный Документы

Культура Документы

Withholding Taxes

Загружено:

Nerdy Eddy0 оценок0% нашли этот документ полезным (0 голосов)

33 просмотров1 страницаWithholding taxes in Ghana

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документWithholding taxes in Ghana

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

33 просмотров1 страницаWithholding Taxes

Загружено:

Nerdy EddyWithholding taxes in Ghana

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

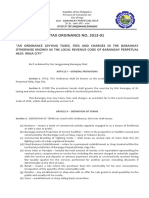

Withholding tax under domestic tax laws

Income Rate (%)

Resident persons

Interest (excluding individuals and resident financial institutions) 8

Dividends 8

Rent on residential properties to individuals and legal persons 8

Rent on non-residential properties to individuals and legal persons 15

Fees to resident individuals as invigilators, examiners and part-time teachers or 10

lecturers, and endorsement fees to individuals

Fees or allowances to directors, managers, board members and trustees who are 20

resident individuals

Commission to insurance, sales, canvassing and lotto agents who are individuals 10

Supplies of goods exceeding GH¢2,000 per annum 3

Supplies of works exceeding GH¢2,000 per annum 5

Supplies of services by an entity exceeding GH¢2,000 per annum 7.5

Supplies of general services by an individual 7.5

Payments to petroleum subcontractors 7.5

Payments for unprocessed precious minerals 3

Royalty, natural resource payments 15

Non-resident persons

Dividends 8

Royalties, natural resources payments and rents 15

Management and technical service fees 20

Goods, works or any services 20

Repatriated branch after-tax profits 8

Interest income (excluding individuals) 8

General insurance premiums 5

Income from telecommunication and transportation business 15

Payments to petroleum subcontractors 15

A withholding agent is required to prepare and provide the withholdee with a withholding

tax certificate within 30 days of the month of deduction.

20 | A quick guide to taxation in Ghana

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- 2021 W2 Marcus RobertsДокумент1 страница2021 W2 Marcus RobertsDAISY CRAINОценок пока нет

- Manual of Accounts - Caffe La TeaДокумент5 страницManual of Accounts - Caffe La TeaMichele RogersОценок пока нет

- Leave Travel Concession (LTC)Документ2 страницыLeave Travel Concession (LTC)hanumanthaiahgowdaОценок пока нет

- World Zakat Performance Index - A Conceptual FrameworkДокумент57 страницWorld Zakat Performance Index - A Conceptual FrameworkKang HolikОценок пока нет

- Case Digests MidtermsДокумент76 страницCase Digests MidtermsCin100% (1)

- Salaries Project Sec 15,16,17Документ47 страницSalaries Project Sec 15,16,17glorydharmarajОценок пока нет

- Business and Transfer Reviewer CompressДокумент11 страницBusiness and Transfer Reviewer CompressMarko JerichoОценок пока нет

- 3annual-Reports SCI PDFДокумент96 страниц3annual-Reports SCI PDFsharmil92Оценок пока нет

- Proforma Journal Entries - Merchandising TransactionsДокумент4 страницыProforma Journal Entries - Merchandising TransactionsJames Christian AvesОценок пока нет

- Chapter 1 General Principles of TaxationДокумент4 страницыChapter 1 General Principles of TaxationAngelie Elizaga SuarezОценок пока нет

- Aguinaldo Industries Corporation vs. Commissioner of Internal Revenue Services Actually RenderedДокумент2 страницыAguinaldo Industries Corporation vs. Commissioner of Internal Revenue Services Actually RenderedCharmila SiplonОценок пока нет

- VNW Terms and Conditions enДокумент8 страницVNW Terms and Conditions enThang NguyenОценок пока нет

- Vuca World Implicated Into SCM - FinalДокумент12 страницVuca World Implicated Into SCM - Finalthanhvan34Оценок пока нет

- Advance-Accounitng MCQДокумент24 страницыAdvance-Accounitng MCQSavani KibeОценок пока нет

- Practice Test 2 - Midterm - M4B PDFДокумент2 страницыPractice Test 2 - Midterm - M4B PDFNguyễn Quốc HưngОценок пока нет

- Taxation (NIRC Sec 1-36Документ11 страницTaxation (NIRC Sec 1-36Angie Louh S. DiosoОценок пока нет

- Myntra Terms of UseДокумент8 страницMyntra Terms of UseNimalanОценок пока нет

- Reviewed 2012-01, Barangay Tax Ordinance (Local Revenue Code)Документ7 страницReviewed 2012-01, Barangay Tax Ordinance (Local Revenue Code)Jessie Serdeño75% (4)

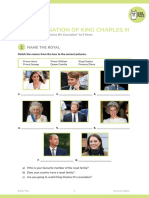

- SV The Coronation of King Charles IIIДокумент9 страницSV The Coronation of King Charles IIIMaria GromovaОценок пока нет

- Gaite v. Fonacier FactsДокумент14 страницGaite v. Fonacier FactsDominique VasalloОценок пока нет

- AlienationsДокумент25 страницAlienationsAnam KhanОценок пока нет

- Chapter 4: Consumption, Saving, and Investment: Cheng ChenДокумент78 страницChapter 4: Consumption, Saving, and Investment: Cheng ChenCS SОценок пока нет

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Документ1 страницаTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Akhilesh GuptaОценок пока нет

- Contract To Sell SampleДокумент3 страницыContract To Sell SampleWalid MacmodОценок пока нет

- Profile t1 InstructionsДокумент4 страницыProfile t1 Instructionsapi-306226330Оценок пока нет

- Ocean Carriers Case StudyДокумент5 страницOcean Carriers Case StudyJennifer Johnson71% (17)

- Tatad v. Sec of DOEДокумент81 страницаTatad v. Sec of DOEGeorgeОценок пока нет

- 02.22 Commissioner of Internal Revenue Vs Fortune Tobacco CorporationДокумент17 страниц02.22 Commissioner of Internal Revenue Vs Fortune Tobacco CorporationAbegail LeriosОценок пока нет

- Chap 011Документ44 страницыChap 011Jessica Cola50% (2)

- Ficci Pre Budget Memorandum 2015 16Документ194 страницыFicci Pre Budget Memorandum 2015 16Viral SavlaОценок пока нет