Академический Документы

Профессиональный Документы

Культура Документы

Bonds - July 19 2018

Загружено:

Tiso Blackstar Group0 оценок0% нашли этот документ полезным (0 голосов)

18 просмотров3 страницыBonds - July 19 2018

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документBonds - July 19 2018

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

18 просмотров3 страницыBonds - July 19 2018

Загружено:

Tiso Blackstar GroupBonds - July 19 2018

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

Markets and Commodity figures

19 July 2018

Total Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Deals Nominal Consideration Deals Nominal Consideration

Current Day 754 27.48 bn Rbn 29.14 224 27.52 bn Rbn 26.58

Week to Date 2 877 104.06 bn Rbn 107.76 1 461 186.94 bn Rbn 179.40

Month to Date 14 156 403.57 bn Rbn 413.75 4 748 613.76 bn Rbn 588.68

Year to Date 174 267 5 322.63 bn Rbn 5 544.03 43 021 5 549.26 bn Rbn 5 545.68

Foreign Client Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Party Deals Nominal Consideration Deals Nominal Consideration

Buy 56 3.56 bn Rbn 3.62 16 1.67 bn Rbn 1.67

Current Day Sell 73 3.74 bn Rbn 3.83 9 2.18 bn Rbn 2.12

Net -17 -0.18 bn Rbn -0.22 7 -0.50 bn Rbn -0.45

Buy 229 17.16 bn Rbn 17.47 96 13.71 bn Rbn 13.22

Week to Date Sell 231 16.15 bn Rbn 16.52 55 11.71 bn Rbn 11.50

Net -2 1.01 bn Rbn 0.95 41 2.00 bn Rbn 1.72

Buy 932 57.44 bn Rbn 58.90 311 54.64 bn Rbn 51.41

Month to Date Sell 907 57.32 bn Rbn 57.86 154 32.04 bn Rbn 31.59

Net 25 0.12 bn Rbn 1.04 157 22.60 bn Rbn 19.82

Buy 11 901 668.57 bn Rbn 698.20 2 286 323.42 bn Rbn 305.65

Year to Date Sell 11 262 701.99 bn Rbn 732.63 2 443 657.57 bn Rbn 698.56

Net 639 -33.42 bn Rbn -34.43 -157 -334.15 bn Rbn -392.92

Index Levels

Code Index Yield Index Previous Return MTD Return YTD

ALBI20 9.034%

All Bond Index Top 617.488

20 Composite 619.406 1.01% 5.02%

GOVI 9.088%Split - 613.133

ALBI20 Issuer Class GOVI 615.124 1.06% 4.52%

OTHI 8.874%

ALBI20 Issuer Class Split - 635.710

OTHI 637.420 0.87% 6.42%

CILI15 3.006%

Composite Inflation 250.090

Linked Index Top 15 250.159 -0.48% -1.04%

ICOR 3.885%

CILI15 Issuer Class 279.100

Split - ICOR 279.459 -0.40% 3.05%

IGOV 2.963%

CILI15 Issuer Class 248.746

Split - IGOV 248.800 -0.49% -1.21%

ISOE 3.775%

CILI15 Issuer Class 253.628

Split - ISOE 254.131 -0.20% 1.22%

MMI JSE Money Market Index

0 241.267 241.216 0.39% 4.08%

ALBI Constituent Bonds

Bond Issuer Maturity MTM Previous YTD Low YTD High

R159 REPUBLIC OF SOUTH

Jan 2020

AFRICA 7.435% 7.385% 6.58% 7.81%

R203 REPUBLIC OF SOUTH

Feb 2020

AFRICA 8.470% 8.420% 7.69% 8.89%

ES18 ESKOM HOLDINGS

MarLIMITED

2021 7.730% 7.680% 6.87% 8.10%

R204 REPUBLIC OF SOUTH

Jan 2023

AFRICA 9.315% 9.270% 8.35% 9.64%

R207 REPUBLIC OF SOUTH

Feb 2023

AFRICA 9.435% 9.390% 8.57% 9.82%

R208 REPUBLIC OF SOUTH

Feb 2023

AFRICA 8.135% 8.090% 7.24% 8.50%

ES23 ESKOM HOLDINGSAprLIMITED

2026 10.005% 9.955% 9.17% 10.44%

DV23 DEVELOPMENT DecBANK

2026

OF SOUTHERN

8.725% AFRICA 8.675% 7.88% 9.16%

R2023 REPUBLIC OF SOUTH

Jan 2030

AFRICA 9.110% 9.060% 8.28% 9.57%

ES26 ESKOM HOLDINGSFebLIMITED

2031 9.210% 9.160% 8.36% 9.64%

R186 REPUBLIC OF SOUTH

Mar 2032

AFRICA 9.305% 9.260% 8.46% 9.74%

R2030 REPUBLIC OF SOUTH

Sep 2033

AFRICA 10.765% 10.715% 9.96% 11.14%

R213 REPUBLIC OF SOUTH

Feb 2035

AFRICA 9.455% 9.410% 8.61% 9.82%

R2032 REPUBLIC OF SOUTH

Mar 2036

AFRICA 9.435% 9.385% 8.62% 9.81%

ES33 ESKOM HOLDINGSJanLIMITED

2037 9.525% 9.475% 8.69% 9.88%

R209 REPUBLIC OF SOUTH

Jan 2040

AFRICA 9.600% 9.555% 8.76% 9.95%

R2037 REPUBLIC OF SOUTH

Feb 2041

AFRICA 9.590% 9.545% 8.73% 9.94%

R214 REPUBLIC OF SOUTH

Apr 2042

AFRICA 10.980% 10.935% 10.13% 11.33%

R2044 REPUBLIC OF SOUTH

Jan 2044

AFRICA 9.635% 9.590% 8.80% 9.98%

R2048 REPUBLIC OF SOUTH

Feb 2048

AFRICA 9.625% 9.585% 8.76% 9.97%

Other Rates

Code Description Rate Previous YTD Low YTD High

SAFEX SAFEX Overnight Deposit Rate6.310% 6.310% 6.31% 6.56%

JIBAR1 JIBAR 1 Month 6.733% 6.733% 6.63% 6.92%

JIBAR3 JIBAR 3 Month 6.958% 6.958% 6.87% 7.16%

JIBAR6 JIBAR 6 Month 7.517% 7.517% 7.38% 7.60%

RSA 2 year retail bond 8.25% 0 0 0

RSA 3 year retail bond 8.50% 0 0 0

RSA 5 year retail bond 9.00% 0 0 0

RSA 3 year inflation linked retail

2.50%

bond 0 0 0

RSA 5 year inflation linked retail

2.75%

bond 0 0 0

RSA 10 year inflation linked retail

3.00%

bond 0 0 0

Nominal Bond Curves (NACS)

9.62

9.12

8.62

8.12

7.62

7.12 Zero

6.62 Par/Swap

6.12

5.62

5.12

4.62

2015 2020 2026 2031 2037 2042 2048 2053 2059

DATA DISCLAIMER

To the extent allowed by law, JSE Limited (the JSE) does not (expressly, tacitly or implicitly) guarantee or warrant the availability,

sequence, accuracy, completeness, reliability or any other aspect of any of the data (Data), or that any Data is up to date.

To the extent allowed by law, neither the JSE nor any of its directors, officers, employees, contractors, agents or representatives are

liable in any way to the reader or to any other natural or juristic person (Person) for any loss or damage as a result of (i) the display

of any Data in this bulltetin, or (ii) any Data being unavailable in this bulletin at any time and for any reason, or (iii) any delay,

inaccuracy, error, or omission in relation to any Data, or (iv) any actions taken or not taken by or on behalf of any Person in reliance

on any Data. The JSE is entitled to terminate the production of any Data at any time, without notice and without liability to any Person.

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

Вам также может понравиться

- Shoprite Food Index 2023Документ19 страницShoprite Food Index 2023Tiso Blackstar GroupОценок пока нет

- BondsДокумент3 страницыBondsTiso Blackstar GroupОценок пока нет

- Arena Holdings Pty LTD - BBBEE Certificate - 2023Документ2 страницыArena Holdings Pty LTD - BBBEE Certificate - 2023Tiso Blackstar GroupОценок пока нет

- Shoprite Food Index 2023Документ19 страницShoprite Food Index 2023Tiso Blackstar GroupОценок пока нет

- LibertyДокумент1 страницаLibertyTiso Blackstar GroupОценок пока нет

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Документ2 страницыLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupОценок пока нет

- Ramaphosa's Letter To MkhwebaneДокумент1 страницаRamaphosa's Letter To MkhwebaneTiso Blackstar GroupОценок пока нет

- Ramaphosa's Letter To MkhwebaneДокумент1 страницаRamaphosa's Letter To MkhwebaneTiso Blackstar GroupОценок пока нет

- Ramaphosa's Letter To MkhwebaneДокумент1 страницаRamaphosa's Letter To MkhwebaneTiso Blackstar GroupОценок пока нет

- Statement From The SA Tourism BoardДокумент1 страницаStatement From The SA Tourism BoardTiso Blackstar GroupОценок пока нет

- Collective InsightДокумент10 страницCollective InsightTiso Blackstar GroupОценок пока нет

- FuelPricesДокумент1 страницаFuelPricesTiso Blackstar GroupОценок пока нет

- Anti Corruption Working GuideДокумент44 страницыAnti Corruption Working GuideTiso Blackstar GroupОценок пока нет

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Документ2 страницыLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupОценок пока нет

- Open Letter To President Ramaphosa - FinalДокумент3 страницыOpen Letter To President Ramaphosa - FinalTiso Blackstar GroupОценок пока нет

- JP Verster's Letter To African PhoenixДокумент2 страницыJP Verster's Letter To African PhoenixTiso Blackstar GroupОценок пока нет

- Sanlam Stratus Funds - July 15 2020Документ2 страницыSanlam Stratus Funds - July 15 2020Lisle Daverin BlythОценок пока нет

- JudgmentДокумент30 страницJudgmentTiso Blackstar GroupОценок пока нет

- LibertyДокумент1 страницаLibertyTiso Blackstar GroupОценок пока нет

- FuelPricesДокумент1 страницаFuelPricesTiso Blackstar GroupОценок пока нет

- Tobacco Bill - Cabinet Approved VersionДокумент41 страницаTobacco Bill - Cabinet Approved VersionTiso Blackstar GroupОценок пока нет

- Sanlam Stratus Funds - August 6 2020Документ2 страницыSanlam Stratus Funds - August 6 2020Lisle Daverin BlythОценок пока нет

- Collective Insight September 2022Документ14 страницCollective Insight September 2022Tiso Blackstar GroupОценок пока нет

- FairbairnДокумент2 страницыFairbairnTiso Blackstar GroupОценок пока нет

- The ANC's New InfluencersДокумент1 страницаThe ANC's New InfluencersTiso Blackstar GroupОценок пока нет

- BondsДокумент3 страницыBondsTiso Blackstar GroupОценок пока нет

- Critical Skills List - Government GazetteДокумент24 страницыCritical Skills List - Government GazetteTiso Blackstar GroupОценок пока нет

- Markets and Commodity Figures: Liberty Excelsior InvestmentsДокумент1 страницаMarkets and Commodity Figures: Liberty Excelsior InvestmentsTiso Blackstar GroupОценок пока нет

- Sanlam Stratus Funds - June 1 2021Документ2 страницыSanlam Stratus Funds - June 1 2021Lisle Daverin BlythОценок пока нет

- Bonds - June 8 2022Документ3 страницыBonds - June 8 2022Lisle Daverin BlythОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Exam FM QuestionsДокумент85 страницExam FM Questionsrhinoboy18Оценок пока нет

- Series 65 Practice Exam For Available Courses PageДокумент8 страницSeries 65 Practice Exam For Available Courses PagePatrick Crutcher100% (3)

- 2016年5月FRM二级模拟考试一(题目)Документ30 страниц2016年5月FRM二级模拟考试一(题目)lowchangsongОценок пока нет

- DEY's B.ST Ch8Sources of Business Finance PPTs As PeДокумент120 страницDEY's B.ST Ch8Sources of Business Finance PPTs As PeIk RarОценок пока нет

- Ketan RathodДокумент92 страницыKetan RathodKetan RathodОценок пока нет

- FCCBДокумент8 страницFCCBRadha RampalliОценок пока нет

- HDFC Mutual Fund StudyДокумент71 страницаHDFC Mutual Fund StudyUzmaamehendiartОценок пока нет

- Chapter-Four Financial InstrumentsДокумент15 страницChapter-Four Financial InstrumentsAbdiОценок пока нет

- BookkeepingДокумент20 страницBookkeepingzhanel bekenovaОценок пока нет

- Adani Green Energy Limited: Earnings PresentationДокумент41 страницаAdani Green Energy Limited: Earnings PresentationSoumitra BhowmikОценок пока нет

- Capital Market and Money MarketДокумент17 страницCapital Market and Money MarketSwastika Singh100% (1)

- Investing ComoditiesДокумент4 страницыInvesting ComoditiesSarthak AroraОценок пока нет

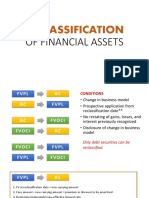

- Reclassification: of Financial AssetsДокумент15 страницReclassification: of Financial AssetsHazel Jane EsclamadaОценок пока нет

- FM9Документ7 страницFM9Farhana UyagОценок пока нет

- Chap 010Документ66 страницChap 010MohitОценок пока нет

- Tire City IncДокумент12 страницTire City Incdownloadsking100% (1)

- BFF3351 S1 2020 FinalДокумент11 страницBFF3351 S1 2020 Finalsardar hussainОценок пока нет

- Form 1455Документ6 страницForm 1455Shevis Singleton Sr.100% (17)

- Interest Rates and Bond Valuation: Solutions To Questions and ProblemsДокумент7 страницInterest Rates and Bond Valuation: Solutions To Questions and ProblemsFelipeОценок пока нет

- Reading 36: Cost of CapitalДокумент41 страницаReading 36: Cost of CapitalEmiraslan MhrrovОценок пока нет

- L 1Документ5 страницL 1Elizabeth Espinosa ManilagОценок пока нет

- Mathematics For Business: Introduction To Quantitative AnalysisДокумент99 страницMathematics For Business: Introduction To Quantitative AnalysisStella Bùi100% (1)

- Canadian Securities: The Capital MarketsДокумент47 страницCanadian Securities: The Capital MarketsNikku SinghОценок пока нет

- Chapter 3Документ19 страницChapter 3GODОценок пока нет

- Interest Rate ProblemsTITLE Discount Price Calculations TITLE Forward Rate DeterminationTITLE Stock Investment ReturnTITLE Treasury Yield CurveДокумент3 страницыInterest Rate ProblemsTITLE Discount Price Calculations TITLE Forward Rate DeterminationTITLE Stock Investment ReturnTITLE Treasury Yield CurveNathan WangОценок пока нет

- An Introduction To Bank Debenture Trading Programs EducДокумент28 страницAn Introduction To Bank Debenture Trading Programs EducLuis Alberto CamusОценок пока нет

- Market Participants in Securities MarketДокумент11 страницMarket Participants in Securities MarketSandra PhilipОценок пока нет

- Federal Fumbles Vol 6Документ66 страницFederal Fumbles Vol 6Dan SnyderОценок пока нет

- Securitization Regulation in Focus: Proposed Liquidity Rules Have Softened, But May Still Deter European Bank InvestorsДокумент8 страницSecuritization Regulation in Focus: Proposed Liquidity Rules Have Softened, But May Still Deter European Bank Investorsapi-228714775Оценок пока нет

- Indian Financial System Dba1749Документ193 страницыIndian Financial System Dba1749Santhosh GeorgeОценок пока нет