Академический Документы

Профессиональный Документы

Культура Документы

BBBBB: (As of 6-January-2017)

Загружено:

grupa2904Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

BBBBB: (As of 6-January-2017)

Загружено:

grupa2904Авторское право:

Доступные форматы

Stock Report | 7-January-2017 | Ticker: SKFB SS

SKF

Recommendation HOLD bbbbb Price

SEK 168.20 (as of 6-January-2017)

12-Mo. Target Price

SEK 150.00

Equity Analyst Firdaus Ibrahim, CFA

GICS Sector Industrials Summary SKF is a Swedish based industrial conglomerate with global activities in the bear-

Sub-Industry Industrial Machinery ings industry.

Key Stock Statistics (Source: S&P Capital IQ, company reports)

52 Wk Range SEK 122.40 - 175.60 S&P EPS 2016E SEK 10.00 Yield (%) 3.27

Trailing 12-Month EPS SEK 8.52 S&P EPS 2017E SEK 11.00 Dividend Rate/Share SEK 5.50

Trailing 12-Month P/E (x) 0.0 Common Shares Outstg. (M) 455.35 Beta 0.48

P/E on S&P EPS 2016E 16.8 Market Capitalisation (M) SEK 76,590.0

Price Performance Qualitative Risk Assessment

30-Week Mov. Avg. 12-Mo. Target Price Volume Above Avg. STARS

LOW MEDIUM HIGH

10-Week Mov. Avg. Below Avg.

Our risk assessment reflects SKF’s cyclical

nature but also its high quality management team

200

and strong global market positions in its core

Share Price

160

product base. Free cash flow generation is also

very good at the company.

140

120

Volume(Mil.)

6

4

2

Quantitative Evaluations

0

S&P Capital IQ Quality Ranking B+

5 3 3 3 3

2 2 2

D C B- B B+ A- A A+

1

FMAMJ J A S OND J FMAMJ J A S OND J FMAMJ J A S OND J FMAMJ J A S OND J FMAMJ J A S OND J F

2012 2013 2014 2015 2016 Revenues / Earnings Data

Past performance is not an indication of future performance and should not be relied upon as such.

Revenues (Million SEK)

Analysis prepared by Equity Analyst Firdaus Ibrahim, CFA on 27-Oct-2016.

1Q 2Q 3Q 4Q Year

Highlights Investment Rationale/Risk

2017 -- -- -- -- 73,363E

ffIn 1H 2016, SKF’s revenue fell by 8% year- ffOur recommendation is 3-STARS (Hold). SKF’s

2016 17,720 18,370 17,912 -- 72,182E

over-year as both Industrial (-10%) and downward revision of its financial targets

Automotive (-4.1%) segments reported lower in February 2016 confirms our view that its 2015 19,454 19,961 18,367 18,215 75,997

revenue. Overall, currency had a negative operating environment will remain challenging 2014 16,734 17,955 17,787 18,499 70,975

impact of -2% and structure contributed in the foreseeable future. Despite lowering

2013 15,152 16,392 15,623 16,430 63,597

-0.7% to the revenue decline. By region, only most of its targets, we think that SKF will have

Middle East & Africa reported higher organic difficulties in achieving them. For example, the 2012 16,931 17,174 15,486 14,984 64,575

sales (+1%), while other regions were lower, company’s organic sales growth target of 5%

Earnings Per Share (SEK)

notably North America (-12%) with lower (from 8% previously) is far-fetch given recent

demand from customers across all industries. reported organic sales growth (2013: -0.7%, 2017 -- -- -- -- 11.00E

Revenue continued to trend lower in 3Q 2016, 2014: 3.3%, 2015: -2.6%) and lower demand 2016 2.40 1.44 2.96 -- 10.00E

falling 3% but we see a pick-up in Automotive outlook in its key markets especially in Asia

customer segment (+5%). Looking to 4Q 2016, 2015 2.46 3.65 1.59 0.82 8.52

and North America, which in total contributed

we expect SKF’s topline to remain under around 50% of SKF’s revenue. On the positive 2014 2.72 2.54 3.01 1.83 10.10

pressure due to lower demand in Industrial side, we have seen encouraging signs at its 2013 1.74 2.36 2.47 -4.57 2.00

customer segments across all regions. Automotive division since the launch of its

2012 2.81 2.63 2.67 2.12 10.23

profit improvement program in 4Q 2015 with

ffOperating profit (excluding one-time items) EBIT margin up 3.5%-pts to 7.1% in 9M 2016. An

fell from EUR6.9 billion in 9M 2015 to EUR5.8 improvement in margins at Industrials will help Fiscal year ended 31 Dec.

billion in 9M 2016, equivalent to a drop of SKF to achieve its target, but slowing demand

16%, as its margin contracted 1.3%-pts to has been holding up the segment’s performance. Dividend Data

10.7% due to lower volume and general

cost inflation. Industrial’s operating profit ffKey downside risks include: (i) significant Ex-Div

Amount (SEK) Payment Date

dropped 10% and its margin contracted by deterioration in demand especially in Date

0.2%-pts to 12.7%. Automotive continued to Europe and emerging markets, (ii) failure 5.50 1-Apr 7-Apr-16

benefit from its profit improvement program, to effectively execute profit enhancement 5.50 27-Mar 2-Apr-15

evidenced by the 3.5%-pts margin expansion program at Automotive division, and (iii)

to 7.1%, which was also helped by its sales adverse movement in currencies that could 5.50 31-Mar 7-Apr-14

growth in 3Q 2016. We expect group margin negatively affect revenue and profit translation. 5.50 29-Apr 7-May-13

to contract in 2016, as the negative margin 5.50 26-Apr 4-May-12

development at Industrial will more than offset ffOur 12-month target price for SKF is SEK150,

5.00 29-Apr 6-May-11

the operational improvement at Automotive. reflecting 2017 P/E of 13.6x, broadly in line with Source: Company reports.

the company’s 5-year historical forward P/E

ffWe expect normalized EPS to trend lower of 12.9x. We believe the valuation is fair as

in 2016 from the lower revenue and margin we balance the potential positive outcome of

contraction. SKF completed the divestment of restructuring initiatives with the challenging Past performance is not an indication of future per-

Kaydon velocity control and fly-by-wire in June outlook. formance and should not be relied upon as such.

2016 for a proceed of SEK3.1 billion.

Share Prices as of the Market close (16.30) on the

price-date quoted, unless otherwise stated at the

top of this page.

Redistribution or reproduction is prohibited without written permission. Copyright © 2016 CFRA.

This document is not intended to provide personal investment advice and it does not take into account the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek independent financial

advice regarding the suitability and/or appropriateness of making an investment or implementing the investment strategies discussed in this document and should understand that statements regarding future prospects may not be realised. Investors should note that income from

such investments, if any, may fluctuate and that the value of such investments may rise or fall. Accordingly, investors may receive back less than they originally invested. Investors should seek advice concerning any impact this investment may have on their personal tax position

from their own tax advisor. Please note the publication date of this document. It may contain specific information that is no longer current and should not be used to make an investment decision. Unless otherwise indicated, there is no intention to update this document.

Stock Report | 7-January-2017 | Ticker: SKFB SS

SKF

Business Summary 25-August-2016 Corporate Information

COMPANY OVERVIEW: SKF is a leading global supplier of products, solutions and services within rolling Office

Hornsgatan 1

bearings, seals, mechatronics, services and lubrication systems. Its services include technical support,

Gothenburg

maintenance services, condition monitoring, asset efficiency optimization, engineering consultancy and

0

training. SKF is headquartered in Sweden and has 115 manufacturing units in 24 countries, with a c. 48,000 Sweden

strong workforce. In 2015, it generated most of its sales in Europe (41%), followed by North America (26%),

Asia Pacific (26%), Latin America (6%) and Middle East/Africa (6%).

Telephone

BUSINESS SEGMENTS: SKF organizes its business according to the three main customer segments that +46 3 13 37 10 00

it serves. (1) Industrial Market (60% of sales, 11.6% operating profit margin in 2015) serves the global

industrial market directly and indirectly through SKF’s worldwide distributor network. Key segments are Website

metals, mining, cement, pulp & paperer, automation, machine tools, industrial drives, railway, marine, www.skf.com

energy and off-highway. (2) Automotive market (26%, 2.5%) provides a range of products, solutions and

Domicile

services to manufacturers of cars, light trucks, heavy trucks, trailers, buses, two-wheelers and the vehicle

Sweden

aftermarket. (3) Specialty Business (14%, 8.2%) consists of five stand-alone businesses with different

customer-specific application solutions - SKF Linear & Actuation Technology, SKF Aerospace, Kaydon Founded

Corporation, PEER Bearing Company and General Bearing Corporation. 1907

MARKET PROFILE: SKF is the world leader on the bearings market with other major international

companies including the Schaeffler Group, Timken, NSK, NTN and JTEKT. SKF estimates that the top 6

bearing manufacturers represent about 60% of the global market.

The global bearings market is generally seen as the worldwide sales of rolling bearings, comprising ball

and roller bearing assemblies of various designs, including mounted bearing units. SKF estimates that the

global rolling bearing market size in 2015 grew by 0-1% year-over-year and reached a value of between

SEK330-340 billion. Europe accounts for 25% of the total world market with Germany alone accounting

for almost 10%. The Americas now represent slightly more than 20% of global demand, of which the U.S.,

Canada and Mexico together account for about 80%. Asia’s share of the world bearing market grew the

most year-over-year and accounted for more than 50% compared to less than 30% fifteen years ago.

China’s share of the total world bearing market grew heavily to about 30%.

CORPORATE STRATEGY: The company focuses on five strategic priorities: (1) creating and capturing

customer value, (2) application-driven innovation, (3) world-class manufacturing, (4) cost competitiveness, Employees

and (5) maximizing cash flow over time.

Its financial targets from 2016 are to achieve, over a business cycle, an organic growth of 5% in local

currencies, a reported operating margin of 12%, a return on capital employed of 16%, a net working capital

of 25% and a net debt/equity ratio of 80%.

NA

FINANCIAL TRENDS: In 2015, SKF’s reported revenue grew by 7% year-over-year, mainly due to currency

tailwinds (+10%) but organic sales saw a decline of 3%. By region, organic sales were higher in Middle Stockholders

East & Africa (+13%), Europe (+0.4%) and Latin America (+0.5%) but declines were observed in North NA

America (-8%) and Asia (-4%). The sales decline in North America was sharper than anticipated due Officers

to lower demand and destocking in the supply chain. By business segments, sales in Automotive

were slightly up by 0.3% organically, while Industrial and Specialty Business declined by 4% and 2%

respectively. We see a lower demand for SKF products and services in 2016 given the continuation of

macroeconomic uncertainty.

Operating margin (excluding one-time items) in 2015 declined 0.3%-pts year-over-year to 11.4%, as margin

fell in Industrial and Specialty Business. Automotive saw an improvement of 0.9%-pts in normalized

operating margin to 5.4%, reflecting its profit improvement program.

Net profit fell by 15% in 2015, due to higher expenses, asset write-downs and other one-off items. Despite

this, dividend was maintained at SEK5.5 per share, equivalent to a payout ratio of 65%. Net debt fell from Board of Directors

SEK18.6 billion to SEK15.3 billion. FCF improved significantly to SEK5.6 billion (2014: SEK76 million).

Redistribution or reproduction is prohibited without written permission. Copyright © 2016 CFRA.

Stock Report | 7-January-2017 | Ticker: SKFB SS

SKF

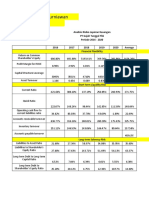

Quantitative Evaluations Key Growth Rates and Averages

Volatility LOW AVERAGE HIGH Past Growth Rate (%) 1Year 3Years 5Years

Sales 7.08 17.69 24.53

Net Income -15.65 -16.77 -24.48

Expanded Ratio Analysis

2017E 2016E 2015 2014 Ratio Analysis (Annual Avg.)

Net Margin (%) 5.11 4.34 5.88

EV/Sales NA NA 1.45 1.50

% LT Debt to Capitalization -27.25 -28.47 -24.16

EV/EBITDA NA NA 11.81 10.86

Return on Equity (%) 16.20 13.97 18.74

EV/EBIT NA NA 15.83 13.98

P/E Ratio 15.29 16.82 19.74 16.65

Avg. Diluted Shares Outstg. (M) 455.35 455.35 455.34 455.33

Figures based on current price.

Company Financials Fiscal Year ending 31-Dec

Per share data (SEK) 2017E 2016E 2015 2014 2013 2012

Tangible Book Value NA NA 7.90 2.71 2.91 25.73

Cash Flow NA NA 20.55 21.61 18.18 19.36

Earnings 11.00 10.00 8.52 10.10 2.00 10.23

Payout Ratio (%) 52.1 55.0 64.5 54.4 274.6 53.7

Prices - High NA NA 230.80 178.90 184.70 174.20

Prices - Low NA NA 135.60 138.40 149.10 128.10

P/E Ratio - High NA NA 27.1 17.7 92.4 17.0

P/E Ratio - Low NA NA 15.9 13.7 74.6 12.5

EV/EBIT NA NA 15.8 14.0 15.7 12.1

Income Statement Analysis (Million SEK)

Revenues 73,363 72,182 75,997 70,975 63,597 64,575

Operating Profit (EBIT) NA NA 6,985 7,642 6,430 7,096

Net Financials NA NA -532 -310 -331 -369

Pre-tax Profit NA NA 5,834 6,668 2,821 6,408

Net Income 5,009 4,554 3,880 4,600 912 4,662

EBIT Margin (%) NA NA 9.2 10.8 10.1 11.0

Interest Cover NA NA 10.9 16.9 14.6 14.7

Capex/Depreciation (%) NA NA 1.1 1.1 1.1 1.3

Net Margin (%) 6.8 6.3 5.1 6.5 1.4 7.2

Balance Sheet & Other Fin. Data (Million SEK)

Cash NA NA 8,500 7,441 6,201 9,057

Current Assets NA NA 38,153 38,807 34,582 34,848

Total Assets NA NA 79,733 81,639 70,991 60,757

Current Liabilities NA NA 15,331 16,102 16,741 13,903

Long Term Debt NA NA 22,383 24,077 19,698 12,730

Shareholder Funds 27,866 25,380 24,815 23,089 20,100 21,340

Capital Expenditure NA NA 2,063 1,845 1,741 1,954

Net Debt/(Cash) NA NA 15,325 18,664 15,143 6,673

Net Gearing (%) NA NA 61.8 80.8 75.3 31.3

Return on Assets (%) NA NA 4.8 6.0 1.4 7.8

Return on Equity (%) 18.8 18.1 16.2 21.3 4.4 21.8

Accounting Standard IFRS IFRS IFRS IFRS IFRS IFRS

NA- Not Available. NM- Not Meaningful. E- Estimated. Source: S&P Capital IQ Equity Research; Company Reports

Company financials data are based on figures as reported, except for EPS and EV/EBIT, which are S&P adjusted.

DPS and BVPS (and related ratios e.g. dividend yield and ROE) are based on consensus estimates.

Redistribution or reproduction is prohibited without written permission. Copyright © 2016 CFRA.

Stock Report | 7-January-2017 | Ticker: SKFB SS

SKF

Industry Outlook Stock Performance

We are neutral on European Industrials, reflecting investment rise, while taxes are cut. This will Month-end Price Performance as of 31-Oct-16

our mixed view on its diverse sub-sectors and our provide a boost to its economy, in our view. We

expectation of a moderate but fragile economic see companies with exposure to the U.S. will 150

growth in the Eurozone in 2017. The Industrials benefit from expected increase in infrastructure

140

sector is highly cyclical due to its dependence on spending and currency tailwinds from USD

the global economic cycle and exposure to the strength. 130

business cycles of a diverse customer base. As a

result, our stock choices are heavily influenced The stabilization of oil price and its potential 120

by company exposures to regional upward trajectory following OPEC’s decision to

%Change

macroeconomic factors. We also favor cut production in November 2016 will boost 110

companies that are undergoing or have recently activity for oil & gas players, and industrial

100

completed restructuring programs, where the companies related to the oil & gas value chain

reduced cost base will boost profitability via (e.g. equipment and machinery suppliers), in our

90

operational leverage in the event of a cyclical opinion. On the other hand, we think airlines will

upturn. see less benefit from fuel cost savings, and 80

together with industry overcapacity and negative

For the Eurozone, we see economic growth will sentiment from terrorist attacks underpin our 70

continue at a moderate pace in 2017, as recent negative view on the airline sub-sector. The

labor market gains and rising private consumption increase in oil price and other commodity prices 60

2011 2012 2013 2014 2015 2016

are being counterbalanced by a number of will also push up raw material costs for most

negative factors such as Brexit and uncertainty industrial companies, in our view.

SKF

from upcoming elections in France, Germany and

the Netherlands. Euro manufacturing PMI came The S&P Europe 350 Industrials Index was up S&P Europe 350 Index

in at 54.9% in December 2016, the strongest 8.8% in 2016, outperforming the S&P Europe 350 S&P Europe 350 - Industrials Index

expansion in factory activity since April 2011, Index which recorded a decline of 0.4% during

reflecting increase in output, new orders and the period. Past performance is not an indication of future per-

employment. Producers reported that orders formance and should not be relied upon as such.

were buoyed by increased competitiveness

resulting from the depreciation of the EUR.

Unemployment in the Eurozone fell to single digit

in November 2016, the first time in five years,

declining steadily from its peak in of 12.1% in 2013

to 9.8%.

We believe the U.S. will outperform in the

advanced economy. The new administration will

begin its policy priorities in 2017 and in this

context the fiscal stance is projected to become

more expansionary as public spending and

Peer Group: Industrial Machinery

Peer Group Exchange Currency Recent P/E 12-Mo. 30-Day 1-Year Yield Stk. Mkt. Ret. on Pretax LTD to

Stock Ratio Trailing Price Price Cap. Equity Margin Cap.

Price EPS Chg. Chg. (%) (%) (%)

(%) (%)

SKF Stockholm SEK 168.20 16.8 8.52 -2.8 27.7 3.3 76,590 (M) 14.4 8.3 44.3

Alfa Laval Stockholm SEK 153.20 20.1 8.65 9.4 4.6 2.8 64,261 (M) 14.1 10.4 35.8

Assa Abloy Stockholm SEK 167.20 20.8 7.26 0.7 -3.1 1.9 186,023 (M) 18.6 15.2 23.9

Atlas Copco Stockholm SEK 279.20 21.5 11.33 0.0 43.5 2.4 332,175 (M) 21.6 17.7 30.9

Cargotec Helsinki EUR 42.22 14.9 2.70 8.1 28.6 2.4 2,732 (M) 11.1 5.4 29.7

GEA Group Xetra EUR 38.15 19.1 1.37 6.8 8.7 2.4 7,344 (M) 12.7 8.2 4.2

Heidelberger Druckmaschinen Xetra EUR 2.59 11.1 0.11 9.8 23.9 Nil 667 (M) 6.7 0.6 58.1

Kone Helsinki EUR 43.23 21.9 1.96 4.8 14.7 3.7 22,746 (M) 47.5 16.2 1.8

Sandvik Stockholm SEK 113.50 19.3 5.14 2.4 59.9 2.5 142,373 (M) 13.0 8.4 47.8

Wartsila Helsinki EUR 42.81 18.4 2.10 6.0 8.2 3.0 8,444 (M) 16.4 9.4 18.4

NA- Not Available. NM- Not Meaningful. Source: S&P Capital IQ Equity Research.

Redistribution or reproduction is prohibited without written permission. Copyright © 2016 CFRA.

Stock Report | 7-January-2017 | Ticker: SKFB SS

SKF

Analyst Research Notes and other Company News

26-OCT-2016 16-OCT-2015

S&P GLOBAL MAINTAINS HOLD ON SKF - SOME POSITIVES IN 3Q 2016 BUT S&P CAPITAL IQ MOVES SKF TO SELL FROM HOLD - LOWER 3Q 2015

TOO EARLY FOR A CONFIRMATION OF A TURNAROUND (SKFB SS, CURRENT ORGANIC SALES AS WEAKENING DEMAND EXPECTED TO CONTINUE (SKFB

PRICE: SEK149.90 AS OF 25-OCT-2016, ***) SS, CURRENT PRICE: SEK155.30 AS OF 15-OCT-2015, **)

We raise our target price for SKF to SEK150 (SEK140), reflecting a 2017 P/E of We cut our 12-month target price to SEK140 (SEK195), implying Capital IQ

13.6 x, broadly in line with its 3-year historical forward P/E of 12.9x, balancing consensus 2016 EV/EBIT of 10.0x. This is a discount to its 5-year historical

its restructuring potential with the challenging outlook. We cut our 2016 EPS

average of 11.4x, which we believe is justified given its lower operating

to SEK10 (SEK10.61) and 2017 EPS to SEK11 (SEK11.56). 3Q 2016 EPS of SEK2.96

came in higher than Capital IQ consensus estimate of SEK2.46. We believe margin (3Q 2015 of 10.8% vs. 5-year average of 12.0%) and challenging

the beat was mainly due to one-off gain arising from its pension plan. We outlook. We cut our 2015 and 2016 revenue forecasts to SEK75 billion and

see some positives in 3Q 2016: (i) sales only fell 3%, which is an improvement SEK77 billion, and the corresponding EPS forecasts to SEK10.27 and SEK13.73.

over the 8% decline in 2Q, (ii) margin at Industrial improved by 1.9%-pts For 3Q 2015, organic revenue was down 5% on lower sales volume as demand

after several quarters of contraction, and (iii) sales at Automotive rose 5% continued to weaken especially in Asia (-8%) and North America (-11%).

on growth in Asia. However, we still expect its near-term outlook to remain Operating margin declined by 1.0%-pts vs. 3Q 2014, contributed by margin

challenging as SKF did not highlight any expected improvement in demand for decline in Industrial (-2.2%-pts) and Specialty Business (-2.7%-pts). We

4Q 2016. In addition, one good quarter is not enough for us to confirm that the believe SKF’s 15% margin target is challenging given the latest margin trend.

company is turning around. /F. Ibrahim, CFA SKF guided a weaker demand entering into 4Q 2015 and we see it continuing

in 2016 given the macro-economic uncertainty. /F. Ibrahim, CFA

21-JUL-2016

S&P GLOBAL MAINTAINS HOLD ON SKF - 2Q 2016 EBIT DRAGGED BY 15-JUL-2015

INDUSTRIAL DESPITE CONTINUED IMPROVEMENT AT AUTOMOTIVE (SKFB S&P CAPITAL IQ MAINTAINS HOLD ON SKF – PROGRESS TOWARDS MARGIN

SS, CURRENT PRICE: SEK132.00 AS OF 21-JUL-2016 13:30 BST, ***) AND CASH TARGETS MITIGATED BY WEAKER END DEMAND (SKFB SS,

We cut our 12-month target price for SKF to SEK140 (SEK155), reflecting CURRENT PRICE: SEK190.50 AS OF 14-JUL-2015, ***)

2016 P/E of 13.2x, broadly in line with SKF’s 5-year historical forward P/E of We maintain our Hold (***) and lower our 12-month target price to SEK 195

12.9x, balancing the restructuring potential with the challenging outlook. We

(SEK 220) which is a 2015 EV/EBIT multiple of 12.3x, vs. a 5-year average of

cut our 2016 EPS to SEK10.61 (SEK11.20) following SKF’s 2Q 2016 earnings

miss as its EBIT (excluding one-offs) of SEK2.0 billion missed Capital IQ 11.4x, reflecting the higher margin potential. SKF H1 15 sales were up 13.6%

consensus estimate of SEK2.1 billion. Net sales fell by 8% year-over-year in (-0.2% organic). Organically, Europe rose 0.8%, despite weaker demand

2Q 2016, dragged by both Industrial (-9%) and Automotive (-5%), with notably in emerging markets and energy, North America fell 4.1% as automotive

weak numbers in North America. EBIT was negatively impacted by margin underperformed, Latam rose 1.5% and MENA rose 15%, while Asia rose only

contraction at Industrial (-3.0%-pts, due to lower volumes and costs inflation), 0.6% on Chinese destocking and lower railway demand. For Q3, SKF guides

which more than offset the margin improvement at Automotive (+1.0%-pts). for demand to be sequentially lower but this is not seasonally adjusted which

We expect 3Q 2016 to be sequentially weaker, but are encouraged by the implies a near flat trend, not as bad as first thought, in our view. Adj. EBIT

continued improvement at Automotive and what we see as signs of uptick in margin at 12.6% in H1 improved on 2014 (11.9%) despite Automotive and

demand in Europe. /F. Ibrahim, CFA Speciality Business failing the 15% margin target (3.8% and 10.4%). Progress

was made on working capital, down SEK300 mln in Q2 while seasonally

29-APR-2016 up. We cut our sales forecasts for 2015 and 2016 by 1% and 1.5% on the

S&P GLOBAL RAISES SKF TO HOLD FROM SELL - RESTRUCTURING announced small disposals. /J. Jarmoszko

PROGRESS AMID STABILIZING END MARKETS (SKFB SS, CURRENT PRICE:

SEK152.00 AS OF 28-APR-2016, ***) 17-APR-2015

We raise our 12-month target price to SEK155 (from SEK127), reflecting 2016 S&P CAPITAL IQ MAINTAINS HOLD ON SKF – MARGINS RISE BUT FLAT

P/E of 13.8x, broadly in-line with SKF’s 5-year historical forward P/E of 12.9x, DEMAND IN Q2 15 (SKFB SS, CURRENT PRICE: SEK210.20 AS OF 17-APR-2015

balancing the restructuring potential and the challenging outlook. We cut

10:45 BST, ***)

our 2016 EPS to SEK11.20 (SEK11.50) as SKF’s 1Q 2016 EPS of SEK2.40 missed

Capital IQ consensus by 7%. SKF’s 1Q 2016 results showed sales falling 8.9% SKF reported adjusted operating profit of SEK2.4 bln in Q1 15, up 25% and in

(organically -6.1%). The bright spot was automotive, a long underperforming line with S&P Capital IQ consensus although sales fell 1% short of consensus.

business, where sales were down 0.2% organically but margins rose from Organic sales growth saw a further sequential decline to 1.4% (Q4 14: 1.8%,

2.2% to 6.4%. Fixing automotive is vital for the group to reach margin targets. Q3 14: 1.9%) including a 2.4% fall in North America due to lower activity in

For once, few one-offs littered the results, with reported EBIT margin at 10.6% mining and oil & gas. However, revenue rose 16.3% on currency effects of

vs. 8.8%, driven by a much reduced expense line - a sign that cost-cutting is in 14.9% from the weakening of the SEK. SKF sees demand remaining flat in Q2

action. SKF guides for slightly higher demand sequentially. We are no longer 15 (versus Q1 15 and 2Q 14) with no pick-up seen yet in Europe. We raise our

negative on the stock as we expect good progress in its restructuring and its EPS to SEK13.72 in 2015E (+4%) and SEK16.21 in 2016E (+13%) to incorporate

end markets to stabilize. /F. Ibrahim, CFA the weakening in SEK (both transactional and translational benefits). We

maintain our Hold (***) and raise our 12-month target price to SEK220

03-FEB-2016 (SEK200) on increased estimates. This is equivalent to a 2015E EV/EBITDA of

S&P CAPITAL IQ MAINTAINS SELL OPINION ON SKF - 55% DROP IN 4Q 2015 11.0x, a premium to the 3-year historic average (9.6x) as we see rising margins

NET PROFIT, LOWERS FINANCIAL TARGETS (SKFB SS, CURRENT PRICE: on cost measures (adj. EBIT of 12.2%, 2014: 11.7%) which are 40% complete.

SEK133.40 AS OF 02-FEB-2016, **) /W. Howlett, CFA

We lower our 12-month target price to SEK127 (from SEK140), reflecting

2016 P/E of 11.0x. The implied discount to SKF’s 5-year historical forward P/E 29-JAN-2015

of 13.3x is fair in our view on lower operating margin (9.2% vs. average of

S&P CAPITAL IQ MAINTAINS HOLD ON SKF – COST MEASURES

12.0% in 2010-2014) and challenging outlook. 2015 reported EPS of SEK8.52

was lower than our and Capital IQ consensus forecasts by 17% and 28% ANNOUNCED (SKFB SS, CURRENT PRICE: SEK195.00 AS OF 28-JAN-2015, ***)

respectively. We lower our 2015 EPS forecast to SEK11.50 (SEK13.73) to factor SKF reported adjusted operating profit of SEK2.08 bln in Q4 14, up 15% and

in the negative outlook. SKF’s 4Q 2015 net profit dropped 55% year-over-year in line with Capital IQ consensus (SEK2.07 bln). Volume growth edged down

to SEK374 million as sales declined by 2% (-5% organically) and operating to 1.8% (Q3 14: 1.9%) and SKF sees demand remaining stable sequentially in

expenses increased by 8%. The period saw a higher-than-expected sales Q1 15. However, net sales rose 12.6% supported by currency effects (+8.9%)

decline in North America (-12%), which was affected by lower demand and following the weakening of the SEK against the USD. The underlying EBIT

supply chain destocking. SKF’s revision of its financial targets confirms our margin fell to 11.2% (Q3 14: 11.8%) and remains below SKF’s target of 15%.

view that its operating environment will remain challenging in the foreseeable SKF announced SEK1.2 bln of cost savings by end-2016 while incurring

future and therefore, we maintain our negative stance on the stock. /F. restructuring costs of SEK1.4 bln through merging the two industrial units

Ibrahim, CFA and reducing headcount. The Automotive division, where profitability lags

well behind the group (underlying EBIT margin: 1.2%), will also see job cuts.

We maintain Hold (***) but raise our 12-month target price to SEK200 (155)

equivalent to a 2015E EV/EBITDA of 10.9x. This is a premium to the 3-year

historic average (9.6x) which we see as warranted given improving margins

on cost measures. /W. Howlett, CFA

Redistribution or reproduction is prohibited without written permission. Copyright © 2016 CFRA.

Stock Report | 7-January-2017 | Ticker: SKFB SS

SKF

opposed to risk and volatility measures associated with share prices. For an

Glossary ETF this reflects on a capitalization-weighted basis, the average qualitative About S&P Global Equity Research’s Distributors:

risk assessment assigned to holdings of the fund.

S&P Capital IQ STARS – Since January 1, 1987, S&P Capital IQ Equity This Research Report is published and originally distributed by CFRA US,

STARS Ranking system and definition: with the following exceptions: In the UK/EU/EEA, it is published and originally

Research has ranked a universe of U.S. common stocks, ADRs (American

Depositary Receipts), and ADSs (American Depositary Shares) based on bbbbb 5-STARS (Strong Buy): distributed by CFRA UK Limited, an Appointed Representative of Hutchinson

a given equity’s potential for future performance. Similarly, S&P Capital IQ Total return is expected to outperform the total return of a relevant Lilley Investments LLP, which is regulated by the Financial Conduct Authority

Equity Research has ranked Asian and European equities since June 30, benchmark, by a wide margin over the coming 12 months, with shares (No. 582181), and in Malaysia by S&P Malaysia, which is regulated by

2002. Under proprietary STARS (STock Appreciation Ranking System), rising in price on an absolute basis. Securities Commission Malaysia, (No. CMSL/A0181/2007) under license

equity analysts rank equities according to their individual forecast of an from CFRA US, and its subsidiaries do not distribute reports to individual

bbbbb 4-STARS (Buy):

equity’s future total return potential versus the expected total return of a (retail) investors and maintain no responsibility for reports redistributed by

Total return is expected to outperform the total return of a relevant third parties such as brokers or financial advisors.

relevant benchmark (e.g., a regional index (S&P Asia 50 Index, S&P

benchmark over the coming 12 months, with shares rising in price on an

Europe 350® Index or S&P 500® Index)), based on a 12-month time

absolute basis.

horizon. STARS was designed to meet the needs of investors looking to

put their investment decisions in perspective. Data used to assist in bbbbb 3-STARS (Hold):

determining the STARS ranking may be the result of the analyst’s own Total return is expected to closely approximate the total return of a relevant

models as well as internal proprietary models resulting from dynamic data benchmark over the coming 12 months, with shares generally rising in price

inputs. on an absolute basis.

S&P Capital IQ Quality Ranking (also known as S&P Capital IQ Earnings bbbbb 2-STARS (Sell):

& Dividend Rankings) - Growth and stability of earnings and dividends Total return is expected to underperform the total return of a relevant

are deemed key elements in establishing S&P Capital IQ’s earnings and benchmark over the coming 12 months, and the share price not anticipated

dividend rankings for common stocks, which are designed to capsulize to show a gain.

the nature of this record in a single symbol. It should be noted, however,

bbbbb 1-STAR (Strong Sell):

that the process also takes into consideration certain adjustments and

modifications deemed desirable in establishing such rankings. The final Total return is expected to underperform the total return of a relevant

score for each stock is measured against a scoring matrix determined by benchmark by a wide margin over the coming 12 months, with shares

analysis of the scores of a large and representative sample of stocks. The falling in price on an absolute basis.

range of scores in the array of this sample has been aligned with the Relevant benchmarks:

following ladder of rankings: In North America, the relevant benchmark is the S&P 500 Index, in Europe

and in Asia, the relevant benchmarks are the S&P Europe 350 Index and the

A+ Highest B Below Average S&P Asia 50 Index, respectively.

A High B- Lower

A- Above Average C Lowest Disclosures

B+ Average D In Reorganization

NR Not Ranked S&P GLOBAL™ and S&P CAPITAL IQ™ are used under license. The owner

S&P Capital IQ EPS Estimates – S&P Capital IQ earnings per share of these trademarks is S&P Global Inc. or its affiliate, which are not affiliated

(EPS) estimates reflect analyst projections of future EPS from continuing with CFRA or the author of this content.

operations, and generally exclude various items that are viewed as

special, non-recurring, or extraordinary. Also, S&P Capital IQ EPS Stocks are ranked in accordance with the following ranking methodologies:

estimates reflect either forecasts of equity analysts; or, the consensus

STARS Stock Reports: Qualitative STARS recommendations are

(average) EPS estimate, which are independently compiled by Capital

determined and assigned by equity analysts. For reports containing STARS

IQ, a data provider to S&P Capital IQ Equity Research. Among the items

recommendations refer to the Glossary section of the report for detailed

typically excluded from EPS estimates are asset sale gains; impairment,

methodology and the definition of STARS rankings.

restructuring or merger-related charges; legal and insurance settlements;

in process research and development expenses; gains or losses on the Quantitative Stock Reports: Quantitative recommendations are determined

extinguishment of debt; the cumulative effect of accounting changes; and by ranking a universe of common stocks based on 5 measures or model

earnings related to operations that have been classified by the company categories: Valuation, Quality, Growth, Street Sentiment, and Price

as discontinued. The inclusion of some items, such as stock option Momentum. In the U.S., a sixth sub-category for Financial Health will also

expense and recurring types of other charges, may vary, and depend be displayed. Percentile scores are used to compare each company to all

on such factors as industry practice, analyst judgment, and the extent to other companies in the same universe for each model category. The five

which some types of data is disclosed by companies. (six) model category scores are then weighted and rolled up into a single

percentile ranking for that company. For reports containing quantitative

S&P Capital IQ Core Earnings- S&P Capital IQ Core Earnings is a uniform

recommendations refer to the Glossary section of the report for detailed

methodology for adjusting operating earnings by focusing on a company’s

methodology and the definition of Quantitative rankings.

after-tax earnings generated from its principal businesses. Included in the

definition are employee stock option grant expenses, pension costs, re- STARS Stock Reports and Quantitative Stock Reports:

structuring charges from ongoing operations, write-downs of depreciable The methodologies used in STARS Stock Reports and Quantitative Stock

or amortizable operating assets, purchased research and development, Reports (collectively, the “S&P Capital IQ Research Reports” or “Research

M&A related expenses and unrealized gains/losses from hedging Reports”) reflect different criteria, assumptions and analytical methods and

activities. Excluded from the definition are pension gains, impairment of may have differing recommendations.

goodwill charges, gains or losses from asset sales, reversal of prior-year The methodologies and data used to generate the different types of

charges and provision from litigation or insurance settlements. Research Reports are believed by the author and distributor reasonable

S&P Capital IQ 12-Month Target Price – The equity analyst’s projection and appropriate. Generally, CFRA does not generate reports with different

of the market price that a given security will command 12 months hence, ranking methodologies for the same issuer. However, in the event that

based on a combination of intrinsic, relative, and private market valuation different methodologies or data are used on the analysis of an issuer, the

metrics. Analysts may also review other proprietary inputs in determining methodologies may lead to different views or recommendations on the

target price. issuer, which may at times result in contradicting assessments of an issuer.

S&P Capital IQ Equity Research – S&P Capital IQ Equity Research is CFRA reserves the right to alter, replace or vary models, methodologies or

produced and distributed by Accounting Research & Analytics, LLC d/b/a assumptions from time to time and without notice to clients.

CFRA (“CFRA US”). Certain research is distributed by CFRA UK Limited

(together with CFRA US, “CFRA”). Certain research is produced by STARS Stock Reports:

Standard & Poor’s Malaysia Sdn. Bhd (“S&P Malaysia”) under contract

Global STARS Distribution as of September 30, 2016

to CFRA US. S&P CAPITAL IQ™ is used under license. The owner of this

trademark is S&P Global Inc. or its affiliate, which are not affiliated with

Ranking North Europe Asia Global

CFRA or the author of this content.

America

Abbreviations Used in S&P Capital IQ Equity Research Reports

CAGR- Compound Annual Growth Rate; CAPEX- Capital Expenditures; Buy 25.00% 29.27% 16.13% 24.57%

CY- Calendar Year; DCF- Discounted Cash Flow; DDM– Dividend Discount

Model; EBIT- Earnings Before Interest and Taxes; EBITDA - Before Hold 50.63 53.66 77.42 54.74

Interest, Taxes, Depreciation and Amortization; EPS- Earnings Per Share;

Sell 24.37 17.07 6.45 20.69

EV- Enterprise Value; FCF- Free Cash Flow; FFO- Funds From Operations;

FY- Fiscal Year; P/E- Price/Earnings; P/NAV- Price to Net Asset Value; PEG

Total 100.0% 100.0% 100.0% 100.0%

Ratio- P/E-to-Growth Ratio; PV- Present Value; R&D- Research &

Development; ROCE- Return on Capital Employed; ROE- Return on Equity;

ROI- Return on Investment; ROIC- Return on Invested Capital; ROA- Analyst Certification

Return on Assets; SG&A- Selling, General & Administrative Expenses; STARS Stock Reports are prepared by the equity research analysts of

SOTP- Sum-Of-The-Parts; WACC-Weighted Average Cost of Capital CFRA and S&P Malaysia, under contract to CFRA. All of the views

Dividends on American Depository Receipts (ADRs) and American expressed in STARS Stock Reports accurately reflect the research

Depository Shares (ADSs) are net of taxes (paid in the country of origin). analyst’s personal views regarding any and all of the subject securities or

S&P Capital IQ Qualitative Risk Assessment. Reflects an equity analyst’s issuers. Analysts generally update stock reports at least four times each

view of a given company’s operational risk, or the risk of a firm’s ability to year. No part of analyst, CFRA, or S&P Malaysia compensation was, is, or

continue as an ongoing concern. The S&P Capital IQ Qualitative Risk will be directly or indirectly related to the specific recommendations or

Assessment is a relative ranking to the S&P U.S. STARS universe, and views expressed in a STARS Stock Report.

should be reflective of risk factors related to a company’s operations, as

Redistribution or reproduction is prohibited without written permission. Copyright © 2016 CFRA.

All trademarks mentioned herein belong to their respective owners.

Stock Report | 7-January-2017 | Ticker: SKFB SS

SKF

General Disclaimers

Notice to all jurisdictions:

Where Research Reports are made available in a language other than English and in the case of

inconsistencies between the English and translated versions of a Research Report, the English version will

control and supersede any ambiguities associated with any part or section of a Research Report that

has been issued in a foreign language. Neither CFRA nor its affiliates guarantee the accuracy of the

translation.

The content of this report and the opinions expressed herein are those of CFRA based upon publicly-available

information that CFRA believes to be reliable and the opinions are subject to change without notice. This analysis

has not been submitted to, nor received approval from, the United States Securities and Exchange Commission or

any other regulatory body. While CFRA exercised due care in compiling this analysis, CFRA AND ALL RELATED

ENTITIES SPECIFICALLY DISCLAIM ALL WARRANTIES, EXPRESS OR IMPLIED, to the full extent permitted by law,

regarding the accuracy, completeness, or usefulness of this information and assumes no liability with respect to

the consequences of relying on this information for investment or other purposes. No content (including ratings,

credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part

thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or

stored in a database or retrieval system, without the prior written permission of CFRA. The Content shall not be

used for any unlawful or unauthorized purposes. CFRA and any third-party providers, as well as their directors,

officers, shareholders, employees or agents do not guarantee the accuracy, completeness, timeliness or

availability of the Content.

Past performance is not necessarily indicative of future results. This document may contain

forward-looking statements or forecasts; such forecasts are not a reliable indicator of future performance.

This report is not intended to, and does not, constitute an offer or solicitation to buy and sell securities or engage in

any investment activity. This report is for informational purposes only. Recommendations in this report are not

made with respect to any particular investor or type of investor. Securities, financial instruments or strategies

mentioned herein may not be suitable for all investors and this material is not intended for any specific investor and

does not take into account an investor’s particular investment objectives, financial situations or needs. Before

acting on any recommendation in this material, you should consider whether it is suitable for your particular

circumstances and, if necessary, seek professional advice.

Additional information on a subject company may be available upon request.

CFRA’s financial data provider is S&P Global Market Intelligence. THIS DOCUMENT CONTAINS COPYRIGHTED

AND TRADE SECRET MATERIAL DISTRIBUTED UNDER LICENSE FROM S&P GLOBAL MARKET INTELLIGENCE.

FOR RECIPIENT’S INTERNAL USE ONLY.

The Global Industry Classification Standard (GICS) was developed by and/or is the exclusive property of MSCI,

Inc. and Capital IQ, Inc. (“Capital IQ”). GICS is a service mark of MSCI and Capital IQ and has been licensed for use

by CFRA.

For residents of the European Union/European Economic Area: Research reports are originally distributed

by CFRA UK Limited (company number 08456139 registered in England & Wales with its registered office address

at 131 Edgware Road, London, W2 2AP, United Kingdom). CFRA UK Limited is an Appointed Representative of

Hutchinson Lilley Investments LLP, which is regulated by the UK Financial Conduct Authority (No. 582181).

For residents of Malaysia: Research reports are originally produced and distributed by S&P Malaysia, under

license from CFRA US. S&P Malaysia is regulated by Securities Commission Malaysia (License No. CMSL/

A0181/2007).

For residents of all other countries: Research reports are originally distributed Accounting Research &

Analytics, LLC d/b/a CFRA.

Copyright © 2016 CFRA. All rights reserved.

CFRA, the CFRA inverted pyramid logo, and STARS are registered trademarks of CFRA.

Redistribution or reproduction is prohibited without written permission. Copyright © 2016 CFRA.

All trademarks mentioned herein belong to their respective owners.

Вам также может понравиться

- Adobe Systems Inc: Stock Report - August 12, 2017 - NNM Symbol: ADBE - ADBE Is in The S&P 500Документ9 страницAdobe Systems Inc: Stock Report - August 12, 2017 - NNM Symbol: ADBE - ADBE Is in The S&P 500Santi11052009Оценок пока нет

- Goldman Sachs Group Inc (The) : Stock Report - September 24, 2016 - NYS Symbol: GS - GS Is in The S&P 500Документ11 страницGoldman Sachs Group Inc (The) : Stock Report - September 24, 2016 - NYS Symbol: GS - GS Is in The S&P 500derek_2010Оценок пока нет

- S&P - AbxДокумент11 страницS&P - Abxderek_2010Оценок пока нет

- Reports CRMДокумент11 страницReports CRMderek_2010Оценок пока нет

- Reports F SLRДокумент11 страницReports F SLRderek_2010Оценок пока нет

- ExpeditorsДокумент11 страницExpeditorsderek_2010100% (1)

- Screenshot 2023-03-07 at 10.17.13 PMДокумент3 страницыScreenshot 2023-03-07 at 10.17.13 PMmanojmarri007Оценок пока нет

- Old Mutual Albaraka Balanced Fund: Fund Information Fund Performance As at 31/08/2021Документ2 страницыOld Mutual Albaraka Balanced Fund: Fund Information Fund Performance As at 31/08/2021Sam AbdurahimОценок пока нет

- Alphabet Inc: Stock Report - October 6, 2015 - NNM Symbol: GOOGL - GOOGL Is in The S&P 500Документ11 страницAlphabet Inc: Stock Report - October 6, 2015 - NNM Symbol: GOOGL - GOOGL Is in The S&P 500derek_2010Оценок пока нет

- Reports GGДокумент11 страницReports GGderek_2010Оценок пока нет

- Options As A Strategic Investment PDFДокумент5 страницOptions As A Strategic Investment PDFArjun Bora100% (1)

- RWC Global Emerging Equity Fund: 30th June 2020Документ2 страницыRWC Global Emerging Equity Fund: 30th June 2020Nat BanyatpiyaphodОценок пока нет

- DSP Mid Cap Fund Aug 2023Документ7 страницDSP Mid Cap Fund Aug 2023RajОценок пока нет

- RBC - ARCC - Revision - 3Q20 Review - 13 PagesДокумент13 страницRBC - ARCC - Revision - 3Q20 Review - 13 PagesSagar PatelОценок пока нет

- Apr 20, 2018 AtlassianCorporationPlc TEAMVeryGood, AgainstGreatExpectationsДокумент9 страницApr 20, 2018 AtlassianCorporationPlc TEAMVeryGood, AgainstGreatExpectationsPradeep RaghunathanОценок пока нет

- OMAlbaraka Equity FundДокумент2 страницыOMAlbaraka Equity FundArdine FickОценок пока нет

- SCHW - ZackДокумент10 страницSCHW - ZackJessyОценок пока нет

- NESTLE BHD Financial Analysis: Group 4Документ14 страницNESTLE BHD Financial Analysis: Group 4Ct TanОценок пока нет

- Kossan Rubber Industries Berhad :FY09 Core Earnings Surged 62% YoY, Beating Estimates - 01/03/2010Документ3 страницыKossan Rubber Industries Berhad :FY09 Core Earnings Surged 62% YoY, Beating Estimates - 01/03/2010Rhb InvestОценок пока нет

- OMAlbaraka Balanced FundДокумент2 страницыOMAlbaraka Balanced FundArdine FickОценок пока нет

- Return On Invested Capital (ROIC)Документ4 страницыReturn On Invested Capital (ROIC)VinodSinghОценок пока нет

- SBI initiates coverage with performer ratingДокумент20 страницSBI initiates coverage with performer ratingPraharsh SinghОценок пока нет

- HSBC Holdings PLCДокумент9 страницHSBC Holdings PLCAnonymous P73cUg73LОценок пока нет

- Patel Brijeshkumar MukeshbhaiДокумент23 страницыPatel Brijeshkumar MukeshbhaiBhaskar NapteОценок пока нет

- UTI Large Cap Fund (Formerly UTI Mastershare Unit Scheme)Документ28 страницUTI Large Cap Fund (Formerly UTI Mastershare Unit Scheme)rinkuparekh13Оценок пока нет

- Monthly investment update for Pure Stock Fund in December 2022Документ11 страницMonthly investment update for Pure Stock Fund in December 2022Rakesh Dey sarkarОценок пока нет

- Initiating Coverage by JefferiesДокумент42 страницыInitiating Coverage by JefferiesSumantha SahaОценок пока нет

- Old Mutual Top 40 Index Fund: Fund Information Fund Performance As at 31/12/2021Документ2 страницыOld Mutual Top 40 Index Fund: Fund Information Fund Performance As at 31/12/2021Ardine FickОценок пока нет

- DSP Small Cap Fund Aug 2023Документ7 страницDSP Small Cap Fund Aug 2023RajОценок пока нет

- Old Mutual Albaraka Equity Fund: Fund Information Fund Performance As at 31/08/2021Документ2 страницыOld Mutual Albaraka Equity Fund: Fund Information Fund Performance As at 31/08/2021Sam AbdurahimОценок пока нет

- EMBRAC.B - RedEyeДокумент16 страницEMBRAC.B - RedEyeJacksonОценок пока нет

- Apr 18, 2018 AtlassianCorporationPlc TEAMThoughtsAheadoftheQuarterPositiveFundamentals, RaisingTargetPriceДокумент10 страницApr 18, 2018 AtlassianCorporationPlc TEAMThoughtsAheadoftheQuarterPositiveFundamentals, RaisingTargetPricePradeep RaghunathanОценок пока нет

- Spandana Sphoorty - Stock Update - 010124Документ11 страницSpandana Sphoorty - Stock Update - 010124sapguru.inОценок пока нет

- First Resources Limited Berhad: Exponential Earnings Growth at Inexpensive - 3/6/2010Документ8 страницFirst Resources Limited Berhad: Exponential Earnings Growth at Inexpensive - 3/6/2010Rhb InvestОценок пока нет

- BTG Pactual JBSДокумент7 страницBTG Pactual JBSRodolphe JoveОценок пока нет

- For those who play to win moreДокумент4 страницыFor those who play to win moreABCОценок пока нет

- Allianz SE ResearchДокумент17 страницAllianz SE Researchphilip davisОценок пока нет

- ZENSARTECH StockReport 20240123 0818Документ13 страницZENSARTECH StockReport 20240123 0818Proton CongoОценок пока нет

- Bonesupport q4 Uncalled Share Drop Gives Attractive Entry Points 2024-02-16Документ17 страницBonesupport q4 Uncalled Share Drop Gives Attractive Entry Points 2024-02-16Antonio Rodríguez de la TorreОценок пока нет

- New O/W: Back To The Future: Countplus (CUP)Документ6 страницNew O/W: Back To The Future: Countplus (CUP)Muhammad ImranОценок пока нет

- FSD CH0497631082 SWC CH enДокумент6 страницFSD CH0497631082 SWC CH enshuzefaОценок пока нет

- Equinix, Inc.: Neutral/ModerateДокумент19 страницEquinix, Inc.: Neutral/ModerateashishkrishОценок пока нет

- Aberdeen Standard Global Emerging Markets Fund: Key Facts ObjectiveДокумент4 страницыAberdeen Standard Global Emerging Markets Fund: Key Facts ObjectiveMiknoos PutinОценок пока нет

- Eastern Pacific Industrial Corporation Berhad: No Surprises - 27/04/2010Документ3 страницыEastern Pacific Industrial Corporation Berhad: No Surprises - 27/04/2010Rhb InvestОценок пока нет

- Bfund Fund Fact Sheet For July - 2017Документ1 страницаBfund Fund Fact Sheet For July - 2017Quofi SeliОценок пока нет

- VBL StockReport 20230907 1553Документ14 страницVBL StockReport 20230907 1553Sangeethasruthi SОценок пока нет

- Etf Wealth RCH 0416fДокумент2 страницыEtf Wealth RCH 0416fMatt EbrahimiОценок пока нет

- Muthoot Finance Pick of the Week ResearchДокумент10 страницMuthoot Finance Pick of the Week ResearchPuneet367Оценок пока нет

- Kinsteel Berhad: in Line Anticipating Weaker 2H-26/05/2010Документ3 страницыKinsteel Berhad: in Line Anticipating Weaker 2H-26/05/2010Rhb InvestОценок пока нет

- XYZ Financial ModelДокумент278 страницXYZ Financial Modelhema.navaniОценок пока нет

- HKTVmall Proposal - S001 ProposalДокумент37 страницHKTVmall Proposal - S001 Proposalas7Оценок пока нет

- Factsheet - Feb 2023Документ2 страницыFactsheet - Feb 2023Vinh NguyenОценок пока нет

- OKE - ArgusДокумент5 страницOKE - ArgusJeff SturgeonОценок пока нет

- Birla Sun Life MNC FundДокумент1 страницаBirla Sun Life MNC Fundellyacool2319Оценок пока нет

- Texchem Resources Berhad: Below Expectations - 01/03/2010Документ3 страницыTexchem Resources Berhad: Below Expectations - 01/03/2010Rhb InvestОценок пока нет

- INF204K01HY3 - Reliance Smallcap FundДокумент1 страницаINF204K01HY3 - Reliance Smallcap FundKiran ChilukaОценок пока нет

- Qatar Electric Water Co 05oct11Документ24 страницыQatar Electric Water Co 05oct11xtrooz abiОценок пока нет

- MFS U.S. Growth Segregated FundДокумент1 страницаMFS U.S. Growth Segregated Fundarrow1714445dongxinОценок пока нет

- VAM World Growth B Fund Fact Sheet - April 2020Документ3 страницыVAM World Growth B Fund Fact Sheet - April 2020Ian ThaiОценок пока нет

- Irb Needle Roller Bearings 2016Документ6 страницIrb Needle Roller Bearings 2016grupa2904Оценок пока нет

- Ariete Multi Vapor Compact 4146Документ2 страницыAriete Multi Vapor Compact 4146grupa2904Оценок пока нет

- Irb Ball Joints 2016Документ1 245 страницIrb Ball Joints 2016Paulo Antonio Mora RojasОценок пока нет

- BR5 015 Link Belt S Series Intermediate Duty Ball Bearings FAQs Product SheetДокумент4 страницыBR5 015 Link Belt S Series Intermediate Duty Ball Bearings FAQs Product Sheetgrupa2904Оценок пока нет

- Why Choose Rexnord?: Valuable ExpertiseДокумент4 страницыWhy Choose Rexnord?: Valuable Expertisegrupa2904Оценок пока нет

- GBC About News Jun2011 r5Документ6 страницGBC About News Jun2011 r5grupa2904Оценок пока нет

- Inch Series Ball BearingsДокумент1 страницаInch Series Ball Bearingsgrupa2904Оценок пока нет

- Why Choose Rexnord?: Valuable ExpertiseДокумент4 страницыWhy Choose Rexnord?: Valuable Expertisegrupa2904Оценок пока нет

- Slide Bearing For Electricar Machines BrochureДокумент6 страницSlide Bearing For Electricar Machines BrochureGabriel BolívarОценок пока нет

- Renk Slide Bearings Foot Mounted ER EG 34-45 SizesДокумент8 страницRenk Slide Bearings Foot Mounted ER EG 34-45 Sizesgrupa2904Оценок пока нет

- BR5 014 Link Belt S, W Series Intermediate Duty Ball Bearings Product SheetДокумент2 страницыBR5 014 Link Belt S, W Series Intermediate Duty Ball Bearings Product Sheetgrupa2904Оценок пока нет

- Renk Slide Bearings Type GДокумент6 страницRenk Slide Bearings Type Ggrupa2904Оценок пока нет

- 1046311Документ6 страниц1046311Jose Antonio VazquezОценок пока нет

- BR5 013 Link Belt Klean Gard Ball Bearings FAQs Product SheetДокумент4 страницыBR5 013 Link Belt Klean Gard Ball Bearings FAQs Product Sheetgrupa2904Оценок пока нет

- Innovative Power Transmission Slide BearingsДокумент6 страницInnovative Power Transmission Slide BearingsharosalesvОценок пока нет

- SKF Tih220m ManualДокумент116 страницSKF Tih220m Manualgrupa2904Оценок пока нет

- Renk Slide Bearings Type HGДокумент4 страницыRenk Slide Bearings Type HGgrupa2904Оценок пока нет

- Renk Slide Bearings Type EFДокумент6 страницRenk Slide Bearings Type EFgrupa2904100% (1)

- NTN Wireless Linear Measuring SystemДокумент12 страницNTN Wireless Linear Measuring Systemgrupa2904Оценок пока нет

- RENK Slide Bearings Type EДокумент20 страницRENK Slide Bearings Type Eagnostic0750% (2)

- 3/14/2012 Quote Tabulation (09/12/2011) Page 1 of 1Документ1 страница3/14/2012 Quote Tabulation (09/12/2011) Page 1 of 1grupa2904Оценок пока нет

- SKF Standard Jaw Pullers TMMP MROДокумент2 страницыSKF Standard Jaw Pullers TMMP MROgrupa2904Оценок пока нет

- NTN Linear Axis NewsДокумент54 страницыNTN Linear Axis Newsgrupa2904Оценок пока нет

- Link Pumps Equipment Datasheet: Pump Number: PCE736Документ2 страницыLink Pumps Equipment Datasheet: Pump Number: PCE736grupa2904Оценок пока нет

- NTN Linear ModulesДокумент136 страницNTN Linear Modulesgrupa2904Оценок пока нет

- NTN Linear Ball BushingsДокумент84 страницыNTN Linear Ball Bushingsgrupa2904Оценок пока нет

- NTN Linear Axis RangeДокумент2 страницыNTN Linear Axis Rangegrupa2904Оценок пока нет

- SKF Standard Jaw Pullers TMMP MROДокумент2 страницыSKF Standard Jaw Pullers TMMP MROgrupa2904Оценок пока нет

- Timken Dial IndicatorДокумент2 страницыTimken Dial Indicatorgrupa2904Оценок пока нет

- Timken Induction Heater VHIN900Документ2 страницыTimken Induction Heater VHIN900grupa2904Оценок пока нет

- Tire City Case AnalysisДокумент10 страницTire City Case AnalysisVASANTADA SRIKANTH (PGP 2016-18)Оценок пока нет

- Fi32rk14 LR PDFДокумент44 страницыFi32rk14 LR PDFGina JamesОценок пока нет

- تمارين +الحل اداريةДокумент14 страницتمارين +الحل اداريةaec216320136Оценок пока нет

- Chapter 11 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Документ141 страницаChapter 11 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais Azeemi67% (3)

- DocumentДокумент26 страницDocumentLorraine Miralles33% (3)

- CAPE Accounting MCQДокумент10 страницCAPE Accounting MCQBradlee Singh100% (1)

- Income Statement: Case 1: RevenuesДокумент3 страницыIncome Statement: Case 1: RevenuesRajivОценок пока нет

- TOA Midterm Exam 2010Документ22 страницыTOA Midterm Exam 2010Patrick WaltersОценок пока нет

- Installment Liquidation Cash Priority ProgramsДокумент9 страницInstallment Liquidation Cash Priority ProgramsAtarom9Оценок пока нет

- Assignment On GAAP, AccountingДокумент7 страницAssignment On GAAP, AccountingAsma Hameed50% (2)

- Test Bank For Structure and Function of The Body 14th Edition ThibodeauДокумент24 страницыTest Bank For Structure and Function of The Body 14th Edition ThibodeauJamesNewmanazpy100% (27)

- Preparing SFP from Trial BalanceДокумент11 страницPreparing SFP from Trial BalanceRance Gerwyn OpialaОценок пока нет

- FAR q1q2Документ7 страницFAR q1q2Leane MarcoletaОценок пока нет

- Plantillas Excel Vio - IiДокумент29 страницPlantillas Excel Vio - IiEduardo Lopez-vegue DiezОценок пока нет

- 002 MAS FS Analysis Rev00 PDFДокумент5 страниц002 MAS FS Analysis Rev00 PDFCyvee Joy Hongayo OcheaОценок пока нет

- Project Report of RILДокумент53 страницыProject Report of RILeakta100% (4)

- Preliminary Income Statement and Balance Sheet for Accounting RecordsДокумент35 страницPreliminary Income Statement and Balance Sheet for Accounting RecordsRomee SinghОценок пока нет

- Appendic 5C-1 - Summarized Disclosure ChecklistДокумент8 страницAppendic 5C-1 - Summarized Disclosure ChecklistLuis Enrique Altamar RamosОценок пока нет

- PT Gajah Tunggal Tbk Financial Risk Analysis 2016-2020Документ26 страницPT Gajah Tunggal Tbk Financial Risk Analysis 2016-2020Ananda LukmanОценок пока нет

- PT Semen Indonesia Q1 2019 Consolidated Financial StatementsДокумент191 страницаPT Semen Indonesia Q1 2019 Consolidated Financial StatementsIka WinantiОценок пока нет

- Collectibles Spreadsheet AnswerДокумент26 страницCollectibles Spreadsheet Answeremre8506Оценок пока нет

- CH 13Документ45 страницCH 13Licia SalimОценок пока нет

- 11 Accountancy t2 Sp01Документ19 страниц11 Accountancy t2 Sp01Lakshy BishtОценок пока нет

- Admission of A New PartnerДокумент36 страницAdmission of A New PartnerSreekanth DogiparthiОценок пока нет

- Kotler SummaryДокумент27 страницKotler Summaryshriya2413Оценок пока нет

- Responsibility Accounting SystemДокумент13 страницResponsibility Accounting SystemTsundere DoradoОценок пока нет

- CH 2 - Financial Statements For Decision MakingДокумент38 страницCH 2 - Financial Statements For Decision MakingAwais JavedОценок пока нет

- Chapter 16-Financial Statement Analysis: Multiple ChoiceДокумент19 страницChapter 16-Financial Statement Analysis: Multiple ChoiceRodОценок пока нет

- Fair Value Measurement and ReportingДокумент79 страницFair Value Measurement and ReportingMai TrầnОценок пока нет

- Basic MasДокумент5 страницBasic MasLycka Bernadette MarceloОценок пока нет