Академический Документы

Профессиональный Документы

Культура Документы

May Salary PDF

Загружено:

omkassОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

May Salary PDF

Загружено:

omkassАвторское право:

Доступные форматы

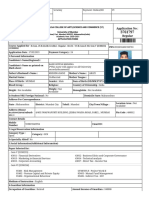

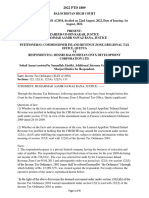

Infinx Services Pvt Ltd

Pay Slip for the month of May-2018

Employee Code : INFX01575 Payable Days : 31.00

Name : Mr. Omkar Sakharam Kotwadekar LWP : 0.00

Department : Pre-Authorization Mahape Arrear Days : 30.00

Designation : Pre Auth Analyst Bank Ac No. : '309002610621 (RATNAKAR BANK LIMITED)

PAN : BWKPK5618K PF No. : MH/42842/MH/42842/4425

Esi No. : 3413635153 UAN No. : 100944954723

Date Of Joining : 23 Sep 2016 Old Employee Id : N1065

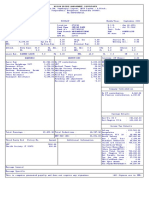

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Consolidated Salary 9364.00 9364.00 308.00 9672.00 PF 1161.00

HRA 468.00 468.00 15.00 483.00 PROF. TAX 200.00

Education Allowance 0.00 0.00 -200.00 -200.00

Conveyance Allowance 0.00 0.00 -1600.00 -1600.00

PLVP 2000.00 0.00 2000.00

Special Allowance 12787.00 12787.00 2924.00 15711.00

Variable 5000.00 0.00 5000.00

GROSS EARNINGS 22619.00 29619.00 1447.00 31066.00 GROSS DEDUCTIONS 1361.00

Net Pay : 29,705.00

Net Pay in words : INR Twenty Nine Thousand Seven Hundred Five Only

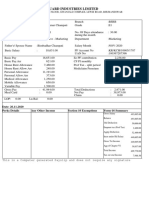

Income Tax Worksheet for the Period April 2018 - March 2019(Proposed Investments)

Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA Calculation(NON-METRO)

Consolidated Salary 112222.00 0.00 112222.00 Investments u/s 80C Exempted Qualifying Rent Paid 0.00

HRA 5609.00 0.00 5609.00 PROVIDENT FUND 13484.80 150000.00 From 01/04/2018

Education Allowance -3.00 0.00 -3.00 To 31/03/2019

Conveyance Allowance -26.00 0.00 -26.00 1. Actual HRA 5609.00

PLVP 3500.00 0.00 3500.00 2. 40% or 50% of Basic 44889.00

Special Allowance 153285.00 0.00 153285.00 3. Rent - 10% Basic 0.00

Variable 5000.00 0.00 5000.00 Least of above is exempt 0.00

Taxable HRA 5609.00

Gross 279587.00 0.00 279587.00 Total of Investments u/s 80C 13484.80 150000.00 TDS Deducted Monthly

Deductions U/S 80C 13484.80 150000.00 Month Amount

Previous Employer Taxable Income 0.00 Total of Ded Under Chapter VI-A 13484.80 150000.00 April-2018 0.00

Professional Tax 2500.00 May-2018 0.00

Under Chapter VI-A 13484.80 Tax Deducted on Perq. 0.00

Standard Deduction 40000.00 Total 0.00

Any Other Income 0.00

Taxable Income 223600.00

Total Tax 0.00

Marginal Relief 0.00

Tax Rebate 0.00

Surcharge 0.00

Tax Due 0.00

Educational Cess 0.00

Net Tax 0.00

Tax Deducted (Previous Employer) 0.00

Tax Deducted on Perq. 0.00

Tax Deducted on Any Other Income. 0.00

Tax Deducted Till Date 0.00

Tax to be Deducted 0.00

Tax/Month 0.00 Total of Any Other Income 0.00

Tax on Non-Recurring Earnings 0.00

Tax Credit Amount (87A) 0.00

Tax Deduction for this month 0.00

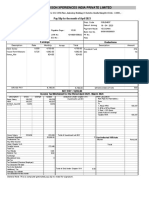

..................................................... Cut Here .....................................................

Personal Note: This is a system generated payslip, does not require any signature.

Вам также может понравиться

- Pay Slip BSNLДокумент1 страницаPay Slip BSNLJohn FernendiceОценок пока нет

- Government of Telangana: PAYSLIP:-DEC-2020Документ2 страницыGovernment of Telangana: PAYSLIP:-DEC-2020Raghavendra BiduruОценок пока нет

- Indiabulls Securities LimitedДокумент1 страницаIndiabulls Securities Limitedraj200224Оценок пока нет

- Jan18 PDFДокумент1 страницаJan18 PDFomkassОценок пока нет

- April2018 PDFДокумент1 страницаApril2018 PDFomkassОценок пока нет

- Salary SlipДокумент1 страницаSalary SlipPhagun BehlОценок пока нет

- March Salary PDFДокумент1 страницаMarch Salary PDFomkassОценок пока нет

- Dec07 PDFДокумент1 страницаDec07 PDFomkassОценок пока нет

- 157salaryslip g5sxl3g6Документ1 страница157salaryslip g5sxl3g6Shakti NaikОценок пока нет

- SRL Limited: Payslip For The Month of JANUARY 2019Документ1 страницаSRL Limited: Payslip For The Month of JANUARY 2019Giri PriyaОценок пока нет

- Salary SlipДокумент1 страницаSalary SlipAnkit SinghОценок пока нет

- Unknown PDFДокумент2 страницыUnknown PDFbijoytvknrОценок пока нет

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Документ2 страницыHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971sumit keshriОценок пока нет

- UnknownДокумент1 страницаUnknownAnji BaduguОценок пока нет

- October 2021Документ1 страницаOctober 2021Zaynn17Оценок пока нет

- PayslipSalary Slips - 9-2020 PDFДокумент1 страницаPayslipSalary Slips - 9-2020 PDFSukant ChampatiОценок пока нет

- Form PDFДокумент2 страницыForm PDFSuresh DoosaОценок пока нет

- Tybfm Imp FormДокумент2 страницыTybfm Imp FormHitesh BaneОценок пока нет

- December (Subho) 21Документ1 страницаDecember (Subho) 21Zaynn17Оценок пока нет

- Sal Jan18 PDFДокумент1 страницаSal Jan18 PDFRaghava SharmaОценок пока нет

- UnknownДокумент1 страницаUnknownBSNL BBOVERWIFIОценок пока нет

- Tata Business Support Services LTD: 00150785 Amir KhanДокумент2 страницыTata Business Support Services LTD: 00150785 Amir KhanAamir KhanОценок пока нет

- 322 PartaДокумент2 страницы322 Partaritik tiwariОценок пока нет

- PayslipДокумент6 страницPayslipmohamed arabathОценок пока нет

- Payslip 6 2018.pdf-Jun-2018Документ1 страницаPayslip 6 2018.pdf-Jun-2018Chetan B RaoОценок пока нет

- Pay Slip Shamim Pay SlipДокумент2 страницыPay Slip Shamim Pay SlipArbaaz KhanОценок пока нет

- Salary Slip OctДокумент1 страницаSalary Slip OctRahul RajawatОценок пока нет

- Slip PDFДокумент1 страницаSlip PDFPratikDuttaОценок пока нет

- SalarySlipwithTaxDetailsДокумент2 страницыSalarySlipwithTaxDetailsN Quinton SinghОценок пока нет

- 175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHДокумент1 страница175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHshamb2020Оценок пока нет

- Employee Details Payment & Leave Details: Arrears Current AmountДокумент1 страницаEmployee Details Payment & Leave Details: Arrears Current AmountJyotirmay SahuОценок пока нет

- PaySlip 0013 Uppu Manjunath May-2020Документ1 страницаPaySlip 0013 Uppu Manjunath May-2020uppu manjunathОценок пока нет

- Kelly PayslipДокумент1 страницаKelly PayslipadtyshkhrОценок пока нет

- November Pay 1111ssДокумент2 страницыNovember Pay 1111ssHanish MeenaОценок пока нет

- Sandy Jan PayslipДокумент1 страницаSandy Jan PayslipJoginderОценок пока нет

- Amazon Development Center India Pvt. LTD: Akash SatputeДокумент2 страницыAmazon Development Center India Pvt. LTD: Akash SatputepyОценок пока нет

- Payslip For The Month of May 2020: Earnings DeductionsДокумент1 страницаPayslip For The Month of May 2020: Earnings DeductionsRОценок пока нет

- SettlementReportДокумент1 страницаSettlementReportSarath KumarОценок пока нет

- PayslipSalary Slips - 11-2020-1 PDFДокумент1 страницаPayslipSalary Slips - 11-2020-1 PDFSukant ChampatiОценок пока нет

- Servlet ControllerДокумент1 страницаServlet ControllerYashasvi GuptaОценок пока нет

- PavanДокумент1 страницаPavanPavan KumarОценок пока нет

- Payslip For MarchДокумент1 страницаPayslip For Marchomkass100% (1)

- RTPCR BillДокумент1 страницаRTPCR BillSIVA SANTHOSHОценок пока нет

- PaySlip 11 2023Документ1 страницаPaySlip 11 2023Sujoy GhoshalОценок пока нет

- Arun Kumar Salary 2019-10Документ1 страницаArun Kumar Salary 2019-10Rizwan AhmadОценок пока нет

- Bill of Supply For Electricity: Due DateДокумент1 страницаBill of Supply For Electricity: Due DateMahamОценок пока нет

- SalarySlipwithTaxDetails PDFДокумент1 страницаSalarySlipwithTaxDetails PDFRahul mishraОценок пока нет

- S - SF - RECEIPT (1) Tution FeeДокумент1 страницаS - SF - RECEIPT (1) Tution FeeDjango DcОценок пока нет

- Salary Slip AugustДокумент1 страницаSalary Slip AugustRonakJainОценок пока нет

- UpdhayДокумент1 страницаUpdhaySTAR POWERZ LUCKNOW MANISHОценок пока нет

- August 2021Документ1 страницаAugust 2021Zaynn17Оценок пока нет

- AugustДокумент1 страницаAugustNikhil DubeyОценок пока нет

- India Payslip January 2022Документ1 страницаIndia Payslip January 2022Mir KazimОценок пока нет

- Payslip 5 2021Документ1 страницаPayslip 5 2021Mehraj PashaОценок пока нет

- Sal Slip Feb 2019Документ1 страницаSal Slip Feb 2019pankajОценок пока нет

- October 2020Документ1 страницаOctober 2020Kiaan RaiОценок пока нет

- June Salry PDFДокумент1 страницаJune Salry PDFomkassОценок пока нет

- April Salary PDFДокумент1 страницаApril Salary PDFomkassОценок пока нет

- Mar18 PDFДокумент1 страницаMar18 PDFomkassОценок пока нет

- Pay Slip For The Month of October-2017Документ1 страницаPay Slip For The Month of October-2017omkassОценок пока нет

- July 2017Документ1 страницаJuly 2017omkass100% (1)

- Nov 2017Документ1 страницаNov 2017omkassОценок пока нет

- Pay Slip For The Month of December-2017Документ1 страницаPay Slip For The Month of December-2017omkassОценок пока нет

- April 2017Документ1 страницаApril 2017omkassОценок пока нет

- Employee DataДокумент1 страницаEmployee DataomkassОценок пока нет

- Employee DataДокумент1 страницаEmployee DataomkassОценок пока нет

- Services Marketing BookДокумент314 страницServices Marketing BookMia KhalifaОценок пока нет

- Land Law ProjectДокумент15 страницLand Law ProjectShubhankar ThakurОценок пока нет

- Exercixe1-Consultant PO 1Документ6 страницExercixe1-Consultant PO 1Saima SharifОценок пока нет

- Profits and Types of IncomeДокумент2 страницыProfits and Types of IncomeVera KramarovaОценок пока нет

- Computation of Income of A FirmДокумент6 страницComputation of Income of A FirmKhushbu GuptaОценок пока нет

- Batalec v. Cir, Cta Case No. 8423Документ23 страницыBatalec v. Cir, Cta Case No. 8423annieeelwsОценок пока нет

- Karim InvoiceДокумент1 страницаKarim InvoiceazzedineОценок пока нет

- Commercial Invoice: Exporter/Shipper Importer/ConsigneeДокумент1 страницаCommercial Invoice: Exporter/Shipper Importer/ConsigneePrem ChanderОценок пока нет

- Constellation Software SH Letters (Merged)Документ105 страницConstellation Software SH Letters (Merged)RLОценок пока нет

- Slip Gaji AriesДокумент1 страницаSlip Gaji AriesDaniel Tommy PassarellaОценок пока нет

- 2022 PTD 1889Документ4 страницы2022 PTD 1889Your AdvocateОценок пока нет

- Políticas de ReservaДокумент12 страницPolíticas de Reservafauno_ScribdОценок пока нет

- Duplicate Receipt Dear Aditya Kumar PandeyДокумент1 страницаDuplicate Receipt Dear Aditya Kumar PandeyAdityaОценок пока нет

- Status of Devolution in India: A ReportДокумент64 страницыStatus of Devolution in India: A Reportdebraj1971Оценок пока нет

- Life Insurance Premium Receipt: Personal DetailsДокумент1 страницаLife Insurance Premium Receipt: Personal Detailsnitish rohiraОценок пока нет

- DeKalb FreePress: 06-14-19Документ24 страницыDeKalb FreePress: 06-14-19Donna S. SeayОценок пока нет

- North Carolina Individual Income Tax Instructions: EfileДокумент24 страницыNorth Carolina Individual Income Tax Instructions: EfileQunariОценок пока нет

- Filinvest Development Corporation vs. CIR 529 SCRA 605Документ11 страницFilinvest Development Corporation vs. CIR 529 SCRA 605Clarinda MerleОценок пока нет

- Concepts in Federal Taxation 2017 24th Edition Murphy Solutions Manual 1Документ73 страницыConcepts in Federal Taxation 2017 24th Edition Murphy Solutions Manual 1hiedi100% (35)

- Cost Sheet Class Practice QuestionsДокумент2 страницыCost Sheet Class Practice QuestionsKajal YadavОценок пока нет

- XДокумент2 страницыXSophiaFrancescaEspinosaОценок пока нет

- Individual Income TaxДокумент13 страницIndividual Income TaxGIRLОценок пока нет

- Henry Has The Following Data For The YeaДокумент3 страницыHenry Has The Following Data For The YeaQueen ValleОценок пока нет

- OD225699435265774000Документ2 страницыOD225699435265774000Akshay singh100% (1)

- Price ListДокумент28 страницPrice ListBrandon BarndtОценок пока нет

- Morpheus Proposal PoLL 2Документ12 страницMorpheus Proposal PoLL 2Papers of the Libertarian LeftОценок пока нет

- Standard Apartment Cost Sheet: 24K OpulaДокумент1 страницаStandard Apartment Cost Sheet: 24K OpulaRavi NigamОценок пока нет

- Idaho Maryland Mine ControversyДокумент13 страницIdaho Maryland Mine ControversyEva ZlimenОценок пока нет

- BSC Quiz On Chapters 1&2-2Документ4 страницыBSC Quiz On Chapters 1&2-2Sachin KripalaniОценок пока нет

- Unit 2: Master Budget: An Overall Plan The Fundamentals of BudgetingДокумент11 страницUnit 2: Master Budget: An Overall Plan The Fundamentals of BudgetingbojaОценок пока нет