Академический Документы

Профессиональный Документы

Культура Документы

Election To Stop Contributing To The Canada Pension Plan, or Revocation of A Prior Election

Загружено:

batmanbittuИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Election To Stop Contributing To The Canada Pension Plan, or Revocation of A Prior Election

Загружено:

batmanbittuАвторское право:

Доступные форматы

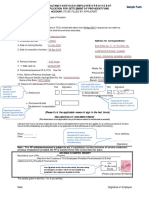

Clear Data Help

Protected B when completed

Election to Stop Contributing to the Canada Pension Plan,

or Revocation of a Prior Election

Use this form if you are an employee who is at least 65 years of age but under 70, you are receiving a Canada Pension Plan (CPP) or Quebec Pension

Plan (QPP) retirement pension, and:

• you are making or will be required to make CPP contributions and you do not want to contribute; or

• you stopped making CPP contributions in a previous year and you want to restart.

Do not use this form:

• if your income is only from self-employment earnings, in which case you should fill out Schedule 8, Canada Pension Plan contributions and overpayment

for 2016, or form RC381, Inter-Provincial Calculation for CPP and QPP Contributions and Overpayments for 2016 instead, and file it with your income tax

and benefit return; or

• if you only contribute to the Quebec Pension Plan. For more information, visit revenuquebec.ca/en.

Go to page 2 for instructions on how to fill out this form and other helpful information.

Part A – Identification

First name and initials Last name Social insurance number

Mailing address: apartment number – street number and name

City Province or territory Postal code Date of Year Month Day

birth

Part B – Eligibility

1. Are you an employee who is at least 65 years of age but under 70? Yes No

2. Are you receiving a CPP or QPP retirement pension? Yes No

If you answered yes to questions 1 and 2, go to question 3 below. If you answered no to either question,

you cannot fill out this form at this time.

3. Have you elected to stop making CPP contributions OR revoked that election so you can restart making Yes No

CPP contributions during this calendar year?

If you answered yes to question 3, you cannot fill out this form until next year.

If you answered no to question 3, fill in Part C to stop making CPP contributions, or Part D to restart making

CPP contributions, whichever applies.

Part C – Election and certification

If you fill out this part, do not fill out Part D.

I do not want to make CPP contributions. I certify that the information given on this election is correct and complete.

Date

Signature of employee Year Month Day

Part D – Revocation and certification

If you fill out this part, do not fill out Part C.

I want to restart making CPP contributions. I certify that the information given on this revocation is correct and complete.

Date

Signature of employee Year Month Day

Personal information is collected under the Income Tax Act to administer tax, benefits, and related programs. It may also be used for any purpose related to the administration or

enforcement of the Act such as audit, compliance and the payment of debts owed to the Crown. It may be shared or verified with other federal, provincial/territorial government

institutions to the extent authorized by law. Failure to provide this information may result in interest payable, penalties or other actions. Under the Privacy Act, individuals have the right

to access their personal information and request correction if there are errors or omissions. Refer to Info Source at cra.gc.ca/gncy/tp/nfsrc/nfsrc-eng.html, Personal Information Bank

CRA PPU 070.

(Vous pouvez obtenir ce formulaire en français à arc.gc.ca/formulaires ou en composant le 1-800-959-7383.)

CPT30 E (16) Page 1 of 2

Clear Data Help

General information When is my election effective?

Who should fill out this form? Your election is effective on the first day of the month after the date

you give a copy of this form to your employer. Your employer should

Fill out this form if you are an employee who is at least 65 years of stop deducting CPP contributions from the first pay in the month

age but under 70, you are receiving a Canada Pension Plan (CPP) after the month you give them a copy of this form. Your employer

or Quebec Pension Plan (QPP) retirement pension, and you are may adjust your CPP contributions if you did not pay the proper

making CPP contributions and would like to stop. amount before the effective date of this election.

You can also fill out this form if you stopped making CPP How long does my election last?

contributions in a previous year and you want to restart.

Your election will stay in effect until you revoke it. You will not have

What income is covered by this choice? to make CPP contributions unless you choose to restart making

them in a later year.

The choice you made will apply to all of your income from

pensionable employment, including self-employment earnings.

Information about restarting

How often can I fill out a CPT30 form? to contribute to the Canada Pension Plan

You can fill out this form only once in a calendar year. Once you file

this form with your employer, you cannot make a change until the How do I restart my CPP contributions?

next calendar year. So, if for example, you elect to stop making CPP

contributions and you give a copy of this completed form to your First, fill out Parts A, B, and if you are eligible, Part D of this form.

employer in the current year, you will have to wait until next year to Do not complete Part C.

file a new form to restart. If you previously filled out this form, go to Promptly give a copy of the form to your employer. If you are working

Part B to see if you are eligible to fill out a new one. If you already or will work for more than one employer, give each employer a copy

sent this form and you need a copy of it, write to us at the address of this completed form.

below.

Keep a copy of the form for your records.

Where do I send the form?

Finally, send the original form to the Winnipeg Tax Centre at the

Send the original to the Canada Revenue Agency at the following address on this page.

address:

When is my revocation effective?

Winnipeg Tax Centre

Specialty Services Section Your revocation to restart making CPP contributions is effective on

66 Stapon Road the first day of the month after the date you give a copy of this form

Winnipeg MB R3C 3M2 to your employer. Your employer will start deducting CPP

contributions from the first pay dated in the month after the month

What if I need help? you signed and dated Part D, as long as you give them enough

notice. Your employer may adjust your CPP contributions if you did

For more information about electing to stop contributing to the CPP, not pay the proper amount after the effective date of this revocation.

revoking the previous election, or using this form,

If you filed your revocation with one employer but delayed giving a

call 1-800-959-8281.

copy to your other employers, your other employers will only start

deducting CPP contributions from the first pay dated in the month

after the month they receive the copy of your form. In such a

Information about stopping situation, you can choose to pay the employer’s share and your

to contribute to the Canada Pension Plan share of CPP contributions. To do this, fill out Form CPT20, Election

to Pay Canada Pension Plan Contributions, and send it with your

How do I stop making CPP contributions? income tax and benefit return or send the completed Form CPT20

separately to your tax centre.

First, fill in Parts A, B, and if you are eligible, Part C of this form.

Do not complete Part D. You must wait until the month in which you How long does my revocation last?

turn 65 years of age before you sign and date the completed form.

When you fill out this form for the first time, the date you write must It will stay in effect until you elect to stop making CPP contributions

be the date you give a copy of the form to your employer. in a later year.

Promptly give a copy of the form to your employer, together with You will have to make CPP contributions until one of these situations

proof of age and proof that you are receiving a CPP or QPP occurs:

retirement pension. If you are working or will work for more than one

employer, give each employer a copy of this completed form. • You file the election form to stop contributing to the CPP, in a

later year.

Keep a copy of the form for yourself so that you can give a copy to • You stop working.

each of your future employers. • You reach 70 years of age.

Finally, send the original form to the Winnipeg Tax Centre at the

address on this page.

Page 2 of 2

Вам также может понравиться

- 104 Places To Find Work-from-Home Proofreading Jobs - July-31-2015Документ58 страниц104 Places To Find Work-from-Home Proofreading Jobs - July-31-2015refurlОценок пока нет

- Six Flag Fatality Lawsuit FilingДокумент93 страницыSix Flag Fatality Lawsuit FilingjeffmosierОценок пока нет

- Credit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!От EverandCredit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!Рейтинг: 1 из 5 звезд1/5 (1)

- Claim ConfirmationДокумент7 страницClaim Confirmationdebra hillОценок пока нет

- How to Enroll in Medicare Health Insurance: Choose a Medicare Part D Drug Plan and a Medicare Supplement PlanОт EverandHow to Enroll in Medicare Health Insurance: Choose a Medicare Part D Drug Plan and a Medicare Supplement PlanОценок пока нет

- ESI & PF Brief InformationДокумент8 страницESI & PF Brief InformationPrashant Dhangar0% (1)

- Employee Provident Fund: Presentation OnДокумент19 страницEmployee Provident Fund: Presentation OnTracey MorinОценок пока нет

- Us W-2 2015 PDFДокумент7 страницUs W-2 2015 PDFkevsОценок пока нет

- Driver's HandbookДокумент156 страницDriver's HandbookbatmanbittuОценок пока нет

- T1 General PDFДокумент4 страницыT1 General PDFbatmanbittuОценок пока нет

- ErgonomicsДокумент9 страницErgonomicsdarkmagician27100% (2)

- Succession PlanningДокумент15 страницSuccession Planningswartiwari100% (1)

- Provident Fund Full DetailsДокумент5 страницProvident Fund Full DetailsGaurav VijayОценок пока нет

- 20 Questions Directors of Not-For-profit Organizations Should Ask About Fiduciary DutyДокумент28 страниц20 Questions Directors of Not-For-profit Organizations Should Ask About Fiduciary DutybatmanbittuОценок пока нет

- Entrepreneursh Ip: Canadian EditionДокумент29 страницEntrepreneursh Ip: Canadian Editionbatmanbittu0% (2)

- Labour Legislation in IndiaДокумент61 страницаLabour Legislation in Indiapentahuse5Оценок пока нет

- Neuber's Rule Accuracy in Predicting Notch Stress-StrainДокумент10 страницNeuber's Rule Accuracy in Predicting Notch Stress-StrainbatmanbittuОценок пока нет

- NestleДокумент18 страницNestleAbdullah Faseh67% (6)

- DMW Citizens Charter 1st Edition CY 2023Документ557 страницDMW Citizens Charter 1st Edition CY 2023Ibrahim AhilОценок пока нет

- The Innovator's DNAДокумент9 страницThe Innovator's DNACiaran O'Leary100% (4)

- Thrift Savings Plan TSP-1-C: Catch-Up Contribution ElectionДокумент2 страницыThrift Savings Plan TSP-1-C: Catch-Up Contribution ElectionIonut NeacsuОценок пока нет

- T1 Schedule 8 CPP PDFДокумент3 страницыT1 Schedule 8 CPP PDFbatmanbittuОценок пока нет

- QC 16161Документ12 страницQC 16161john englishОценок пока нет

- The List of Documents Required For PF and ESI Registration Is Given BelowДокумент63 страницыThe List of Documents Required For PF and ESI Registration Is Given BelowManjinder SinghОценок пока нет

- Application For Refund of Educational Contributions: (VEAP, Chapter 32, Title 38, U.S.C.)Документ2 страницыApplication For Refund of Educational Contributions: (VEAP, Chapter 32, Title 38, U.S.C.)Emette E. MasseyОценок пока нет

- PdataДокумент6 страницPdataRazor11111Оценок пока нет

- Canada Pension Plan Contributions and Overpayment: T1-2021 Schedule 8Документ6 страницCanada Pension Plan Contributions and Overpayment: T1-2021 Schedule 8Greg KnightОценок пока нет

- Return of Income - FaqsДокумент4 страницыReturn of Income - FaqsSushil PrajapatiОценок пока нет

- Frequently Asked Questions Post SurrenderДокумент4 страницыFrequently Asked Questions Post SurrenderAayush BansalОценок пока нет

- Employees' Pension Scheme, 1995 Form 10-C (EPS) : Who Can Apply ?Документ6 страницEmployees' Pension Scheme, 1995 Form 10-C (EPS) : Who Can Apply ?Siji SasidharanОценок пока нет

- CMS40B eДокумент4 страницыCMS40B eDunkMeОценок пока нет

- Proposal Form: Single Life Traditional Plans Full UnderwritingДокумент14 страницProposal Form: Single Life Traditional Plans Full Underwritingankitag612Оценок пока нет

- Kertas Kerja PinjamanДокумент18 страницKertas Kerja PinjamanWan AzmanОценок пока нет

- Contribution Rate Employee (12%)Документ4 страницыContribution Rate Employee (12%)Kiran MettuОценок пока нет

- Direct Rollover and Withholding Form For Lump Sum Pension PaymentsДокумент5 страницDirect Rollover and Withholding Form For Lump Sum Pension PaymentsMichaelMorganОценок пока нет

- Form p50Документ2 страницыForm p50Carlos ResendeОценок пока нет

- P1 WD Document 6Документ16 страницP1 WD Document 6Magda Cruz BarretoОценок пока нет

- Employees' Provident Fund Scheme: (0.18 %)Документ9 страницEmployees' Provident Fund Scheme: (0.18 %)Shubhabrata BanerjeeОценок пока нет

- Election Form and Compensation Reduction Agreement: Sagitec Solutions LLCДокумент2 страницыElection Form and Compensation Reduction Agreement: Sagitec Solutions LLCFinding FannyОценок пока нет

- Redirection of Benefit PaymentДокумент4 страницыRedirection of Benefit PaymentStephanie PrangnellОценок пока нет

- Territory Revenue Office Life Insurance Return: Stamp Duty ActДокумент20 страницTerritory Revenue Office Life Insurance Return: Stamp Duty ActPandurang UpparamaniОценок пока нет

- Wages Payment FormДокумент2 страницыWages Payment Formjiggster1990Оценок пока нет

- Income-Driven Repayment Plan Request How To Complete YourДокумент13 страницIncome-Driven Repayment Plan Request How To Complete YourAnonymous 6jR6DuОценок пока нет

- Faq Income Tax Proof Submission - 2010Документ4 страницыFaq Income Tax Proof Submission - 2010Rajesh JhaОценок пока нет

- TotalEnergies SchemePays Voluntary Notice of Election-2023Документ3 страницыTotalEnergies SchemePays Voluntary Notice of Election-2023Kyle KellyОценок пока нет

- Jobkeeper Employee Nomination Notice: Section AДокумент2 страницыJobkeeper Employee Nomination Notice: Section AAnonymous H8viqHlM3wОценок пока нет

- General Purpose Distribution Request FormДокумент19 страницGeneral Purpose Distribution Request FormWilliamОценок пока нет

- Pradhan Mantri Suraksha Bima YojanaДокумент2 страницыPradhan Mantri Suraksha Bima YojanaRavindra ParmarОценок пока нет

- A. Eligibility and Opting For The Scheme: Quarterly Returns With Monthly Payment SchemeДокумент5 страницA. Eligibility and Opting For The Scheme: Quarterly Returns With Monthly Payment SchemeKushal VermaОценок пока нет

- Advances From AGIF: GeneralДокумент11 страницAdvances From AGIF: GeneralshanksОценок пока нет

- Participant Get Form DocumentДокумент14 страницParticipant Get Form DocumentRonald SandersОценок пока нет

- FaqДокумент5 страницFaqG MОценок пока нет

- Quarterly Returns With Monthly Payment ScheДокумент5 страницQuarterly Returns With Monthly Payment Schebikas kumarОценок пока нет

- Maternity Benefit FormДокумент12 страницMaternity Benefit Formapi-259279833Оценок пока нет

- 67.calculation of Relief Under Sections 89 89AДокумент5 страниц67.calculation of Relief Under Sections 89 89ARaghu SNОценок пока нет

- CHECKLISTДокумент2 страницыCHECKLISTJОценок пока нет

- 2014 Bridging The Gap Colorado ApplicationДокумент2 страницы2014 Bridging The Gap Colorado ApplicationTodd GroveОценок пока нет

- Separation From Employment Withdrawal RequestДокумент28 страницSeparation From Employment Withdrawal Request20210021661Оценок пока нет

- Income Driven Repayment FormДокумент13 страницIncome Driven Repayment Formtumi50Оценок пока нет

- Checklist Form I. Applicant Information.: STD From Regular Board (Yes/No)Документ2 страницыChecklist Form I. Applicant Information.: STD From Regular Board (Yes/No)Tushar patilОценок пока нет

- Bonnie J. Dankanich 2016 NW Canoe PL Seattle WA 98117Документ43 страницыBonnie J. Dankanich 2016 NW Canoe PL Seattle WA 98117Anonymous nIieZAY2y8Оценок пока нет

- Alliance Trust Full Sipp Handbook 2011Документ14 страницAlliance Trust Full Sipp Handbook 2011rohit1000Оценок пока нет

- CPTPA Eligible For Rollover Distribution Form Fillable PDFДокумент12 страницCPTPA Eligible For Rollover Distribution Form Fillable PDFmichael jensenОценок пока нет

- Oracle FAQsДокумент15 страницOracle FAQsjhakanchanjsrОценок пока нет

- Maternity Benefit: What Do I Need To Complete This Application Form?Документ16 страницMaternity Benefit: What Do I Need To Complete This Application Form?Vlad PerjuОценок пока нет

- About This Form: Starter ChecklistДокумент2 страницыAbout This Form: Starter ChecklistcallejerocelesteОценок пока нет

- EPF For Construction WorkersДокумент10 страницEPF For Construction WorkersBIJAY KRISHNA DASОценок пока нет

- DATE: To: FROM: April 6, 2009 Director of A LicensedДокумент29 страницDATE: To: FROM: April 6, 2009 Director of A Licensedapi-26136370Оценок пока нет

- GPF Withdrawal Rules 1960Документ3 страницыGPF Withdrawal Rules 1960BrianОценок пока нет

- PPP Loan Forgiveness Application (Revised 6.16.2020)Документ5 страницPPP Loan Forgiveness Application (Revised 6.16.2020)LaurenОценок пока нет

- Artifact 5a - Guidelines For Filling PF Withdrawal Form TCSДокумент3 страницыArtifact 5a - Guidelines For Filling PF Withdrawal Form TCSAmy Brady100% (3)

- FPF060 Member'sContributionRemittance V01Документ3 страницыFPF060 Member'sContributionRemittance V01christine_balanagОценок пока нет

- GAVL ConcallДокумент3 страницыGAVL ConcallbatmanbittuОценок пока нет

- Essay 1st Draft-CloningДокумент4 страницыEssay 1st Draft-CloningbatmanbittuОценок пока нет

- GAVL Annual ReportДокумент17 страницGAVL Annual ReportbatmanbittuОценок пока нет

- GAVL Annual Report 201Документ17 страницGAVL Annual Report 201batmanbittuОценок пока нет

- Skills Matrix - Pilkington - Mechanical Engineer - Saptarshi DattaДокумент1 страницаSkills Matrix - Pilkington - Mechanical Engineer - Saptarshi DattabatmanbittuОценок пока нет

- History LetterДокумент2 страницыHistory LetterbatmanbittuОценок пока нет

- History RoleplayДокумент3 страницыHistory RoleplaybatmanbittuОценок пока нет

- Energy Drinks-Question: by Shounak DattaДокумент1 страницаEnergy Drinks-Question: by Shounak DattabatmanbittuОценок пока нет

- Cansat Competition Consent and Release FormДокумент1 страницаCansat Competition Consent and Release FormbatmanbittuОценок пока нет

- T778 Child Care Expenses DeductionДокумент4 страницыT778 Child Care Expenses DeductionbatmanbittuОценок пока нет

- T1 Schedule 1 PDFДокумент2 страницыT1 Schedule 1 PDFbatmanbittuОценок пока нет

- Lesson-2 Operating 1010Документ42 страницыLesson-2 Operating 1010batmanbittuОценок пока нет

- The Structure of ArabyДокумент1 страницаThe Structure of ArabybatmanbittuОценок пока нет

- Turn Off Your Phones Close The Lid of Your Laptops No Eating During The Class SessionДокумент19 страницTurn Off Your Phones Close The Lid of Your Laptops No Eating During The Class SessionbatmanbittuОценок пока нет

- Standard Normal Probabilities: Table Entry For Is The Area Under The Standard Normal Curve To The Left ofДокумент2 страницыStandard Normal Probabilities: Table Entry For Is The Area Under The Standard Normal Curve To The Left ofbatmanbittuОценок пока нет

- OAC Poster Saptarshi DattaДокумент1 страницаOAC Poster Saptarshi DattabatmanbittuОценок пока нет

- Blast From The Past: Courier-Journal Coverage of Corbin Factory ExplosionДокумент71 страницаBlast From The Past: Courier-Journal Coverage of Corbin Factory ExplosionMichael LindenbergerОценок пока нет

- CV Mihaela Negrila - HR Business PartnerДокумент4 страницыCV Mihaela Negrila - HR Business Partnermnegrilam2002Оценок пока нет

- Voluntary Self Identification of Disability TemplateДокумент19 страницVoluntary Self Identification of Disability Templateshayan aliОценок пока нет

- Guidelines Low IncomeДокумент48 страницGuidelines Low IncomeLidiaMaciasОценок пока нет

- Evolution of Organizational BehaviourДокумент27 страницEvolution of Organizational BehaviourBlazio M ManoboОценок пока нет

- Upma Sharma Offer LetterДокумент7 страницUpma Sharma Offer LetterKaran KumarОценок пока нет

- Importance of HRIS: A Critical Study On Service and Auto SectorДокумент4 страницыImportance of HRIS: A Critical Study On Service and Auto SectorEditor IJRITCCОценок пока нет

- Bulwark FRДокумент76 страницBulwark FRuniformguy1155Оценок пока нет

- COMPENSATION 1 - Pay Plans - Basic IssuesДокумент48 страницCOMPENSATION 1 - Pay Plans - Basic IssuesArefin Wisea AblagОценок пока нет

- Mind Map - RegulationДокумент1 страницаMind Map - RegulationhafiszulhamzahОценок пока нет

- Restaurant Cover LetterДокумент6 страницRestaurant Cover Letterafaydebwo100% (1)

- HRMДокумент7 страницHRMrunjhunОценок пока нет

- Job Satisfaction of Insurance Company EmployeesДокумент31 страницаJob Satisfaction of Insurance Company EmployeesCaz Tee-NahОценок пока нет

- OT Programme Handbook 2016-17Документ182 страницыOT Programme Handbook 2016-17Alexander León PuelloОценок пока нет

- 1 Evolution of ManagementДокумент56 страниц1 Evolution of ManagementYASH SANJAY.INGLEОценок пока нет

- Professional Safety Experience Update FormДокумент2 страницыProfessional Safety Experience Update FormTissa1969Оценок пока нет

- Environmental Management Course ObjectiveДокумент7 страницEnvironmental Management Course ObjectiveKuriakose JosephОценок пока нет

- Nazmul Islam Final Internship ReportДокумент44 страницыNazmul Islam Final Internship ReportAnika Tasnim HaqueОценок пока нет

- Expatriate Employment Full ReportДокумент32 страницыExpatriate Employment Full ReportRubel MiaОценок пока нет

- E2-Managing Performance at HaierДокумент9 страницE2-Managing Performance at Haiersanthosh_annamОценок пока нет

- Educators File Grievance Over North East ISD ReopeningДокумент3 страницыEducators File Grievance Over North East ISD ReopeningMary Claire PattonОценок пока нет

- Agency 2002Документ162 страницыAgency 2002edtatel73Оценок пока нет