Академический Документы

Профессиональный Документы

Культура Документы

Tayug Rural Bank vs. Central Bank of The Phils 146 SCRA 120 G.R. No. L-46158 Nov. 28, 1986 Facts: Issue

Загружено:

carlo_tabangcuraОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tayug Rural Bank vs. Central Bank of The Phils 146 SCRA 120 G.R. No. L-46158 Nov. 28, 1986 Facts: Issue

Загружено:

carlo_tabangcuraАвторское право:

Доступные форматы

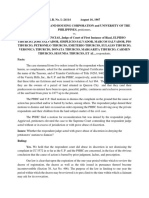

Tayug Rural Bank vs.

Central Bank of the Phils rules and regulations authorize the Central

Bank to impose additional reasonable

146 SCRA 120; G.R. No. L-46158; Nov. 28, 1986 penalties.

FACTS:

ISSUE:

Tayug Rural is a bank in Pangasinan which took out

WON The Central Bank can validly impose the 10%

13 loans from Central Bank in 1962 and1963, all

penalty via Memorandum Circular No. DLC-8

covered by promissory notes, amounting to 813k. In

late 1964, Central Bank released a circular; HELD:

Memorandum Circular No. DLC-8 thru the Director

of Loans and Credit. This circular allinformed all NO. A reading of the circular and pertinent

rural banks that an additional 10% per annum penalty provisions, including that of RA 720, shows that

interest would be assessed on all past due loans nowhere therein is the authority given to the

beginning 1965. Monetary Board to mete out additional penalties to

the rural banks on past due accounts with the Central

This was enforced beginning July 1965.In 1969, the Bank.

outstanding balance of Tayug was at 444k. Tayug

Rural filed a case in CFI Manila to recover the 10% As said by the CFI, while the Monetary Board

penalty it paid up to 1968, amounting to about 16k, possesses broad supervisory powers, nonetheless, the

and to restrain Central bank from further imposing retroactive imposition of administrative penalties

the penalty. Central Bank filed a counterclaim for the cannot be taken as a measure SUPERVISORY in

outstanding balance includingthe10% penalty, stating character. Administrative rules have the force and

that it was legally imposed under the Rules and effect of law. There are, however, limitations in the

Regulations Governing Rural Banks promulgated by rulemaking power of administrative agencies. All

the Monetary Board on 1958, under RA 720.Tayug’s that is required of administrative rules and

defense was that the counterclaim should be regulations is to implement given legislation by not

dismissed since the unpaid obligation of Tayug was contradicting it and conform to the standards

due to Central Bank’s flexible and double standard prescribed by law.

policy of its rediscounting privileges to Tayug Rural Rules and regulations cannot go beyond the basic

and its subsequent arbitrary and illegal imposition of law. Since compliance therewith can be enforced by

the 10% penalty. Tayug Rural contends that no such a penal sanction, an administrative agency cannot

10% penalty starting from 1965 was included in the implement a penalty not provided in the law

promissory notes covering the loans. A judgment was authorizing it, much less one that is applied

rendered by CFI Manila in favor of Central Bank retroactively.

ordering Tayug Rural Bank to pay10% penalty in the

amount of around 19k pesos for loans up to July The new clause imposing an additional penalty was

1969, and to pay nothing for the next remaining not part of the promissory notes when Tayug took out

loans.Tayug’s claim in the case was however its loans. The law cannot be given retroactive effect.

successful, and so Tayug was also ordered to pay More to the point, the Monetary Board revoked the

444k, with interest to the Central Bank for the additional penalty later in 1970, which clearly shows

overdue accounts with respect to the promissory an admission that it had no power to impose the

notes. Central Bank appealed to the CA, but also lost same. The Central bank hoped to rectify the defect by

on the ground that only a legal question had been revising the DLC Form later. However, Tayug Rural

raised in the pleadings. The case was then raised to must pay the additional 10% in case of suit, since in

the SC, with each party arguing in the following the promissory notes, 10% should be paid in

manner: attorney’s fees and costs of suit and collection.

Judgment AFFIRMED with modification

CFI rules that the circular’s retroactive effect

on past due loans impairs the obligation of

contracts and deprives Tayug Rural of

property without due process of law.

Central Bank reasons that Tayug Rural,

despite the loans, should have known that

Вам также может понравиться

- BNL Reviewer - Set AДокумент8 страницBNL Reviewer - Set ARowena JeanОценок пока нет

- Invoice: Olga Ioan BLD - DACIEI, BL.40/853, AP.42, PARTER, SC.D Giurgiu România, Giurgiu, 224678Документ2 страницыInvoice: Olga Ioan BLD - DACIEI, BL.40/853, AP.42, PARTER, SC.D Giurgiu România, Giurgiu, 224678Schindler OskarОценок пока нет

- Bullying As Reflected in Wonder by RJ Palacio 2Документ9 страницBullying As Reflected in Wonder by RJ Palacio 2callista giovanniОценок пока нет

- William Cooper - Operation MajorityДокумент6 страницWilliam Cooper - Operation Majorityvaneblood1100% (4)

- Zabihullah Mohmand AffidavitДокумент5 страницZabihullah Mohmand AffidavitNBC Montana0% (1)

- G.R. No. 96605. May 8, 1992 Facts:: Marcoso vs. Court of AppealsДокумент5 страницG.R. No. 96605. May 8, 1992 Facts:: Marcoso vs. Court of AppealsChrisel Joy Casuga SorianoОценок пока нет

- Securities and Exchange Commission vs. Picop Resources Inc.Документ2 страницыSecurities and Exchange Commission vs. Picop Resources Inc.Arianne AstilleroОценок пока нет

- Melendres v. ComelecДокумент14 страницMelendres v. ComelecJoanne CamacamОценок пока нет

- Vinta Maritime Inc. v. NLRCДокумент2 страницыVinta Maritime Inc. v. NLRCDennis CastroОценок пока нет

- Brgy San Roque VS Heirs of PastordigestДокумент2 страницыBrgy San Roque VS Heirs of PastordigestKkee DdooОценок пока нет

- (Credit Trans) Castillo vs. UniwideДокумент25 страниц(Credit Trans) Castillo vs. UniwideCHERRIE LOU A AGSOYОценок пока нет

- Election Law CasesДокумент2 страницыElection Law CasesEunice SerneoОценок пока нет

- 3 - Pasagui vs. VillablancaДокумент5 страниц3 - Pasagui vs. VillablancaKatОценок пока нет

- Philippine Association of Service Exporters, Inc V. Hon. Ruben D. TorresДокумент5 страницPhilippine Association of Service Exporters, Inc V. Hon. Ruben D. TorresglaiОценок пока нет

- Facts:: Mendoza V Coa G.R. No. 195395Документ1 страницаFacts:: Mendoza V Coa G.R. No. 195395loschudentОценок пока нет

- Provisional Remedies Case General Vs de VeneciaДокумент1 страницаProvisional Remedies Case General Vs de VeneciaSam FajardoОценок пока нет

- Case Diges1Документ5 страницCase Diges1benjamin ladesmaОценок пока нет

- Respondents, G.R. No. 187317. April 11, 2013Документ3 страницыRespondents, G.R. No. 187317. April 11, 2013Jim M. MagadanОценок пока нет

- CONSTI Magalona vs. ErmitaДокумент2 страницыCONSTI Magalona vs. ErmitaPafra BariuanОценок пока нет

- Gabriel Et Al Vs CA DigestДокумент4 страницыGabriel Et Al Vs CA DigestMichael Parreño VillagraciaОценок пока нет

- Nha Vs Pascual DigestДокумент1 страницаNha Vs Pascual DigestBianca Camille Bodoy SalvadorОценок пока нет

- Spouses Rodrigo Imperial JRДокумент3 страницыSpouses Rodrigo Imperial JRNoel Christopher G. BellezaОценок пока нет

- BPI Leasing v. Court of AppealsДокумент7 страницBPI Leasing v. Court of AppealsMp CasОценок пока нет

- Group 1 - Case DigestДокумент6 страницGroup 1 - Case DigestANGELO DEL ROSARIOОценок пока нет

- China Bank V LagonДокумент1 страницаChina Bank V LagonInnah Agito-RamosОценок пока нет

- Chavez v. PCGG, 299 Scra 744 (1998)Документ9 страницChavez v. PCGG, 299 Scra 744 (1998)Chino SisonОценок пока нет

- John Hay vs. Lim GR 119775Документ3 страницыJohn Hay vs. Lim GR 119775preciousrain07100% (1)

- NAPOCOR Vs Spouses ChiongДокумент9 страницNAPOCOR Vs Spouses ChiongKatrina Budlong100% (1)

- De Leon Vs Court of Appeals, 287 SCRA 94 GR No. 104796, March 6, 1998Документ2 страницыDe Leon Vs Court of Appeals, 287 SCRA 94 GR No. 104796, March 6, 1998Mida SalisaОценок пока нет

- 230241-2019-Philippine National Construction Corp. V.20210429-12-Cyx8hdДокумент8 страниц230241-2019-Philippine National Construction Corp. V.20210429-12-Cyx8hdKim FloresОценок пока нет

- DANTE V. LIBAN, Et Al. v. RICHARD GORDON G.R. No. 175352Документ1 страницаDANTE V. LIBAN, Et Al. v. RICHARD GORDON G.R. No. 175352Gale Charm SeñerezОценок пока нет

- BASCO v. PAGCOR, G.R. No. 91649Документ2 страницыBASCO v. PAGCOR, G.R. No. 91649Arvhie Santos100% (1)

- G.R. No. 170432 March 24, 2008 Francia vs. Municipality of Meycauayan Corona, J.Документ16 страницG.R. No. 170432 March 24, 2008 Francia vs. Municipality of Meycauayan Corona, J.Gracelyn Enriquez BellinganОценок пока нет

- 06 Ching vs. CAДокумент2 страницы06 Ching vs. CAKelsey Olivar MendozaОценок пока нет

- LBP V CELADA GR. 164876 AdvinculaДокумент1 страницаLBP V CELADA GR. 164876 AdvinculaChristopher AdvinculaОценок пока нет

- Del Mar vs. PagcorДокумент30 страницDel Mar vs. PagcorG Ant MgdОценок пока нет

- MMDA Vs GarinДокумент2 страницыMMDA Vs GarinbeverlyrtanОценок пока нет

- Final Compilation CCДокумент106 страницFinal Compilation CCRae ManarОценок пока нет

- Gumaua Vs ESPINOДокумент3 страницыGumaua Vs ESPINOYeshua TuraОценок пока нет

- Malaga vs. Penachos, 213 SCRA 516Документ12 страницMalaga vs. Penachos, 213 SCRA 516Mak Francisco100% (1)

- Bautista v. JuinioДокумент1 страницаBautista v. JuinioDi CanОценок пока нет

- LTD Set 2 4. REPUBLIC Vs ZURBARAN REALTYДокумент1 страницаLTD Set 2 4. REPUBLIC Vs ZURBARAN REALTYhully gullyОценок пока нет

- Zoleta vs. Land Bank of The Philippines, G.R. No. 205108, August 9, 2017Документ2 страницыZoleta vs. Land Bank of The Philippines, G.R. No. 205108, August 9, 20172F SABELLANO, ALVINОценок пока нет

- Reyes v. Rural BankДокумент1 страницаReyes v. Rural Bankd2015memberОценок пока нет

- AsdasdasdasdДокумент43 страницыAsdasdasdasdbarrystarr1Оценок пока нет

- Abella, Jr. v. Civil Service CommissionДокумент2 страницыAbella, Jr. v. Civil Service CommissionIrish Ann0% (1)

- Case Digests 2 and 7Документ5 страницCase Digests 2 and 7Ren Concha100% (1)

- Association of Philippine Coconut Desiccators vs. Philippine Coconut Authority 286 SCRA 109, February 10, 1998Документ13 страницAssociation of Philippine Coconut Desiccators vs. Philippine Coconut Authority 286 SCRA 109, February 10, 1998CHENGОценок пока нет

- Case Digest General WelfareДокумент8 страницCase Digest General Welfarecrystine jaye senadreОценок пока нет

- Visayan Refining Co. v. Camus, G.R. No. L-15870 December 3, 1919Документ10 страницVisayan Refining Co. v. Camus, G.R. No. L-15870 December 3, 1919AB AgostoОценок пока нет

- Villegas vs. SubidoДокумент6 страницVillegas vs. Subidorols villanezaОценок пока нет

- Dionisio Manaquil v. Roberto MoicoДокумент6 страницDionisio Manaquil v. Roberto MoicoRon Ico RamosОценок пока нет

- Assoc. of Small Landowers in The Phils Inc. V Sec. of Agrarian Reform Case Digest - Constitutional LawДокумент1 страницаAssoc. of Small Landowers in The Phils Inc. V Sec. of Agrarian Reform Case Digest - Constitutional LawMichael BongalontaОценок пока нет

- SBC SyllabusДокумент33 страницыSBC SyllabusHarvey MarquezОценок пока нет

- Admin Case DigestsДокумент50 страницAdmin Case DigestsJennyMariedeLeon100% (1)

- Due Process 1. Cruz vs. Civil Service CommissionДокумент7 страницDue Process 1. Cruz vs. Civil Service Commissionchiiwapanda yangОценок пока нет

- Cailles vs. BonifacioДокумент5 страницCailles vs. BonifacioVienna Mantiza - PortillanoОценок пока нет

- 209 SCRA 711 Luzon Polymers Corp. Vs ClaveДокумент7 страниц209 SCRA 711 Luzon Polymers Corp. Vs ClaveFran SuarezОценок пока нет

- M. Construction and Interpretation I. Cir vs. Puregold Duty Free, Inc. G.R. NO. 202789, JUNE 22, 2015Документ3 страницыM. Construction and Interpretation I. Cir vs. Puregold Duty Free, Inc. G.R. NO. 202789, JUNE 22, 2015Marry LasherasОценок пока нет

- Statcon Midterm Reviewer With Case DetailsДокумент5 страницStatcon Midterm Reviewer With Case DetailsLouie Uie LouОценок пока нет

- BIR Vs Ombudsman Case DigestДокумент2 страницыBIR Vs Ombudsman Case DigestCarmela SalazarОценок пока нет

- Digested Cases For Legal Aspects in School Administration and SupervisionДокумент3 страницыDigested Cases For Legal Aspects in School Administration and SupervisionRAE SEAN CATANОценок пока нет

- Seville V NDAДокумент13 страницSeville V NDAJA Llorico100% (1)

- Tayug Rural Bank Vs CB DigestДокумент2 страницыTayug Rural Bank Vs CB DigestMczoC.Mczo100% (1)

- G.R. No. L-46158 - Tayug Vs Central Bank - Administrative Rules and Regulations (Digest)Документ14 страницG.R. No. L-46158 - Tayug Vs Central Bank - Administrative Rules and Regulations (Digest)Apoi FaminianoОценок пока нет

- Commercial Law Review Abella PDFДокумент71 страницаCommercial Law Review Abella PDFcarlo_tabangcuraОценок пока нет

- Gotesco V. ChattoДокумент2 страницыGotesco V. Chattocarlo_tabangcuraОценок пока нет

- Updates in Mercantile Law 2017 Dean Eduardo AbellaДокумент12 страницUpdates in Mercantile Law 2017 Dean Eduardo Abellacarlo_tabangcuraОценок пока нет

- Cristobal vs. CA PDFДокумент12 страницCristobal vs. CA PDFcarlo_tabangcuraОценок пока нет

- Reyes vs. Spouses RamosДокумент21 страницаReyes vs. Spouses Ramoscarlo_tabangcuraОценок пока нет

- Case 26Документ19 страницCase 26carlo_tabangcuraОценок пока нет

- Forensic Medicine Case DigestsДокумент4 страницыForensic Medicine Case Digestscarlo_tabangcuraОценок пока нет

- Castillo vs. CastilloДокумент15 страницCastillo vs. Castillocarlo_tabangcuraОценок пока нет

- Suntay vs. SuntayДокумент16 страницSuntay vs. Suntaycarlo_tabangcuraОценок пока нет

- Case 25Документ6 страницCase 25carlo_tabangcuraОценок пока нет

- Republic of The Philippines, Petitioner, vs. MERLINDA L. OLAYBAR, RespondentДокумент11 страницRepublic of The Philippines, Petitioner, vs. MERLINDA L. OLAYBAR, Respondentcarlo_tabangcuraОценок пока нет

- Guerrero vs. RTC of IlocosДокумент8 страницGuerrero vs. RTC of Ilocoscarlo_tabangcuraОценок пока нет

- Maquiling vs. COMELECДокумент72 страницыMaquiling vs. COMELECcarlo_tabangcuraОценок пока нет

- Soriano Vs PeopleДокумент5 страницSoriano Vs PeopleSamantha BaricauaОценок пока нет

- Income Tax (Deduction For Expenses in Relation To Secretarial Fee and Tax Filing Fee) Rules 2014 (P.U. (A) 336-2014)Документ1 страницаIncome Tax (Deduction For Expenses in Relation To Secretarial Fee and Tax Filing Fee) Rules 2014 (P.U. (A) 336-2014)Teh Chu LeongОценок пока нет

- 726 PDFДокумент191 страница726 PDFRonnieymess dos Santos AveiroОценок пока нет

- CyberbullyingДокумент20 страницCyberbullyingapi-306003749Оценок пока нет

- Star Paper Corporation vs. Simbol 487 SCRA 228 G.R. No. 164774 April 12 2006Документ13 страницStar Paper Corporation vs. Simbol 487 SCRA 228 G.R. No. 164774 April 12 2006Angelie FloresОценок пока нет

- Case Digest On Right&ObliДокумент20 страницCase Digest On Right&ObliCrest PedrosaОценок пока нет

- Memorial For The AppellantДокумент26 страницMemorial For The AppellantRobin VincentОценок пока нет

- WillsДокумент35 страницWillsYolanda Janice Sayan Falingao100% (1)

- Sweet Delicacy Through Soft Power: Oppenheimer (2023) Relevance To Contemporary World RealityДокумент4 страницыSweet Delicacy Through Soft Power: Oppenheimer (2023) Relevance To Contemporary World RealityAthena Dayanara100% (1)

- Maths QuestionsДокумент5 страницMaths QuestionsjayanthОценок пока нет

- Partnership PRE-MID PersonalДокумент12 страницPartnership PRE-MID PersonalAbigail LicayanОценок пока нет

- Innovyze Software Maintenance Support AgreementДокумент2 страницыInnovyze Software Maintenance Support Agreementshahrukhkhalid1359Оценок пока нет

- Operasi Lalang 2Документ6 страницOperasi Lalang 2Zul Affiq IzhamОценок пока нет

- CharltonДокумент6 страницCharltonStephen SmithОценок пока нет

- United States v. Calvin Lee Everette, 4th Cir. (2013)Документ3 страницыUnited States v. Calvin Lee Everette, 4th Cir. (2013)Scribd Government DocsОценок пока нет

- Red Mafiya: How The Russian Mob Has Invaded America - Robert I. FriedmanДокумент289 страницRed Mafiya: How The Russian Mob Has Invaded America - Robert I. FriedmanMarcelo Carreiro80% (5)

- 20) Unsworth Transport V CAДокумент2 страницы20) Unsworth Transport V CAAlfonso Miguel LopezОценок пока нет

- Maria The CoptДокумент2 страницыMaria The CoptmascomwebОценок пока нет

- Environmental Law: Submitted By: Submitted To: Jan Vernon L. Hernan Ambassador Tolentino 2AДокумент6 страницEnvironmental Law: Submitted By: Submitted To: Jan Vernon L. Hernan Ambassador Tolentino 2AJavi HernanОценок пока нет

- HighNote4 AK Grammar Quiz AДокумент5 страницHighNote4 AK Grammar Quiz Aeng teaОценок пока нет

- Maharashtra Welfare Officer Rules 1966Документ7 страницMaharashtra Welfare Officer Rules 1966Vaiby Cool83% (6)

- The Most Expensive Ring in The ShopДокумент3 страницыThe Most Expensive Ring in The ShopgratielageorgianastoicaОценок пока нет

- FRQs OutlinesДокумент33 страницыFRQs OutlinesEunae ChungОценок пока нет

- Indici Patient Portal Terms and Conditions v0 2 - 2Документ3 страницыIndici Patient Portal Terms and Conditions v0 2 - 2hine1009Оценок пока нет

- People's Trans East v. Doctors of New MillenniumДокумент3 страницыPeople's Trans East v. Doctors of New MillenniumJayson RacalОценок пока нет