Академический Документы

Профессиональный Документы

Культура Документы

Essay 1

Загружено:

Sunil Bawa0 оценок0% нашли этот документ полезным (0 голосов)

25 просмотров2 страницыDirectors should be concerned with the best interest of the company's employees, customers and suppliers in addition to its own interest and that of its shareholders. Directors are required to volunteer information to auditors as failure to do so would attract unlimited fines and two year prison sentence. If a company and its directors are convicted of flouting company law they could be named in a central register, similar to 'naming and shaming' strategy.

Исходное описание:

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

DOC, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документDirectors should be concerned with the best interest of the company's employees, customers and suppliers in addition to its own interest and that of its shareholders. Directors are required to volunteer information to auditors as failure to do so would attract unlimited fines and two year prison sentence. If a company and its directors are convicted of flouting company law they could be named in a central register, similar to 'naming and shaming' strategy.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

25 просмотров2 страницыEssay 1

Загружено:

Sunil BawaDirectors should be concerned with the best interest of the company's employees, customers and suppliers in addition to its own interest and that of its shareholders. Directors are required to volunteer information to auditors as failure to do so would attract unlimited fines and two year prison sentence. If a company and its directors are convicted of flouting company law they could be named in a central register, similar to 'naming and shaming' strategy.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

The basic goal, identified by the paper, of the directors is the success of the company.

The directors should

be concerned mainly with the best interest of the company’s employees, customers and suppliers in

addition to its own interest and that of its shareholders. This is to help maintain and improve company’s

reputation in the business world and its impact on business community. Although this could be perceived

as a definite improvement on the previous directors’ duties it could lead to confusion which one is likely to

turn into litigation as some of the duties outlined in the proposal are rather nebulous. In the process of

promoting company’s success it could become rather difficult for the directors to decide the strategy which

would be in everybody’s best interest. Although, the paper supports the directors’ duties towards

employees and customers, the duties towards its creditors are still under review as it requires the directors

to identify the risk to creditors as soon as company starts to suffer financial difficulties and runs the risk of

going into insolvent liquidation. However, this particular aspect is considered in more detail in the

Insolvency Act 1986 and it should not, therefore, be included in the Company law.

It is vitally important that the directors should consider implications of their short and long-term actions.

They should also take into account how their actions would affect the parties interested in the company’s

affairs.

The directors are required to volunteer information to auditors as failure to do so would attract unlimited

fines and two year prison sentence. Under current legislation section 389 A of the Companies Act 1985 it is

an offence to deliberately make a false statement to the auditor but a deliberate intention to mislead is not

necessary in order to establish an offence. Also if a company and its directors are convicted of flouting

company law they could be named in a central register, similar to ‘naming and shaming’ strategy. In

general the directors are owed duties to the company rather than to the individual shareholders. This then

follows that the company itself, and not the shareholders, who is normally able to bring the claim.

Obviously, this could be a problem when it comes to enforcing these duties as the directors are in control of

the company’s affairs.

It is interesting to note that a company can only be sued for a wrongdoing performed by itself, rather than it

agents unless these agents have exceeded their authority.

Another important proposal is with regard to a contract which a company itself is unable to accept due to

lack of resources for example, then a director may be able to take that contract personally for his own

benefit. This allows directors to make full use of information, property etc which belong to the company for

their own benefit without the consent of the shareholders and members provided they obtain the

authorisation from the Board of Directors to do so. The important difference here which must be noted is, in

case of private companies, the board of directors will have such powers to authorise a director to exploit a

corporate opportunity like that unless it has been expressly denied in the company’s constitution. On the

other hand, in case of Public limited companies, the board of directors will not have such powers bestowed

upon them as they need authorisation from the shareholders first unless a specific provision to authorise

such transaction has been made in the company’s constitution.

Conclusion

The express and implied terms of a directors’ employment contract are covered by agency and fiduciary

duties stated by the company’s constitution and by statute. If the majority shareholders of the company are

unhappy with the directors’ conduct of the company’s affairs, are the directors allowed to just shun the

wishes stating that majority shareholders’ wishes are not in the best inertest of the company as a whole?.

No. However, this must be kept in mind that fifty one percent of the shareholders can pass an ordinary

resolution to remove the directors of the company. On the other hand if the directors try to carry out the

wishes of the majority shareholders only, they are restricting their discretion which is awarded to them in

trust for the company as a whole and therefore they may become liable to the minority shareholders for

causing unfair prejudice. It is interesting to note that in Boulting v Association of Cinematograph, Television

and Allied Technicians Lord Denning MR stated that if the directors wanted to prefer majority shareholders’

interest they can do so as long as it is in the best interest of the company. If the director’s decision affects

different groups of shareholders then he must act fairly.

From the above discussions it is apparent the directors’ duties to the company are fiduciary and as an

agent of the company. They are accountable to the shareholders regardless of their shareholding. The

analysis shows that the director’s owes duty of care and skill primarily to his principal, the company. It is

worth considering that fiduciary duties are owed to “corporate beneficiaries” including duty of good faith.

Bibliography 1. Company Law by Charelsworth and Morse page 119 published by Thomson Sweet &

Maxwell, Sixteenth Edition

2. Company law by Hicks & Goo, 5th Edition

3. Gower and Davies’ Principles of Modern Company Law, Seventh Edition by Paul Davies published by

Sweet & Maxwell

4. Company Law by Janet Dine published by Palgrave Law Masters fourth Edition

5. Levy Solicitors’ Web site: Article by Peter watson

Вам также может понравиться

- Date Cashback AmountДокумент6 страницDate Cashback AmountSunil BawaОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- McKinsey 7sДокумент2 страницыMcKinsey 7sSunil BawaОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Sales From SageДокумент26 страницSales From SageSunil BawaОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- C39IA Accounting Information, Communication & Technology: Not Just A Load of Old Numbers .Документ34 страницыC39IA Accounting Information, Communication & Technology: Not Just A Load of Old Numbers .Sunil BawaОценок пока нет

- Insung Jung An Colin Latchem - Quality Assurance and Acreditatión in Distance Education and e - LearningДокумент81 страницаInsung Jung An Colin Latchem - Quality Assurance and Acreditatión in Distance Education and e - LearningJack000123Оценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Foxit PhantomPDF For HP - Quick GuideДокумент32 страницыFoxit PhantomPDF For HP - Quick GuidekhilmiОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- GB BioДокумент3 страницыGB BiolskerponfblaОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- ''Want To Learn To Speak Latin or Greek This (2018) Summer''Документ10 страниц''Want To Learn To Speak Latin or Greek This (2018) Summer''ThriwОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- 221-240 - PMP BankДокумент4 страницы221-240 - PMP BankAdetula Bamidele OpeyemiОценок пока нет

- The Role of Mahatma Gandhi in The Freedom Movement of IndiaДокумент11 страницThe Role of Mahatma Gandhi in The Freedom Movement of IndiaSwathi Prasad100% (6)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Practice Test 4 For Grade 12Документ5 страницPractice Test 4 For Grade 12MAx IMp BayuОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Shielded Metal Arc Welding Summative TestДокумент4 страницыShielded Metal Arc Welding Summative TestFelix MilanОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Professional Experience Report - Edu70012Документ11 страницProfessional Experience Report - Edu70012api-466552053Оценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Gandhi Was A British Agent and Brought From SA by British To Sabotage IndiaДокумент6 страницGandhi Was A British Agent and Brought From SA by British To Sabotage Indiakushalmehra100% (2)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Forever Living Presentation PDFДокумент34 страницыForever Living Presentation PDFCasey Rion100% (1)

- The Berenstain Bears and Baby Makes FiveДокумент33 страницыThe Berenstain Bears and Baby Makes Fivezhuqiming87% (54)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Del Monte Usa Vs CaДокумент3 страницыDel Monte Usa Vs CaChe Poblete CardenasОценок пока нет

- Analog Electronic CircuitsДокумент2 страницыAnalog Electronic CircuitsFaisal Shahzad KhattakОценок пока нет

- Unified Power Quality Conditioner (Upqc) With Pi and Hysteresis Controller For Power Quality Improvement in Distribution SystemsДокумент7 страницUnified Power Quality Conditioner (Upqc) With Pi and Hysteresis Controller For Power Quality Improvement in Distribution SystemsKANNAN MANIОценок пока нет

- Simulation of Channel Estimation and Equalization For WiMAX PHY Layer in Simulink PDFДокумент6 страницSimulation of Channel Estimation and Equalization For WiMAX PHY Layer in Simulink PDFayadmanОценок пока нет

- Introduction To ICT EthicsДокумент8 страницIntroduction To ICT EthicsJohn Niño FilipinoОценок пока нет

- A Photograph (Q and Poetic Devices)Документ2 страницыA Photograph (Q and Poetic Devices)Sanya SadanaОценок пока нет

- Biology - Solved ExamДокумент27 страницBiology - Solved ExamlyliasahiliОценок пока нет

- Grammar Reference With Practice Exercises: Unit 1Документ25 страницGrammar Reference With Practice Exercises: Unit 1violet15367% (3)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Win Tensor-UserGuide Optimization FunctionsДокумент11 страницWin Tensor-UserGuide Optimization FunctionsadetriyunitaОценок пока нет

- Jyotish - 2003 Sri Jagannath Center - Narayan Iyer - Divisional Charts - Divining Through DivisionsДокумент36 страницJyotish - 2003 Sri Jagannath Center - Narayan Iyer - Divisional Charts - Divining Through DivisionsDeepa MishraОценок пока нет

- Focus Group DiscussionДокумент13 страницFocus Group DiscussionSumon ChowdhuryОценок пока нет

- Trump's Fake ElectorsДокумент10 страницTrump's Fake ElectorssiesmannОценок пока нет

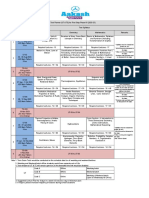

- UT & TE Planner - AY 2023-24 - Phase-01Документ1 страницаUT & TE Planner - AY 2023-24 - Phase-01Atharv KumarОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- ID2b8b72671-2013 Apush Exam Answer KeyДокумент2 страницыID2b8b72671-2013 Apush Exam Answer KeyAnonymous ajlhvocОценок пока нет

- Panulaang FilipinoДокумент21 страницаPanulaang FilipinoKriza Erin B BaborОценок пока нет

- Reflection On Harrison Bergeron Society. 21ST CenturyДокумент3 страницыReflection On Harrison Bergeron Society. 21ST CenturyKim Alleah Delas LlagasОценок пока нет

- Apache Hive Essentials 2nd PDFДокумент204 страницыApache Hive Essentials 2nd PDFketanmehta4u0% (1)

- Information Theory Entropy Relative EntropyДокумент60 страницInformation Theory Entropy Relative EntropyJamesОценок пока нет