Академический Документы

Профессиональный Документы

Культура Документы

Quiz - Ppe Cost

Загружено:

Ana Mae HernandezОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Quiz - Ppe Cost

Загружено:

Ana Mae HernandezАвторское право:

Доступные форматы

College of Business Administration

ACTG 109A – APPLIED AUDITING

Audit of Property, Plant and Equipment

NAME:_____________________________________________COURSE & YEAR: __________SCORE:______

1. Which of the following accounts would most likely be reviewed by the auditor to gain reasonable assurance

that additions to the equipment account are not understated?

a. Repairs and maintenance expense. b. Depreciation expense.

c. Gain on disposal of equipment. d. Accounts payable.

2. The most significant audit step in substantiating additions to the office furniture account balance is

a. Examination of vendors' invoices and receiving reports for current year's acquisitions.

b. Review of transactions near the balance sheet date for proper period cutoff.

c. Calculation of ratio of depreciation expense to gross office equipment cost.

d. Comparison to prior year's acquisitions.

3. An auditor is verifying the existence of newly acquired fixed assets recorded in the accounting records.

Which of the following is the best evidence to help achieve this objective?

a. Documentary support obtained by vouching entries to subsidiary records and invoices.

b. Physical examination of a sample of newly recorded fixed assets.

c. Oral evidence obtained by discussions with operating management.

d. Documentary support obtained by reviewing titles and tax returns.

4. When there are few property and equipment transactions during the year, the continuing auditor usually

makes a

a. Complete review of the related internal controls and assesses control risk relative to them.

b. Complete review of the related internal controls and performs analytical review tests to verify

current year additions to property and equipment.

c. Preliminary review of the related internal controls and performs a thorough examination of the

balances at the beginning of the year.

d. Preliminary review of the related internal controls and performs extensive tests of current year

property and equipment transactions.

5. An auditor analyzes repairs and maintenance accounts primarily to obtain evidence in support of the audit

assertion that all

a. Non-capitalizable expenditures for repairs and maintenance have been properly charged to

expense.

b. Expenditures for property and equipment have not been charged to expense.

c. Non-capitalizable expenditures for repairs and maintenance have been recorded in the proper

period.

d. Expenditures for property and equipment have been recorded in the proper period.

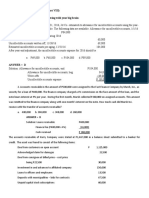

Problem 1

Aliaga Corporation was incorporated on January 2, 2017. The following items relate to the Aliaga’s property and

equipment transactions:

Cost of land, which included an old apartment building

appraised at ₱300,000 ₱ 3,000,000

Apartment building mortgage assumed, including

related interest due at the time of purchase 80,000

Deliquent property taxes assumed by Aliaga 30,000

Payments to tenants to vacate the apartment building 20,000

Cost of razing the apartment building 40,000

Proceeds from sale of salvaged materials 10,000

Architects fee for new building 60,000

Building permit for new construction 40,000

Fee for title search 25,000

Survey before construction of new building 20,000

Excavation before construction of new building 100,000

Payment to building contractor 10,000,000

Assessment by city for drainage project 15,000

Cost of grading and levelling 50,000

Temporary quarters for construction crew 80,000

Temporary building to house tools and materials 50,000

Cost of changes during construction to make new

building more energy efficient 90,000

Interest cost on specific borrowing incurred during construction 360,000

Payment of medical bills of employees accidentally

injured while inspecting building construction 18,000

Cost of paving driveway and parking lot 60,000

Page 1 “Libyae Lustare”

Cost of installing lights in parking lot 12,000

Premium for insurance on building during construction 30,000

Cost of open house party to celebrate opening of new building 50,000

Cost of windows broken by vandals distracted by the celebration 12,000

QUESTIONS:

Based on the above and the result of your audit, determine the following:

1. Cost of land

a. ₱2,980,000 b. ₱3,270,000 c. ₱3,185,000 d. ₱3,205,000

2. Cost of building

a. ₱10,810,000 b. ₱10,895,000 c. ₱10,875,000 d. ₱11,110,000

3. Cost of Land Improvements

a. ₱12,000 b. ₱72,000 c. ₱122,000 d. ₱0

4. Amount that should be expensed when incurred

a. ₱80,000 b. ₱110,000 c. ₱62,000 d. ₱50,000

5. Total depreciable property and equipment

a. ₱11,182,000 b. ₱10,967,000 c. ₱10,947,500 d. ₱10,882,000

Problem 2

The property, plant and equipment section of Zaragosa Corporation’s statement of financial position at

December 31, 2009 included the following items:

Land ₱2,100,000

Land improvements 560,000

Buildings 3,600,000

Machinery and equipment 6,600,000

During 2010 the following data were available to you upon your analysis of the accounts:

Cash paid on purchased of the land ₱10,000,000

Mortgage assumed on the land bought, including interest at 16% 16,000,000

Realtor’s commission 1,200,000

Legal fees, realty taxes and documentation expenses 200,000

Amount paid to relocate persons squatting on the property 400,000

Cost of tearing down and old building on the land 300,000

Amount recovered from the salvage of the building demolished 200,000

Cost of fencing the property 440,000

Amount paid to a contractor for the building erected 8,000,000

Building permit fees 50,000

Excavation expenses 250,000

Architect’s fees 100,000

Interest that would have been earned had the money used during

the period of contraction been invested in the money market 600,000

Invoice cost of machinery acquired 8,000,000

Freight, unloading, and delivery charges 240,000

Customs duties and other charges 560,000

Allowances, hotel accommodations, etc., paid to foreign technicians

during installation and the test run of machines 1,600,000

Royalty payment on machines purchased

(based on units produced and sold) 480,000

QUESTIONS:

Based on the above and the result of your audit, compute for the following as of December 31, 2010:

1. Land

a. ₱30,000,000 b. ₱14,000,000 c. ₱29,900,000 d. ₱29,600,000

2. Land Improvements

a. ₱1,300,000 b. ₱1,000,000 c. ₱1,250,000 d. ₱560,000

3. Building

a. ₱12,300,000 b. ₱11,750,000 c. ₱12,000,000 d. ₱11,700,000

4. Machinery and equipment

a. ₱14,840,000 b. ₱16,440,000 c. ₱15,400,000 d. ₱17,000,000

Page 2 “Libyae Lustare”

Вам также может понравиться

- AP Ppe Quizzer QДокумент28 страницAP Ppe Quizzer Qkimberly bumanlagОценок пока нет

- Intermediate Accounting I - Ppe AnswersДокумент3 страницыIntermediate Accounting I - Ppe AnswersJoovs Joovho50% (2)

- Promlem Solving Problem 1: Property, Plant and Equipment (Answer Key)Документ27 страницPromlem Solving Problem 1: Property, Plant and Equipment (Answer Key)Rica Regoris100% (1)

- Chapter 5 Audit of Property, Plant and EquipmentДокумент26 страницChapter 5 Audit of Property, Plant and EquipmentDominique Anne BenozaОценок пока нет

- Ppe 2Документ13 страницPpe 2Jerome BaluseroОценок пока нет

- Acctg 2 quiz covers depreciation, depletionДокумент3 страницыAcctg 2 quiz covers depreciation, depletionArjay CarolinoОценок пока нет

- Acquiring New Manufacturing EquipmentДокумент46 страницAcquiring New Manufacturing EquipmentjhouvanОценок пока нет

- Synthesis - AudProb (Q)Документ8 страницSynthesis - AudProb (Q)Anna Gian SobrevillaОценок пока нет

- PPE Plus Depn1Документ3 страницыPPE Plus Depn1Sheena GutierrezОценок пока нет

- Chapter 2 Asset Valuation ProblemsДокумент167 страницChapter 2 Asset Valuation ProblemsKim BihagОценок пока нет

- Camilon Francisco PPEДокумент21 страницаCamilon Francisco PPEGrace GamillaОценок пока нет

- Audit of Liab ModuleДокумент13 страницAudit of Liab ModuleChristine Mae Fernandez MataОценок пока нет

- Audit of Allowance For Doubtful AccountsДокумент4 страницыAudit of Allowance For Doubtful AccountsCJ alandyОценок пока нет

- PUP Review Handout 2 OfficialДокумент5 страницPUP Review Handout 2 OfficialDonalyn CalipusОценок пока нет

- Donors Taxation Quiz Copy 2Документ6 страницDonors Taxation Quiz Copy 2Yoongi MinОценок пока нет

- Cash and Cash Equivalents: Answer: CДокумент142 страницыCash and Cash Equivalents: Answer: CGarp BarrocaОценок пока нет

- Solution: LCNRV Cost Bags 550,000 Bags 800,000 Shoes 1,000,000 Shoes 1,000,000 Clothing 700,000 Clothing 700,000 Lingerie 350,000 Lingerie 500,00Документ3 страницыSolution: LCNRV Cost Bags 550,000 Bags 800,000 Shoes 1,000,000 Shoes 1,000,000 Clothing 700,000 Clothing 700,000 Lingerie 350,000 Lingerie 500,00Christian Clyde Zacal ChingОценок пока нет

- DLSA AP Intangibles For DistributionДокумент7 страницDLSA AP Intangibles For DistributionJan Renee EpinoОценок пока нет

- DocxДокумент15 страницDocxjhouvanОценок пока нет

- Ppe Bio AssetДокумент2 страницыPpe Bio AssetEvita Faith LeongОценок пока нет

- Chris Company accounting entries for equipment, notes, and lawsuitsДокумент4 страницыChris Company accounting entries for equipment, notes, and lawsuitshazel alvarezОценок пока нет

- A.) Land: Problem No.1Документ7 страницA.) Land: Problem No.1MARICEL URBINAОценок пока нет

- Examination About Investment 15Документ3 страницыExamination About Investment 15BLACKPINKLisaRoseJisooJennieОценок пока нет

- IRS CPA Review Book Value Per ShareДокумент12 страницIRS CPA Review Book Value Per ShareJasper Bryan BlagoОценок пока нет

- Mas - 3Документ36 страницMas - 3AzureBlazeОценок пока нет

- ReviewerДокумент5 страницReviewermaricielaОценок пока нет

- Man Company investment income from Kind CorpДокумент12 страницMan Company investment income from Kind Corpbobo kaОценок пока нет

- Financial Accounting P 1 Quiz 3 KeyДокумент6 страницFinancial Accounting P 1 Quiz 3 KeyJei CincoОценок пока нет

- Buang Ang TaxДокумент17 страницBuang Ang TaxEdeksupligОценок пока нет

- Cherein Pael - Midterm Project Sept 30 - PROBLEM1Документ1 страницаCherein Pael - Midterm Project Sept 30 - PROBLEM1cherein6soriano6paelОценок пока нет

- University of San Jose-Recoletos: Intangible Assets - Research and Development Department Quiz 5 (Type Text)Документ5 страницUniversity of San Jose-Recoletos: Intangible Assets - Research and Development Department Quiz 5 (Type Text)hyunsuk fhebieОценок пока нет

- Far Test BankДокумент37 страницFar Test BankheyheyОценок пока нет

- Quiz 5Документ5 страницQuiz 5Mickaellah MacasОценок пока нет

- Cash and Cash EquivДокумент8 страницCash and Cash EquivMonina Cabalag0% (1)

- Accounting 102 Intermediate Accounting Part 1 PPE, Government Grant, Borrowing Costs QuizДокумент10 страницAccounting 102 Intermediate Accounting Part 1 PPE, Government Grant, Borrowing Costs QuizKissy LorОценок пока нет

- Investment Property GainsДокумент4 страницыInvestment Property GainsBLACKPINKLisaRoseJisooJennieОценок пока нет

- Long-Term Construction Contracts (Pfrs 15) : Start of DiscussionДокумент3 страницыLong-Term Construction Contracts (Pfrs 15) : Start of DiscussionErica DaprosaОценок пока нет

- Business Combination Module 3Документ8 страницBusiness Combination Module 3TryonОценок пока нет

- ACCO 30033 LGUs With AnswersДокумент3 страницыACCO 30033 LGUs With AnswersMika MolinaОценок пока нет

- Quiz VIII - ARДокумент3 страницыQuiz VIII - ARBLACKPINKLisaRoseJisooJennieОценок пока нет

- Intangible Assets Exam QuestionsДокумент3 страницыIntangible Assets Exam QuestionsBLACKPINKLisaRoseJisooJennieОценок пока нет

- Equity YyyДокумент33 страницыEquity YyyJude SantosОценок пока нет

- Nfjpia Nmbe Afar 2017 AnsДокумент10 страницNfjpia Nmbe Afar 2017 AnshyosungloverОценок пока нет

- Ppe Problems 3Документ4 страницыPpe Problems 3venice cambryОценок пока нет

- Audit of PPE - Homework - AnswersДокумент15 страницAudit of PPE - Homework - AnswersMarnelli CatalanОценок пока нет

- Major Assessment - Current Liab-MahusayДокумент5 страницMajor Assessment - Current Liab-MahusayJeth Mahusay100% (1)

- Oct 4 - LectureДокумент4 страницыOct 4 - LectureCarl Dhaniel Garcia SalenОценок пока нет

- PFRS 4 accounting practices test questionsДокумент1 страницаPFRS 4 accounting practices test questionsJerauld BucolОценок пока нет

- PPE Audit ProblemsДокумент4 страницыPPE Audit ProblemsFiona MoralesОценок пока нет

- Property, Plant and Equipement: Prior To Expense AfterДокумент8 страницProperty, Plant and Equipement: Prior To Expense AfterAvox EverdeenОценок пока нет

- Ppe Test BankДокумент10 страницPpe Test BankAna Mae HernandezОценок пока нет

- Plants, Property and EquipmentДокумент21 страницаPlants, Property and EquipmentAna Mae HernandezОценок пока нет

- Problem Set PpeДокумент11 страницProblem Set PpeHdhsiaihagatataОценок пока нет

- Ppe - ModuleДокумент7 страницPpe - ModuleYejin ChoiОценок пока нет

- Assessment No. 3-Midterm - Exam SheetДокумент7 страницAssessment No. 3-Midterm - Exam Sheetarnel buanОценок пока нет

- AP DLSA 05 PPE For DistributionДокумент10 страницAP DLSA 05 PPE For DistributionStela Marie CarandangОценок пока нет

- PpeДокумент7 страницPpeJer Rama100% (1)

- Assignment PPE PArt 1Документ7 страницAssignment PPE PArt 1JP Mirafuentes100% (1)

- LEC03B - BSA 2102 - 012021-Problems, Part IДокумент3 страницыLEC03B - BSA 2102 - 012021-Problems, Part IKatarame LermanОценок пока нет

- Property Plant and Equipment: Problem 1Документ13 страницProperty Plant and Equipment: Problem 1A.B AmpuanОценок пока нет

- Libyae Lustare - Audit of Inventories College of Business AdministrationДокумент1 страницаLibyae Lustare - Audit of Inventories College of Business AdministrationAna Mae HernandezОценок пока нет

- Quiz - Inventories CostingДокумент1 страницаQuiz - Inventories CostingAna Mae Hernandez67% (3)

- Quiz - IntangiblesДокумент1 страницаQuiz - IntangiblesAna Mae HernandezОценок пока нет

- Libyae Lustare - Audit Cash & Equivalents Under 40 CharactersДокумент1 страницаLibyae Lustare - Audit Cash & Equivalents Under 40 CharactersAna Mae HernandezОценок пока нет

- Ppe Test BankДокумент10 страницPpe Test BankAna Mae HernandezОценок пока нет

- Quiz - Compound Fin InstДокумент1 страницаQuiz - Compound Fin InstAna Mae HernandezОценок пока нет

- Quiz - Acts PayableДокумент2 страницыQuiz - Acts PayableAna Mae HernandezОценок пока нет

- Quiz - Inventories Cut-Off Test 2Документ1 страницаQuiz - Inventories Cut-Off Test 2Ana Mae HernandezОценок пока нет

- Quiz - Current LiabДокумент2 страницыQuiz - Current LiabAna Mae HernandezОценок пока нет

- Plants, Property and EquipmentДокумент21 страницаPlants, Property and EquipmentAna Mae HernandezОценок пока нет

- Quiz - ReceivablesДокумент2 страницыQuiz - ReceivablesAna Mae HernandezОценок пока нет

- Quiz - Recl FinancingДокумент1 страницаQuiz - Recl FinancingAna Mae HernandezОценок пока нет

- College: of Business AdministrationДокумент5 страницCollege: of Business AdministrationAna Mae HernandezОценок пока нет

- Analyzing Trading Securities TransactionsДокумент6 страницAnalyzing Trading Securities TransactionsAna Mae Hernandez33% (3)

- Quiz - Receivables FinalДокумент1 страницаQuiz - Receivables FinalAna Mae HernandezОценок пока нет

- Quiz - ReceivableДокумент2 страницыQuiz - ReceivableAna Mae Hernandez0% (1)

- Quiz - Ppe Cost 2Документ1 страницаQuiz - Ppe Cost 2Ana Mae HernandezОценок пока нет

- Quiz - Ppe DepreciationДокумент1 страницаQuiz - Ppe DepreciationAna Mae HernandezОценок пока нет

- Quiz - Ppe Borrowing CostДокумент1 страницаQuiz - Ppe Borrowing CostAna Mae HernandezОценок пока нет

- Kapoor Case StudyДокумент13 страницKapoor Case StudyBristi ChoudhuryОценок пока нет

- Iarc 2016 Riesgos Cambio Climatico Ingles DefДокумент3 страницыIarc 2016 Riesgos Cambio Climatico Ingles DefCristina Díaz ÁlvarezОценок пока нет

- Global Marketing Strategies - RitulДокумент11 страницGlobal Marketing Strategies - RitulritulОценок пока нет

- 6019SSL CW2Документ18 страниц6019SSL CW2Muhammad Salman KhanОценок пока нет

- International Business: by Charles W.L. HillДокумент35 страницInternational Business: by Charles W.L. HillhabibshadОценок пока нет

- Sample UploadДокумент14 страницSample Uploadparsley_ly100% (6)

- BN 21050 3575598 Wedge Anchor M6x50Документ6 страницBN 21050 3575598 Wedge Anchor M6x50Juliano André PetryОценок пока нет

- Position of Responsibility: Bindu Chandra Shekhar MishraДокумент2 страницыPosition of Responsibility: Bindu Chandra Shekhar Mishraankit mohanОценок пока нет

- Finance Current Affairs March RevisionДокумент47 страницFinance Current Affairs March RevisionRte FrthОценок пока нет

- Performance PrismДокумент12 страницPerformance PrismParandeep ChawlaОценок пока нет

- Annual Report 2017: Towards Infinite PossibilitiesДокумент460 страницAnnual Report 2017: Towards Infinite PossibilitiesrakhalbanglaОценок пока нет

- Career With Deloitte TaxДокумент2 страницыCareer With Deloitte TaxRishi SinghaiОценок пока нет

- Agile Solutions Need Agile DevelopmentДокумент4 страницыAgile Solutions Need Agile DevelopmentGabriel Vazquez SantosОценок пока нет

- Request For Quotation (RFQ) : Page 1 of 15Документ15 страницRequest For Quotation (RFQ) : Page 1 of 15Nundeep RakshitОценок пока нет

- BCG Matrix of Coc-Cola, IndiaДокумент25 страницBCG Matrix of Coc-Cola, Indiakaran_tiff92% (13)

- Resilient and Green Human Settlements Framework 2023Документ64 страницыResilient and Green Human Settlements Framework 2023annisaaindrariniОценок пока нет

- GUE Concepts - Part 1Документ30 страницGUE Concepts - Part 1Hitesh Valecha100% (1)

- Regional Sales Operations Director in Chicago IL Resume Thomas LemmenДокумент2 страницыRegional Sales Operations Director in Chicago IL Resume Thomas LemmenThomasLemmenОценок пока нет

- Power Engineering Pakistan +923224852220Документ2 страницыPower Engineering Pakistan +923224852220Ethan HarryОценок пока нет

- Taaca, Alexa M. Humss 11-C: I. Project Title: Trashketball Project II. Project ProponentsДокумент2 страницыTaaca, Alexa M. Humss 11-C: I. Project Title: Trashketball Project II. Project ProponentsKatryn Marie Bajo0% (1)

- International Business: Strategy, Management, and The New RealitiesДокумент25 страницInternational Business: Strategy, Management, and The New Realitiesmobeenscribd1Оценок пока нет

- KhadimДокумент26 страницKhadimFizza KhanОценок пока нет

- The Fundamentals of Managerial Economics Answers To Questions and ProblemsДокумент42 страницыThe Fundamentals of Managerial Economics Answers To Questions and Problemsrodop82Оценок пока нет

- Accounting Cycle of A Service Business-Step 4-Trial BalanceДокумент30 страницAccounting Cycle of A Service Business-Step 4-Trial BalancedelgadojudithОценок пока нет

- Long 4e TB Ch06Документ5 страницLong 4e TB Ch06abhi74Оценок пока нет

- Blank Accounting FormsДокумент21 страницаBlank Accounting FormsAdam Zakri100% (1)

- DIENA Case SolutionДокумент8 страницDIENA Case SolutionSuryansh SinghОценок пока нет

- Ma 1Документ2 страницыMa 1Suresh JayaramaОценок пока нет

- Impact of Globalisation On Tamil NaduДокумент11 страницImpact of Globalisation On Tamil Nadukirthumuthamilselvan100% (1)

- Accenture Capital Projects Report Metals MiningДокумент24 страницыAccenture Capital Projects Report Metals Miningjkj_13874100% (1)