Академический Документы

Профессиональный Документы

Культура Документы

STP HDFC

Загружено:

vikas9saraswatОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

STP HDFC

Загружено:

vikas9saraswatАвторское право:

Доступные форматы

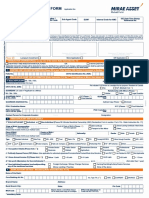

S SYSTEMATIC Enrolment Form

T TRANSFER (Please refer Product labeling available on cover page of the

KIM and terms and conditions overleaf)

P PLAN Enrolment Form No.

April 30, 2016

KEY PARTNER / AGENT INFORMATION (Investors applying under Direct Plan must mention “Direct” in ARN column.) FOR OFFICE USE ONLY

Internal Code Employee Unique (TIME STAMP)

ARN/ RIA Code ARN/ RIA Name Sub Agent’s ARN Bank Branch Code for Sub-Agent/ Identification Number

Employee (EUIN)

ARN-

Upfront commission shall be paid directly by the investor to the ARN Holder (AMFI registered Distributor) based on the investors’ Date: D D M M Y Y Y Y

assessment of various factors including the service rendered by the ARN Holder.

EUIN Declaration (only where EUIN box is left blank) (Refer Instruction No. 18)

I/We hereby confirm that the EUIN box has been intentionally left blank by me/us as this transaction is executed without any interaction or advice by the

employee/relationship manager/sales person of the above distributor/sub broker or notwithstanding the advice of in-appropriateness, if any, provided by the

employee/relationship manager/sales person of the distributor/sub broker.

Sign Here Sign Here Sign Here

First / Sole Unit Holder / Guardian Second Unit Holder Third Unit Holder

I/ We hereby declare and confirm that I/we have read and agree to abide by the terms and conditions of the scheme related documents and the terms & conditions mentioned overleaf of Systematic

Transfer Plan (STP) and the relevant Scheme(s) and hereby apply for enrolment under the Systematic Transfer Plan of the following Scheme(s)/Plan(s)/Options(s). The ARN holder (AMFI registered

Distributor) has disclosed to me/us all the commissions (in the form of trail commission or any other mode), payable to him/them for the different competing Schemes of various Mutual Funds

from amongst which the Scheme is being recommended to me/us.

Please (P

) any one. NEW REGISTRATION CANCELLATION

Folio No. of ‘Transferor’ Scheme (for existing Unit holder) / Application No. (for new investor)

KYC is mandatory#

Name of the Applicant

Please (P)

PAN# Proof Attached

Name of First/Sole Applicant or

PEKRN#

PAN# Proof Attached

Name of Guardian in case First/Sole Applicant is a minor or

PEKRN#

PAN# Proof Attached

Name of Second Applicant or

PEKRN#

PAN# Proof Attached

Name of Third Applicant or

PEKRN#

# Please attach Proof. If PAN/PEKRN/KYC is already validated, please don’t attach any proof. Refer Instruction No. 15 and 16

Name of ‘Transferor’ Scheme/Plan/Option (Investors applying under Direct Plan must mention “Direct” against the Scheme name).

Name of ‘Transferee’ Scheme/Plan/Option (Investors applying under Direct Plan must mention “Direct” against the Scheme name).

For Fixed Systematic Transfer Plan Amount of Transfer per Installment: Rs. _____________________________

(FSIP) Daily# No. of Installments:* _________________

(Please P any one)

Weekly$ [Day of Transfer (Please P

any one)] No. of Installments:* _________________

(Refer Instruction No. 7) Monday Tuesday Wednesday Thursday Friday

+

+

Monthly Quarterly Enrolment Period*:

Date of Transfer (Please P

any one) From: M M Y Y Y Y

+

1st 5th 10th 15th 20th 25th

To: M M Y Y Y Y

+

For Capital Appreciation Systematic Monthly Quarterly Enrolment Period*:

Transfer Plan (CASTP) Date of Transfer (Please P

any one) From: M M Y Y Y Y

(Please P any one) 1st 5th 10th

+

15th 20th 25th

(Refer Instruction No. 8) To: M M Y Y Y Y

In case of multiple registrations, please fill up separate Enrolment Forms.

+

#Refer Instruction No. 7 (a) $Refer Instruction No. 7 (b) *Refer Instruction No. 9 Default Frequency/Date/Day [Refer Instruction 9(a)(v)&(vi)]

SIGNATURE(S)

First / Sole Unit Holder / Guardian Second Unit Holder Third Unit Holder

Please note : Signature(s) should be as it appears on the Application Form and in the same order.

In case the mode of holding is joint, all Unit holders are required to sign.

ACKNOWLEDGEMENT SLIP (To be filled in by the Unit holder)

HDFC MUTUAL FUND

Enrolment

Date: Head Office : HDFC House, 2nd Floor, H.T. Parekh Marg,

165-166, Backbay Reclamation, Churchgate, Mumbai - 400 020. Form No./Folio No.

ISC Stamp & Signature

Received from Mr./Ms./M/s. ___________________________________________ ‘STP’ application for transfer of Units;

from Scheme / Plan / Option _______________________________________________________________________________

to Scheme / Plan / Option __________________________________________________________________________________

TERMS & CONDITIONS / INSTRUCTIONS FOR STP

1. STP is a facility wherein unit holder(s) of designated open- 20th or 25th of the first month of each quarter. The 10. In respect of STP enrollments made in the above-mentioned

ended scheme(s) of HDFC Mutual Fund (Transferor Scheme) beginning of the quarter could be of any month e.g. Scheme(s), the Load Structure prevalent at the time of

can opt to transfer a fixed amount or capital appreciation April, August, October, November, etc. enrollment shall govern the investors during the tenure of the

amount at regular intervals to designated open-ended *an open-ended equity linked savings scheme with a lock-in STP.

schemes) of HDFC Mutual Fund (Transferee Scheme). The period of 3 years. For Scheme load structure, please refer to Key Information

STP Facility is available only for units held / to be held in Non - In case there is no minimum amount (as specified above Memorandum or contact the nearest Investor Service Centre

demat Mode in the Transferor and the Transferee Scheme. under each Option) available in the unit holder’s account, the (ISC) of HDFC Mutual Fund or visit our website

Currently, the schemes (including Direct Plan thereunder) residual amount will be transferred to the Transferee Scheme www.hdfcfund.com

eligible for this facility are as follows: and account will be closed. 11. STP will be automatically terminated if all units are liquidated

HDFC Growth Fund, HDFC Equity Fund, HDFC Top 200 Fund, If STP date/day is a non-Business Day, then the next Business or withdrawn from the Transferor Scheme or pledged or upon

HDFC Capital Builder Fund, HDFC Index Fund, HDFC Day shall be the STP Date/ Day and the same will be receipt of intimation of death of the unit holder.

Children’s Gift Fund, HDFC Balanced Fund, HDFC Prudence considered for the purpose of determining the applicability of 12. The provision of ‘Minimum Redemption Amount’ as specified

Fund, HDFC Long Term Advantage Fund*, HDFC TaxSaver*, NAV. in the Scheme Information Document(s) of the respective

HDFC MF Monthly Income Plan (an open-ended income Unit holders should be aware that if they decide to take up this designated Transferor Schemes and ‘Minimum Application

scheme. Monthly income is not assured and is subject to facility, there is possibility of erosion of capital e.g. If the unit Amount’ specified in the Scheme Information Document(s)

availability of distributable surplus), HDFC Core & Satellite holder decides to transfer Rs. 3,000 every quarter and the of the respective designated Transferee Schemes will not be

Fund, HDFC Premier Multi-Cap Fund, HDFC Mid-Cap appreciation is Rs. 2,500, then such transfer proceeds will applicable for STP.

Opportunities Fund, HDFC Infrastructure Fund, HDFC Gold comprise of Rs. 2,500 from the capital appreciation and 13. Unit holders will have the right to discontinue the STP facility

Fund**, HDFC Arbitrage Fund, HDFC Income Fund, HDFC Rs. 500 from the unit holder’s capital amount. at any time by sending a written request to the ISC. Notice of

High Interest Fund, HDFC Short Term Plan, HDFC Short Term 8. Under the CASTP- Monthly Interval, unit holders will be such discontinuance should be received at least 10 days

Opportunities Fund, HDFC Medium Term Opportunities Fund, eligible to transfer the entire capital appreciation amount prior to the due date of the next transfer date. On receipt of

HDFC Cash Management Fund - Treasury Advantage Plan, (minimum Rs. 300) by way of capital appreciation on the 1st, such request, the STP facility will be terminated.

HDFC Gilt Fund, HDFC Floating Rate Income Fund, HDFC 5th, 10th, 15th, 20th or 25th of each month. Under the 14. Units of HDFC Long Term Advantage Fund and HDFC

Multiple Yield Fund- Plan 2005, HDFC Large Cap Fund, HDFC CASTP-Quarterly Interval, unit holders will be eligible to TaxSaver (open-ended equity linked savings schemes with a

Small and Mid Cap Fund, HDFC Dynamic PE Ratio Fund of transfer the entire capital appreciation amount (minimum Rs. lock-in period of 3 years) cannot be assigned / transferred /

Funds, HDFC Banking and PSU Debt Fund, HDFC Corporate 1,000) by way of capital appreciation on the 1st, 5th, 10th, pledged/ redeemed / switched - out until completion of 3

Debt Opportunities Fund, HDFC Equity Savings Fund and 15th, 20th or 25th of the first month of each quarter. The years from the date of allotment of the respective units.

HDFC Retirement Savings Fund***. beginning of the quarter could be of any month e.g. April, 15. Permanent Account Number

*an open-ended equity linked savings scheme with a lock-in August, October, November, etc. Please note that no transfers SEBI has made it mandatory for all applicants (in the case of

period of 3 years will take place if there is no minimum capital appreciation application in joint names, each of the applicants) to mention

** an open-ended fund of funds scheme investing in HDFC amount (except for last transfer leading to closure of his/her permanent account number (PAN) {Except as

Gold Exchange Traded Fund account). The capital appreciation, if any, will be calculated mentioned below} irrespective of the amount of investment.

***An open-ended notified tax savings cum pension scheme from the enrolment date of the CASTP under the folio, till the Where the applicant is a minor, and does not possess his / her

with no assured returns. Units shall be subject to a lock-in of first transfer date. Subsequent capital appreciation, if any, will own PAN, he / she shall quote the PAN of his/ her father or

5 years from the date of allotment. be the capital appreciation between the previous CASTP date mother or the guardian, as the case may be. Applications not

The above list is subject to change from time to time. (where CASTP has been processed and paid) and the next complying with the above requirement may not be accepted/

Please contact the nearest Investor Service Centre (ISC) CASTP date e.g. if the appreciation is Rs. 3,500 in the first processed. PAN card copy is not required separately if KYC

of HDFC Mutual Fund for updated list. quarter and Rs. 3,000 in the second quarter, the unit holder acknowledgement letter is made available.

2. The STP Enrolment Form should be completed in English and will receive only the appreciation i.e. Rs. 3,500 in the first For further details, please refer Section ‘Permanent Account

in Block Letters only. Please tick (✓ ) in the appropriate box quarter and Rs. 3,000 in the second quarter. Number’ under Statement of Additional Information available

(¨ ), where boxes have been provided. The STP Enrolment 9. a. i) The minimum number of installments under Daily on our website www.hdfcfund.com

Form complete in all respects, should be submitted at any of FSTP is as follows: PAN Exempt Investments

the Official Points of Acceptance of HDFC Mutual Fund. • For schemes other than HDFC TaxSaver* PAN Exempt KYC Reference Number (PEKRN) holders may

3. One STP Enrolment Form can be filled for one Scheme/Plan/ and HDFC Long Term Advantage Fund*: enroll for this facility. For further details on PAN exempt

Option only. - where installment amount is less than Investments, refer Instructions of Scheme Application Form

4. Investors are advised to read the Key Information Rs. 1,000/- : 12 or Statement of Additional Information. However, if the

Memorandum(s) (KIMs) and Scheme Information - where installment amount is equal to amount per installment is Rs.50,000 or more, in accordance

Document(s) (SIDs) of the Transferee Scheme(s) and or greater than Rs. 1,000/- : 6 with the extant Income Tax rules, investors will be required to

Statement of Additional Information (SAI) carefully before • For HDFC TaxSaver* and HDFC Long furnish a copy of PAN to the Mutual Fund.

investing. The SIDs / KIMs of the respective Scheme(s) and Term Advantage Fund*: 6 16. Know Your Customer (KYC) Compliance: Investors should

SAI are available with the ISCs of HDFC Mutual Fund, * an open-ended equity linked savings scheme note that it is mandatory for all registrations for Systematic

brokers/distributors and also displayed at the HDFC Mutual with a lock-in period of 3 years. Transfer Plan (STP) to quote the KYC Compliance Status of

Fund website i.e. www.hdfdund.com (ii) There should be a minimum of 6 Installments for each applicant (guardian in case of minor) in the application

5. Unit holders should note that unit holders’ details and mode of enrolment under Weekly FSTP, Monthly FSTP and and attach proof of KYC Compliance viz. KYC

holding (single, joint, anyone or survivor) in the Transferee CASTP and 2 installments for Quarterly FSTP and Acknowledgement Letter. For more details, please refer to the

Scheme will be as per the existing folio number of the CASTP. Statement of Additional Information available on our website

Transferor Scheme, Units will be allotted under the same folio (iii) Also, the minimum unit holder’s account balance www.hdfcfund.com

number. Unitholders’ names should match with the details in or a minimum amount of application at the time of 17. Investors with existing STP enrolment, who wish to invest

the existing folio number, failing which, the application is STP enrolment in the Transferor Scheme should under the Direct Plan of the Transferee Scheme must cancel

liable to be rejected. be Rs. 12,000. their existing enrollment and register afresh for the facility.

6. STP offers unit holders the following two Plans: (iv) In case of FSTP Daily / Weekly Interval and 18. Investment through Distributors

i. Fixed Systematic Transfer Plan (FSTP) Monthly/ Quarterly Interval, Unitholders are Distributors / Agents are not entitled to distribute units of

ii Capital Appreciation Systematic Transfer Plan (CASTP) required to fill in the number of installments and mutual funds unless they are registered with Association of

FSTP offers transfer facility at daily, weekly, monthly and the enrolment period respectively in the Mutual Funds in India (AMFI). Every employee/ relationship

quarterly intervals and CASTP offers transfer facility at Enrollment Form, failing which the Form is liable to manager/ sales person of the distributor of mutual fund

monthly and quarterly intervals. Unit holder is free to opt for be rejected. products to quote the Employee Unique Identification

any of the Plans and also choose the frequency of such (v) In case Day of Transfer has not been indicated Number (EUIN) obtained by him/her from AMFI in the

transfers. If no frequency is chosen, Monthly frequency shall under FSTP- Weekly frequency, Friday shall be Application Form. Individual ARN holders including senior

be treated as the Default Frequency. treated as Default day of transfer. citizens distributing mutual fund products are also required to

7. a. Under the FSTP -Daily Interval, unit holders will be (vi) In case, the Enrolment Period has been filled, but obtain and quote EUIN in the Application Form. Hence, if your

eligible to transfer a fixed amount (minimum Rs. 500 the STP Date and/or Frequency (Monthly/ investments are routed through a distributor, please ensure

and in multiples of Rs. 100 thereafter for schemes other Quarterly) has not been indicated, Monthly that the EUIN is correctly filled up in the Application Form

than HDFC Long Term Advantage Fund* and HDFC frequency shall be treated as Default frequency However, in case of any exceptional cases where there is no

TaxSaver* and minimum Rs. 500 and in multiples of Rs. and 10th shall be treated as Default Date. interaction by the employee/ sales person/relationship

500 thereafter for HDFC TaxSaver* and HDFC Long b. In case of FSTP - Daily and Weekly Interval, the manager of the distributor/sub broker with respect to the

Term Advantage Fund*) on every Business Day. commencement date shall be within 15 days from the transaction and EUIN box is left blank, you are required to

b. Under the FSTP - Weekly Interval, unit holders will be date of receipt of a valid request. provide the duly signed declaration to the effect as given in

eligible to transfer a fixed amount (minimum Rs. 1,000 c. The application for enrollment for FSTP - Monthly & the form. For further details on EUIN you may kindly refer to

and in multiples of Rs. 100 thereafter for schemes other Quarterly Interval and CASTP - Monthly & Quarterly the instructions of the Scheme Application Form or

than HDFC Long Term Advantage Fund* and HDFC Interval should be submitted at least 10 Days and not Statement of Additional Information.

TaxSaver* and minimum Rs. 500 and in multiples of Rs. more than 90 days before the desired commencement These requirements do not apply to Overseas Distributors.

500 thereafter for HDFC TaxSaver* and HDFC Long date. New cadre distributors: New cadre distributors are

Term Advantage Fund*) on any Business Day of the In case the Start Date is mentioned but End Date is not permitted to sell eligible schemes of the Fund (details of

week i.e. Monday, Tuesday, Wednesday, Thursday or mentioned, the application will be registered for the eligible scheme is available on www.hdfcfund.com)They

Friday. minimum number of installments. also hold an EUIN which must be quoted in the application

c. Under the FSTP - Monthly Interval, unit holders will be In case the End Date is mentioned but Start Date is not form. In case your application through such distributor is not

eligible to transfer a fixed amount (minimum Rs. 1,000 mentioned, the application will be registered after for an eligible scheme, it is liable to be rejected.

and in multiples of Rs. 100 thereafter for schemes other expiry of 10 days from submission of the application Direct Investments

than HDFC TaxSaver* and HDFC Long Term Advantage from the default date i.e. 10th of each month / quar ter Investors applying under Direct Plan must mention “Direct” in

Fund* and minimum Rs. 500 and in multiples of Rs. (or the immediately succeeding Business Day), ARN column. In case Distributor code is mentioned in the

500 thereafter for HDFC TaxSaver* and HDFC Long provided the minimum number of installments are met. application form, but “Direct Plan” is indicated against the

Term Advantage Fund*) on the 1st, 5th, 10th, 15th, d. There will be no maximum duration for STP enrolment. Transferee Scheme name, the Distributor code will be

20th or 25th of each month. However, STPs will be registered in a folio held by a ignored and the application will be processed under Direct

d. Under the FSTP - Quarterly Interval, unit holders will be minor, only till the date of the minor attaining majority, Plan.

eligible to transfer a fixed amount (minimum Rs. 3,000 even though the instructions may be for a period 19. HDFC Mutual Fund / HDFC Asset Management Company

and in multiples of Rs. 100 thereafter for schemes other beyond that date. The STP facility will automatically Limited reserves the right to change/modify the terms and

than HDFC TaxSaver* and HDFC Long Term Advantage stand terminated upon the Unit Holder attaining 18 conditions of the STP. For the updated terms and conditions of

Fund* and minimum Rs. 500 and in multiples of Rs. years of age. STP, contact the nearest ISC or visit our website

500 thereafter for HDFC TaxSaver* and HDFC Long www.hdfcfund.com

Term Advantage Fund*) on the 1st, 5th, 10th, 15th,

HDFC Mutual Fund

Вам также может понравиться

- Gel Electrophoresis Lab ReportДокумент10 страницGel Electrophoresis Lab Reportapi-31150900783% (6)

- Protecting The Pianist's Hand: The Carrezando Touch and MoreДокумент6 страницProtecting The Pianist's Hand: The Carrezando Touch and MoreAdrianОценок пока нет

- Gulliver's Travels Misogyny or MisanthropyДокумент3 страницыGulliver's Travels Misogyny or MisanthropyKingshuk MondalОценок пока нет

- Deepa CVДокумент3 страницыDeepa CVDeepa M PОценок пока нет

- ASTM 3950 Testing Methods For Strapping Versie 2007 211007 PDFДокумент7 страницASTM 3950 Testing Methods For Strapping Versie 2007 211007 PDFNestor CzerwackiОценок пока нет

- Record of Appropriations and Obligations: TotalДокумент1 страницаRecord of Appropriations and Obligations: TotaljomarОценок пока нет

- Atestat EnglezaДокумент29 страницAtestat EnglezaAdrianaОценок пока нет

- HDFC Common Application FormДокумент3 страницыHDFC Common Application FormTirthGanatraОценок пока нет

- Enrolment Form For SIP/ Micro SIPДокумент4 страницыEnrolment Form For SIP/ Micro SIPSaranyaОценок пока нет

- CAMS Common Application FormДокумент4 страницыCAMS Common Application Formranjan sharmaОценок пока нет

- CAMS Common Application FormДокумент4 страницыCAMS Common Application Forminstacom54Оценок пока нет

- HDFC Mutual Fund Common SIP NACH Mandate Application FormДокумент6 страницHDFC Mutual Fund Common SIP NACH Mandate Application FormTarun TiwariОценок пока нет

- Application Form: First/ Sole Applicant/ Guardian Third Applicant Second ApplicantДокумент4 страницыApplication Form: First/ Sole Applicant/ Guardian Third Applicant Second ApplicantRinkiОценок пока нет

- HDFC Retirement Savings Fund: First/ Sole Applicant/ Guardian Third Applicant Second ApplicantДокумент7 страницHDFC Retirement Savings Fund: First/ Sole Applicant/ Guardian Third Applicant Second ApplicantAltamash FaridОценок пока нет

- Mirae SIP FormДокумент5 страницMirae SIP FormdurgeshОценок пока нет

- PGIM Common Application With SIPДокумент6 страницPGIM Common Application With SIPRakesh LahoriОценок пока нет

- Common Application FormДокумент5 страницCommon Application FormNeeraj KumarОценок пока нет

- HDFC CafДокумент3 страницыHDFC CafSachin JamaiyarОценок пока нет

- Common APP AND SIP (1)Документ8 страницCommon APP AND SIP (1)successinvestment2005Оценок пока нет

- Common Application Form MAHINDRAДокумент4 страницыCommon Application Form MAHINDRAsathisha123Оценок пока нет

- SIP Application FormДокумент3 страницыSIP Application FormspeedenquiryОценок пока нет

- Boi Axa Common Application With SipДокумент4 страницыBoi Axa Common Application With SipRakesh LahoriОценок пока нет

- Please Fill All Fields With Black Ball Point, in Block Letters and All Fields Are MandatoryДокумент4 страницыPlease Fill All Fields With Black Ball Point, in Block Letters and All Fields Are MandatoryApurv DixitОценок пока нет

- Franklin Application FormДокумент3 страницыFranklin Application FormNitinОценок пока нет

- Application Form For New InvestorsДокумент8 страницApplication Form For New InvestorsShuja MirОценок пока нет

- Transaction Charges: For Office Use OnlyДокумент2 страницыTransaction Charges: For Office Use Onlypunitwishes7157Оценок пока нет

- ICICI Prudential Common Application With SIPДокумент5 страницICICI Prudential Common Application With SIPRakesh LahoriОценок пока нет

- SIP Auto Debit Form 2011Документ4 страницыSIP Auto Debit Form 2011Anirudha MohapatraОценок пока нет

- Reliance Tax Saver ELSS CAF Full Form ARN 39091Документ21 страницаReliance Tax Saver ELSS CAF Full Form ARN 39091tariq1987Оценок пока нет

- BNP Common Application With SIPДокумент3 страницыBNP Common Application With SIPRakesh LahoriОценок пока нет

- Application Form For Sip & Flex SipДокумент3 страницыApplication Form For Sip & Flex SipNikesh MewaraОценок пока нет

- Mahindra MF Application FromДокумент4 страницыMahindra MF Application FromnanduvermaОценок пока нет

- INVESCO Common Application With SIPДокумент6 страницINVESCO Common Application With SIPRakesh LahoriОценок пока нет

- Kotak MF Common Application With SIPДокумент4 страницыKotak MF Common Application With SIPRakesh LahoriОценок пока нет

- BOI - Sip Shield FormДокумент6 страницBOI - Sip Shield Formabhi07_gzbОценок пока нет

- One Time Mandate Registration Form/ Debit Mandate Form NACH/ ECS/ Direct DebitДокумент2 страницыOne Time Mandate Registration Form/ Debit Mandate Form NACH/ ECS/ Direct DebitAnand KopareОценок пока нет

- SIP Form DebtДокумент6 страницSIP Form DebtNilesh MahajanОценок пока нет

- Boi MF Common Application FormДокумент3 страницыBoi MF Common Application FormQUSI E. ABDОценок пока нет

- AXIS-New Common Application Form 2023 1Документ4 страницыAXIS-New Common Application Form 2023 1Brahmbhatt ConsultancyОценок пока нет

- Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Документ2 страницыApplication Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Chintan JainОценок пока нет

- SR Form - PANДокумент1 страницаSR Form - PANBhavin PatelОценок пока нет

- NipponIndia SMART STeP (EUIN) FormДокумент2 страницыNipponIndia SMART STeP (EUIN) FormOneappОценок пока нет

- Common Application FormsДокумент5 страницCommon Application Formsvgudge8475Оценок пока нет

- HDFC Children Fund FormДокумент6 страницHDFC Children Fund FormAadeesh JainОценок пока нет

- Sip Enrollment DetailsДокумент2 страницыSip Enrollment DetailsDBCGОценок пока нет

- Common Application FormДокумент4 страницыCommon Application FormRaghav ArroraОценок пока нет

- Common Application FormДокумент4 страницыCommon Application FormShubham TamrakarОценок пока нет

- Common and Sip 5formДокумент7 страницCommon and Sip 5formavinash sengarОценок пока нет

- JM Equity Tax Saver FundДокумент4 страницыJM Equity Tax Saver Funddrashti.investments1614Оценок пока нет

- Systematic Transfer Plan / Systematic Withdrawal Plan: Existing Unit Holder InformationДокумент1 страницаSystematic Transfer Plan / Systematic Withdrawal Plan: Existing Unit Holder Informationvikas9saraswatОценок пока нет

- Common Transaction Slip 05 05 2017 Sample PDFДокумент1 страницаCommon Transaction Slip 05 05 2017 Sample PDFvenkatnimmsОценок пока нет

- US Internal Revenue Service: f8453p - 2004Документ2 страницыUS Internal Revenue Service: f8453p - 2004IRSОценок пока нет

- Apply for Samco Mutual FundДокумент4 страницыApply for Samco Mutual FundRavindraОценок пока нет

- Slip PDFДокумент1 страницаSlip PDFPrachi BhosaleОценок пока нет

- PMV Request Form: A-Requestor To CompleteДокумент1 страницаPMV Request Form: A-Requestor To CompleteRAJОценок пока нет

- Sole / First Applicant Second Applicant Third ApplicantДокумент2 страницыSole / First Applicant Second Applicant Third ApplicantAnkur KaushikОценок пока нет

- Common Application Form: For Lump Sum/Systematic InvestmentsДокумент4 страницыCommon Application Form: For Lump Sum/Systematic Investmentspunitwishes7157Оценок пока нет

- UTI - Unit Linked Insurance Plan (UTI-ULIP) New Aplication FormДокумент8 страницUTI - Unit Linked Insurance Plan (UTI-ULIP) New Aplication FormAnilmohan SreedharanОценок пока нет

- US Internal Revenue Service: f8453p - 1999Документ2 страницыUS Internal Revenue Service: f8453p - 1999IRSОценок пока нет

- Common Transaction SlipДокумент3 страницыCommon Transaction Slipabdriver2000Оценок пока нет

- BNP MF Common Application Form EquityДокумент2 страницыBNP MF Common Application Form EquityQUSI E. ABDОценок пока нет

- ICICI Prudential - Common Application FormДокумент2 страницыICICI Prudential - Common Application FormkrishnaОценок пока нет

- Application Form For Existing Investors: My DetailsДокумент8 страницApplication Form For Existing Investors: My Detailsvikas9saraswatОценок пока нет

- Kim of Motilal Oswal Most Focused Multicap 35 FundДокумент46 страницKim of Motilal Oswal Most Focused Multicap 35 Fundvikas9saraswatОценок пока нет

- Systematic Transfer Plan / Systematic Withdrawal Plan: Existing Unit Holder InformationДокумент1 страницаSystematic Transfer Plan / Systematic Withdrawal Plan: Existing Unit Holder Informationvikas9saraswatОценок пока нет

- DSP Us Nri DeclarationДокумент1 страницаDSP Us Nri DeclarationAmit Desai PredictorОценок пока нет

- CAMS CKYC Application FormДокумент4 страницыCAMS CKYC Application Formdibyaduti_20009197Оценок пока нет

- Systematic Transfer Plan / Systematic Withdrawal Plan: Existing Unit Holder InformationДокумент1 страницаSystematic Transfer Plan / Systematic Withdrawal Plan: Existing Unit Holder Informationvikas9saraswatОценок пока нет

- Kim Amp Application FormДокумент70 страницKim Amp Application FormshridharmasterОценок пока нет

- DSP BRДокумент1 страницаDSP BRvikas9saraswatОценок пока нет

- CAMS CKYC Application FormДокумент4 страницыCAMS CKYC Application Formdibyaduti_20009197Оценок пока нет

- New Kyc FormДокумент3 страницыNew Kyc Formvikas9saraswatОценок пока нет

- NJ To NJ Bro Change-4-1Документ43 страницыNJ To NJ Bro Change-4-1vikas9saraswatОценок пока нет

- Common SIP Stop FormДокумент1 страницаCommon SIP Stop Formvikas9saraswatОценок пока нет

- New Kyc FormДокумент3 страницыNew Kyc Formvikas9saraswatОценок пока нет

- FATCA-CRS Declaration FormДокумент6 страницFATCA-CRS Declaration Formvikas9saraswatОценок пока нет

- Commo 1Документ1 страницаCommo 1vikas9saraswatОценок пока нет

- 10 Science NcertSolutions Chapter 10 ExercisesДокумент9 страниц10 Science NcertSolutions Chapter 10 Exercisesvikas9saraswatОценок пока нет

- Orbeez Sorting and Patterns Learning ExperienceДокумент5 страницOrbeez Sorting and Patterns Learning Experienceapi-349800041Оценок пока нет

- Shakuntala and Other Works, by KåalidåasaДокумент255 страницShakuntala and Other Works, by KåalidåasaMohamed Sayed AbdelrehimОценок пока нет

- Wag Acquisition v. Vubeology Et. Al.Документ29 страницWag Acquisition v. Vubeology Et. Al.Patent LitigationОценок пока нет

- Special Functions of Signal ProcessingДокумент7 страницSpecial Functions of Signal ProcessingSaddat ShamsuddinОценок пока нет

- LNG Bunker QraДокумент58 страницLNG Bunker QraEngineer165298Оценок пока нет

- Adele Lyrics Play the Adele QuizДокумент2 страницыAdele Lyrics Play the Adele QuizkomangОценок пока нет

- Image/Data Encryption-Decryption Using Neural Network: Shweta R. Bhamare, Dr. S.D.SawarkarДокумент7 страницImage/Data Encryption-Decryption Using Neural Network: Shweta R. Bhamare, Dr. S.D.SawarkarPavan MasaniОценок пока нет

- CGE Quester Spec Sheet E29Документ2 страницыCGE Quester Spec Sheet E29Ruveen Jeetun100% (1)

- QUARMEN Prerequisites - SEM1Документ12 страницQUARMEN Prerequisites - SEM1Valérie NguyenОценок пока нет

- Right to Personal Liberty and Judicial Process in IndiaДокумент636 страницRight to Personal Liberty and Judicial Process in IndiaDrDiana PremОценок пока нет

- 100 Seniman Yang Membentuk Sejarah DuniaДокумент134 страницы100 Seniman Yang Membentuk Sejarah DuniaIBRAHIM S.Sos,IОценок пока нет

- Tauros TBM Guidance SystemДокумент3 страницыTauros TBM Guidance SystemMiloš StanimirovićОценок пока нет

- Sujet Dissertation Sciences PolitiquesДокумент7 страницSujet Dissertation Sciences PolitiquesDoMyPaperSingapore100% (1)

- Tiotropium Bromide: Spiriva Handihaler, Spiriva RespimatДокумент9 страницTiotropium Bromide: Spiriva Handihaler, Spiriva RespimatAssem Ashraf KhidhrОценок пока нет

- Role and Function of Government As PlanningДокумент6 страницRole and Function of Government As PlanningakashniranjaneОценок пока нет

- BV14 Butterfly ValveДокумент6 страницBV14 Butterfly ValveFAIYAZ AHMEDОценок пока нет

- (Homebrew) ShamanДокумент15 страниц(Homebrew) ShamanVictor Wanderley CorrêaОценок пока нет

- Gram Negative Rods NonStool Pathogens FlowchartДокумент1 страницаGram Negative Rods NonStool Pathogens FlowchartKeithОценок пока нет

- Corporate Social Responsibility International PerspectivesДокумент14 страницCorporate Social Responsibility International PerspectivesR16094101李宜樺Оценок пока нет

- CH06 Binding MaterialsДокумент114 страницCH06 Binding MaterialsAbass AwalehОценок пока нет

- Key concepts in biology examДокумент19 страницKey concepts in biology examAditya RaiОценок пока нет

- AA Practice Problems on Amino Acids and Peptides (less than 40 charsДокумент20 страницAA Practice Problems on Amino Acids and Peptides (less than 40 charsNurlaeli NaelulmunaMajdiyahОценок пока нет

- Circle, Cube, and CuboidsДокумент27 страницCircle, Cube, and CuboidsYohanes DhikaОценок пока нет