Академический Документы

Профессиональный Документы

Культура Документы

Tax 1 Syllabus-A PDF

Загружено:

blimjuco0 оценок0% нашли этот документ полезным (0 голосов)

22 просмотров15 страницОригинальное название

TAX 1 SYLLABUS-A.pdf

Авторское право

© © All Rights Reserved

Доступные форматы

PDF или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

22 просмотров15 страницTax 1 Syllabus-A PDF

Загружено:

blimjucoАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

Вы находитесь на странице: 1из 15

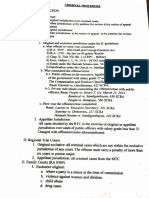

SYLLABUS IN TAXATION [

(REVISED BY 2016-2017)

GENERAL PRINCIPLES &

INCOME TAXATION (tor updating wih RA 10965 provisions)

A. General Principies of Taxation

1. Concept Underlying Basis2 and Purpose

Taxation, Taxes Defined

Attributes or Characteristics of Taxes

1) Cebu Portland Cement v, CTA, L-29059, 15 Dec 1987, 156 SCRA 535 (Lifeblood of the

Governmen:)

‘

4)_-Mun. of Makati v. CA, et al, L-89898, 01 Oct 1990, 190 SCRA 206 (Exempt from execution)

CIR. Algue, Inc etal, L-28896, 17 Feb 1988, 158 SCRA 9 (Lifeblood Theory; Rationale is

Symolotic Raleionship; timeliness of assessment / collection; effect of warrant of distraint &

levy; deductibility of promotional expense)3

igs Bank v. CA etal, 330 SCRA S07, 12 Apr 2000 (Mutual Observance of

is for refund due to losses, how to prove entitlement) 4

2. Principles of a Sound Tax System

Fiscal Adequacy

‘Theoretical justice

Administrative Feasibility

Will the non-obse:vance of these principles invalidate the tax law? No, unless

other inherent and constitutional limitations are infringed.

3. Scope of axation

No attribute of sovereignty is more pervading, unlimited, plenary,

‘comprehensive and supreme

What isthe concept cf taration? I: cam be viewed in two ways, namely@a) asa power to tax and (b) asthe act

‘or process by which taxing power ic exercised

What isthe theory or underiying besis of taxation? It is @ necessity without which no government could exist

revenues collected are incended to finance government and its 100k)

See Rev Reg No, 2-82, 29 Mar 1982 - taxation of sales of shares of stocks classified as

capital assets

See Rit 7~2003 ~ capital assets vs ordinary assets

(Cash reward to informers 1096, max of 1M [see Sec 282, NIRC)

Non-resident Citizen

From withit Phil ~ same rules as to resident citizen

Without Phil ~exempt

Resident Alien

‘Same rules as to resident citizen, but only on income earned from within Phil

Non-resident Alien

Engaged in business (183 days) - same as resideat alien with respect to compensation,

‘business, other income and passive income, but not entitled to additional exemption,

except: dividends from domestic corp - 20% (See 25(4)(2)

Not engages! ~ 25% on gross income (but entitled to preferred rates for sale of shares of

stocks and real property)

Dividends from domestic corp ~ 25%

Royalties, prizes & winnings ~ 25%

Employed by OBU, RHQ/ ROHQ, MNC, petroleum service contractors / subcon (same

treatment to Filipino of same rank & job ~ 15% based on gross income of non-

residents, whether individual or corp from transactions with depositary banks

under ecpanded! foreign currency deposit system - exempt from income tax, Sec 27

VGH

Estates and Trusts (Sec 60 to 66, NIRC)

CATEGORIES OF INCOME OF INDIVIDUAL TAXPAYERS

Compensation

Fringe Eenefits

Income ‘rom Trade / Business

Exercise of Profession

Passive income

Osher Dealings in P-operty

COMPUTATION OF INCOME TAX DUE OF INDIVIDUAL WHO EARNS BUSINESS, COMPENSATION

AND OTHER INCOME

Gross Seles / Receipts

Less: Séles Returns & Discounts

Met Sales

Less: Cost of Sales / Servi

‘Gross Income from business or exercise of profession

Campersation income (purely compensation income is not entitled to business deductions)

Other Income (other than taose subject to final tax)

Total Gross Income

Less: Itemized! Deductions or optional standard deduction

Personal ard additional exemptions

Taxable income

Tax Due (Tax tabl 5% to 32%)

Creditable W/Tax

Tax still due / refund

V'YPE OF GROSS INCOME OF INDIVIDUALS SUBJECT TO 5% TO 32% TAX

Compensation

Trade / Business

Exercise of Profession

Frizes / Winnings ~P 10K or less

Capital enins on real property sold to government - 6% oF 5% to 32%

Gther capital gains from dealings in phoperty [except those subject to 6% final tax on land and

£9 or 19% final tax on shares of stocks and ¥ of 19 transaction tax on shares of stocks traded

2nd sold through the stock exchanges; see below

Cepital gains otner chan from real property and shares of stocks are stil subject tothe rules on

long term and short term investments, ie. 1 year or less and over 1 year holding period: loss

carry ov2r and deduction rues of capital loss v. capital gains and ordinary income only.

INCOME OF INDIVIDUALS SUBJECT TO FINAL TAX

Fassive Income

Prizes / winni

Dividends.

Royslties

Interest

Capital Gains from sale or exchange of shares of stock (outside of stock exchanges):

Capical gains from sale of real property (held as capitsl asset)

Compensation from ROHQ/RHQ, OBU, ete

Informner's reward

‘5 >PLOK, except from PCSO, ete

GENERAL PROFESSIONAL PARTNERSHIP (Sec 26) -

Exempt from income tax as a corporation but its partners are taxable on their share whether

distributed or not

79) Its exclusion is a classification clause not an exemption thus construed in favour of taxpayer,

CIR. Ledesma, 31 SCRA 95, 30 Jan 1970

£0) Sison v. Ancheta and Tan v. Del Rosario, supra

TAX BASE AND TAX RATES APPLICABLE TO CORP (Sec 27 ~

Heaning, of Corp 0° partnership

Sharing not taxable ~ Paseual v. CIR, 166 SCRA 560 (1988)

o-ownership is oct taxable, Ona v. CIR, 45 SCRA 74; Obillos v. CIR, 139 SCRA 436 (1985);

rited Ona, Evangelista cases

‘Afisco Insurance v. CIR, GR No. L-112675, 25 Jan 1999; taxed as a corporation the pool of

insurance companies

Joint Emergency Operations Coll v. Batangas, 54 0G 6724

Power ef Attorney for operation of mining claims deemed partnership Philex Mining . CIR,

|, NIRC)

GR No, 148187, 16 Apr 2008,

Kinds af Corporation

Domestic (Sec 27)

Profit-orienced (3286); effective July 1,2005 ~ 35% effective January 1, 2009 - 30% pet

PA9337

Proprietary educational and non-profit hospital - 1096 of taxable income, except passive

{ncome; contrast with atax exempt non-stock and non-profit educational institution; See

‘art. XIV, See 8(3) of the Constitution; Central Mindanao State Universtiy v. Dept of

‘Agrarian Reform 215 SCRA 86 (1992); and Abra Valley College, Inc. v. Aquino, 162

SCRA 106 (1988)

Government Corps - S85, GSIS, PHIC, PCSO & PAGCOR (Pageor now taxable under RA

337)

Foreign (See 23)

Resident ~ engaged in business

Non-resident

Others whose activities or ventures considered as corporation for income tax purposes

“AXATION OF DIFFERENT TYPES OF INCOME OF DOMESTIC CORP - SUBJECT TO TAX ON INCOME

ARNED FROM ALL SOURCES (WITHIN & WITHOUT THE PHILS); see NV Reederif Amsterdam v.

CIR GR No, 46029, 23 june 1988

‘On taxable income (other than passive income) ~ 34%, 33% or 32% starting 2000, 35%;

clfective January 1, 2009 ~ 30% per RA 9337

‘On Passive Income

Royalty ~ 20%

Interest / Yield from bank deposits, deposit substitutes, Trust Fund and similar

arrangement ~ 20% [CIR v. Solidbank, GR No, 148191, 25 Nov 2003 - GRT v.

2W7 = no double taxation; accrued v. constructive}

Interest Income (expanded foreign currency) - 75%

Interest Income of depositary banks from deposits in foreign currency & loans to

residents ~ 10%

Interest income from non-residents, whether individual or corp exempt

Interest (5 years or more maturity) ~ exempt: if pre terminated <3- 20%, <4 ~ 12%,

<5 5%

Interest passed on by parent company to its subsidiaries on reimbursement basis

re taxable to parent company. The real lender is che banks. [CTA Case No.

7036, 10 Jan 2008]

Dividends from domestic corp and taxable partnership ~ exempt from regular

income tax (See Sec 73, NIC]

Dividends from foreign corp subject to regular income tax

Capita’ gains from sale of real property located in the Phil ~ 6%

Where sale of land was made between PEZA-registered enterprises subject to 5%

preferential tax ” in Meu of all other taxes", the same is not subject to 6% CGT,

VAI or DST [DA 025-2008, 22 Jan 2008]

Sale of “eal property held for investment by a holding company and not engaged in

real estate business is subject to 6% CCT & DST but exempt from VAT [DA 011-

2008, 15 Jan 2008]

Buyers af real property who are not engaged in trade or business are required to

‘w:lhhold the creditable tax from the purchase price. If seller already remitted

the tax, thez2 is no more obligation to pay the tax or the penalty, (DA 02-2008,

‘08 Jan 2008)

Sale ci stocks 07 domestic corp

Listed and thru stock exchange - exempt from income tax, but subject to

business tax at % of 1% of gross (Sec 127)

1P9 of a taxpayer granted with legislative air transport franchise is not

subject to IPO tax because of ipso facto provision in its franchise that levels

‘tie playing field with competition. The competition franchise provides that

it shall pay 2% franchise tax or basic corp income tax whichever is lower, “in

lieu of other taxes’. The issuance of shares of stocks is likewise not subject to

DST. (DA 05-2008, 9 Jan 2008}

Wot listed or iflisted, not trade thru stock exchange ~ 5%, 10% (100K, >100k)

Sew RR 7-2003 Capital assets v. Ordinary Assets

/M% MCIT BASED ON GROSS INCOME (see Rev Reg 9-98, 25 Aug 1998)

Eeginnirg immed.avely on the 4* taxable year from start of operations; compare tax based on

30% ind 29% of Gross income whichever is higher. Carry Forward of Excess MCIT vs regular

tax for 3 immestiately succeeding years

Relies due to prulonged labor disptes, force majeure, and other legit buss reverses

Gross Income seans Gross Sales less sale returns, discounts & allowances & Cost of Goods

Sold (CGS). C5 include all expenses to produce the goods to bring them to their present

location & use. For tracing or merchandising, CIF & duties; for manufacturing, cost of goods

manafactured and sold, cost of producing finished goods; for seller of services, Gross

Receipts less sales returns, discounts, allowances & cost of services, facilites, salaries,

benefits, equipa.ent, rent supplies; for banks, include interest expense.

£1) CREBS Ine v. Ese Secretary, etal - GR NO, 160756, 09 March 2010 (Validity of imposition of

(MCT and otter “elated issues)

5% OF GROSS INCOME |S: AN OPTION TO CORPORATION

Tax effor: ratio = 22% of GNP

Income tax collect] = 40% total revenues

VAT = 4% of GNP

Consolic ated Publ c Sector Financial Positir

9% of GNP

RESIDENT FOREIGN CORFORATION

20% effe-tive Jam. ry 1, 2009 ~ same as domestic corp, except that taxable income should come

from Phil scur-vs

{nernational Carrer ~2 % of Gross Phil Billings (GPB)

‘Air Carrier continuous and uninterrupted Might originating from Phil regardless of place of

issue and payment, exchange with other airlines; but in transhipment. ony the leg from

vail

Shipping ~ ori

slocument

(2) CAR’ Toky> Saipping Co. GR No, L-66252, 25 May 1995 [Claim for refund of tax on GPE fom

hare or vessel Clif refund construed stuitcssint juris nding of fact by CTA tha vessel ft

with ut suger laden; 15 vears lapsed without refund though at one point lawyer of BIR said i was

approved: Ki goose thot lay che golden eg}

(0% -Otishore banicng units - income from foreign transactions with local and resident banks,

Inching fron ‘oreign leans with residents

5% Branch profits remittances based on total profits applied or earmarked for remittance

‘without decue: on oftax component paid via withholding system

lexcept sctivitiesrejistered with PEZA

13): of ince» rent, dividends, salaries, omuneraticn, capital gains, royalty, et if not effectively

onvcte with tv conduct of ts trade oF Business inthe Phils [see CIR v. Marubeni, 177 SCRA

500

0% - REQ. AH, IAQ - Sec 22 DD & EE, NIC, or definitions

20% -oninterest: royaltes

1 interest income from expanded foreign currency denominated units in a depositary

cating fom Phil up to final destination; regardless of sale or payment of

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Chapter 5 CharterpartiesДокумент24 страницыChapter 5 Charterpartiesblimjuco100% (3)

- Chapter 5 CharterpartiesДокумент24 страницыChapter 5 Charterpartiesblimjuco100% (3)

- Lecture in Obligations and CONTRACTS With JurisprudenceДокумент105 страницLecture in Obligations and CONTRACTS With JurisprudenceEmerson L. Macapagal84% (19)

- Colinares Vs PeopleДокумент2 страницыColinares Vs PeopleblimjucoОценок пока нет

- Mariano V ReyesДокумент13 страницMariano V ReyesblimjucoОценок пока нет

- Gabrito V CAДокумент6 страницGabrito V CAblimjucoОценок пока нет

- Reviewer in Local Government (Law On Public Corporation) : Fall in L (Aw) Ve.Документ41 страницаReviewer in Local Government (Law On Public Corporation) : Fall in L (Aw) Ve.blimjucoОценок пока нет

- Demande de Conversion de Certificat de Vaccination en Cle85188dДокумент2 страницыDemande de Conversion de Certificat de Vaccination en Cle85188dblimjucoОценок пока нет

- Tax I Syllabus-B PDFДокумент9 страницTax I Syllabus-B PDFblimjucoОценок пока нет

- Charter PartyДокумент4 страницыCharter Partyjcfish07Оценок пока нет

- Holiday Gift TagДокумент1 страницаHoliday Gift TagblimjucoОценок пока нет

- Tax 1 Syllabus-AДокумент15 страницTax 1 Syllabus-AblimjucoОценок пока нет

- Tax I Syllabus-B PDFДокумент9 страницTax I Syllabus-B PDFblimjucoОценок пока нет

- People vs. AstorgaДокумент2 страницыPeople vs. AstorgablimjucoОценок пока нет

- Tax 1 Syllabus-A PDFДокумент15 страницTax 1 Syllabus-A PDFblimjucoОценок пока нет

- Tax 1 Syllabus-A PDFДокумент15 страницTax 1 Syllabus-A PDFblimjucoОценок пока нет

- Criminal ProcedureДокумент36 страницCriminal ProcedureblimjucoОценок пока нет

- Tax I Syllabus-B PDFДокумент9 страницTax I Syllabus-B PDFblimjucoОценок пока нет

- Tax 1 Syllabus-A PDFДокумент15 страницTax 1 Syllabus-A PDFblimjucoОценок пока нет

- LEGRESДокумент128 страницLEGRESblimjucoОценок пока нет

- LEGRES - FlattenedДокумент2 страницыLEGRES - FlattenedblimjucoОценок пока нет

- CrimPro SyllabusДокумент8 страницCrimPro SyllabusblimjucoОценок пока нет

- Tax I Syllabus-B PDFДокумент9 страницTax I Syllabus-B PDFblimjucoОценок пока нет

- Part 5Документ2 страницыPart 5blimjucoОценок пока нет

- Part 4Документ2 страницыPart 4blimjucoОценок пока нет

- Part 2Документ2 страницыPart 2blimjucoОценок пока нет

- Gsis SSS Philhealth Pag-Ibig (HDMF) : ER EE XPTДокумент2 страницыGsis SSS Philhealth Pag-Ibig (HDMF) : ER EE XPTblimjucoОценок пока нет

- Contributions/ Fees 1. EE's Contribution: Members Who Can AffordДокумент2 страницыContributions/ Fees 1. EE's Contribution: Members Who Can AffordblimjucoОценок пока нет