Академический Документы

Профессиональный Документы

Культура Документы

Boos 2018 Pfs

Загружено:

Reform AustinИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Boos 2018 Pfs

Загружено:

Reform AustinАвторское право:

Доступные форматы

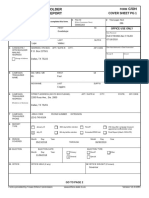

PERSONAL FINANCIAL STATEMENT FORM PFS

COVER SHEET

PAGE 1

PAGE #

Filed in accordance with chapter 572 of the Government Code. 13

For filings required in 2018, covering calendar year ending December 31, 2017.

ACCOUNT #

Use FORM PFS--INSTRUCTION GUIDE when completing this form. 00068095

1 NAME TITLE; FIRST; MI OFFICE USE ONLY

Mr. Jonathan M. Date Received

ELECTRONICALLY FILED

NICKNAME; LAST; SUFFIX 02/13/2018

Boos

2 ADDRESS ADDRESS / PO BOX; APT / SUITE #; CITY; STATE; ZIP

Receipt #

PO Box 495072

HD / PM Amount

Garland, TX 75049

Date Processed

(CHECK IF FILER'S HOME ADDRESS)

3 TELEPHONE AREA CODE PHONE NUMBER; EXTENSION Date Imaged

NUMBER

(972) 965-6098

4 REASON

FOR FILIING

STATEMENT X State Representative - District 113

CANDIDATE ____________________________________________________________ (INDICATE OFFICE)

ELECTED OFFICER ______________________________________________________ (INDICATE OFFICE)

APPOINTED OFFICER ____________________________________________________ (INDICATE AGENCY)

EXECUTIVE HEAD _______________________________________________________ (INDICATE AGENCY)

FORMER OR RETIRED JUDGE SITTING BY ASSIGNMENT

STATE PARTY CHAIR ____________________________________________________ (INDICATE PARTY)

OTHER ________________________________________________________________ (INDICATE POSITION)

5 Family members whose financial activity you are reporting (see instructions).

SPOUSE _____________________________________________________________________________________________________

DEPENDENT CHILD 1. ______________________________________________________________________________________

2. ______________________________________________________________________________________

3. ______________________________________________________________________________________

In Parts 1 through 18, you will disclose your financial activity during the preceding calendar year. In Parts 1 through 14, you are

required to disclose not only your own financial activity, but also that of your spouse or a dependent child (see instructions).

Forms provided by Texas Ethics Commission www.ethics.state.tx.us Version V1.0.5683

SOURCES OF OCCUPATIONAL INCOME

PART 1A

If the requested information is not applicable, indicate that on Page 2 of the Cover Sheet, and DO NOT include this page in the report.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by providing the number under

which the child is listed on the Cover Sheet.

1 INFORMATION RELATES TO

X FILER SPOUSE DEPENDENT CHILD _____

2 EMPLOYMENT NAME AND ADDRESS OF EMPLOYER / POSITION HELD

X EMPLOYED BY ANOTHER (Check if Filer's Home Address)

EMPLOYER

J2B Holdings, LLC

ADDRESS / PO BOX; APT / SUITE #; CITY; STATE; ZIP CODE

PO Box 803600

Dallas, TX 75380

POSITION HELD

Owner / General Counsel

NATURE OF OCCUPATION

SELF-EMPLOYED

Forms provided by Texas Ethics Commission www.ethics.state.tx.us Version V1.0.5683

MUTUAL FUNDS

PART 4

If the requested information is not applicable, indicate that on Page 2 of the Cover Sheet, and DO NOT include this page in the report.

List each mutual fund and the number of shares in that mutual fund that you, your spouse, or a dependent child held or acquired during the

calendar year and indicate the category of the number of shares of mutual funds held or acquired. If some or all of the shares of a mutual fund

were sold, also indicate the category of the amount of the net gain or loss realized from the sale. For more nformation, see FORM PFS--

INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by providing the number under

which the child is listed on the Cover Sheet.

1 MUTUAL FUND NAME

Vanguard Total Stock Market ETF

2 SHARES OF MUTUAL FUND

HELD OR ACQUIRED BY X FILER SPOUSE DEPENDENT CHILD ______________

3 NUMBER OF SHARES OF

MUTUAL FUND X LESS THAN 100 100 TO 499 500 TO 999 1,000 TO 4,999

5,000 to 9,999 10,000 OR MORE

4 IF SOLD NET GAIN

LESS THAN $5,000 $5,000 - $9,999 $10,000 - $24,999 $25,000--OR MORE

NET LOSS

MUTUAL FUND NAME

Vanguard Value ETF

SHARES OF MUTUAL FUND

HELD OR ACQUIRED BY X FILER SPOUSE DEPENDENT CHILD ______________

NUMBER OF SHARES OF

MUTUAL FUND X LESS THAN 100 100 TO 499 500 TO 999 1,000 TO 4,999

5,000 to 9,999 10,000 OR MORE

IF SOLD NET GAIN

LESS THAN $5,000 $5,000 - $9,999 $10,000 - $24,999 $25,000--OR MORE

NET LOSS

MUTUAL FUND NAME

Vanguard Mid-Cap Value ETF

SHARES OF MUTUAL FUND

HELD OR ACQUIRED BY X FILER SPOUSE DEPENDENT CHILD ______________

NUMBER OF SHARES OF

MUTUAL FUND X LESS THAN 100 100 TO 499 500 TO 999 1,000 TO 4,999

5,000 to 9,999 10,000 OR MORE

IF SOLD NET GAIN

LESS THAN $5,000 $5,000 - $9,999 $10,000 - $24,999 $25,000--OR MORE

NET LOSS

MUTUAL FUND NAME

Vanguard Small-Cap Value ETF

SHARES OF MUTUAL FUND

HELD OR ACQUIRED BY X FILER SPOUSE DEPENDENT CHILD ______________

NUMBER OF SHARES OF

MUTUAL FUND X LESS THAN 100 100 TO 499 500 TO 999 1,000 TO 4,999

5,000 to 9,999 10,000 OR MORE

IF SOLD NET GAIN

LESS THAN $5,000 $5,000 - $9,999 $10,000 - $24,999 $25,000--OR MORE

NET LOSS

Forms provided by Texas Ethics Commission www.ethics.state.tx.us Version V1.0.5683

MUTUAL FUNDS

PART 4

If the requested information is not applicable, indicate that on Page 2 of the Cover Sheet, and DO NOT include this page in the report.

List each mutual fund and the number of shares in that mutual fund that you, your spouse, or a dependent child held or acquired during the

calendar year and indicate the category of the number of shares of mutual funds held or acquired. If some or all of the shares of a mutual fund

were sold, also indicate the category of the amount of the net gain or loss realized from the sale. For more nformation, see FORM PFS--

INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by providing the number under

which the child is listed on the Cover Sheet.

1 MUTUAL FUND NAME

Vanguard FTSE Developed Markets

2 SHARES OF MUTUAL FUND

HELD OR ACQUIRED BY X FILER SPOUSE DEPENDENT CHILD ______________

3 NUMBER OF SHARES OF

MUTUAL FUND LESS THAN 100 X 100 TO 499 500 TO 999 1,000 TO 4,999

5,000 to 9,999 10,000 OR MORE

4 IF SOLD NET GAIN

LESS THAN $5,000 $5,000 - $9,999 $10,000 - $24,999 $25,000--OR MORE

NET LOSS

MUTUAL FUND NAME

Vanguard FTSE Emerging Markets

SHARES OF MUTUAL FUND

HELD OR ACQUIRED BY X FILER SPOUSE DEPENDENT CHILD ______________

NUMBER OF SHARES OF

MUTUAL FUND X LESS THAN 100 100 TO 499 500 TO 999 1,000 TO 4,999

5,000 to 9,999 10,000 OR MORE

IF SOLD NET GAIN

LESS THAN $5,000 $5,000 - $9,999 $10,000 - $24,999 $25,000--OR MORE

NET LOSS

MUTUAL FUND NAME

iShares National AMT-Free Muni Bond ETF

SHARES OF MUTUAL FUND

HELD OR ACQUIRED BY X FILER SPOUSE DEPENDENT CHILD ______________

NUMBER OF SHARES OF

MUTUAL FUND X LESS THAN 100 100 TO 499 500 TO 999 1,000 TO 4,999

5,000 to 9,999 10,000 OR MORE

IF SOLD NET GAIN

LESS THAN $5,000 $5,000 - $9,999 $10,000 - $24,999 $25,000--OR MORE

NET LOSS

MUTUAL FUND NAME

iShares iBoxx $ Investment Grade Corporate Bond ETF

SHARES OF MUTUAL FUND

HELD OR ACQUIRED BY X FILER SPOUSE DEPENDENT CHILD ______________

NUMBER OF SHARES OF

MUTUAL FUND X LESS THAN 100 100 TO 499 500 TO 999 1,000 TO 4,999

5,000 to 9,999 10,000 OR MORE

IF SOLD NET GAIN

LESS THAN $5,000 $5,000 - $9,999 $10,000 - $24,999 $25,000--OR MORE

NET LOSS

Forms provided by Texas Ethics Commission www.ethics.state.tx.us Version V1.0.5683

MUTUAL FUNDS

PART 4

If the requested information is not applicable, indicate that on Page 2 of the Cover Sheet, and DO NOT include this page in the report.

List each mutual fund and the number of shares in that mutual fund that you, your spouse, or a dependent child held or acquired during the

calendar year and indicate the category of the number of shares of mutual funds held or acquired. If some or all of the shares of a mutual fund

were sold, also indicate the category of the amount of the net gain or loss realized from the sale. For more nformation, see FORM PFS--

INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by providing the number under

which the child is listed on the Cover Sheet.

1 MUTUAL FUND NAME

Vanguard Total International Bond ETF

2 SHARES OF MUTUAL FUND

HELD OR ACQUIRED BY X FILER SPOUSE DEPENDENT CHILD ______________

3 NUMBER OF SHARES OF

MUTUAL FUND X LESS THAN 100 100 TO 499 500 TO 999 1,000 TO 4,999

5,000 to 9,999 10,000 OR MORE

4 IF SOLD NET GAIN

LESS THAN $5,000 $5,000 - $9,999 $10,000 - $24,999 $25,000--OR MORE

NET LOSS

MUTUAL FUND NAME

iShares Emerging Markets USD Bond ETF

SHARES OF MUTUAL FUND

HELD OR ACQUIRED BY X FILER SPOUSE DEPENDENT CHILD ______________

NUMBER OF SHARES OF

MUTUAL FUND X LESS THAN 100 100 TO 499 500 TO 999 1,000 TO 4,999

5,000 to 9,999 10,000 OR MORE

IF SOLD NET GAIN

LESS THAN $5,000 $5,000 - $9,999 $10,000 - $24,999 $25,000--OR MORE

NET LOSS

Forms provided by Texas Ethics Commission www.ethics.state.tx.us Version V1.0.5683

INCOME FROM INTEREST, DIVIDENDS, ROYALTIES & RENTS

PART 5

If the requested information is not applicable, indicate that on Page 2 of the Cover Sheet, and DO NOT include this page in the report.

List each source of income you, your spouse, or a dependent child received in excess of $500 that was derived from interest, dividends, royalties,

and rents during the calendar year and indicate the category of the amount of the income. For more information, see FORM PFS--

INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by providing the number under

which the child is listed on the Cover Sheet.

1 SOURCE OF INCOME NAME AND ADDRESS

Lending Club

X Publicly held corporation ADDRESS / PO BOX; APT / SUITE #; CITY; STATE; ZIP CODE

2 RECEIVED BY

X FILER SPOUSE DEPENDENT CHILD ______________

3 AMOUNT

X $500 - $4,999 $5,000 - $9,999 $10,000 - $24,999 $25,000--OR MORE

Forms provided by Texas Ethics Commission www.ethics.state.tx.us Version V1.0.5683

PERSONAL NOTES AND LEASE AGREEMENTS

PART 6

If the requested information is not applicable, indicate that on Page 2 of the Cover Sheet, and DO NOT include this page in the report.

Identify each guarantor of a loan and each person or financial institution to whom you, your spouse, or a dependent child had a total financial

liability of more than $1,000 in the form of a personal note or notes or lease agreement at any time during the calendar year and indicate the

category of the amount of the liability. For more information, see FORM PFS--INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by providing the number under

which the child is listed on the Cover Sheet.

1 PERSON OR INSTITUTION PenFed Credit Union

HOLDING NOTE OR

LEASE AGREEMENT

2 LIABILITY OF

X FILER SPOUSE DEPENDENT CHILD ______________

3 GUARANTOR NONE

4 AMOUNT

X $1,000 - $4,999 $5,000 - $9,999 $10,000 - $24,999 $25,000--OR MORE

PERSON OR INSTITUTION Wells Fargo Education Services

HOLDING NOTE OR

LEASE AGREEMENT

LIABILITY OF

X FILER SPOUSE DEPENDENT CHILD ______________

GUARANTOR Boos, Michael & Denise

AMOUNT

$1,000 - $4,999 X $5,000 - $9,999 $10,000 - $24,999 $25,000--OR MORE

PERSON OR INSTITUTION ED Financial Services

HOLDING NOTE OR

LEASE AGREEMENT

LIABILITY OF

X FILER SPOUSE DEPENDENT CHILD ______________

GUARANTOR Boos, Michael & Denise

AMOUNT

$1,000 - $4,999 $5,000 - $9,999 X $10,000 - $24,999 $25,000--OR MORE

PERSON OR INSTITUTION Fed Loan Servicing

HOLDING NOTE OR

LEASE AGREEMENT

LIABILITY OF

X FILER SPOUSE DEPENDENT CHILD ______________

GUARANTOR Boos, Michael & Denise

AMOUNT

X $1,000 - $4,999 $5,000 - $9,999 $10,000 - $24,999 $25,000--OR MORE

Forms provided by Texas Ethics Commission www.ethics.state.tx.us Version V1.0.5683

PERSONAL NOTES AND LEASE AGREEMENTS

PART 6

If the requested information is not applicable, indicate that on Page 2 of the Cover Sheet, and DO NOT include this page in the report.

Identify each guarantor of a loan and each person or financial institution to whom you, your spouse, or a dependent child had a total financial

liability of more than $1,000 in the form of a personal note or notes or lease agreement at any time during the calendar year and indicate the

category of the amount of the liability. For more information, see FORM PFS--INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by providing the number under

which the child is listed on the Cover Sheet.

1 PERSON OR INSTITUTION Fed Loan Servicing

HOLDING NOTE OR

LEASE AGREEMENT

2 LIABILITY OF

X FILER SPOUSE DEPENDENT CHILD ______________

3 GUARANTOR Boos, Michael & Denise

4 AMOUNT

X $1,000 - $4,999 $5,000 - $9,999 $10,000 - $24,999 $25,000--OR MORE

PERSON OR INSTITUTION Navient

HOLDING NOTE OR

LEASE AGREEMENT

LIABILITY OF

X FILER SPOUSE DEPENDENT CHILD ______________

GUARANTOR Boos, Michael & Denise

AMOUNT

X $1,000 - $4,999 $5,000 - $9,999 $10,000 - $24,999 $25,000--OR MORE

Forms provided by Texas Ethics Commission www.ethics.state.tx.us Version V1.0.5683

INTEREST IN BUSINESS ENTITIES

PART 7B

If the requested information is not applicable, indicate that on Page 2 of the Cover Sheet, and DO NOT include this page in the report.

Describe all beneficial interests in business entities held or acquired by you, your spouse, or a dependent child during the

calendar year. If the interest was sold, also indicate the category of the amount of the net gain or loss realized from the sale.

For an explanation of "beneficial interest" and other specific directions for completing this section, see FORM PFS--INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by providing the number under

which the child is listed on the Cover Sheet.

1 HELD OR ACQUIRED BY

X FILER SPOUSE DEPENDENT CHILD ______________

2 DESCRIPTION NAME AND ADDRESS

(Check if Filer's Home Address)

J2B Holdings, LLC

PO Box 803600

Dallas, TX 75380

3 IF SOLD NET GAIN

LESS THAN $5,000 $5,000 - $9,999 $10,000 - $24,999 $25,000--OR MORE

NET LOSS

HELD OR ACQUIRED BY

X FILER SPOUSE DEPENDENT CHILD ______________

DESCRIPTION NAME AND ADDRESS

(Check if Filer's Home Address)

Vendi Vidi Vici Holdings, LLC

PO Box 495072

Garland, TX 75049

IF SOLD NET GAIN

LESS THAN $5,000 $5,000 - $9,999 $10,000 - $24,999 $25,000--OR MORE

NET LOSS

Forms provided by Texas Ethics Commission www.ethics.state.tx.us Version V1.0.5683

ASSETS OF BUSINESS ASSOCIATIONS

PART 11A

If the requested information is not applicable, indicate that on Page 2 of the Cover Sheet, and DO NOT include this page in the report.

Describe all assets of each corporation, firm, partnership, limited partnership, limited liability partnership, professional corporation, professional

association, joint venture, or other business association in which you, your spouse, or a dependent child held, acquired, or sold 50 percent or more

of the outstanding ownership and indicate the category of the amount of the assets. For more information, see FORM PFS--INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by providing the number under which

the child is listed on the Cover Sheet.

1 BUSINESS NAME AND ADDRESS

ASSOCIATION (Check If Filer's Home Address)

Vendi Vidi Vici Holdings, LLC

PO Box 495072

Garland, TX 75049

2 BUSINESS TYPE

Limited Liability Company

3 HELD, ACQUIRED,

OR SOLD BY X FILER SPOUSE DEPENDENT CHILD ______________

4 ASSETS DESCRIPTION CATEGORY

Equipment LESS THAN $5,000 $5,000 - $9,999

X $10,000 - $24,999 $25,000 OR MORE

Working capital LESS THAN $5,000 X $5,000 - $9,999

$10,000 - $24,999 $25,000 OR MORE

Forms provided by Texas Ethics Commission www.ethics.state.tx.us Version V1.0.5683

BOARDS AND EXECUTIVE POSITIONS

PART 12

If the requested information is not applicable, indicate that on Page 2 of the Cover Sheet, and DO NOT include this page in the report.

List all boards of directors of which you, your spouse, or a dependent child are a member and all executive positions you, your spouse, or a

dependent child hold in corporations, firms, partnerships, limited partnerships, limited liability partnerships, professional corporations, professional

associations, joint ventures, other business associations, or proprietorships, stating the name of the organization and the position held. For more

information, see FORM PFS--INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by providing the number under which

the child is listed on the Cover Sheet.

1 ORGANIZATION Big Brothers Big Sisters - Dallas Area Junior Board of Directors

2 POSITION HELD Board Member

3 POSITION HELD BY

X FILER SPOUSE DEPENDENT CHILD ______________

ORGANIZATION Selective Service System Board - Texas Detachment 2-20

POSITION HELD Board Member

POSITION HELD BY

X FILER SPOUSE DEPENDENT CHILD ______________

ORGANIZATION Noon Exchange Club Of Garland

POSITION HELD Board Member - Treasurer

POSITION HELD BY

X FILER SPOUSE DEPENDENT CHILD ______________

ORGANIZATION J2B Holdings, LLC

POSITION HELD Executive

POSITION HELD BY

X FILER SPOUSE DEPENDENT CHILD ______________

ORGANIZATION Vendi Vidi Vici Holdings, LLC

POSITION HELD Executive

POSITION HELD BY

X FILER SPOUSE DEPENDENT CHILD ______________

Forms provided by Texas Ethics Commission www.ethics.state.tx.us Version V1.0.5683

PERSONAL FINANCIAL STATEMENT FORM PFS

PARTS MARKED "NOT APPLICABLE" BY FILER COVER SHEET

PAGE 2

On this page, indicate any Parts of Form PFS that are not applicable to you. If you do not place a check in a box, then pages for that Part must

be included in the report. If you place a check in a box, do NOT include pages for that Part in the report.

6 PARTS NOT APPLICABLE TO FILER

N/A Part 1A - Sources of Occupational Income

X N/A Part 1B - Retainers

X N/A Part 2 - Stock

X N/A Part 3 - Bonds, Notes & Other Commercial Paper

N/A Part 4 - Mutual Funds

N/A Part 5 - Income from Interest, Dividends, Royalties & Rents

N/A Part 6 - Personal Notes and Lease Agreements

X N/A Part 7A - Interests in Real Property

N/A Part 7B - Interests in Business Entities

X N/A Part 8 - Gifts

X N/A Part 9 - Trust Income

X N/A Part 10A - Blind Trusts

X N/A Part 10B - Trustee Statement

N/A Part 11A - Assets of Business Associations

X N/A Part 11B - Liabilities of Business Associations

N/A Part 12 - Boards and Executive Positions

X N/A Part 13 - Expenses Accepted Under Honorarium Exception

X N/A Part 14 - Interest in Business in Common with Lobbyist

X N/A Part 15 - Fees Received for Services Rendered to a Lobbyist or Lobbyist's Employer

X N/A Part 16 - Representation by Legislator Before State Agency

X N/A Part 17 - Benefits Derived from Functions Honoring Public Servant

X N/A Part 18 - Legislative Continuances

Forms provided by Texas Ethics Commission www.ethics.state.tx.us Version V1.0.5683

PERSONAL FINANCIAL STATEMENT AFFIDAVIT

The law requires the personal financial statement to be verified. Without proper verification, the statement is not considered filed.

The verification page on a personal statement filed electronically with the Texas Ethics Commission must have the electronic signature of the

individual required to file the personal financial statement.

The verification page on a personal financial statement filed with an authority other than the Texas Ethics Commission must have the signature

of the individual required to file the personal financial statement as wells as the signature and stamp or seal of office of a notary public or other

person authorized by law to administer oaths and affirmations.

I swear, or affirm, under penalty of perjury, that this financial statement

covers calendar year ending December 31, 2017 , and is true and correct

and includes all information required to be reported by me under chapter

572 of the Government Code.

Mr. Jonathan M. Boos

Signature of Filer

AFFIX NOTARY STAMP / SEAL ABOVE

Sworn to and subscribed before me, by the said _________________________________________, this the ___________________ day

of___________________, 20________, to certify which, witness my hand and seal of office.

Signature of officer administering oath Printed name of officer administering oath Title of officer administering oath

Forms provided by Texas Ethics Commission www.ethics.state.tx.us V1.0.5683

Вам также может понравиться

- New Revised Fidelity Bonding Application Form in ExcelДокумент4 страницыNew Revised Fidelity Bonding Application Form in ExcelHad Sebuan88% (26)

- FIDELITY BONDING Attachment 3 Annex D TC No. 02 2019 2Документ4 страницыFIDELITY BONDING Attachment 3 Annex D TC No. 02 2019 2Seven De Los ReyesОценок пока нет

- Fidelity Bond Application Form FBAFДокумент2 страницыFidelity Bond Application Form FBAFMark Idaloy0% (1)

- Philippine Health Insurance Corporation: Part I - Member InformationДокумент1 страницаPhilippine Health Insurance Corporation: Part I - Member InformationjhunОценок пока нет

- Oath of Voter Challenged For Illegal ActsДокумент1 страницаOath of Voter Challenged For Illegal ActsVlad Reyes100% (3)

- California Oath of OfficeДокумент2 страницыCalifornia Oath of Officesilverbull8Оценок пока нет

- Cynthia "Cindy" Wheless Personal Financial StatementДокумент34 страницыCynthia "Cindy" Wheless Personal Financial StatementRyan GallagherОценок пока нет

- Lessor-Lessee Info SheetДокумент2 страницыLessor-Lessee Info SheetIPОценок пока нет

- AEP New Application FormДокумент1 страницаAEP New Application Formcamille samsonОценок пока нет

- Disclosure No. 996 2019 Annual Report For Fiscal Year Ended December 31 2018 SEC Form 17 AДокумент320 страницDisclosure No. 996 2019 Annual Report For Fiscal Year Ended December 31 2018 SEC Form 17 ASamael LightbringerОценок пока нет

- ANI Consolidated FS 2019 FinalДокумент189 страницANI Consolidated FS 2019 FinalJohn AzellebОценок пока нет

- Private Government Household: This Portion To Be Filled Up by Philhealth Employer'S Remittance ReportДокумент1 страницаPrivate Government Household: This Portion To Be Filled Up by Philhealth Employer'S Remittance ReportHanna PentiñoОценок пока нет

- PAG-IBIG Loan Payment-Feb 2020Документ4 страницыPAG-IBIG Loan Payment-Feb 2020Tonie Naelgas GutierrezОценок пока нет

- Short-Term Loan Remittance Form (STLRF)Документ2 страницыShort-Term Loan Remittance Form (STLRF)maricorОценок пока нет

- Statement of Interests FormДокумент4 страницыStatement of Interests FormJoe BowenОценок пока нет

- CF1 JabasДокумент1 страницаCF1 JabasqarlbalongОценок пока нет

- State of Missouri: Request For TerminationДокумент3 страницыState of Missouri: Request For TerminationvickykirschОценок пока нет

- SIRV Annual Report FormДокумент2 страницыSIRV Annual Report FormMarius AngaraОценок пока нет

- AAF238 OTBPublicAuctionJuridical V02Документ2 страницыAAF238 OTBPublicAuctionJuridical V02JC JoseОценок пока нет

- Financial Report Summary FormДокумент2 страницыFinancial Report Summary Formabhishankawasthi786Оценок пока нет

- STL Application Form - Rev20221024Документ2 страницыSTL Application Form - Rev20221024Apura DroОценок пока нет

- Employer'S Data Form (Edf) : For Private Employers For Private EmployersДокумент2 страницыEmployer'S Data Form (Edf) : For Private Employers For Private EmployersHRD-EFI PampangaОценок пока нет

- Certification Regarding Beneficial Owners of Legal Entity MembersДокумент3 страницыCertification Regarding Beneficial Owners of Legal Entity MembersReymart EscobarОценок пока нет

- Flexi-Fund Enrollment Form: Social Security SystemДокумент2 страницыFlexi-Fund Enrollment Form: Social Security SystemJoseph EleazarОценок пока нет

- Customer Information Sheet and DPC With Terms and Conditions - Individual - v2020Документ8 страницCustomer Information Sheet and DPC With Terms and Conditions - Individual - v2020jason geronaОценок пока нет

- Gis 2015Документ6 страницGis 2015peppa ruizОценок пока нет

- Certificate of Discharge From Federal Tax Lien: Instructions On How To Apply ForДокумент4 страницыCertificate of Discharge From Federal Tax Lien: Instructions On How To Apply ForLaLa BanksОценок пока нет

- New Account RequestДокумент4 страницыNew Account RequestmerОценок пока нет

- 2020 DITO CME SEC FS REISSUED - Separate - FinalДокумент56 страниц2020 DITO CME SEC FS REISSUED - Separate - FinalPaulОценок пока нет

- NPS-103 - Death Withdrawal FormДокумент5 страницNPS-103 - Death Withdrawal FormSubahan ShaikОценок пока нет

- s1905 Registration Update HtiДокумент1 страницаs1905 Registration Update HtijustinandreestrellamendozaОценок пока нет

- Stock Corporation General Instructions:: General Information Sheet (Gis)Документ12 страницStock Corporation General Instructions:: General Information Sheet (Gis)JImlan Sahipa IsmaelОценок пока нет

- 5ea7fb0c57f53 SEC Form 17A Dec2019Документ222 страницы5ea7fb0c57f53 SEC Form 17A Dec2019BromanineОценок пока нет

- Psbank 2020 Sec 17 A ReportДокумент245 страницPsbank 2020 Sec 17 A ReportGuevarra, Ronan Gail A.Оценок пока нет

- Sss-R1.employer Registration Form PDFДокумент2 страницыSss-R1.employer Registration Form PDFElsie Mercado67% (6)

- Registration Update Sheet: Vision Mount Tabor Finance CorporationДокумент1 страницаRegistration Update Sheet: Vision Mount Tabor Finance CorporationMa. Teresa GallardoОценок пока нет

- Employer'S Change of Information Form (Ecif) : InstructionsДокумент2 страницыEmployer'S Change of Information Form (Ecif) : InstructionsGarcia Supermart, Inc.Оценок пока нет

- Form BN 4: Registration of Business Names Act Statement of Additional Particulars To Be Furnished by A Firm or IndividualДокумент4 страницыForm BN 4: Registration of Business Names Act Statement of Additional Particulars To Be Furnished by A Firm or IndividualJasmine JacksonОценок пока нет

- Fill-In PDFДокумент2 страницыFill-In PDFaviral guptaОценок пока нет

- Taxpayer Registration Form OrganisationДокумент4 страницыTaxpayer Registration Form OrganisationMagdalene AmewodzoОценок пока нет

- Escort Application PDFДокумент2 страницыEscort Application PDFshashank shuklaОценок пока нет

- Escort ApplicationДокумент2 страницыEscort Applicationshashank shuklaОценок пока нет

- PFF002 - Employer's Data Form - V04 - PDF PDFДокумент2 страницыPFF002 - Employer's Data Form - V04 - PDF PDFarlyn100% (1)

- Cover Sheet: Vitar I CH Co R Porat IonДокумент8 страницCover Sheet: Vitar I CH Co R Porat IonIrene SalvadorОценок пока нет

- SLF028 ApplicationMoratoriumSTLAmortizationPayments V05Документ2 страницыSLF028 ApplicationMoratoriumSTLAmortizationPayments V05Jhonson MedranoОценок пока нет

- SLF017 ShortTermLoanRemittanceForm V02Документ2 страницыSLF017 ShortTermLoanRemittanceForm V02Marites Paragua75% (4)

- Philhealth ClaimForm1 SignedДокумент1 страницаPhilhealth ClaimForm1 Signedjobelyn calaudОценок пока нет

- SEC Form 17A 2018 - Final - PSE Upload - v2Документ225 страницSEC Form 17A 2018 - Final - PSE Upload - v2Myda RafaelОценок пока нет

- Sss P.E.S.O. Fund Amendment Form: Social Security SystemДокумент1 страницаSss P.E.S.O. Fund Amendment Form: Social Security Systemfrangeline torreresОценок пока нет

- English Winner ClaimДокумент3 страницыEnglish Winner ClaimHenrique FerreiraОценок пока нет

- Philhealth Er2 FormДокумент2 страницыPhilhealth Er2 FormXyrusJohnОценок пока нет

- Change of Address: Complete This Part To Change Your Home Mailing AddressДокумент2 страницыChange of Address: Complete This Part To Change Your Home Mailing AddressTrevorОценок пока нет

- Gehl Finance ApplicationДокумент1 страницаGehl Finance ApplicationRazvan MitruОценок пока нет

- EIN Letter INCДокумент2 страницыEIN Letter INCDjibzlaeОценок пока нет

- Employer's Data Form (EDF, HQP-PFF-002, V03.2)Документ2 страницыEmployer's Data Form (EDF, HQP-PFF-002, V03.2)Roniel Cedeño100% (5)

- Employer's Data Form (EDF, HQP-PFF-002, V03.2) PDFДокумент2 страницыEmployer's Data Form (EDF, HQP-PFF-002, V03.2) PDFPamela Angelica Obaniana FisicoОценок пока нет

- Employer'S Remittance Report: Tri-Silver Builders IncorporatedДокумент1 страницаEmployer'S Remittance Report: Tri-Silver Builders Incorporatedabby santosОценок пока нет

- Philippine Health Insurance Corporation: Part I - Member InformationДокумент1 страницаPhilippine Health Insurance Corporation: Part I - Member InformationSnyrah AmbagОценок пока нет

- PhilHealth Revised Employer Remittance Report-RF-1Документ2 страницыPhilHealth Revised Employer Remittance Report-RF-1Grace GayonОценок пока нет

- Short-Term Loan Remittance Form (STLRF) : Pag-Ibig Employer'S Id NumberДокумент8 страницShort-Term Loan Remittance Form (STLRF) : Pag-Ibig Employer'S Id NumberJo ShОценок пока нет

- The Realtor & Investor's Complete Step by Step Guide To Mastering Foreclosures By State (Insider Secrets to Finding, Listing, Selling AND Profiting from Foreclosure Properties in ALL 50 States!)От EverandThe Realtor & Investor's Complete Step by Step Guide To Mastering Foreclosures By State (Insider Secrets to Finding, Listing, Selling AND Profiting from Foreclosure Properties in ALL 50 States!)Оценок пока нет

- Gregg Abbott 20018 Campaign ContributionsДокумент7 418 страницGregg Abbott 20018 Campaign ContributionsReform AustinОценок пока нет

- Paul Workman Campaign ContributionsДокумент289 страницPaul Workman Campaign ContributionsReform AustinОценок пока нет

- Jurisdiction Report 1990-1995Документ7 страницJurisdiction Report 1990-1995Reform AustinОценок пока нет

- Lupe Valdez Campaign ContributionsДокумент286 страницLupe Valdez Campaign ContributionsReform AustinОценок пока нет

- Denis Paul Campaign ContributionsДокумент9 страницDenis Paul Campaign ContributionsReform AustinОценок пока нет

- Brad Buckley ContributionsByFilerIDДокумент20 страницBrad Buckley ContributionsByFilerIDReform AustinОценок пока нет

- Matt Shaheen Campaign ContributionsДокумент52 страницыMatt Shaheen Campaign ContributionsReform AustinОценок пока нет

- Tony Tinderholt Campaign ContributionsДокумент60 страницTony Tinderholt Campaign ContributionsReform AustinОценок пока нет

- Texans For Rodney Anderson SPAC ContributionsByFilerID PDFДокумент70 страницTexans For Rodney Anderson SPAC ContributionsByFilerID PDFReform AustinОценок пока нет

- Morgan Meyer Campaign ContributionsДокумент139 страницMorgan Meyer Campaign ContributionsReform AustinОценок пока нет

- Dwayne Bohac ContributionsДокумент318 страницDwayne Bohac ContributionsReform AustinОценок пока нет

- Gary Elkins Campaign ContributionsДокумент133 страницыGary Elkins Campaign ContributionsReform AustinОценок пока нет

- Paul Workman ContributionsДокумент1 страницаPaul Workman ContributionsReform AustinОценок пока нет

- Jonathan Stickland ContributionsДокумент241 страницаJonathan Stickland ContributionsReform AustinОценок пока нет

- Jose Lozano ContributionsДокумент76 страницJose Lozano ContributionsReform AustinОценок пока нет

- Mike Schofield ContributionsДокумент65 страницMike Schofield ContributionsReform AustinОценок пока нет

- Steve Allison Campaign ContributionsДокумент38 страницSteve Allison Campaign ContributionsReform AustinОценок пока нет

- Don Huffines ContributionsДокумент110 страницDon Huffines ContributionsReform AustinОценок пока нет

- Tony Dale Campaign ContributionsДокумент114 страницTony Dale Campaign ContributionsReform AustinОценок пока нет

- Matt Shaheen Campaign ContributionsДокумент52 страницыMatt Shaheen Campaign ContributionsReform AustinОценок пока нет

- Linda Koop Career Political ContributionsДокумент101 страницаLinda Koop Career Political ContributionsReform AustinОценок пока нет

- Killeen ISD School Board Minutes 2003Документ127 страницKilleen ISD School Board Minutes 2003Will AxfordОценок пока нет

- Tony Dale Campaign ContributionsДокумент114 страницTony Dale Campaign ContributionsReform AustinОценок пока нет

- Gary Elkins Campaign ContributionsДокумент8 страницGary Elkins Campaign ContributionsReform AustinОценок пока нет

- Ken Strange IRS CompaintДокумент2 страницыKen Strange IRS CompaintReform AustinОценок пока нет

- Wimberley ISD - Combined Check RegistersДокумент6 страницWimberley ISD - Combined Check RegistersReform AustinОценок пока нет

- Konni Burton Political ContributionsДокумент233 страницыKonni Burton Political ContributionsReform AustinОценок пока нет

- Dent v. West VirginiaДокумент9 страницDent v. West VirginiaowenОценок пока нет

- Baptism: Are You Vowing An Oath Before God?Документ4 страницыBaptism: Are You Vowing An Oath Before God?SonofManОценок пока нет

- Notaries Public BookletДокумент25 страницNotaries Public BookletLarry Fritz SignabonОценок пока нет

- ThesisДокумент25 страницThesisphjosep36Оценок пока нет

- Mata vs. BayonaДокумент3 страницыMata vs. BayonaEarl NuydaОценок пока нет

- Judicial Affidavit FormДокумент3 страницыJudicial Affidavit FormAiken Alagban LadinesОценок пока нет

- Law of Evidence 2 Notes On Witnesses OATH & AFFIRMATION IN KENYA (Law of Evidence Ii) Chege Kibathi & Co. Advocates LLPДокумент12 страницLaw of Evidence 2 Notes On Witnesses OATH & AFFIRMATION IN KENYA (Law of Evidence Ii) Chege Kibathi & Co. Advocates LLPLisa NОценок пока нет

- Tr45 Oaths and SwearingДокумент8 страницTr45 Oaths and SwearingWendell RicardoОценок пока нет

- Doctrine of OathДокумент8 страницDoctrine of Oaththelightheartedcalvinist6903Оценок пока нет

- BILLA MOSHIE vs. THE REPUBLICДокумент10 страницBILLA MOSHIE vs. THE REPUBLICvbsv9w592cОценок пока нет

- The Oath in Ancient Egypt by John A. Wilson. JNES 7, 1948, 129-156Документ29 страницThe Oath in Ancient Egypt by John A. Wilson. JNES 7, 1948, 129-156Лукас МаноянОценок пока нет

- 10 Common Elements of Oath of Office-RW-2Документ3 страницы10 Common Elements of Oath of Office-RW-2Albert BermudezОценок пока нет

- 106883402-76160156-UST-GN-2011-Legal EthicsДокумент130 страниц106883402-76160156-UST-GN-2011-Legal EthicsTimmy HaliliОценок пока нет

- The Schleitheim Confession PDFДокумент4 страницыThe Schleitheim Confession PDFbetakobolОценок пока нет

- Der GiftpilzДокумент6 страницDer GiftpilzShrawan MinzОценок пока нет

- 1 People Vs Bisda SCRAДокумент47 страниц1 People Vs Bisda SCRAkwonpenguinОценок пока нет

- Judicial Affidavit Lanie SarillaДокумент10 страницJudicial Affidavit Lanie SarillaDence Cris RondonОценок пока нет

- Inner VowsДокумент15 страницInner VowsKarleneShugart100% (1)

- LLB NiyyahДокумент62 страницыLLB NiyyahSiti Nur Syahida HarisОценок пока нет

- Case 198742Документ24 страницыCase 198742MV FadsОценок пока нет

- Accion Publician Judicial AffidavitДокумент6 страницAccion Publician Judicial AffidavitMel Phildrich Defiño GanuhayОценок пока нет

- Cap 15 The Oaths and Statutory Declarations ActДокумент7 страницCap 15 The Oaths and Statutory Declarations ActEkai NabenyoОценок пока нет

- Military Customs and Traditions 2Документ5 страницMilitary Customs and Traditions 2אנג' ליקה100% (3)

- EssaysДокумент8 страницEssaysashvinОценок пока нет

- Copeland-English-Akkadian Dictionary Boo PDFДокумент256 страницCopeland-English-Akkadian Dictionary Boo PDFwaleexasОценок пока нет

- Manangan, John Erick B. BSCRIM E2018Документ19 страницManangan, John Erick B. BSCRIM E2018John Erick Bambico MananganОценок пока нет

- Oath and Its Implications From Islamic Perspective: January 2014Документ10 страницOath and Its Implications From Islamic Perspective: January 2014Shaira MPОценок пока нет