Академический Документы

Профессиональный Документы

Культура Документы

Solutions of Consignment&Agency

Загружено:

Sheila Mae AramanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Solutions of Consignment&Agency

Загружено:

Sheila Mae AramanАвторское право:

Доступные форматы

Solutions

CONSIGNMENT

Problem 1:

1. Sales (700 motors * $220) $154,000

Less: Charged by Consignee

Various Expense 2,000

Commission ($154,000 * 10%) 15,400

Freight-in 14,400

Due to Consignor 122,200

Less: Advances to Consignor 50,000

Cash Remittance $72,200

2. Destroyed Motors (100 motors * $150) $15,000

Add: Charged by Consignor

Freight-Out ($10,000 * 100/1000) 1,000

Insurance ($1500 * 100/1000) 150

Abnormal Loss $16,150

3. Inventory on hand (200 motors * $150) $30,000

Add: Charged by Consignor

Freight-Out ($10,000 * 200/1000) 2,000

Insurance ($1,500 * 200/1000) 300

Add: Charged by Consignee

Freight-In ($14,400 * 200/900) 3,200

Cost of Inventory on consignment $35,500

Problem 2:

Prepared by: Sheila Mae M. Araman

1. Sales (10 units sold * $8000 ) $80,000

Less: Charged by Consignee

Freight-In 1,500

Delivery and Installation Expense (10 units sold * $500) 5,000

Commission (($80,000-$6,000) * 10%) 7,400

Sales Allowance 6,000

Doubtful Accounts 25,000

Amount due to Sandy Company $35,100

2. Sales (10 units sold * $8000 ) $80,000

Less: Charged by Consignor

Cost of Goods Sold (10 units sold * $3000) 30,000

Freight-Out ($3,500 * 15/20) 2,625

Less: Charged by Consignee

Freight-In ($1,500 * 15/20) 1,125

Delivery and Installation Expense (10 units sold * $500) 5,000

Commission (($80,000-$6,000) * 10%) 7,400

Sales Allowance 6,000

Doubtful Accounts 25,000

Net Profit $2,850

3. Cost of Inventory on hand (5 units unsold * $3000) $15,000

Add: Charged by Consignor

Freight-Out ($3,500 * 5/20) 875

Add: Charged by Consignee

Freight-In ($1,500 * 5/20) 375

Cost of Inventory on consignment $16,250

AGENCY

Prepared by: Sheila Mae M. Araman

Problem 1:

1. Cost of Goods Sold (P1,500,000 * 90%) 1,350,000

Divide by Cost ratio ÷ 70%

Net Sales P1,928,571.43

Sales P1,928,571.43

Sales Discount 105,000

Net Sales 1,823,571.43

Less: Cost of Goods Sold 1,350,000

Gross Profit 473, 571.43

Less: Various Expense 28,750

Advertising Expense 3,333.33

Depreciation Expense ((P350,000 * 85%) / 8 months) 37,187.5

Freight-Out 7,800

Net Income P396,500.6

2. Journal Entries

Sample Inventory –Agency 20,000

Merchandise Inventory 20,000

Working Fund –Agency 300,000

Cash 300,000

Accounts Receivable 1,928,571.43

Sales - Agency 1,928571.43

Cost of Goods Sold – Agency 1,350,000

Merchandise Inventory 1,350,000

Freight-Out 7,800

Cash 7,800

Cash 420,000

Sales Discount - Agency 105,000

Accounts Receivable 525,000

Machinery -Agency 350,000

Cash 350,000

Machinery -Agency 350,000

Cash 350,000

Depreciation Expense – Agency 37,187.5

Accumulated depreciation – Machinery (Agency) 37,187.5

Prepared by: Sheila Mae M. Araman

Various Expense -Agency 28,750

Working Fund –Agency 28,750

Advertising Expense 3,333.33

Sample Inventory 3,333.33

Sales –Agency 1,928,571.43

Cost of Goods Sold – Agency 1,350,000

Sales Discount - Agency 105,000

Freight-Out 7,800

Depreciation Expense – Agency 37,187.5

Various Expense –Agency 28,750

Advertising Expense 3,333.33

Income Summary – Agency 396,500.6

Income Summary – Agency 396,500.6

Income Summary 396,500.6

Problem 2:

1. Collections:

w/o discount (380,500 * 80%) 304,400

w/ 4.5% discount ((380,500 * 20%) / 95.5%) 79,685.86

Total Gross Collection 384,085.86

Less: Accounts Receivable 650,000

Remaining Accounts Receivable 265,914.14

Multiply by: % of Doubtful Account * 5%

Agency’s uncollectible amount 13,295.71

2. Sales –Agency 650,000

Less; Sales Discount - Agency 3585.86

Net Sales 646,414.14

Cost of Goods Sold – Agency 552,500

Gross Profit 93,914.14

Depreciation Expense – Agency 1875

Doubtful Accounts – Agency 13,295.71

Prepared by: Sheila Mae M. Araman

Rent Expense –Agency 25,000

Selling Expense –Agency 15,000

Utilities Expense –Agency 10,500

Advertising Expense 14,600

Net Income –Agency 13,643.43

3. Journal Entries

Sample Inventory –Agency 50,000

Merchandise Inventory 50,000

Working Fund –Agency 250,000

Cash 250,000

Accounts Receivable 650,000

Sales - Agency 650,000

Cost of Goods Sold – Agency 552,500

Merchandise Inventory 552,500

Cash 380,500

Sales Discount - Agency 3585.86

Accounts Receivable 384,085.86

Furniture and Fixtures-Agency 90,000

Cash 90,000

Depreciation Expense – Agency 1875

Accumulated depreciation – Fur&Fix (Agency) 1875

Doubtful Accounts - Agency 13,295.71

Allowance for Doubtful Accounts 13,295.71

Rent Expense -Agency 25,000

Selling Expense –Agency 15,000

Utilities Expense –Agency 10,500

Cash 135,000

Advertising Expense 14,600

Sample Inventory 14,600

Sales –Agency 650,000

Prepared by: Sheila Mae M. Araman

Cost of Goods Sold – Agency 552,500

Sales Discount - Agency 3585.86

Depreciation Expense – Agency 1875

Doubtful Accounts – Agency 13,295.71

Rent Expense –Agency 25,000

Selling Expense –Agency 15,000

Utilities Expense –Agency 10,500

Advertising Expense 14,600

Income Summary – Agency 13,643.43

Income Summary – Agency 13,643.43

Income Summary 13,643.43

Prepared by: Sheila Mae M. Araman

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- FACTORINGДокумент6 страницFACTORINGsadathnooriОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Chapter 7 ReceivablesДокумент87 страницChapter 7 ReceivablesLEE WEI LONGОценок пока нет

- AHM Chapter 4 - SolutionsДокумент24 страницыAHM Chapter 4 - SolutionsNitin KhareОценок пока нет

- CPA Board Exam Quizzer Vol. 2Документ13 страницCPA Board Exam Quizzer Vol. 2John Mahatma AgripaОценок пока нет

- Krispy Kreme-Case Study Solution FinanceДокумент32 страницыKrispy Kreme-Case Study Solution FinanceHayat Omer Malik100% (3)

- Chapter 21 Accounting For Non Profit OrganizationsДокумент21 страницаChapter 21 Accounting For Non Profit OrganizationsHyewon100% (1)

- Chapter 7: Receivables: Principles of AccountingДокумент50 страницChapter 7: Receivables: Principles of AccountingRohail Javed100% (1)

- Activity Based-WPS OfficeДокумент6 страницActivity Based-WPS OfficeSheila Mae AramanОценок пока нет

- Concept Map - CARBOДокумент1 страницаConcept Map - CARBOSheila Mae AramanОценок пока нет

- Factual Recount-WPS OfficeДокумент4 страницыFactual Recount-WPS OfficeSheila Mae AramanОценок пока нет

- Chemical Bonding: Lewis Dot Carbon Hydrogen OxygenДокумент17 страницChemical Bonding: Lewis Dot Carbon Hydrogen OxygenSheila Mae AramanОценок пока нет

- Immersing into-WPS OfficeДокумент6 страницImmersing into-WPS OfficeSheila Mae AramanОценок пока нет

- Comparing and C-WPS OfficeДокумент5 страницComparing and C-WPS OfficeSheila Mae AramanОценок пока нет

- Compounds (Noxious Compounds Produced by The Plant) Determined The Usage ofДокумент25 страницCompounds (Noxious Compounds Produced by The Plant) Determined The Usage ofSheila Mae AramanОценок пока нет

- When Does A Team Rotate?Документ3 страницыWhen Does A Team Rotate?Sheila Mae AramanОценок пока нет

- Literature Is i-WPS OfficeДокумент2 страницыLiterature Is i-WPS OfficeSheila Mae AramanОценок пока нет

- Or Bad Genes? (Book by David Raup, W.W. Norton, Co.)Документ4 страницыOr Bad Genes? (Book by David Raup, W.W. Norton, Co.)Sheila Mae AramanОценок пока нет

- Concept Map - CARBOДокумент1 страницаConcept Map - CARBOSheila Mae AramanОценок пока нет

- Cut SentencesДокумент4 страницыCut SentencesSheila Mae AramanОценок пока нет

- Similarities of Philippines and ThailandДокумент2 страницыSimilarities of Philippines and ThailandSheila Mae Araman100% (1)

- PrecipitationДокумент1 страницаPrecipitationSheila Mae AramanОценок пока нет

- The coronavirus-WPS OfficeДокумент8 страницThe coronavirus-WPS OfficeSheila Mae AramanОценок пока нет

- Jimboy ProbabilityДокумент7 страницJimboy ProbabilitySheila Mae AramanОценок пока нет

- Article Review - The Problem of Adaptation in The Study of Human BehaviorДокумент1 страницаArticle Review - The Problem of Adaptation in The Study of Human BehaviorSheila Mae AramanОценок пока нет

- Impact of COVID19 To CommunityДокумент3 страницыImpact of COVID19 To CommunitySheila Mae AramanОценок пока нет

- Cash TransferДокумент2 страницыCash TransferSheila Mae AramanОценок пока нет

- Additional PartДокумент1 страницаAdditional PartSheila Mae AramanОценок пока нет

- c19WPS OfficeДокумент3 страницыc19WPS OfficeSheila Mae AramanОценок пока нет

- Lessons of Covid19Документ1 страницаLessons of Covid19Sheila Mae AramanОценок пока нет

- MACROEVOLUTIONДокумент7 страницMACROEVOLUTIONSheila Mae AramanОценок пока нет

- ) P (1-U) + Q (V) - The First Part On The Right Is Accounts For Alleles NotДокумент14 страниц) P (1-U) + Q (V) - The First Part On The Right Is Accounts For Alleles NotSheila Mae AramanОценок пока нет

- Phylogenetic AnalysisДокумент6 страницPhylogenetic AnalysisSheila Mae AramanОценок пока нет

- Plants (Desiccation Resistant), Marine Organisms (Fusiform Body), Cryptic Insects AllДокумент23 страницыPlants (Desiccation Resistant), Marine Organisms (Fusiform Body), Cryptic Insects AllSheila Mae AramanОценок пока нет

- Chapter 3Документ6 страницChapter 3Sheila Mae AramanОценок пока нет

- mitosis-WPS OfficeДокумент5 страницmitosis-WPS OfficeSheila Mae AramanОценок пока нет

- Risk management-WPS OfficeДокумент6 страницRisk management-WPS OfficeSheila Mae AramanОценок пока нет

- Web DeveloperceДокумент2 страницыWeb DeveloperceSheila Mae AramanОценок пока нет

- Chapter 20 - Accounts Receivable and Inventory ManagementДокумент22 страницыChapter 20 - Accounts Receivable and Inventory Managements1137425863Оценок пока нет

- Liquidity of Short-Term AssetsДокумент23 страницыLiquidity of Short-Term AssetsRoy Navarro VispoОценок пока нет

- Change or Die: Inside The Mind of A ConsultantДокумент53 страницыChange or Die: Inside The Mind of A ConsultantAdamОценок пока нет

- Exercise 5-9 (Part Level Submission) : Allessandro Scarlatti Company Balance Sheet (Partial) DECEMBER 31, 2014Документ3 страницыExercise 5-9 (Part Level Submission) : Allessandro Scarlatti Company Balance Sheet (Partial) DECEMBER 31, 2014Tntnntnt ntntОценок пока нет

- Book Keeping and Accounts Past Paper Series 4 2014Документ12 страницBook Keeping and Accounts Past Paper Series 4 2014cheah_chinОценок пока нет

- Form No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarДокумент14 страницForm No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarPrabin JainОценок пока нет

- Customer Refund: Responsibility: Yodlee US AR Super User Navigation: Transactions TransactionsДокумент12 страницCustomer Refund: Responsibility: Yodlee US AR Super User Navigation: Transactions TransactionsAziz KhanОценок пока нет

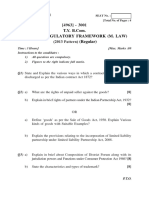

- Business Regulatory Framework (M. Law) (Regular)Документ127 страницBusiness Regulatory Framework (M. Law) (Regular)Yogesh SaindaneОценок пока нет

- Bad Debts & Allowance For Doubtful DebtsДокумент24 страницыBad Debts & Allowance For Doubtful Debtsyyy10Оценок пока нет

- Installment Sales QДокумент5 страницInstallment Sales QRed YuОценок пока нет

- Case Studv 3: Required: For The Purposes of The Cash Flow Statement Under The Direct Method, You Are Required ToДокумент2 страницыCase Studv 3: Required: For The Purposes of The Cash Flow Statement Under The Direct Method, You Are Required ToTanya PribylevaОценок пока нет

- GBI - SCF Guide - 2012-FINAL PDFДокумент107 страницGBI - SCF Guide - 2012-FINAL PDFReckon IndepthОценок пока нет

- Working Capital MNGMNT of FertiliserДокумент357 страницWorking Capital MNGMNT of FertiliserTilak Kumar VadapalliОценок пока нет

- F3.ffa Examreport d14Документ4 страницыF3.ffa Examreport d14Kian TuckОценок пока нет

- SW - Chapter 7Документ8 страницSW - Chapter 7andrie gardoseОценок пока нет

- 12 The Revenue Cycle - Sales To Cash CollectionДокумент18 страниц12 The Revenue Cycle - Sales To Cash CollectionayutitiekОценок пока нет

- InnovBase Features ListДокумент5 страницInnovBase Features ListHappy DealОценок пока нет

- Assignment 3 (Acc - Receivable) BaruДокумент23 страницыAssignment 3 (Acc - Receivable) BaruniaОценок пока нет

- Ap-1403 ReceivablesДокумент18 страницAp-1403 ReceivablesElaine YapОценок пока нет

- Analysis and Interpretation of Financial StatementsДокумент27 страницAnalysis and Interpretation of Financial StatementsRajesh PatilОценок пока нет

- 04 - Activity - 1 - Umayam - Bsa701 - AuditingДокумент4 страницы04 - Activity - 1 - Umayam - Bsa701 - AuditingLove CoОценок пока нет

- Single Entry (F. Y. B.com) Sem.1Документ13 страницSingle Entry (F. Y. B.com) Sem.1Jignesh Togadiya0% (2)

- Ast-Chapter 1 p3, p5, p6Документ8 страницAst-Chapter 1 p3, p5, p6Geminah BellenОценок пока нет