Академический Документы

Профессиональный Документы

Культура Документы

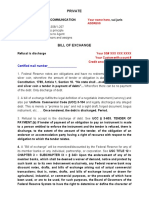

Bill of Exchange

Загружено:

genaro2010Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Bill of Exchange

Загружено:

genaro2010Авторское право:

Доступные форматы

9 THE BILL OF EXCHANGE

In this process, you will actually create the Bill of Exchange. The “bill” which was presented

to you, is now “exchanged” by you to “pay” the account and send back to them. There are many

writings, essays and schools of thought on the bill of exchange process. Below are two

commentaries to consider.

Bills of Exchange are an instruction to the payee to use their financial institution to

facilitate your authorization to use your exemption to discharge a public debt. This is a

setoff and adjustment - not a draw on the treasury. There are no funds to transfer in an

exchange involving an exemption. It is a setoff and an adjustment to adjust the open

public account using your exemption from having to pay for anything when there is no

“specie” (coined money, gold and silver) in circulation outside the box. What could the

man (who is outside the US box) possibly use to pay a debt? There is nothing outside

the box to do that. That is why the strawman is so convenient. The strawman can use

FRN's inside the box to pay the tax on not paying for the items. Great idea -- right????

EXCHANGE CONTRACTS – AN UNOFFICIAL BRIEF

Provisions for exchange contracts based on priority tax exemptions are scattered

throughout various legislative acts, joint resolutions and executive orders in 1933 and

in the Congressional Record based on HJR-192, confirmed by the U.S. Supreme Court

in 1939 – Guarantee Trust of New York v. Henwood, et al (FN3) and codified in Public

Law 73-10.

However, the exchange process must only be used as an “Accepted For Value”

response. A written claim must be received. Only then can the Secured Party

respond. Mr. Paul O’Neill recently made it clear to a Senator from Arkansas that when

he is aware of and receives Bills of Exchange, he holds them, thus honoring them.

Private sector claims can be discharged using a negotiable instrument such as the Bill

of Exchange, etc. and must be processed through a local financial institution that holds

or has access to a Treasury Tax and Loan account. The TTL account is administered

and controlled by the Technical Support Division of the IRS. This is a change under

re-organization wherein these accounts were formerly administered by the Special

Procedure Function Division of the IRS. All of these actions take time and must be

based on written claims.

Furthermore, as near as I have been able to ascertain, all public debts are discharged

with a simple ledger entry and computer transfer for credit and debit through the IRS

Technical Support Division. However, certain individuals at the Department of the

Treasury persist in misrouting many of the documents presented to the Secretary of

the Treasury by labeling them as Treasury Securities (which they are not) sending

them to the Bureau of Public Debt instead of to the UCC Contract Trust Department of

the IRS.

Private sector debts are discharged through a slightly more involved process requiring

Claimant’s bank to process the negotiable instrument through to the Secretary of the

Treasury, the Federal Window, that officially became a bank at 1500 Pennsylvania

Ave. NW in Washington, D.C. in 2001. Under Commercial Banking Codes the bank

that processes the negotiable instrument through its TTL Department is required to

issue a credit to the account and place a hold on the credit for a designated number of

days, then Release the Order for credit to the designated account. Many bankers

claim they are not familiar with the Bill of Exchange even though the details regarding

it have been published in Witkin – Negotiable Instruments, Vol. III for well over 80

years and is considered to be the banking industry standard. Many banks hesitate to

process this class of negotiable instrument. However, Federal Banking Regulations

and a growing number of court decisions (stare decisis) make it clear that the banks

Chapter 9 Page1 2003-08-17

must accept and process these negotiable instruments. The IRS has indicated that

regulations now require each Bill of Exchange presented into the private sector must

also be attached to a 1099 OID that requires notification to the IRS of the transaction.

Major changes took place in the operation of the Federal Reserve beginning January 1,

2001. All public windows were closed at all Federal Reserve Banks. Only member

banks of the Federal Reserve can do business with them. With one exception all

Federal Reserve Banks no longer process non-electronic negotiable instruments. Pass-

thru negotiable instruments such as the Bill of Exchange must be processed through a

local financial institution sent directly to the Secretary of the Treasury via Certified

Mail. All other non-cash commercial paper is now handled through the Depository

Trust Corporation.

The Department of the Treasury Bank (DTB), the Federal Reserve and many local

banks acknowledge the lawful Bill of Exchange. However, these documents directed to

the Secretary of the Treasury must be presented through a financial institution, signed

by them (bonded) as the agent for direct presentment. Upon honor of the document

by the Secretary of the Treasury, the bank is authorized to release the hold and credit

the Claimant’s account. According to banking regulations, Witkin- Negotiable

Instruments - and an increasing number of court decisions the Bill of Exchange is to be

treated the same as a check except it must be sent directly to the Secretary via

Certified Mail. Complete routing instructions must be included (Letter of Advice) in

order for the Bill of Exchange to be processed and honored. Each Bill of Exchange set

of documents is to be attached to an IRS 1099 OID form. Each set of document must

be delivered via Certified mail to the Secretary. Only the Secretary of the Treasury

has the authority and jurisdiction to honor or dishonor these negotiable instruments.

Some government agents attempt to usurp that authority and many such documents

have been misdirected to the Bureau of Public Debt. Many banks attempt to reject

these instruments even though the regulations and the courts direct them to process

them as instructed.

We do not, at this time, advocate the use of a 1099 OID. Until one fully understands the

import of sending and filing such a document, please do NOT use one.

As you go through this process, not only keep in mind what “money” really is, but also

remember the Fair Debt Collections Practice Act (which applies to the strawman) and the UCC.

Arizona Revised Statute (look it up in your state)

47-3603 reads: Tender of payment:

A. If tender of payment of an obligation to pay an instrument is made to a person

entitled to enforce the instrument, the effect of tender is governed by principles of

law applicable to tender of payment under a simple contract.

B. If tender of payment of an obligation to pay an instrument is made to a person

entitled to enforce the instrument and the tender is refused, there is discharge, to

the extent of the amount of the tender, of the obligation of an indorser or

accommodation party having a right of recourse with respect to the obligation to

which the tender relates.

C. If tender of payment of an amount due on an instrument is made to a person

entitled to enforce the instrument, the obligation of the obligor to pay interest after

the due date on the amount tendered is discharged. If presentment is required

with respect to an instrument and the obligor is able and ready to pay on the due

date at every place of payment stated in the instrument, the obligor is deemed to

have made tender of payment on the due date to the person entitled to enforce

the instrument.

There is some disagreement as to the exact meaning of “B” above. One interpretation is that

you are tendering payment and they are accepting by acquiescence or refusing it, therefore, the

Chapter 9 Page2 2003-08-17

debt is discharged. BoE’s vary a little in their language, depending on the writer. Another

interpretation might be that only the right of recourse is conferred. Depending on which is truly

the correct interpretation, a BoE will resolve the matter if done properly. As we learn more

about bonds of discharge, it may be the easiest way to settle the account, but will have to be

accompanied with instructions. Always be sure of the course you chose to follow. Either way,

all contain the value, the date, and your signature.

Remember, in this process you are offering to let them negotiate the BoE or Bond AFTER

they have proven their claims, so please ensure you have specified in your conditional

acceptance that they can only negotiate AFTER their production of the verified documents you

have requested.

In some instances, you will not fill in the value in words and numbers because you cannot

equate what the value is. In that instance, you will include instructions for them to fill in the

value and notify you of the amount, after they have proven their claims and provided their proof.

Yours may be an overlay you photocopy onto their bill. It must NOT be contained in a box, and

is best if it is printed in red and signed by you in blue ink. It might look like this:

Accepted for Value

Exempt from Levy

I accept this Presentment for value or performance, including all related indorsements,

front and back, for immediate release of the proceeds, products, accounts and fixtures,

according to the Uniform Commercial Code 10-104 and UCC 1-104, as it has been

adopted in this State, and House Joint Resolution 192, June 5, 1933,

Value $__________________ Date__________________

Employer Identification #

______________________________________________________ (your signature)

Or

Accepted for assessed value and returned in

exchange for closure and settlement of this

accounting.

Date________________________, 2003

Employer Identification #

(your signature)

Chapter 9 Page3 2003-08-17

Вам также может понравиться

- PRIVATE CHECK v1 - For Discharge and PurchaseДокумент10 страницPRIVATE CHECK v1 - For Discharge and PurchaseAlberto98% (65)

- The Artificial Person and the Color of Law: How to Take Back the "Consent"! Social Geometry of LifeОт EverandThe Artificial Person and the Color of Law: How to Take Back the "Consent"! Social Geometry of LifeРейтинг: 4.5 из 5 звезд4.5/5 (9)

- Secured Party Indemnity Bond and Discharging Debts................... UnderstandДокумент3 страницыSecured Party Indemnity Bond and Discharging Debts................... Understandamenelbey96% (24)

- Dealing With A PresentmentДокумент4 страницыDealing With A PresentmentMaryUmbrello-Dressler100% (14)

- Promissory Note NotesДокумент14 страницPromissory Note NotesFreeman Lawyer90% (29)

- Introduction to Negotiable Instruments: As per Indian LawsОт EverandIntroduction to Negotiable Instruments: As per Indian LawsРейтинг: 5 из 5 звезд5/5 (1)

- Code Breaker; The § 83 Equation: The Tax Code’s Forgotten ParagraphОт EverandCode Breaker; The § 83 Equation: The Tax Code’s Forgotten ParagraphРейтинг: 3.5 из 5 звезд3.5/5 (2)

- Bill of Exchange (Careful... )Документ12 страницBill of Exchange (Careful... )Jayanth Kumar93% (61)

- Private Document Tender of PaymentДокумент2 страницыPrivate Document Tender of PaymentPennyDoll94% (18)

- International Bill of Exchange and Promissory NotesДокумент41 страницаInternational Bill of Exchange and Promissory NotesW897% (37)

- Deadly Weapon Cover Letter For RedemptionДокумент2 страницыDeadly Weapon Cover Letter For Redemptiondouglas jones95% (40)

- Regstered Bonded Promissory NoteДокумент2 страницыRegstered Bonded Promissory NoteAnonymous nYwWYS3ntV94% (17)

- Promissory Note - Mary Final-1Документ3 страницыPromissory Note - Mary Final-1MaryUmbrello-Dressler92% (12)

- Transfer of OwnershipДокумент8 страницTransfer of OwnershipRicardo Vargas100% (6)

- Memorandum For Discharge For Property TaxesДокумент4 страницыMemorandum For Discharge For Property TaxesGary Krimson100% (17)

- UCC IRS Private BankingДокумент52 страницыUCC IRS Private BankingPETE97% (37)

- 005 Negotiable Debt Instruments OtherДокумент5 страниц005 Negotiable Debt Instruments OtherBrad100% (8)

- Why Efts Work and The Corresponding LawsДокумент5 страницWhy Efts Work and The Corresponding LawsNaomi Stevens100% (6)

- Indemnity BondДокумент7 страницIndemnity Bondfreedom61390% (10)

- 0000 AA - 2 Certified Coupon Bond For The WebДокумент1 страница0000 AA - 2 Certified Coupon Bond For The WebJacky Shen100% (1)

- Affidavit of Confirmation/ Notice of Non Response/ No Contest & AcceptanceДокумент3 страницыAffidavit of Confirmation/ Notice of Non Response/ No Contest & AcceptanceSuzanne Cristantiello100% (14)

- BOE Bonded TemplateДокумент2 страницыBOE Bonded TemplateSuzanne Cristantiello100% (6)

- Acceptance For Value and Returened For DischargeДокумент2 страницыAcceptance For Value and Returened For Dischargecharlescrump1100% (32)

- Setoff BondДокумент1 страницаSetoff BondMichael Kovach95% (42)

- Letter of AdviceДокумент3 страницыLetter of AdviceGreg Wilder100% (13)

- Negotiable Debt Instruments PDFДокумент7 страницNegotiable Debt Instruments PDFNova100% (2)

- Notice and Declaration of Bank)Документ3 страницыNotice and Declaration of Bank)sspikes100% (3)

- Acknowledge DischargeДокумент5 страницAcknowledge Dischargealmaurikanos96% (23)

- 3 Day Notice To Report PDFДокумент1 страница3 Day Notice To Report PDFMARSHA MAINES100% (2)

- Private Registered Setoff BondДокумент1 страницаPrivate Registered Setoff BondDarrell Wilson100% (3)

- Negotiable International Promissory NoteДокумент4 страницыNegotiable International Promissory Notejoe100% (7)

- Negotiable Debt InstrumentsДокумент5 страницNegotiable Debt Instrumentsbrucefarmer88% (8)

- Bankers Notice of Accept PrestmДокумент13 страницBankers Notice of Accept PrestmNova91% (11)

- Notice of Memorandum of Law Points and Authorities in Support of International Bill of ExchangeДокумент15 страницNotice of Memorandum of Law Points and Authorities in Support of International Bill of ExchangeJason Henry100% (10)

- Banking Law AssignmentДокумент16 страницBanking Law AssignmentAmbrose YollahОценок пока нет

- AR ProcessДокумент5 страницAR ProcessJohn Wallace80% (5)

- Bill of ExchangeДокумент14 страницBill of ExchangeMa Angelica Micah Labitag100% (8)

- Lawful Money Full Discharge Instrument-Payment Authorities PDFДокумент2 страницыLawful Money Full Discharge Instrument-Payment Authorities PDFApril Clay100% (19)

- Bailment Bond and Eft Over LetterДокумент7 страницBailment Bond and Eft Over LetterNikki Cofield100% (10)

- Notice of Acceptance TemplateДокумент17 страницNotice of Acceptance TemplateEl Zargermone86% (7)

- Affidavit of EFT (January 28, 2013)Документ7 страницAffidavit of EFT (January 28, 2013)Carla DiCapri100% (10)

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionОт EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionОценок пока нет

- 7 NEW Charge Back Letter No 2Документ1 страница7 NEW Charge Back Letter No 2party2495% (19)

- Affidavit by Declaration To Discharge DebtДокумент4 страницыAffidavit by Declaration To Discharge DebtAkil Bey100% (5)

- Discharge Debts For Free Info LetterДокумент3 страницыDischarge Debts For Free Info LetterDaniel M. Furesz100% (2)

- 3 Day Notice To ReportДокумент1 страница3 Day Notice To ReportMarsha MainesОценок пока нет

- Promissory NoteДокумент19 страницPromissory NoteUndra Watkins100% (2)

- Tender Payment SCДокумент3 страницыTender Payment SCsolution4theinnocent100% (1)

- Supercedes Bond To Pay Our DebtsДокумент2 страницыSupercedes Bond To Pay Our DebtsFreeman Lawyer100% (7)

- Three Day Right of Recission of Signature For ReportДокумент1 страницаThree Day Right of Recission of Signature For ReportMARSHA MAINES100% (2)

- 1 Certified Promissory NoteДокумент5 страниц1 Certified Promissory NoteLouis100% (8)

- Advice For Closing MortgagesДокумент4 страницыAdvice For Closing MortgagesMegan McAuley83% (6)

- Ahriman's Prophecy Walk ThroughДокумент106 страницAhriman's Prophecy Walk ThroughAngga Nata100% (1)

- Pressuremeter TestДокумент33 страницыPressuremeter TestHo100% (1)

- Piezometers: Types, Functions, & How It Works?Документ38 страницPiezometers: Types, Functions, & How It Works?Encardio RiteОценок пока нет

- Banking Adbl EnglishДокумент74 страницыBanking Adbl Englishdevi ghimireОценок пока нет

- Negotiable InstrumentsДокумент72 страницыNegotiable InstrumentsFaraz AliОценок пока нет

- Nego Case DigestДокумент16 страницNego Case DigestFatimaОценок пока нет

- Petitioner Respondent Ongkiko & Dizon Law Offices Lao, Veloso-Lao & LaoДокумент11 страницPetitioner Respondent Ongkiko & Dizon Law Offices Lao, Veloso-Lao & LaoEm-em DomingoОценок пока нет

- Chapter 1 General ConsiderationsДокумент6 страницChapter 1 General Considerationsjoymiles08Оценок пока нет

- Research Topics For Economics Thesis in PakistanДокумент7 страницResearch Topics For Economics Thesis in PakistanStacy Vasquez100% (2)

- TTD Accommodation ReceiptДокумент2 страницыTTD Accommodation ReceiptDharani KumarОценок пока нет

- Consider Typical Robots Consider Typical RobotsДокумент16 страницConsider Typical Robots Consider Typical RobotsOthers ATBP.Оценок пока нет

- Review Women With Moustaches and Men Without Beards - Gender and Sexual Anxieties of Iranian Modernity PDFДокумент3 страницыReview Women With Moustaches and Men Without Beards - Gender and Sexual Anxieties of Iranian Modernity PDFBilal SalaamОценок пока нет

- Beg 2018 XXДокумент42 страницыBeg 2018 XXFranz Gustavo Vargas MamaniОценок пока нет

- 9.LearnEnglish Writing A2 Instructions For A Colleague PDFДокумент5 страниц9.LearnEnglish Writing A2 Instructions For A Colleague PDFوديع القباطيОценок пока нет

- Ventilation WorksheetДокумент1 страницаVentilation WorksheetIskandar 'muda' AdeОценок пока нет

- Monster Energy v. Jing - Counterfeit OpinionДокумент9 страницMonster Energy v. Jing - Counterfeit OpinionMark JaffeОценок пока нет

- Report On Sonepur MelaДокумент4 страницыReport On Sonepur Melakashtum23Оценок пока нет

- JapanДокумент15 страницJapanceazar BugtongОценок пока нет

- Hamilton-Resume 4Документ1 страницаHamilton-Resume 4api-654686470Оценок пока нет

- Chapter 1 - Lesson 2 - Transforming Equations From Standard Form To General FormДокумент8 страницChapter 1 - Lesson 2 - Transforming Equations From Standard Form To General FormhadukenОценок пока нет

- Ottawa County May ElectionДокумент7 страницOttawa County May ElectionWXMIОценок пока нет

- Islami Bank Bangladesh Limited: Ibbl Ibanking ServiceДокумент2 страницыIslami Bank Bangladesh Limited: Ibbl Ibanking ServiceShaikat AlamОценок пока нет

- Mock MeetingДокумент2 страницыMock MeetingZain ZulfiqarОценок пока нет

- 329 Cryogenic Valves September 2016Документ8 страниц329 Cryogenic Valves September 2016TututSlengeanTapiSopanОценок пока нет

- Revised Implementing Rules and Regulations Ra 10575Документ79 страницRevised Implementing Rules and Regulations Ra 10575Rodel D. LuyaoОценок пока нет

- Public Economics - All Lecture Note PDFДокумент884 страницыPublic Economics - All Lecture Note PDFAllister HodgeОценок пока нет

- Akebono NVH White PaperДокумент4 страницыAkebono NVH White Paperapi-3702571100% (1)

- Nestle IndiaДокумент74 страницыNestle IndiaKiranОценок пока нет

- Migloo's Day Info SheetДокумент4 страницыMigloo's Day Info SheetCandlewick PressОценок пока нет

- Problem Sheet 3 - External Forced Convection - WatermarkДокумент2 страницыProblem Sheet 3 - External Forced Convection - WatermarkUzair KhanОценок пока нет

- HDMI To MIPI and LVDS To MIPI Converter Rotator Board Solutions From Q VioДокумент2 страницыHDMI To MIPI and LVDS To MIPI Converter Rotator Board Solutions From Q VioSubham KumarОценок пока нет

- Train Collision Avoidance SystemДокумент4 страницыTrain Collision Avoidance SystemSaurabh GuptaОценок пока нет

- Jibachha's Textbook of Animal Health Volume-IIДокумент16 страницJibachha's Textbook of Animal Health Volume-IIjibachha sahОценок пока нет

- Relativity Space-Time and Cosmology - WudkaДокумент219 страницRelativity Space-Time and Cosmology - WudkaAlan CalderónОценок пока нет