Академический Документы

Профессиональный Документы

Культура Документы

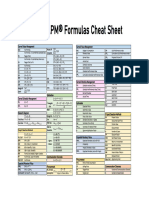

Fórmulas: PMBOK - PMI: Cod. Nombre Descripción EV

Загружено:

William Rojas Morales0 оценок0% нашли этот документ полезным (0 голосов)

53 просмотров4 страницыОригинальное название

PMI_AnexoAFormulas.pdf

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

53 просмотров4 страницыFórmulas: PMBOK - PMI: Cod. Nombre Descripción EV

Загружено:

William Rojas MoralesАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

Fórmulas: PMBOK - PMI

Cod. Nombre Descripción

EV Earned Value The estimated value of the work completed.

The completed portion of the originally estimated, total value.

PV Planned Value The value of the work planned to be be done by now

AC Actual Cost The current amount spent.

The total cost so far for the work completed.

BAC Budget At Completion The total project budget

How much did we originally expect the total project to cost?

BAC = PV of entire project

CV Cost Variance Value of work accomplished – cost incurred

EV – AC

SV Schedule Variance The value of work completed – The value of work planned to be completed.

EV – PV Work completed – Expected work completed

Negative is behind schedule. Positive is ahead of schedule.

CPI Cost Performance Index We are getting X value out of each $ spent.

EV / AC Also as: “Cumulative CPI” when figures used are costs to date.

SPI Schedule Performance Index We are progressing at X rate originally planned.

EV / PV We are getting X value per original planned value.

EAC Estimate At Completion What we currently expect the total cost to be. Current cost + Bottom up (redone) estimate of remaining

AC + Bottom-up ETC cost. Used when original estimate was flawed.

BAC / CPI Currently, the total cost estimate per (cumulative) performance.

AC + (BAC – EV) Used when there is no variance from BAC. Most common on exam.

AC+[ (BAC-EV)/( CPI*SPI)] Current cost + Remaining work TBD.

PMBOK 5ta Edición - Ernesto Calvo

1

Fórmulas: PMBOK - PMI

Cod. Nombre Descripción

TCPI To Complete Performance The remaining work TBD per the remaining money.

Index In order to stay on budget, what remaining performance is needed?

(BAC – EV) / (BAC – AC)

ETC Estimate To Complete How much more will the project cost?

EAC – AC Updated total cost – current cost

Reestimate Reestimating the work from the bottom up.

VAC Variance At Completion How much over/under budget will we be?

BAC – EAC

EAD Expected Activity Duration The most likely estimated is weighed 4 times the pessimistic or optimistic.This and all formulas

( P + 4M + O ) / 6 below can be used for activity time and cost

AV Activity Variance A quantifiable deviation from an expected baseline or estimate. Also equal to standard

[ ( P - O ) / 6 ] ^2 deviation squared.

SD Standard Deviation The square root of the variance. Used to calculate the activity range. EAD +/- SD

(P–O)/6

Activity EAD +/- SD The estimated scope from EAD – Standard Deviation to EAD + Standard Deviation.

Range

Project EAD + EAD + EAD The sum of the EAD’s / PERT estimates

Expected

Duration

Project SD Standard deviation of the Each of the activity variances (AV) on the critical path are calculated individually. The square

projectsqrt root of their sum is the project standard deviation. It is used to calculate the project range.

[AV + AV + AV ...]

Project The project expected duration The sum of the project EADs +/- the project standard deviation.

Range +/- Project SD

PMBOK 5ta Edición - Ernesto Calvo

2

Fórmulas: PMBOK - PMI

Cod. Nombre Descripción

EMV Expected Monetary Value EMV = Probability times Impact

EMV = P * I

Communicati [ n (n-1) ] / 2 The number of channels between people. n is the number of people

on Channels

PTA [(CP - TP) / BSR] + TC Point of total assumption.

The amount at which seller pays all additional costs. Used in FPIF contracts.

The margin between the maximum and target prices is divided by the buyer’s portion of the

sharing ratio and added to the target cost

Final Fee FF = (TC – AC) x SSR + Sellers fee/profit is adjusted for cost performance.

TF The target fee is adjusted by adding: target cost – actual cost times the sellers portion of the

sharing ratio

Final Price FP = AC + FF (or CP, Final price equals actual cost plus final fee (or ceiling price)

whichever is lower)

Buy or Lease Purchase Cost + Owning So if something costs $1,000 to buy and $10 / day to maintain but costs $50 / day to rent, how

Cost * Time = Leasing many days does it take to break even? 1,000 + 10 * t = 50 * t The break even point is 25 days.

Cost * Time

Float Float = LF – EF or Late Finish – Early Finish or Late Start – Early Start

LS – ES

Late Finish LS = (LF - Duration + 1)

Early Finish EF = (ES + Duration - 1)

PMBOK 5ta Edición - Ernesto Calvo

3

Fórmulas: PMBOK - PMI

Nombre Valor

Order of Magnitude Estimate -25% - +75% (-50% to +100%)

Budget Estimate -10% - +25%

Definitive Estimate -5% - +10%

Present Value PV FV / (1 + r)^n

Net Present Value Bigger is better (NPV)

Internal Rate of Return Bigger is better (IRR)

Benefit Cost Ratio Bigger is better (Benefit / Cost)

Payback Period Less is better

Point of Total Assumption (PTA) ((Ceiling Price - Target Price)/buyer's Share Ratio) +

Target Cost

1σ = 68.27%

2σ = 95.45%

Sigma σ

3σ = 99.73%

6σ = 99.99985%

PMBOK 5ta Edición - Ernesto Calvo

4

Вам также может понравиться

- Formulas - Math For PMPДокумент2 страницыFormulas - Math For PMPabhi10augОценок пока нет

- VI VI - PMP Formula Pocket GuideДокумент1 страницаVI VI - PMP Formula Pocket GuideSMAKОценок пока нет

- PMP Formulas Pocket GuideДокумент2 страницыPMP Formulas Pocket Guidesantiroes pmp80% (5)

- 17 PMP Formulas Mentioned in The PMBOK GuideДокумент14 страниц17 PMP Formulas Mentioned in The PMBOK GuideStéphane SmetsОценок пока нет

- PMP Formulas - Cheat Sheet v0.6Документ2 страницыPMP Formulas - Cheat Sheet v0.6Don GiovzОценок пока нет

- PMP Quick Reference GuideДокумент20 страницPMP Quick Reference Guidevivek100% (2)

- Key Concept and Formulas For PMP ExamДокумент4 страницыKey Concept and Formulas For PMP ExamaaranganathОценок пока нет

- Assessment Plan: Sample Test Activity Date Score Strongest Area Weakest Area Scheduled CompletedДокумент3 страницыAssessment Plan: Sample Test Activity Date Score Strongest Area Weakest Area Scheduled CompletedAbdulla Jawad AlshemaryОценок пока нет

- PMP Exam Cheat SheetДокумент10 страницPMP Exam Cheat Sheethema_cse4Оценок пока нет

- PMP Formulas: 1. Number of Communication ChannelsДокумент5 страницPMP Formulas: 1. Number of Communication ChannelsramaiahОценок пока нет

- PMP Memory SheetsДокумент6 страницPMP Memory SheetsAamirMalik100% (1)

- Basic PMP FormulasДокумент9 страницBasic PMP Formulasgirishkris100% (2)

- PMP Practice ExercisesДокумент122 страницыPMP Practice ExercisesElie ShalhoubОценок пока нет

- Exam Flashcards: by Jonathan DonadoДокумент520 страницExam Flashcards: by Jonathan DonadoAndreeaОценок пока нет

- PMP Exam Prep: (What It Really Takes To Prepare and Pass)Документ26 страницPMP Exam Prep: (What It Really Takes To Prepare and Pass)meetvisu118100% (1)

- Exam Cram Essentials Last-Minute Guide to Ace the PMP Exam: First EditionОт EverandExam Cram Essentials Last-Minute Guide to Ace the PMP Exam: First EditionОценок пока нет

- PMP Prep Notes Project LifecycleДокумент3 страницыPMP Prep Notes Project LifecycletrudiddleОценок пока нет

- Midi's Free ITTO SpreadsheetДокумент25 страницMidi's Free ITTO Spreadsheetthepreparedpm100% (1)

- PMP Itto MnemonicsДокумент5 страницPMP Itto MnemonicsChandan Raj Singh100% (1)

- PMP Exam PrepДокумент10 страницPMP Exam Prepjaisingla100% (1)

- PMP Itto ChartДокумент25 страницPMP Itto ChartMuhammad Amir JamilОценок пока нет

- PMP Exam ExperienceДокумент11 страницPMP Exam ExperiencePM_CHAMPОценок пока нет

- PMP Exam Compa SimulatorДокумент1 страницаPMP Exam Compa SimulatorHanish GaonjurОценок пока нет

- PMP NotesДокумент49 страницPMP Notesgirishkris100% (1)

- PMP Sample Questions PDFДокумент106 страницPMP Sample Questions PDFmp272Оценок пока нет

- 25 PMP Formulas To Pass The PMPДокумент20 страниц25 PMP Formulas To Pass The PMPMarceta BrankicaОценок пока нет

- PMP Formula Pocket GuideДокумент1 страницаPMP Formula Pocket Guidesunil_v5Оценок пока нет

- PMP Knowledge Areas & Process GroupsДокумент1 страницаPMP Knowledge Areas & Process GroupsChristien MarieОценок пока нет

- Knowledge Area ITTO Study SheetДокумент46 страницKnowledge Area ITTO Study Sheetrajaabid100% (1)

- PMP Formulas Cheat Sheet StatementДокумент1 страницаPMP Formulas Cheat Sheet StatementdercoconsultoresОценок пока нет

- PMP ExamДокумент24 страницыPMP Exambharikrishnan17701100% (2)

- PMP Study NotesДокумент76 страницPMP Study Notesikrudis100% (3)

- Itto For PMP ExamДокумент28 страницItto For PMP ExamDebayan0% (1)

- Comparison of 6th & 7th EditionДокумент25 страницComparison of 6th & 7th EditionHsaung Hnin Phyu100% (1)

- PMP Formulas - Cheat Sheet v0.6Документ2 страницыPMP Formulas - Cheat Sheet v0.6Mohamed LabbeneОценок пока нет

- Memorizing Inputs Tools and OutputsДокумент8 страницMemorizing Inputs Tools and OutputsJose Miguel Sanchez100% (1)

- Sale or Reproduction.: Figure 4-1. Project Integration Management OverviewДокумент14 страницSale or Reproduction.: Figure 4-1. Project Integration Management OverviewHot SummerОценок пока нет

- PMP NotesДокумент160 страницPMP NotesAtul Patil100% (2)

- Difference Between PMBOK 5th and 6th Edition: A Quick GlimpseДокумент2 страницыDifference Between PMBOK 5th and 6th Edition: A Quick GlimpseSanjay Kumar Rajpoot100% (1)

- Importance of PMP CertificationДокумент48 страницImportance of PMP CertificationPRAPTHIIAS100% (2)

- Mastering PMP ITO PDFДокумент15 страницMastering PMP ITO PDFSamuel ZvimbaОценок пока нет

- Cheat SheetДокумент9 страницCheat SheetRobincrusoe100% (1)

- PMP Exam QuestionsДокумент31 страницаPMP Exam QuestionsAsuelimen tito100% (1)

- PMP Key PointsДокумент8 страницPMP Key PointsironpushaОценок пока нет

- PMP TipsДокумент13 страницPMP Tipskumar31052003100% (3)

- The Affinity Diagram: PMP Planning Tools That You Should KnowДокумент2 страницыThe Affinity Diagram: PMP Planning Tools That You Should KnowSamuel ZvimbaОценок пока нет

- CAPM ReferencesДокумент4 страницыCAPM Referenceskinisha kk100% (1)

- 343.1 - PMP Full Sample Exam-Answers and RationalesДокумент200 страниц343.1 - PMP Full Sample Exam-Answers and RationalesSuhailshah1234Оценок пока нет

- PMBOK Cheat SheetДокумент2 страницыPMBOK Cheat SheetAhmed NasserОценок пока нет

- My PMP NotesДокумент252 страницыMy PMP NotesRashmita Sahu100% (2)

- 150 Important Points For PMPДокумент4 страницы150 Important Points For PMPsrini.eticala2614100% (3)

- Here Are Your ResultsДокумент72 страницыHere Are Your ResultsfransyunetОценок пока нет

- PMP Formulas and CalculationsДокумент19 страницPMP Formulas and CalculationstutikaОценок пока нет

- The PM PrepCast - Module and Lesson DirectoryДокумент9 страницThe PM PrepCast - Module and Lesson DirectoryAshenafiОценок пока нет

- Estimate Costs Tools and Techniques: Cert Prep: Project Management Professional (PMP) ® (2018)Документ3 страницыEstimate Costs Tools and Techniques: Cert Prep: Project Management Professional (PMP) ® (2018)Satish Raghupathi100% (1)

- Rita Process ChartДокумент1 страницаRita Process Chartaa k100% (1)

- ITTO Matrix 6thed AllДокумент16 страницITTO Matrix 6thed AllGillianiОценок пока нет

- Formulas Math For PMPДокумент3 страницыFormulas Math For PMPramorclОценок пока нет

- Diseño Viga NCH 433Документ1 страницаDiseño Viga NCH 433Ed BedsОценок пока нет

- 1999 ChronicleДокумент11 страниц1999 ChroniclerhasОценок пока нет

- f201 19Документ20 страницf201 19Fabio Ventura JОценок пока нет

- Implementing Last Planner in Open Pit Mining Projects: Case StudyДокумент11 страницImplementing Last Planner in Open Pit Mining Projects: Case StudyJavier GonzalesОценок пока нет

- Quickref PDFДокумент35 страницQuickref PDFSuri Kens MichuaОценок пока нет

- DM Modelling PDFДокумент12 страницDM Modelling PDFΈνκινουαν Κόγκ ΑδάμουОценок пока нет

- Aqwa FlowДокумент0 страницAqwa FlowSridhar RaoОценок пока нет

- ACT Customization Guide For Fluent PDFДокумент22 страницыACT Customization Guide For Fluent PDFWilliam Rojas MoralesОценок пока нет

- ACT Customization Guide For SpaceClaimДокумент18 страницACT Customization Guide For SpaceClaimWilliam Rojas MoralesОценок пока нет

- ACT Customization Guide For Fluent PDFДокумент22 страницыACT Customization Guide For Fluent PDFWilliam Rojas MoralesОценок пока нет

- ACT Customization Guide For DesignModelerДокумент28 страницACT Customization Guide For DesignModelerWilliam Rojas MoralesОценок пока нет

- Leaving A Party: Questions Your Teacher Will AskДокумент1 страницаLeaving A Party: Questions Your Teacher Will AskFernando RamirezОценок пока нет

- ACT Customization Guide For AIMДокумент66 страницACT Customization Guide For AIMWilliam Rojas MoralesОценок пока нет

- ACT APIs For Mechanical GuideДокумент50 страницACT APIs For Mechanical GuideWilliam Rojas MoralesОценок пока нет

- Sprocketequations 2 LockДокумент4 страницыSprocketequations 2 LockWilliam Rojas MoralesОценок пока нет

- Job Stress InterventionsДокумент5 страницJob Stress InterventionscocaralucamihaelaОценок пока нет

- ARRANGING For Marchong or Concert BandДокумент13 страницARRANGING For Marchong or Concert BandCheGus AtilanoОценок пока нет

- Annexure To SOW 3 STD Specification For Welding and NDT PipingДокумент15 страницAnnexure To SOW 3 STD Specification For Welding and NDT PipingASHISH GORDEОценок пока нет

- The 100 Best Books For 1 Year Olds: Board Book HardcoverДокумент17 страницThe 100 Best Books For 1 Year Olds: Board Book Hardcovernellie_74023951Оценок пока нет

- What Role Does Imagination Play in Producing Knowledge About The WorldДокумент1 страницаWhat Role Does Imagination Play in Producing Knowledge About The WorldNathanael Samuel KuruvillaОценок пока нет

- Benefits and Drawbacks of Thermal Pre-Hydrolysis For Operational Performance of Wastewater Treatment PlantsДокумент7 страницBenefits and Drawbacks of Thermal Pre-Hydrolysis For Operational Performance of Wastewater Treatment PlantsmartafhОценок пока нет

- Directorate of Indian Medicines & Homoeopathy, Orissa, Bhubaneswar Listof The Homoeopathic Dispensaries BhadrakДокумент1 страницаDirectorate of Indian Medicines & Homoeopathy, Orissa, Bhubaneswar Listof The Homoeopathic Dispensaries Bhadrakbiswajit mathematicsОценок пока нет

- Water Works RTAДокумент15 страницWater Works RTAalfaza3Оценок пока нет

- LG) Pc-Ii Formulation of Waste Management PlansДокумент25 страницLG) Pc-Ii Formulation of Waste Management PlansAhmed ButtОценок пока нет

- Training Structure - Thinkific Plus TemplateДокумент7 страницTraining Structure - Thinkific Plus TemplateQIONG WUОценок пока нет

- Principles of Inheritance and Variation - DPP 01 (Of Lecture 03) - Lakshya NEET 2024Документ3 страницыPrinciples of Inheritance and Variation - DPP 01 (Of Lecture 03) - Lakshya NEET 2024sibasundardutta01Оценок пока нет

- The Uv Environment Production System Best Practice OperationДокумент2 страницыThe Uv Environment Production System Best Practice OperationFarzad ValizadehОценок пока нет

- System Administration ch01Документ15 страницSystem Administration ch01api-247871582Оценок пока нет

- ZEROPAY WhitepaperДокумент15 страницZEROPAY WhitepaperIlham NurrohimОценок пока нет

- STIHL TS410, TS420 Spare PartsДокумент11 страницSTIHL TS410, TS420 Spare PartsMarinko PetrovićОценок пока нет

- LANY Lyrics: "Thru These Tears" LyricsДокумент2 страницыLANY Lyrics: "Thru These Tears" LyricsAnneОценок пока нет

- Ethernet: Outline Multiple Access and Ethernet Intro Ethernet Framing CSMA/CD Protocol Exponential BackoffДокумент25 страницEthernet: Outline Multiple Access and Ethernet Intro Ethernet Framing CSMA/CD Protocol Exponential BackoffcheckОценок пока нет

- Archetypal Approach To Macbeth by William ShakespeareДокумент9 страницArchetypal Approach To Macbeth by William ShakespeareLenka Koutná100% (1)

- LUNG ARTIFACTSreviewДокумент13 страницLUNG ARTIFACTSreviewMayra ValderramaОценок пока нет

- OSX ExpoДокумент13 страницOSX ExpoxolilevОценок пока нет

- Early Childhood Education and CareДокумент53 страницыEarly Childhood Education and CareBianca ALbuquerqueОценок пока нет

- Character Paragraph Analysis RubricДокумент2 страницыCharacter Paragraph Analysis RubricDiana PerrottaОценок пока нет

- Ten Reasons To Oppose The Death PenaltyДокумент5 страницTen Reasons To Oppose The Death PenaltyAlvin ArellanoОценок пока нет

- Benson Ivor - The Zionist FactorДокумент234 страницыBenson Ivor - The Zionist Factorblago simeonov100% (1)

- Curriculum Vitae: Educational Background Certification Major Name of Institute PeriodДокумент2 страницыCurriculum Vitae: Educational Background Certification Major Name of Institute PeriodTHEVINESHОценок пока нет

- ESG Conundrum PDFДокумент30 страницESG Conundrum PDFVijay Kumar SwamiОценок пока нет

- Manual ML 1675 PDFДокумент70 страницManual ML 1675 PDFSergio de BedoutОценок пока нет

- Workshop Manual: 3LD 450 3LD 510 3LD 450/S 3LD 510/S 4LD 640 4LD 705 4LD 820Документ33 страницыWorkshop Manual: 3LD 450 3LD 510 3LD 450/S 3LD 510/S 4LD 640 4LD 705 4LD 820Ilie Viorel75% (4)

- Decolonization DBQДокумент3 страницыDecolonization DBQapi-493862773Оценок пока нет

- CV - Mohsin FormatДокумент2 страницыCV - Mohsin FormatMuhammad Junaid IqbalОценок пока нет