Академический Документы

Профессиональный Документы

Культура Документы

Indian Financial System

Загружено:

Abdul Manaf SАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Indian Financial System

Загружено:

Abdul Manaf SАвторское право:

Доступные форматы

i

Find out which type of financial system your country has. According to you,

which system is good for your country?

The financial system of a country is a vital tool of its economic development. It creates a flow

of savings between household and business to improve the wealth of both parties. The primary

function of financial system according to Robinson is “to provide a link between savings and

investment for creation of wealth and to permit portfolio adjustment in the composition of

existing wealth”.

The financial system of a country is concerned with,

Mobilization of savings

Allocation of savings

Facilitating transactions

Providing funds

Developing financial markets

Formulate and implement a legal financial framework

Provide financial and advisory services

According to the market structure such as ‘stability of environment’ ‘influence of market

mechanisms’ etc., the financial system of any country can be divided as bank oriented financial

system and capital-market oriented financial system. The bank oriented financial system can

again divide into bank oriented with government participation and bank oriented without

government participation. Bank oriented with government participation is a redundant model

which is completely against the economic development of a country.

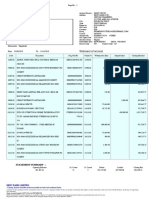

India’s financial system is kind of a mixture of both bank oriented and market oriented. It is

debatable and can be portray as both. Current structure of Indian financial system is as follows,

Private Bank

Comercial Banks

Public Bank

Co-Operative

Banks

Banking

Institutions

Financial Regional Rural

Institutions Banks

Non-banking

Institutions

Foreign Banks

Unorganised Secondary Market

Financial System Financial Markets Capital Market

Organised Primary Market

Financial Assets /

Money Market

Instruments

Fund based Leasing, Hire Purchace, Consumer Credit, Bill

Services Discounting, Factoring, Insurance etc.

Financial Services

Issue Management, Merchant Banking, Credit

Fee based services

Rating, Debate Restructuring, Stock Broking etc

ii

Even though India’s financial system is kind of a mixture of both bank oriented and market

oriented system, the influence of banking system and regulations from government are quite

large as compared to other similar economies. Almost all the capital market policies are either

formed or at least guided by either the bank or the government. On another hand, since the

equity capital share of existing companies in the economy is hundreds of trillion it may appear

that the market is important than banking. But on a closer look, even though policy makers are

driven by capital market, almost all other components are tightly controlled by government

policies, which explains the slow and unsustainable GDP growth and the following

shortcomings of current financial system,

1. The formal financial system is a failure in absorbing half of the household savings in

India. They are either going to the informal institutions or ending up in dead

investments like land or gold.

2. The formal financial institutions are forced to allocate most of the available funds to

less productive areas like agriculture, government companies, unorganised MSMEs etc.

due to government regulations. Much more productive private companies are receiving

much lesser than that of less productive sectors.

3. The cost of capital in India is higher as well as the benefit of investment is lesser

compared to similar economies because of the failure of financial institutions in

mobilizing capital as well as allocating funds.

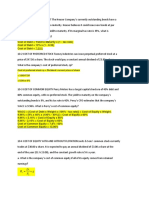

Here comes the importance of a comprehensive capital-market oriented financial system which

will not only help in a sustainable rapid growth of GDP but also help in spreading its benefits

broadly. It can fix the above-mentioned shortcomings of current economy and improve it

beyond expectations. A research conducted by McKinsey Global Institute (MGI) states that

these reforms can add $47 billion to Indian economy each year, which will increase the GDP

to around 9.4% per year. It will also increase the household income by 30%, results in less

poverty.

So, the current mixed financial system is an appropriate one in Indian scenario, given that the

market will have an upper hand and the government regulations should be brought down to a

minimal level.

Вам также может понравиться

- 2CEXAM Mock Question Licensing Examination Paper 7Документ10 страниц2CEXAM Mock Question Licensing Examination Paper 7Tsz Ngong Ko100% (1)

- Understanding Media PlanningДокумент28 страницUnderstanding Media PlanningSivaKumar RamamoorthyОценок пока нет

- BRIC EconomiesДокумент12 страницBRIC EconomiesLinh BùiОценок пока нет

- Summer Internship Project in CONCOR at ICD Tughlakabad ON ANALYSIS & PROMOTION OF LCL CARGOДокумент17 страницSummer Internship Project in CONCOR at ICD Tughlakabad ON ANALYSIS & PROMOTION OF LCL CARGOhaidersyed06100% (1)

- PEST-2 PrimarkДокумент3 страницыPEST-2 PrimarkAicha BliliОценок пока нет

- Liberalization & PrivatizationДокумент23 страницыLiberalization & Privatizationshweta_466640% (2)

- Bank Statement FinalДокумент2 страницыBank Statement FinalShemeem SОценок пока нет

- A Study On Fixed Income Securities and Their Awareness Among Indian InvestorsДокумент82 страницыA Study On Fixed Income Securities and Their Awareness Among Indian InvestorsSourav LodhaОценок пока нет

- UNIT 1 Indian Financial SystemДокумент50 страницUNIT 1 Indian Financial Systemamol_more37Оценок пока нет

- China Vs India 3Документ28 страницChina Vs India 3sn07860Оценок пока нет

- Indian Financial SystemДокумент91 страницаIndian Financial SystemAnkit Sablok100% (2)

- Paytm's Revenue Model: Advertising, Commissions, Escrow AccountsДокумент1 страницаPaytm's Revenue Model: Advertising, Commissions, Escrow AccountsVaishali BansalОценок пока нет

- SCM LectureДокумент14 страницSCM LecturejesseewilsonОценок пока нет

- Successful Practice of Total Quality Management Involves Both Technical and People Aspects That Cover The Entire Organization and Extend To Relationships With Suppliers and CustomersДокумент5 страницSuccessful Practice of Total Quality Management Involves Both Technical and People Aspects That Cover The Entire Organization and Extend To Relationships With Suppliers and CustomersrithikkumuthaОценок пока нет

- ANA The Importance of Social CRMДокумент12 страницANA The Importance of Social CRMDemand MetricОценок пока нет

- Introduction To Securities MarketДокумент13 страницIntroduction To Securities MarketSandra PhilipОценок пока нет

- E CRMДокумент12 страницE CRMkdprachuОценок пока нет

- MBA1038 Banking & Insurance: Key ConceptsДокумент3 страницыMBA1038 Banking & Insurance: Key ConceptsnanakethanОценок пока нет

- India China RelationsДокумент8 страницIndia China Relationsranjan@799Оценок пока нет

- Indian Financial System: An Overview of Key ComponentsДокумент23 страницыIndian Financial System: An Overview of Key ComponentsSujeet KhadeОценок пока нет

- THE ROLE OF FINANCIAL SYSTEMS IN ECONOMIC DEVELOPMENTДокумент5 страницTHE ROLE OF FINANCIAL SYSTEMS IN ECONOMIC DEVELOPMENTCritical ThinkerОценок пока нет

- Assignment On Marketing Management: New Product Development Process in "Jaul"Документ18 страницAssignment On Marketing Management: New Product Development Process in "Jaul"Sandip KarОценок пока нет

- The Misunderstanding of Memes: Biography of An Unscienti C Object, 1976-1999Документ30 страницThe Misunderstanding of Memes: Biography of An Unscienti C Object, 1976-1999mombarreОценок пока нет

- AssignmentДокумент5 страницAssignmentASHHAR AZIZОценок пока нет

- Sugar IndustryДокумент44 страницыSugar IndustryRuishabh RunwalОценок пока нет

- Introduction to CRM and its ImportanceДокумент24 страницыIntroduction to CRM and its Importanceshahruchir0% (1)

- Impact of Advertisement of On Youth With Respect To FMCG ProductsДокумент26 страницImpact of Advertisement of On Youth With Respect To FMCG ProductsAMIT K SINGH0% (1)

- Media-Conventional and New AgeДокумент5 страницMedia-Conventional and New AgeSameer RoopawallaОценок пока нет

- Understanding India's Financial SystemДокумент46 страницUnderstanding India's Financial SystemAkshay AhirОценок пока нет

- What Is A Distribution Channel?: Assortments. Wholesalers and Retailers Purchase Large Quantities of Goods FromДокумент11 страницWhat Is A Distribution Channel?: Assortments. Wholesalers and Retailers Purchase Large Quantities of Goods Fromirshad_cbОценок пока нет

- Strategic Marketing Plan for Deligram to Attract Women CustomersДокумент15 страницStrategic Marketing Plan for Deligram to Attract Women CustomersNure Alam SiddiqueОценок пока нет

- What Is EconomicsДокумент14 страницWhat Is Economicsapi-88846630Оценок пока нет

- 7 P's of Marketing Research Firm-Deepika, Maitri, Mradul@BДокумент27 страниц7 P's of Marketing Research Firm-Deepika, Maitri, Mradul@BmradulrajОценок пока нет

- Presented by Group 18: Neha Srivastava Sneha Shivam Garg TarunaДокумент41 страницаPresented by Group 18: Neha Srivastava Sneha Shivam Garg TarunaNeha SrivastavaОценок пока нет

- Balance Sheet Comparison-AFAДокумент15 страницBalance Sheet Comparison-AFAAhsan IshaqОценок пока нет

- Indian Financial Institutions GuideДокумент26 страницIndian Financial Institutions GuideRimple Abhishek Delisha ViraajvirОценок пока нет

- Communication ProcessДокумент3 страницыCommunication ProcessErna Mae AlajasОценок пока нет

- A Comparative Analysis of Foreign Direct Investment in China and IndiaДокумент10 страницA Comparative Analysis of Foreign Direct Investment in China and IndiaAlexander DeckerОценок пока нет

- IFM5 Exc Rate Theories Parity ConditionsДокумент42 страницыIFM5 Exc Rate Theories Parity Conditionsashu khetan100% (1)

- Media Planning and Strategy Guide for Event ManagementДокумент5 страницMedia Planning and Strategy Guide for Event Managementharishk2060Оценок пока нет

- Creative Aspects of AdvertisingДокумент11 страницCreative Aspects of AdvertisingRajanVermaОценок пока нет

- E-commerce impact on Indian SME growthДокумент5 страницE-commerce impact on Indian SME growthSudheera LingamaneniОценок пока нет

- Impact of Advertisement On SocietyДокумент8 страницImpact of Advertisement On SocietyMilind AudichyaОценок пока нет

- Introdution: Bharat Sanchar Nigam Limited BSNLДокумент28 страницIntrodution: Bharat Sanchar Nigam Limited BSNLHemaОценок пока нет

- Methods of Credit Control Used by Central BankДокумент5 страницMethods of Credit Control Used by Central BanknitinОценок пока нет

- New Issue MarketДокумент18 страницNew Issue MarketKaran JainОценок пока нет

- HBL MARKETING RESEARCH DATA GATHERINGДокумент41 страницаHBL MARKETING RESEARCH DATA GATHERINGSaliha SaeedОценок пока нет

- Customer Equity ManagementДокумент1 страницаCustomer Equity ManagementPradyot100% (1)

- Comparison Between India and ChinaДокумент92 страницыComparison Between India and Chinaapi-3710029100% (3)

- Impact of Ambush Marketing On Consumers Buying Behaviour A Study of Snapdeals Marketing StrategyДокумент7 страницImpact of Ambush Marketing On Consumers Buying Behaviour A Study of Snapdeals Marketing StrategyarcherselevatorsОценок пока нет

- A Sustainable Platform Economy and The Future of Corporate GovernanceДокумент38 страницA Sustainable Platform Economy and The Future of Corporate GovernanceRiaОценок пока нет

- Colin Fraser and Restrepo Estrada - Community Radio HandbookДокумент105 страницColin Fraser and Restrepo Estrada - Community Radio HandbookBurmaClubОценок пока нет

- CRM Strategy Optimizes Customer RelationshipsДокумент25 страницCRM Strategy Optimizes Customer RelationshipsPriya PriyaОценок пока нет

- Evolution of Corporate Governance in IndiaДокумент7 страницEvolution of Corporate Governance in IndiaVaishnavi VenkatesanОценок пока нет

- Consumer Rights and ProtectionsДокумент8 страницConsumer Rights and ProtectionsPrakash VadavadagiОценок пока нет

- Pepsi PerformanceДокумент68 страницPepsi PerformanceSingh AmandeepОценок пока нет

- Hand N0tes IMCДокумент93 страницыHand N0tes IMCTalha SiddiquiОценок пока нет

- Microsoft Word Finance NotesДокумент54 страницыMicrosoft Word Finance NotesAmitPandeyОценок пока нет

- Payment and Small BanksДокумент27 страницPayment and Small BanksDr.Satish RadhakrishnanОценок пока нет

- Importance of HR in Education Sector: Role of Human Resources and Human Resource ManagementДокумент9 страницImportance of HR in Education Sector: Role of Human Resources and Human Resource ManagementajayОценок пока нет

- Indian Financial SystemДокумент24 страницыIndian Financial SystemsarthakОценок пока нет

- Notes On Introduction To Financial ServicesДокумент18 страницNotes On Introduction To Financial ServicesKirti Giyamalani100% (1)

- Financial Markets & ServicesДокумент32 страницыFinancial Markets & ServicesSam GeorgeОценок пока нет

- Fundamental & Technical Analysis On HDFC BankДокумент56 страницFundamental & Technical Analysis On HDFC BankYogendra SanapОценок пока нет

- Quiz 01 Financial Management Total Marks 30Документ1 страницаQuiz 01 Financial Management Total Marks 30Repunzel RaajОценок пока нет

- DO IT Chapter 7 Internal Control and FraudДокумент3 страницыDO IT Chapter 7 Internal Control and Fraudukandi rukmanaОценок пока нет

- Tax Invoice: Billing Address Installation Address Invoice DetailsДокумент1 страницаTax Invoice: Billing Address Installation Address Invoice DetailsSiva Sagar JaggaОценок пока нет

- CKSBДокумент23 страницыCKSBayushiОценок пока нет

- IDBI Bank's Executive Summary and ProfileДокумент41 страницаIDBI Bank's Executive Summary and Profilesee2vickyОценок пока нет

- Mutual Funds in Nepal PDFДокумент11 страницMutual Funds in Nepal PDFGalijang ShampangОценок пока нет

- Repco Home Finance LTD - Detail ReportДокумент11 страницRepco Home Finance LTD - Detail ReportSrinivasan IyerОценок пока нет

- Forex ICAI ModifiedДокумент34 страницыForex ICAI Modifiedantim routОценок пока нет

- Vanguard: Vanguard All-Equity ETF PortfolioДокумент4 страницыVanguard: Vanguard All-Equity ETF PortfolioJanko JerinićОценок пока нет

- Investment Banking Industry Analysis Report PDFДокумент46 страницInvestment Banking Industry Analysis Report PDFricky franklinОценок пока нет

- Bar Graph Unit MonthДокумент2 страницыBar Graph Unit MonthshrikantОценок пока нет

- CH 1 Quantitative - Methods RVF45YESAU PDFДокумент308 страницCH 1 Quantitative - Methods RVF45YESAU PDFSiravit AriiazОценок пока нет

- Wainaina the+Relationship+Between+Capital+Structure+and+Financial+Performance+of+Insurance+Companies+in+KenyaДокумент52 страницыWainaina the+Relationship+Between+Capital+Structure+and+Financial+Performance+of+Insurance+Companies+in+KenyaBasant WaheedОценок пока нет

- Parmanand Cibil PresentationДокумент17 страницParmanand Cibil PresentationparamsatnaОценок пока нет

- Initial Project Screening Method - Payback Period: Lecture No.15 Contemporary Engineering EconomicsДокумент32 страницыInitial Project Screening Method - Payback Period: Lecture No.15 Contemporary Engineering EconomicsAfiq de WinnerОценок пока нет

- Finman Financial Ratio AnalysisДокумент26 страницFinman Financial Ratio AnalysisJoyce Anne SobremonteОценок пока нет

- Unit 1: Derivatives - FuturesДокумент90 страницUnit 1: Derivatives - Futuresseema mundaleОценок пока нет

- Branch and Unit BankingДокумент1 страницаBranch and Unit BankingSheetal Thomas100% (1)

- Piramal PhytocareДокумент3 страницыPiramal PhytocareDynamic LevelsОценок пока нет

- Financial System of BangladeshДокумент24 страницыFinancial System of Bangladeshmoin06100% (2)

- Assignment 5 2020Документ5 страницAssignment 5 2020林昀妤Оценок пока нет

- Bonus Assignment 1Документ4 страницыBonus Assignment 1Zain Zulfiqar100% (2)

- Clearing-Settlement and Risk Management of BATS at ISLAMABADДокумент4 страницыClearing-Settlement and Risk Management of BATS at ISLAMABADhafsa1989Оценок пока нет

- Download: The Rosen Market Timing LetterДокумент8 страницDownload: The Rosen Market Timing LetterjohnnemanicОценок пока нет

- Republic of The Philippines Department of Education Public Technical - Vocational High SchoolsДокумент10 страницRepublic of The Philippines Department of Education Public Technical - Vocational High SchoolsKristel AcordonОценок пока нет

- Accrual Cash BasisДокумент2 страницыAccrual Cash BasisSaranjam KhanОценок пока нет