Академический Документы

Профессиональный Документы

Культура Документы

Factsheet Al Amal) June 2010

Загружено:

sureniimbИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Factsheet Al Amal) June 2010

Загружено:

sureniimbАвторское право:

Доступные форматы

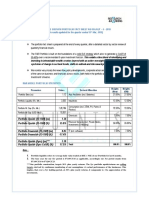

FACTSHEET FINCORP AL AMAL FUND

30 Jun 2010

FUND NAV - OMR 1.425 Fund Size (OMR Thousands) 5,607

Index Value (MSM 30) 6,058

PERFORMANCE (Since Inception)

AL AMAL FUND MSM 30

Performance * FUND MSM 30 Bonus Cash Div.

YTD -0.55% -4.88% 300 2008 10%

1 Month -1.52% -4.10% 250 2010 10%

3 Months -7.47% -9.71%

200

1 Year 6.79% 7.95%

3 Years 7.64% -4.43% 150

Since Inception 63.99% 40.74% 100

(*) includes bonus units of 10% ( 23. 03.2008 ) 16-Apr-05 16-Apr-06 16-Apr-07 16-Apr-08 16-Apr-09 16-Apr-10

10% cash dividend ( 18.03.2010)

ASSET ALLOCATION INVESTMENT PHILOSOPHY

Investment Allocation FUND OBJECTIVE: The Fund seeks to achieve long-term capital

Holding Cos.,

Oil Mktg. Cos.,

Banking &

appreciation and income returns through investments primarily

3%

12% Financial in equities listed on the Muscat Securities Market (MSM) and

Services, 33% other GCC bourses.

Oil, Gas & Engg.

Service Cos.,

11%

INVESTMENT STRATEGY: The Fund employs an active

management style with a blend of growth and value via sector-

rotation, stock-picking, and cost effective trading. Securities

with strong fundamentals and favorable outlook are utilized to

build a diversified portfolio. Emphasis is on bottom-up stock

Telecom, 13% selection guided through analysis of top-down macroeconomic

Mfg. & Cement

Cos., 28% drivers.

HISTORICAL PERFORMANCE

YEAR Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year

2005 4.80% 7.80% 8.40% -0.60% -1.70% -2.70% -2.80% -0.70% 0.20% 12.50%

2006 12.70% -3.80% 5.90% -6.10% -5.30% 0.90% -3.40% 8.70% 3.80% 5.60% -4.00% 1.10% 15.00%

2007 3.30% 0.80% 0.80% 5.00% 4.70% 2.10% 1.00% 1.30% 4.20% 10.60% 4.70% 10.80% 61.20%

2008 -2.70% 14.80% 2.20% 14.80% 0.20% 0.00% -6.80% -12.70% -9.80% -26.60% -1.60% -10.70% -38.50%

2009 -10.00% -0.80% 7.70% 12.30% 8.50% 2.20% 3.40% 7.10% 2.20% -2.60% -1.90% -0.70% 28.60%

2010 1.57% 2.77% 2.19% 2.61% -8.21% -1.52% -0.55%

RISK ANALYSIS

Probability Distribution - of Monthly Returns

Parameters FUND MSM 30

42%

35% Sharpe Ratio 0.32 0.19

Beta** 0.93 1.00

8% 10% Annualised Standard Deviation** 27.74% 27.27%

2% 2% 2%

Annualised Returns ** 10.59% 6.93%

**Based on Monthly Returns

-30.00% -20.00% -10.00% 0.00% 10.00% 20.00% 30.00%

<---------------- Monthly RETURNS---------------> ** Since 18th Feb 2006

KEY INFORMATION CONTACT DETAILS

Fund Type Open – Ended The Financial Corporation Co. SAOG

Currency Rial Omani (OMR) Asset Management Division

Benchmark MSM 30 Index P.O. Box 782, PC 131, Sultanate of Oman

Investment Manager The Financial Corporation Co. S.A.O.G. (FINCORP)

NAV Publication Daily Tel: (+968) 24816655

Subscription & Redemption Dates Daily

Entry Load NIL e-mail: alamal@fincorp.org

Exit Load 2% if redeemed within 1yr of investment

1% if redeemed after 1yr & within 2yr of investment Website: http://www.alamalfund.com/

NIL if redeemed after 2 years

Processing Fee 0.50%

Disclaimer: Mutual Funds are subject to market risks and yields may fluctuate depending on various factors affecting capital/debt markets. There is no assurance or

guarantee that the objectives of the portfolio will be achieved. Please note that past performance of the scheme, instruments and the portfolio does not

necessarily indicate the future prospects and performance thereof. Such past performance may or may not be sustained in future.

Вам также может понравиться

- JPM ASEAN Equity Fund Factsheet - C Acc USD - 1120 - SEASGIIДокумент4 страницыJPM ASEAN Equity Fund Factsheet - C Acc USD - 1120 - SEASGIIsidharth guptaОценок пока нет

- Satori Fund II LP Monthly Newsletter - 2023 06Документ7 страницSatori Fund II LP Monthly Newsletter - 2023 06Anthony CastelliОценок пока нет

- MASIF FactsheetДокумент3 страницыMASIF Factsheethello.easygiftsОценок пока нет

- Yli Holdings (Yli-Ku) : Indicator ComponentsДокумент1 страницаYli Holdings (Yli-Ku) : Indicator ComponentsCf DoyОценок пока нет

- Global Quality Income Index Net TR: Description CharacteristicsДокумент4 страницыGlobal Quality Income Index Net TR: Description Characteristicscena1987Оценок пока нет

- ABR 75 - 25 Volatility Strategy - Fact Sheet - UCITS - E - K - Class March 2023Документ2 страницыABR 75 - 25 Volatility Strategy - Fact Sheet - UCITS - E - K - Class March 2023Frankie GarciaОценок пока нет

- HWPF FactsheetДокумент3 страницыHWPF Factsheethello.easygiftsОценок пока нет

- Investment Objective: Fund Fact Sheet As of September 2020Документ2 страницыInvestment Objective: Fund Fact Sheet As of September 2020Neil MijaresОценок пока нет

- Peso Powerhouse Fund - Fund Fact Sheet - December - 2020Документ2 страницыPeso Powerhouse Fund - Fund Fact Sheet - December - 2020Jayr LegaspiОценок пока нет

- PUF Fact Sheet 6-30-08Документ2 страницыPUF Fact Sheet 6-30-08MattОценок пока нет

- Mfu Indiaeq Acc enДокумент4 страницыMfu Indiaeq Acc enAlly Bin AssadОценок пока нет

- Invesco India Caterpillar PortfolioДокумент1 страницаInvesco India Caterpillar PortfolioAnkurОценок пока нет

- ACRMSMS FactsheetДокумент1 страницаACRMSMS FactsheetJoni NizartОценок пока нет

- Shinhan Balance Fund - Agustus - 2023 - enДокумент1 страницаShinhan Balance Fund - Agustus - 2023 - enwongjuliusОценок пока нет

- Equity Fund: % Top 10 Holding As On 31st March 2019Документ1 страницаEquity Fund: % Top 10 Holding As On 31st March 2019Sajith KumarОценок пока нет

- R&R Stable Growth Portfolio Fact Sheet As On July - 4 - 2019Документ3 страницыR&R Stable Growth Portfolio Fact Sheet As On July - 4 - 2019Jaspreet SinghОценок пока нет

- Capital Growth FundДокумент1 страницаCapital Growth FundHimanshu AgrawalОценок пока нет

- NAFA GIPS Jun 2016 ReportДокумент26 страницNAFA GIPS Jun 2016 ReportHIRA -Оценок пока нет

- Syailendra Sharia Money Market Fund - Mei - 2022Документ1 страницаSyailendra Sharia Money Market Fund - Mei - 2022Moslem CompanyОценок пока нет

- NAFA Stock Fund September 2016Документ1 страницаNAFA Stock Fund September 2016jeb38293Оценок пока нет

- Malaysian Pacific Industries Berhad: Stronger Growth Ahead-27/05/2010Документ5 страницMalaysian Pacific Industries Berhad: Stronger Growth Ahead-27/05/2010Rhb InvestОценок пока нет

- 10 07 23 Q22010AnalystsMeetingДокумент87 страниц10 07 23 Q22010AnalystsMeetingdanimetricsОценок пока нет

- CFMitonUKSmallerCompanies FactsheetДокумент2 страницыCFMitonUKSmallerCompanies Factsheetmissteeray 1Оценок пока нет

- HDFC Mid-Cap Opportunities Fund(G) Performance SummaryДокумент1 страницаHDFC Mid-Cap Opportunities Fund(G) Performance SummaryKiran ChilukaОценок пока нет

- HDFC Large and Mid Cap Fund Regular PlanДокумент1 страницаHDFC Large and Mid Cap Fund Regular Plansuccessinvestment2005Оценок пока нет

- Reksa Dana Syariah Syailendra Ovo Bareksa Tunai Likuid (Sobatl)Документ1 страницаReksa Dana Syariah Syailendra Ovo Bareksa Tunai Likuid (Sobatl)Windy Nur MalasariОценок пока нет

- Ffs Pfi Jun 30 2019Документ1 страницаFfs Pfi Jun 30 2019Ramil MontealtoОценок пока нет

- Ishares Msci Emerging Markets Etf: Fact Sheet As of 03/31/2021Документ3 страницыIshares Msci Emerging Markets Etf: Fact Sheet As of 03/31/2021hkm_gmat4849Оценок пока нет

- Quill Capita Trust: 1HFY12/10 Gross Revenue Grows 3% YoY - 30/07/2010Документ3 страницыQuill Capita Trust: 1HFY12/10 Gross Revenue Grows 3% YoY - 30/07/2010Rhb InvestОценок пока нет

- Discovery DecДокумент1 страницаDiscovery DecGauravОценок пока нет

- ALFM PESO BOND FUND, INC. FUND FACT SHEET As of May 31, 2021Документ2 страницыALFM PESO BOND FUND, INC. FUND FACT SHEET As of May 31, 2021kimencinaОценок пока нет

- HDFC Opportunities FundДокумент1 страницаHDFC Opportunities FundManjunath BolashettiОценок пока нет

- Allianz Malaysia Berhad: To Grow Both Life and General Business - 02/03/2010Документ4 страницыAllianz Malaysia Berhad: To Grow Both Life and General Business - 02/03/2010Rhb InvestОценок пока нет

- Odyssey RecordДокумент1 страницаOdyssey RecordAuromae IseloОценок пока нет

- PMS Navigator, May 2021Документ47 страницPMS Navigator, May 2021Pushpa DeviОценок пока нет

- 2010 Sept Participation Banks PresentationДокумент26 страниц2010 Sept Participation Banks PresentationisfinturkОценок пока нет

- Jupiter UK Smaller Companies Focus Fund FACT-PRO-NCO-jupiter-uk-smaller-companies-focus-fund-l-gbp-inc-ie00blp58f76-en-GB-eu PDFДокумент4 страницыJupiter UK Smaller Companies Focus Fund FACT-PRO-NCO-jupiter-uk-smaller-companies-focus-fund-l-gbp-inc-ie00blp58f76-en-GB-eu PDFSaif MonajedОценок пока нет

- MP - 3 - Peso Growth FundДокумент2 страницыMP - 3 - Peso Growth FundFrank TaquioОценок пока нет

- Kotak Infrastructure and Economic Reform FundДокумент14 страницKotak Infrastructure and Economic Reform FundArmstrong CapitalОценок пока нет

- MIEF-factsheet 230320 152602Документ3 страницыMIEF-factsheet 230320 152602ryanbud96Оценок пока нет

- Ffs-Jambaf Jan2021Документ2 страницыFfs-Jambaf Jan2021Johan CahyantoОценок пока нет

- University Malaya Executive Diploma in Business Management: Accounting & Financial Management AssignmentДокумент6 страницUniversity Malaya Executive Diploma in Business Management: Accounting & Financial Management AssignmentLystra OngОценок пока нет

- Sbi Life Top 300 Fund PerformanceДокумент1 страницаSbi Life Top 300 Fund PerformanceVishal Vijay SoniОценок пока нет

- Pinnacle Indonesia Large Cap ETF (XPLC) : March 2020Документ1 страницаPinnacle Indonesia Large Cap ETF (XPLC) : March 2020putu dediОценок пока нет

- MOTILALOFS - Investor Presentation - 28-Jul-22 - TickertapeДокумент30 страницMOTILALOFS - Investor Presentation - 28-Jul-22 - TickertapeNDHP4 BIHARОценок пока нет

- TradeSys Diversified FundДокумент2 страницыTradeSys Diversified Fundamro7Оценок пока нет

- Bond Fund (: Sfin - ULIF002100105BONDULPFND111)Документ1 страницаBond Fund (: Sfin - ULIF002100105BONDULPFND111)Pawan SinghjiОценок пока нет

- NAFA Stock Fund October 2016Документ1 страницаNAFA Stock Fund October 2016jeb38293Оценок пока нет

- Media Chinese Int'l Berhad: FY10 Core Net Profit Surged 95.6% YoY - 27/05/2010Документ4 страницыMedia Chinese Int'l Berhad: FY10 Core Net Profit Surged 95.6% YoY - 27/05/2010Rhb InvestОценок пока нет

- Analysts Meeting BM Q2-2019 (LONG FORM)Документ104 страницыAnalysts Meeting BM Q2-2019 (LONG FORM)RadiSujadi24041977Оценок пока нет

- RHB Islamic Global Developed Markets FundДокумент2 страницыRHB Islamic Global Developed Markets FundIrfan AzmiОценок пока нет

- Nikko AM Shenton Singapore Dividend Equity Fund SGD - Fund Fact SheetДокумент3 страницыNikko AM Shenton Singapore Dividend Equity Fund SGD - Fund Fact SheetSaran SОценок пока нет

- Fund Manager'S Report (Islamic Funds) January 2017: AMC Rating: AM2 by JCR-VISДокумент8 страницFund Manager'S Report (Islamic Funds) January 2017: AMC Rating: AM2 by JCR-VISmuhammad taufikОценок пока нет

- Schroder 90 Plus Equity Fund AllДокумент1 страницаSchroder 90 Plus Equity Fund AllDadang SuhermanОценок пока нет

- PRU - Asia Pacific Ex-Japan FundДокумент2 страницыPRU - Asia Pacific Ex-Japan FundNapolean DynamiteОценок пока нет

- HDFC BlueChip FundДокумент1 страницаHDFC BlueChip FundKaran ShambharkarОценок пока нет

- Fund Allocation Investment Objective: Pami Equity Index Fund, IncДокумент1 страницаFund Allocation Investment Objective: Pami Equity Index Fund, IncRamil MontealtoОценок пока нет

- CFP SDL UK Buffettology Fund Factsheet Highlights Strong ReturnsДокумент2 страницыCFP SDL UK Buffettology Fund Factsheet Highlights Strong Returnssky22blueОценок пока нет

- International Developed Equity Allocation FundДокумент2 страницыInternational Developed Equity Allocation Fundb1OSphereОценок пока нет

- Handbook of Singapore — Malaysian Corporate FinanceОт EverandHandbook of Singapore — Malaysian Corporate FinanceTan Chwee HuatОценок пока нет

- Goldman Sachs India Equity Lu0333810181 - enДокумент2 страницыGoldman Sachs India Equity Lu0333810181 - ensureniimbОценок пока нет

- Oman Yield CurveДокумент1 страницаOman Yield CurvesureniimbОценок пока нет

- Tower in Down-Town PDFДокумент3 страницыTower in Down-Town PDFsureniimbОценок пока нет

- Etihad Etisalat - Global Report Nov 1, 2011Документ4 страницыEtihad Etisalat - Global Report Nov 1, 2011sureniimbОценок пока нет

- Tower (Down-Town Burj Dubai) : Features FactilitiesДокумент4 страницыTower (Down-Town Burj Dubai) : Features FactilitiessureniimbОценок пока нет

- Calendar 2012 MonthlyДокумент12 страницCalendar 2012 MonthlysureniimbОценок пока нет

- CV Investment Specialist Surendra PatelДокумент4 страницыCV Investment Specialist Surendra PatelsureniimbОценок пока нет

- ETFS Natural Gas Fact SheetДокумент4 страницыETFS Natural Gas Fact SheetsureniimbОценок пока нет

- VarahamihiraДокумент107 страницVarahamihiraprakasamnvs81Оценок пока нет

- ETFS Natural Gas Fact SheetДокумент4 страницыETFS Natural Gas Fact SheetsureniimbОценок пока нет

- Al Fajar WorkingДокумент3 страницыAl Fajar WorkingsureniimbОценок пока нет

- (Property) Course SyllabusДокумент2 страницы(Property) Course SyllabusJMXОценок пока нет

- eTicket Itinerary Receipt Lion Air Flight DetailsДокумент3 страницыeTicket Itinerary Receipt Lion Air Flight DetailsBogieGunturОценок пока нет

- Salary Slip (31221188 June, 2019)Документ1 страницаSalary Slip (31221188 June, 2019)ahmed aliОценок пока нет

- Past Paper Analysis CAF-08 CMACДокумент1 страницаPast Paper Analysis CAF-08 CMACMuneer DhamaniОценок пока нет

- Never Stand Still:, You Can Clearly See The Visionary Ideas That Are "Cooked" Inside The BMWДокумент5 страницNever Stand Still:, You Can Clearly See The Visionary Ideas That Are "Cooked" Inside The BMWVineet LalОценок пока нет

- Pre Operating Cash FlowДокумент43 страницыPre Operating Cash FlowCamille ManalastasОценок пока нет

- VN Loa VNDT 2018 KingДокумент1 страницаVN Loa VNDT 2018 Kingbebo94Оценок пока нет

- Quick Ref Guide: Booking Easyjet Through AmadeusДокумент21 страницаQuick Ref Guide: Booking Easyjet Through AmadeusAkinsanya Adeshina AdewaleОценок пока нет

- Citi Portfolio CorpДокумент2 страницыCiti Portfolio CorpCarrieonicОценок пока нет

- PPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPДокумент29 страницPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPPSaptarshi MitraОценок пока нет

- Rey MartДокумент1 страницаRey Marttoshiba satelliteОценок пока нет

- PunchTab - Group 10Документ2 страницыPunchTab - Group 10Sudhanshu VermaОценок пока нет

- Corpo 6Документ2 страницыCorpo 6KLОценок пока нет

- Case Study in MGT 4Документ4 страницыCase Study in MGT 4Kunal Sajnani100% (1)

- Chap015 With AnswerДокумент2 страницыChap015 With AnswerSharonLargosaGabriel0% (1)

- BBA Course Curriculum UGC Approved America Bangladesh UniversityДокумент3 страницыBBA Course Curriculum UGC Approved America Bangladesh UniversityKiron KamruzzamanОценок пока нет

- Low Fares, On-Time Flights and A Hassle-Free Experience: 1. OperationsДокумент4 страницыLow Fares, On-Time Flights and A Hassle-Free Experience: 1. OperationsNeel NarsinghaniОценок пока нет

- Auditors' DutiesДокумент15 страницAuditors' DutiesSyad Shahidah100% (1)

- Tax Saving Fund Performance AnalysisДокумент13 страницTax Saving Fund Performance AnalysisRajkamalChichaОценок пока нет

- GEOGRAPHIC, DEMOGRAPHIC, PSYCHOGRAPHIC SEGMENTATIONДокумент20 страницGEOGRAPHIC, DEMOGRAPHIC, PSYCHOGRAPHIC SEGMENTATIONTushar AgarwalОценок пока нет

- Sea MonstersДокумент12 страницSea MonstersRomuel PioquintoОценок пока нет

- Tax Policy Assessment and Design in Support of Direct InvestmentДокумент226 страницTax Policy Assessment and Design in Support of Direct InvestmentKate EloshviliОценок пока нет

- Royal British rule: doctrine Bank v of Turquand constructive noticeДокумент30 страницRoyal British rule: doctrine Bank v of Turquand constructive noticedownloader10280% (5)

- Designing BrandsДокумент154 страницыDesigning BrandsDora Luz Contreras100% (1)

- Labor Recruitment RulesДокумент10 страницLabor Recruitment RulesRuby ReyesОценок пока нет

- 11 Accountancy TP Ch04 01 Ladger and Trial BalanceДокумент3 страницы11 Accountancy TP Ch04 01 Ladger and Trial Balancerenu bhattОценок пока нет

- Fundamental Analysis of StocksДокумент26 страницFundamental Analysis of StocksGaurav DewanОценок пока нет

- Gorilla V Contract Dispute.: Rowan Wins Against BP inДокумент3 страницыGorilla V Contract Dispute.: Rowan Wins Against BP inOSDocs2012Оценок пока нет

- 3 - Cost Basis CalculatorДокумент2 страницы3 - Cost Basis Calculatorsumit6singhОценок пока нет

- 7Ps Marketing Mix Big BazaarДокумент8 страниц7Ps Marketing Mix Big BazaarMayank RajОценок пока нет