Академический Документы

Профессиональный Документы

Культура Документы

Partnership Lump Sum & Installment Liquidation PDF

Загружено:

Angela100%(1)100% нашли этот документ полезным (1 голос)

2K просмотров4 страницыОригинальное название

Partnership Lump sum & Installment Liquidation.pdf

Авторское право

© © All Rights Reserved

Доступные форматы

PDF или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

100%(1)100% нашли этот документ полезным (1 голос)

2K просмотров4 страницыPartnership Lump Sum & Installment Liquidation PDF

Загружено:

AngelaАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

|

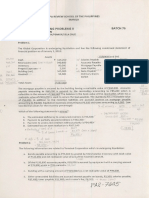

CPA REVIEW SCHOOL OF THE PHILIPPINES

MANILA

PRACTICAL ACCOUNTING PROBLEMS II BATCH 76

PARTNERSHIP LUMP-SUM & INSTALLMENT LIQUIDATION,

(GUERRERO/GERMAN/LIM/SIY/FERRER/DELA CRUZ

Problem, A, Band C are partners in a business being liquidated, The partnership has cash of P22,000,

noncash assets with a book value of P264,000 and liabilities of P173,250. The following data relates to

the partners as of June 1, 2014:

(a) Ahas capital balance of P129,250, personal assets of P27,500, personal liabilities of P43,750.

(0) B extended a loan to the partnership in the amount of P13,750, deficit of P38,500, personal

assets of P41,250, personel liabilities of P16,500.

(c) Chas a capital balance of P8,250, personal assets of P68,750 and personal liabilities of P41,250.

(@) Their profit and loss ratio is 3:1:1, A, B and C, respectively.

On June 12, 2014, assets with a book value of P82,500 were sold for P55,000 cash. The proceeds were

Used to pay off liabilities of the partnership. During the remainder of June, no additional assets were

realized and outside creditors began to pressure the partnership for payment,

On July 3, the partners agreed to contribute personal assets, to whatever extent possible, in order to

eliminate their respective deficits. Shortly thereafter, assets with book value of P55,000 and a fair value

of P63,250 were distributed to A.

‘Assuming additional noncash assets with book value of P110,000 were soid in July for P148,500.

How much cash would be distributed to C?

A fe

12,100

3,850 S00

8,800 ! ?

S50 22

gorP

Problem 2. SCA Partnership has the following account balances before liquidation

Cash ____F 350,000 Liabilities P__1,125,000_]

| Noncash assets 7,375,000___|LoanfromA 50,000

[Hoan toc ___ 150,000 |S, Capital (40%) 41,250,000

Receivable from S ____ 20,000 _| C, Capital (40%) 1,900,000 -}

Expenses 2,230,000 A, Capital (20%) 4,000,000

Revenues 4,800,000

During June, some noncash assets were sold that resulted to a loss of P46,125. Liquidation expenses of

P175,000 were paid and additional expenses amounting to 90,000 were expected to be incurred

through the following months of liquidation the partnership. Liabilities to outsiders amounting to

__P875,000 were paid

PA2-7662

2,375,000

2,130,000

2,328,875

2,083,875

poeP

Problem 3. The partnership of MB, NC, and OP was dissolved on May 31, 2014, and the account

balances after all noncash assets are converted to cash on July 1, 2014, along with residual P/L sharing

ratios, are:

Cash 262,500 Accounts payable 630,000

NC, Capita! (30%) 315,000 MB, Capital (30%) 472,500

OP, Capital (40%) 525,000

Personal assets and liabilities of the partners at July 1, 2014 are:

Personal Assets Personal Liabilities

MB. 420,000 472,500

NC 525,000 320,250

oP 997,500 420,000,

If OP contributed P367,500 to the partnership to provide cash to pay the creditors, what amount of

M's P472,500 partnership equity would appear to be recoverable:

414,750

425,250 £

472,500 95,2

oP Oo

eee

Problem 4. The Partnership of DBM, TRA and MDS became inscivent on December 31, 2013 and is to be

liquidated, DBM, TRA and MDS has the following balances respectively, 455,000, (P210,000), (P28,000).

‘After paying their personal liabilities, DBM has still 70,000 while TRA has P105,000 of their personal

assets, However, MDS has still unpaid personal liabilities amounting to-P280,000 and his personal assets

amounted only to P210,000. The partners share profits and losses equally.

How much is the maximum amount that DBM can expect to receive from the partnership?

‘A. P217,000

B. P245,000 x

c. P427,000

D. P322,000

Problem 5. J, A, and C are partners who share profits and losses as follows: J 35%, A 25%, and C 40%.

‘The Statement of Financial Position of the partnership 2s of December 21, 2013 is given below:

seis | eee

As of December 31, 2013

Assets = Ubilitiesand Equity x |

Cash P8,000 | Liabilities 48,000 |

Noncash Assets 110,000 | Loan from A 2,000 |

| | 4, Capital 32,700 |

| A Capital | 23,500 |

| C,Capital | 41,800 |

| Total Liabilities and Equity | P118,000 |

On January 1, 2014, the partners decided to liquidate. For the month of January, some assets were sold

for a loss of P2,000. Payment to partners J, A, and C from the initial sale of assets were P150, P2,250,

‘and P4,600 respectively. Cash withheld for possible liquidatior expenses and unrecognized liabilities

‘amounted to P1,258. ag

What was the book/carrying value of the noncash assets sold in January?

28,258

19,000

P18,258

20,258

poe>

Problem 6. V, F, and H are partners who share profits and losses as follows: V 35%, F 25%, and H 40%.

‘The Statement of Financial Position of the partnership as of December 31, 2013 is given below:

VFH Company

Statement of Financial Posit on

‘As of December 31, 2013

Assets

Cash 420,000 | tial 1,050,000

Noncash Assets 41,650,000 | Loan from V 41,400

| | V, Capital 257,700

| F, Capital | 90,000

H, Capital 330,900

Total Assets P1,770,000 | Total Liabilities and Equity | 4,770,000

(On Jenuary 1, 2014, the partners decided to liquidate. All the rartners are solvent. If after the sale of

noncash assets but before additional investment to cover the capital deficiency of any partner, F's

capital balance was a'debit of P45,000.

What is the total amount that V will receive?

90,300

P110,100

68,700

47,700

one>

Problem 7.

financial position prior to liquidation:

Assets

Cash P 24,000

Noncash assets 360,000

Total 384,000

Uibilities and Capital

Liabilities 70,000

Loan payable to} 30,000

4, Capital (50%) 90,000:

F, Capital (30%) 140,000

K, Capital (20%) 54,000

Total P.384,000

JFK partnership engaged in steet manufacturing business had the following condensed

Assuming assets with a book value of P140,000 were sold for P100,000 and that all available cash was

distributed,

PA2-2602

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- RFBT Nmbe 2018 PDFДокумент20 страницRFBT Nmbe 2018 PDFAngelaОценок пока нет

- Estate Tax PrelimsДокумент28 страницEstate Tax PrelimsSeanmigue TomaroyОценок пока нет

- Chapter 3 Sol 2012 PDFДокумент10 страницChapter 3 Sol 2012 PDFAngelaОценок пока нет

- Chapter 3 Sol 2012 PDFДокумент10 страницChapter 3 Sol 2012 PDFAngelaОценок пока нет

- Multiple Choice Question On IFRS - Caglobal PDFДокумент103 страницыMultiple Choice Question On IFRS - Caglobal PDFAngela100% (2)

- CPAR First Preboard in Prac II With Answer PDFДокумент10 страницCPAR First Preboard in Prac II With Answer PDFAngelaОценок пока нет

- Intellectual Property LawДокумент11 страницIntellectual Property LawaiswiftОценок пока нет

- Chapter 12—Electronic Commerce SystemsДокумент12 страницChapter 12—Electronic Commerce SystemsPatricia Ann GuetaОценок пока нет

- Corporate Liquidation PDFДокумент4 страницыCorporate Liquidation PDFAngela100% (3)

- Corporate Liquidation PDFДокумент4 страницыCorporate Liquidation PDFAngelaОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)