Академический Документы

Профессиональный Документы

Культура Документы

Growth Vs Profitability The Importance of Roce PDF

Загружено:

hamsИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Growth Vs Profitability The Importance of Roce PDF

Загружено:

hamsАвторское право:

Доступные форматы

on the job

Growth vs Profitability:

The Importance of ROCE

ROCE companies focus all their strategies on achieving it, says

Shyam Pattabiraman

M S

any companies and inves- ROCE-linked differences in valu-

tors think that growth is ation multiples can be found both

the ‘be-all’, and ‘end-all’, tudy findings within industries and across indus-

of value, at the risk of on listed companies tries. For instance, textiles vs FMCG, IT

ignoring profitability. Yet, services vs manufacturing, or HDFC

time and again, the capital markets show that the ROCE Bank vs ICICI Bank. The takeaway is

have proven that in the long term, metric has an that ROCE has both industry-specific

profitability is critical and growth for and firm-specific components. Even

growth’s sake can destroy value. important influence Warren Buffett has gone on record

on the valuation to say that when a management with

Analysis a reputation for brilliance tackles a

A study of listed companies that multiple that a firm business with a reputation for bad

constitute the BSE 100 Index indicates enjoys. A firm that economics, it is the reputation of the

that, on average, companies that deliv- business that remains intact. Certain

er better Return on Capital Employed

can expand its industries such as airlines and tex-

(ROCE) – which is a comprehensive ROCE, can expand tiles are by nature poor compounders

profitability metric - experience a of capital over the long term due to

higher valuation that is measured in

its valuation multiple certain intrinsic characteristics such

terms of the price to book (P/B) mul- as, their capital-intensive nature,

tiple at which their shares trade. wafer-thin margins, and inability to

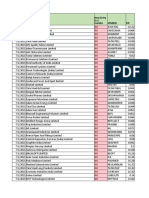

In fact, the analysis reveals that capital employed in their business at pass on cost increases to customers,

firms arranged in an ascending order low rates of return. The implication among others. However, there are a

of ROCE, exhibit a progressively in- of this is also less dilution of equity few companies in these sectors such as,

creasing P/B multiple mean (average). for future fund raising initiatives for Southwest Airlines and Indigo in the

Firms in the lowest ROCE bucket have those firms that are superior managers aviation space which have bucked this

a mean P/B multiple of 2.27 and a me- of capital. trend by adopting astute strategies.

dian P/B multiple of 1.96. In contrast, The corollary to this is that while But, taking a look at the IT services or

firms that belong to the highest ROCE the market expects firms to grow, FMCG sector, it is clear that even the

bucket have a mean P/B multiple growth for growth’s sake without a smaller and less efficient firms can

of 11.81 (See Chart 1) and a median handle on the ROCE may in fact be record a 20 per cent+ ROCE comfort-

P/B multiple of 8.34. These findings value eroding in terms of the market ably. As a result, it is common to see

indicate that the ROCE metric has an multiple commanded by the firm. companies operating in low ROCE

important influence on the valuation

multiple that a firm enjoys. A firm that Chart 1: Impact of ROCE on P/B Multiple 56.13

60 (analysis of BSE 100 quartile mean)

can expand its ROCE, can expand its

valuation multiple. 50

Mean P/B

40 multiple

What does this mean? Mean

23.84

In simple terms, this means that 30 ROCE (%)

the market rewards firms that can 20 12.54

11.81

compound the capital they employ in 6.53 4.84

10 3.20

their business at high rates of return, 2.27

by valuing them at a higher premium 0

compared to peers that compound 1st Bucket (lowest ROCE) 2nd Bucket 3rd Bucket 4th Bucket (highest ROCE)

30 CFOCONNECT March 2013

on the job

industries, such as, aviation, textiles

150% Chart 2: ROCE Impact on Stock Returns

and power, leveraging to boost return

104%

on equity (ROE), while companies

100%

operating in high ROCE industries

56%

need no incentive to leverage up, and 56%

50%

rightly so. 13%

24%

7%

High ROCE is correlated with su-

0%

perior stock returns especially during

BSE 100-1st BSE 100-2nd BSE 100-3rd BSE 100-4th

high inflation Bucket (lowest Bucket Bucket Bucket (highest

-50% ROCE) ROCE)

Among the major events that have -14%

taken place in the last five years are, -58%

-100%

the following: a) the Mumbai stock Past 5 yrs Stock Return Mean ROCE

market Sensitive Index (Sensex)

peaked in January 2008, and is yet to required margin of safety to continue Indian company or group aspiring to

scale its previous high; b) India has generating positive ROCE over and raise capital, diversify, pursue M&A,

experienced a period of extraordinary above high interest rates and inflation, and go global.

inflation; and c) the world has under- during difficult times. Nestle is one In the past few years, Indian firms

gone a mighty recession, and is yet such company from the high ROCE have had to face pressures of increas-

to fully recover from it. These factors bucket that clocks average ROCE in ing cost of capital and operating costs

have caused investors to shift to gold excess of 100 per cent. Nestle will con- (thanks to inflation and commodity

investments leading to a run up in its tinue to be an economically attractive bubbles), as well as a slowdown in

demand and consequently, its price. business, despite interest rates or infla- growth. Many companies saw their

However, an analysis of BSE 100 tion moving to double digits, because ROCE eroding, and subsequently,

companies based on ROCE levels in- the difference between the safer FD their valuation. The effect is more

dicates that companies in the highest returns and what its business gener- pronounced in a few sectors such

ROCE bucket have on average, deliv- ates is considerably large. The differ- as, infrastructure-related businesses,

ered stock returns of 104 per cent in ence is also attributable to the FMCG compared to others.

the last five years compared to 73 per sector, to which Nestle belongs. It is

cent returns posted by gold (measured really hard for a company to be in the Conclusion

in USD). Chart 2 shows that the two FMCG business and generate less than ROCE is an important shareholder

higher ROCE buckets of BSE 100 firms a 20 per cent ROCE. No surprises that value metric, yet most annual reports

have posted positive returns vis-a-vis the FMCG index has recorded 132 per of companies do not even talk about

the market during this period, while cent returns during the last five years it. It has been observed that organisa-

the two lower ROCE buckets have compared to -6 per cent for the Sensex. tions which have a superior ROCE

posted significantly negative returns compared to their industry, have a

vis-a-vis the market. Linkage to strategy relentless focus on driving their or-

On the other hand, firms with a Having a keen eye on ROCE is a ganisations towards achieving it. Such

ROCE that did not even compensate must during the stages of ideation organisations link all their strategic

for the returns from risk-adjusted and implementation of a strategy – be and operational initiatives, including

equivalents (safer alternatives) such it for running a business or for invest- performance metrics across functions

as, returns from fixed deposits, were ing. Unfortunately, the abundant and and levels, to the key ROCE value driv-

losing money in real terms during this cheap availability of capital can cause ers such as, fixed asset productivity,

period. When a company consistently firms to lose sight of profitability in the working capital turns, and operating

does not get a ROCE which is in excess lure of empire building. During such margins. Targets are set against these

of returns from safer alternatives (such times, arguments such as, ‘owning a during the planning and budgeting

as, the fixed deposit), the capital em- small portion of a large pie is better process, and initiatives are prioritised

ployed by the firm is better off getting than having a large portion of a small based on how important they are in

re-deployed elsewhere. The market pie’, are made without thinking about preserving or enhancing ROCE. One

penalises such firms with negative the quality of the pie in the first place. company with a good ROCE discipline

stock returns and rewards those that This usually results in investments in is Bajaj Auto, which has put its small

continue to add economic value (high mediocre projects, non-core expan- car project on hold, despite having

ROCE firms) with positive returns. sions, over-priced and grandiose invested time and money in this effort,

Especially in periods of high inflation M&As, and other decisions which because the project did not meet its

and high interest rates, a business lack fundamental soundness but can ROCE requirements. n

that seemed viable in a low interest be justified in the name of growth

rate and low inflation rate period can and market share. This is exactly Shyam Pattabiraman - Manager,

become unviable. what happened in the early part of Finance Effectiveness, PwC

High ROCE companies have the this millennium – with almost every Consulting

March 2013 CFOCONNECT 31

Вам также может понравиться

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationОт EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationОценок пока нет

- JManagResAnal 8 3 131 138Документ8 страницJManagResAnal 8 3 131 138Sofia Isabelle GonzalesОценок пока нет

- SSRN Id3940100Документ8 страницSSRN Id3940100SHIVANI CHAVANОценок пока нет

- Valuation With Market Multiples Avoid Pitfalls in The Use of Relative ValuationДокумент15 страницValuation With Market Multiples Avoid Pitfalls in The Use of Relative ValuationAlexCooks100% (1)

- Capital Structure Lecturer's NameДокумент8 страницCapital Structure Lecturer's NameAnonymous in4fhbdwkОценок пока нет

- Capsim Success MeasuresДокумент10 страницCapsim Success MeasuresalyrОценок пока нет

- II Equitycompounders enДокумент8 страницII Equitycompounders enpatrickОценок пока нет

- D Ayoush 2021 Liquidity Leverage and Solvency WhaДокумент12 страницD Ayoush 2021 Liquidity Leverage and Solvency WhaEspecialista ContabilidadОценок пока нет

- Reflective Quiz 01Документ6 страницReflective Quiz 01moorthyvaniОценок пока нет

- Economic Value Added The Best Indicator For MeasurДокумент14 страницEconomic Value Added The Best Indicator For MeasurvishalОценок пока нет

- Factors Influencing Stock Return in Coal Mining Sub-Sector Registered in Indonesia Stock Exchange in Period of 2011 To 2015Документ8 страницFactors Influencing Stock Return in Coal Mining Sub-Sector Registered in Indonesia Stock Exchange in Period of 2011 To 2015Anonymous izrFWiQОценок пока нет

- Csci 2022 q4 Portfolio OptimizationДокумент20 страницCsci 2022 q4 Portfolio OptimizationНикита МузафаровОценок пока нет

- BosniaДокумент23 страницыBosniaSamantha RodriguezОценок пока нет

- Advantage, Returns, and Growth-In That OrderДокумент4 страницыAdvantage, Returns, and Growth-In That OrderLuis Daniel Napa TorresОценок пока нет

- Personality and Leadership: A Benchmark Study of Success and FailureДокумент19 страницPersonality and Leadership: A Benchmark Study of Success and FailureLara KrekicОценок пока нет

- Effect of Profitability, Leverage, and Liquidity To The Firm ValueДокумент12 страницEffect of Profitability, Leverage, and Liquidity To The Firm Valueteuku masnur ramadhanОценок пока нет

- Scientific and Medical Equipment House - Al Rajhi CapitalДокумент18 страницScientific and Medical Equipment House - Al Rajhi Capitalikhan809Оценок пока нет

- II If en April2015 EquitycompoundersДокумент8 страницII If en April2015 EquitycompoundersbgyggghjkkОценок пока нет

- Case 1 2Документ2 страницыCase 1 2Mika MolinaОценок пока нет

- Profitability Ratios (Teoría)Документ14 страницProfitability Ratios (Teoría)leonardo ramirezОценок пока нет

- BajconДокумент22 страницыBajcon354Prakriti SharmaОценок пока нет

- Newell Company Corporate StrategyДокумент7 страницNewell Company Corporate StrategyPERKYPOKIE94Оценок пока нет

- Alsharairi 2020 HOW DOES REAL EARNINGS Affect Firm Future ProfitabilityДокумент9 страницAlsharairi 2020 HOW DOES REAL EARNINGS Affect Firm Future Profitabilitygustin padwa sariОценок пока нет

- The Right Role For Multiples in ValuationДокумент7 страницThe Right Role For Multiples in ValuationEugene Nzioki MutisoОценок пока нет

- Commercial Real Estate - Article - FINAL 080610Документ4 страницыCommercial Real Estate - Article - FINAL 080610danarubinsteinОценок пока нет

- Measuring Resources For Supporting Resource-Based CompetitionДокумент6 страницMeasuring Resources For Supporting Resource-Based CompetitionI Putu Eka Arya Wedhana TemajaОценок пока нет

- 1995.12.13 - The More Things Change, The More They Stay The SameДокумент20 страниц1995.12.13 - The More Things Change, The More They Stay The SameYury PopovОценок пока нет

- Open Letter To Larry Ellison Boost ORCL by 65 Billion New ConstructsДокумент19 страницOpen Letter To Larry Ellison Boost ORCL by 65 Billion New ConstructsTed MaragОценок пока нет

- Financial Statement AnalysisДокумент15 страницFinancial Statement AnalysisAbdul RehmanОценок пока нет

- Integrative Case StudyДокумент15 страницIntegrative Case Studychristinenyamoita2019Оценок пока нет

- Chapter 10 Other MultiplesДокумент28 страницChapter 10 Other Multipleskren24Оценок пока нет

- What Drives Your Return On EquityДокумент1 страницаWhat Drives Your Return On Equitysilverjade03Оценок пока нет

- Calculating Return On Invested Capital - CSДокумент23 страницыCalculating Return On Invested Capital - CSnpapadokostasОценок пока нет

- Ratios: Interpreting Financial StatementsДокумент3 страницыRatios: Interpreting Financial StatementsMr RizviОценок пока нет

- 7 Points Comparison On ROE Vs ROCE - Yadnya Investment AcademyДокумент3 страницы7 Points Comparison On ROE Vs ROCE - Yadnya Investment AcademyPrakash JoshiОценок пока нет

- Investment Framework Chirag DagliДокумент21 страницаInvestment Framework Chirag DagliTheMoneyMitraОценок пока нет

- Uti Equity Fund: Why Multi Cap Funds?Документ2 страницыUti Equity Fund: Why Multi Cap Funds?Suresh DhanasekarОценок пока нет

- Universitas Islam Kalimantan Muhammad Arsyad Al Banjary Banjarmasin Jalan Adhiyaksa No. 2 Kayu Tangi Banjarmasin - Telp. 0511-3304352 - Fax. 0511-3305834Документ6 страницUniversitas Islam Kalimantan Muhammad Arsyad Al Banjary Banjarmasin Jalan Adhiyaksa No. 2 Kayu Tangi Banjarmasin - Telp. 0511-3304352 - Fax. 0511-3305834Dona KarLina TjОценок пока нет

- BUS 5110 Managerial Accounting - Written Assignment Unit 7Документ7 страницBUS 5110 Managerial Accounting - Written Assignment Unit 7LaVida LocaОценок пока нет

- Working CapitalДокумент12 страницWorking CapitalRoziana Nur AiniОценок пока нет

- The Holt Methodology: Key Concepts of The CFROI and CFROE MetricДокумент15 страницThe Holt Methodology: Key Concepts of The CFROI and CFROE MetricAkash Kumar100% (1)

- 11 Chapter 5Документ60 страниц11 Chapter 5Priyanka Sameer ShettiОценок пока нет

- Pengaruh Current Ratio CR Debt To EquityДокумент11 страницPengaruh Current Ratio CR Debt To EquitySandraОценок пока нет

- Efficient Frontiers in Revenue Management PDFДокумент16 страницEfficient Frontiers in Revenue Management PDFLetdemuzik PlayОценок пока нет

- 52 Essential Metrics For The Stock MarketДокумент10 страниц52 Essential Metrics For The Stock Marketzekai yangОценок пока нет

- Finance 301 Exam 1 Flashcards - QuizletДокумент11 страницFinance 301 Exam 1 Flashcards - QuizletPhil SingletonОценок пока нет

- HDFC Business Cycle Fund NFO - LeafletДокумент2 страницыHDFC Business Cycle Fund NFO - LeafletdcpjimmyОценок пока нет

- Woolworths Group LimitedДокумент9 страницWoolworths Group LimitedMuhammad AnnasОценок пока нет

- Financial Ratios and Indicators That Determine Return On EquityДокумент18 страницFinancial Ratios and Indicators That Determine Return On EquityVincent SusantoОценок пока нет

- Carve-Out DealsДокумент7 страницCarve-Out DealsYaasОценок пока нет

- HOLT Notes - FadeДокумент3 страницыHOLT Notes - FadeElliott JimenezОценок пока нет

- K. Palepu - Business Analysis Valuation - Ch.1Документ40 страницK. Palepu - Business Analysis Valuation - Ch.1Alessandro ConficoniОценок пока нет

- HDFC Business Cycle Fund NFOДокумент2 страницыHDFC Business Cycle Fund NFOleenagalaОценок пока нет

- Quarterly Update Report Laurus Labs Q1 FY24Документ8 страницQuarterly Update Report Laurus Labs Q1 FY24RAHUL NIMMAGADDAОценок пока нет

- Post Merger and Acquisition Financial Pe PDFДокумент8 страницPost Merger and Acquisition Financial Pe PDFSaravanakkumar KRОценок пока нет

- ERP's Second Wave: Maximizing The Value of ERP-Enabled ProcessesДокумент28 страницERP's Second Wave: Maximizing The Value of ERP-Enabled ProcessesBrenno BarcelosОценок пока нет

- Financial Ratios - Financial Sector (7-7-22)Документ8 страницFinancial Ratios - Financial Sector (7-7-22)slohariОценок пока нет

- Comparative Study of Ratio Analysis With Reference To Shree Steel CompanyДокумент15 страницComparative Study of Ratio Analysis With Reference To Shree Steel CompanypriyankarajkumarОценок пока нет

- The Search For The Best Financial Performance MeasureДокумент10 страницThe Search For The Best Financial Performance MeasuremariaОценок пока нет

- Som Distilleries & Breweries LimitedДокумент7 страницSom Distilleries & Breweries LimitedhamsОценок пока нет

- Sumitomo Chemicals: CRAMS Offers Strong Visibility AheadДокумент7 страницSumitomo Chemicals: CRAMS Offers Strong Visibility AheadhamsОценок пока нет

- Why Inflation Matters ?: Rohit ChauhanДокумент9 страницWhy Inflation Matters ?: Rohit ChauhanhamsОценок пока нет

- PB Fintech Icici SecuritiesДокумент33 страницыPB Fintech Icici SecuritieshamsОценок пока нет

- HDFC Securities Institutional Equities Aditya Birla Sunlife AMC Initiating CoverageДокумент13 страницHDFC Securities Institutional Equities Aditya Birla Sunlife AMC Initiating CoveragehamsОценок пока нет

- AIR INDIA - Concessionary FareДокумент2 страницыAIR INDIA - Concessionary FarehamsОценок пока нет

- Index 12jul2021Документ76 страницIndex 12jul2021hamsОценок пока нет

- Yes Yes Yes Yes Yes Yes YesДокумент5 страницYes Yes Yes Yes Yes Yes YeshamsОценок пока нет

- No No No No No No No No No No No No No No NoДокумент3 страницыNo No No No No No No No No No No No No No NohamsОценок пока нет

- Date New Entry In3 Months: YES YES YES YES YES YES YES YES YESДокумент6 страницDate New Entry In3 Months: YES YES YES YES YES YES YES YES YEShamsОценок пока нет

- Oppositional Defiant Disorder: A Case of Platinum MetallicumДокумент6 страницOppositional Defiant Disorder: A Case of Platinum MetallicumhamsОценок пока нет

- Investment Banking: Kotak Mahindra Capital Company LimitedДокумент3 страницыInvestment Banking: Kotak Mahindra Capital Company LimitedhamsОценок пока нет

- Date Mcap Rank Quality Momentu M RankДокумент23 страницыDate Mcap Rank Quality Momentu M RankhamsОценок пока нет

- Australian Flora and FaunaДокумент12 страницAustralian Flora and FaunahamsОценок пока нет

- Top50 Quality Jul21Документ12 страницTop50 Quality Jul21hamsОценок пока нет

- MSG - 30 - 25177 - E-Calendar For The Academic Year 2021-22Документ1 страницаMSG - 30 - 25177 - E-Calendar For The Academic Year 2021-22hamsОценок пока нет

- MH-weekly VCP - RANGE V2, Technical Analysis ScannerДокумент6 страницMH-weekly VCP - RANGE V2, Technical Analysis ScannerhamsОценок пока нет

- Top50-Quality-Jul21 - 601 - 1100Документ12 страницTop50-Quality-Jul21 - 601 - 1100hamsОценок пока нет

- Australian Flora and FaunaДокумент12 страницAustralian Flora and FaunahamsОценок пока нет

- Broyhill Portfolio Update 2020.Q3 PDFДокумент49 страницBroyhill Portfolio Update 2020.Q3 PDFhamsОценок пока нет

- Suspected COVID 19 Patients in Emergency Department: HRCT Chest and CO-RADS Classification System, A Pictorial ReviewДокумент5 страницSuspected COVID 19 Patients in Emergency Department: HRCT Chest and CO-RADS Classification System, A Pictorial ReviewhamsОценок пока нет

- Renewal Notice PrintДокумент1 страницаRenewal Notice PrinthamsОценок пока нет

- Press Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionДокумент7 страницPress Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionhamsОценок пока нет

- Mi - ST - ATH: Invest in This Smallcase HereДокумент1 страницаMi - ST - ATH: Invest in This Smallcase HerehamsОценок пока нет

- Pecson Vs CAДокумент3 страницыPecson Vs CASophiaFrancescaEspinosaОценок пока нет

- Biodiversity Management Bureau: Repucjuf The Philippines Department of Environment and Natural ResourcesДокумент36 страницBiodiversity Management Bureau: Repucjuf The Philippines Department of Environment and Natural ResourcesMarijenLeañoОценок пока нет

- 2.1 Article On Reasonable Compensation Job Aid 4-15-2015Документ3 страницы2.1 Article On Reasonable Compensation Job Aid 4-15-2015Michael GregoryОценок пока нет

- VLLAR2019Документ81 страницаVLLAR2019Christian MallorcaОценок пока нет

- Namma Kalvi 12th Maths Chapter 4 Study Material em 213434Документ17 страницNamma Kalvi 12th Maths Chapter 4 Study Material em 213434TSG gaming 12Оценок пока нет

- LTE ID RNP StandardizationДокумент9 страницLTE ID RNP Standardizationahdanizar100% (1)

- Brochure PVM enДокумент36 страницBrochure PVM enBenny Kurniawan LimОценок пока нет

- Final Report Air ConditioningДокумент42 страницыFinal Report Air ConditioningAzmi Matali73% (11)

- Sydney Boys 2017 2U Accelerated Prelim Yearly & SolutionsДокумент26 страницSydney Boys 2017 2U Accelerated Prelim Yearly & Solutions黄心娥Оценок пока нет

- The Lafayette Driller: President's Message By: Lindsay LongmanДокумент7 страницThe Lafayette Driller: President's Message By: Lindsay LongmanLoganBohannonОценок пока нет

- Reemployment Assistance Application EngДокумент6 страницReemployment Assistance Application EngMelissa RatliffОценок пока нет

- Ch08 Project SchedulingДокумент51 страницаCh08 Project SchedulingTimothy Jones100% (1)

- Thermo King CG 2000Документ155 страницThermo King CG 2000Connie TaibaОценок пока нет

- T BeamДокумент17 страницT BeamManojОценок пока нет

- International Advertising: Definition of International MarketingДокумент2 страницыInternational Advertising: Definition of International MarketingAfad KhanОценок пока нет

- Sustainability and Economy - A Paradigm For Managing Entrepreneurship Towards Sustainable DevelopmentFДокумент21 страницаSustainability and Economy - A Paradigm For Managing Entrepreneurship Towards Sustainable DevelopmentFArmando Tarupí MontenegroОценок пока нет

- Modern Theory of Interest: IS-LM CurveДокумент36 страницModern Theory of Interest: IS-LM CurveSouvik DeОценок пока нет

- Leadership Assesment ToolДокумент5 страницLeadership Assesment ToolJayeeta DebnathОценок пока нет

- Remedial Law Syllabus 2013Документ6 страницRemedial Law Syllabus 2013Mirriam Ebreo100% (1)

- Writing White PapersДокумент194 страницыWriting White PapersPrasannaYalamanchili80% (5)

- Ten Rules of NetiquetteДокумент11 страницTen Rules of NetiquetteAriel CancinoОценок пока нет

- 24th SFCON Parallel Sessions Schedule (For Souvenir Program)Документ1 страница24th SFCON Parallel Sessions Schedule (For Souvenir Program)genesistorres286Оценок пока нет

- Node MCU CarДокумент4 страницыNode MCU CarYusuf MuhthiarsaОценок пока нет

- HP Deskjet Printer Supply ChainДокумент19 страницHP Deskjet Printer Supply ChainJose Barnon86% (7)

- Malik Tcpdump FiltersДокумент41 страницаMalik Tcpdump FiltersombidasarОценок пока нет

- EAU 2022 - Prostate CancerДокумент229 страницEAU 2022 - Prostate Cancerpablo penguinОценок пока нет

- TQM - Juran ContributionДокумент19 страницTQM - Juran ContributionDr.K.Baranidharan100% (2)

- 2011 Hyundai Service FiltersДокумент18 страниц2011 Hyundai Service FiltersTan JaiОценок пока нет

- I-Lt-Cyclomax 3.7-3Документ10 страницI-Lt-Cyclomax 3.7-3Luis Fernando OrtigozaОценок пока нет

- HYD CCU: TICKET - ConfirmedДокумент2 страницыHYD CCU: TICKET - ConfirmedRahul ValapadasuОценок пока нет