Академический Документы

Профессиональный Документы

Культура Документы

SLL Policy Snapshot

Загружено:

Anonymous Mfv2xOfАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

SLL Policy Snapshot

Загружено:

Anonymous Mfv2xOfАвторское право:

Доступные форматы

SM

RETHINKING RISKSM

POLICY SNAPSHOT

THE 5 COVERED PERILS: The SLLSM (hereinafter, “SLL”) policy covers five specific perils – fire, smoke,

explosion, water discharge, and sewer backup.

WHAT TRIGGERS A LOSS: Damages caused by negligent acts of student residents or their guests.

Damages must be accidental and not the result of an intentional or criminal act.

THE POLICY: The SLL policy is written on a Master Policy under the Renters Legal Liability Risk Purchasing

Group. With SLL you have no shared or aggregate limits! This means each insured/member receives their

own policy limits, and there is no cap on the number of claims that the insurance company will pay out

during your policy period.

$100,000 LIMIT: The most the insurance company will pay for any one claim caused by a negligent

resident. No aggregate limit applies.

RESIDENT PERSONAL PROPERTY LIMIT: Included within the occurrence limit but only available if the

$100,000 is not exhausted. This limit is designed as an added benefit to help you protect your resident’s

personal property when adversely affected by a covered loss. The owner/management chooses between

a $15,000, $20,000, or $25,000 limit, which will be the same limit for all properties within the owner/

management’s portfolio.

$15,000 FUNGUS, WET ROT, DRY ROT, AND BACTERIA LIMIT: Also included within the occurrence

limit but only available if the $100,000 is not exhausted. This is the only coverage that is aggregated,

meaning it is the most the insurance company will pay out during your 12-month policy period for fungus,

wet rot, dry rot and bacteria.

$250 DEDUCTIBLE: The SLL policy will pay for damages caused by a covered loss minus the $250

deductible. For example, if the cost to replace damaged cabinets is $1,000 the most the insurance

company will pay is $750

REPLACEMENT COST: We made sure the SLL policy pays out claims on a Replacement Cost basis. This

means the insurance company pays the amount it costs to replace an item at the present time, according

to its current worth. .

RESIDENT'S INSURANCE POLICY: The SLL policy is not an HO-4 policy and does not provide primary

property or liability coverage to the resident. The building owner or manager is the insured under the SLL

policy, not the tenant/resident.

Renters Legal Liability LLC

280 South 400 West, Suite 220 Office: (801) 994-0237 rllinsure.com

Salt Lake City, Utah 84101-1844 Toll Free: (800) 770-9660 sales@rllinsure.com

© 2018 RLL is a registered mark of Renters Legal Liability LLC. All rights reserved. CONFIDENTIAL – PREPARED FOR THE EXCLUSIVE USE OF OUR DISTRIBUTORS/AGENTS

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Derm CodingДокумент8 страницDerm CodingVinay100% (1)

- Cooling & Heating: ShellmaxДокумент3 страницыCooling & Heating: Shellmaxvijaysirsat2007Оценок пока нет

- Chapter 11 Blood Specimen Handling: Phlebotomy, 5e (Booth)Документ35 страницChapter 11 Blood Specimen Handling: Phlebotomy, 5e (Booth)Carol Reed100% (2)

- Social Learning TheoryДокумент23 страницыSocial Learning TheoryJacqueline Lacuesta100% (2)

- Burns SeminarДокумент66 страницBurns SeminarPratibha Thakur100% (1)

- 2 - Electrical Energy Audit PDFДокумент10 страниц2 - Electrical Energy Audit PDFPrachi BhaveОценок пока нет

- Marathon Electric Motors Price List for Motors and Fans Effective March 15, 2019Документ24 страницыMarathon Electric Motors Price List for Motors and Fans Effective March 15, 2019Mohan BabuОценок пока нет

- Research Journal DNA PolymeraseДокумент12 страницResearch Journal DNA PolymeraseMauhibahYumnaОценок пока нет

- wk4 Stdconferencereflection ElmoreajaДокумент4 страницыwk4 Stdconferencereflection Elmoreajaapi-316378224Оценок пока нет

- The Baking and Frozen Dough MarketДокумент4 страницыThe Baking and Frozen Dough MarketMilling and Grain magazineОценок пока нет

- Navi Cure prospectus summaryДокумент50 страницNavi Cure prospectus summaryGaurav SrivastavaОценок пока нет

- The Concepts Good Side and Bad Side of HumansДокумент9 страницThe Concepts Good Side and Bad Side of HumansFAITHINGODMISSIONARIESОценок пока нет

- SEAS Scoliosis Course NYC Feb 2018Документ4 страницыSEAS Scoliosis Course NYC Feb 2018BorislavОценок пока нет

- Adapted Sports & Recreation 2015: The FCPS Parent Resource CenterДокумент31 страницаAdapted Sports & Recreation 2015: The FCPS Parent Resource CenterkirthanasriОценок пока нет

- Spiegel Et Al 1999 Psycho OncologyДокумент12 страницSpiegel Et Al 1999 Psycho Oncologyfatimaramos31Оценок пока нет

- ERAS DR - TESAR SP - AnДокумент26 страницERAS DR - TESAR SP - AnAhmad Rifai R AОценок пока нет

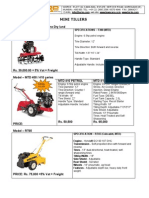

- Optimize soil preparation with a versatile mini tillerДокумент2 страницыOptimize soil preparation with a versatile mini tillerRickson Viahul Rayan C100% (1)

- Definitions of Abnormality by Dr. Kanwal QadeerДокумент7 страницDefinitions of Abnormality by Dr. Kanwal QadeerHaya EishaОценок пока нет

- Aloe Vera as an Alternative Treatment for Wound HealingДокумент5 страницAloe Vera as an Alternative Treatment for Wound HealingJeffllanoОценок пока нет

- Using Casts For ImmobilizationДокумент17 страницUsing Casts For Immobilizationmpmayer2Оценок пока нет

- Rhodes-Solutions Ch2 PDFДокумент16 страницRhodes-Solutions Ch2 PDFOscar GarzónОценок пока нет

- Police Constable - GK MCQsДокумент56 страницPolice Constable - GK MCQsSk Abdur RahmanОценок пока нет

- Proforma For Iphs Facility Survey of SCДокумент6 страницProforma For Iphs Facility Survey of SCSandip PatilОценок пока нет

- XFY1548移动式筛分站术规格书Документ16 страницXFY1548移动式筛分站术规格书abangОценок пока нет

- Quality and Functionality of Excipients-Art (Alumnos-S) PDFДокумент14 страницQuality and Functionality of Excipients-Art (Alumnos-S) PDFLaura PerezОценок пока нет

- Mini-Pitch Session Exceptionalities and InclusionДокумент18 страницMini-Pitch Session Exceptionalities and Inclusionapi-486583325Оценок пока нет

- Jose Irizarry ResumeДокумент2 страницыJose Irizarry ResumeAnastasia GloverОценок пока нет

- PR GL Fragmentiser Best PracticeДокумент51 страницаPR GL Fragmentiser Best PracticeMohamedSaidОценок пока нет

- HVDCProjectsListingMarch2012 ExistingДокумент2 страницыHVDCProjectsListingMarch2012 ExistingHARLEY SANDERSОценок пока нет

- RC14001® & RCMS®: Your Guide To Implementing A Responsible Care® Management SystemДокумент4 страницыRC14001® & RCMS®: Your Guide To Implementing A Responsible Care® Management SystemMohammed MehranОценок пока нет