Академический Документы

Профессиональный Документы

Культура Документы

Problem 7.4

Загружено:

SamerИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Problem 7.4

Загружено:

SamerАвторское право:

Доступные форматы

Problem 7.

4 Sallie Schnudel

Sallie Schnudel trades currencies for Keystone Funds in Jakarta. She focuses nearly all of her time and attention on the

U.S. dollar/Singapore dollar ($/S$) cross-rate. The current spot rate is $0.6000/S$. After considerable study, she has

concluded that the Singapore dollar will appreciate versus the U.S. dollar in the coming 90 days, probably to about

$0.7000/S$. She has the following options on the Singapore dollar to choose from:

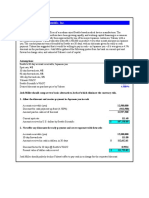

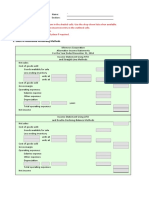

Option Strike Price Premium

Put on Sing $ $0.6500/S$ $0.00003/S$

Call on Sing $ $0.6500/S$ $0.00046/S$

a. Should Sallie buy a put on Singapore dollars or a call on Singapore dollars?

b. What is Sallie's breakeven price on the option purchased in part (a)?

c. Using your answer from part (a), what is Sallie's gross profit and net profit (including premium) if the spot rate at the

end of 90 days is indeed $0.7000/S$?

d. Using your answer from part (a), what is Sallie's gross profit and net profit (including premium) if the spot rate at the

end of 90 days is $0.8000/S$?

Option choices on the Singapore dollar: Call on S$ Put on S$

Strike price (US$/Singapore dollar) $0.6500 $0.6500

Premium (US$/Singapore dollar) $0.00046 $0.00003

Assumptions Values

Current spot rate (US$/Singapore dollar) $0.6000

Days to maturity 90

Expected spot rate in 90 days (US$/Singapore dollar) $0.7000

a. Should Sallie buy a put on Singapore dollars or a call on Singapore dollars?

Since Sallie expects the Singapore dollar to appreciate versus the US dollar, she should buy a call on Singapore dollars.

This gives her the right to BUY Singapore dollars at a future date at $0.65 each, and then immediately resell them in the

open market at $0.70 each for a profit. (If her expectation of the future spot rate proves correct.)

b. What is Sallie's breakeven price on the option purchased in part a)?

Per S$

Strike price $0.65000

Note this does not include any interest cost on the premium. Plus premium $0.00046

Breakeven $0.65046

c. What is Sallie's gross profit and net profit (including premium) if the ending spot rate is $0.70/S$?

Gross profit Net profit

(US$/S$) (US$/S$)

Spot rate $0.70000 $0.70000

Less strike price ($0.65000) ($0.65000)

Less premium ($0.00046)

Profit $0.05000 $0.04954

d. What is Sallie's gross profit and net profit (including premium) if the ending spot rate is $0.80/S$?

Gross profit Net profit

(US$/S$) (US$/S$)

Spot rate $0.80000 $0.80000

Less strike price ($0.65000) ($0.65000)

Less premium ($0.00046)

Profit $0.15000 $0.14954

Вам также может понравиться

- Bus 322 Tutorial 5-SolutionДокумент20 страницBus 322 Tutorial 5-Solutionbvni50% (2)

- Problem 8.1 Peregrine Funds - JakartaДокумент5 страницProblem 8.1 Peregrine Funds - JakartaAlexisОценок пока нет

- Problem 7.1 Amber Mcclain: A. B. C. Assumptions Values Values ValuesДокумент25 страницProblem 7.1 Amber Mcclain: A. B. C. Assumptions Values Values Valuesveronika100% (1)

- DerivativeДокумент16 страницDerivativeShiro Deku100% (1)

- FX IV PracticeДокумент10 страницFX IV PracticeFinanceman4100% (4)

- Chap08 Pbms SolutionsДокумент25 страницChap08 Pbms SolutionsDouglas Estrada100% (1)

- Problem CH 8 Finc 320Документ2 страницыProblem CH 8 Finc 320Fatema AliОценок пока нет

- Chap 6 ProblemsДокумент5 страницChap 6 ProblemsCecilia Ooi Shu QingОценок пока нет

- FX II PracticeДокумент10 страницFX II PracticeFinanceman4Оценок пока нет

- Chapter 2 - Part 2 - Problems - AnswersДокумент3 страницыChapter 2 - Part 2 - Problems - Answersyenlth940% (2)

- Ch07 SSolДокумент7 страницCh07 SSolvenkeeeee100% (1)

- Shapiro Chapter 07 SolutionsДокумент12 страницShapiro Chapter 07 SolutionsRuiting Chen100% (1)

- Total Inflow Total Outflow Net Inflow or Ouftlow Expected Exchange Rate Net Inflow or Outflow As Measured in US Dollars British PoundsterlingДокумент3 страницыTotal Inflow Total Outflow Net Inflow or Ouftlow Expected Exchange Rate Net Inflow or Outflow As Measured in US Dollars British Poundsterlingcatarina alexandriaОценок пока нет

- Inventory Simulation Game Student HandoutДокумент3 страницыInventory Simulation Game Student HandoutRhobeMitchAilarieParelОценок пока нет

- Chap 10 IfmДокумент17 страницChap 10 IfmNguyễn Gia Phương Anh100% (1)

- Swaps: Problem 7.1Документ4 страницыSwaps: Problem 7.1Hana LeeОценок пока нет

- UntitledДокумент5 страницUntitledsuperorbitalОценок пока нет

- International Finance Tutorial 3 Answer-HafeezДокумент5 страницInternational Finance Tutorial 3 Answer-HafeezMohd Hafeez NizamОценок пока нет

- MBFinance Chap06-Pbms-finalДокумент20 страницMBFinance Chap06-Pbms-finalLinda YuОценок пока нет

- Accounting Textbook Solutions - 50Документ19 страницAccounting Textbook Solutions - 50acc-expertОценок пока нет

- MBF14e Chap06 Parity Condition PbmsДокумент23 страницыMBF14e Chap06 Parity Condition Pbmsanon_355962815Оценок пока нет

- SS - 08partДокумент11 страницSS - 08partMrudul KotiaОценок пока нет

- IfДокумент14 страницIfĐặng Thuỳ HươngОценок пока нет

- Summer 2021 FIN 6055 New Test 2Документ2 страницыSummer 2021 FIN 6055 New Test 2Michael Pirone0% (1)

- FNE306 Assignment 6 AnsДокумент9 страницFNE306 Assignment 6 AnsCharles MK ChanОценок пока нет

- Pbm7 2Документ1 страницаPbm7 2jordi92500Оценок пока нет

- International Financial Management: Assignment # 1Документ7 страницInternational Financial Management: Assignment # 1Sadia JavedОценок пока нет

- Tutorial Week 8Документ3 страницыTutorial Week 8Lena ZhengОценок пока нет

- Finance - Module 7Документ3 страницыFinance - Module 7luckybella100% (1)

- CH 1 AmericoДокумент10 страницCH 1 Americojordi92500Оценок пока нет

- Ex - TransExposure SOLДокумент5 страницEx - TransExposure SOLAlexisОценок пока нет

- Week 2 Tutorial QuestionsДокумент4 страницыWeek 2 Tutorial QuestionsWOP INVESTОценок пока нет

- Problem 19.1 Trefica de Honduras: Assumptions ValuesДокумент2 страницыProblem 19.1 Trefica de Honduras: Assumptions ValueskamlОценок пока нет

- Chap 12 SolutionДокумент15 страницChap 12 SolutionMarium Raza0% (1)

- Tutorial 5 Exercises TemplateДокумент17 страницTutorial 5 Exercises TemplateHà VânОценок пока нет

- Assignment 1Документ3 страницыAssignment 1sukayna4ameenОценок пока нет

- 6.18 East Asiatic CompanyДокумент2 страницы6.18 East Asiatic Companydummy yummyОценок пока нет

- Chap12 Pbms MBF12eДокумент10 страницChap12 Pbms MBF12eBeatrice BallabioОценок пока нет

- Chapter 8 PDFДокумент43 страницыChapter 8 PDFCarlosОценок пока нет

- Ch14 P13 Build A ModelДокумент6 страницCh14 P13 Build A ModelRayudu Ramisetti0% (2)

- MBF14e Chap02 Monetary System PbmsДокумент13 страницMBF14e Chap02 Monetary System PbmsKarlОценок пока нет

- Blades, Inc. Case: Sirisha Prasanna Purba Mukherjee Smita Wardhan Soumya Sucharita Mahapatra Suchanda SomДокумент13 страницBlades, Inc. Case: Sirisha Prasanna Purba Mukherjee Smita Wardhan Soumya Sucharita Mahapatra Suchanda Somsmita379Оценок пока нет

- Assignment Worksheet Swaps SolutionsДокумент427 страницAssignment Worksheet Swaps SolutionsRimpy Sondh0% (1)

- Tutorial 4 Exercises IFMДокумент5 страницTutorial 4 Exercises IFMNguyễn Gia Phương Anh100% (1)

- Vertical Supply Chain of Zara: Suppliers Across World ZARA Manufacturing Unit in SpainДокумент1 страницаVertical Supply Chain of Zara: Suppliers Across World ZARA Manufacturing Unit in SpainADITYAROOP PATHAKОценок пока нет

- Solutions For Futures Questions and ProblemsДокумент8 страницSolutions For Futures Questions and ProblemsFomeОценок пока нет

- Problem 1.9 Americo's Earnings and The Fall of The Dollar: Appreciation CaseДокумент4 страницыProblem 1.9 Americo's Earnings and The Fall of The Dollar: Appreciation CaseSamerОценок пока нет

- Chapter 11Документ2 страницыChapter 11atuanaini0% (1)

- Blades Chapter 11Документ2 страницыBlades Chapter 11yanks246Оценок пока нет

- Week 10-11-Tutorial Questions Answers - RevisedДокумент5 страницWeek 10-11-Tutorial Questions Answers - RevisedDivya chandОценок пока нет

- Topic 4 Yield Measures and The Yield Curves: FINA 4120 - Fixed Income 1Документ73 страницыTopic 4 Yield Measures and The Yield Curves: FINA 4120 - Fixed Income 1MingyanОценок пока нет

- Week 8-9-Tutorial Questions AnswersДокумент4 страницыWeek 8-9-Tutorial Questions AnswersAvisha SinghОценок пока нет

- 2Документ2 страницы2akhil107043Оценок пока нет

- Spot Exchange Markets. Quiz QuestionsДокумент14 страницSpot Exchange Markets. Quiz Questionsym5c2324100% (1)

- BUS322Tutorial8 SolutionДокумент10 страницBUS322Tutorial8 Solutionjacklee1918100% (1)

- Chapter 08Документ1 страницаChapter 08Joel AldaveОценок пока нет

- Chap08 Pbms MBF12eДокумент15 страницChap08 Pbms MBF12eBeatrice BallabioОценок пока нет

- Week 4 Tutorial ProblemsДокумент5 страницWeek 4 Tutorial ProblemsWOP INVESTОценок пока нет

- Problem Set 5: Futures, Options & Swaps Q1.: British Pound Futures, US$/pound (CME) Contract 62,500 PoundsДокумент9 страницProblem Set 5: Futures, Options & Swaps Q1.: British Pound Futures, US$/pound (CME) Contract 62,500 PoundsSumit GuptaОценок пока нет

- Personal Bal SheetДокумент6 страницPersonal Bal SheetIrfan MalikОценок пока нет

- Anscombe's Data WorkbookДокумент5 страницAnscombe's Data WorkbookSamerОценок пока нет

- Example One Sample T TestДокумент1 страницаExample One Sample T TestSamerОценок пока нет

- NeedlesPOA12e - P 02-05Документ9 страницNeedlesPOA12e - P 02-05SamerОценок пока нет

- Example Selecting Cases in SPSSДокумент1 страницаExample Selecting Cases in SPSSSamerОценок пока нет

- Needles POA 12e - P 12-07Документ4 страницыNeedles POA 12e - P 12-07SamerОценок пока нет

- NeedlesPOA 12e - P 07-02Документ6 страницNeedlesPOA 12e - P 07-02SamerОценок пока нет

- NeedlesPOA12e - P 05-03Документ6 страницNeedlesPOA12e - P 05-03SamerОценок пока нет

- NeedlesPOA12e - P 02-08Документ8 страницNeedlesPOA12e - P 02-08SamerОценок пока нет

- NeedlesPOA12e - P 16-11Документ2 страницыNeedlesPOA12e - P 16-11SamerОценок пока нет

- NeedlesPOA12e - P 05-06Документ4 страницыNeedlesPOA12e - P 05-06SamerОценок пока нет

- NeedlesPOA12e - P 08-04Документ2 страницыNeedlesPOA12e - P 08-04SamerОценок пока нет

- NeedlesPOA12e - P 16-01Документ3 страницыNeedlesPOA12e - P 16-01SamerОценок пока нет

- NeedlesPOA12e - P 02-03Документ8 страницNeedlesPOA12e - P 02-03SamerОценок пока нет

- Needles POA 12e - P 12-03Документ2 страницыNeedles POA 12e - P 12-03SamerОценок пока нет

- NeedlesPOA 12e - P 06-04Документ3 страницыNeedlesPOA 12e - P 06-04SamerОценок пока нет

- Aslam ReplaceДокумент85 страницAslam ReplaceSOHEL BANGIОценок пока нет

- Project of AXIS BANKДокумент23 страницыProject of AXIS BANKvvvttОценок пока нет

- International Economics 4th Edition Feenstra Solutions Manual DownloadДокумент15 страницInternational Economics 4th Edition Feenstra Solutions Manual DownloadJane Wright100% (22)

- 2018 FinQuiz CFA Level 3 Study PlanДокумент3 страницы2018 FinQuiz CFA Level 3 Study PlanIvanPetrovicОценок пока нет

- FMI7e ch02Документ31 страницаFMI7e ch02Naimul KaderОценок пока нет

- A Business Raises Capital by Issuing SharesДокумент4 страницыA Business Raises Capital by Issuing SharesLeaОценок пока нет

- Difference Between IFRS and IASДокумент2 страницыDifference Between IFRS and IASArslan KhalidОценок пока нет

- Notes in Term Bonds and Serial Bonds (Discount or Premium)Документ12 страницNotes in Term Bonds and Serial Bonds (Discount or Premium)Jae GrandeОценок пока нет

- Decision Analysis IIДокумент6 страницDecision Analysis IIAinYazidОценок пока нет

- Foreign Exchange Dissertation TopicsДокумент7 страницForeign Exchange Dissertation TopicsBuyPapersOnlineBaltimore100% (1)

- Future Generali ProjectДокумент24 страницыFuture Generali ProjectSandeepa Biswas100% (4)

- 5225 NotesДокумент2 страницы5225 NotesKoh JZОценок пока нет

- Hw2 Mfe Au14 SolutionДокумент7 страницHw2 Mfe Au14 SolutionWenn Zhang100% (1)

- Banking Sector in PakistanДокумент30 страницBanking Sector in PakistanUmair NadeemОценок пока нет

- Executive Summary: Ohio University Christ College Academy For Management Education 1Документ73 страницыExecutive Summary: Ohio University Christ College Academy For Management Education 1Shoyeb MohdОценок пока нет

- Bank M&a Survey - Google Forms AДокумент4 страницыBank M&a Survey - Google Forms Aarjunprakash100% (2)

- Unit 3Документ52 страницыUnit 3Kingsman kuku100% (1)

- EC3332 Tutorial 1Документ6 страницEC3332 Tutorial 1kachuaОценок пока нет

- MACD Trend Following Strategy PDFДокумент25 страницMACD Trend Following Strategy PDFNam Tran91% (11)

- How Securities Are TradedДокумент21 страницаHow Securities Are TradedAriful Haidar MunnaОценок пока нет

- Deprival ValueДокумент16 страницDeprival ValueKartik Raj VarshneyОценок пока нет

- Investment AvenuesДокумент103 страницыInvestment AvenuesSuresh Gupta50% (2)

- Fedai Objective QuestionsДокумент12 страницFedai Objective Questionsshaunak goswami73% (11)

- The Asian Financial Crisi Indonesia and The Currency Board ProposalДокумент25 страницThe Asian Financial Crisi Indonesia and The Currency Board Proposalzanmatto22100% (1)

- Southeastern Asset Management Report To SECДокумент23 страницыSoutheastern Asset Management Report To SECmattpaulsОценок пока нет

- Term Paper of International Financial InstitutionДокумент35 страницTerm Paper of International Financial InstitutionFairuz SadafОценок пока нет

- Etextbook PDF For Financial Markets and Institutions 7th Edition by Anthony SaundersДокумент61 страницаEtextbook PDF For Financial Markets and Institutions 7th Edition by Anthony Saundersronald.allison470100% (40)

- In Gold We Trust 2015Документ140 страницIn Gold We Trust 2015Gold Silver Worlds100% (1)

- Short Term Trading StrategiesДокумент9 страницShort Term Trading StrategiesMikhail Harris80% (5)

- A Study On Comparative Analysis Between Indian Stock Market World Stock ExchangeДокумент45 страницA Study On Comparative Analysis Between Indian Stock Market World Stock ExchangeBalakrishna ChakaliОценок пока нет