Академический Документы

Профессиональный Документы

Культура Документы

Malayan Vs Philippines First

Загружено:

Di ko alamОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Malayan Vs Philippines First

Загружено:

Di ko alamАвторское право:

Доступные форматы

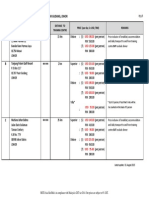

MALAYAN VS PHILIPPINES FIRST (G.R. NO.

184300 JULY

11, 2012) (TOPIC: INSURABLE INTEREST)

Malayan Insurance Co., Inc vs Philippines First Insurance Co., Inc

G.R. No. 184300 July 11, 2012

Facts: Since 1989, Wyeth Philippines, Inc. (Wyeth) and respondent Reputable Forwarder Services, Inc. (Reputable)

had been annually executing a contract of carriage, whereby the latter undertook to transport and deliver the

former’s products to its customers, dealers or salesmen. On November 18, 1993, Wyeth procured Marine Policy No.

MAR 13797 (Marine Policy) from respondent Philippines First Insurance Co., Inc. (Philippines First) to secure its

interest over its own products. Philippines First thereby insured Wyeth’s nutritional, pharmaceutical and other

products usual or incidental to the insured’s business while the same were being transported or shipped in the

Philippines. The policy covers all risks of direct physical loss or damage from any external cause, if by land, and

provides a limit of P6,000,000.00 per any one land vehicle. On December 1, 1993, Wyeth executed its annual

contract of carriage with Reputable. It turned out, however, that the contract was not signed by Wyeth’s

representative/s. Nevertheless, it was admittedly signed by Reputable’s representatives, the terms thereof faithfully

observed by the parties and, as previously stated, the same contract of carriage had been annually executed by the

parties every year since 1989. Under the contract, Reputable undertook to answer for “all risks with respect to the

goods and shall be liable to the COMPANY (Wyeth), for the loss, destruction, or damage of the goods/products due

to any and all causes whatsoever, including theft, robbery, flood, storm, earthquakes, lightning, and other force

majeure while the goods/products are in transit and until actual delivery to the customers, salesmen, and dealers of

the COMPANY”. The contract also required Reputable to secure an insurance policy on Wyeth’s goods. Thus, on

February 11, 1994, Reputable signed a Special Risk Insurance Policy (SR Policy) with petitioner Malayan for the

amount of P1,000,000.00. On October 6, 1994, during the effectivity of the Marine Policy and SR Policy, Reputable

received from Wyeth 1,000 boxes of Promil infant formula worth P2,357,582.70 to be delivered by Reputable to

Mercury Drug Corporation in Libis, Quezon City. Unfortunately, on the same date, the truck carrying Wyeth’s

products was hijacked by about 10 armed men. They threatened to kill the truck driver and two of his helpers should

they refuse to turn over the truck and its contents to the said highway robbers. The hijacked truck was recovered two

weeks later without its cargo. Malayan questions its liability based on sections 5 and 12 of the SR Policy.

Issue: Whether the insurable interest of Wyeth over the property subject matter of both insurance contracts is also

different and distinct from that of Reputable's

Held: Yes. Since there is no double insurance, the interest of Wyeth over the property subject matter of both

insurance contracts is also different and distinct from that of Reputable’s. The policy issued by Philippines First was

in consideration of the legal and/or equitable interest of Wyeth over its own goods. On the other hand, what was

issued by Malayan to Reputable was over the latter’s insurable interest over the safety of the goods, which may

become the basis of the latter’s liability in case of loss or damage to the property and falls within the contemplation

of Section 15 of the Insurance Code.

Therefore, even though the two concerned insurance policies were issued over the same goods and cover the same

risk, there arises no double insurance since they were issued to two different persons/entities having distinct

insurable interests. Necessarily, over insurance by double insurance cannot likewise exist. Hence, as correctly ruled

by the RTC and CA, neither Section 5 nor Section 12 of the SR Policy can be applied.

Вам также может понравиться

- Malayan VS PficДокумент2 страницыMalayan VS Pficjoel ayonОценок пока нет

- MALAYAN INSURANCE CO V PHIL. FIRST INSURANCEДокумент2 страницыMALAYAN INSURANCE CO V PHIL. FIRST INSURANCEEm AlayzaОценок пока нет

- Loadmaster v. Glodel BrokerageДокумент2 страницыLoadmaster v. Glodel Brokeragequi_micaelОценок пока нет

- Westwind v. UCPBДокумент1 страницаWestwind v. UCPBMarco CervantesОценок пока нет

- 50 ICTSI Vs Prudential GuaranteeДокумент5 страниц50 ICTSI Vs Prudential GuaranteeteepeeОценок пока нет

- Saludo, Jr. Vs CA, Trans World Airlines, Inc., and Phil Airlines, Inc.Документ2 страницыSaludo, Jr. Vs CA, Trans World Airlines, Inc., and Phil Airlines, Inc.Amado EspejoОценок пока нет

- MARINA PORT SERVICES, INC. v. AMERICAN HOME ASSURANCE CORPORATIONДокумент3 страницыMARINA PORT SERVICES, INC. v. AMERICAN HOME ASSURANCE CORPORATIONEthel Joi Manalac MendozaОценок пока нет

- Iron Bulk Shipping Phils Inc. vs. Remington Industrial Sales CorpДокумент2 страницыIron Bulk Shipping Phils Inc. vs. Remington Industrial Sales CorpNaiza Mae R. BinayaoОценок пока нет

- Northwest V CuencaДокумент2 страницыNorthwest V CuencaArrow PabionaОценок пока нет

- CHPT 3 GtranspoДокумент15 страницCHPT 3 GtranspoGIGI KHOОценок пока нет

- Choa Tiek Seng Vs CA (Marine Insurance)Документ2 страницыChoa Tiek Seng Vs CA (Marine Insurance)Carl GuevaraОценок пока нет

- Safic Alcan Vs Imperial VegetableДокумент7 страницSafic Alcan Vs Imperial VegetableJessa PuerinОценок пока нет

- Case Digest Del Carmen v. BacoyДокумент4 страницыCase Digest Del Carmen v. BacoymagenОценок пока нет

- 1-UTAK v. ComelecДокумент8 страниц1-UTAK v. ComelecKenrey LicayanОценок пока нет

- Central Mindanao University vs. Department of Agrarian Reform Adjudication BoardДокумент18 страницCentral Mindanao University vs. Department of Agrarian Reform Adjudication BoardPMV100% (1)

- AMERICAN PRESIDENT LINES Vs CAДокумент2 страницыAMERICAN PRESIDENT LINES Vs CAZachary SiayngcoОценок пока нет

- Asian Terminals, Inc. v. First Lepanto-Taisho Insurance CorpДокумент2 страницыAsian Terminals, Inc. v. First Lepanto-Taisho Insurance CorpBigs BeguiaОценок пока нет

- RCBC-vs-CA-289-SCRA-292Документ9 страницRCBC-vs-CA-289-SCRA-292Yvon BaguioОценок пока нет

- 7 Saura V Phil Intl SuretyДокумент1 страница7 Saura V Phil Intl SuretyFrancesca Isabel MontenegroОценок пока нет

- Case Digest Transportation To Be SubmittedДокумент41 страницаCase Digest Transportation To Be SubmittedAbbygaleOmbaoОценок пока нет

- CIR vs. PNBДокумент2 страницыCIR vs. PNBEzi AngelesОценок пока нет

- Geagonia v. Court of Appeals G.R. No. 114427 - February 6, 1995 - Davide, JR., J. FactsДокумент2 страницыGeagonia v. Court of Appeals G.R. No. 114427 - February 6, 1995 - Davide, JR., J. FactsCrissyОценок пока нет

- Traspo LTFRB vs. GV FloridaДокумент3 страницыTraspo LTFRB vs. GV FloridaNarniaОценок пока нет

- 2 The Nature of Legal ReasoningДокумент26 страниц2 The Nature of Legal ReasoningAilyn Bagares AñanoОценок пока нет

- 2-FedEx Vs American Home AssДокумент8 страниц2-FedEx Vs American Home AssJoan Dela CruzОценок пока нет

- Victory Liner, Inc Vs GammadДокумент2 страницыVictory Liner, Inc Vs Gammadjdg jdgОценок пока нет

- NATIONAL STEEL CORPORATION, Petitioner, vs. CAДокумент3 страницыNATIONAL STEEL CORPORATION, Petitioner, vs. CAVenus Jane FinuliarОценок пока нет

- Philippine Airlines, Inc., Petitioner, vs. Court of Appeals and GILDA C. MEJIA, RespondentsДокумент2 страницыPhilippine Airlines, Inc., Petitioner, vs. Court of Appeals and GILDA C. MEJIA, Respondentsapple_doctoleroОценок пока нет

- Loadstar Shipping v. Malayan InsuranceДокумент2 страницыLoadstar Shipping v. Malayan InsuranceAthina Maricar CabaseОценок пока нет

- TranspoCase Digest NFA Vs CA - DeadfreightДокумент1 страницаTranspoCase Digest NFA Vs CA - DeadfreightRhows BuergoОценок пока нет

- Planters Products, Inc. vs. Court of AppealsДокумент4 страницыPlanters Products, Inc. vs. Court of Appealsmei atienzaОценок пока нет

- Philippine Charter Insurance Corporation vs. Chemoil Lighterage CorporationДокумент7 страницPhilippine Charter Insurance Corporation vs. Chemoil Lighterage CorporationLance Christian ZoletaОценок пока нет

- 2 Provrem Central Sawmill Vs Alto SuretyДокумент10 страниц2 Provrem Central Sawmill Vs Alto SuretyNicholas FoxОценок пока нет

- 4 - Aboitiz Shipping Corp Vs New India Assurance CoДокумент2 страницы4 - Aboitiz Shipping Corp Vs New India Assurance Comyreen reginioОценок пока нет

- Peralta de Guerrero v. Madrigal Shipping Co. Inc.Документ1 страницаPeralta de Guerrero v. Madrigal Shipping Co. Inc.Lynne SanchezОценок пока нет

- Transportation Law WILLIAMS V YANGCOДокумент4 страницыTransportation Law WILLIAMS V YANGCOGracia Sullano100% (1)

- Transpo DigestДокумент24 страницыTranspo DigestRaine VerdanОценок пока нет

- TRANSPORTATION LAW Vigilance Over Goods Duration of Liability Temporary Unloading or Storage Oriental Assurance Corp. v. Ong - MagbojosДокумент1 страницаTRANSPORTATION LAW Vigilance Over Goods Duration of Liability Temporary Unloading or Storage Oriental Assurance Corp. v. Ong - MagbojosKristine MagbojosОценок пока нет

- Libra: Laguna Tayabas Bus Co. V Cornista, GR No. L-22193 FactsДокумент1 страницаLibra: Laguna Tayabas Bus Co. V Cornista, GR No. L-22193 FactsElaizza ConcepcionОценок пока нет

- New WordДокумент19 страницNew WordgheljoshОценок пока нет

- Burden of Proof Employee CasesДокумент2 страницыBurden of Proof Employee CasesLeulaDianneCantosОценок пока нет

- PAL Vs MIANOДокумент1 страницаPAL Vs MIANOShaira Mae CuevillasОценок пока нет

- Valenzuela Hardwood and Industrial Supply Inc v. CA and Seven Brothers Shipping CorporationДокумент2 страницыValenzuela Hardwood and Industrial Supply Inc v. CA and Seven Brothers Shipping CorporationJustine Camille RiveraОценок пока нет

- 3 - 4 - 5 - 10 Mercantile DigestДокумент6 страниц3 - 4 - 5 - 10 Mercantile DigestjoОценок пока нет

- 32-40 CasesДокумент40 страниц32-40 CasesWilfredo Guerrero IIIОценок пока нет

- PRATS vs. PHOENIX INSURANCE COMPANYДокумент5 страницPRATS vs. PHOENIX INSURANCE COMPANYStef OcsalevОценок пока нет

- Asian Terminals Inc V First LepantoДокумент3 страницыAsian Terminals Inc V First LepantoMia VinuyaОценок пока нет

- San Miguel Corporation Vs Heirs of Sabimiano InguitoДокумент7 страницSan Miguel Corporation Vs Heirs of Sabimiano InguitoMark Adrian ArellanoОценок пока нет

- Documents - Tips - Transpo Chapter 4 DigestДокумент13 страницDocuments - Tips - Transpo Chapter 4 DigestHans B. TamidlesОценок пока нет

- Conflicts of LawДокумент7 страницConflicts of LawAlexPamintuanAbitanОценок пока нет

- Julian T. Balbin and Dolores E. Balbin, Complainants, vs. Atty. Mariano Baranda, Jr. Respondent., Ac. No. 12041, Nov 05, 2018Документ2 страницыJulian T. Balbin and Dolores E. Balbin, Complainants, vs. Atty. Mariano Baranda, Jr. Respondent., Ac. No. 12041, Nov 05, 2018Karen Joy MasapolОценок пока нет

- Involuntary Dealings Digest LTDДокумент2 страницыInvoluntary Dealings Digest LTDLei MorteraОценок пока нет

- Societe Des Produits Nestle Vs CA and CFC CorporationДокумент2 страницыSociete Des Produits Nestle Vs CA and CFC CorporationCes DavidОценок пока нет

- Unsworth Transport International Inc. v. CAДокумент9 страницUnsworth Transport International Inc. v. CAValentine MoralesОценок пока нет

- The Philippine American General Insurance Company, Inc. v. Court of AppealsДокумент16 страницThe Philippine American General Insurance Company, Inc. v. Court of AppealsLiene Lalu NadongaОценок пока нет

- Philippine Aluminum Wheels Vs FASGI EnterprisesДокумент4 страницыPhilippine Aluminum Wheels Vs FASGI EnterprisesGillian CalpitoОценок пока нет

- InsuranceДокумент12 страницInsuranceJimcris Posadas HermosadoОценок пока нет

- G.R. No. L-3678 - Mendoza v. Philippine Air Lines, IncДокумент4 страницыG.R. No. L-3678 - Mendoza v. Philippine Air Lines, IncMegan AglauaОценок пока нет

- Malayan Insurance vs. Philippine First InsuranceДокумент2 страницыMalayan Insurance vs. Philippine First InsurancempivergaraОценок пока нет

- Reyes, J.: Malayan Insurance Co., Inc. Vs Philippines First Insurance Co., Inc and Reputable Forwarder ServicesДокумент2 страницыReyes, J.: Malayan Insurance Co., Inc. Vs Philippines First Insurance Co., Inc and Reputable Forwarder ServicesLunaОценок пока нет

- A.04 - Leung Yee VS Strong Machinery Co., 37 Phil 644Документ3 страницыA.04 - Leung Yee VS Strong Machinery Co., 37 Phil 644R.A. GregorioОценок пока нет

- Cases AccessionДокумент37 страницCases AccessionDi ko alamОценок пока нет

- Civil Law Review PDFДокумент90 страницCivil Law Review PDFDi ko alamОценок пока нет

- Cases For Quieting of Title To CoownershipДокумент41 страницаCases For Quieting of Title To CoownershipDi ko alam100% (1)

- 'Hate Speech' Explained A Toolkit (2015 Edition)Документ3 страницы'Hate Speech' Explained A Toolkit (2015 Edition)Di ko alamОценок пока нет

- Geagonia Vs CA DigestДокумент1 страницаGeagonia Vs CA DigestDi ko alamОценок пока нет

- Dream Village vs. Bases Dev AuthorityДокумент14 страницDream Village vs. Bases Dev AuthorityDi ko alamОценок пока нет

- 1 Aranda VS RepublicДокумент4 страницы1 Aranda VS RepublicDi ko alamОценок пока нет

- 21 Republic Vs TANДокумент3 страницы21 Republic Vs TANDi ko alamОценок пока нет

- 'Hate Speech' Explained A Toolkit (2015 Edition)Документ91 страница'Hate Speech' Explained A Toolkit (2015 Edition)ewnesssОценок пока нет

- OSIAS ACADEMY vs. DOLEДокумент1 страницаOSIAS ACADEMY vs. DOLEEAОценок пока нет

- 1 Aranda Vs RepublicДокумент15 страниц1 Aranda Vs RepublicDi ko alamОценок пока нет

- 1 Aranda Vs RepublicДокумент15 страниц1 Aranda Vs RepublicDi ko alamОценок пока нет

- LTD-No. 8 - Director of Lands Vs IACДокумент15 страницLTD-No. 8 - Director of Lands Vs IACDi ko alamОценок пока нет

- SPS. VALENZUELA Vs SPS. MANOДокумент5 страницSPS. VALENZUELA Vs SPS. MANODi ko alam0% (1)

- Secretary of DENR V YapДокумент45 страницSecretary of DENR V YapWilfredo MolinaОценок пока нет

- PNB VS Lui SheДокумент8 страницPNB VS Lui SheDi ko alamОценок пока нет

- 56 Santos Vs CAДокумент1 страница56 Santos Vs CADi ko alamОценок пока нет

- 12 - Heirs of Tengco VS Heirs of AliwalasДокумент4 страницы12 - Heirs of Tengco VS Heirs of AliwalasDi ko alamОценок пока нет

- 21 Republic Vs TANДокумент9 страниц21 Republic Vs TANDi ko alamОценок пока нет

- LTD-No. 8 - Director of Lands Vs IACДокумент15 страницLTD-No. 8 - Director of Lands Vs IACDi ko alamОценок пока нет

- TING HO, JR Vs TENG GUIДокумент5 страницTING HO, JR Vs TENG GUIDi ko alamОценок пока нет

- 5 Binalay Vs ManaloДокумент6 страниц5 Binalay Vs ManaloDi ko alamОценок пока нет

- 4 Paramount Vs Castro DigestДокумент2 страницы4 Paramount Vs Castro DigestDi ko alamОценок пока нет

- BPI Vs CA Case DigestДокумент1 страницаBPI Vs CA Case DigestDi ko alamОценок пока нет

- In Re: Petition For Separation of Property Elena Buenaventura Muller, Petitioner, vs. Helmut Muller, RespondentДокумент4 страницыIn Re: Petition For Separation of Property Elena Buenaventura Muller, Petitioner, vs. Helmut Muller, RespondentDi ko alamОценок пока нет

- LTD # 32 Casimiro VS MateoДокумент7 страницLTD # 32 Casimiro VS MateoDi ko alamОценок пока нет

- 13 - Cruz VS Secretary of Denr+puno Separate OpinionДокумент36 страниц13 - Cruz VS Secretary of Denr+puno Separate OpinionDi ko alamОценок пока нет

- THE INSULAR LIFE ASSURANCE COMPANY, LTD. vs. PAZ Y. KHU, FELIPE Y. KHU, JR., and FREDERICK Y. KHUДокумент3 страницыTHE INSULAR LIFE ASSURANCE COMPANY, LTD. vs. PAZ Y. KHU, FELIPE Y. KHU, JR., and FREDERICK Y. KHUDi ko alam100% (2)

- Yht Realty CorpДокумент2 страницыYht Realty CorpJill DLОценок пока нет

- Case No COMP/M.1672 - Volvo/Scania: REGULATION (EEC) No 4064/89 Merger ProcedureДокумент87 страницCase No COMP/M.1672 - Volvo/Scania: REGULATION (EEC) No 4064/89 Merger Procedureكـروري كـشخةةОценок пока нет

- Enkei Catalog 2013Документ32 страницыEnkei Catalog 2013Hakim 'n BilalОценок пока нет

- Product Information MAURER Point DrainageДокумент2 страницыProduct Information MAURER Point DrainageRenato BastosОценок пока нет

- MICT Terminal Information 2018Документ2 страницыMICT Terminal Information 2018Jorwin ButialОценок пока нет

- P66 XC Aviation Hydraulic Oil SDSДокумент8 страницP66 XC Aviation Hydraulic Oil SDSMik AeilОценок пока нет

- Emirates AirlinesДокумент8 страницEmirates AirlinesMuhammad AliОценок пока нет

- Cellular Life and Genetics - Active TransportДокумент1 страницаCellular Life and Genetics - Active Transportapi-287775028Оценок пока нет

- JF015E Calibration Parte3Документ4 страницыJF015E Calibration Parte3EdgarditoОценок пока нет

- 2024 HTДокумент6 страниц2024 HTvincent GОценок пока нет

- MBA80 Manual - Sneak Peek PDFДокумент14 страницMBA80 Manual - Sneak Peek PDFAnonymous cnKOR7QОценок пока нет

- Water Bottle Refill Station - ProposalДокумент6 страницWater Bottle Refill Station - ProposalOmar ShahidОценок пока нет

- 25 M Fast Supply Vessel Swe v1Документ2 страницы25 M Fast Supply Vessel Swe v1Sebastian RentschОценок пока нет

- Traffic IslandsДокумент6 страницTraffic IslandsQayes Al-Quqa100% (2)

- Carspotting: The Real Adventures of Irvine Welsh by Sandy MacnairДокумент40 страницCarspotting: The Real Adventures of Irvine Welsh by Sandy MacnairBlack & White Publishing100% (1)

- THD 235/23 JUL/SGN-BKK: - Not For Real World NavigationДокумент27 страницTHD 235/23 JUL/SGN-BKK: - Not For Real World NavigationAnish LahaОценок пока нет

- 22 81 00 12400 00 BДокумент1 страница22 81 00 12400 00 BNikolay RomadanovОценок пока нет

- Ali CVДокумент1 страницаAli CVAli EidОценок пока нет

- Piping Design Tank FarmДокумент36 страницPiping Design Tank Farmkemo10100% (1)

- Automatic Train Protection - Wikipedia, The Free EncyclopediaДокумент4 страницыAutomatic Train Protection - Wikipedia, The Free EncyclopediasaospieОценок пока нет

- Ad 2.12 Runway Physical Characteristics: AD 2-FAHG-5 AIP South AfricaДокумент2 страницыAd 2.12 Runway Physical Characteristics: AD 2-FAHG-5 AIP South AfricaKHUSHAL BANSALОценок пока нет

- West Tower vs. Phil. Ind. Corp.Документ14 страницWest Tower vs. Phil. Ind. Corp.Antonio Dominic SalvadorОценок пока нет

- Information On Pick Up Services & Hotel-Msts Johor (Pasir Gudang) (Wef 01.08.2015)Документ5 страницInformation On Pick Up Services & Hotel-Msts Johor (Pasir Gudang) (Wef 01.08.2015)bebulalaОценок пока нет

- HM 40 Feb 2023 Edi, Cow, EditableДокумент36 страницHM 40 Feb 2023 Edi, Cow, EditableAung Htet KyawОценок пока нет

- Storage Tank Loading Schedules at LNG Terminals A Dynamic Simulation ApproachДокумент3 страницыStorage Tank Loading Schedules at LNG Terminals A Dynamic Simulation ApproachElbahi DjaalabОценок пока нет

- Escalator Switches AdjustmentДокумент6 страницEscalator Switches AdjustmentSANAL KUMAR SОценок пока нет

- Sea King's MaliceДокумент144 страницыSea King's MaliceBrent Tanner100% (4)

- Ship UnloadersДокумент2 страницыShip UnloadersNos GoteОценок пока нет

- Kiswire Steel Wire RopeДокумент28 страницKiswire Steel Wire RopeMulatua Sirait100% (3)

- Evidencia 4 Resumen "Product Distribution The Basics"Документ3 страницыEvidencia 4 Resumen "Product Distribution The Basics"leonard_cantillo_1Оценок пока нет

- Siemens PLM NX Automotive Packaging Fs 68168 A3 - tcm27 29307Документ5 страницSiemens PLM NX Automotive Packaging Fs 68168 A3 - tcm27 29307SoumenAtaОценок пока нет