Академический Документы

Профессиональный Документы

Культура Документы

Sale Under Tpa

Загружено:

shubhamОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Sale Under Tpa

Загружено:

shubhamАвторское право:

Доступные форматы

SALE OF IMMOVABLE PROPERTY 1

SALE

Submitted by

Prashant Shukla

Roll No.: - 164140049

Class: - B. Com LLB 5th Semester

Of

Faculty of Law

Dr Shakuntala Misra National

Rehabilitation University

Lucknow

In

10/2018

Under the guidance of

DR GULAB RAI

(ASSISTANT PROFESSOR)

TRANSFER OF PROPERTY ACT-1882 1|Page

SALE OF IMMOVABLE PROPERTY 2

ACKNOWLEDGEMENT

I would like to express my special thanks of gratitude to my Ass. Prof. Dr Gulab Rai, who

gave me the golden opportunity to do this wonderful topic Sale of Immovable Property,

which also helped me in doing a lot of Research and I came to know about so many new things

I am really thankful to them.

PRASHANT SHUKLA

TRANSFER OF PROPERTY ACT-1882 2|Page

SALE OF IMMOVABLE PROPERTY 3

TABLE OF CONTENT

SR. NO TOPIC PAGE. NO

01) Introduction 04-05

02) Definition of sale 05-06

03) Essential elements of sale 06-07

04) Rights and Liabilities of seller and buyer 07-13

05) Marshalling by subsequent purchases 14

06) Discharge of Encumbrances on Sale 14-15

07) Bibliography 16

TRANSFER OF PROPERTY ACT-1882 3|Page

SALE OF IMMOVABLE PROPERTY 4

SALE OF IMMOVABLE PROPERTY

INTRODUCTION

'Sale1' is defined as "a transfer of ownership in exchange for a price paid or promised or part-

paid and part promised'. (Section 54, Transfer of Property Act, 1882)

A Sale, as the name suggests, involves two parties, a seller and a buyer of the goods. The buyer

agrees to pay a price as fixed mutually or by contract of sale. If the sale involves a movable

object, then with the transfer of ownership, the property also goes into possession of the buyer

but if the property is immovable, only the ownership of that immovable property changes

hands.

After every Sale, the buyer (owner) acquires all rights of ownership and possession over the

property as per the "Sale Agreement". Ideally every Sale is registered at the Sub-Registrar

Office. A verbal contract is also valid along with a written contract, though not advisable.

Stamp duty is paid in each sale transaction, depending upon the price determined or the sale

value of the property.

Section 54 of the transfer of property act has three parts vis-a-vis (a) definition of sale, (b) Sale

how made and (c) Contract of sale.

Statement of Problem

The proposed study intends Firstly, to study about the concept of Sale and the essentials thereof; and

Secondly, to study the rights and liabilities of the buyer & seller in Sale of immovable property.

Hypothesis

After every Sale, the buyer (owner) acquires all rights of ownership and possession over the property

as per the "Sale Agreement".

1

Section 54, T.P.A.

TRANSFER OF PROPERTY ACT-1882 4|Page

SALE OF IMMOVABLE PROPERTY 5

Research Objective

• To study the concept of sale with respect to Transfer of Property Act.

• To study the essentials of Sale

• To study the Rights and Liabilities of the Parties in the sale of immovable property i.e. the rights

and liabilities of the Buyer and the Seller of the Immovable Property.

DEFINITION OF SALE

“Sale” is a transfer of ownership in exchange for the price paid or promised or part-paid and

part-promised.

Sale is defined as a transfer of the ownership. In sale there is absolute transfer of all the rights

in the property sold. The words “transfer of ownership” stand in contrast with the words

“transfer of an interest” occurring in section 58 in the definition of mortgage and with “transfer

of a right to enjoy property” in the definition of lease. In a mortgage or in a lease there is partial

transfer of rights while in a sale all the rights of ownership which the transferor has, pass to the

transferee. A sale must be distinguished from a hire – purchase agreement. If the transferee has

to pay entire purchase price, it indicates that the transaction is sale but where the transferee is

given right to terminate the agreement, the transaction may be a hire –purchase agreement.2

The transfer by way of sale of tangible immovable property of the value of rupee one hundred

and above can be made by a registered instrument. The transfer by way of sale of tangible

immovable property of the value of less than one hundred rupees may be made either by a

registered instrument or by delivery of the property.

"Transfer" This term is defined specifically under the Income-tax Act but not in Transfer of

Property Act. Although the term "transfer" would be understood in the general sense of

conveying or passing or making over the title from one person (the Owner) to another, it is

used in a much wider sense under the Income-tax Act. According to the said definition in

section 2(47) of I.T. Act, "Transfer" in relation to a capital asset includes: -

1) Sale, exchange or relinquishment of the asset; or

2

Shukla, S.N., TRANSFER OF PROPERTY ACT, ALLAHABAD LAW AGENCY, Chapter III, Of sale of

immoveable property, Comments- Definition of Sale, p.178

TRANSFER OF PROPERTY ACT-1882 5|Page

SALE OF IMMOVABLE PROPERTY 6

2) Extinguishment of any rights therein; or

3) Compulsory acquisition of the asset under any law; or

4) Conversion of the capital asset into stock-in-trade of one's own business;

5) Transaction u/s. 53 A of the Transfer of Property Act i.e. allowing possession

of any immovable property to be taken or retained in part performance of the

contract; or

6) Any transaction e.g. by way of becoming a member of a society, company etc.

or any agreement or arrangement which transfers or enables enjoyment of the

immovable property to another person.

The words Sale, Exchange, Relinquishment or extinguishment are not defined or explained in

the Income-Tax Act but are so explained in the Transfer of Property Act.

Contract of sale

As per Section 54 of the T. P. Act, a contract for the sale of immovable property is a contract

laying down that the 'Sale' of such property shall take place on the terms settled between the

parties in the said contract. Such contract for sale does not create any interest in or charge on

such immovable property. The contract for sale does not result in any transfer of ownership.

However, a sort of obligation is created in respect of the ownership of the property.

ESSENTIAL ELEMENTS OF SALE ARE AS UNDER:

1. Parties

Individuals competent to enter into Contract as per the provisions of Section II of the

Indian Contract Law, 1872. A minor or lunatic cannot be a transferor / vendor as he is

not competent to contract under Section II of the Indian Contract Act, 1872. However,

it has been held that a minor or a lunatic can be a transferee or purchaser in the case of

transfer by way of sale or mortgage, represented by his Guardian.

2. Subject matter

The concerned immovable property that is considered as saleable. Subject matter is the

transferable immovable property.

TRANSFER OF PROPERTY ACT-1882 6|Page

SALE OF IMMOVABLE PROPERTY 7

3. Price

Price is an essential ingredient for all transactions of sale and in the absence of the price

or the consideration, the transfer is not regarded as a sale. The transfer by way of sale

must be in exchange for a price. It has been held that price normally means money.

Money that is mutually agreed to by both parties to be paid/ received. An agreement at

the price is reached at, before the property changes hands. The price can be paid fully

in cash or it can be partly paid and partly promised to be paid in future. The price can

be fixed by the agreement between the parties before the conveyance of the property.

The price is to be fixed reasonably.

4. Delivery of Property

Transfer by way of sale in the case of tangible property worth less than rupees One

Hundred can be made either by a registered instrument or by delivery of property by

putting the purchaser or the person directed by the purchaser, in possession of property.

If the consideration for the sale is more than Rs.100/- then the instrument must be

registered under the Registration Act, 1908 or by placing the buyer with possession.

RIGHTS AND LIABILITIES OF SELLER THE BUYER3253

Introduction

A buyer of property has some rights and liabilities. According to the Transfer of Property Act,

buyers of immovable property are entitled to some rights and have some responsibilities, which

they need to fulfil statutorily.

A buyer is bound to disclose to a seller any fact as to the nature or extent of the seller’s interest

in the property of which the buyer is aware, but of which he has reason to believe that the seller

is not aware, and which materially increases the value of such interest. An omission to make

such disclosures is fraudulent.

Also, the buyer is liable to pay or tender, at the time and place of completing the sale, the

purchase money to the seller or such person as he directs. The payment should be as per the

3

Dr H.N. Tiwari, T.P.A., page no 259, ALLAHABAD LAW AGENCY.

TRANSFER OF PROPERTY ACT-1882 7|Page

SALE OF IMMOVABLE PROPERTY 8

agreed terms and conditions. Where the property is sold free from encumbrances, the buyer

may retain out of the purchase money the amount of any encumbrances on the property existing

at the date of the sale and should pay the amount so retained to the persons entitled to get the

encumbrances released.

Moreover, where the ownership of the property has passed to the buyer, as between himself

and the seller, the buyer is liable to pay all public charges and rent which may become payable

in respect of the property, the principal money due on any encumbrances subject to which the

property is sold, and the interest due later. Once the ownership has been transferred to the

buyer, the buyer is liable to pay all the statutory charges like municipal taxes, property taxes,

cess, electricity, water charges etc.

Section 55 of the T. P. Act deals with the rights and liabilities of the buyer and the seller. In

the absence of a contract to the contrary, the buyer and the seller of immovable property

respectively are subject to the liabilities and have the rights mentioned in the rules as laid down

in section 55 or such of them as are applicable to the property sold.

"seller" - means a person who sells or agrees to sell goods

Rights and liabilities of the seller

In the absence of the contract to the contrary, the section 55 of the transfer of the property act

provides for the provision for the rights and liabilities of the seller and the buyer. The rights

and liabilities before the completion are of sale are contractual.

Liabilities of the seller

The liabilities/ duties of the seller before the completion of the sale are:

(a) to disclose material defects in the property or in the seller’s title thereto [section

55(1)(a)];

(b) To produce title deeds [section 55(1)(b)];

(c) To answer questions as to title [section 55(1)(c)];

(d) To execute conveyance [Section 55(1)(d)]

(e) To take care of the property [Section 55(1)(e)]

(f) To pay outgoings [Section 55(1)(g)].

TRANSFER OF PROPERTY ACT-1882 8|Page

SALE OF IMMOVABLE PROPERTY 9

(a) Seller’s duty of disclosure

The seller is under a duty to disclose to the buyer every material defect in the property or

in his own title thereto.

The duty arises when the seller is aware of the defects and the buyer could not with ordinary

care have discovered, that is, the duty is with regard to the latent defects but not patent

defects which the buyer could by himself discover. For example,

(1) The existence of an open right of way or the ruinous state of building is an apparent

defect while a deed is a latent defect.

(2) Similarly, an underground drain is a latent defect and if the buyer does not know of its

existence, the seller is duty bound to inform of its existence.

Therefore, the material defect to be disclosed must be either with regard to the property

itself or the title of the seller or the vendor. The failure to disclose these effects follows the

below mentioned consequences: -

i) If the purchaser discovers such defects before the completion of the sale the he may:

a. Either rescind the contract, or

b. Take the property and later claim damages.

ii) If the defects are discovered after the sale is completed, the buyer is entitled to

claim damages and he may sue to set aside the sale. Although the general rule that

once a sale always a sale cannot be avoided. But in the case of the non-disclosure

of the material defects the rule is otherwise, reason being an omission to make such

disclosure is fraudulent.

Under the latter half of clause (g) of Section 55 (1) of the Transfer of Property Act where

the property is not sold subject to any encumbrance, the vendor is bound to discharge all

encumbrances on the property then existing and he is bound to give an assurance to that

effect. Hence a covenant of title to the effect that the said premises are free from all

TRANSFER OF PROPERTY ACT-1882 9|Page

SALE OF IMMOVABLE PROPERTY 10

encumbrances, claims and demands occasioned or created by the vendor, would not be in

compliance with section 55 (1) (g) of the Transfer of Property Act.4

(b) Production of title deeds.

It is the seller's duty to produce title-deeds relating to the immovable property contracted

to be sold for the inspection of the buyer in order that the buyer should satisfy himself as

to title. It is the buyer's interest to inspect the title deeds for otherwise he may be fixed with

constructive notice of matters which he would have discovered if he had investigated the

title.

(c) Seller's duty to answer material questions as to title.

The seller is further bound to answer all relevant questions put to him by the buyer in

respect of the property or title. The right to put questions to the seller does not affect his

duty to make disclosure as required by clause (a). The buyer's right to take objections and

to insist on proof of a title free from doubt may be lost by waiver.

Illustration: A contracts to sell a house to B. Before the execution of the deed of sale, B

enters into possession and tries to raise money on a mortgage of the house. B had waived

his right to make objections to the title to A.

(d) Seller's duty to execute conveyance.

It is the seller's duty to execute conveyance. This execution of the conveyance by the seller

and the payment of the price by the buyer is to take place, in the absence of a contract to

the contrary, simultaneously. If either party uses for specific performance, he must show

that he was ready and willing to perform his duty.

Section 55 (1) (d) of the Transfer of Property Act says that the seller is bound on payment

or tender of the amount due in respect of the price to execute a proper conveyance of the

property when the buyer tenders it to him for execution at a proper time and place. As a

matter of grammar, the word is being the latter portion of the clause refers to the

conveyance and therefore the words at a proper time and place would refer only to the

buyer tendering the conveyance to the seller for execution at a proper time and place. In

4

G. Gopala Chettiar v. N. Giriappa Gowden, (1971) 2 M.L.J. 481.

TRANSFER OF PROPERTY ACT-1882 10 | P a g e

SALE OF IMMOVABLE PROPERTY 11

other words, there is no explicit mention of the words 'proper time and place' in respect of

the first portion of Section 55 (1) (d), namely, of payment or tender of the amount due in

respect of the price. Normally, since the payment or tender of the amount due has to be

made to the seller, it has to be made at the seller's place; it would not be correct to contend

that the normal place of payment of the purchase-money is at the place of registration.

(e) Care of property.

It is the duty of the seller to take care of the property between the date of contract and the

delivery of the property to the buyer. The seller is sometimes said to be a trustee for the

buyer. His duties are, therefore, analogous to those imposed upon a trustee by Section 15

of the Indian Trusts Act. If the seller neglects his duty, the buyer is entitled to compensation

in the event of any loss or damage to the property.5

(f) Payment of outgoings

The last duty of the seller is to pay public charges and rent, etc., up to the date of the

completion of sale. Public charges would include government revenue, municipal taxes, etc.

The seller is also under a duty to discharge all encumbrances on the property existing at the

time of the sale except where the property is sold subject to encumbrances.

Rights of the seller: Before the completion

Until ownership is passed to the purchaser, the seller is owner and the rents and profits belong

to him. It should be recalled that a contract of sale does not create any interest in favor the

purchaser and, therefore, he cannot claim the rents and profits until the ownership passes to

him. In case the seller refuses to execute the sale-deed as agreed, the purchaser is entitled to

claim compensation from the date when the deed should have been executed. On the other

hand, if the buyer takes possession before the completion of the sale, the seller is entitled to

interest on the unpaid purchase-money from the date on which the possession is taken.6

5

Clark v. Ramuz, 2 Q.B. 456., Shukla, S.N., ibid.

6

Maung Shew v. Muang Inn. (1917)44 I.A. 15, ibid.

TRANSFER OF PROPERTY ACT-1882 11 | P a g e

SALE OF IMMOVABLE PROPERTY 12

"Buyer" means a person who buys or agrees to buy goods

The Buyer’s liabilities before completion of the sale are: -

(a) To disclose facts materially increasing the value of the property [section 55(a)];

(b) To pay the price [section 55(5)(b)]

(a) Duty to disclose facts

The buyer is bound to disclose to the seller any fact as to the nature or extent of the seller’s

interest in the property. This duty corresponds to the duty of the seller to disclose material

defects in the property. Under the last paragraph of this section, a non-disclosure of such fact

on the part of the buyer would be fraudulent just as much as a non-disclosure by the seller

would be. The obligation of the buyer to disclose facts extends only to the nature and extent of

the seller's interest in the property: and this obligation arises only: (i) if the buyer knows or has

reason to believe that the seller does not know the nature and extent of his interest; and (ii) if

the fact materially increases the value of the property. In an English case, Summers v. Griffith3,

an old woman of eighty-eight, being in distress and without legal assistance, was induced to

sell to her property at one-fourth of face value under the impression that she could not make

out a good title whereas the purchaser knew that she could and thus concealed the fact from

her, the court said:

“if a person comes to me and offence to sell me a property which I know to be five times the

value he offers it for, he being ignored of his rights and in the belief that he could not make a

good title which I know he can; and I conceal that knowledge from him is not that a suppression

very which is one of the elements which constitutes a fraud?”

It has however, been held that a buyer is under no duty to disclose latent advantage of the

property although he many not make fraudulent statement.

(b)Payment of price:

Ordinarily, the obligation to pay the purchase money on one hand and the obligation to

execute the conveyance or complete the sale on the other are obligations which should be

performed concurrently. By the proviso an exception is allowed in favor of the buyer who

has brought property as free from encumbrances and finds that an encumbrance has not been

TRANSFER OF PROPERTY ACT-1882 12 | P a g e

SALE OF IMMOVABLE PROPERTY 13

paid off. He may retain out of the purchase money a sum sufficient to pay a large amount

than the price, he may recover the difference by a separate suit against the seller.7

Buyer’s Rights

The buyer has two rights. One of them is before the completion of the sale and other is after

completion of the sale. They are as follows: Before completion: Buyer's lien.

According to the last clause of Paragraph 6, the buyer has, on the seller failing to complete

the sale, a charge for the amount paid by him in advance on account of the purchase money.

This charge is converse of the seller's charge for unpaid price. The charge, unlike the seller's

charge, can be enforced against all persons holding the property irrespective of the question

of notice. Such charge can even be enforced against a purchaser for consideration with or

without notice of the charge.

The question whether a buyer by pre-payment can obtain a charge on the property depends on

whether the default in completing the sale rests with him or with the seller. The rule is that a

buyer is entitled to a charge for the prepaid price and interest thereon to the extent of the

seller's interest in the property but in case he has improperly declined to take delivery, the

charge is lost. As regards the earnest or money deposit if the contract goes off through the

default of the buyer, the seller is entitled to retain the earnest money as forfeited, but if, on the

other hand, the seller is in default, the buyer is entitled to a refund of the earnest money.

It is clear from Section 55 of the Transfer of Property Act that law has clearly laid down that

unless the buyer improperly declines to accept the delivery of the property, the amount of

purchase money paid to the buyer in anticipation of the delivery and for interest on such amount

shall remain as a charge on the property as against the seller and all persons claiming under

him.8

7

Mehtab Singh v. Collector of Saharanpur, 30 A.L.J. 556

8

Msf. Anchi v. Maida Ram, AIR 1987 Rajasthan, 11, Jaipur Bench.

TRANSFER OF PROPERTY ACT-1882 13 | P a g e

SALE OF IMMOVABLE PROPERTY 14

MARSHALLING BY SUBSEQUENT PURCHASES

If the owner of two or more properties mortgages them to one person and then sells one or

more of the properties to another person, the buyer is, in the absence of a contract to the

contrary, entitled to have the mortgage-debt satisfied out of the property or properties not sold

to him, so far as the same will extend, but not so as to prejudice the rights of the mortgagee or

persons claiming under him or of any other person who has for consideration acquired an

interest in any of the properties.

a) Where there is a contract to the contrary between the buyer and the mortgagor;9

b) Where the rights of the mortgagee or any person claiming under him or of any other

who has for consideration acquired an interest in any of the properties, are prejudiced.

DISCHARGE OF ENCUMBRANCES ON SALE

Provision by Court for encumbrances and sale freed therefrom -:

(a) Where immoveable property subject to any encumbrance, whether immediately payable or

not, is sold by the Court or in execution of a decree, or out of Court, the Court may, if it thinks

fit, on the application of any party to the sale, direct or allow payment into Court,

1) in case of an annual or monthly sum charged on the property, or of a capital sum

charged on a determinable interest in the property - of such amount as, when invested

in securities of the central Government, the Court considers will be sufficient, by means

of the interest thereof, to keep down or otherwise provide for that charge, and

(2) in any other case of a capital sum charged on the property of the amount sufficient

to meet the encumbrance and any interest due thereon. But in either case there shall

also be paid into Court such additional amount as the Court considers will be sufficient

to meet the contingency of further costs, expenses and interest, and any other

contingency, except depreciation of investments, not exceeding one-tenth part of the

original amount to be paid in, unless the Court for special reasons (which it shall record)

thinks fit to require a large additional amount.

9

Mangayya v. Achchayamma, (1954) A.M. 224.

TRANSFER OF PROPERTY ACT-1882 14 | P a g e

SALE OF IMMOVABLE PROPERTY 15

(b) Thereupon the Court may, if it thinks fit, and after notice to the encumbrance, unless

the Court, for reasons to be recorded in writing, thinks fit to dispense with such notice,

declare the property to be freed from the encumbrance, and make any order for conveyance,

or vesting order, proper for giving effect to the sale, and give directions for the retention and

investment of the money in Court.

(c) After notice served on the persons interested in or entitled to the money or fund in Court,

the Court may direct payment or transfer thereof to the persons entitled to receive or give a

discharge for the same, and generally may give directions respecting the application or

distribution of the capital or income thereof.

(d) An appeal shall lie from any declaration, order or direction under this section as if the same

were a decree.

(e) In this section "Court" means - (i) a High Court in the exercise of its ordinary or

extraordinary original civil jurisdiction, (ii) the Court of a District Judge within the local limits

of whose jurisdiction the property or any part thereof is situate, (iii) any other Court which the

State Government may, from time to time, by notification in the Official Gazette, declare to be

competent to exercise the jurisdiction conferred by this section.

TRANSFER OF PROPERTY ACT-1882 15 | P a g e

SALE OF IMMOVABLE PROPERTY 16

BIBLIOGRAPHY

BOOKS AND STATUTES

1) Singh Avtar (Dr), transfer of property act, 3rd ed., Universal law publishing Co., New

delhi,2013.

2) Tripathi, G.P. (Dr), transfer of property act, 17th ed., Central law publications,

Allahabad,2011.

3) Sinha R.K., transfer of property act, 15th ed., Central law publications,

Allahabad,2014.

4) Transfer of property Act,1882

WEBLINKS

1) http//www.lawnotes.in/section 54 of transfer of property act,1882.

TRANSFER OF PROPERTY ACT-1882 16 | P a g e

Вам также может понравиться

- 1) SaleДокумент10 страниц1) SaleCharran saОценок пока нет

- Modes of Transfer of Immovable Property - Sale and Gift By: Divyansh HanuДокумент11 страницModes of Transfer of Immovable Property - Sale and Gift By: Divyansh HanuLatest Laws Team100% (1)

- Essentials of TransferДокумент4 страницыEssentials of Transfersamsun009Оценок пока нет

- Section 51. Improvements Made by Bona Fide Holders Under Defective Title ImprovementsДокумент3 страницыSection 51. Improvements Made by Bona Fide Holders Under Defective Title Improvementssyed Nihal50% (2)

- DowerДокумент3 страницыDowerAdan Hooda100% (1)

- Concept of Karta in Hindu Joint FamilyДокумент5 страницConcept of Karta in Hindu Joint FamilyShubham PhophaliaОценок пока нет

- Discuss Position, Powers, Privileges and Obligations of Karta of The Hindu Joint Family. Can Women Be The Karta Ol A Hindu Joint Family ?Документ35 страницDiscuss Position, Powers, Privileges and Obligations of Karta of The Hindu Joint Family. Can Women Be The Karta Ol A Hindu Joint Family ?RupeshPandyaОценок пока нет

- Family Law II - All Long AnswersДокумент61 страницаFamily Law II - All Long AnswersGSAINTSSA100% (3)

- Tpa NotesДокумент14 страницTpa NotesAdv Deepak Garg100% (1)

- Kharchi-i-pandan: A wife's personal allowance under Muslim lawДокумент4 страницыKharchi-i-pandan: A wife's personal allowance under Muslim lawSHUBHAM RAJ33% (3)

- What Is Fraudulent Transfer: Section 53 Transfer of Property Act, 1882Документ3 страницыWhat Is Fraudulent Transfer: Section 53 Transfer of Property Act, 1882Adan Hooda100% (1)

- Object and Scope of TpaДокумент2 страницыObject and Scope of TpaAdan Hooda100% (1)

- Wills Under Muslim LawДокумент22 страницыWills Under Muslim LawSoujanyaa Manna60% (5)

- Condition Restraining Alienation ExplainedДокумент9 страницCondition Restraining Alienation ExplainedMohammad Ziya AnsariОценок пока нет

- LeaseДокумент16 страницLeaseAbir Al Mahmud KhanОценок пока нет

- Project ReportДокумент5 страницProject ReportAvtar singhОценок пока нет

- Religious Endowments ConceptsДокумент12 страницReligious Endowments Conceptsarebellion100% (1)

- Criminal Law Project On Topic: "Mischief"Документ12 страницCriminal Law Project On Topic: "Mischief"Satwant Singh100% (1)

- Assignment Section 14Документ6 страницAssignment Section 14Rajat choudharyОценок пока нет

- Devolution of Interest in Coparcenary PropertyДокумент11 страницDevolution of Interest in Coparcenary Propertyavi thakurОценок пока нет

- Guardianship Under Muslim LawДокумент13 страницGuardianship Under Muslim LawHimani Anand100% (2)

- Liability of Public Corporations ExplainedДокумент19 страницLiability of Public Corporations ExplainedSumeet Nayak100% (1)

- Hindu Minority Act ExplainedДокумент30 страницHindu Minority Act Explainedsandeep0% (2)

- Stridhan and Women EstateДокумент5 страницStridhan and Women EstateArunaMLОценок пока нет

- COPARCENARY WITHIN COPARCENARY: RIGHTS OF SUCH COPARCENERSДокумент21 страницаCOPARCENARY WITHIN COPARCENARY: RIGHTS OF SUCH COPARCENERSSwati Kriti50% (4)

- Sources of Muslim Law: 1. QuranДокумент10 страницSources of Muslim Law: 1. Quranmohd sakibОценок пока нет

- Fraudulent Transfer Under Section 53 of Transfer of Property Act, 1882Документ17 страницFraudulent Transfer Under Section 53 of Transfer of Property Act, 1882AnantHimanshuEkkaОценок пока нет

- Explain in Detail The Character of Mitakshara and Dayabhaga CoparcenaryДокумент8 страницExplain in Detail The Character of Mitakshara and Dayabhaga CoparcenarySamiksha Pawar100% (1)

- Doctrine of Acceleration Project TPA (A)Документ11 страницDoctrine of Acceleration Project TPA (A)Vishrut Verma100% (1)

- Rule Against Accumulation Section 17Документ2 страницыRule Against Accumulation Section 17Irfan Aijaz100% (3)

- Contingent and Vested InterestДокумент3 страницыContingent and Vested InterestAdan Hooda100% (1)

- Rights and Liabilities of Parties To An ExchangeДокумент18 страницRights and Liabilities of Parties To An ExchangeVijay Singh100% (3)

- Acknowledgement of Paternity Under Islamic LawДокумент5 страницAcknowledgement of Paternity Under Islamic Lawjoshi A rahulОценок пока нет

- Expiry & Repeal of Statutes - IДокумент79 страницExpiry & Repeal of Statutes - IPrasun Tiwari100% (2)

- VOID BEQUESTS - AssignmentДокумент49 страницVOID BEQUESTS - AssignmentAkshay GaykarОценок пока нет

- Understanding Lease, License and EasementДокумент22 страницыUnderstanding Lease, License and EasementKushagra SrivastavaОценок пока нет

- Rule of Feeding Grant by Estoppel: Section 43Документ21 страницаRule of Feeding Grant by Estoppel: Section 43mehak khanОценок пока нет

- Parliamentary Control of Delegated Legislation A Critical AnalysisДокумент15 страницParliamentary Control of Delegated Legislation A Critical AnalysisNitish GuptaОценок пока нет

- ProspectusДокумент14 страницProspectusSimran ChaudharyОценок пока нет

- Transfer of Property Law Notes IndiaДокумент96 страницTransfer of Property Law Notes IndiaArunaML100% (1)

- Q 1.5 Paralegal Traing and Legal AidДокумент5 страницQ 1.5 Paralegal Traing and Legal Aidateeshborole100% (1)

- Constructive Joint LiabilityДокумент20 страницConstructive Joint LiabilityArnav50% (2)

- Antecedent Debt in Hindu LawДокумент19 страницAntecedent Debt in Hindu Lawinderpreet100% (1)

- Parentage, Legitimacy & Acknowledgement Under IslamДокумент13 страницParentage, Legitimacy & Acknowledgement Under Islamlexscientiaa100% (1)

- 3 - Meaning, Object and Necessity of InterpretationДокумент9 страниц3 - Meaning, Object and Necessity of Interpretationtanay chaudhary100% (1)

- 2017-2018 Property Law-Ii Final Draft Topic - Comparative Study of Gift As Under The Transfer of Property Act, 1882Документ14 страниц2017-2018 Property Law-Ii Final Draft Topic - Comparative Study of Gift As Under The Transfer of Property Act, 1882Bharat JoshiОценок пока нет

- Indian Partnership ActДокумент16 страницIndian Partnership ActMilind Ghate100% (6)

- Companies Act Prospectus ReportДокумент17 страницCompanies Act Prospectus ReportAnantHimanshuEkkaОценок пока нет

- Vesting LegacyДокумент11 страницVesting LegacyArunaML100% (6)

- Clubbing of Income-10Документ7 страницClubbing of Income-10s4sahithОценок пока нет

- Transfer For Benefit of Unborn PersonДокумент7 страницTransfer For Benefit of Unborn PersonKHUSHI KATRE100% (1)

- Accumulation-Sec17-Transfer of PropertyДокумент18 страницAccumulation-Sec17-Transfer of PropertyArunaML71% (7)

- Hindu Law Key ConceptsДокумент6 страницHindu Law Key ConceptsNisha NishaОценок пока нет

- Actionable ClaimДокумент14 страницActionable ClaimkainatОценок пока нет

- Lease Under Transfer of Property ActДокумент11 страницLease Under Transfer of Property Actdivyavishal100% (3)

- Schools of Hindu LawДокумент18 страницSchools of Hindu LawAshishSharma83% (6)

- Theories of NegligenceДокумент5 страницTheories of NegligencenawazkhankakarОценок пока нет

- University Institute of Legal Studies Panjab University: Sale of Immovable PropertyДокумент19 страницUniversity Institute of Legal Studies Panjab University: Sale of Immovable PropertyRitika KambojОценок пока нет

- Tpa ProjectДокумент23 страницыTpa ProjectTushar Chowdhary50% (2)

- Glocal Law School: Synopsis OF Property LawДокумент6 страницGlocal Law School: Synopsis OF Property LawSyed renoba100% (1)

- Classification of Business EnvironmentДокумент12 страницClassification of Business Environmentshubham80% (5)

- Privatization Project Analyzes Benefits and DrawbacksДокумент16 страницPrivatization Project Analyzes Benefits and DrawbacksshubhamОценок пока нет

- Land Law ProjectДокумент14 страницLand Law Projectvipin jaiswalОценок пока нет

- GSTR-1 TITLEДокумент5 страницGSTR-1 TITLEshubhamОценок пока нет

- Dr. Shakuntala Misra National Rehabilitation UniversityДокумент14 страницDr. Shakuntala Misra National Rehabilitation UniversityshubhamОценок пока нет

- Case Analysis (Criminal)Документ17 страницCase Analysis (Criminal)shubhamОценок пока нет

- Moot Court DIARyДокумент9 страницMoot Court DIARyMukesh Lal0% (2)

- The Legal Environment of BusinessДокумент15 страницThe Legal Environment of BusinessshubhamОценок пока нет

- Faculty of Law case study on Deep Singh vs The Gizzy Pvt LtdДокумент1 страницаFaculty of Law case study on Deep Singh vs The Gizzy Pvt LtdshubhamОценок пока нет

- DRVBHVДокумент1 страницаDRVBHVshubhamОценок пока нет

- Submited To: Submited byДокумент1 страницаSubmited To: Submited byshubhamОценок пока нет

- Trade Union-The History of Labor Unions in India: Dr. Shakuntala Misra National Rehabilitation UniversityДокумент15 страницTrade Union-The History of Labor Unions in India: Dr. Shakuntala Misra National Rehabilitation UniversityshubhamОценок пока нет

- The Legal Environment of BusinessДокумент15 страницThe Legal Environment of BusinessshubhamОценок пока нет

- Land Tenure: An Introduction: February 2002Документ14 страницLand Tenure: An Introduction: February 2002shubhamОценок пока нет

- Introduction of Investment BankingДокумент18 страницIntroduction of Investment Bankingshubham100% (2)

- Sources of International LawДокумент42 страницыSources of International Lawshubham100% (2)

- Classification of Business EnvironmentДокумент16 страницClassification of Business EnvironmentshubhamОценок пока нет

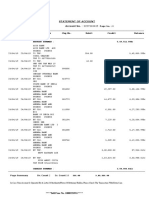

- Statement of Account: M/S Best Agency Account No.: 3157343415Документ1 страницаStatement of Account: M/S Best Agency Account No.: 3157343415shubhamОценок пока нет

- Research Project ON Double Taxation: Faculty of Law Dr. Shakuntala Misra National Rehabilitation University, LucknowДокумент9 страницResearch Project ON Double Taxation: Faculty of Law Dr. Shakuntala Misra National Rehabilitation University, LucknowshubhamОценок пока нет

- U P Land Law AssignmentДокумент22 страницыU P Land Law AssignmentShalini Sonkar100% (1)

- Statement of Account: M/S Best Agency Account No.: 3157343415Документ1 страницаStatement of Account: M/S Best Agency Account No.: 3157343415shubhamОценок пока нет

- Labor Laws OverviewДокумент14 страницLabor Laws OverviewshubhamОценок пока нет

- Statement of Account: M/S Best Agency Account No.: 3157343415Документ1 страницаStatement of Account: M/S Best Agency Account No.: 3157343415shubhamОценок пока нет

- Sources of Int'l LawДокумент12 страницSources of Int'l LawshubhamОценок пока нет

- US CHINA Trade WarДокумент47 страницUS CHINA Trade WarshubhamОценок пока нет

- Corporate Accounting Mid Term Exam SolutionДокумент5 страницCorporate Accounting Mid Term Exam SolutionshubhamОценок пока нет

- Research Project ON Double Taxation: Faculty of Law Dr. Shakuntala Misra National Rehabilitation University, LucknowДокумент9 страницResearch Project ON Double Taxation: Faculty of Law Dr. Shakuntala Misra National Rehabilitation University, LucknowshubhamОценок пока нет

- Issue and Redemption of DebenturesДокумент41 страницаIssue and Redemption of DebenturesshubhamОценок пока нет

- Research Project ON Plaint & Written StatementДокумент10 страницResearch Project ON Plaint & Written StatementshubhamОценок пока нет

- Issue, Forfeiture and Reissue of Equity SharesДокумент58 страницIssue, Forfeiture and Reissue of Equity SharesshubhamОценок пока нет

- Manila Pilots Association Immune from Attachment for Member's DebtДокумент2 страницыManila Pilots Association Immune from Attachment for Member's DebtAngelic ArcherОценок пока нет

- Toolkit:ALLCLEAR - SKYbrary Aviation SafetyДокумент3 страницыToolkit:ALLCLEAR - SKYbrary Aviation Safetybhartisingh0812Оценок пока нет

- CSR of Cadbury LTDДокумент10 страницCSR of Cadbury LTDKinjal BhanushaliОценок пока нет

- Classen 2012 - Rural Space in The Middle Ages and Early Modern Age-De Gruyter (2012)Документ932 страницыClassen 2012 - Rural Space in The Middle Ages and Early Modern Age-De Gruyter (2012)maletrejoОценок пока нет

- Ejercicio 1.4. Passion Into ProfitДокумент4 страницыEjercicio 1.4. Passion Into ProfitsrsuaveeeОценок пока нет

- Training Effectiveness ISO 9001Документ50 страницTraining Effectiveness ISO 9001jaiswalsk1Оценок пока нет

- Autos MalaysiaДокумент45 страницAutos MalaysiaNicholas AngОценок пока нет

- Codilla Vs MartinezДокумент3 страницыCodilla Vs MartinezMaria Recheille Banac KinazoОценок пока нет

- Java Interview Questions: Interfaces, Abstract Classes, Overloading, OverridingДокумент2 страницыJava Interview Questions: Interfaces, Abstract Classes, Overloading, OverridingGopal JoshiОценок пока нет

- Otto F. Kernberg - Transtornos Graves de PersonalidadeДокумент58 страницOtto F. Kernberg - Transtornos Graves de PersonalidadePaulo F. F. Alves0% (2)

- Solidworks Inspection Data SheetДокумент3 страницыSolidworks Inspection Data SheetTeguh Iman RamadhanОценок пока нет

- The Relationship Between Family Background and Academic Performance of Secondary School StudentsДокумент57 страницThe Relationship Between Family Background and Academic Performance of Secondary School StudentsMAKE MUSOLINIОценок пока нет

- Kedudukan Dan Fungsi Pembukaan Undang-Undang Dasar 1945: Pembelajaran Dari Tren GlobalДокумент20 страницKedudukan Dan Fungsi Pembukaan Undang-Undang Dasar 1945: Pembelajaran Dari Tren GlobalRaissa OwenaОценок пока нет

- Battery Genset Usage 06-08pelj0910Документ4 страницыBattery Genset Usage 06-08pelj0910b400013Оценок пока нет

- 05 Gregor and The Code of ClawДокумент621 страница05 Gregor and The Code of ClawFaye Alonzo100% (7)

- ModalsДокумент13 страницModalsJose CesistaОценок пока нет

- Resarch Paper On Franchising Business MacobДокумент8 страницResarch Paper On Franchising Business MacobAngelika Capa ReyesОценок пока нет

- Corporate Account: Department of Commerce Doctor Harisingh Gour Vishwavidyalaya (A Central University) SAGAR (M.P.)Документ6 страницCorporate Account: Department of Commerce Doctor Harisingh Gour Vishwavidyalaya (A Central University) SAGAR (M.P.)Aditya JainОценок пока нет

- Overlord Volume 1 - The Undead King Black EditionДокумент291 страницаOverlord Volume 1 - The Undead King Black EditionSaadAmir100% (11)

- EE-LEC-6 - Air PollutionДокумент52 страницыEE-LEC-6 - Air PollutionVijendraОценок пока нет

- Equity Inv HW 2 BHДокумент3 страницыEquity Inv HW 2 BHBen HolthusОценок пока нет

- 4AD15ME053Документ25 страниц4AD15ME053Yàshánk GøwdàОценок пока нет

- Housekeeping NC II ModuleДокумент77 страницHousekeeping NC II ModuleJoanne TolopiaОценок пока нет

- MinePlan Release NotesДокумент14 страницMinePlan Release NotesJuanJo RoblesОценок пока нет

- Communicative Competence: Noam ChomskyДокумент2 страницыCommunicative Competence: Noam ChomskyKiara Denise SuarezОценок пока нет

- Apple NotesДокумент3 страницыApple NotesKrishna Mohan ChennareddyОценок пока нет

- LLB 1st Year 2019-20Документ37 страницLLB 1st Year 2019-20Pratibha ChoudharyОценок пока нет

- Note-Taking StrategiesДокумент16 страницNote-Taking Strategiesapi-548854218Оценок пока нет

- EAPP Q2 Module 2Документ24 страницыEAPP Q2 Module 2archiviansfilesОценок пока нет

- Tutorial Basico Del Metodo AJAX Con PHP y MySQLДокумент14 страницTutorial Basico Del Metodo AJAX Con PHP y MySQLJeese Bahena GarciaОценок пока нет