Академический Документы

Профессиональный Документы

Культура Документы

Statement of Cash Flows Answer

Загружено:

anber mohammadИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Statement of Cash Flows Answer

Загружено:

anber mohammadАвторское право:

Доступные форматы

STATEMENT OF CASH FLOWS

Multiple Choice Answers

Item Ans. Item Ans. Item Ans.

1 c 6 B 11 a

2 c 7 c 12 c

3 d 8 a 13 B

4 A 9 d 14 C

5 a 10 b 15 c

EXERCISES

Solution 1

1. B and C 7. D 13. A

2. B 8. None 14. None

3. A 9. None 15. B

4. B 10. A 16. None

5. A 11. B

6. A 12. F

Solution 2

(a) Investing activities:

Purchase or sale of noncurrent assets

Purchase or sale of securities of other entities

Loans or collection of principal of loans to other entities

(b) Financing activities:

Issuing or reacquiring stock

Issuing or redeeming debt

Paying cash dividends to stockholders

(c) Significant noncash transactions:

Acquiring assets by issuing stock or debt

Capital leases

Conversion or refinancing of debt

Exchanges of nonmonetary assets

(d) Not shown on statement of cash flows:

Stock dividends

Appropriations of retained earnings

Solution 3

(a) Add $10,000 (e) Investing $53,000; Deduct $1,000 (gain)

(b) Deduct $12,000 (f) Noncash $60,000

(c) Not shown (g) Add $3,000

(d) Add $1,600 (h) Financing ($60,000)

Solution 4

(1) Cash inflow from investing activities $30,000

(2) Sales price $30,000

Book value 28,000

Gain on sale $ 2,000 Deduct from net income

(3) Cost $48,000

Book value 28,000

Accumulated depreciation 20,000

Deduct decrease in accumulated depreciation (6,000)

Depreciation expense $14,000 Add to net income

Solution 5

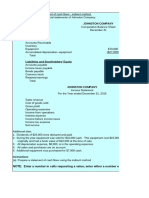

Prince Corporation

Statement of Cash Flows

For the Year Ended December 31, 2004

Increase (Decrease) in Cash

Cash flows from operating activities

Net income $ 63,300

Adjust. to reconcile net income to net cash provided

by operating activities:

Depreciation expense $22,000

Patent amortization 5,000

Increase in accounts receivable (13,600)

Decrease in inventory 30,000

Increase in prepaid expenses (700)

Increase in accounts payable 6,000

Decrease in accrued liabilities (9,000) 39,700

Net cash provided by operating activities 103,000

Cash flows from investing activities

Purchase of land (40,000)

Purchase of buildings (43,000)

Sale of patents 10,000

Net cash used by investing activities (73,000)

Cash flows from financing activities

Sale of bonds 75,000

Purchase of treasury stock (7,000)

Payment of cash dividends (25,000)

Net cash provided by financing activities 43,000

Net increase in cash $ 73,000

Cash, January 1, 2004 27,000

Cash, December 31, 2004 $100,000

Solution 6

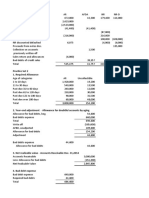

Vincent Corporation

Statement of Cash Flows

For the Year Ended December 31, 2004

Increase (Decrease) in Cash

Cash flows from operating activities

Net income $218,000

Adjustments to reconcile net income to net cash

provided by operating activities:

Equity in subsidiary loss $ 60,000

Depreciation expense 152,000

Gain on sale of short-term investments (22,500)

Decrease in deferred tax liability (15,500)

Increase in accounts receivable (69,900)

Increase in inventory (64,200)

Decrease in prepaid expenses 18,300

Decrease in accounts payable (90,700)

Increase in accrued liabilities 21,500 (11,000)

Net cash provided by operating activities 207,000

Cash flows from investing activities

Sale of short-term investments 103,000

Purchase of plant and equipment (210,000)

Major repairs to equipment (22,000)

Net cash provided by investing activities (129,000)

Cash flows from financing activities

Payment of cash dividend (123,000)

Sale of serial bonds 80,000

Net cash used by financing activities (43,000)

Net increase in cash 35,000

Cash, January 1, 2004 111,000

Cash, December 31, 2004 $146,000

Вам также может понравиться

- Assignment - CASH FLOWДокумент6 страницAssignment - CASH FLOWFariha tamannaОценок пока нет

- BE Chap 17Документ3 страницыBE Chap 17TIÊN NGUYỄN LÊ MỸОценок пока нет

- Practice Set 2 SCFДокумент10 страницPractice Set 2 SCFDiya BasuОценок пока нет

- Practice Set 2 SCFДокумент10 страницPractice Set 2 SCFAtul DarganОценок пока нет

- Practice Problems, CH 5 SolutionДокумент6 страницPractice Problems, CH 5 SolutionscridОценок пока нет

- Practice Set 3 SCFДокумент10 страницPractice Set 3 SCFNISHA BANSALОценок пока нет

- AFE5008-B Exam Type Question-2-Model AnswerДокумент2 страницыAFE5008-B Exam Type Question-2-Model AnswerDiana TuckerОценок пока нет

- 2208 ch22Документ7 страниц2208 ch22Clyde Ian Brett PeñaОценок пока нет

- Problem 23 2Документ5 страницProblem 23 2Muhammad SyahbinОценок пока нет

- Jawaban Chapter 23 - Soal DikerjakanДокумент2 страницыJawaban Chapter 23 - Soal Dikerjakanabd storeОценок пока нет

- Jawaban 11 - Statement of Cash FlowДокумент2 страницыJawaban 11 - Statement of Cash FlowBie SapuluhОценок пока нет

- Asdos Jawaban 4Документ5 страницAsdos Jawaban 4mutiaoooОценок пока нет

- Chapter 42 - Teacher's ManualДокумент13 страницChapter 42 - Teacher's ManualHohohoОценок пока нет

- Canapi - 04 Quiz 1Документ2 страницыCanapi - 04 Quiz 1sora fpsОценок пока нет

- Trần Thị Thu Nguyệt-Pa3-Hwchapter17Документ2 страницыTrần Thị Thu Nguyệt-Pa3-Hwchapter17Nguyet Tran Thi ThuОценок пока нет

- QUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanДокумент4 страницыQUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDaffa Ramadhan ArcheryОценок пока нет

- Ventura, Mary Mickaella R - Cashflowp.321 - Group 3Документ5 страницVentura, Mary Mickaella R - Cashflowp.321 - Group 3Mary Ventura100% (1)

- FAChapter 12Документ3 страницыFAChapter 12zZl3Ul2NNINGZzОценок пока нет

- Cash Flow - Additional Exercises - SOLДокумент5 страницCash Flow - Additional Exercises - SOLMathieu HindyОценок пока нет

- AdditionalДокумент3 страницыAdditionalsheryllopez108Оценок пока нет

- Kelompok 5 - Cash Flow - ALKДокумент16 страницKelompok 5 - Cash Flow - ALKSiti Ruhmana SiregarОценок пока нет

- Net Cash Provided by Operating Activities 104,000Документ2 страницыNet Cash Provided by Operating Activities 104,000Gayzelle MirandaОценок пока нет

- Statement of Cash Flows AДокумент7 страницStatement of Cash Flows ABabylyn NavarroОценок пока нет

- Garing, Aireen - Sa No.13 Statement of CashflowsДокумент3 страницыGaring, Aireen - Sa No.13 Statement of CashflowsAireen GaringОценок пока нет

- FinanceДокумент53 страницыFinanceSheethal RamachandraОценок пока нет

- Annisa Nabila Kanti - Task 17Документ4 страницыAnnisa Nabila Kanti - Task 17Annisa Nabila KantiОценок пока нет

- Ch5 Additional Q OnlyДокумент13 страницCh5 Additional Q OnlynigaroОценок пока нет

- CASH FLOW ExampleДокумент4 страницыCASH FLOW ExampleBiancaОценок пока нет

- Tutorial 17.5Документ4 страницыTutorial 17.5نور عفيفهОценок пока нет

- Question 2: Ias 7 Statements of Cash Flows: The Following Information Is RelevantДокумент3 страницыQuestion 2: Ias 7 Statements of Cash Flows: The Following Information Is RelevantamitsinghslideshareОценок пока нет

- B2 2022 May AnsДокумент15 страницB2 2022 May AnsRashid AbeidОценок пока нет

- Solutions Chapter 23Документ11 страницSolutions Chapter 23Avi SeligОценок пока нет

- ACT320 Assignment ProjectДокумент11 страницACT320 Assignment ProjectMd. Shakil Ahmed 1620890630Оценок пока нет

- Net Cash Flow From Operating Activities 1,222,000Документ1 страницаNet Cash Flow From Operating Activities 1,222,000Jen DeloyОценок пока нет

- Examination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash FlowДокумент2 страницыExamination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoОценок пока нет

- Chapter: Non-Current Assets and Depreciation Answers For Model QuestionДокумент4 страницыChapter: Non-Current Assets and Depreciation Answers For Model QuestionRAJIB HOSSAINОценок пока нет

- Solution Key To Problem Set 1Документ6 страницSolution Key To Problem Set 1Ayush RaiОценок пока нет

- Examination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash FlowДокумент3 страницыExamination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoОценок пока нет

- Huchapter 41 Statement of Cash Flows: Problem 41-1: True or FalseДокумент14 страницHuchapter 41 Statement of Cash Flows: Problem 41-1: True or FalseklairvaughnОценок пока нет

- Financial Accounting End TermДокумент6 страницFinancial Accounting End TermJohnny ProОценок пока нет

- Excel1 AccountingДокумент10 страницExcel1 AccountingJohnny ProОценок пока нет

- Problem 2-14 & 2-15Документ12 страницProblem 2-14 & 2-15Qudsiya KalhoroОценок пока нет

- CH23 - Transactional Approach and CFExercises and SolutionsДокумент6 страницCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehОценок пока нет

- Cash FlowsДокумент7 страницCash FlowsJasmine ActaОценок пока нет

- 01 ELMS Activity 3Документ2 страницы01 ELMS Activity 3Gonzaga FamОценок пока нет

- CashFlowStatement AssignmentДокумент15 страницCashFlowStatement AssignmentAnanta Vishain0% (1)

- Practice Set 1Документ6 страницPractice Set 1moreОценок пока нет

- Problem - 1: (A) WorkingsДокумент4 страницыProblem - 1: (A) Workingsashraf hossain saifОценок пока нет

- IA3 Engaging Activity, PT1 PT2 PT3 & QUIZДокумент8 страницIA3 Engaging Activity, PT1 PT2 PT3 & QUIZKaye Ann Abejuela RamosОценок пока нет

- Crystal Meadows of TahoeДокумент8 страницCrystal Meadows of TahoePrashuk Sethi100% (1)

- FA Practice 2 - QuestionsДокумент10 страницFA Practice 2 - QuestionsZhen WuОценок пока нет

- Bba 122 Fai 11 AnswerДокумент12 страницBba 122 Fai 11 AnswerTomi Wayne Malenga100% (1)

- Prob 8 SdftestvhsДокумент1 страницаProb 8 SdftestvhsAngelia TОценок пока нет

- Cash Flow Indirect and DirectДокумент2 страницыCash Flow Indirect and DirectKatherine Borja0% (1)

- The Hong Kong Polytechnic University Hong Kong Community CollegeДокумент6 страницThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithОценок пока нет

- Raine SДокумент6 страницRaine Sapi-664248097Оценок пока нет

- Tutorial 14 Introductory Accounting Teaching Assistant TeamДокумент2 страницыTutorial 14 Introductory Accounting Teaching Assistant TeamAris KurniawanОценок пока нет

- Equity Valuation: Models from Leading Investment BanksОт EverandEquity Valuation: Models from Leading Investment BanksJan ViebigОценок пока нет

- FATCA Self-Certification For Legal Entity Clients: Supporting Document For Plausibility Checks (V1.1)Документ8 страницFATCA Self-Certification For Legal Entity Clients: Supporting Document For Plausibility Checks (V1.1)DhavalОценок пока нет

- AFAR Quiz 2Документ3 страницыAFAR Quiz 2Philip LarozaОценок пока нет

- Notes - MARKETING - OF - FINANCIAL SERVICES - 2020Документ69 страницNotes - MARKETING - OF - FINANCIAL SERVICES - 2020Rozy SinghОценок пока нет

- Capital Structure: Aamer ShahzadДокумент52 страницыCapital Structure: Aamer Shahzadmaham qaiserОценок пока нет

- FinMan AssignmentДокумент11 страницFinMan AssignmentCzarise Krichelle Mendoza SosaОценок пока нет

- Dream Catcher Events Financial PlanДокумент10 страницDream Catcher Events Financial PlanPrince Jeffrey FernandoОценок пока нет

- Week 10 11 AssignmentДокумент4 страницыWeek 10 11 AssignmentAsdfghjkl LkjhgfdsaОценок пока нет

- Project Report On UnderwritingДокумент21 страницаProject Report On Underwritinganu251269% (13)

- Top Down Ebit Tax Rate Nopat 6600: Net Sales 100,000Документ2 страницыTop Down Ebit Tax Rate Nopat 6600: Net Sales 100,000Jayash KaushalОценок пока нет

- Sources and Uses of Funds Islamic BankДокумент2 страницыSources and Uses of Funds Islamic BankAkma AseriОценок пока нет

- Adani Case StudyДокумент35 страницAdani Case StudyGrim ReaperОценок пока нет

- Aviva 2012 Annual ReportДокумент280 страницAviva 2012 Annual ReportAviva GroupОценок пока нет

- Fundamentals of Financial Management Concise 8E: Eugene F. Brigham & Joel F. HoustonДокумент17 страницFundamentals of Financial Management Concise 8E: Eugene F. Brigham & Joel F. Houstondas413Оценок пока нет

- Module AkmenДокумент14 страницModule AkmenNeshaОценок пока нет

- Osage Farm Supply Had Poor Internal Control Over Its CashДокумент1 страницаOsage Farm Supply Had Poor Internal Control Over Its CashAmit PandeyОценок пока нет

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationДокумент6 страницEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaanОценок пока нет

- Byrd and Chens Canadian Tax Principles 2018 2019 1st Edition Byrd Test BankДокумент14 страницByrd and Chens Canadian Tax Principles 2018 2019 1st Edition Byrd Test BankDavidRobertsdszbc100% (9)

- BW ControversyДокумент4 страницыBW ControversyJenny RanilloОценок пока нет

- Aacounting For Musharakah FinancingДокумент12 страницAacounting For Musharakah Financingyiera ypienОценок пока нет

- Answer Any Four Questions. (4X6 24) : Time: 3 Hours Max. Marks:120Документ5 страницAnswer Any Four Questions. (4X6 24) : Time: 3 Hours Max. Marks:120hanumanthaiahgowdaОценок пока нет

- AA Assignment 1Документ2 страницыAA Assignment 1Vedvati PetkarОценок пока нет

- Lesson 4 - Types and Costs of Financial CapitalДокумент18 страницLesson 4 - Types and Costs of Financial CapitalChristel YeoОценок пока нет

- ACCA FR S20 NotesДокумент154 страницыACCA FR S20 NotesFuhad AhmedОценок пока нет

- Exercise 13 Statement of Cash Flows - 054924Документ2 страницыExercise 13 Statement of Cash Flows - 054924Hoyo VerseОценок пока нет

- 25 Taka Platforms Fy 2023-24Документ4 страницы25 Taka Platforms Fy 2023-24KOTHAPATNAM SACHIVALAYAMОценок пока нет

- Corporate Governance Tutorial Week 1 N 2Документ11 страницCorporate Governance Tutorial Week 1 N 2Faidhi RazakОценок пока нет

- Turnover TransmittalДокумент6 страницTurnover TransmittalDarwin LasinОценок пока нет

- Assign 3 - Sem 2 11-12 - RevisedДокумент5 страницAssign 3 - Sem 2 11-12 - RevisedNaly BergОценок пока нет

- Summary Group 09Документ2 страницыSummary Group 09Resan AhamedОценок пока нет

- Group Ariel StudentsДокумент8 страницGroup Ariel Studentsbaashii4Оценок пока нет