Академический Документы

Профессиональный Документы

Культура Документы

Depreciation Chart Use

Загружено:

Nitin JadhavИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Depreciation Chart Use

Загружено:

Nitin JadhavАвторское право:

Доступные форматы

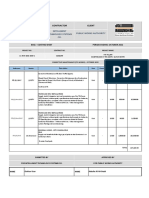

How to use depreciation rate chart:

Above table is very user-friendly and provide better navigation. You can search assets

in search box e.g. “furniture”, you will get depreciation rate of furniture. You can decide

to show 10, 25,50 or 100 rows at a time. You can take print out or take PDF version by

selecting 100 rows (for all entries) and clicking on respective option which is available at

the end of post. You can sort table.

ASSET BLOCK SUB ITEM RATE OF

ASSET TYPE

CLASS NUMBER NUMBER DEPRECIATION

Residential buildings except hotels and boarding

Building Block-01 i. 5%

houses

Other than Residential buildings (not covered in Block

Building Block-02 ii. 10%

No.1 and3)

Buiding acquired on or after 01st Sep,2002 for

installing PandM forming part of water supply project or

Building Block-03 i. water treatment systmen and which is put to use for 100%

the prupose of business of providing infrasturcture

facilities u/s 80-IA(4)(i)

Building Block-03 ii. Purely temporary erections such as wooden structures 100%

Furniture – Any furniture / fittings including electricals

Furniture Block-04 i. 10%

fittings

ASSET BLOCK SUB ITEM RATE OF

ASSET TYPE

CLASS NUMBER NUMBER DEPRECIATION

Plant and Motor cars other than thouse used in a business of

Block-05 i. 15%

Machinery running them on hire

Plant and

Block-05 ii. PandM other those covered in block no. 6 to 11 below. 15%

Machinery

Plant and Motor buses/taxies/lorries used in a business of

Block-06 i. 30%

Machinery running them on hire

Plant and

Block-06 ii. Moulds used in plastic and rubber factories 30%

Machinery

Plant and PandM used in semi conductor industry other than

Block-06 iii. 30%

Machinery those covered in Block no. 11 below

Must Read: Service Tax in Tally

Вам также может понравиться

- 4587 - 4167!3!2241 - 87 - Depreciation Rates As Per Income Tax 2012-13Документ2 страницы4587 - 4167!3!2241 - 87 - Depreciation Rates As Per Income Tax 2012-13saah007Оценок пока нет

- Notes - Income Under The Head Business or ProfessionДокумент4 страницыNotes - Income Under The Head Business or ProfessionSajan N ThomasОценок пока нет

- Annexure-5 (Benefits (A) )Документ3 страницыAnnexure-5 (Benefits (A) )SUMIT PODDARОценок пока нет

- II Rates of Depreciation (Applicable W.E.F. A.Y. 2006-07, Rate % I Buildings: (See Note 2) 5Документ2 страницыII Rates of Depreciation (Applicable W.E.F. A.Y. 2006-07, Rate % I Buildings: (See Note 2) 5sahitya493Оценок пока нет

- Income Tax Act For A.Y. 2010-11Документ2 страницыIncome Tax Act For A.Y. 2010-11sanjayedsОценок пока нет

- Depreciation Rates For AY 2017-18 As Per Income Tax Act, 1961Документ16 страницDepreciation Rates For AY 2017-18 As Per Income Tax Act, 1961NatarajОценок пока нет

- CA Inter PGBP Nov. 2020 PDFДокумент27 страницCA Inter PGBP Nov. 2020 PDFAmar SharmaОценок пока нет

- Depreciation RatesДокумент19 страницDepreciation Ratesmuthum44499335Оценок пока нет

- Depreciation Table: (See Rule 5)Документ5 страницDepreciation Table: (See Rule 5)Kailas NimbalkarОценок пока нет

- TM 5-4930-230-10-HR Tank and Pump UnitДокумент24 страницыTM 5-4930-230-10-HR Tank and Pump UnitAdvocateОценок пока нет

- Lecture 24 - 25Документ30 страницLecture 24 - 25Pankaj MahantaОценок пока нет

- Tendernotice 1Документ774 страницыTendernotice 1Hari Krishna RajuОценок пока нет

- I, P, S R: Vijay Kumar, George Bekey, Yuan ZhengДокумент8 страницI, P, S R: Vijay Kumar, George Bekey, Yuan ZhengVishal DhimanОценок пока нет

- Tariff Adv. Committee, Mumbai Sheet 31/03/01 1Документ16 страницTariff Adv. Committee, Mumbai Sheet 31/03/01 1khaleedsyedОценок пока нет

- Federal Register / Vol. 85, No. 20 / Thursday, January 30, 2020 / NoticesДокумент4 страницыFederal Register / Vol. 85, No. 20 / Thursday, January 30, 2020 / NoticesIndra MishraОценок пока нет

- Income Tax DepartmentДокумент19 страницIncome Tax DepartmentGizachew ZelekeОценок пока нет

- Depreciation Rates and Provisions As Per Companies Act 2013Документ9 страницDepreciation Rates and Provisions As Per Companies Act 2013hetalОценок пока нет

- SECTION 08 42 33 Revolving Door EntrancesДокумент14 страницSECTION 08 42 33 Revolving Door EntrancesJuanPaoloYbañezОценок пока нет

- Vindur Top Operating Manual PDFДокумент358 страницVindur Top Operating Manual PDFfarmasi rsbsaОценок пока нет

- PGBP - PrintДокумент50 страницPGBP - PrintKamalakar ParvathiОценок пока нет

- Industry 4.0 Revolution PowerPoint TemplatesДокумент81 страницаIndustry 4.0 Revolution PowerPoint TemplatesKruthika K CОценок пока нет

- J59C 7071 030 - SRF1 JIG (04.mar.2019)Документ16 страницJ59C 7071 030 - SRF1 JIG (04.mar.2019)Võ Trung HiếuОценок пока нет

- Chapter 3 - Industrial Building AllowanceДокумент13 страницChapter 3 - Industrial Building AllowanceNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)Оценок пока нет

- Chapter 3 - Industrial Building AllowanceДокумент13 страницChapter 3 - Industrial Building AllowanceNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)Оценок пока нет

- Ife Dvo 062022 0008 (Beta Building Quotation)Документ3 страницыIfe Dvo 062022 0008 (Beta Building Quotation)Rue PedrosoОценок пока нет

- Ooredoo DetailsДокумент5 страницOoredoo DetailsSameh سامح MaherОценок пока нет

- CCA TablesДокумент1 страницаCCA TablesGKОценок пока нет

- Depreciation Rates As Per Income Tax ActДокумент19 страницDepreciation Rates As Per Income Tax Actpankajadv67% (3)

- Rollers Scoring Sheet Misamis OrientalДокумент19 страницRollers Scoring Sheet Misamis Orientaljuan carlosОценок пока нет

- Capital AllowanceДокумент11 страницCapital Allowancemay leeОценок пока нет

- Depreciation Rates As Per Income Tax ActДокумент17 страницDepreciation Rates As Per Income Tax ActDaimi AitemadОценок пока нет

- Income Tax Department Dep AllДокумент18 страницIncome Tax Department Dep AllSHANTОценок пока нет

- 2013-04-28 IEC61850 Engineering ManualДокумент18 страниц2013-04-28 IEC61850 Engineering Manualfayssal salvadorОценок пока нет

- Final Guidelines ATL With Contact DetailsДокумент7 страницFinal Guidelines ATL With Contact DetailsshivendrakumarОценок пока нет

- Manual Servicio Linde t18 Modelo 360Документ53 страницыManual Servicio Linde t18 Modelo 360colive133% (3)

- BS6180 Test Report Q Railing Easy Glass View UK C PDFДокумент17 страницBS6180 Test Report Q Railing Easy Glass View UK C PDFMustafa NaesaОценок пока нет

- Zx240-3 Operator's ManualДокумент42 страницыZx240-3 Operator's ManualCayanan Mostiero John JoelОценок пока нет

- Disposal Land Rules 1979 Part2 FinalДокумент107 страницDisposal Land Rules 1979 Part2 Finalrg4281Оценок пока нет

- Industrial Profiles 2018 Bros enДокумент28 страницIndustrial Profiles 2018 Bros enBrcakОценок пока нет

- Annexure-A EoI - E2 - 1704778159Документ22 страницыAnnexure-A EoI - E2 - 1704778159MKTG THE SALEM AEROPARKОценок пока нет

- IBC2015 Egress CalculatorДокумент53 страницыIBC2015 Egress CalculatorAnonymous C2Scx5nkdK0% (1)

- Terminal Points & Exclusions: Section - Vii-EДокумент1 страницаTerminal Points & Exclusions: Section - Vii-EAnonymous 7ZYHilDОценок пока нет

- Ca Cia 3aДокумент8 страницCa Cia 3aSankalp KashyapОценок пока нет

- Structural Safety and Services: Chapter-5Документ33 страницыStructural Safety and Services: Chapter-5Mukesh Kumar ShankhwarОценок пока нет

- Costing Sheet-Oct 2022Документ2 страницыCosting Sheet-Oct 2022Hasan YousefОценок пока нет

- Rates of Depreciation As Per Income Tax Act For A.YДокумент11 страницRates of Depreciation As Per Income Tax Act For A.YAshish SalujaОценок пока нет

- (Micfil) Produkt ModularДокумент9 страниц(Micfil) Produkt ModularAbdulrahman Al HuribyОценок пока нет

- To Whom It May Concern: PentagonДокумент13 страницTo Whom It May Concern: PentagonSystems ManagerОценок пока нет

- Robot Different ApplicationsДокумент4 страницыRobot Different Applicationsdeepa82eceОценок пока нет

- Automate 10 - INGLES - V1Документ2 страницыAutomate 10 - INGLES - V1Andrés M. ReyesОценок пока нет

- Technical Service Bulletin: Manufacturer Machine Type Series Engine Model Job Order NoДокумент5 страницTechnical Service Bulletin: Manufacturer Machine Type Series Engine Model Job Order NoKhincho ayeОценок пока нет

- Depreciation RatesДокумент26 страницDepreciation RatesNatarajОценок пока нет

- Base Radio User Guide: 900 MHZ Ism BandДокумент49 страницBase Radio User Guide: 900 MHZ Ism BandHAROL ALEXIS VALENCIA OSPINAОценок пока нет

- Adminstration Block Lot 3 Blank Boq RevisedДокумент17 страницAdminstration Block Lot 3 Blank Boq RevisedChobwe Stephano KanyinjiОценок пока нет

- Fluor Daniel - GENERAL RECOMMENDATIONS FOR SPACINGДокумент7 страницFluor Daniel - GENERAL RECOMMENDATIONS FOR SPACINGharishcsharmaОценок пока нет

- Making Money With Drones, Drones in the Construction Industry. Second Edition.: Making money with drones, #1От EverandMaking Money With Drones, Drones in the Construction Industry. Second Edition.: Making money with drones, #1Оценок пока нет

- Understanding the Industrial Internet the $$$ Trillion Opportunities for Your EnterprisesОт EverandUnderstanding the Industrial Internet the $$$ Trillion Opportunities for Your EnterprisesОценок пока нет

- Laboratory Rules and SafetyДокумент2 страницыLaboratory Rules and SafetySamantha Tachtenberg100% (1)

- AILET Last 5 Year Question Papers Answer Key 2019 2023Документ196 страницAILET Last 5 Year Question Papers Answer Key 2019 2023Pranav SinghОценок пока нет

- Construction Cost Analysis in Residential SectorДокумент11 страницConstruction Cost Analysis in Residential SectorRishikesh MishraОценок пока нет

- Course Outline Atty. Joanne L. Ranada Negotiable Instruments Law First Semester, AY 2019 - 2020Документ12 страницCourse Outline Atty. Joanne L. Ranada Negotiable Instruments Law First Semester, AY 2019 - 2020Nica Cielo B. LibunaoОценок пока нет

- de Thi Chon HSG 8 - inДокумент4 страницыde Thi Chon HSG 8 - inPhương Chi NguyễnОценок пока нет

- Standard Chartered SWIFT CodesДокумент3 страницыStandard Chartered SWIFT Codeskhan 6090Оценок пока нет

- Od124222428139339000 4Документ2 страницыOd124222428139339000 4biren shahОценок пока нет

- Fees and ChecklistДокумент3 страницыFees and ChecklistAdenuga SantosОценок пока нет

- Case Studies Management 4 SamsungДокумент2 страницыCase Studies Management 4 Samsungdtk3000Оценок пока нет

- Q3 Las WK 2 - Applied EconomicsДокумент10 страницQ3 Las WK 2 - Applied Economicsmichelle ann luzon100% (1)

- Global Wealth Databook 2017Документ165 страницGlobal Wealth Databook 2017Derek ZОценок пока нет

- Important InformationДокумент193 страницыImportant InformationDharmendra KumarОценок пока нет

- Informal Sectors in The Economy: Pertinent IssuesДокумент145 страницInformal Sectors in The Economy: Pertinent IssuesshanОценок пока нет

- HI 5001 Accounting For Business DecisionsДокумент5 страницHI 5001 Accounting For Business Decisionsalka murarkaОценок пока нет

- HW2Документ6 страницHW2LiamОценок пока нет

- Phil Government Procument Policy BoardДокумент4 страницыPhil Government Procument Policy BoardRyan JD LimОценок пока нет

- Pye, D.-1968-The Nature and Art of WorkmanshipДокумент22 страницыPye, D.-1968-The Nature and Art of WorkmanshipecoaletОценок пока нет

- Tinashe Tagarira-Eureka Gold Mine-Geology ReportДокумент11 страницTinashe Tagarira-Eureka Gold Mine-Geology Reporttinashe tagariraОценок пока нет

- Textile Conv Belt - 4410-155R-QVM-Q-002-01 PDFДокумент10 страницTextile Conv Belt - 4410-155R-QVM-Q-002-01 PDFCaspian DattaОценок пока нет

- Introduction To Town PlanningДокумент17 страницIntroduction To Town PlanningKripansh Tyagi100% (1)

- The Pioneer 159 EnglishДокумент14 страницThe Pioneer 159 EnglishMuhammad AfzaalОценок пока нет

- In Re: Rnnkeepers Usa Trust. Debtors. - Chapter LL Case No. 10 13800 (SCC)Документ126 страницIn Re: Rnnkeepers Usa Trust. Debtors. - Chapter LL Case No. 10 13800 (SCC)Chapter 11 DocketsОценок пока нет

- Company Analysis - Applied Valuation by Rajat JhinganДокумент13 страницCompany Analysis - Applied Valuation by Rajat Jhinganrajat_marsОценок пока нет

- Metro Manila, Philippines: by Junio M RagragioДокумент21 страницаMetro Manila, Philippines: by Junio M RagragiofrancisОценок пока нет

- 9th CAMC - FIDFДокумент7 страниц9th CAMC - FIDFSankarMohanОценок пока нет

- Perkembangan Kebun Teh Danau Kembar Dari Tahun 2000 - 2017.Документ12 страницPerkembangan Kebun Teh Danau Kembar Dari Tahun 2000 - 2017.niaputriОценок пока нет

- CH 13 Measuring The EconomyДокумент33 страницыCH 13 Measuring The Economyapi-261761091Оценок пока нет

- 8 Trdln0610saudiДокумент40 страниц8 Trdln0610saudiJad SoaiОценок пока нет

- Pasamuros PTD 308 - PentairДокумент5 страницPasamuros PTD 308 - PentairJ Gabriel GomezОценок пока нет

- LiberalisationДокумент6 страницLiberalisationkadamabariОценок пока нет