Академический Документы

Профессиональный Документы

Культура Документы

Cash Items 1. Cash On Hand

Загружено:

Marjorie PagsinuhinИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cash Items 1. Cash On Hand

Загружено:

Marjorie PagsinuhinАвторское право:

Доступные форматы

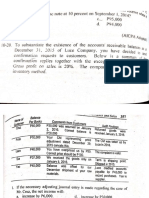

CASH ITEMS

1. Cash on hand

a. Bills and coins – paper bills, metal coins

b. Different checks

Customer’s check – received from customer

Travelers’ check – with security feature and signature

Manager’s check – issued by bank managers, guaranty

Cashier’s check – issued by bank cashiers

Company’s undelivered checks – to be delivered, as long as nasa kanila yung

check, cash parin yun ng company

Company’s Postdated checks – natanggap na ng mga may utang, di pa pwede

bayaran hangga’t di pa nadating yung date na nakasaad, part padin ng cash

balance ng company (customer may utang)

Company’s stale checks – tsekeng pambayad ng company kaso lumagpas sa due

date, kasama padin sa cash balance nila, hihingi ulit ng panibagong check ang

nagpapautang kapag babayaran na nung company

c. Bank Drafts – documents issued by company

d. Postal Money Orders – money na pinapadala thru post office

1. Cash in Bank

a. Savings Account – usual and regular na ipon, may interest

b. Checking account – may checkbook, parang tseke ganun galing sa bangko, maybibigay na

tseke sa pinag utangan tapos babayran thru account sa bank

c. Bank accounts in foreign currency – cash items na nasa foreign currency

2. Working fund

a. Petty Cash Fund – pambayad sa small expenses

b. Change fund – panukli ng cashier

c. Payroll fund – pangsweldo sa employees

d. Dividend fund – pambigay sa stockholders

e. Tax fund – pambayad sa tax

f. Interest fund – pambayad sa interest sa utang

SPECIFIC NON-CASH ITEMS (hindi pwede maconsider as cash)

1. Receivables – lahat ng receivables

a. Cash in closed banks

b. Customer’s postdated checks – company yung may utang

c. Customer’s NSF –

d. Customer’s stale checks – di pa nakukuha nung company on time

e. IOU (I Owe You) – utang ng employee sa company

2. Prepaid assets

a. Advances for employee travel

b. Postage stamps –

c. Supplies

3. Temporary investment

a. Trading security – share mo sa stock ng ibang company

4. Non-current Assets

a. Restricted Foreign Bank Accounts – di pwede mawithdraw

b. Bond Sinking Fund – payment of bonds payable na magmamature na

c. Plant Expansion/Acquisition Fund – pambayad ng PPE

d. Retirement Fund – para sa employees

e. Pension – para sa mga veterans

f. Contingent Funds – pang worst case scenario

5. Expenses

a. Expense Voucher – nagastos na gamit ang voucher

CASH MANAGEMENT

1. Segregation of Duties

a. Authorization – pang high level, para sa requisition orders

b. Custodian – may hawak ng pera

c. Recording – ginagawa ng mga accountant at bookkeeper

2. Imprest system –

3. Voucher system – kailangan ng authorization ng high level manager

4. Internal Audit at irregular intervals

Вам также может понравиться

- Estmt - 2016 07 08Документ10 страницEstmt - 2016 07 08Dennis Chen100% (1)

- Wynn ResortsДокумент54 страницыWynn ResortsSimone Trice100% (6)

- Cash and Cash Equivalents ReviewerДокумент4 страницыCash and Cash Equivalents ReviewerEileithyia KijimaОценок пока нет

- Cash and Cash Equivalent AuditingДокумент8 страницCash and Cash Equivalent Auditing수지Оценок пока нет

- Test Bank - Chapter13 Relevant CostingДокумент43 страницыTest Bank - Chapter13 Relevant CostingAiko E. Lara93% (14)

- Audit Sampling PlanДокумент2 страницыAudit Sampling PlanMarjorie PagsinuhinОценок пока нет

- Chapter 21 Intangible AssetsДокумент27 страницChapter 21 Intangible Assetsshelou_domantayОценок пока нет

- BS Real Estate Management 2016Документ2 страницыBS Real Estate Management 2016Marlo Aristorenas67% (3)

- Interest Rate Derivatives - A Beginner's Module CurriculumДокумент66 страницInterest Rate Derivatives - A Beginner's Module CurriculumPankaj Bhasin100% (1)

- CFAS - Bank ReconciliationДокумент5 страницCFAS - Bank ReconciliationAltessa Lyn ContigaОценок пока нет

- Funacc RebyuwerДокумент4 страницыFunacc RebyuwerBea ManalotoОценок пока нет

- This Study Resource Was: Nature and Composition of CashДокумент4 страницыThis Study Resource Was: Nature and Composition of CashJanna GunioОценок пока нет

- Nature and Composition of CashДокумент4 страницыNature and Composition of CashJanna GunioОценок пока нет

- Intermediate Accounting 1: Cash and Cash EquivalentДокумент17 страницIntermediate Accounting 1: Cash and Cash EquivalentClar AgramonОценок пока нет

- Cash and Cash EquivalentsДокумент5 страницCash and Cash Equivalentsco230435Оценок пока нет

- IC3 Internal Control in Transactions CyclesДокумент5 страницIC3 Internal Control in Transactions CyclesLimar DyОценок пока нет

- Reviewer Fundamentals of Accounting 2Документ3 страницыReviewer Fundamentals of Accounting 2Astro LunaОценок пока нет

- Ia1 Mod 1Документ9 страницIa1 Mod 1omssheshОценок пока нет

- ACC117 - NotesДокумент5 страницACC117 - NotesNenny CandyОценок пока нет

- 1 - Cash and Cash EquivalentsДокумент6 страниц1 - Cash and Cash EquivalentsPrincess Raniah AcmadОценок пока нет

- Accounting For Cash and Cash TransactionДокумент63 страницыAccounting For Cash and Cash TransactionAura Angela SeradaОценок пока нет

- Cash and Cash TransactionsДокумент61 страницаCash and Cash TransactionsLourdes EyoОценок пока нет

- Bank Reconciliation and Proof of CashДокумент2 страницыBank Reconciliation and Proof of CashDarwyn HonaОценок пока нет

- Cash and Cash EquivsДокумент7 страницCash and Cash EquivsVic BalmadridОценок пока нет

- ACC 102 - Cash and Cash EquivalentsДокумент4 страницыACC 102 - Cash and Cash Equivalentswerter werterОценок пока нет

- LeaP FABM2 Q3 Week4 Day 12Документ7 страницLeaP FABM2 Q3 Week4 Day 12Danna Marie EscalaОценок пока нет

- Audit of Cash Chapter 1Документ8 страницAudit of Cash Chapter 1SAN FELIPE Maria Czarina MontereseОценок пока нет

- Ap2904 Cash and Cash EquivalentsДокумент8 страницAp2904 Cash and Cash EquivalentsMa Yra YmataОценок пока нет

- Ap2904 Cash and Cash EquivalentsДокумент8 страницAp2904 Cash and Cash EquivalentsMa Yra YmataОценок пока нет

- FABM REVIEWER 2nd QUARTERДокумент5 страницFABM REVIEWER 2nd QUARTERMikaella Adriana GoОценок пока нет

- 01 Intermediate Accounting 1 PrelimДокумент7 страниц01 Intermediate Accounting 1 PrelimRoyu BreakerОценок пока нет

- 01 Cash & CE CompositionДокумент3 страницы01 Cash & CE Compositionsharielles /Оценок пока нет

- Statement of Financial Position and Comprehensive IncomeДокумент2 страницыStatement of Financial Position and Comprehensive Incomebuenaflorgladys11Оценок пока нет

- Cash and Cash EquivalentsДокумент12 страницCash and Cash EquivalentsbelliissiimmaaОценок пока нет

- and Highly Liquid Investment Readily Convertible Into CashДокумент3 страницыand Highly Liquid Investment Readily Convertible Into CashGirl Lang AkoОценок пока нет

- Cash and Cash EquivalentsДокумент5 страницCash and Cash EquivalentsErla PilapilОценок пока нет

- Substantive of Audit of Cash Audit Objectives For Cash BalancesДокумент6 страницSubstantive of Audit of Cash Audit Objectives For Cash BalancesMa Tiffany Gura RobleОценок пока нет

- Cash and Cash EquivalentsДокумент2 страницыCash and Cash EquivalentsMarieson Guillermo MandacОценок пока нет

- L1 - Cash and Cash EquivalentsДокумент5 страницL1 - Cash and Cash EquivalentsAshley BrevaОценок пока нет

- Intac Reviewer 2Документ10 страницIntac Reviewer 2rochelle lagmayОценок пока нет

- Cash and Cash EquivalentsДокумент10 страницCash and Cash EquivalentsMs VampireОценок пока нет

- Cash EquivalentДокумент8 страницCash EquivalentEyra MercadejasОценок пока нет

- Iv.-Cash and Cash EquivalentsДокумент4 страницыIv.-Cash and Cash Equivalentsby ScribdОценок пока нет

- Summary of Cash and Cash EquivalentsДокумент4 страницыSummary of Cash and Cash EquivalentsMhico Mateo100% (1)

- Cce Part1 Cash and Cash Equivalents CompressДокумент2 страницыCce Part1 Cash and Cash Equivalents CompressMARK JHEN SALANGОценок пока нет

- AP.2904 - Cash and Cash EquivalentsДокумент7 страницAP.2904 - Cash and Cash EquivalentsRОценок пока нет

- Audit of Cash and Cash Equivalents: Internal Control Measures For CashДокумент7 страницAudit of Cash and Cash Equivalents: Internal Control Measures For CashmoОценок пока нет

- LongquizДокумент2 страницыLongquizHarold AlcantaraОценок пока нет

- Cash and Cash EquivalentsДокумент9 страницCash and Cash EquivalentsJna MarieОценок пока нет

- Audit Problems FinalДокумент48 страницAudit Problems FinalShane TabunggaoОценок пока нет

- Audit ProblemsДокумент47 страницAudit ProblemsShane TabunggaoОценок пока нет

- Notes On Cash and Cash EquivalentsДокумент5 страницNotes On Cash and Cash EquivalentsLeonoramarie BernosОценок пока нет

- LECTURE NOTES - Aud ProbДокумент15 страницLECTURE NOTES - Aud ProbJean Ysrael Marquez100% (1)

- Topic 1 - Audit of Cash Transactions and BalancesДокумент6 страницTopic 1 - Audit of Cash Transactions and BalancesChelsea PagcaliwaganОценок пока нет

- INTACC - Chapter 1Документ4 страницыINTACC - Chapter 1MeriiiОценок пока нет

- Cce PrintДокумент1 страницаCce PrintkikoОценок пока нет

- Intacc 1 Notes Part 1Документ13 страницIntacc 1 Notes Part 1Crizelda BauyonОценок пока нет

- 1 Page Summary Internal ControlsДокумент2 страницы1 Page Summary Internal ControlsFahim zaibОценок пока нет

- FABM2 - Q1 - v1 Page 133 139Документ7 страницFABM2 - Q1 - v1 Page 133 139Kate thilyОценок пока нет

- Ia1 NotesДокумент23 страницыIa1 NotesAssej C AustriaОценок пока нет

- Intacc 1Документ3 страницыIntacc 1Prescilla Dela SernaОценок пока нет

- Accounting Policy - Cash Receipts and Bounced ChecksДокумент13 страницAccounting Policy - Cash Receipts and Bounced ChecksneilОценок пока нет

- Fundmanagement 150509075339 Lva1 App6892Документ21 страницаFundmanagement 150509075339 Lva1 App6892NILA CAYA TRINIDADОценок пока нет

- Negotiable Instruments Assignment 2Документ4 страницыNegotiable Instruments Assignment 2Christine Joy OriginalОценок пока нет

- Chapter 1 Cash and Cash EquivalentsДокумент10 страницChapter 1 Cash and Cash EquivalentsNicka NavarroОценок пока нет

- Chapter 12 Testbank CapBud PDFДокумент58 страницChapter 12 Testbank CapBud PDFMarjorie PagsinuhinОценок пока нет

- CPAR FringeДокумент6 страницCPAR FringeMarjorie PagsinuhinОценок пока нет

- Pagsinuhin, Marjorie Act. 4 AudSPIДокумент2 страницыPagsinuhin, Marjorie Act. 4 AudSPIMarjorie PagsinuhinОценок пока нет

- IACFMAS-ASSIGN MarjДокумент4 страницыIACFMAS-ASSIGN MarjMarjorie PagsinuhinОценок пока нет

- Pagsinuhin, Marjorie Act. 3 AudSPIДокумент2 страницыPagsinuhin, Marjorie Act. 3 AudSPIMarjorie PagsinuhinОценок пока нет

- Dayag CH 10Документ10 страницDayag CH 10Marjorie PagsinuhinОценок пока нет

- ONLINE CHESS TOURNAMENT GuidelinesДокумент1 страницаONLINE CHESS TOURNAMENT GuidelinesMarjorie PagsinuhinОценок пока нет

- Activity ReceivablesДокумент6 страницActivity ReceivablesMarjorie PagsinuhinОценок пока нет

- Berk Prob AnswersДокумент7 страницBerk Prob AnswersMarjorie PagsinuhinОценок пока нет

- Reaction Paper PagsinuhinДокумент1 страницаReaction Paper PagsinuhinMarjorie PagsinuhinОценок пока нет

- Pagsinuhin Reaction Paper - Dirty Money 46234Документ2 страницыPagsinuhin Reaction Paper - Dirty Money 46234Marjorie PagsinuhinОценок пока нет

- This Is The New NormalДокумент2 страницыThis Is The New NormalMarjorie PagsinuhinОценок пока нет

- Pagsinuhin Long Association ActivityДокумент2 страницыPagsinuhin Long Association ActivityMarjorie PagsinuhinОценок пока нет

- Money Banking and Financial Markets 4th Edition Cecchetti Solutions ManualДокумент15 страницMoney Banking and Financial Markets 4th Edition Cecchetti Solutions Manualsamsondorothyuu2100% (26)

- Internal Control Internal Audit Internal Checks by Good PDFДокумент8 страницInternal Control Internal Audit Internal Checks by Good PDFpnditdeepak786Оценок пока нет

- Accounting Nov 2010 Eng PDFДокумент21 страницаAccounting Nov 2010 Eng PDFHeinrich DanielsОценок пока нет

- Reviewer From Prelim To FinalsДокумент324 страницыReviewer From Prelim To FinalsRina Mae Sismar Lawi-an100% (1)

- Seminar 7 N1591 - MCK Chaps 14 & 20 QuestionsДокумент4 страницыSeminar 7 N1591 - MCK Chaps 14 & 20 QuestionsMandeep SОценок пока нет

- Request ListДокумент21 страницаRequest ListHadi SumartonoОценок пока нет

- Chapter 1 SolutionsДокумент53 страницыChapter 1 SolutionsMarwan YasserОценок пока нет

- Jose Maria College College of Business Education: Audit TheoryДокумент10 страницJose Maria College College of Business Education: Audit TheoryMendoza Ron NixonОценок пока нет

- Kinds of ProspectusДокумент5 страницKinds of ProspectusPriya KumariОценок пока нет

- Evolution of Monetary Policy in India Early PhaseДокумент15 страницEvolution of Monetary Policy in India Early PhaseNitesh kuraheОценок пока нет

- Chapter 16Документ11 страницChapter 16Aarti J50% (2)

- Assignment Nicmar / Code OfficeДокумент8 страницAssignment Nicmar / Code OfficeRevanth KumarОценок пока нет

- Greek CrisisДокумент3 страницыGreek CrisisΕυα ΕυαОценок пока нет

- Franchise AccountingДокумент17 страницFranchise AccountingCha EsguerraОценок пока нет

- Responsibilityaccounting 160428005250Документ16 страницResponsibilityaccounting 160428005250RajanSharmaОценок пока нет

- Evaluation CriteriaДокумент6 страницEvaluation Criteriabahaman417Оценок пока нет

- Economy India EnglishДокумент76 страницEconomy India EnglishSudama Kumar BarailyОценок пока нет

- Change Management@iciciДокумент3 страницыChange Management@icicisanthiya balaraman100% (1)

- m339w Sample ThreeДокумент8 страницm339w Sample ThreeMerliza JusayanОценок пока нет

- Bsda FormДокумент1 страницаBsda FormGayathriSureshОценок пока нет

- Develop Understanding of TaxationДокумент14 страницDevelop Understanding of Taxationnatanme794Оценок пока нет

- MFiN HkustДокумент26 страницMFiN Hkustjackson510024Оценок пока нет

- Credit Eda Case Study: Aparna Trivedi Ashish Nipane DS C29Документ13 страницCredit Eda Case Study: Aparna Trivedi Ashish Nipane DS C29aparnaОценок пока нет

- George Soros, S SecretsДокумент21 страницаGeorge Soros, S Secretscorneliusflavius7132Оценок пока нет

- Pooja: Sugam Darshan: Token DetailДокумент1 страницаPooja: Sugam Darshan: Token Detailmind linesОценок пока нет