Академический Документы

Профессиональный Документы

Культура Документы

Cajournal August18 17

Загружено:

Himanshu GaurОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cajournal August18 17

Загружено:

Himanshu GaurАвторское право:

Доступные форматы

Ind AS Implementation

258

Indian Accounting Standard (Ind AS) 115,

Revenue from Contracts with Customers

Fe

India had the unique opportunity to early adopt Ind AS 115 as compared to rest of world.

Nonetheless, entities will have to once again undergo the process of unlearning and relearning.

The five step model is robust and would serve as a useful compass for all types of transactions

in the new digital era. The new challenges which would emerge due to the new standard would

have to be addressed over a period of time (issue which were resolved under old standard may

resurface under the new standard). However consistency, uniformity, transparency and detailed

guidance for accounting revenue in case of complex transaction would outweigh the difficulties.

The impact of accounting on transition to new standard under Income tax law could be an

additional challenge which Corporate India will have to deal with. Application of Ind AS 115

will require new as well as different thinking! Read on to know more…

Overview

Considering the need to converge on one of the

most significant pillar of financial statement,

‘Revenue’, IASB and FASB after more than a

decade of joint work in May 2014 issued converged Av

guidance on recognizing revenue in contracts with On

CA. Sandeep Shah and customers. The IASB titled the standard as ‘IFRS

CA. Milan Mody

15- Revenue from Contracts with Customers’ and

(The authors are members of the

Institute. They can be reached at FASB also titled it ‘Revenue from Contracts with

milanmody23@gmail.com) Customers (Topic 606)’.

54 THE CHARTERED ACCOUNTANT AUGUST 2018 www.icai.org

Portfolio Management

and Accounting Software

Capital Gains with Grandfathering Simplified

Featured in Featured on Over 150,000+

Downloads

§ Manage Stocks, MFs, Bonds, FDs, Insurance, ULIPs,

F&O and Other Assets

§ Import contract notes, mutual fund and bank

statements from over 3,000+ sources

§ Capital gains reports for Stocks, Bonds, Equity &

Debt MFs (with or without indexation)

§ Detailed long-term capital gains reports for stocks &

equity mutual funds with PP, FMV and CA as per

grandfathering clause

§ Simplified Accounting with Bank Import and auto

generated vouchers from Portfolio Management

§ Other reports such as Annualised Returns (XIRR),

Income Reports, Trial Balance, P&L and Balance

Sheet

§ Auto price updates and historical prices

Available

Online @

MProfit Software Pvt. Ltd. | Nariman Point, Mumbai

022-4002-4149 | www.mprofit.in

Ind AS Implementation

260

Ind AS 115 which is aligned to IFRS 15 was notified Reasons for issuing the new standard on

by MCA on 28th March, 2018 & is applicable Revenue:

for accounting periods beginning on or after a. remove inconsistencies and weakness in existing

1st April, 2018. revenue recognition guidelines

b. improve comparability of revenue recognition

Ind AS 115 & IFRS 15 replaces the following

practices across entities, jurisdictions and capital

standards and interpretations :

markets

Indian Accounting Standard Title IFRS

Ind AS 18 Revenue IAS 18

Ind AS 18 Guidance note on accounting for Real Estate Transactions IFRIC 15

(note 1)

Appendix A to Ind AS 18 Revenue-xxx Barter Transactions involving Advertising SIC 31

services

Appendix B to Ind AS 18 Customer Loyalty Programmes IFRIC 13

Appendix C to Ind AS 18 Transfer of Assets from Customers IFRIC 18

Ind AS 11 Construction Contracts IAS 11

Note 1 - Guidance note withdrawn by ICAI in

terms of announcement dated 1st June, 2018. Ind AS 115 provides more guidance for deciding

whether revenue is recognised at a point in time or

Note 2 - Service Concession Arrangement & over time. It also provides new and more detailed

disclosures which was part of Ind AS 11 (Appendix guidance on specific topics such as multiple element

A & B) will now be part of Ind AS 115 (Appendix arrangements, variable consideration, contract

D & E). modification, price allocation,

warranties, licensing, etc.

Comparison with Ind AS 18/11 & Ind AS 115

Ind AS 18/11 Ind AS 115

Separate models for: Single model for performance obligations

Construction contracts Satisfied over time

Goods Satisfied at a point in time

Services

Focus on risks and rewards Focus on control

Limited guidance on: More guidance on:

Multiple element arrangements Separating elements

Variable considerations Allocating the transaction price

Licenses Variable consideration

Licenses

Options

Repurchase arrangements

Revenue measured at the fair value of the Consideration measured as the amount the entity

consideration received or receivable. expects to be entitled to.

Contract Revenue-initial amount & variations in Transaction price including variable

contract work. consideration.

Limited disclosure under Ind AS 18. Sufficient disclosure to understand the nature,

amount, timing and uncertainty of revenue and

cash flows arising from contracts.

56 THE CHARTERED ACCOUNTANT AUGUST 2018 www.icai.org

Ind AS Implementation

262

c. provide more useful information to users also provides requirements for the accounting for

of financial statements through improved contract modifications.

disclosure requirements Step 2: Identify performance obligations in

d. provide a single comprehensive framework Contract

to recognize revenue from customers A contract includes promises to transfer goods or

∙ Ind AS 115 provides more guidance for services to a customer. If those goods or services are

deciding whether revenue is recognised at distinct, the promises are performance obligations

a point in time or over time. It also provides and are accounted for separately. A good or services

new and more detailed guidance on specific is distinct if the customer can benefit from the

topics such as multiple element arrangements, good or service on its own or together with other

variable consideration, contract modification, resources that are readily available to the customer

price allocation, warranties, licensing, etc. and the entity’s promise to transfer the good or

service to the customer is separately identifiable

Scope: from other promises in the contract.

∙ The new revenue model would apply to all Step 3: Determine transaction price

contracts with customers except Leases,

Insurance contracts, Financial Instruments The transaction price is the amount of consideration

including those covered by Consolidated (for example, payment) to which an entity expects

Financial Statements/ Joint Arrangements/ to be entitled in exchange for transferring promised

Separate Financial Statements/ Investments goods or services to a customer, excluding amounts

in Associates and Joint Ventures and non- collected on behalf of third parties (for e.g. Goods

monetary exchange between entities in same and Service Tax).

business line to facilitate sales to customers or The transaction price can be fixed amount of

potential customers. Extraction of mineral ore customer consideration, but it may sometimes

will be covered as this is not specifically scoped include variable consideration or consideration in

out. a form other than cash.

∙ In case a contract which is partially within the Step 4: Allocate the transaction price to the

scope of Ind AS 115 & another standard, in performance obligations in the contract

case the other standard specify how to separate An entity typically allocates the transaction price

or measure one or more parts of the contracts, to each performance obligation on the basis of

then an entity shall first apply requirement of the relative stand-alone selling prices of each

that standard and in absence thereof, Ind AS distinct good or services promised in the contract.

115 will be applied. If a stand-alone price is not observable, an entity

Five- step model-heart of the standard: estimates it. Various methods that may be used,

including:

Step by step guidance on when, how and how much

should the revenue be recognised: ∙ Adjusted market assessment approach

∙ Expected cost plus a margin approach

Step 1: Identify Contract(s) with a customer

∙ Residual approach (only permissible in

A contract is an agreement between two or limited circumstances)

more parties that creates enforceable rights and

obligations and which has been agreed upon Step 5: Recognise revenue when (or as) the

with a customer and meets specified criteria. entity satisfies a performance obligation

The contract could be oral or written or based on An entity recognises revenue when it satisfies

customary industry practise. In some cases, Ind a performance obligation by transferring a

AS 115 requires an entity to combine contracts promised good or services to a customer (When

& account for them as one contract. Ind AS 115 customer obtains control of that good or service).

58 THE CHARTERED ACCOUNTANT AUGUST 2018 www.icai.org

Ind AS Implementation

264

A performance obligation may be satisfied at a point Incremental costs to obtain a contract

in time or over time. For performance obligations These are the incremental costs to obtain a contract

satisfied over time, an entity recognises revenue & would not have been incurred if the contract

over time by selecting an appropriate method for was not obtained- example sales commission. Such

measuring the entity’s progress towards complete costs are not expensed in profit or loss as incurred

satisfaction of that performance obligations. but are recognized as a Contract asset provided

New and important terms / concepts they are expected to be recovered. For contract

Recognition of revenue at a point in time duration below 12 months as a practical expedient,

or over time such costs can be treated as expense.

The entity will recognize a revenue over time if any Costs to fulfil a contract

of the following criteria are met: Costs incurred to fulfil a contract with a customer

∙ The customer receives and consumes the are not within the scope of another standard are

benefits of the seller’s performance as the recognised as an asset only if all the following

seller performs criteria are met:

∙ The seller creating a work in progress asset a. Costs are directly related to contract

which is controlled by the customer b. Costs generate or enhance resources that will

∙ The seller creating a work in progress asset be used to satisfy performance obligations in

which could not be directed to a different future

customer and in respect of which the c. The entity expects to recover the cost

customer has an obligation to pay for the Examples: Direct labour, direct materials,

entity’s work to date payments to subcontractors, etc.

Over a period of time is somewhat akin to Contract Modifications

percentage of work completed method (POCM)

under the erstwhile Ind AS 11 Construction A contract modification is a change in the scope or

contracts and the Guidance Note on Accounting price (or both) that is approved by the contracting

for Real Estate Transactions. parties & can be accounted as a separate contract

provide both of the conditions are met:

An entity will recognise a revenue at a point in time

for performance obligations that do not meet the ∙ The scope of the contract increases because

criteria for recognition of revenue over time. of the addition of promised goods or services

that are distinct

Factors which may indicate that control is passed

at a point in time include, but are not limited to: ∙ Price of the contract increases by an amount

of consideration that reflects the entity’s

∙ The entity has a present right to payment for stand-alone selling price of the additional

the asset; goods or services & any other adjustments

∙ The customer has legal title to the asset;

E-commerce market place where bundle of

∙ The entity has transferred physical possession products on on-going basis are added to the

of the asset; contract and prices of existing/new products are

∙ The customer has significant risks and rewards not always on standalone price, the revenue per

related to the ownership of the asset; and product (balance of original and new products/

∙ The customer has accepted the asset. quantities) will have to be determined carefully.

Contract Cost Repurchase agreements

Ind AS 115 provides a guidance about two types A repurchase agreement is a contract in which an

of costs related to the contract, namely cost to entity sells an asset and also promises or has the

obtain the contract and cost to fulfil the contract option (either in the same contract or in another

60 THE CHARTERED ACCOUNTANT AUGUST 2018 www.icai.org

Ind AS Implementation

266

contract) to repurchase the asset. The repurchased ∙ The most likely amount ( where there are

asset may be the asset that was originally sold to few amounts to consider)

the customer, an asset that is substantially the same Constraining estimate : include variable

as that asset, or another asset of which the asset consideration only to the extent that it is highly

that was originally sold is a component. probable that a significant reversal in the amount

of cumulative revenue recognised will not occur

when the uncertainty associated with the variable

Non-refundable upfront fees includes additional fees consideration is subsequently resolved.

charged at (or near) the inception of the contract

(e.g. joining fees, activation fees, set-up fees etc.). Warranties

Treatment depends on whether the fee relates to Assurance type (apply Ind AS 37) :

the transfer of goods or services to the customer at

inception. In most of the cases, it would be enabler for ∙ An assurance to the customer that the good

provision for future supply of goods and services and or service will function as specified

hence will be treated as advance payment. ∙ The customer cannot purchase this warranty

separately from the entity

Service type (accounted for separately in

Repurchase agreements generally come in three accordance with Ind AS 115) :

forms:

∙ A service is provided in addition to an

∙ an entity’s obligation to repurchase the asset assurance to the customer that the good or

(a forward) service will function as specified

∙ an entity’s right to repurchase the asset (a ∙ This applies regardless of whether the

call option) customer is able to purchase this warranty

∙ an entity’s obligation to repurchase the asset separately from the entity

at the customer’s request (a put option) In determining the classification (or part thereof)

Under all the scenarios detailed accounting of a warranty, an entity considers:

guidance is provided as to whether the transaction

Legal requirements: warranties required by

is to be accounted as (a) Lease transaction, (b)

law are usually assurance

financing arrangement or (c) sale of product with

type

a right to return.

Length: longer the length of

Variable considerations coverage, more likely

If the consideration promised in a contract additional services are

includes a variable amount, an entity shall estimate being provided

the amount of consideration (subject to constraint) Nature of tasks: do they provide a service

to which the entity will be entitled in exchange for or are they related to

transferring the promised goods or services to a assurance

customer.

Non-refundable upfront fees

Examples: Discounts, rebates, refunds, credits,

Includes additional fees charged at (or near)

incentives, performance bonuses, penalties, etc.

the inception of the contract (e.g. joining fees,

An entity shall estimate an amount of variable activation fees, set-up fees etc.). Treatment

consideration by using either of the following depends on whether the fee relates to the transfer

methods : of goods or services to the customer at inception. In

∙ The expected value based on probability most of the cases, it would be enabler for provision

weighted amounts within a range (i.e. for for future supply of goods and services and hence

large number of similar contracts) will be treated as advance payment. The revenue

62 THE CHARTERED ACCOUNTANT AUGUST 2018 www.icai.org

Ind AS Implementation

267

recognition period may in some cases be longer Impact on bottom-line due to changes in

than the contractual period if the customer has guidance on top line

a right to, and is reasonably expected to, extend/ ∙ It is difficult to conclude whether revenue

renew the contract. would be accelerated or postponed, each

Licensing (of an entity’s intellectual industry will have different impact.

property (IP)) ∙ Due to combining of contracts, revenue

would be deferred, but due to separating of

Ind AS 115 includes specific guidance on performance obligations, the revenue may

accounting for Licences & whether it is distinct be recognised earlier.

from other goods or services or not.

∙ For real estate the impact has been elaborated

below in the section on challenges

The new standards focus on qualitative and ∙ For software, telecom and construction

quantitative disclosures. The disclosure companies the impact would be significant

requirements are more exhaustive but at the same on certain specific nature of transactions.

time the standard requires a balance between too ∙ Incremental cost to acquire a contract being

much information and too little information. The

objective of the disclosure requirements in the new accounted as an asset as opposed to expense

standards is to provide “sufficient information to will improve the net result position.

enable users of financial statements to understand ∙ Given the pervasive nature of the impact

the nature, amount, timing and uncertainty of of the standard, in addition to the financial

revenue and cash flows arising from contracts with

customers.”

reporting impact, companies would also

have to assess impact on business contracts

and processes, as well as the needs of

Other items: stakeholders such as investors and analysts.

This article deals with only few of the topics Presentation and disclosures

and not with application concerning specific The new standards focus on qualitative and

conditions and situations. Considering that quantitative disclosures. The disclosure

Ind AS 11 & Ind AS 18 are being combined requirements are more exhaustive but at the same

into single standard, Ind AS 115 also lays time the standard requires a balance between too

down principles as to whether Goods and much information and too little information.

Services will constitute distinct contract or

The objective of the disclosure requirements in the

single performance obligation. In particular

new standards is to provide “sufficient information

Engineering, Procurement, Construction and/

to enable users of financial statements to understand

or Management (EPC or EPCM), Hospitality

the nature, amount, timing and uncertainty of

(wedding function wherein rooms, function

revenue and cash flows arising from contracts with

areas & other services are provided), Telecom

customers.” To achieve that objective, entities are

/ IT & IT enabled industry, Engineering

required to provide disclosures about its contracts

companies in supply of capital goods with

with customers, the significant judgements and

extensive integration into existing facilities will

changes in those judgements used in applying the

have to reassess / analyse the ongoing contracts

standards and assets arising from costs to obtain

in light of the principles enunciated. Once

and fulfil its contract.

having analysed, each component will also have

to be tested whether the performance obligation Transition

is satisfied at a point in time or over time. There An entity can elect to adopt the new standard

can be various combination in a single contract retrospectively with or without optional practical

and price allocation to each of the component expedient or through cumulative effect adjustment

will have to be determined. on the date of initial application i.e. 01st April, 2018

www.icai.org THE CHARTERED ACCOUNTANT AUGUST 2018 63

Ind AS Implementation

268

Contract Period Full retrospective approach Cumulative effect approach

A 01st April, 2017- Begins and ends in same financial Contract completed on or

31st March, 2018 year and completed before the date of before the date of initial

initial application – Practical expedient application- Do not apply

available

B Begins in 01st April, Adjust opening balance of each affected Contract completed on or

2015 and ends on component of equity for the earlier prior before the date of initial

31st March, 2018 period presented (01st April, 2017) application- Do not apply

C Begins in 01st April, Adjust opening balance of each affected Adjust opening balance of

2015 and ends on component of equity for the earlier prior each affected component

31st March, 2020 period presented (01st April, 2018) of equity at date of initial

application (01st April, 2018).

Also disclosures are required.

Challenges ∙ Determination, allocation & re-assessment

of transaction price including non-cash

∙ Where an entity concludes that revenue consideration by customer at fair value,

should be recognised over time, it will need to variable consideration taking into account

consider how to measure progress towards various factors. In Retail, wholesale and

complete satisfaction of performance distribution sector, it is common for

obligations. (Measure of progress excludes warranties to include both elements

any goods or services for which control is i.e. assure the quality of the product and

not transferred to customers). Measure provide a free maintenance plan. In such

of progress and percentage of revenue cases judgement will be needed in order

to be recognised may be affected in case to determine how to allocate transaction

of real estate sector which hitherto was price to a product and service in a

based on Guidance Note on Real Estate reasonable manner.

Transaction. In absence of bright line test, ∙ In cases where the amounts collected (non-

judgement will be applied and in specific refundable or otherwise) were treated

para 44 and 45 relating to reasonable as a liability since conditions of revenue

measure of progress will need to be recognition were not met earlier, will have

applied. to be reassessed on continuous basis for

∙ Whether a contract modification determining whether the conditions of

should be accounted for prospectively para 9 have been met subsequently or not

or retrospectively & how to account of

variable consideration not recognised

earlier due to constraint.

∙ Whether to capitalise certain costs,

distinguishing between those costs

associated with obtaining contract

(e.g. sales commission) and those costs

associated with fulfilling a contract. E.g.

Bid costs incurred prior to contract being

awarded.

64 THE CHARTERED ACCOUNTANT AUGUST 2018 www.icai.org

Ind AS Implementation

269

or one of the event specified in para 15

has occurred i.e. (i) no further obligation

remaining & whole or substantially whole

of promised consideration received and

that amount is no longer refundable or (2)

contract is terminated and consideration

received is non-refundable. What

constitutes termination of contract will

have to be assessed in light of the principles

enunciated under contract law or under

the terms of the contract before the entity

can conclude that condition of para 15(b)

are met.

∙ To build in comprehensive Revenue

recognition test module in the software

which amongst various items includes

nature of contract verbal, written or

customary practice, rights of each parties,

payments terms clearly identified, whether

contract has commercial substance,

collection probability test, how variable

consideration is dealt with, whether

contract contains multiple performance

obligation /deliverable elements including

whether goods and services promised are

distinct or not, treatment in case contract

is modified, performance obligation

whether met at a point in time or over

time, when control is deemed to have been

passed, information for compliance with

disclosures etc

Conclusion

With the challenges come the opportunity, the new

standard has articulated in detail the accounting

for several type and nature of transaction &

also provides the much needed clarity to avoid

ambiguity/diversity while dealing with complex

situation and cases where there are multiple

elements. In nutshell, the standard continues to

propagate prudence apart from other qualitative

principles whether during course of recognising

revenue or whilst entering into commercial

contracts. n

www.icai.org THE CHARTERED ACCOUNTANT AUGUST 2018 65

Better than a thousand hollow words, is one word that brings peace - Buddha

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- A Man Found A Cocoon of A ButterflyДокумент2 страницыA Man Found A Cocoon of A ButterflyHimanshu GaurОценок пока нет

- An Old Man Had Three SonsДокумент2 страницыAn Old Man Had Three SonsHimanshu Gaur0% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- I Woke One Morning and Realized Something AmazingДокумент2 страницыI Woke One Morning and Realized Something AmazingHimanshu GaurОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- This Short Story The Brahmin and His Enemies Is Quite Interesting To All The PeopleДокумент2 страницыThis Short Story The Brahmin and His Enemies Is Quite Interesting To All The PeopleHimanshu Gaur100% (1)

- This Short Story The Clever Crow Is Quite Interesting To All The PeopleДокумент3 страницыThis Short Story The Clever Crow Is Quite Interesting To All The PeopleHimanshu GaurОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- This Short Story The Arrogant Swans Is Quite Interesting To All The PeopleДокумент2 страницыThis Short Story The Arrogant Swans Is Quite Interesting To All The PeopleHimanshu GaurОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- This Short Story The Bonded Donkey Is Quite Interesting To All The PeopleДокумент2 страницыThis Short Story The Bonded Donkey Is Quite Interesting To All The PeopleHimanshu GaurОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- This Short Story Reward For Bravery Is Quite Interesting To All The PeopleДокумент3 страницыThis Short Story Reward For Bravery Is Quite Interesting To All The PeopleHimanshu Gaur100% (1)

- Tenali Raman and His Wife Were Going To A FriendДокумент3 страницыTenali Raman and His Wife Were Going To A FriendHimanshu GaurОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Jessica Was An Intelligent GirlДокумент3 страницыJessica Was An Intelligent GirlHimanshu GaurОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Two Friends Were Walking Through The DesertДокумент2 страницыTwo Friends Were Walking Through The DesertHimanshu GaurОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- One Stormy Night Many Years AgoДокумент3 страницыOne Stormy Night Many Years AgoHimanshu GaurОценок пока нет

- Two Twin Boys Were Raised by An Alcoholic FatherДокумент2 страницыTwo Twin Boys Were Raised by An Alcoholic FatherHimanshu GaurОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- He Pushed His Wife To Save Himself From A Sinking Cruise ShipДокумент2 страницыHe Pushed His Wife To Save Himself From A Sinking Cruise ShipHimanshu GaurОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Once Upon A Time There Was A Huge Apple TreeДокумент2 страницыOnce Upon A Time There Was A Huge Apple TreeHimanshu GaurОценок пока нет

- Once Up A Time There Were Three MonkeysДокумент5 страницOnce Up A Time There Were Three MonkeysHimanshu GaurОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Malar Lived at Keeranur Village in Pudukottai District With Her FamilyДокумент2 страницыMalar Lived at Keeranur Village in Pudukottai District With Her FamilyHimanshu GaurОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- A Short Story: Foolish ImitationДокумент1 страницаA Short Story: Foolish ImitationHimanshu GaurОценок пока нет

- This Short Story Hercules Is Quite Interesting To All The PeopleДокумент2 страницыThis Short Story Hercules Is Quite Interesting To All The PeopleHimanshu GaurОценок пока нет

- The Cab Driver Picked Up His Passenger in The Dead of The NightДокумент3 страницыThe Cab Driver Picked Up His Passenger in The Dead of The NightHimanshu GaurОценок пока нет

- Improve Observation, Perception and Expression With MeditationДокумент2 страницыImprove Observation, Perception and Expression With MeditationHimanshu GaurОценок пока нет

- This Brought Me To TearsДокумент1 страницаThis Brought Me To TearsHimanshu GaurОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- A Man Who Was The Lone Survivor of A Terrible Shipwreck Was Washed Ashore On A Tiny Uninhabited IslandДокумент1 страницаA Man Who Was The Lone Survivor of A Terrible Shipwreck Was Washed Ashore On A Tiny Uninhabited IslandHimanshu GaurОценок пока нет

- One of The Greatest Challenges in Life Is Being Yourself in A World ThatДокумент2 страницыOne of The Greatest Challenges in Life Is Being Yourself in A World ThatHimanshu GaurОценок пока нет

- This Short Story Children Are Wiser Than Elders Is Quite Interesting To All The PeopleДокумент2 страницыThis Short Story Children Are Wiser Than Elders Is Quite Interesting To All The PeopleHimanshu GaurОценок пока нет

- It Was A Bright and Sunny MorningДокумент3 страницыIt Was A Bright and Sunny MorningHimanshu GaurОценок пока нет

- To DoДокумент30 страницTo Doray_baller_feltonОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- FitchДокумент9 страницFitchTiso Blackstar Group100% (1)

- Silabus Cgc. FixДокумент5 страницSilabus Cgc. FixTeguh PurnamaОценок пока нет

- BNV6200 - Individual Honors Project - Research Proposal - Coursework 01 - 22212876Документ52 страницыBNV6200 - Individual Honors Project - Research Proposal - Coursework 01 - 22212876Ahmed Ansaf100% (1)

- INSURANCE SECTOR PPT PPT Final PresentationДокумент35 страницINSURANCE SECTOR PPT PPT Final PresentationAdarsh KumarОценок пока нет

- E Payment FormДокумент1 страницаE Payment Formalienz909Оценок пока нет

- Managing Risks of Internet Banking - PresentationДокумент32 страницыManaging Risks of Internet Banking - PresentationK T A Priam KasturiratnaОценок пока нет

- Gsis 101Документ88 страницGsis 101Gayle AbayaОценок пока нет

- InventДокумент172 страницыInventSafianu Abbas Abdul-RaheemОценок пока нет

- PDFДокумент1 351 страницаPDFChapter 11 DocketsОценок пока нет

- CAR Proposal-Bridge and Roof Co. (India) Ltd. - Bailey BridgeДокумент2 страницыCAR Proposal-Bridge and Roof Co. (India) Ltd. - Bailey BridgeUjjawal PrakashОценок пока нет

- Accounting Standard 15: It's Relevance To GRCДокумент6 страницAccounting Standard 15: It's Relevance To GRCTulika JeendgarОценок пока нет

- Program Planning WorksheetДокумент3 страницыProgram Planning Worksheetapi-354977225Оценок пока нет

- Volksbank Presentation PDFДокумент8 страницVolksbank Presentation PDFCIBPОценок пока нет

- FEDEX V AHAC DigestДокумент2 страницыFEDEX V AHAC DigestAnonChieОценок пока нет

- Mishkin 6ce TB Ch10Документ27 страницMishkin 6ce TB Ch10JaeDukAndrewSeo100% (1)

- PS Enterprise Payroll For North America 9.1Документ1 358 страницPS Enterprise Payroll For North America 9.1ronaldcgreyОценок пока нет

- Notes BMGT 211 Introduction To Risk and Insurance May 2020-1Документ94 страницыNotes BMGT 211 Introduction To Risk and Insurance May 2020-1jeremieОценок пока нет

- VRL Adi 2Документ3 страницыVRL Adi 2Arun Kumar GoyalОценок пока нет

- HR Internship ReportДокумент57 страницHR Internship ReportMuhammad Naveed75% (4)

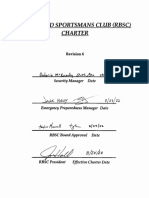

- RBSC Charter Rev6 - FinalДокумент9 страницRBSC Charter Rev6 - Finalapi-168692567Оценок пока нет

- PFRS 17Документ19 страницPFRS 17Princess Jullyn ClaudioОценок пока нет

- Insurance Contracts: International Financial Reporting Standard 4Документ18 страницInsurance Contracts: International Financial Reporting Standard 4xxx101xxxОценок пока нет

- Credit Application For CEE Home Improvement Loan Programs: I. Lender InformationДокумент3 страницыCredit Application For CEE Home Improvement Loan Programs: I. Lender InformationsandyolkowskiОценок пока нет

- 5 Insular Life Vs PazДокумент2 страницы5 Insular Life Vs PazRoger Pascual CuaresmaОценок пока нет

- Baxter - AXA ComplaintДокумент17 страницBaxter - AXA ComplaintKirk HartleyОценок пока нет

- Study of Tax Saving Schemes in Mutual Funds Mba ProjectДокумент74 страницыStudy of Tax Saving Schemes in Mutual Funds Mba ProjectSachin Gala33% (6)

- UMW Toyota Motor SDN BHD (60576-K) Estimated Price List For Peninsular Malaysia Effective From 18 October 2018Документ1 страницаUMW Toyota Motor SDN BHD (60576-K) Estimated Price List For Peninsular Malaysia Effective From 18 October 2018INSTECH ConsultingОценок пока нет

- Policy 19743435 23012021Документ7 страницPolicy 19743435 23012021Lallu KalluОценок пока нет

- Annual Report 2019-20Документ501 страницаAnnual Report 2019-20ankitОценок пока нет

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОценок пока нет

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialРейтинг: 4.5 из 5 звезд4.5/5 (32)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)