Академический Документы

Профессиональный Документы

Культура Документы

Dont Mind

Загружено:

Airene Talisic Patungan0 оценок0% нашли этот документ полезным (0 голосов)

83 просмотров1 страницаDont mind too

Оригинальное название

Dont mind

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документDont mind too

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

83 просмотров1 страницаDont Mind

Загружено:

Airene Talisic PatunganDont mind too

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

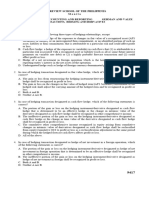

Airene T.

Patungan LM31FB1 Assignment # 1 July 2, 2018

Resident Citizen TAX TYPE TAX RATE

1) Interest from peso bank deposit, BDO, Makati FWTx 20%

2) Interest from US dollar bank deposit, BPI-Manila FWTx 7.5%

3) Interest from a foreign currency deposit in Japan BTx Tax Table

4) Interest from money market placement, Philippines FWTx 20%

5) Interest from a foreign currency deposit in Australia by a NRA Exempt -

6) Interest from overdue a/r, Philippines BTx Tax Table

7) Compensation income, Philippines BTx Tax Table

8) Business income, Philippines BTx Tax Table

9) Gain on sale of car for personal use BTx Tax Table

10) Gain on sale of delivery truck BTx Tax Table

11) Royalties, in general, Davao city FWTx 20%

12) Royalties, books published in Manila FWTx 20%

13) Prizes amounting to P30,000, Philippines FWTx 20%

14) Prizes amounting to P10,000, Philippines BTx Tax Table

15) Prizes amounting to P40,000, USA BTx Tax Table

16) P30,000 Other Winnings, Philippines FWTx 20%

17) P10,000 Other Winnings, Philippines FWTx 20%

18) P15,000 Other Winnings, Canada BTx Tax Table

19) P10,000 Phil, Lotto/PSCO winnings Exempt -

20) P100,000 PSCO winnings by a RA Exempt -

21) Phil, Lotto/PSCO winnings by a NRA-NETB FWTx 25%

22) Lotto winnings in London BTx Tax Table

23) Interest income from long-term bank deposit by a RA Exempt -

24) Interest income from long-term bank deposit by a NRA-NETB FWTx 20%

25) Interest income from a government issued bonds w/ maturity of 10yrs. FWTx 20%

26) Interest income from a bonds issued by PLDT w/ maturity of 10yrs. FWTx 10%

27) Dividend income from a domestic corporation FWTx 10%

28) Dividend income from a resident foreign corporation BTx Tax Table

29) Dividend income from a nonresident foreign corporation BTx Tax Table

30) Dividend income from a domestic corporation by a NRA-ETB FWTx 20%

31) Dividend income from a domestic corporation by a NRA-NETB FWTx 25%

32) Gain on sale of shares of stock of a domestic corporation sold directly to a buyer BTx Tax Table

33) Gain on sale of shares of stock of a domestic corpo. traded in the local stock exchange Exempt -

34) Gain on sale of real properties used in business BTx Tax Table

35) Gain on sale of real properties classified as capital asset located in Singapore BTx Tax Table

Вам также может понравиться

- PESTLE Analysis of ChinaДокумент4 страницыPESTLE Analysis of ChinaAmit Pathak67% (3)

- Pye, D.-1968-The Nature and Art of WorkmanshipДокумент22 страницыPye, D.-1968-The Nature and Art of WorkmanshipecoaletОценок пока нет

- Test - Income Tax For IndividualsДокумент9 страницTest - Income Tax For IndividualsNikka Nicole Arupat100% (5)

- Full Report Case 4Документ13 страницFull Report Case 4Ina Noina100% (4)

- Total Cash Receipt From Issuance of BondsДокумент11 страницTotal Cash Receipt From Issuance of Bondskrisha milloОценок пока нет

- RFBT - Chapter 8 - Ease of Doing BusinessДокумент15 страницRFBT - Chapter 8 - Ease of Doing Businesslaythejoylunas21Оценок пока нет

- HW2Документ6 страницHW2LiamОценок пока нет

- Cyber Nations User Player GuideДокумент13 страницCyber Nations User Player GuideOzread100% (1)

- Maruti Suzuki Strives To Consistently Improve The Environmental Performance of Its Manufacturing OperationsДокумент6 страницMaruti Suzuki Strives To Consistently Improve The Environmental Performance of Its Manufacturing OperationsandljnnjdsОценок пока нет

- Business Tax Chapter 7 ReviewerДокумент2 страницыBusiness Tax Chapter 7 ReviewerMurien LimОценок пока нет

- Partnership Dissolution ProblemsДокумент22 страницыPartnership Dissolution ProblemsMikhaella ZamoraОценок пока нет

- Midterm Quiz 2Документ11 страницMidterm Quiz 2SGwannaBОценок пока нет

- Bond Valuation Exam 1Документ2 страницыBond Valuation Exam 1Ronah Abigail BejocОценок пока нет

- Chapter 9 - AnswerДокумент2 страницыChapter 9 - AnswerwynellamaeОценок пока нет

- Problem 14-5: Kayla Cruz & Gabriel TekikoДокумент7 страницProblem 14-5: Kayla Cruz & Gabriel TekikoNURHAM SUMLAYОценок пока нет

- Discussion 2 CHAPДокумент4 страницыDiscussion 2 CHAPHannah LegaspiОценок пока нет

- CE On Agriculture T1 AY2020-2021Документ2 страницыCE On Agriculture T1 AY2020-2021Luna MeowОценок пока нет

- CH 5 Test BankДокумент15 страницCH 5 Test Bankhaidy gabrОценок пока нет

- Cost Concept, Terminologies and BehaviorДокумент8 страницCost Concept, Terminologies and BehaviorANDREA NICOLE DE LEONОценок пока нет

- Economic Development Midterm ExaminationДокумент4 страницыEconomic Development Midterm ExaminationHannagay BatallonesОценок пока нет

- PRELIM Chapter 9 10 11Документ37 страницPRELIM Chapter 9 10 11Bisag AsaОценок пока нет

- Reviewer - Accounting FOR Labor Reviewer - Accounting FOR LaborДокумент3 страницыReviewer - Accounting FOR Labor Reviewer - Accounting FOR LaborJuan FrivaldoОценок пока нет

- Shareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)Документ18 страницShareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)nmdl123Оценок пока нет

- Requirement 1: Problem 7 (Transfer Pricing)Документ5 страницRequirement 1: Problem 7 (Transfer Pricing)Jane TuazonОценок пока нет

- Income Tax On Partnerships - QuestionsДокумент9 страницIncome Tax On Partnerships - QuestionsJembrain CanubasОценок пока нет

- SARIEPHINE GRACE ARAS-ACTIVITY No 2 Corporate Income TaxДокумент8 страницSARIEPHINE GRACE ARAS-ACTIVITY No 2 Corporate Income TaxSariephine Grace ArasОценок пока нет

- Activity Chapter 4: Ans. 2,320 SolutionДокумент2 страницыActivity Chapter 4: Ans. 2,320 SolutionRandelle James FiestaОценок пока нет

- Chapter 10 AIS Seatwork Finals Questions PDFДокумент4 страницыChapter 10 AIS Seatwork Finals Questions PDFdesblahОценок пока нет

- Presumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateДокумент5 страницPresumptive Input Tax-4% of Gross Value: He Will Be Allowed An Input Tax On His Inventory On The Transition DateLala AlalОценок пока нет

- Module 5&6Документ29 страницModule 5&6Lee DokyeomОценок пока нет

- Set A Leases Problem SERANAДокумент6 страницSet A Leases Problem SERANASherri BonquinОценок пока нет

- Solution Chapter 14Документ26 страницSolution Chapter 14grace guiuanОценок пока нет

- Corporation As A TaxpayerДокумент27 страницCorporation As A TaxpayerBSA-2C John Dominic Mia100% (1)

- TAX-1101: Capital Assets, Capital Gains & Losses: - T R S AДокумент3 страницыTAX-1101: Capital Assets, Capital Gains & Losses: - T R S AVaughn TheoОценок пока нет

- TaxationДокумент7 страницTaxationDorothy ApolinarioОценок пока нет

- De Leon Solman 2014 2 CostДокумент95 страницDe Leon Solman 2014 2 CostJohn Laurence LoplopОценок пока нет

- Module 5Документ6 страницModule 5Mon Ram0% (1)

- Mas QuestionsДокумент2 страницыMas QuestionsEll VОценок пока нет

- Dry RunДокумент5 страницDry RunMarc MagbalonОценок пока нет

- Mantuhac, Anthony BSA-3Документ3 страницыMantuhac, Anthony BSA-3Anthony Tunying MantuhacОценок пока нет

- Current LiabilitiesДокумент3 страницыCurrent LiabilitiesAhlaya Lyrica Cadence SadoresОценок пока нет

- Standard Costing and Analysis of VarianceДокумент13 страницStandard Costing and Analysis of VarianceRuby P. Madeja100% (1)

- Midterm Exam Problem Submissions: 420, 000andshareholder Equityof SДокумент3 страницыMidterm Exam Problem Submissions: 420, 000andshareholder Equityof SkvelezОценок пока нет

- ABC Co. Started Its OperationsДокумент1 страницаABC Co. Started Its OperationsQueen ValleОценок пока нет

- M4 - Gross Estate - Special Rules For Married Decedents - Students'Документ14 страницM4 - Gross Estate - Special Rules For Married Decedents - Students'micaella pasionОценок пока нет

- Tax 321 Prelim Quiz 1 Key PDFДокумент13 страницTax 321 Prelim Quiz 1 Key PDFJeda UsonОценок пока нет

- Relevant Costing Simulated Exam Ans KeyДокумент5 страницRelevant Costing Simulated Exam Ans KeySarah BalisacanОценок пока нет

- BA 118.1 SME Exercise Set 5Документ1 страницаBA 118.1 SME Exercise Set 5Ian De DiosОценок пока нет

- Chapter 15 PDFДокумент12 страницChapter 15 PDFDarijun SaldañaОценок пока нет

- 9417 - Foreign Currency Transactions Hedging and DerivativesДокумент7 страниц9417 - Foreign Currency Transactions Hedging and Derivativesjsmozol3434qcОценок пока нет

- 05 Quiz 1Документ3 страницы05 Quiz 1Goose ChanОценок пока нет

- Cash of Foregoing A Cash DiscountДокумент3 страницыCash of Foregoing A Cash DiscountRОценок пока нет

- 05 Handout 1 PDFДокумент5 страниц05 Handout 1 PDFjhomar benavidezОценок пока нет

- Strategic Analysis of Operating Income and Final VarianceДокумент2 страницыStrategic Analysis of Operating Income and Final VarianceZen OrtegaОценок пока нет

- Answer Midterm Finals Quizes SET A PDFДокумент117 страницAnswer Midterm Finals Quizes SET A PDFMary DenizeОценок пока нет

- Conceptual Framework and Accounting Standards Ms. Leslie Anne T. GandiaДокумент2 страницыConceptual Framework and Accounting Standards Ms. Leslie Anne T. GandiaJm SevallaОценок пока нет

- CAT Exam 1 1Документ5 страницCAT Exam 1 1YeppeuddaОценок пока нет

- Week 3 Course Material For Income TaxationДокумент11 страницWeek 3 Course Material For Income TaxationAshly MateoОценок пока нет

- Income Tax Quiz 3 and Quiz 4 Answers PDFДокумент32 страницыIncome Tax Quiz 3 and Quiz 4 Answers PDFJeda UsonОценок пока нет

- For The Month.: Answer: The Total Allowable Deduction From Business Income of Lucky Corporation Is 258,923Документ2 страницыFor The Month.: Answer: The Total Allowable Deduction From Business Income of Lucky Corporation Is 258,923Aleksa FelicianoОценок пока нет

- AsdasdДокумент3 страницыAsdasdMark Domingo MendozaОценок пока нет

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #21 To 25Документ1 страница(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #21 To 25John Carlos DoringoОценок пока нет

- Construction ContractДокумент17 страницConstruction ContractYvonne Gam-oyОценок пока нет

- Allowable Deductions Part 1Документ3 страницыAllowable Deductions Part 1John Rich GamasОценок пока нет

- AEC7 - Tañote - BSA-2A - UNIT III - Assignment 2Документ2 страницыAEC7 - Tañote - BSA-2A - UNIT III - Assignment 2Daisy TañoteОценок пока нет

- TaxationДокумент2 страницыTaxationBlezyl A. Dela FuenteОценок пока нет

- Global Wealth Databook 2017Документ165 страницGlobal Wealth Databook 2017Derek ZОценок пока нет

- The Economic Crisis in Pakistan and Their Solutions: T E C P T SДокумент6 страницThe Economic Crisis in Pakistan and Their Solutions: T E C P T SRaja EhsanОценок пока нет

- ISO Hole Limits TolerancesДокумент6 страницISO Hole Limits ToleranceskumarОценок пока нет

- Ol NW Mock 2022 Economics 2Документ2 страницыOl NW Mock 2022 Economics 2Lukong EmmanuelОценок пока нет

- The Proof of Agricultural ZakatДокумент7 страницThe Proof of Agricultural ZakatDila Estu KinasihОценок пока нет

- Month Average USD/CNY Min USD/CNY Max USD/CNY NB of Working DaysДокумент3 страницыMonth Average USD/CNY Min USD/CNY Max USD/CNY NB of Working DaysZahid RizvyОценок пока нет

- Pub Rethinking Development GeographiesДокумент286 страницPub Rethinking Development Geographiesxochilt mendozaОценок пока нет

- Latitudes Not AttitudesДокумент7 страницLatitudes Not Attitudesikonoclast13456Оценок пока нет

- Microeconomics - CH9 - Analysis of Competitive MarketsДокумент53 страницыMicroeconomics - CH9 - Analysis of Competitive MarketsRuben NijsОценок пока нет

- MKT 465 ch2 SehДокумент51 страницаMKT 465 ch2 SehNaimul KaderОценок пока нет

- Urban Forestry Manual TigardДокумент113 страницUrban Forestry Manual TigardAndrewBeachОценок пока нет

- P2P and O2CДокумент59 страницP2P and O2Cpurnachandra426Оценок пока нет

- Rasanga Curriculum VitaeДокумент5 страницRasanga Curriculum VitaeKevo NdaiОценок пока нет

- Table of ContentsДокумент6 страницTable of ContentsRakeshKumarОценок пока нет

- ECONOMICS ASSIGNMENT - Docx DДокумент2 страницыECONOMICS ASSIGNMENT - Docx DDurgesh 136Оценок пока нет

- Master Coin CodesДокумент19 страницMaster Coin CodesPavlo PietrovichОценок пока нет

- GCCA Newsletter - FEBRUARY 2023Документ1 страницаGCCA Newsletter - FEBRUARY 2023ArnaldoFortiBattaginОценок пока нет

- Metro Manila, Philippines: by Junio M RagragioДокумент21 страницаMetro Manila, Philippines: by Junio M RagragiofrancisОценок пока нет

- Important InformationДокумент193 страницыImportant InformationDharmendra KumarОценок пока нет

- Ibm 530Документ6 страницIbm 530Muhamad NasirОценок пока нет

- Peso Appreciation SeminarДокумент3 страницыPeso Appreciation SeminarKayzer SabaОценок пока нет

- Attacking and Defending Through Operations - Fedex: Assignment Submitted By: Pradeep DevkarДокумент14 страницAttacking and Defending Through Operations - Fedex: Assignment Submitted By: Pradeep Devkarsim4misОценок пока нет

- Taxation As A Fiscal Policy FinalДокумент34 страницыTaxation As A Fiscal Policy FinalLetsah BrightОценок пока нет

- Economic Development Complete NotesДокумент36 страницEconomic Development Complete Notessajad ahmadОценок пока нет