Академический Документы

Профессиональный Документы

Культура Документы

Journal - R Anitha 10aug16mrr

Загружено:

Borivoje SoldatovicОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Journal - R Anitha 10aug16mrr

Загружено:

Borivoje SoldatovicАвторское право:

Доступные форматы

ISSN: 2249-7196

IJMRR/August 2016/ Volume 6/Issue 8/Article No-10/1079-1089

R. Anitha et. al., / International Journal of Management Research & Review

A STUDY ON THE IMPACT OF TRAINING ON EMPLOYEE PERFORMANCE IN

PRIVATE INSURANCE SECTOR, COIMBATORE DISTRICT

R. Anitha*1, Dr. M. Ashok Kumar2

1

Head, Dept. of Skill/Career Development, SNS College of Technology, Coimbatore &

Research Scholar in Management, Dept. of Management Studies and Research, Karpagam

University, Coimbatore, India.

2

Prof. & Head, Dept. of Management Studies, Karpagam University, Coimbatore, India.

ABSTRACT

Employees – the vital part of the organisation should be developed as they are contributing

for the organisation‟s success. Organisations requires the employees of highly skilled,

knowledgeable with right attitude for its smooth functioning and development. Training is the

important managerial function in any organisation to educate / impart knowledge to the

employees about their work in which they are involved. The training brings tremendous

change in the employee‟s skill level, knowledge and performance. Now-a-days organisations

have started providing opportunities for the employees to improve their skill sets, which

successively develop the individual and organizational growth. But the training have an

impact on employees‟ performance needs to be studied. Insurance industry is the important

one in providing employees training and the performance of the employees very much relies

on the training provided to them. Hence this research study was conducted at the private

insurance sector in Coimbatore district. The main objectives of this study are;

To study the impact of training on employees performance.

To study the factors determining the employee productivity through training and

To study the effect of other Human Resource Management (HRM) practices on employees‟

performance.

This study was conducted only at the private insurance sector in Coimbatore consisting of

Life and Non-Life Insurance companies. The data was collected through the questionnaire

method. The sample size was 75.The sampling method used for this study was Random

Sampling Method. The data collected were analyzed through t-test, Chi Square.

The results obtained reveal that the training given to the employees in Private Insurance

Sector, Coimbatore District improves the performance level of the employees. The increase is

formed in the employee productivity after the training. The education level, staff category

and the work experiences of the employees are the factors determining the growth of

employees performance in the organisation after the training.

*Corresponding Author www.ijmrr.com 1079

R. Anitha et. al., / International Journal of Management Research & Review

Human Resource is considered as the most important resource in an organisation. The

employees should be offered with proper training to improve their efficient and effective

functioning in an organisaton.

Keywords: Training, Organisation, Employees, Performance, Insurance, Human Resource.

INTRODUCTION

Training is the continuous and the systematic development among all levels of employees,

knowledge, skills and attitudes which contribute to their welfare and that of the company

(Planty, M.C. Cord & Efferson, 2007). Training provides organisation, the employees with

a caliber of increasing the organization‟s productivity & profitability.

Employee performance refers to the ability of employees to perform a job in an effective and

efficient way to produce the best results. When the employees are provided with the proper

training, they will be more committed towards their job and improve their performance in the

organisation. There are different types of training being given to the employees like

orientation/induction, refresher training, product training, cross functional training etc.

Organisation must provide the training to the employees, if organisation really wants the

employees to perform well and has to improve the productivity & profitability. Insurance is

one such sector which concentrates more and invests more on the employee training. This

training should have impact on the employees‟ performance.

INSURANCE INDUSTRY

The advent of life insurance business in India is with the establishment of Oriental Life

Insurance Company, Calcutta in 1818. Boon for economic development provides long- term

funds for infrastructure development at the same time strengthening the risk taking ability of

the country. Today there are 27 general insurance companies including the ECGC and

Agriculture Insurance Corporation of India and 24 life insurance companies in the country.

Insurance Industry is regulated by the Insurance Regulatory and Development Authority

(IRDA).

INDUSTRY STRUCTURE / MARKET SIZE

In Insurance industry, insurance can be of various types like automobile insurance, fire

insurance, life insurance etc. In case of any damage to the life or asset to the insured person

due to the reasons mentioned in the policy, her or his representatives are entitled to receive

the insurance cover money. This amount is calculated by the insurance agent on the

parameters of loss incurred, its type and the amount of premium paid by the insured entity.

India's life insurance sector is the biggest sector in the world with about 360 million policies

which are expected to increase at a Compound Annual Growth Rate (CAGR) of 12-15 per

cent over the next five years. The insurance industry plans to hike penetration levels to five

per cent by 2020. At the period of April 2015 to February 2016, the life insurance industry

recorded a new premium income of Rs 1.072 trillion (US$ 15.75 billion), indicating a growth

rate of 18.3 per cent. The general insurance industry recorded 14.1 per cent growth in Gross

Direct Premium underwritten in FY2016 up to the month of February 2016 at Rs 864.2

billion (US$ 12.7 billion) (IRDA).

Copyright © 2016 Published by IJMRR. All rights reserved 1080

R. Anitha et. al., / International Journal of Management Research & Review

The country‟s insurance market is expected to quadruple in size over the next 10 years from

its current size of US$ 60 billion. During this period, the life insurance market is slated to

cross US$ 160 billion. The general insurance business in India is currently at Rs 78,000 crore

(US$ 11.44 billion) premium per annum industry and is growing at a healthy rate of 17 per

cent (IRDA).

The Indian insurance market is a huge business opportunity waiting to be harnessed. India

currently accounts for less than 1.5 per cent of the world‟s total insurance premiums and

about 2 per cent of the world‟s life insurance premiums despite being the second most

populous nation. The country is the fifteenth largest insurance market in the world in terms of

premium volume, and has the potential to grow exponentially in the coming years.

Nowadays, insurance is a vital need of the people and the organizations to be prepared for

any unforeseen and unfortunate event or mishap (IRDA).

Training is compulsory to employees in the insurance industry. They have to undergo with

the orientation/induction at the time of joining, refresher and product training frequently.

These training ensure the improvement of employees performance in the organisation. This

study was conducted to find out the impact of training on employees‟ performance of Private

Insurance Sector in Coimbatore district.

RESEARCH METHODOLOGY

The Study on “Impact of Training on Employee Performance in Private Insurance Sector,

Coimbatore District” was conducted as a descriptive study deals with collecting,

summarizing and simplifying data and drawing conclusion. The main Objectives of this

research are to study the impact of training on employees performance and to know the

determinant factors that determine the employee productivity.

Population of the study, Impact of Training on employee performance in Private Insurance

Sector, Coimbatore District” is 10 companies from both life & non-life insurance sectors.

Employees of Private Insurance Sectors in Coimbatore District are taken for this study.

Sample refers to the respondents. Sampling is the process of choosing a representative

portion of the entire population, the population of employees in private insurance sectors in

Coimbatore district. Employees present in all departments of the company are selected for the

study which comes around 15-20 in number.

Sampling Unit: Refers to the place of the study, which is in Coimbatore.

Sampling Technique followed is the Random Sampling Method.

Sample Size of the study is 75 respondents from the 10 companies of Private Life & Non-life

insurance sectors.

Data Collection has been done through the primary data collection by “Questionnaire

Method” designed with questions on the different aspects of employee performance and

given with 5 point Likert scale rating choice to the respondents for choosing demographic

details.

Copyright © 2016 Published by IJMRR. All rights reserved 1081

R. Anitha et. al., / International Journal of Management Research & Review

Employees‟ performance scores were calculated by adding the ratings given by the

respondents for all the items. Ratings were assigned as 1 = Strongly Agree, 2=Agree,

3=Undecided, 4= Disagree, 5=Strongly Disagree.

RESEARCH TOOLS used are t-Test, and Chi Square.

STATEMENT OF THE PROBLEM:

Employee training is a learning experience, it seeks relatively permanent changes in the

employees that improves their job performance (David A De Cenzo & Stephen P. Robbins,

2007). Insurance industry is the major contributor in Indian economy (IC 33, Life Insurance

by Dr. Sashidharan Kutty & Prof. Pranav Misra, 2014). The insurance sector is a colossal

one now, witha consistent growth rate of 32% - 34% and its present worth is 41 billion US

dollars (CII). Insurance services add about 7% to the country‟s GDP. Employees in insurance

sector of Coimbatore district - the Life Insurance, Non-Life Insurance (Medical Insurance &

General Insurance) are studied for this research.

The reason for this study is the importance of training in industrial sector has become

necessary one to impart knowledge and skills to employees for the better performance, in the

job Industries like insurance sector are concentrating more on training both freshers and

existing employees. The time and money spent on training in insurance industry is also

comparatively more. But, it‟s a big question. Does the training bring changes in the

employees‟ tendency, attitude & performance?

They seems self-oriented or towards the self-development than contributing for the

company‟s development. Hence the attrition rate in the insurance sector is also high.

Employees are moving to other companies after acquiring the necessary skills through the

training provided by the previous companies. How does the organisation get benefited

through the employees performance? Is there improvement in employees‟ productivity and

organisations profitability? Hence, this study has been conducted to find out the effective and

efficient functioning of employees after the training.

REVIEW OF LITERATURE

The effective functioning of an organisation depends upon the efficiency or capability of the

human resources. This human resource‟s potential can be elevated to the next level through

the proper training which helps the organizational growth & success.

Vaasan Ammattikorkeakoulu (2013) conducted a case study to evaluate the effects of

training on employee performance, using the telecommunication industry in Uganda. The

study was based on three case studies of the biggest telecommunication companies operating

in Uganda. A qualitative research approach of the data collection was adopted using a

questionnaire comprising of 18 questions distributed to 120 respondents. Based on this

sample the results obtained indicate that the training is a clear effect on the performance of

employees.

In the insurance sector, the training and development function holds a key responsibility by

helping employees to upgrade their performance on a continuous basis. A study by Shefali

Verma & Rita Goyal (2011) analyzed the status of the various training and development

Copyright © 2016 Published by IJMRR. All rights reserved 1082

R. Anitha et. al., / International Journal of Management Research & Review

practices in Life Insurance Corporation in India and explores the proposed link between the

training and employees productivity. This study emphasizes the importance of training for the

effective functioning of the organisation.

The employee performance is measured in terms of the improvement in Productivity,

Absenteeism and the Employee Job Satisfaction. Prasadini N Gamage & Mr. Lionel

Imbulana (2013) conducted a study for identifying the effectiveness of the training and

development of the call center staff of the Sri Lanka Telecom. The performance was

measured with the dimensions of employees Productivity, Absenteeism and the Job

Satisfaction. The statistical analysis of the study revealed that that there is a significant

positive relationship between the training &development and the employee productivity.

Hemanalini R (2013) conducted a study, to examine the impact of the training and

development programs on employee performance in IBFI Federal Life Insurance Company

Ltd, Coimbatore. The available evidence from descriptive research and the model were tested

with a survey sample (n=200). This study carried two dimensions such as training and

development and employee performance with two inter-dependent variables such as work

attitude and job involvement. The data was obtained by questionnaire method and random

sampling method was used. The purpose of this study was to examine and gain a better

understanding of the drivers that influence the impact of training and development on the

employee performance. It is found that there is a high relationship between training &

development and employee performance. The factors age, tenure and marital status over

employee performance is high association between each other.

According to Amir Elnaga & Amen Imran (2013) training plays vital role in the building of

competencies of new as well as current employees to perform their job in an effective way.

Their study in hand chiefly focuses on the role of training in enhancing the performance of

the employees. It also prepares employees to hold future position in an organization with full

capabilities and helps to overcome the deficiencies in any job related area. Training is

considered as that sort of investment by the firm that not only brings high return on

investment but also supports to achieve competitive advantage.

Uzma Hafeez & Waqar Akbar (2015) in their research aims to see the “Impact of Training

on Employee Performance in Pharmaceutical Industry in Karachi Pakistan”, in which the

training is considered as independent whereas dependent variable „Employee Performance„

having its performance areas i.e.; demonstrating team work, communication skill, customer

service, interpersonal relationship and reduced absenteeism and its development areas i.e.;

job-satisfaction, employee motivation, new technologies, efficiencies in process and

innovation in strategies as its levers. Four pharmaceutical companies are selected. A survey

of 356 employees via self administrated questionnaire with the help of random sampling

technique is conducted with the response rate of 96%. The analysis shows that when the

employee get more the training, more efficient their level of performance would be.

Mubashar Farooq & Muhamamd Aslam Khan (2011) had conducted a study to elaborate

the impact of Training and Feedback on increasing the performance of employees. The

review of the literature conducted explains and highlights the role of effective training and

the feedback in improving the quality of task process which ultimately results in the

Copyright © 2016 Published by IJMRR. All rights reserved 1083

R. Anitha et. al., / International Journal of Management Research & Review

improvement of performance of employees. An empirical study was conducted and data was

collected through questionnaires to find the results. Findings of this study suggest arranging

and adopting more effective training programs and techniques in order to give the progressive

shape to the results achieved through this study.

Hotel sector which is actually the services business needs a lot of training for all the staff of

the hotel. According to Ameeq-ul-Ameeq & FurqanHanif (2013) the training in services

sector is very important because most of the staff are directly in contact with the customer

and they are giving them the services. Their study reveals that the training programs of the

hotels of Lahore are actually helping the employees to develop and perform their task.

The relationship between the training and performance has been studied in previously in

many research. But the impact of training on employee performance in the private insurance

sector with respect to Coimbatore district has not been studied so far. Hence it id decided to

do the study on “Impact of Training on Employee Performance in Private Insurance Sector,

Coimbatore District”.

RESULTS AND DISCUSSION

The study on “Impact of Training on Employee Performance in Private Insurance Sector,

Coimbatore District” reveals the following facts that;

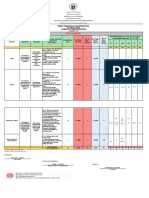

The table V.1 shows the mean employee performance scores calculated from the different

groups of age, staff category etc. Significant differences are found in the employee

performance scores among different age groups as well as staff category. The employees

between the age 21-25 & 26 – 30 are the better performers than the other age groups. The age

in years have significance at 5% level. Amongst the staff category of the employees, the

administrative staff are performing better than the sales personnel. The staff category has 1%

significant level.

Table No. V.2 indicates that in the improvement of employee productivity at the variable

education qualification has 5% significance level. This reveals that the employees who have

completed their under graduation have performed well in organisation and it has the Chi –

Square value of 13.859 significant at 1% level. The other variables like gender, age, monthly

income & experience have no significance.

The performance of employees in the organisation before and after the training is compared

Table No V.3. Data collected through this study was analyzed through the Chi-square test. It

results that the training improves the performance / productivity of employees. There is a

significant increase in the employee performance level. Among the employees who are in the

performance level of 75%-90% before training, 45% of them have improved their

performance to 90% - 100%. The highest level of employees productivity increase is 78.6%

from 50%-75% to 75%-90%. The next highest percentage is 65.2% from below 50% to

50%-75%.50% of the employees have not shown any improvement in their productivity.

They remain in the same percentage of productivity 90% - 100%.

The Impact of Human Resources Management (HRM) practices have also been analyzed

through this study. In Table V.4, the assessment of training needs & the motivational

programmes have a significant impact on employee performance. Monetary & Non-monetary

Copyright © 2016 Published by IJMRR. All rights reserved 1084

R. Anitha et. al., / International Journal of Management Research & Review

benefits provided to the employees have also impact on employees‟ performance. For

example, the motivation given to the employees improves their performance. The results

reveal that whenever the performance appraisal has properly been done and the respective

feedback is communicated to the employees they are able to concentrate on their feedback

and improve their performance. The growth of opportunities available in the organisation also

have a remarkable impact on employees‟ performance.

FINDINGS

Insurance industry is the complex one, wherein diversified employees are there with similar

kinds of targets in sales and works in the administrative side. The employees‟ demographic

factors reveal that the age of the employees in the sales department plays a major role. As the

targets fixed in sales, and maintaining back office work for these policies is hectic, the

employees‟ age group of 21-25 is showing improvement in their performance. This is

gradually reduced and remains almost same till the age of 35 years. As they gain experience

after that they are showing improvement in their performance after 40 years.

For the better performance and the consistence growth the Undergraduate education is

sufficient. The PG degree doesn‟t play any special role in their business.

The performance of the Sales personnel is depending on the market trend and the economic

condition of the people for both taking insurance policy and paying the premium. Hence the

sales managers finding it difficult to show consistent improvement in their business though

the training is being given. The administrative staff are showing improvement in their

performance after training.

It is revealed from this study that the training plays a major role in the employees‟

performance. There is consistent growth in their performance after the training. They have

shown improvement in their performance level from 20% - 25% growth after the training.

The employees those who are already performing 90%-100% shown consistency in their

performance level. Find out the time taken for achieving their target within the month period

time could be the future research scope in this study.

The Human Resource Management (HRM) practices other than the training followed in the

organisations are very important to the employees for enhancing their interest toward the

training and the subsequent developmental aspects.

The performance level & the knowledge in their products, work procedure determines the

necessity of the employee training other than the freshers. It also reveals that the periodical

training programmes are mandatory to the employees in the Private Insurance Sector.

SUGGESTIONS

Employees in the organisation should be offered with the proper training periodically to

improve their performance in job. The training needs the employees should be properly

identified through the performance appraisal system. The training provided should not be

restricted with the newly joined staff, the existing staff members should also be provided with

refresher training, cross-functional training etc. it keeps them updated with their knowledge,

technology and working practices.

Copyright © 2016 Published by IJMRR. All rights reserved 1085

R. Anitha et. al., / International Journal of Management Research & Review

The management should take all initiatives to maintain a cordial relationship with the

employees as the study reveals that the motivation has also an impact on the employees‟

productivity.

The senior officials should understand the needs of the employees on the training aspects and

other aspects to plan for the training programmes ensure the employees have active

participation in these programmes.

While framing the rules and regulations of the organisations, the HRM practices should be

duly taken care with Human Resource Management (HRM) practices hence it also has an

impact on the employee productivity.

Recognition of the employees as and when they contributed special or additional for the

organisation is very important. This includes both monetary and non-monetary benefits. It

will make the employees more committed towards their job, which improves their

performance level.

The effectiveness of the training should be monitored through the observation, collecting

feedback from the trainees and evaluating the performance level after the training

programmes of the employees.

Growth opportunities for the employees in the organisation by the management to improve

the effective & enthusiastic participation of employees in the work and produce better results.

CONCLUSION

Human Resource is the work force, which brings changes in the organisations and needs to be

taken for the welfare of the organisation. Their needs & development should be specially

addressed by the management. Employees will be productive and committed towards their

job only when they are provided with the required inputs, let it be machine, material or the

skills sets. Training is a tool which improves the skills sets and knowledge of the employees

that improves the productivity & profitability of the organisation. This study on Impact of

training on employee performance has been conducted in the Private Insurance Sector,

Coimbatore District with a sample size of 75 respondents. The survey has done through the

Questionnaire Method. Data obtained were analyzed through t-test and Chi-square.

Results obtained reveal that the effective training improves the performance of employees.

The effectiveness of the training should be improved through the proper periodical

scheduling of the training, selection of quality trainers, implementing the best training

methods etc.

Training should be given to both freshers and existing employees. Their feedback should be

obtained and evaluation of their performance after the training programme should also be

done to improve the training effectiveness. It also analyzes the employee performance after

the training.

Copyright © 2016 Published by IJMRR. All rights reserved 1086

R. Anitha et. al., / International Journal of Management Research & Review

The Human Resource Management (HRM) practices, motivation, monetary and non-

monetary benefits to the employees to recognize their contribution are also influence the

employee performance.

Age, educational qualification and work experience are the other factors which determine the

employees‟ performance in the organisation through the training. This study clearly indicates

that the training have impact on employee performance.

FUTURE SCOPE OF THE STUDY

Training plays a major role on the employees‟ performance. This study reveals that the

effective training enhance the efficiency of employees and effectiveness of organizational

function. The organizations are investing huge amount on training. The measuring of Returns

on the Investment (ROI) make in the insurance sector can be studied through measuring the

profitability of the organisation could be future scope of this study.

Table No. V.1: Comparison of related personal variables.

Variable Groups Mean Standard Number T- F- Significance

Deviation Value Value

Gender Male 61.04 4.18 52

Female 61.17 5.51 23 0.117 Ns

21-25 yrs 62.5 5.84 16 *

26-30 yrs 59.65 4.05 17

31-35 yrs 59.21 3.99 19

36-40 yrs 62.63 4 16

Age in years Above 40 yrs 62.86 3.24 7

Total 61.08 4.59 75 2.517

Education GRADUATE 60.72 4.4 57 1.216 Ns

Qualification POST 62.22 5.09 18

GRADUATE

Total 61.08 4.59 75

Marital Status Married 61.37 4.31 41 0.059 Ns

Unmarried 60.74 4.95 34

Total 61.08 4.59 75

Staff Category Sales 60.29 4.21 62 3.493 **

Administration 64.85 4.62 13

Total 61.08 4.59 75

Monthly Rs.2-3 Lacs 60.32 5.25 19 0.347 Ns

Income (In Rs.) Rs.3-4 Lacs 61.35 4.3 37

Rs.4-5 Lacs 61.32 4.61 19

Total 61.08 4.59 75

Experience in 1-2 yrs 61.8 5.05 35 0.892 Ns

present 3-4 yrs 60.32 4.26 34

company 5 yrs & above 61.17 3.31 6

Total 61.08 4.59 75

What is the 90% -100% 62.2 5.71 15 1.741 Ns

improvement in 75% - 90% 61.82 3.73 34

productivity 50% - 75% 59.55 5.04 22

after your Below 50% 59 0.82 4

motivation Total 61.08 4.59 75

programme?

Ns: Not significant,* Significant at 5% level (95% Probability),** Significant at 1% level (99% Probability

Source: Primary Data collected and calculated through questionnaire.

Copyright © 2016 Published by IJMRR. All rights reserved 1087

R. Anitha et. al., / International Journal of Management Research & Review

Table No.V.2: Improvement in productivity after the training programme

What is the improvement in productivity after your Total

training programme? Chi

VARIABLES GROUPS 90% - 75% - 90% 50% - 75% Below 50% No. % Square Significance

100% Value

No. % No. % No. % No. %

Male 8 15.4 25 48.1 15 28.8 4 7.7 52 100

Gender Female 7 30.4 9 39.1 7 30.4 23 100

Total 15 20 34 45.3 22 29.3 4 5.3 75 100 3.871 Ns

21-25 yrs 5 31.3 7 43.8 4 25 16 100

26-30 yrs 2 11.8 11 64.7 2 11.8 2 11.8 17 100

31-35 yrs 3 15.8 8 42.1 6 31.6 2 10.5 19 100

Age in years

36-40 yrs 2 12.5 5 31.3 9 56.3 16 100

Above 40 yrs 3 42.9 3 42.9 1 14.3 7 100

Total 15 20 34 45.3 22 29.3 4 5.3 75 100 16.981 Ns

GRADUATE 6 10.5 30 52.6 18 31.6 3 5.3 57 100

Education POST

Qualification GRADUATE 9 50 4 22.2 4 22.2 1 5.6 18 100

Total 15 20 34 45.3 22 29.3 4 5.3 75 100 13.859 **

Rs.2-3 Lacs 5 26.3 8 42.1 6 31.6 19 100

Monthly

Rs.3-4 Lacs 6 16.2 22 59.5 7 18.9 2 5.4 37 100

Income (In

Rs.4-5 Lacs 4 21.1 4 21.1 9 47.4 2 10.5 19 100

Rs.)

Total 15 20 34 45.3 22 29.3 4 5.3 75 100 10.28 Ns

1-2 yrs 11 31.4 16 45.7 7 20 1 2.9 35 100

Experience in

3-4 yrs 2 5.9 16 47.1 13 38.2 3 8.8 34 100

present

5 yrs& above 2 33.3 2 33.3 2 33.3 6 100

company

Total 15 20 34 45.3 22 29.3 4 5.3 75 100 9.911 Ns

Ns: Not significant,* Significant at 5% level (95% Probability),** Significant at 1% level (99% Probability);

Source: Primary Data collected and calculated through questionnaire.

Table No. V. 3 : Employee performance before and after the training programme.

What is the improvement in productivity after your total

training programme?

90% -100% 75% - 90% 50% - 75% Below 50% No. %

No. % No. % No. % No. %

What is the 90% -100% 2 50 1 25 1 25 4 100

percentage of 75% - 90% 9 45 9 45 2 10 20 100

business you have 50% - 75% 2 7.1 22 78.6 4 14.3 28 100

done before your Below 50% 2 8.7 2 8.7 15 65.2 4 17.4 23 100

training programme total 15 20 34 45.3 22 29.3 4 5.3 75 100

Source: Primary Data collected and calculated through questionnaire.

Chi-Square Test

Value df Sig.

Chi-Square 49.708 9 **

Table V.4: Impact of Human Resource Practices on employees productivity

N Min. Max. Mean S.D

Motivational programmes are being conducted by the 75 1 5 3.9067 0.80829

management

Motivation is important in business / job to perform well 75 3 5 4.28 0.53423

Workers put in their best when they are motivated well and 75 1 5 4.12 0.71584

allowed to work freely

Well-motivated staffs have a positive attitude towards work 75 2 5 4.04 0.62472

Adequate and relevant information about the organization and 75 3 5 4.12 0.51883

job is provided

The training needs of the employees in our organization are 75 3 5 4.1733 0.55443

assessed

The contents of the training programs organized are always 75 2 5 4.04 0.68655

relevant

Our organization follows the policy of matching pay with 75 2 5 4.0533 0.6554

performance

Copyright © 2016 Published by IJMRR. All rights reserved 1088

R. Anitha et. al., / International Journal of Management Research & Review

The existing reward and incentive plans do not motivate us for 75 1 5 3.9333 1.06965

better performance.

Our organization appraises the performance of its employees at 75 2 5 3.8 0.73521

regular intervals

Performance appraisal in our organization aims at improving 75 2 5 4.24 0.6543

employee performance.

Our performance goals are set at realistic levels 75 1 5 3.9867 0.7797

We receive proper feedback on how we are performing 75 2 5 4.16 0.65842

Adequate growth opportunities are available in our organization 4.0933 0.52436

75 2 5

for those who perform well

In our organization good performers get promoted first 75 2 5 4.1333 0.74132

Source: Primary Data collected and calculated through questionnaire.

REFERENCES

[1] Kutty S, Misra P. IC 33 Life Insurance, Insurance Institute of India, Mumbai, 2012.

[2] Decenzo, Robbins. Human Resource Management, Wiley, 8th Edition 2007.

[3] Korkeakoulu V, Nassazi A. Effects of training on Employee performance. Evidence from

Uganda, Koskinen Ossi, 203.

[4] Verma S, Goyal R. A Study Of Training In Insurance And Their Impact On Employees

Productivity. International Journal of Research in Economics and Social Sciences 2011; 1(1).

[5] Gamage PN, Imbulana L. International Journal of Marketing, Finance Service &

Management Research 2013; 2(9).

[6] Hemanalini R. Analysis of Imapct of Training and Development on Employees

Performance at Life Insurance Company. IJSR - International Journal of Scientific Research

2013; 2(10).

[7] Elnaga A, Imran A. European Journal of Business and Management 2013; 5(4).

[8] Hafeez U, Md. Jinnah A. Impact of Training on Employees Performance (Evidence from

Pharmaceutical Companies in Karachi, Pakistan). Business Management and Strategy 2015;

6(1).

[9] Farooq M, Md. Khan A. Impact of Training and Feedback on Employee Performance. Far

East Journal of Psychology and Business 2011; 5(1).

[10] Ameeq-ul-Ameeq, Hanif F. Superior University Lahore, Journal of Business Studies

Quarterly 2013; 4(4).

[11] Andrews G, Russell M. Employability skills development : strategy , evaluation and

impact 2012; 2(1): 33–44. http://doi.org/10.1108/20423891211197721

[12] Asmaak L, Corresponding S. Employability Awareness among Malaysian

Undergraduates 2010; 5(8): 119–124

Copyright © 2016 Published by IJMRR. All rights reserved 1089

Вам также может понравиться

- H-2B Temporary Nonimmigrant Worker Visa Program Enforcement: U.S. Department of Labor Wage and Hour DivisionДокумент25 страницH-2B Temporary Nonimmigrant Worker Visa Program Enforcement: U.S. Department of Labor Wage and Hour DivisionBorivoje SoldatovicОценок пока нет

- Mohamud - The Effect of Training On Employee Performance in Public Sector Organizations in Kenya - The Case of Nhif Machakos CountyДокумент107 страницMohamud - The Effect of Training On Employee Performance in Public Sector Organizations in Kenya - The Case of Nhif Machakos CountyBorivoje SoldatovicОценок пока нет

- 2019 Ultimate Recruiting ToolboxДокумент48 страниц2019 Ultimate Recruiting ToolboxBorivoje Soldatovic100% (2)

- Financial Report ViewerДокумент285 страницFinancial Report ViewerBorivoje SoldatovicОценок пока нет

- Internship QuestionsДокумент1 страницаInternship QuestionsBorivoje SoldatovicОценок пока нет

- AMD VISION Engine Marketing BriefДокумент9 страницAMD VISION Engine Marketing BriefBorivoje SoldatovicОценок пока нет

- A International GuideДокумент10 страницA International GuideBorivoje SoldatovicОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Part Time Civil SyllabusДокумент67 страницPart Time Civil SyllabusEr Govind Singh ChauhanОценок пока нет

- The Piano Lesson Companion Book: Level 1Документ17 страницThe Piano Lesson Companion Book: Level 1TsogtsaikhanEnerelОценок пока нет

- Britannia Volume 12 Issue 1981 (Doi 10.2307/526240) Michael P. Speidel - Princeps As A Title For 'Ad Hoc' CommandersДокумент8 страницBritannia Volume 12 Issue 1981 (Doi 10.2307/526240) Michael P. Speidel - Princeps As A Title For 'Ad Hoc' CommandersSteftyraОценок пока нет

- IG Deck Seal PumpДокумент3 страницыIG Deck Seal PumpSergei KurpishОценок пока нет

- A - PAGE 1 - MergedДокумент73 страницыA - PAGE 1 - MergedGenalyn DomantayОценок пока нет

- PreviewpdfДокумент83 страницыPreviewpdfJohana GavilanesОценок пока нет

- Monitor Stryker 26 PLGДокумент28 страницMonitor Stryker 26 PLGBrandon MendozaОценок пока нет

- Protection in Distributed GenerationДокумент24 страницыProtection in Distributed Generationbal krishna dubeyОценок пока нет

- Agile ModelingДокумент15 страницAgile Modelingprasad19845Оценок пока нет

- Lesson Plan SustainabilityДокумент5 страницLesson Plan Sustainabilityapi-501066857Оценок пока нет

- IFR CalculationДокумент15 страницIFR CalculationSachin5586Оценок пока нет

- Bigbazaar PDFДокумент14 страницBigbazaar PDFazhagu sundaramОценок пока нет

- The Grass Rink Summer Final 2019Документ9 страницThe Grass Rink Summer Final 2019api-241553699Оценок пока нет

- Kidney Stone Diet 508Документ8 страницKidney Stone Diet 508aprilОценок пока нет

- What Says Doctors About Kangen WaterДокумент13 страницWhat Says Doctors About Kangen Waterapi-342751921100% (2)

- Settlement Report - 14feb17Документ10 страницSettlement Report - 14feb17Abdul SalamОценок пока нет

- Session4 Automotive Front End DesignДокумент76 страницSession4 Automotive Front End DesignShivprasad SavadattiОценок пока нет

- Ideal Gas Law Lesson Plan FinalДокумент5 страницIdeal Gas Law Lesson Plan FinalLonel SisonОценок пока нет

- Electric Motor Cycle and ScooterДокумент9 страницElectric Motor Cycle and ScooterA A.DevanandhОценок пока нет

- Formal Letter LPДокумент2 страницыFormal Letter LPLow Eng Han100% (1)

- Dialog InggrisДокумент4 страницыDialog Inggrisبايو سيتياوانОценок пока нет

- 21st CENTURY TECHNOLOGIES - PROMISES AND PERILS OF A DYNAMIC FUTUREДокумент170 страниц21st CENTURY TECHNOLOGIES - PROMISES AND PERILS OF A DYNAMIC FUTUREpragya89Оценок пока нет

- CDR Writing: Components of The CDRДокумент5 страницCDR Writing: Components of The CDRindikuma100% (3)

- T-Tess Six Educator StandardsДокумент1 страницаT-Tess Six Educator Standardsapi-351054075100% (1)

- LS01 ServiceДокумент53 страницыLS01 ServicehutandreiОценок пока нет

- Revised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10Документ6 страницRevised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10May Ann GuintoОценок пока нет

- Brochure International ConferenceДокумент6 страницBrochure International ConferenceAnubhav Sharma sf 12Оценок пока нет

- DxDiag Copy MSIДокумент45 страницDxDiag Copy MSITạ Anh TuấnОценок пока нет

- Migne. Patrologiae Cursus Completus: Series Latina. 1800. Volume 51.Документ516 страницMigne. Patrologiae Cursus Completus: Series Latina. 1800. Volume 51.Patrologia Latina, Graeca et OrientalisОценок пока нет

- 100 20210811 ICOPH 2021 Abstract BookДокумент186 страниц100 20210811 ICOPH 2021 Abstract Bookwafiq alibabaОценок пока нет