Академический Документы

Профессиональный Документы

Культура Документы

Money Times Tower Talk - 26th Nov'18

Загружено:

DeepakGarudИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Money Times Tower Talk - 26th Nov'18

Загружено:

DeepakGarudАвторское право:

Доступные форматы

*Caution: Please note that your copy/access to our website is for your exclusive use only.

Any attempt to share your access to our website or forwarding your copy to a

non-subscriber will disqualify your membership and we will be compelled to stop your supply and forfeit your subscription thereafter without any refund to you.

T I M E S

A TIME COMMUNICATIONS PUBLICATION

VOL XXVIII No.4 Monday, 26 November - 2 December 2018 Pgs.21 Rs.20

Markets are indecisive Now follow us on Instagram, Facebook &

By Sanjay R. Bhatia Twitter at moneytimes_1991 on a daily basis

The markets remained rangebound last week. Though the Nifty to get a view of the stock market and the

managed to move above the 10770 mark, it failed to sustain at happenings which many may not be aware of.

the higher level due to lack of follow-up buying support. The

markets witnessed intermediate bouts of profit-booking and selling pressure due to overbought conditions. The breadth

of the market remained negative amidst low volumes.

The FIIs turned net sellers in the cash and derivatives

segment. The DIIs, however, were seen buying at the

lower levels and remained net buyers during the week.

Believe it or not!

Despite the negative sentiment in the markets

The global markets remained volatile. Crude oil prices

softened further as US crude inventories rose to the last week, some of our stocks have delivered

highest level since December 2017 amid concerns of an decent returns!

emerging global glut. However, expected supply cut by ✓ Banswara Syntex recommended at Rs.92.80 in

OPEC is likely to prevent further drops. On the domestic

TT last week, zoomed to Rs.100.45 appreciating

front, the fall in crude oil prices is good for the market

sentiment and the rupee.

8% in just 1 week!

✓ Lambodhara Textiles recommended at

Technically, the prevailing negative technical conditions

Rs.49.80 in TF last week, zoomed to Rs.52.05

weighed on the market sentiment. The RSI and KST are

both placed below their respective averages on the daily appreciating 5% in just 1 week!

and weekly charts. Further, the Stochastic is placed below ✓ IOL Chemicals & Pharmaceuticals

its average on the daily chart and remains in the recommended at Rs.170.60 in BE last week,

overbought zone on the weekly chart. Moreover, the Nifty zoomed to Rs.177.50 appreciating 4% in just 1

is placed below its 50-day SMA, 100-day SMA and 200- week!

day SMA. The Nifty’s 50-day SMA is placed below its 100- ✓ India Cements recommended at Rs.93.85 in BB

day SMA and 200-day SMA signaling a ‘Death Cross’ last week, zoomed to Rs.97 appreciating 3% in

breakdown. All these negative technical conditions could just 1 week!

lead to profit-booking and selling pressure especially at ✓ Aditya Birla Capital recommended at

the higher levels.

Rs.113.35 in SB last week, zoomed to Rs.116.90

The prevailing positive technical conditions, however, still appreciating 3% in just 1 week!

hold good. The MACD is placed above its average on the

daily chart. Further, the Stochastic is placed above its (BB – Best Bet; BE – Bull’s Eye; SB – Stock Buzz;

average on the weekly chart. These positive technical TF – Techno Funda; TT – Tower Talk)

conditions could lead to buying support at the lower

levels.

This happens only in Money Times!

The -DI line has moved above the +DI line but both are

Now in its 28th Year

A Time Communications Publication 1

converging. The ADX line is placed below 17, which indicates indecisiveness and lack of a trend. The Nifty has closed

below the 10589 level, which does not augur well for the markets. It is important for the Nifty to move and close above

10589 in order to rise further.

10400 is now an important support level. The market

sentiment remains tentative and indecisive ahead of state

election results next month. The markets are likely to turn

volatile ahead of the F&O segment expiry on Thursday.

Meanwhile, the markets will take cues from the news flow on

state elections, Dollar-Rupee exchange rate, global markets and

crude oil prices.

Technically, the Sensex faces resistance at the 35187, 35400,

35606, 36350, 36602 and 37165 levels and seeks support at

the 34748, 34344, 33723 and 33349 levels. The resistance

levels for the Nifty are placed at 10589, 10625, 10710, 10756

and 10843 while its support levels are placed at 10419, 10340,

10283, 10200 and 10000.

EDITOR’S BRIEF

Mint St. stumps Dalal St.!

By R.N. Gupta

Marketmen and seasoned investors were not unduly worried at the 10-month long correction in the stock markets after

the 2-year old smart rally in 2016 and 2017. It was a long overdue correction in a bull market they reckoned. Barely

anyone subscribed to the view that the bear market had set in while volatility had become a way of life.

So while Diwali on 7th November 2018 was to usher in new cheer or the bourses, they suffered another sudden pitfall as

the financial world was hit by the stand-off between the mandarins of the North Block or the Finance Ministry in New

Delhi and the Old Lady of Mint Street i.e. the Reserve Bank of India (RBI). The atmosphere was so charged that many

speculated that RBI Governor, Urjit Patel, would resign rather than give into the pressure from Delhi to release more

funds from its reserves as dividend to the Government of India over and above the Rs.50000 crore already declared.

The discomfiture of the RBI was evident by Dy. Governor, Viral Acharya’s outburst on 29 th October, which shattered the

peace of the financial world. It was a long suppressed angst against the central government, which was steadily

encroaching upon the independence of the RBI. The government’s threat to invoke Article 7 of the RBI Act to force its

way was the proverbial last straw that set the shock waves and sent the stock markets into a tizzy.

While a stand-off or even a face-off between a central bank of a country and the government of the day is not unusual, it

rarely precipitates a crisis leading one or the other party to climb down or quit. But in the Indian context, this seemed

very likely and had Governor Urjit Patel put in his papers, one or two deputy governors may have followed suit, which

would have a triggered crisis that would hit global fund flows and put the economy in a limbo even though temporarily.

Thank God, wisdom prevailed and the massive 9-hour long meeting on Monday, 19 November 2018, finally cooled

tempers as both sides conducted themselves very professionally and were able to hammer out a solution.

So what was at stake? The BJP-led NDA government at the centre was in a tearing hurry to inject liquidity in the system

as it was gearing up for elections in Chhattisgarh, Karnataka, MP, Rajasthan, Meghalaya, Mirzoram, Nagaland and

Tripura. After earning the flak of its traditional supporters compromising businessmen, shopkeepers and traders for

demonetisation and GST, the BJP was keen to woo them back with easy loans or restructured loans as a face saving

device. Clearly, a short term measure to garner votes.

The RBI was naturally worried that the easy liquidity envisaged by the political mavens in New Delhi will have a

cascading effect on prices of commodities and goods and unleash the specter of inflation that has been tightly controlled

over the past six years. So the medium-to-long term impact of such a move was certainly not good for the country. More

money chasing the same level of productivity can only lead to higher prices is a classical economic theory that even a

high school student will confirm.

Thus in reality, it was a case of political opportunism knocking off conservative banking that has stood the test of time.

History is full of the financial misadventures of dictators or strong leaders who ran their county’s economy aground with

their short-term outlook. All political leaders know that their glory can never be everlasting but they try all tricks to

A Time Communications Publication 2

remain in power by amending constitutions, dismissing honest and unobliging bureaucrats, bankers or fudges or

embrace their rivals with impurity to retain their chair or tinker with the economy without realizing the implications or

even go to war for this purpose. These power hungry individuals or groups are egocentrics who subscribe to the biblical

adage ‘after me, the deluge!’

This is classic power structure that has dogged societies for ages wherein the political power seeker wants his cronies to

head the army, police, treasury, judiciary and even the religious and now the media too just to retain power. Ideology

and beliefs become secondary as megalomania takes over. It is ‘my way or the highway’ thereafter! And this is common

to all parties and countries.

So if the 83-year old RBI was led to the brink, investors have something to think about seriously. Independent

institutions like the Election Commission, Judiciary, Reserve Bank, Media and Defence Services are the hallmark of a

great democracy that must be preserved at all costs. We all know what happened when Mrs. Indira Gandhi subverted

these institutions with her inglorious ‘Emergency’ and paid a colossal price for it thereafter.

Let this not happen again. The Finance Ministry has been trying to check the RBI for the past six years ever since Y.U.

Reddy retired as the Governor. He was replaced by Subbarao from the Finance Ministry but who refused to toe the line

of the then Finance Minister P. Chidambaram once he took over. Obviously, he was not granted an extension or plum

assignment by the UPA government who brought in Dr. Raghuram Rajan from USA. Rajan changed the image of the RBI

with his media savvy but sound economic expositions. But he did not earn the encomiums, which he possibly deserved

in the NDA set up. Resultantly, he hung up his boots and returned to teaching in USA. He is said to have opposed

demonetisation and cooked his goose with his NDA bosses. But he did sound his word of caution at the recent imbroglio

when the Centre was clamoring for growth and the RBI for caution when he said that while the government was the

driver of the economy, the RBI was the safety belt.

Need anything more be said. The two sides having patched up with the RBI releasing Rs.8000 crore by way of

subscription to government bonds, cheer should once again return to Dalal Street.

TRADING ON TECHNICALS

Resistance in higher range

Sensex Daily Trend DRV Weekly Trend WRV Monthly Trend MRV

Last Close 34981 Down 35185 Down 35743 Up 33029

Start Date - 22-11-18 - 21-09-18 - 31-05-16 -

Start Level - 34981 - 36841 - 26667 -

Gain/Loss (-) - 0 - 1860 - 8314 -

% Gain/Loss (-) - 0.00 - 5.05 - 31.18 -

Last week, the Sensex opened at 35647.62, made a high at 35818.82 and moved to a low of 34937 before it closed the

week at 34981.02 and thereby registered a net fall of 476 points on a week-to-week basis.

Daily Chart

The resistance gap was at 35820-35975. A fall was seen after Monday along with a bearish candle and lower high, lower

low formation.

A swing top was formed on the daily chart last week with

support around 34672.

The band of movement was 35975-34672.

The Sensex may test the support level of 34672. A close below

34672 with a bearish candle could extend the slide to 33776-

33291.

Weekly Chart

A dark cloud cover candlestick pattern on the weekly chart

suggests a rise above 35818 on a weekly closing basis.

Resistance levels are placed at 35245-35553-35818. Lower

range for the week is 34673-33792. A fall and close below

34672 with a bearish candle at the end of the week will drag

the Sensex lower to 33723-33291 levels.

A Time Communications Publication 3

A pullback rally is possible if the weekly close is above 35818. Subsequently, a rise to 36145 and 36809 may be tested.

But as of now, the objective remains to exit long at the resistance levels till the Sensex does not cross 35818 on a daily

and weekly closing basis.

BSE Mid-Cap Index

Weekly chart:

The band of movement is 15065-14650 and a directional movement is outside the band.

BSE Small-Cap Index

Weekly chart:

Expect a rise above 14752 closing. Till then, expect resistance and selling pressure.

Strategy for the week

Exit long and sell on a rise to 35245-35553 with a stop loss of 35820. Expect the lower range of 34673-33792 to be

tested.

The downside momentum will continue below 34672

Trade long if the Sensex sustains above 35820 on Friday.

WEEKLY UP TREND STOCKS

Let the price move below Center Point or Level 2 and when it move back above Center Point or Level 2 then buy with whatever low

registered below Center Point or Level 2 as the stop loss. After buying if the price moves to Level 3 or above then look to book profits as

the opportunity arises. If the close is below Weekly Reversal Value then the trend will change from Up Trend to Down Trend. Check on

Friday after 3.pm to confirm weekly reversal of the Up Trend.

Note: R1-(Resistance), R2- (Resistance), R3- Resistance, S1- Support & S2- Support

Weekly Up

Scrip Last Relative

S1 S2 - R1- R2- Reversal Trend

Close Strength

Value Date

Weak Demand Demand Supply Supply

below point point point point

LINDE INDIA LTD 644.60 613.9 621.8 636.7 659.4 697.0 74.2 585.4 2/11/2018

VINDHYA TELELINKS 1876.00 1710.0 1759.0 1827.0 1944.0 2129.0 68.5 1718.5 2/11/2018

SKF INDIA 1878.00 1850.0 1855.0 1873.0 1896.0 1937.0 64.2 1830.0 19-10-18

LARSEN & TOUBRO 1409.00 1394.0 1394.7 1408.3 1422.7 1450.7 61.3 1382.3 2/11/2018

PIDILITE INDUSTRIES 1154.00 1110.0 1121.7 1142.3 1174.7 1227.7 61.2 1073.3 2/11/2018

*Note: Up and Down Trend are based of set of moving averages as reference point to define a trend. Close below

averages is defined as down trend. Close above averages is defined as up trend. Volatility (Up/Down) within Down

Trend can happen/ Volatility (Up/Down) within Up Trend can happen. Relative Strength (RS) is statistical

indicator. Weekly Reversal is the value of the average.

WEEKLY DOWN TREND STOCKS

Let the price move above Center Point or Level 3 and when it move back below Center Point or Level 3 then sell with whatever high

registered above Center Point or Level 3 as the stop loss. After selling if the prices moves to Level 2 or below then look to cover short

positions as the opportunity arises. If the close is above Weekly Reversal Value then the trend will change from Down Trend to Up Trend.

Check on Friday after 3.pm to confirm weekly reversal of the Down Trend.

Note: R1-(Resistance), R2- (Resistance), R3- Resistance, S1- Support & S2- Support

Weekly Down

Scrip Last Relative

S1 S2 - R1- R2- Reversal Trend

Close Strength

Value Date

Demand Demand Supply Supply Strong

point point point point above

CENTRAL BANK 30.50 28.3 29.9 31.0 31.5 32.0 24.04 31.43 22-11-18

NTPC 146.10 134.2 143.0 148.8 151.9 154.5 30.70 153.09 21-09-18

INDBULLS REAL ESATE 83.10 76.2 80.9 83.4 85.6 86.0 33.80 85.60 22-11-18

PRESTIGE ESTATE PROJ 172.20 160.8 169.2 174.6 177.6 180.0 34.02 182.15 9/11/2018

SAIL 60.40 54.4 58.9 61.8 63.4 64.8 34.16 64.99 16-11-18

A Time Communications Publication 4

*Note: Up and Down Trend are based of set of moving averages as reference point to define a trend. Close below

averages is defined as down trend. Close above averages is defined as up trend. Volatility (Up/Down) within Down

Trend can happen/ Volatility (Up/Down) within Up Trend can happen.

EXIT LIST

Note: R1- (Resistance), R2- (Resistance), R3- Resistance, S1- Support & SA- Strong Above

Scrip Last Close R1 R2 R3 SA S1 Monthly RS

WEST COAST PAPER MIL 353.75 367.86 376.77 385.69 414.55 292.3 47.27

TECH MAHINDRA 690.95 708.44 715.67 722.91 746.35 647.1 49.62

LTTS 1511.80 1584.84 1620.00 1655.16 1769.00 1286.8 59.04

BUY LIST

Note: R1-(Resistance), R2- (Resistance), R3- Resistance, S1- Support & WB- Weak Below

Scrip Last Close S3 S2 S1 WB R1 Monthly RS

LINDE INDIA LTD 644.00 583.65 554.50 525.35 431.00 830.7 64.45

VINDHYA TELELINKS 1876.00 1751.83 1700.50 1649.17 1483.00 2186.8 57.01

PUNTER PICKS

Note: Positional trade and exit at stop loss or target whichever is earlier. Not an intra-day trade. A delivery based trade for a possible time frame

of 1-7 trading days. Exit at first target or above.

Note: SA-Strong Above, DP-Demand Point, SP- Supply Point, SA- Strong Above, RS- Strength

Weak Supply Supply RS-

Scrip BSE Code Last Close Demand Point Trigger

below point point Strength

DARJEELING 539770 99.65 97.50 100.30 93.60 104.4 111.1 84.14

SHREESHAY ENGG 541112 24.70 23.50 24.75 20.00 27.7 32.4 72.83

INDIAN HUME PIPE CO. 504741 318.30 311.20 324.25 303.70 337.0 357.5 68.88

ORIENTAL CARBON & CH 506579 1157.00 1137.00 1172.00 1128.00 1199.2 1243.2 66.3

STOVEC INDUSTRIES 504959 2624.00 2575.00 2690.00 2416.00 2859.3 3133.3 55.43

LANCOR HOLDINGS 509048 20.55 20.00 20.90 18.35 22.5 25.0 52.99

TOWER TALK

✓ Dr. Reddy’s Laboratories has received a favourable judgment in a litigation pertaining to Suboxone sublingual film

in USA. A big positive for the company. Buy.

✓ Adani Gas has been authorized to expand its city gas footprint in 13 new geographical areas. Buy.

✓ Power Finance Corporation and REC are both faring well and have good dividend yields. Buy.

✓ Dewan Housing Finance Corporation posted fantastic Q2 results with 52% higher PAT and is likely to notch an

EPS of over Rs.52 for FY19. Buy.

✓ IDBI Bank may be back in the black by Q1FY20 on the back of better cash management and selling LIC plans.

Accumulate in small quantities.

✓ Vodafone Idea plans to liquidate Rs.14000 crore worth assets because of its business synergies over the next 1-2

years. Buy on dips.

✓ Deepak Fertilisers & Petrochemicals Corporation fell sharply after its profitability took a small beating.

However, the ongoing capex is likely to boost its earnings going forward. Buy.

✓ Cyient is expected to grow at over 20% CAGR in the next few years on the back of strong long-term client orders.

The stock could rise by ~30% in the next 6 months.

✓ Sheet rubber prices are falling on account of higher production. J.K. Tyre Industries will be a big beneficiary. Buy.

✓ There may be consensus among the promoters of Yes Bank about reaching a truce. At the current beaten down

level, there is nothing more to lose. Buy.

✓ Piramal Enterprises may soon raise ~Rs.1000 crore by way of non-convertible debentures (NCDs) to fund its

expansion and working capital requirements. The company is on an expansion spree. Buy.

A Time Communications Publication 5

✓ NBCC is bidding for J.P. Infra to expand projects. With orders worth ~Rs.90000 crore in hand, its future looks bright.

Buy immediately for good returns in 2 years.

✓ Not all NBFCs are in a financial mess.

IndiaBulls Housing Finance will

bounce back sharply. Start

One more successful year for

accumulating. TF+ subscribers…

✓ Maruti Suzuki (India) has introduced “Think Short-Term Investment…

a new version of Ertiga priced at Rs.7.44 Think TECHNO FUNDA PLUS”

lakh. The stock may bounce back.

✓ State-owned Oil & Natural Gas Techno Funda Plus is a superior version of the Techno Funda

Corporation has hit an all-time high in column that has recorded near 90% success since launch!

natural gas production. Gas prices are

Every week, Techno Funda Plus identifies three fundamentally

also on the rise. Buy. sound and technically strong stocks that can yield handsome

✓ Kanchi Karpooram reported excellent returns against their peers in the short-to-medium-term.

results for Q2 and is expected to notch

an EPS of Rs.90 for FY19. The stock is a Most of our recommendations have fetched excellent returns to

our subscribers. Of the 156 stocks recommended between 11

steal at the current level. Buy.

January 2016 and 2 January 2017 (52 weeks), we booked 2-43%

✓ Aurobindo Pharma will launch its first profit in 125 stocks, 28 triggered the stop loss of 1-21%.

set of speciality drugs in the oncology

segment in USA. This major Of the 156 stocks recommended between 9 January 2017 and 1

breakthrough will boost its earnings. January 2018 (52 weeks), we booked 7-41% profit in 124 stocks,

Buy. 30 triggered the stop loss of 2-18%.

✓ Kaveri Seed Company has launched Of the 99 stocks recommended between 8 January 2018 and 20

new products that are expected to boost August 2018 (33 weeks), we booked 3-41% profit in 61 stocks, 11

its cotton seeds business. It also plans triggered the stop loss of 4-8% while 27 stocks are still open.

to expand its footprint in newer

geographies. Buy. If you want to earn like this,

✓ Reliance Jio is likely to replace Bharti subscribe to TECHNO FUNDA PLUS today!

Airtel as a service provider for the For more details, contact Money Times on

Railways from 1 January 2019. A big 022-22616970/22654805 or moneytimes.support@gmail.com.

positive for Reliance Industries. Subscription Rate: 1 month: Rs.2500; 3 months: Rs.6000;

Moreover, all its verticals are now good 6 months: Rs.11000; 1 year: Rs.18000.

profit centres. Buy.

✓ The value of Huhtamaki PPL’s land in Thane is much more than its current market cap. The stock is available near

its 52-week low and is a screaming buy!

✓ Saksoft reported a stellar performance in Q2 with an EPS of Rs.9 and expects H2 to be equally good. It has grown

consistently at over 20%. The stock may double from the current level.

✓ PTC India Financial Services is being accumulated by people in the know how on expectations of a 50% jump in its

share price.

✓ An Ahmedabad-based analyst recommends RACL Geartech, Reliance Chemotex Industries and 20 Microns. From

his previous recommendations, Goldiam International appreciated 17% from Rs.70.1 to Rs.81.7 in just 1.5 months!

BEST BET

Cochin Shipyard Ltd

(BSE Code: 540678) (CMP: Rs.377.15) (FV: Rs.10)

By Bikshapathi Thota

Incorporated in 1972, Cochin Shipyard Ltd (CSL) has emerged as a forerunner in the shipbuilding and ship repair

industry having exported 45 ships to various commercial clients outside India such as National Petroleum Construction

Company (Abu Dhabi), the Clipper Group (Bahamas), Vroon Offshore (Netherlands) and SIGBA AS (Norway). It has built

and repaired some of the largest ships in India and is now building the prestigious Indigenous Aircraft Carrier for the

A Time Communications Publication 6

Indian Navy. Apart from bulk carriers, it builds smaller and more technically sophisticated vessels such as Platform

Supply Vessels (PSVs) and Anchor Handling Tug Supply Vessels (AHTSVs). Its key shipbuilding clients in the domestic

market include the Indian Navy, the Indian Coast Guard and the Shipping Corporation of India. The Government of India

holds 75% stake in the company.

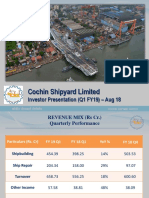

Shipbuilding: CSL generated an income of Rs.1731.86 crore in FY18 from this vertical v/s Rs.1515.82 crore in FY17.

During the year, it delivered 2 double-ended Ro-Ro vessels for Kochi Municipal Corporation apart from various other

projects. It also commenced work on some major projects. Its Phase III contract is expected to be concluded by FY19

end.

Ship Repair: CSL is a market leader in the ship repair segment with ~39% market share. Its ship repair business is

twice more profitable compared to its shipbuilding business. It has executed over 2,000 projects in this vertical. It

undertakes complex and sophisticated repairs of all types of vessels including Oil Rigs, Naval and Coast Guard Vessels,

Offshore Vessels, Dredgers, Fishing Vessels, Passenger Ships, Port Crafts, etc. It is the only yard in India to undertake dry

dock repairs of Aircraft Carriers INS Viraat and INS Vikramaditya. It has also undertaken major revamping and

refurbishing of oil rigs including steel renewal, up gradation of drilling, cementing, mechanical, piping systems in almost

all major offshore vessels and rigs of ONGC. The management also wishes to capitalize on inland water transportation

and coastal shipping space through various capacity building initiatives.

Recent Developments:

a) CSL is in the process of enhancing its existing capacity by building a new dry dock on its premises and setting up an

international ship repair facility (ISRF) at the Cochin Port Trust land. Post expansion, it will have the capacity to

repair ~150 ships in Kochi v/s ~80-100 ships currently. Therefore, it expects the ISRF facility to add another Rs.300

crore in revenue in the second year of its operation.

b) CSL has signed MoUs with the Mumbai Port Trust and Kolkata

Port Trust for setting up ship repair facilities at the Indira Dock Financial Performance: (Rs. in crore)

in Mumbai and Netaji Subhash Dock in Kolkata. Post expansion, Particulars FY16 FY17 FY18 FY19E

its Mumbai facility is expected to generate revenues of ~Rs.150- Sales 1993 2057 2355 2612

200 crore in 2.5 years while the Kolkata facility is expected to

EBITDA 419 493 604 676

generate revenues of ~Rs.30-40 crore.

c) CSL formed a JV with Hooghly Dock and Port Engineers Ltd to Net Profit 273 312 397 454

operationalize the Salkia and Nazirgunge facilities for the EPS (Rs.) 24 28 31 35.2

construction and repair of vessels for inland and coastal NPM (%) 13.8% 15.6% 16.8% 17.2%

waterways.

It signed a MoU with United Shipbuilding Corporation (USC), Russia, to collaborate for the design, development and

execution of high-end, state-of-the-art vessels for inland and coastal waterways. It signed a MoU with Defence

Research and Development Organisation (DRDO) for export of defence vessels.

d) CSL emerged as the lowest bidder for a Rs.5400 crore project of the Indian Navy comprising 8 vessels. It also won

the contract for Sagar Bhushan from ONGC and Sagardhwani of DRDO.

Outlook and Valuation: CSL’s overall order book stands at over Rs.12000-13000 crore. In the ship building vertical, it

expects over Rs.2000 crore worth projects being executed in FY19. It believes that the ongoing and upcoming expansion

projects will help free up more space for repairing large international vessels and doubling its ship repairing revenue to

Rs.1200 crore in the next 3 years. CSL is also looking at setting up a facility in the Andaman & Nicobar Islands.

CSL has cash and cash equivalents of Rs.3367 as at FY18, which is ~65% of its market cap. Its current order book stands

at ~Rs.7000 crore. With best-in-class execution capabilities, leverage-free balance sheet, substantial orders in hand,

planned capex and acquisition plans, its future seems bright with good earnings visibility. Therefore, we have a Buy on

the stock with a price target of Rs.525 (15x FY19E earnings) within a year.

STOCK WATCH

By Amit Kumar Gupta

Ramkrishna Forgings Ltd

(BSE Code: 532527) (CMP: Rs.562.45) (FV: Rs.10) (TGT: Rs.675+)

Incorporated in 1981, Kolkata-based Ramkrishna Forgings Ltd (RFL) manufactures die forgings of carbon and alloy

steel, micro alloy steel and stainless steel. It offers crown wheels/ ring gears, I-beams, crankshafts, connecting rods,

A Time Communications Publication 7

knuckles, center wedges, steering and tie rod arms, stub axles, brake flanges, wheel hubs, yokes, front engine mounting

arms, tooth products, hammer bars, bearing caps, counterweights, ring gear carriers, pinions, front hubs, shafts, coupling

flanges, gears, clutch collars, etc. It also provides screw couplings, bolster suspensions, side frame keys and draw gear

assemblies. Its products find application in various industries including automotive, earth moving and mining, farm

equipment, steel plants, railways, general engineering, bearing, oil and gas as well as OEMs (original equipment

manufacturers).

With growth coming from North America and Mexico, we expect RFL’s export business to grow further. Exports to

Europe are expected to kick in from Q4FY19. Higher exports will supplement higher machining capacity utilisation,

driven by demand from customers in Europe and North America. We expect revenue to grow at 14% CAGR over FY18-

20, primarily driven by a 32% export CAGR to Rs.7250 million in FY20, up from Rs.4120 million in FY18. We expect

EBIDTA to grow at 17% CAGR over FY18-20. Also, the greater proportion of exports will ensure better working capital

(debtor days in Europe are 60-70 v/s 162 for North America). Continuing export traction in FY19 and FY20, a shift in the

geographic mix to European markets from higher press-lines and diversification to light commercial vehicles (LCVs) and

passenger vehicles augur well for RFL’s long-term growth and margin expansion.

We believe that its domestic growth will be driven by market-share gains and addition of new customers. The

management plans to incur capex of Rs.4840 million over the next two years towards LCVs, passenger cars, the Railways

and forging parts for bearings. We expect operations to go commercial from September 2020 and believe that this is a

positive move.

Technical Outlook: The stock looks good on the daily chart for medium-term investment. It has formed a downward

channel pattern and trades below important moving averages like the 200 DMA level on the daily chart.

Start accumulating at this level of Rs.562.45 and on dips to Rs.535 for medium-to-long term investment and a possible

price target of Rs.675+ in the next 12 months.

******

Ahluwalia Contracts (India) Ltd

(BSE Code: 532811) (CMP: Rs.310.55) (FV: Rs.2) (TGT: Rs.375+)

Incorporated in 1965, New Delhi based Ahluwalia Contracts (India) Ltd (ACIL) operates through two segments: Contract

Work and Lease Rental. Its project portfolio includes residential and commercial properties, institutional properties,

corporate offices, power plants, hospitals, hotels, IT parks, metro stations and depots, automated car parking lots and

other properties. It also leases a commercial complex in bus terminal and depot at Kota in Rajasthan and trades in real

estate properties.

ACIL reported a strong performance in Q2FY19. Its

top-line grew 31% YoY to Rs.4400 million (+9% Are you passionate about stocks?

QoQ) while EBITDA grew 15% YoY to Rs.574

million (+9% QoQ). EBITDA margin stood at 13.1% Can you spot a winner?

v/s 14.9% in Q2FY18 and 13% in Q1FY19. PAT Are you keen to write?

jumped 21% YoY and 11% QoQ to Rs.312 million

v/s our estimate of Rs.256 million. If your answer is YES to all the three questions, MONEY TIMES,

ACIL received order inflow of Rs.31000 million in launched by the pioneers of investment journalism, invites

FY19 YTD (year-to-date) taking its total order you to join its team of contributors.

backlog to Rs.53000 million (3.2x of FY18 revenue). Each and every analyst on our panel is passionate about stock

Upgrading order inflow guidance to Rs.40000 investments and is an expert in his field. What is, however,

million from Rs.24000 million, the management has more significant is that most of them were our subscribers

maintained revenue growth guidance of 15-20% first and have been writing for over 20 years now.

with EBITDA margin of more than 13% for FY19

and over 30% revenue growth in FY20E. We So if you want to join this eminent group, write to

continue to maintain our positive stance on ACIL moneytimes.support@gmail.com and send us a sample of

given its healthy balance sheet, asset light business your article written or published.

model and superior return ratios.

A pick-up in execution especially in new secured orders aided ACIL to report a healthy performance. While the

management maintained its revenue growth guidance of 15-20% for FY19E, it hinted at a revenue growth of more than

30% in FY20E, mainly led by strong addition of order book.

A Time Communications Publication 8

Having seen dismal order inflow of Rs.13000 million in FY18, ACIL witnessed a sizeable order inflow of Rs.31000 million

(excluding Rs.1250 million L1) in FY19 YTD, thus exceeding its inflow guidance of Rs.24000 million for FY19E. However,

as the management is currently bidding for projects worth Rs.30000 million now, it has enhanced its inflow guidance to

Rs.40000 million. Current order backlog, which stands at Rs.53000 million (3.2x of FY18 revenue), provides a decent

revenue visibility. Notably, 78% of the total order book is government projects while 22% belong to private contracts

including 11% in private residential projects. ACIL has not witnessed any payment issues from any private real estate

clients until now.

Technical Outlook: The stock looks very good on the daily chart for medium-term investment. It has formed a small

spike formation pattern and trades below important moving averages like the 200 DMA level on the daily chart.

Start accumulating at this level of Rs.310.55 and on dips to Rs.275 for medium-to-long term investment and a possible

price target of Rs.375+ in the next 12 months.

MARKET REVIEW

Global concerns hit

MONEY TIMES

markets

By Devendra A. Singh

announces

The Sensex fell 476.14 points to DIWALI BONANZA OFFER 2018

settle at 34981.02 while the Nifty

of its specialized newsletters

closed 155.45 points lower at

10526.75 for the week that ended For medium-to-long-term investors:

on Thursday, 22 November 2018. Offer 1: 6-month Package @ Rs.6000 v/s Rs.8000

India’s exports rose 17.86% to ▪ Panchratna (Issue nos.20 & 21) (5 stocks/quarter)

$26.98 billion in October 2018 ▪ Early Bird Gains (1 stock/week)

while imports rose 17.62% to

Offer 2: 3-month Package @ Rs.6000 v/s Rs.8000

$44.11 billion leading to widening

of trade deficit to $17.13 billion on ▪ Mid-Cap Twins (Issue nos. 5, 6 & 7) (2 stocks/month)

account of higher oil imports bill. ▪ Beat the Street 6 (Issue no. 23) (6 stocks/quarter)

The trade deficit widened despite a For Short-term Traders & Investors: 2-month Package @ Rs.7000 v/s Rs.9000

steep decline of 42.9% in gold

▪ Techno Funda Plus (3 stocks/week)

imports to $1.68 billion. During

April-October 2018, exports rose ▪ Fresh One Up Trend Weekly (1 stock/week)

13.27% to $191 billion while For Daily Traders: 1-month Package @ Rs.5000 v/s Rs.6500

imports rose 16.37% to $302.47 ▪ Live Market Intra-Day Calls

billion leaving a trade deficit of

$111.46 billion. Crude oil imports in ▪ Fresh One Up Trend Daily (1 stock/day)

October 2018 rose 52.64% to Take advantage of this Diwali Offer, which ends on Friday, 30 November 2018.

$14.21 billion. The non-oil imports

To subscribe, you can deposit cheque/ cash or transfer the amount via RTGS/NEFT to the

were up 6% at $29.9 billion in the company bank account:

same month.

(1) Time Communications (India) Ltd - State Bank of India C/A 10043795661, Fort Market

India’s industrial output in Branch, Fort, Mumbai 400 001 (IFSC: SBIN0005347) or

September 2018 grew 4.5% from a

(2) Time Communications India Limited - ICICI Bank C/A 623505381145, Fort Branch, Fort,

year earlier. Fitch ratings agency

Mumbai – 400 001 (IFSC: ICIC0006235)

has retained its sovereign rating for

Note: For cash deposit, kindly add Rs.50 extra for SBI or Rs.100 extra for ICICI Bank as cash

India at BBB-, the lowest

counting charges levied by the bank.

investment grade with a stable

outlook, stating that a weak fiscal After transfer, please advise us by e-mail mentioning the bank & branch, electronic transfer

position continues to constrain the number and date of payment with your subscriber name and the product selected to

ratings and there were significant enable us to begin your supply immediately.

risks to the macroeconomic * No cancellation/ refund of subscription will be entertained

outlook. Fitch had last upgraded

India’s sovereign rating from BB+ to Contact us on 022-22616970, 22654805 or moneytimes.support@gmail.com.

A Time Communications Publication 9

BBB- with a stable outlook on 1 August 2006.

The Government of India (GoI) has made a strong pitch to Fitch for an upgrade after rival Moody’s Investors Service in

November 2017 gave India its first sovereign rating upgrade since 2004.

Fitch believes that the Indian economy continues to exhibit some structural weaknesses relative to peers and is less

developed on a number of metrics. It has raised the real GDP growth in the current financial year to 7.8%, up from 6.7%

in FY18.

“This forecast is however subject to downside risks from tightening financial conditions, weak financial-sector balance

sheets and high international oil prices. We forecast growth to decelerate to a still-strong 7.3% in both FY20 and FY21

for the same reasons,” Fitch said in its report.

Fitch expects current account deficit (CAD) to widen to 3% in FY19 and 3.1% in FY20 from 1.9% in FY18.

On the US Federal Reserve front, the Federal Open Market Committee (FOMC) unanimously approved keeping the

federal funds rates unchanged in a range of 2-2.25%. There was no mention of the volatility that has gripped the

financial markets since mid-October 2018. The committee noted that the unemployment rate has declined since the

September meeting. The US Federal’s statement also noted that the growth of business fixed investment has moderated

from its rapid pace earlier in the year.

Key index advanced on Monday, 19 November 2018, on buying of equities by the FIIs. The Sensex was up 317.72 points

to close at 35774.88.

Key index plunged on Tuesday, 20 November 2018, on global cues. The Sensex was down 300.37 points to close at

35474.51.

Key index fell on Wednesday, 21 November 2018, on profit-booking by market participants. The Sensex was down

274.71 points to close at 35199.80.

Key index corrected on Thursday, 22 November 2018, on selling-off equities. The Sensex was down 218.78 points to

close at 34981.02.

The Indian stock markets remained closed on Friday, 23 November 2018, on account of Guru Nanak Jayanti.

National and global macro-economic figures, Brexit and other events will dictate the movement of the markets and

influence investor sentiment in the near future. Market participants will closely watch the trend of the Indian rupee

against the US Dollar, which is currently hovering around 71-72 levels.

On the global front, the Danish Central Bank (DCB) will publish its quarterly financial stability report on Friday, 30

November 2018. The Reserve Bank of Australia (RBA) is scheduled to hold its interest rate and financial stability meet

next month on Wednesday, 5 December 2018.

EXPERT EYE

By Vihari

Cambridge Technology Enterprises Ltd: Bright prospects!

(BSE Code: 532801) (CMP: Rs.51.95) (FV: Rs.10)

Incorporated in 1999 and promoted by Aashish Kalra (Chairman & CEO), Cambridge Technology Enterprises Ltd (CTEL)

is a global business and technology services provider that provides business value through a combination of process

excellence and innovative service delivery models. It leverages world-class talent, relevant technology, patented and

proven tools and methodologies and global development centres to provide innovative and competitive solutions. It has

offices in multiple locations in North America and offshore development offices at Hyderabad and Bangalore in India. It

has an employee base of around 350. It helps organisations capture new enterprise value by leveraging the convergence

of big data and the cloud and unleashing the potential of Artificial Intelligence (AI) and Machine Learning (ML). It offers

an end-to-end approach in designing and implementing enterprise IT strategies leveraging the cloud wherever it is

possible and necessary. As at FY18, it has 4 wholly-owned subsidiaries: Cambridge Technology Inc (USA); Cambridge

Innovations Capital LLC (USA); Cambridge Technology Investments Pte. Ltd (Singapore); and Cambridge Bizserve Pvt

Ltd (India).

CTEL operates under the following business verticals: Energy and Utilities; Life Sciences/Pharmaceuticals; Industrial;

Banking, Finance & Insurance (BFI); Data Infrastructure; Rapid Prototyping via Cambridge Innovations (CI); and

Managed Services via Cambridge Bizserve (CB). The CB vertical focuses on effectively managing business processes and

provides business insights through analytics to clients. It provides data support and managed services for the

A Time Communications Publication 10

applications it builds. CI is a fast-growing vertical and revenue generator. It attracts and upskills talent while providing

financial upside through equity participation to the companies it helps.

CTEL has strengthened its partner ecosystem by achieving the ‘Platinum Partner’ status with Oracle, Premier Partner

with Amazon Web Services while building partnerships with Pentaho, Apica Systems, ForgeRock, Rackspace, Tableau

and New Relic. Through its partner network, it gains access to the best technology framework and solutions,

strengthening its delivery capabilities.

For FY18, CTEL reported 24% lower PAT of Rs.12.9 crore on 1.5% lower income of Rs.99 crore and an EPS of Rs.6.6.

During Q2FY18, it reported 89% higher PAT of Rs.6.2 crore on 2% higher income of Rs.24.3 crore and an EPS of Rs.3.2.

During H1FY19, it reported 56% higher PAT of Rs.8.9 crore on 4% higher sales of Rs.48.1 crore and an EPS of Rs.4.6.

With an equity capital of Rs.19.6 crore and reserves of Rs.37.4 crore, CTEL’s share book value works out to Rs.29. Its

debts are Rs.12 crore. Cash, investments, loans and advances and other current assets amount to Rs.59 crore, which

gives the company a debt-free status. The value of its gross block is Rs.13 crore. The promoters hold 46.9% of the equity

capital, which leaves 53.1% stake with the investing public.

In line with providing global clients access to 24/7 development cycle, CTEL reinforced its US presence with 6 offices

and expanding its offshore delivery centres in India across Hyderabad, Bangalore and Chennai. Further, realizing the

significance of trained and skilled employees, it has invested heavily into training employees via its competency centres

in India and USA.

CTEL is focused on building its SaaS based long-term revenue model as more than 60% of its consolidated revenue

comes from contracts that are long-term in nature (tenure of over 3 years). The management focuses on value and not

the number of contracts. It aims to have at least 75% of its service contracts as long-term in nature. Under this

predictable model, it expects to deliver over $50 million in service revenues over the next 5 years from its existing

clients. Further, the management is focused on building reusable and scalable blocks of technology and reserves the

rights to some of the technology in majority of its contracts.

Cloud and Big Data, fuelled by AI and ML will define new and redefine existing industries thereby transforming data into

a valuable knowledge asset and a catalyst for disruption. According to a report from A.T. Kearney, the overall big data

spend could grow at 30% CAGR through 2018 and each IT job created in the process of upgrading will create 3

additional jobs outside IT.

India’s IT and ITeS industry grew to $167 billion in FY18. The market for IoT (Internet of Things) is growing rapidly.

GE’s ‘Industrial Internet Insights’ report predicts that the IoT will add $10-15 trillion to global GDP over the next 20

years.

With the base built in the last 2 years, CTEL is inspired to achieve ‘Vision 2020’ and be a part of this transformation, for

which it will focus on organic growth. Over the next 3 years, it expects annual revenue of ~$10 million on an average

from each of its 4 growth drivers i.e. Cambridge Bigdata, CB, Cambridge DataScience and CI.

CTEL is assessed at Maturity Level 5 for CMMI v1.3 with ISO 27001:2013 certification. Its expertise across multiple

domains makes it the preferred choice for organizations seeking an AI Partner to innovate and stay ahead in the market.

Based on its growth initiatives and bright industry prospects, CTEL is likely to notch an EPS of Rs.12 in FY19. At the CMP

of Rs.51.95, the stock trades at a forward P/E of 4.3x on FY19E earnings. A reasonable P/E of 8.5x will take its share

price to Rs.102 in the medium-to-long term. The stock’s 52-week high/low is Rs.102.9/40.8.

STOCK BUZZ

By Subramanian Mahadevan

Adani Gas Ltd: City gas!

(BSE Code: 542066) (CMP: Rs.111.35) (FV: Re.1)

Adani Gas Ltd (AGL) belonging to the renowned Adani group was listed on the bourses this month at around

Rs.80/share post its demerger from the parent company Adani Enterprises Ltd (AEL). The demerger was aimed at

unlocking the value of AEL’s city gas distribution (CGD) business including the piped natural gas (PNG) business and

enable shareholders to get direct exposure to the high growth CGD business by dispensing the holding company

discount.

The promoters hold 74.92% stake in AGL. AGL operates CGD networks in Ahmedabad and Vadodara in Gujarat,

Faridabad in Haryana and Khurja in Uttar Pradesh covering ~3,50,000 households. It supplies CNG to over 2,00,000

A Time Communications Publication 11

vehicles. It has obtained rights to set up CGD networks in 13 other cities independently and another 16 through a joint

venture with state-owned Indian Oil Corporation (IOC). This makes it the largest listed private CGD player in India with

a pipeline network of over 5,500 kms, 70+ CNG stations and a client base of 4,50,000+. For FY18, it reported a top-line of

Rs.1394 crore with EBITDA of Rs.374 crore.

Currently, there are 3 government-owned listed CGD firms in India - Indraprastha Gas Ltd, Mahanagar Gas Ltd and

Gujarat Gas Ltd. AGL’s future looks bright given the phenomenal potential of the CGD business in India where the

number of players is very low but the entry barriers in the industry are high.

The Adani group owns 25% stake in a 5 MMT (million

metric tonne) LNG import terminal at Mundra in Gujarat Growth Estimates:

where it runs the country’s biggest port apart from a 5 Particulars Operational To be Operational

MMT LNG import terminal at its Dhamra port in Odisha by FY25E

and a 3.2 MMT LPG terminal at Mundra. Another 1.2 MMT Adani Gas 4 13

LPG terminal at Dhamra is under construction. JV with Indian Oil - 18

AGL is a solid domestic growth story. Investors can Volumes (mmscmd) 1.4 10.5

accumulate the stock at every decline since it has the CNG Stations 65 1,030

potential to touch Rs.200 in the next 2-4 years just like Customers (in million) 0.35 6

Adani Transmission. Its market cap stands at Rs.12246.39

crore.

MARKET OUTLOOK

Selling pressure to continue

By Rohan Nalawade

Last week, the Nifty faced strong resistance at the 10790 level before it slipped towards 10500. Now, 10650-100700

have become strong resistance levels and a selling opportunity may emerge around 10690-10700 levels. Sell on rise.

10440 is a strong support level for the bulls. If the Nifty breaches this level, then the selling pressure may continue for

10200-9500 levels. Buying trend will emerge only if the Nifty crosses 10750.

The December F&O contract series will start this week. State election results will have a major impact on the market. If

the BJP wins, the markets will rally but if the BJP loses, the market sentiment will turn negative and the markets may

continue to correct for another 2-3 months till March 2019. The election outcome of important states like Rajasthan,

Madhya Pradesh, etc, will play a crucial role in determining the outcome of the upcoming Lok Sabha elections in May

2019. So trade cautiously till then.

Among stocks,

✓ Sell Bharat Petroleum Corporation below Rs.322 for a target of Rs.310-305 (SL: Rs.328)

✓ Sell Hindalco Industries at Rs.220 for a target of Rs.210-205 (SL: Rs.225)

✓ Sell Yes Bank at Rs.196 for a target of Rs.190-185-180 (SL: Rs.205)

✓ Sell Mahindra & Mahindra below Rs.745 for a target of Rs.715 (SL: Rs.755)

PRESS RELEASE

Mac Hotels on an expansion spree

Goa-based Mac Hotels Ltd, which owns 52 rooms, has ambitious expansion plans. It added 26 rooms since 1 October

2018 and plans to add another 160 rooms with effect from 1 January 2019, taking the total number of rooms to 238. The

full impact of revenues and profitability will be partly reflected in FY19 and fully in FY20. The management plans to

increase its inventory of rooms to 500 going forward.

Mac Hotels will now enter a new orbit and adopt the managed and franchised hotel model, which is an asset light model

ensuring a high return on shareholders’ funds. It is being operated by the Cotta Family for the last 25 years. It runs its

properties at Miramar and Calangute under the following brands: Resort Village Royale, Hotel Miramar and Hotel Park

Avenue. It also runs a franchised store under the brand ‘The Chocolate Room.’

A Time Communications Publication 12

Mac Hotels is the first Goan firm to be listed on BSE’s SME platform last month. Its IPO, which was priced at Rs.24/share,

was oversubscribed 1.52 times despite the negative sentiment in the markets. The stock currently trades at Rs.56.50 (a

return of 135% in less than 2 months).

******

Reliance MF announces FFO of CPSE ETF

Reliance Nippon Life Asset Management Ltd announced the third further fund offer (FFO 3) of its Central Public Sector

Enterprises (CPSE) exchange-traded fund (ETF) to raise Rs.8000 crore as a part of the government’s overall divestment

programme. An upfront discount of 4.5% is offered to all investors. The offer will open for anchor investors on 27

November 2018 and for other investors during 28-30 November 2018. CPSE ETF’s new fund offer (NFO), FFO and FFO 2

raised Rs.3000 crore, Rs.6000 crore and Rs.2500 crore respectively.

IMPORTANCE OF FUNDAMENTAL ANALYSIS

By Laxmikant Bhole

“Risk comes from not knowing what you are doing” – Warren Buffet, Investment guru

In 1993, when a student at Columbia University Business School in New York asked Buffet how he evaluated

investments and risks, Buffett gave the example of the Washington Post Company as a safe investment in 1973. He

pointed out that the company’s market value at that time was underestimated as it was substantially lower than the

value of the properties it owned. Since it was run by honest and able people who had a significant part of their net worth

in the business, it wouldn’t have bothered him to put his entire net worth in it. But the ‘The Washington Post’ and other

newspapers and media organizations turned risky because of the internet induced media turmoil. Amazon boss, Jeff

Bezos, purchased the paper in 2013.

A growing trend in today's inconsistent financial times is self-research and planning. Taking control and planning your

own financial future has become increasingly important because it has been proved that research and fundamental

analysis alone creates wealth for investors.

What is fundamental analysis? Many investors assume that fundamental analysis is analyzing the financial position of a

company and check its valuations. While this is partially true, fundamental analysis goes far beyond this. It analyses a

company’s quantitative and qualitative factors that help identify its current business stature and future business

potential. And understanding the business imperatives of a company is as important as its financials. But peer

comparison is equally important. Thus, there are a few points that investors should think about before investing - What

is its market position today and what is it going to be tomorrow? Is the company in a strong position to beat its

competitors in future? Who are its competitors? What are the future prospects of its products? What are the macro and

micro parameters that affect its business? What is its promoter and management background? How much debt does it

carry and can it service the debt easily? How are the cash flows? Is there growth in earnings? How significant is the

promoter holding? Is it rising or declining, etc.

Once you get the answers to these questions, it

is easier to determine whether the company is

Seminars on Financial Literacy

undervalued, fairly valued or overvalued in the of Stock Markets

market. Stock research is important because the Date Time Venue Organizers

financial history of companies gives investors a 25/11/18 10.30 am Kolhapur Investors Supported by SEBI &

better sense of the future. Of course no one can Association Hall, organized by Kolhapur

assure the trend of a stock but evaluating the Sterling Towers, Investors Association.

past performance of a company can help Gavat Mandai Road, Courtesy: CDSL.

determine the trend and the best way to obtain Shahupuri, Kolhapur.

such information is from the Annual Reports. 1/12/18 3 pm P.J. High School Hall, Organized by

Why is fundamental analysis essential? This is Main road, Wada, Dist. Yogakshema

Palghar. Consultancy Services,

because stock prices are determined by

Palghar

sentiments in the short run due to various

Chandrashekhar Thakur: CDSL BO Protection Fund.

reasons such as news, future outlook, stock

Tel: 9820389051; csthakur@cdslindia.com

market conditions, micro and macro-economic BSE Building, 16th Floor, Dalal Street, Fort, Mumbai - 400001

and political factors, etc.

A Time Communications Publication 13

As a result, stock prices often deviate from their true value due to such external factors. However, fundamentals always

prevail in the long term and stock prices eventually reflect the true fundamental value. Thus, fundamental analysis of a

company is really important in order to fetch good returns in the long term.

What is the difference between a great business and a great investment? The answer is - price. If you pay a very high

price even for the best stock in the world, you will not get a good return on your investment. Hence, a great investment

bet need not have a high price. The price that you pay for a stock matters. It is the most important factor for good

returns. Thus, analyzing the fundamentals of a company thoroughly is very important before investing.

When you put your hard-earned money into a stock, you need to research it thoroughly and consider various factors like

the company’s investments, debt status, cash flows, clientele and whether the stock trades at a reasonable market

valuation.

Many traders often ignore fundamental analysis and rely on technical analysis or just market intuition. They feel that

fundamental analysis is primarily for the long-term and does not help in short-term trading. But a trader wishing to

trade next year, is a long-term investor and there is little disparity in their horizon. The real problem people have with

fundamental analysis is that it involves subjective judgments and does not give clear ‘buy’ or ‘sell’ signal generally

received through technical analysis. Technical analysis is heavily based on market sentiments in the near term, which is

risky as they change quickly. Therefore, one needs to track the sentiment in the stock regularly, which requires high

degree of time commitment and calls for higher risk. But in fundamental analysis, there is virtually no ‘sell’ signal

required if the stock is fundamentally good. Investment guru Warren Buffet believes that the holding period should be

forever and that makes a long-term investor who believes in fundamental analysis, free of short-term sentiment

volatility giving peace of mind in investments.

Summary: In today’s times, investors do not believe in stock research but solely rely on the ‘tips’ that they receive either

from friends, family or other sources. This is certainly injurious to financial health. Stock analysis is crucial for spotting

the right stocks that can create wealth than any other form of saving or any other asset class. One must understand that

in the short-term, stock price movements are influenced by market sentiments but in the long run, the market price of a

stock tends to move towards its intrinsic value, which is the true value of a company calculated by fundamental analysis.

Hence, analyzing the fundamentals of a company is very important for reaping good returns.

Courtesy: www.profitpokket.com

TECHNO FUNDA

By Nayan Patel

Hindustan Tin Works Ltd

(BSE Code: 530315) (CMP: Rs.68.45) (FV: Rs.10)

Incorporated in 1958, New Delhi based Hindustan Tin Works Ltd (HTWL) is a leading manufacturer and exporter of high

performance cans, printed sheets and related components to consumer marketing companies. Its marquee clients

include Asian Paints, Amul, Bikanerwala, DS Group, Del Monte, Danone India, Haldiram, Nestle India, Patanjali, Reckitt

Benckiser, etc. It supplies a diverse range of aerosol cans, food cans, beverage cans, baby food cans and can components

to a wide variety of food, beverages, baby food, health, beauty and luxury companies across 30+ countries in Africa,

Australia, Europe, Middle East, New Zealand, USA and parts of South East Asia. Its fully integrated and automated

manufacturing facility is supported by high-speed automatic printing and lacquering machines. Its 10 acre

manufacturing facility in Murthal houses state-of-the-art machines imported from countries like UK, Germany, USA,

Taiwan, Italy, Switzerland, etc.

HTWL has an equity capital of Rs.10.4 crore supported by huge

Financial Performance: (Rs. in crore)

reserves of Rs.127.41 crore. The promoters hold 40.46% of the

Particulars Q2FY19 Q2FY18 H1FY19 H1FY18

equity capital, which leaves 59.54% stake with the investing

public. General Insurance Corporation of India holds 4.81%, Sales 88.5 73.68 179.4 159.21

United India Insurance Company holds 5.02% and ace investor PBT 4.08 3.21 7.64 5.51

Subramanian P holds 4.09% stake in the company. Its share book Tax 1.77 1.22 2.99 2.11

value works out to Rs.132.5 and P/BV is attractive at 0.5x. PAT 2.31 1.99 4.65 3.4

During Q2FY19, HTWL reported 16% higher PAT of Rs.2.31 crore EPS (Rs.) 2.25 1.9 4.54 3.26

on 20% higher sales of Rs.88.5 crore and an EPS of Rs.2.25.

A Time Communications Publication 14

During H1FY19, it reported 37% higher PAT of Rs.4.65 crore on higher sales of Rs.179.4 crore and an EPS of Rs.4.54. It

paid 10% dividend for FY18.

Currently, the stock trades at a P/E of just 6.5x and looks attractive for investment based on its financial parameters.

Investors can accumulate the stock with a stop loss of Rs.60. On the upper side, it could zoom to Rs.100-110 in the

medium-to-long term. The stock’s all-time high is Rs.150.

******

Superhouse Ltd

(BSE Code: 523283) (CMP: Rs.140.95) (FV: Rs.10)

Incorporated in 1980, Kanpur-based Superhouse Ltd manufactures and sells finished leather, leather goods and textile

garments. It offers finished leather, safety and welted footwear and combat boots. It also offers leather accessories such

as leather bags, business cases, portfolios, trolley bags, belts and soles; leather garments including jackets and vests,

trousers, skirts and camisoles; and breeches, riding boots and riding products. In addition, it offers woven and knitted

garments; and safety garments comprising coveralls, bib-trousers, trousers, jackets, aprons, dust coats, chef coats,

doctor coats, hi-visibility vests and jackets, army uniforms and fleece jackets as well as socks and fall protection

products. It sells its products primarily under the ‘Allen Cooper’ and ‘Double Duty’ brands. It also exports its products.

With an equity capital of Rs.11.42 crore and reserves of Rs.289.33 crore, Superhouse’s consolidated share book value

works out to Rs.263 and P/BV is around 0.5x. The promoter holds 54.88% of the equity capital, which leaves 45.12%

stake with the investing public.

During Q2FY19, Superhouse reported 740% higher PAT of Financial Performance: (Rs. in crore)

Rs.6.8 crore on 14% higher sales of Rs.154.11 crore and an Particulars Q2FY19 Q2FY18 H1FY19 H1FY18

EPS of Rs.6. During H1FY19, it reported 271% higher PAT of Sales 154.11 135.26 302.36 278.08

Rs.12.45 crore on higher sales of Rs.302.36 crore and an EPS PBT 10.48 1.51 19.51 5.16

of Rs.11.3.

Tax 3.68 0.70 7.06 1.8

Currently, the stock trades at a P/E of just 7x and is available PAT 6.80 0.81 12.45 3.36

at 33% discount to its 52-week high of Rs.209.9 recorded in EPS (in Rs.) 6.17 0.74 11.29 3.05

January 2018. Investors can buy the stock with a stop loss of

Rs.120. On the upper side, it could zoom to Rs.185-200 in the medium-to-long term.

BULL’S EYE

Safari Industries (India) Ltd

(BSE Code: 523025) (CMP: Rs.741.85) (FV: Rs.2)

By Pratit Nayan Patel

We had recommended this stock at Rs.536.65 on 19 February 2018 and once again at Rs.867.8 on 20 August 2018, where-

after it zoomed to Rs.1005! The stock has fallen sharply in line with the recent market crash but its fundamentals remain

intact. Therefore, we recommend this stock once again based on its strong H1FY19 numbers.

Company Background: Incorporated in 1980, Mumbai-based Safari Industries (India) Ltd (Safari) manufactures and

trades in luggage and luggage accessories. Its products include wheel upright trolleys, duffles and rolling duffles;

business cases, laptop satchels and tablet sleeves; casual and formal backpacks and backpack trolleys as well as travel

essentials and foldables. It operates through retail stores and also through an e-commerce channel. It manufactures hard

luggage mainly made of Poly Propylene (PP) and Poly Carbonate (PC) at its plant in Halol, Gujarat. It mainly imports soft

luggage, which are made of various fabrics.

Financials: Safari has an equity capital of just Rs.4.46 crore Performance Review: (Rs. in crore)

supported by huge reserves of Rs.168.39 crore. The promoters Particulars Q2FY19 Q2FY18 H1FY19 H1FY18

hold 57.69% of the equity capital, Malabar India Fund holds

Total Income 127.39 88.16 283.45 192.64

8.53%, Malabar Value Fund holds 1.8% and Tano India Pvt

Equity Fund 2 holds 12.18%, which leaves 19.8% stake with PBT 8.70 6.13 27.69 11.05

the investing public. Tax 2.54 2.62 9.36 4.27

Performance Review: For FY18, Safari reported 118% higher PAT 6.17 3.51 18.33 6.78

PAT of Rs.21.21 crore on 17% higher sales of Rs.415.36 crore EPS (Rs.) 2.77 1.69 8.23 3.27

A Time Communications Publication 15

and an EPS of Rs.10.

During Q2FY19, it reported 76% higher PAT of Rs.6.17 crore on 45% higher sales of Rs.127.39 crore and an EPS of

Rs.2.77. During H1FY19, it reported 170% higher PAT of Rs.18.33 crore on 47% higher sales of Rs.283.45 crore and an

EPS of Rs.8.23. It paid 25% dividend for FY18.

Industry Overview: The industry growth in the organised sector accelerated during the year with the introduction of

GST and rising consumer demand fueled by higher air travel, continuous shift of consumer preference from non-branded

to branded products, wedding season based purchasing, change in lifestyle and improvement in the standard of living,

rising disposable income, rising urbanization and the government's focus on promoting tourism.

Good growth was seen across general trade and retail. Hyper market and e-commerce channels continue to grow

strongly mainly due to a better and more convenient shopping experience. The overall outlook for the travel and

tourism sector looks bright, with domestic air traffic continuing its strong growth at over 17% in 2017. Direct travel and

tourism industry is expected to grow at 7.1% in India over 2018-28 compared to 3.8% growth globally.

Conclusion: Safari has posted excellent results for H1FY19 and is likely to retain such high earnings growth for at least a

couple of years. Canteen Stores Department (CSD) as a channel continues to lose its dependency on Safari’s revenue

generation. New product launches supported by effective marketing spends and robust distribution led to the positive

growth. The management continued to develop its multi-brand strategy during the year with Safari and Magnum brands

operating at wider price points and broader consumer demographics in each category. To accelerate growth of acquired

brands Genius and Genie, the management is focusing on campus gear targeted towards the youth. Apart from launching

a new range of backpacks, these brands also launched a range of Fashion Bags. It introduced an exclusive polycarbonate

range for specific e-commerce platforms to drive strong share growth in the channel. It significantly increased its

presence in Hypermarkets with focused activities in the top hyper-market chains. It also operates from 50+ exclusive

retail stores. It has started hedging its foreign exchange exposure to mitigate risks arising out of foreign exchange

fluctuation and rupee depreciation.

The stock currently trades at a P/E of 50x and looks attractive for investment based on its financial parameters.

Investors can accumulate the stock on dips at Rs.750-700 with a stop loss of Rs.645 for a price target of Rs.1100-1200 in

the next 15-18 months. The stock’s 52-week high/low is Rs.1005/430.50. Its market cap stands at Rs.1655.33 crore.

MID-CAP TWINS: New promise & hope!

Mid-Cap Twins will now be steered by Mr. Dildar Singh Makani,

a stock market veteran of over 30 years and an avid corporate watcher.

He has several profitable investment ideas to his credit.

A fundamental analyst, Mr. Makani will hopefully reinvigorate Mid-Cap Twins to the high

level Money Times products are known for.

Have a look at the grand success story of ‘Mid-Cap Twins’ launched on 1st August 2016

Sr. Scrip Name Recomm. Recomm. Highest % Gain

No. Date Price (Rs.) since (Rs.)

1 Mafatlal Industries 01-08-16 332.85 374.40 12

2 Great Eastern Shipping Co. 01-08-16 335.35 482.40 44

3 India Cements 01-09-16 149.85 226 51

4 Tata Global Beverages 01-09-16 140.10 328.80 135

5 Ajmera Realty & Infra India 01-10-16 137.00 365.65 167

6 Transpek Industry 01-10-16 447.00 1730 287

7 Greaves Cotton 01-11-16 138.55 178 28

8 APM Industries 01-11-16 67.10 84.40 26

9 OCL India 01-12-16 809.45 1620 100

10 Prism Cement (Prism Johnson) 01-12-16 93.25 158.95 70

11 Mahindra CIE Automotive 01-01-17 182.50 301.80 65

12 Swan Energy 01-01-17 154.10 235 52

13 Hindalco Industries 01-02-17 191.55 283.95 48

A Time Communications Publication 16

14 Century Textiles & Industries 01-02-17 856.50 1471.85 72

15 McLeod Russel India 01-03-17 171.75 248.30 44

16 Sonata Software 01-03-17 191.00 428.75 124

17 ACC 01-04-17 1446.15 1869 29

18 Walchandnagar Industries 01-04-17 142.25 272.90 92

19 Oriental Veneer Products 01-05-17 222.30 728 227

20 Tata Steel 01-05-17 448.85 792.55 76

21 Sun Pharmaceuticals Industries 01-06-17 501.40 678.80 35

22 Ujjivan Financial Services 01-06-17 307.45 432.05 40

23 Ashok Leyland 01-07-17 93.85 167.50 78

24 KSB Pumps 01-07-17 759.55 936 23

25 IRB Infrastructure Developers 01-08-17 224.95 286 27

26 JTL Infra 01-08-17 70 208 197

27 Liberty Shoes 01-09-17 187.40 308.90 65

28 Ramco Industries 01-09-17 271.20 326.10 20

29 JSW Energy 01-10-17 73.65 97.50 32

30 Sanco Industries 01-10-17 74.10 97.80 32

31 Shalimar Paints 01-11-17 206 223.15 8

32 JITF Infralogistics 01-11-17 38 57.90 52

33 Aditya Birla Capital 01-12-17 194.65 196.80 1

34 Welspun India 01-12-17 71.80 82.50 15

35 Stock ‘A’ 01-01-18 59.25 71.90 21

36 Stock ‘B’ 01-01-18 72.85 82.20 13

37 Stock ‘C’ 01-02-18 234.90 302.90 29

38 Stock ‘D’ 01-02-18 164.25 335 104

39 Stock ‘E’ 01-03-18 575.15 635.25 10

40 Stock ‘F’ 01-03-18 211.80 216.80 2

41 Stock ‘G’ 01-04-18 45.80 58.20 27

42 Stock ‘H’ 01-04-18 51 57.35 12

43 Stock ‘I’ 01-05-18 107.55 117.70 9

44 Stock ‘J’ 01-05-18 320.45 360 12

The next edition of ‘Mid-Cap Twins’ will be released on 1 December 2018.

Happy reading & happier money making as Mid-cap Twins enters its third year!

Attractively priced at Rs.2000 per month, Rs.11000 half yearly and Rs.20,000 annually,

‘Mid-cap Twins’ will be available both as print edition or online delivery.

Early Bird Gains – A Performance Review

Early Bird Gains (EBG), our newsletter specializing in multi-baggers, has performed well for the last 15

years. Here’s the performance review of the 52 stocks featured between 27 th September 2017 and 26th

September 2018.

Issue Date of Recomm. Highest since Gain

Scrip Name

No. Recomm. Price (Rs.) (Rs.) %

1 GHCL 27-09-17 210.55 357.50 70

2 Gitanjali Gems 04-10-17 67.20 104.80 56

3 Vivimed Labs 11-10-17 132.85 137.25 3

4 Mangalam Organics 18-10-17 86 510 493

5 Kriti Nutrients 25-10-17 23 56.95 148

A Time Communications Publication 17

6 Premier Explosives 01-11-17 427.70 536.25 25

7 N.R. Agarwal Industries 08-11-17 297.80 615.85 107

8 Sintex Industries 15-11-17 25.20 28 11

9 Larsen & Toubro Infotech 22-11-17 975.85 1469.60 51

10 KPIT Technologies 29-11-17 177.70 314.80 77

11 Talwalkar Better Value Fitness 06-12-17 302.15 358.05 18

12 Security and Intelligence Services (India) 13-12-17 1261.25 1404.80 11

13 Elnet Technologies 20-12-17 190.40 204 7

14 Kellton Tech Solutions 27-12-17 103.10 137 33

15 Lupin 03-01-18 875.70 986 13

16 International Paper APPM 10-01-18 383.35 591.15 54

17 Star Paper Mills 17-01-18 293.10 318.20 8

18 Steel Strips Wheels 24-01-18 1124.30 1473.70 31

19 Yes Bank 31-01-18 353.45 404 14

20 Lincoln Pharmaceuticals 07-02-18 215.10 314 46

21 Dewan Housing Finance Corporation 14-02-18 524.55 690 31

22 Just Dial 21-02-18 439.30 637.80 45

23 Jindal Poly Films 28-02-18 351.60 362.55 3

24 KSE 07-03-18 2497.55 4000 60

25 Rico Auto Industries 14-03-18 71.60 87.25 22

26 Virinchi 21-03-18 105.60 137 30

27 Honeywell Automation India 28-03-18 16466 24178 47

28 Jay Bharat Maruti 04-04-18 482.85 528.90 9

29 Bodal Chemicals 11-04-18 137.10 156.25 14

30 Simmonds Marshall 18-04-18 125.80 154.90 23

31 Mahanagar Gas 25-04-18 908.35 984.40 8

32 Hinduja Global Solutions 02-05-18 957.05 974.75 2

33 Mishra Dhatu Nigam 09-05-18 135.55 160.40 18

34 Pondy Oxides & Chemicals 16-05-18 414.10 452.70 9

35 Manaksia 23-05-18 54.90 60 9

36 RACL Geartech 30-05-18 65.40 75.50 15

37 Sintex Industries 06-06-18 15.05 17.85 19

38 Natco Pharma 13-06-18 791.95 849 7

39 UFO Moviez India 20-06-18 366.60 396 8

40 Sharda Cropchem 27-06-18 365.45 424 16

41 Vindhya Telelinks 04-07-18 1008.55 1698.80 68

42 Pix Transmissions 11-07-18 174.40 284.40 63

43 Meghmani Organics 18-07-18 86.80 99.05 14

44 Federal Bank 25-07-18 87.70 92.75 6

45 Everest Industries 01-08-18 486.15 597.50 23

46 Rites 08-08-18 275.25 326.55 19

47 International Paper APPM 15-08-18 459.45 591.15 29

48 Patel Engineering 22-08-18 52.30 53 1

49 Jindal Poly Films 29-08-18 280.15 324.95 16

50 Shreyans Industries 05-09-18 179.30 202.35 13

51 Eimco Elecon (India) 12-09-18 368.65 390 6

52 Jasch Industries 19-09-18 62.30 67 7

Subscription Rate: 6 Months: Rs.4000, 1 Year: Rs.7000,

2 Years: Rs.12000, 3 Years: Rs.15000

For more details, contact Money Times on 022-22616970/22654805 or moneytimes.support@gmail.com

A Time Communications Publication 18

Editorial & Business Office: Goa Mansion (Gr. Floor), 58 Dr. S.B. Path (Goa St.), Near GPO, Fort, Mumbai – 400 001.

Phone: 022-2265 4805, 2261 6970.

Editor & Publisher: R.N. GUPTA

Asst. Editor & Associate Publisher: NEHAR SAKARIA

CHENNAI: T.A.S. Venkatasubba Rao (Phone: 044-24917241, Mobile: 9444024664)

JAIPUR: Satram Das (Phone: 0141-2636341)

DELHI: P. K. Vasudevan (Mobile: 9810513247)

All rights reserved. No portion of this publication may be copied or reproduced without the written permission of the publisher.

Any infringement of this condition will be liable to prosecution.

Printed & Published by R.N. Gupta for the proprietors Time Communications (India) Ltd. and printed by him at Inquilab Offset Printers Ltd. 156,

DJ Dadajee Road, Tardeo, Mumbai - 400072. Registration No.: 63312/91, Post Regn. No. MCS/006/2015-17

Disclaimer: Investment recommendations made in Money Times are for information purposes only and derived from sources that are deemed to

be reliable but their accuracy and completeness are not guaranteed. Money Times or the analyst/writer does not accept any liability for the use of

this column for the buying or selling of securities. Readers of this column who buy or sell securities based on the information in this column are

solely responsible for their actions. The author, his company or his acquaintances may/may not have positions in the above mentioned scrip.

A Time Communications Publication 19

Subscription Form

Please fill in the subscription coupon in CAPITAL LETTERS only and send it to:

The Subscription Manager

Time Communications (India) Ltd.

Goa Mansion (Gr. Flr.), 58, Dr. S.B. Path (Goa St.), Near G.P.O., Fort, Mumbai – 400 001.

Tel. Nos.: 022-22654805, 22616970, Email: moneytimes.support@gmail.com, Website: www.moneytimes.in

I wish to subscribe to:

FUNDAMENTAL PRODUCTS TECHNICAL PRODUCTS

MEDIUM-TO-LONG-TERM: PRE-MARKET DAILY:

Money Times (Post/Courier/Online) Nifty & Bank Nifty 1 mnth = Rs.3500, 1 yr = Rs.30000

1 yr = Rs.1000, 2 yrs = Rs.1900, Nifty Options 1 mnth = Rs.1500, 1 yr = Rs.12000

3 yrs = Rs.2700 LIVE MARKET DAILY:

Early Bird Gains (Courier/Online) Live Market Calls (Cash & Futures)

6 mnths = Rs.4000, 1 yr = Rs.7000, 1 mnth = Rs.4000, 1 yr = Rs.36000

2 yrs = Rs.12000, 3 yrs = Rs.15000 FRESH ONE UP TREND DATA

Panchratna (Courier/Online) Fresh One Up Trend Daily

1 qtr = Rs.2500, 2 qtrs = Rs.4000, 1 mnth = Rs.2500, 1 yr = Rs.25000

1 yr = Rs.7000 Fresh One Up Trend Weekly

Mid-Cap Twins (Courier/Online) 1 mnth = Rs.2000, 1 yr = Rs.18000

1 Mnth = Rs.2000, 6 Mnths = Rs.11000 Fresh One Up Trend (Mnthly/Qtrly/Yrly) 1 yr= Rs.17000

1 yr = Rs.20000 Fresh One Up Trend /Down Trend Futures Daily

Beat the Street 6 (Courier/Online) 1 mnth = Rs.4000, 1 yr = Rs.36000

1 qtr = Rs.2000, 2 qtrs = Rs.3500, PROFITRAK TRENDS

3 qtrs = Rs.5000, 1 yr = Rs.6500 Profitrak Daily

SHORT-TERM (1 wk – 3 mnths): 1 mnth = Rs.2500, 3 mnths = Rs.7000

Techno Funda Plus (Courier/Online) 6 mnths = Rs.13000, 1 yr = Rs.20000

1 mnth = Rs.2500, 3 mnths = Rs.6000, Profitrak Weekly 1 yr = Rs.24000

6 mnths = Rs.11000, 1 yr = Rs.18000 Profitrak Short-Term Gains 1 yr = Rs.8000

Profitrak Medium-Term Gains 1 yr = Rs.8000

Profitrak Winners Long-Term Gains 1 yr = Rs.6000

POWER OF RS 1 yr = Rs.3100

(For courier delivery, add Rs.40 per issue or Rs.2080 per year to the subscription amount.

No cancellation/ refund of subscription will be entertained)

a) I am enclosing Demand Draft/Cheque No. ________________ payable at par in Mumbai favouring

‘Time Communications (India) Ltd.’ dated _____________ on _____________________________ at Branch

______________________________________ for Rs. _____________.

b) I have deposited Cash or electronically transferred Rs._____________ via RTGS/NEFT to:

Time Communications (India) Ltd. State Bank of India 10043795661, Fort Market Branch, Fort, Mumbai - 400 001

(IFSC: SBIN0005347) or

Time Communications India Limited ICICI Bank 623505381145, Fort Branch, Mumbai - 400 001