Академический Документы

Профессиональный Документы

Культура Документы

LP in ABM

Загружено:

GLICER MANGARONОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

LP in ABM

Загружено:

GLICER MANGARONАвторское право:

Доступные форматы

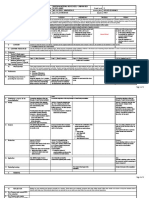

A LESSON PLAN in

SHS-Accountancy, Business and Management (ABM)

RULES OF DEBITS AND CREDITS

I. Objectives

At the end of the lesson, the students should be able to:

determine the common rules of debits and credits;

appreciate the usefulness of debits and credits through group activity;

perform all the activities regarding debits and credits.

II. Subject Matter

Topic: Rules of Debits and Credits

Reference: Textbook in Basic Accounting

Author: Win Ballada (pp. 4-5 to 4-6)

Materials: Envelope, Questionnaire, Index Card

III. Procedure

A. Learning Activities

Teacher’s Activity Student’s Activity

Teacher will greet the students Students give their response to the teacher

Teacher will call a volunteer from the class to

One student will lead the prayer

lead the prayer

Teacher will ask the students to listen

attentively since there will be a quiz after the Students listen attentively

discussion, and that will serves as their

attendance for the day.

The teacher will ask the following questions:

Some of the students raise their hands

Who among you here have a family

business? Any kind of business.

Are your parents going through a Some of the students may say yes, others

proper analysis of their business may say no.

transaction?

Presentation

Activity:

The teacher will divide the class into two

groups. The left and the right group. The

teacher will give each group a bunch of papers

containing with different parts of the words Students participate in the activity

they must build. From that, they must

assemble the word LEFT for the left group, and

the word RIGHT for the right group.

But the real purpose of the activity is to reveal

the words which are written at the back of the

puzzle. The word DEBIT for the LEFT group and

the word CREDIT for the RIGHT group. Students participate in the activity

This activity is made to give the students an

overview that in the business world LEFT is

associated with the word DEBIT and RIGHT for

CREDIT.

After the word building activity, the teacher

will start the discussion.

Abstraction:

Accounting is based on the double entry

system which means that the dual effects of

the business transaction are recorded.

A debit side entry must have a corresponding

credit side entry. Students listen attentively

For every transaction, there must be one or

more accounts debited and one or more

accounts credited.

Each transaction affects at least two accounts.

The total debits for a transaction must equal

the total credits.

An account is debited when an amount is

entered on the left side of the account and

credited when an amount is entered on the

right side.

Increases in assets are recorded as debits while

decreases in assets are recorded as credits.

Conversely, increases in liabilities and owner’s

equity are recorded by credits and decreases Students listen attentively

are entered as debits.

The rules of debit and credit for income and

expense accounts are based on the relationship

of these accounts to owner’s equity. Increases

in income are recorded as credits and

decreases as debits. Increases in expenses are

recorded as debits and decreases as credits

These are the rules of debits and credits.

Analysis:

In dealing with the topic (rules of debits and

credits), the students thinking skills will be

utilized through analysis of the different rules

of debits and credits and how to use it in

business transactions.

As the discussion goes on, the teacher will

present some simple business transactions and

asks the students to give the debits and credits

of each account and whether it increases or

decreases the accounts affected.

Transactions:

Aug. 1 Mr. Batulan started his new business Students will give their answers on the

by investing P250,000 questions asked

Aug. 5 Computer equipment costing

P178,000 is acquired on cash basis.

Aug. 10 Computer supplies in the amount of

P9,000 are purchased on account.

Students will give their answers on the

Aug. 12 Billed customers for services questions asked

rendered, P28,000.

Aug. 20 Made partial payment on supplies

acquired on account, P5,000.

Aug. 25 Received payment from customers

already billed, P10,000. Students participate actively

Aug. 28 Withdrew cash for personal use,

P20,000.

Application:

The class will be divided into groups,

(groupings will depend upon the number of

students). Each group must be given an

envelope with a problem and a sheet of index

Students participate actively

card inside. The index card already has T-

account for different accounts. The group must

fill in the debits and credits of each account in

a period of 2 minutes only. The group who

garnered the most number of correct items

must win the group activity.

Transactions inside the envelope:

Aug. 01 Mr. Keith invested P200,000 in the

business.

Aug. 05 Bought office equipment on account,

P150,000.

Aug. 12 Billed clients P35,000 for services

already rendered during the month.

Students participate actively

Aug. 20 Keith partially paid P25,000 for the

Aug. 05 purchase of office equipment.

Aug. 23 Received cash of P30,000 from clients

for billing dated Aug. 12.

IV. Evaluation :

Quiz: Fill in the blanks (1/4 sheet of paper)

1. The Accounting equation states that Assets = __________ + _________

(Ans. Liabilities, Owner’s Equity)

2. An account is ________ when the amount is entered on the left side. (Ans. Debited)

3. An account is ________ when the amount is entered on the right side. ( Ans. Credited)

4. Decreases in assets are recorded as _______ (Ans. Credit)

5. Decreases in liabilities are entered as _______ (Ans. Debit)

V. Assignment :

(In ½ sheet of paper)

1. Research the steps in the Accounting Cycle and their Aim.

2. Define General Journal, The Ledger and The Journal.

Prepared By:

GLICERIO S. MANGARON JR.

SHS Teacher II

Вам также может понравиться

- Lesson Plan 1 - Household AccountsДокумент5 страницLesson Plan 1 - Household Accountsapi-252884016Оценок пока нет

- DEMOДокумент27 страницDEMORamil TabanaoОценок пока нет

- Lesson Plan Accounting 2.2Документ2 страницыLesson Plan Accounting 2.2Jevie GibertasОценок пока нет

- Lesson Plan in FABM2Документ2 страницыLesson Plan in FABM2Dimple Grace AstorgaОценок пока нет

- FABM 2 - WEEK 2 - Louise Peralta - 11 - FairnessДокумент3 страницыFABM 2 - WEEK 2 - Louise Peralta - 11 - FairnessLouise Joseph PeraltaОценок пока нет

- ABM - FABM11-IIIg - J - 28Документ2 страницыABM - FABM11-IIIg - J - 28Mary Grace Pagalan Ladaran0% (1)

- Tos in FABM2 Second QuarterДокумент2 страницыTos in FABM2 Second QuarterLAARNI REBONGОценок пока нет

- DLL FABM Week5Документ3 страницыDLL FABM Week5sweetzelОценок пока нет

- Accounting Equation: LessonДокумент14 страницAccounting Equation: LessonJdkrkejОценок пока нет

- Fabm2 q2 m3 Bank Reconciliation EditedДокумент29 страницFabm2 q2 m3 Bank Reconciliation EditedMaria anjilu VillanuevaОценок пока нет

- Lesson Plan in FABM2Документ2 страницыLesson Plan in FABM2Dimple Grace AstorgaОценок пока нет

- DLL Abm 1 Week 7-8Документ4 страницыDLL Abm 1 Week 7-8Christopher Selebio100% (1)

- Lesson 2 ACCOUNTING AS THE LANGUAGE OF BUSINESSДокумент9 страницLesson 2 ACCOUNTING AS THE LANGUAGE OF BUSINESSamora elyseОценок пока нет

- q4 Abm Fundamentals of Abm1 11 Week 3Документ6 страницq4 Abm Fundamentals of Abm1 11 Week 3Judy Ann Villanueva100% (1)

- Chapter 7 - Basic Documents and Transactions Related To Bank DepositsДокумент12 страницChapter 7 - Basic Documents and Transactions Related To Bank DepositsAmie Jane MirandaОценок пока нет

- Fabm1 Summative ExamДокумент8 страницFabm1 Summative ExamAbegail PanangОценок пока нет

- Part 2 - Module 7 - The Nature of Merchandising Business 1Документ13 страницPart 2 - Module 7 - The Nature of Merchandising Business 1jevieconsultaaquino2003Оценок пока нет

- Midterm - Financial Acctg & Reporting First Sem (Sy2021 2022) BДокумент6 страницMidterm - Financial Acctg & Reporting First Sem (Sy2021 2022) BLENNETH MONESОценок пока нет

- Chapter 10 Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business 1Документ37 страницChapter 10 Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business 1Ian SumastreОценок пока нет

- Daily Lesson Log: Abm - Fabm11-Ilib-C-17 Abm - Fabm11-Ilid-E-19 Abm - Fabm11-Iilb-C-17Документ7 страницDaily Lesson Log: Abm - Fabm11-Ilib-C-17 Abm - Fabm11-Ilid-E-19 Abm - Fabm11-Iilb-C-17Abegail PanangОценок пока нет

- Demo LPДокумент5 страницDemo LPJo Ann Ramboyong100% (1)

- Detailed Lesson Plan in Fundamentals of AccountancyДокумент5 страницDetailed Lesson Plan in Fundamentals of AccountancyKrisha Joy CofinoОценок пока нет

- Abm Basic DocumentsДокумент6 страницAbm Basic DocumentsAmimah Balt GuroОценок пока нет

- Illustrative Problem 2.1-2Документ3 страницыIllustrative Problem 2.1-2Chincel G. ANIОценок пока нет

- FABM2 Module - 1Документ3 страницыFABM2 Module - 1Jennifer NayveОценок пока нет

- Business Finance For Video Module 2Документ16 страницBusiness Finance For Video Module 2Bai NiloОценок пока нет

- Types of Business According To Activities: (WEEK 5)Документ12 страницTypes of Business According To Activities: (WEEK 5)Mark Domingo MendozaОценок пока нет

- Chapter 7 Managing Personal FinanceДокумент34 страницыChapter 7 Managing Personal FinanceLala BubОценок пока нет

- Orgmngmt DLL Week 9Документ4 страницыOrgmngmt DLL Week 9Rizalyn AbilaОценок пока нет

- Fabm Adjusting EntriesДокумент69 страницFabm Adjusting Entriesiama0unknownОценок пока нет

- FABM2 12 Quarter1 Week7Документ10 страницFABM2 12 Quarter1 Week7Princess DuquezaОценок пока нет

- Major Accounts Demo POWERPOINT PRESENTATIONДокумент31 страницаMajor Accounts Demo POWERPOINT PRESENTATIONRandy MagbudhiОценок пока нет

- DLL Fundamentals May 2 - 6Документ6 страницDLL Fundamentals May 2 - 6Ma. Grace HermogenesОценок пока нет

- 4th FABM 2Документ2 страницы4th FABM 2Keisha MarieОценок пока нет

- MODULE 3 Business FinДокумент16 страницMODULE 3 Business FinWinshei CaguladaОценок пока нет

- Senior High School Department: Quarter 3 - Module 8: Merchandising Concern (Part 1)Документ9 страницSenior High School Department: Quarter 3 - Module 8: Merchandising Concern (Part 1)Jaye RuantoОценок пока нет

- TG #01 - ABM 006Документ9 страницTG #01 - ABM 006Cyrill Paghangaan VitorОценок пока нет

- Fabm1 LPДокумент2 страницыFabm1 LPRaul Soriano CabantingОценок пока нет

- FABM1 Q4 Module 16Документ20 страницFABM1 Q4 Module 16Earl Christian BonaobraОценок пока нет

- Daily Lesson Log: I. ObjectivesДокумент4 страницыDaily Lesson Log: I. ObjectivesAngelicaHermoParasОценок пока нет

- Business Ethics and Social Responsibility: 2 Semester: Learning Module 1 Quarter: Week 7-8Документ2 страницыBusiness Ethics and Social Responsibility: 2 Semester: Learning Module 1 Quarter: Week 7-8Jessa GallardoОценок пока нет

- Fundamentals of Accountancy Business and Management 1 11 3 QuarterДокумент4 страницыFundamentals of Accountancy Business and Management 1 11 3 QuarterPaulo Amposta CarpioОценок пока нет

- Time Value of Money: Family Economics & Financial EducationДокумент32 страницыTime Value of Money: Family Economics & Financial EducationBhagirath AshiyaОценок пока нет

- First Quarter Test Grade 12: Fundamental of ABM-2Документ2 страницыFirst Quarter Test Grade 12: Fundamental of ABM-2manuel hipolitoОценок пока нет

- OrgMan - Basic Concepts of Small Family BusinessДокумент11 страницOrgMan - Basic Concepts of Small Family BusinessDIVINA GRACE RODRIGUEZ0% (1)

- Marketing Principles and StrategiesДокумент17 страницMarketing Principles and StrategiesMagdalena OrdoñezОценок пока нет

- Journalizing: Information Sheet 1.3-1Документ29 страницJournalizing: Information Sheet 1.3-1Marilyn GОценок пока нет

- Fabm1 Assmnt Q2 WK1-2 FinalДокумент9 страницFabm1 Assmnt Q2 WK1-2 FinalIrish D. CudalОценок пока нет

- Abm PPT Week 1 and 2Документ50 страницAbm PPT Week 1 and 2Robertojr sembranoОценок пока нет

- Fundamentals of Accountancy Business and Management II Module 2Документ5 страницFundamentals of Accountancy Business and Management II Module 2Rafael RetubisОценок пока нет

- September 2 2019Документ3 страницыSeptember 2 2019Vinza AcobОценок пока нет

- Merchandising BusinessДокумент31 страницаMerchandising BusinessAngelo ReyesОценок пока нет

- Accounting in Action: Financial Accounting, IFRS Edition Weygandt Kimmel KiesoДокумент61 страницаAccounting in Action: Financial Accounting, IFRS Edition Weygandt Kimmel Kiesosyahrani muthiatiОценок пока нет

- Pre and Post of Accounting 2Документ14 страницPre and Post of Accounting 2Nancy AtentarОценок пока нет

- Week 2Документ5 страницWeek 2Jemar Alipio100% (1)

- Namma Kalvi 12th Commerce Chapter 1 To 17 Study Material em 214296Документ63 страницыNamma Kalvi 12th Commerce Chapter 1 To 17 Study Material em 214296Aakaash C.K.100% (2)

- Fabm 2 2ndДокумент8 страницFabm 2 2ndMark Gil GuillermoОценок пока нет

- Daily-Lesson LogДокумент3 страницыDaily-Lesson LogFaith Tulmo De Dios100% (1)

- Lesson Plan in Bookkeeping For DemoДокумент5 страницLesson Plan in Bookkeeping For DemoJudy BalaseОценок пока нет

- Community HotlineДокумент5 страницCommunity HotlineGLICER MANGARONОценок пока нет

- Entrepreneurship M1 W1 PDFДокумент15 страницEntrepreneurship M1 W1 PDFAdrian ValdezОценок пока нет

- Department of Education: Lesson Plan in Applied Economics Grade 12Документ2 страницыDepartment of Education: Lesson Plan in Applied Economics Grade 12GLICER MANGARON100% (4)

- EconomicsДокумент3 страницыEconomicsGLICER MANGARON100% (2)

- Supply Chain Logistics PDFДокумент3 страницыSupply Chain Logistics PDFNadia Mezghani100% (1)

- E-Commerce: Digital Markets, Digital GoodsДокумент65 страницE-Commerce: Digital Markets, Digital GoodsB.L. SiamОценок пока нет

- Errors and Irregularities in The Transaction CycleДокумент22 страницыErrors and Irregularities in The Transaction CycleVatchdemonОценок пока нет

- Earn Money From Home With ChatGPT A StepbyStep Guideiijcn PDFДокумент2 страницыEarn Money From Home With ChatGPT A StepbyStep Guideiijcn PDFfemaletest63Оценок пока нет

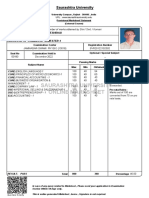

- Dear Vivek Vinod Chaube: 13-Mar-2024 Generated By: 2669663 - LAL CHAND SHARMAДокумент1 страницаDear Vivek Vinod Chaube: 13-Mar-2024 Generated By: 2669663 - LAL CHAND SHARMAchoube varunОценок пока нет

- Acc407 - Final Project (Simulation) - InstructionsДокумент2 страницыAcc407 - Final Project (Simulation) - InstructionsAmirul AmriОценок пока нет

- E-Ticket: Trip 1: Patna To SuratДокумент2 страницыE-Ticket: Trip 1: Patna To Suratenjoy begening lifeОценок пока нет

- JPMCStatement (1) Chase Credit Caed STMNTДокумент4 страницыJPMCStatement (1) Chase Credit Caed STMNTbhawanihpi100% (1)

- Https WWW - Cimb.bizchannel - Com.my Corp Front Transactioninquiry - Do Action Doprint PDFДокумент1 страницаHttps WWW - Cimb.bizchannel - Com.my Corp Front Transactioninquiry - Do Action Doprint PDFSyed HanafieОценок пока нет

- Incoterms Power Point PresentationДокумент39 страницIncoterms Power Point Presentationanshpaul100% (1)

- CV - Mario Andres HernandezДокумент2 страницыCV - Mario Andres HernandezJuan VelasquezОценок пока нет

- Product Sold by APPLE AustraliaДокумент1 страницаProduct Sold by APPLE AustraliaImran KhanОценок пока нет

- Candidate Contact Information: Election and Information ServicesДокумент13 страницCandidate Contact Information: Election and Information ServicesnmpaccОценок пока нет

- Sample - Cpcu553 Course GuideДокумент100 страницSample - Cpcu553 Course Guidekalai87100% (1)

- Multiple Access Techniques in Wireless CommunicationsДокумент48 страницMultiple Access Techniques in Wireless CommunicationsPritish KamathОценок пока нет

- JD-COM - General Banking Officer - Clearing & Collection PDFДокумент3 страницыJD-COM - General Banking Officer - Clearing & Collection PDFfaexasultanaОценок пока нет

- Miss Ntuli Ned NovДокумент4 страницыMiss Ntuli Ned NovBilal Same50% (2)

- 01 OSPF LAB SolutionДокумент53 страницы01 OSPF LAB SolutionMahmudul HaqueОценок пока нет

- AdjustmentsДокумент16 страницAdjustmentsScouter SejatiОценок пока нет

- TENDER RFX NO. 2122100065 Supply of Skilled Manpower Services For Works in Generation DivisionДокумент3 страницыTENDER RFX NO. 2122100065 Supply of Skilled Manpower Services For Works in Generation Divisionxafajat881Оценок пока нет

- Auditing-23 A 1Документ5 страницAuditing-23 A 1Johnfree VallinasОценок пока нет

- Struktur Organisasi SumbawaДокумент7 страницStruktur Organisasi SumbawaJanVpotОценок пока нет

- Marksheet PDFДокумент1 страницаMarksheet PDFD igg v D oh vОценок пока нет

- b2b 110309235703 Phpapp01Документ25 страницb2b 110309235703 Phpapp01vineet_bhatia_iafОценок пока нет

- Bedford Hospital NHS Trust: Examining The Management of The Inpatient Waiting ListДокумент81 страницаBedford Hospital NHS Trust: Examining The Management of The Inpatient Waiting ListPeter LouisОценок пока нет

- Personal Loan EMI Accounting Entry in Tally PrimeДокумент17 страницPersonal Loan EMI Accounting Entry in Tally PrimeVansh Gusai0% (1)

- Chapter 13: Basics of Commercial BankingДокумент2 страницыChapter 13: Basics of Commercial BankingShane Tabunggao100% (1)

- SRM 3006 Reference Book Prof DR WuschekДокумент13 страницSRM 3006 Reference Book Prof DR WuschekBama RamachandranОценок пока нет

- Benefit IllustrationДокумент5 страницBenefit IllustrationPrabaKaranОценок пока нет