Академический Документы

Профессиональный Документы

Культура Документы

Shell LNG Outlook 2017 Infographic

Загружено:

UJJWALИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Shell LNG Outlook 2017 Infographic

Загружено:

UJJWALАвторское право:

Доступные форматы

SHELL LNG OUTLOOK 2017

Demand absorbing Changing drivers of LNG demand growth

new supply LNG imports by role in domestic market (MTPA)

Countries/regions

LNG imports by role in meeting gas demand (MTPA) Gas market type Countries/regions

500

Bunker fuel

Atlantic Middle East US

Pacific Europe

■■ Strong growth in LNG supply in 2016, Balances Europe

Northwest LNG market Northwest Europe

400

one-third of new supply online LNG replaces India Egypt*

declining domestic Thailand Kuwait

Ku lan sh*

C ys s*

Pa am *

M ppi

LNG demand growth from China, India and

u

al ne

et ia

E *

ili ia

Indonesia UAE

ai e

ki *

production into

w d

ol ia

do *

ng

Th lad

UA stan

■■

In rain

Vi mb

Ph nes

Ba ait

Ba pt*

Eg a

300 existing demand Malaysia Colombia*

n

new entrants absorbed supply growth in 2016

h

y

di

Pakistan*

In

pe

Egypt and Pakistan have shown how quickly

LNG complements Southern Cone China

a

or one

■■

ro

ng p

ic

Si an* uro

domestic and pipeline Eastern Europe Singapore

er

N l Eu

in rn C

Isr the e

emerging LNG demand can start and grow

ste o*

200

Am

u or

rd E

ae rn

supply Southern Europe

Ea occ

Jo rn

So ap

Ch the

M a

th

North America

or

u

So

■■ LNG demand growth is coming from

Solely dependent on Japan Puerto Rico

countries that need to offset decline in 100 Dominican

LNG Korea

ic

Ta a o

pu n

Pu am

re Ric

bl

n a*

e a*

Re ica

domestic gas production and to meet Taiwan Republic

m

Do an

Pa aic

Ja an

in

Ko rto

iw

m

p

growing energy demand

Ja

0

■■ LNG use in the transport sector continues to 2000 2005 2010 2015 2020 2025 2030

grow globally to meet demand for a lower * Denotes new or emerging LNG importing countries

emissions alternative to diesel and heavy fuel oil LNG demand driver

Bunker Fuel LNG replaces declining domestic Gas supply solely

production into existing demand dependent on LNG

LNG compliments domestic

Balances LNG supply

and pipeline supply

Source: Shell interpretation of Wood Mackenzie Q4 2016 data

2016 import growth dominated by China, India and new entrants

Million

tonnes

8

Net imports vs 2015 = +17.0 million tonnes China

6

India Egypt

4

2 Pakistan

Jordan

0

Source: Shell interpretation of IHS (LNG Waterborne Trade) data, delivered volumes; red denotes new entrants (2015-2016)

Growing imports

2016 GLOBAL LNG DEMAND

NEW

6

35

IMPORTING

265

Enough to power COUNTRIES

6%

500

in 2015

and 2016:

ANNUAL AVERAGE MILLION

MILLION Colombia, Egypt, Jamaica,

DEMAND tonnes (MT)

homes per year

LNG Jordan, Pakistan and Poland

GROWTH IMPORTING

COUNTRIES

for global LNG up from 10 at the start

since 2000 of this century

Million

tonnes

Growth in LNG demand absorbed

2016 Supply Highlights 20

increase in supply

■■ 17 MT: increase in total global LNG exports Net exports:

15 2016 YoY

■■ 15 MT: increase in Australia exports

10

■■ 2.9 MT: delivered from the Sabine Pass terminal in Louisiana, USA

■■ 3.8 MT: increase in exports from Qatar, Indonesia and Angola 5

■■ 3.5 MT: fall in production from other Atlantic Basin projects 0

Supply Australia US Rest of World

-5 Source: Shell interpretation of IHS data, delivered volumes

Structural changes Trend to shorter and smaller contracts with emerging buyers

Average contract length, years Average contract volume, MTPA LNG buyer credit ratings

■■ Increased economic uncertainty has 20 2.5 100%

contributed to a decrease in final

16 2.0 80%

investment decisions

12 1.5 60%

■■ LNG sellers need a large portfolio and

8 1.0 40%

sufficient flexibility to supply a growing

number of countries, including more 4 0.5 20%

developing economies 0 0.0 0%

2008 2016 2008 2016 2008 2016

A-rated B-rated

Source: Shell interpretation of IHS (Energy LNG Sales Contracts Database), Moody’s and Fitch data Non-investment grade

Policymakers increasingly Future trends

choose gas

40% LESS

CO2 ■■ Continued LNG supply growth to 2020

LNG emits around 40% less CO2 than

■■ Global demand for gas is expected to increase

coal when burnt for electricity by 2% a year between 2015 and 2030; LNG

is set to rise at twice that rate at 4 to 5%

■■ Future LNG demand growth will be driven by:

China adopted its 13th Five Year Plan, which identifies 45 bcm of additional policy, floating storage regasification units,

gas demand – more than total gas demand in the Netherlands – to improve air replacing declining domestic gas production,

quality in cities. small scale LNG and transport

■■ LNG and Russian gas imports required to

France and Canada announced plans to phase out coal fired generation by 2023 balance European gas demand

and 2030 respectively, joining Austria, Belgium, Britain, Denmark and Portugal in

pledging to close coal fired generation by the end of the next decade. ■■ New investments required to meet growing

LNG demand after 2020

170+ members agree to a global 0.5% sulphur cap on marine fuel that will take effect ■■ LNG trade is changing to meet the evolving

from 2020. LNG as a fuel contains virtually zero sulphur vs. 3.5% specification for needs of buyers, including shorter-term and

global marine fuel today. lower-volume contracts

www.shell.com/lngoutlook

Вам также может понравиться

- 2.2.2 Gunvor Annual Report 2020Документ84 страницы2.2.2 Gunvor Annual Report 2020Andres SerranoОценок пока нет

- Route 292 2023-08-06 FINALДокумент2 страницыRoute 292 2023-08-06 FINALA. O. GilmoreОценок пока нет

- 8.6x12.14 (D) Anjam SB AlipurДокумент4 страницы8.6x12.14 (D) Anjam SB AlipurKhalid TararrОценок пока нет

- (Cont. Next Page) 6 Hilux: Engine Control (2TR-FE)Документ4 страницы(Cont. Next Page) 6 Hilux: Engine Control (2TR-FE)autocomtrucksОценок пока нет

- Foundation Drawing 01Документ1 страницаFoundation Drawing 01Pawan ShettyОценок пока нет

- 220kV Feeder Zone ProtectionДокумент4 страницы220kV Feeder Zone ProtectionMidhun VargheseОценок пока нет

- NationalMineralPolicy2013 120313 PDFДокумент24 страницыNationalMineralPolicy2013 120313 PDFRizwan YousafОценок пока нет

- Birla AlokyaДокумент18 страницBirla AlokyaanjaligargisbОценок пока нет

- Oetc Grid Map-2011Документ5 страницOetc Grid Map-2011Krishna PardeshiОценок пока нет

- D109817754 9301792268157071 SchedulescДокумент3 страницыD109817754 9301792268157071 SchedulescGyasuddin MalekОценок пока нет

- CD100MДокумент2 страницыCD100MmuahdibОценок пока нет

- Activa 3GДокумент2 страницыActiva 3GInsidious PcОценок пока нет

- List of Companies Involved in Battery Recycling 2021Документ1 страницаList of Companies Involved in Battery Recycling 2021Huynh Nghiep ThanhОценок пока нет

- Annur New Bypass Nov 2Документ1 страницаAnnur New Bypass Nov 2Anonymous IG5yMrVa75% (4)

- AJA Converter MatrixДокумент1 страницаAJA Converter Matrixnokia9600Оценок пока нет

- Guia Seleccion de Bombas RUHRPUMPENДокумент28 страницGuia Seleccion de Bombas RUHRPUMPENYadir Bojaca100% (1)

- VW Q1 2015 Obd Ii Cal Id and CVN Data: o Ri NДокумент5 страницVW Q1 2015 Obd Ii Cal Id and CVN Data: o Ri NAdrianBalaОценок пока нет

- D095269113 3774922073732992 SchedulescДокумент3 страницыD095269113 3774922073732992 Schedulescmansoor 31 shaikhОценок пока нет

- 315c Excavator Hydraulic System - Attachment Two-Way With OnДокумент2 страницы315c Excavator Hydraulic System - Attachment Two-Way With OnAlessandro GomesОценок пока нет

- PDF Resize PDFДокумент1 страницаPDF Resize PDFJyotirmoy BandyopadhayayaОценок пока нет

- Tank Top: Ballast, Bilge, Fire Main and OWS System Lubricating Oil SystemДокумент1 страницаTank Top: Ballast, Bilge, Fire Main and OWS System Lubricating Oil SystemSean Chen GyarinoОценок пока нет

- CD150M Technical Specification: Standard Pump Material SpecificationДокумент2 страницыCD150M Technical Specification: Standard Pump Material SpecificationAbcehmu EgiОценок пока нет

- CHEXV4DOC02 Hussain PDFДокумент34 страницыCHEXV4DOC02 Hussain PDFAmmar HrzОценок пока нет

- Periodic TableДокумент1 страницаPeriodic Tableunknown userОценок пока нет

- Periodic TableДокумент14 страницPeriodic Tableemilrottmayer3Оценок пока нет

- Kings Park Book - Draft 8Документ38 страницKings Park Book - Draft 8Masun Nabhan HomsiОценок пока нет

- 2nd 1305103963 - 455247 - Chapter 2-3Документ32 страницы2nd 1305103963 - 455247 - Chapter 2-3fudya hanum pratiwiОценок пока нет

- CD300M Technical Specification: Standard Pump Material SpecificationДокумент2 страницыCD300M Technical Specification: Standard Pump Material SpecificationAbcehmu EgiОценок пока нет

- Section-Vi: DrawingsДокумент8 страницSection-Vi: Drawingssantosh yevvariОценок пока нет

- Periodic TableДокумент1 страницаPeriodic TableUnique CreativityОценок пока нет

- Diagrama Hidraulico 325b Carga BoomДокумент2 страницыDiagrama Hidraulico 325b Carga Boomcristian chuquicondor torres100% (2)

- Single Bearing AssemblyДокумент1 страницаSingle Bearing AssemblySonidar GroupОценок пока нет

- Panos Lianos - Final ExamДокумент16 страницPanos Lianos - Final ExamPanagiotis LianosОценок пока нет

- Creativeevolutio 00 BerguoftДокумент450 страницCreativeevolutio 00 BerguoftGabriel ProañoОценок пока нет

- PM104135-02-04 - R0 - Piping Layout Sprinkler PM AДокумент1 страницаPM104135-02-04 - R0 - Piping Layout Sprinkler PM Amarpaung saberindoОценок пока нет

- Ride The World2 PDFДокумент1 страницаRide The World2 PDFManny SinghОценок пока нет

- Periodic Table of Elements W Chemical Group Block PubChemДокумент1 страницаPeriodic Table of Elements W Chemical Group Block PubChemRoy BibanoОценок пока нет

- Periodic Table MLZДокумент1 страницаPeriodic Table MLZsenior highОценок пока нет

- CD80D Technical Specification: Standard Pump Material SpecificationДокумент2 страницыCD80D Technical Specification: Standard Pump Material SpecificationmuahdibОценок пока нет

- E00248 HTG-CMI-DWG-220-400-220-8570-Rev 0 - Details For Manufacturing Pipes Between Structures - VERIFДокумент52 страницыE00248 HTG-CMI-DWG-220-400-220-8570-Rev 0 - Details For Manufacturing Pipes Between Structures - VERIFBMWGОценок пока нет

- Catalog C-1 Accumulators and ReceiversДокумент17 страницCatalog C-1 Accumulators and ReceiversPutra LangitОценок пока нет

- Catalog C-1 Accumulators and ReceiversДокумент17 страницCatalog C-1 Accumulators and ReceiversHewa AkreyОценок пока нет

- 320B Excavators One Way/One Pump Flow Third Pedal Straight Travel Hydraulic System - AttachmentДокумент2 страницы320B Excavators One Way/One Pump Flow Third Pedal Straight Travel Hydraulic System - Attachmentlalo11715Оценок пока нет

- CD75 Technical Specification: Standard Pump Material SpecificationДокумент2 страницыCD75 Technical Specification: Standard Pump Material SpecificationmuahdibОценок пока нет

- Periodic Table of Elements W Standard State PubChemДокумент1 страницаPeriodic Table of Elements W Standard State PubChemHuey KaОценок пока нет

- Activa Policy 2 PageДокумент2 страницыActiva Policy 2 PageShakil SayyedОценок пока нет

- PP Aaa PP1 108Документ18 страницPP Aaa PP1 108Rabah AmidiОценок пока нет

- Document ID: 4486513: Fuel Controls - Fuel PumpДокумент3 страницыDocument ID: 4486513: Fuel Controls - Fuel PumpAlfredo MedinaОценок пока нет

- Power Grid - MP: PROJECT - 132kV-D/C Monopole (Enquiry For PGICL TBCB MP PHASE-I/TL01) Summary SheetДокумент1 страницаPower Grid - MP: PROJECT - 132kV-D/C Monopole (Enquiry For PGICL TBCB MP PHASE-I/TL01) Summary SheetMOHAMMAD ZUEF - SKIPPER LIMITEDОценок пока нет

- Relationship Between GDP Growth and In:lation in The UK (1989 - 2013)Документ1 страницаRelationship Between GDP Growth and In:lation in The UK (1989 - 2013)fusionОценок пока нет

- Lancaster Paint Monthly Specials April-May 31, 2011Документ16 страницLancaster Paint Monthly Specials April-May 31, 2011SteveОценок пока нет

- BALAJI AD49994GC20 sg1 PDFДокумент290 страницBALAJI AD49994GC20 sg1 PDFVasanth DamodharanОценок пока нет

- 28449789-GLIN153-72-C-D-A1-02 Rev 2 PILE LAYOUT DWG-SHT-1Документ1 страница28449789-GLIN153-72-C-D-A1-02 Rev 2 PILE LAYOUT DWG-SHT-1Hks InfrastructureОценок пока нет

- Configuring BGP4Документ60 страницConfiguring BGP4putakoОценок пока нет

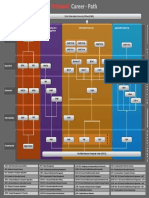

- EC Council Career Path 2015 PDFДокумент1 страницаEC Council Career Path 2015 PDFadyanganefiОценок пока нет

- EC Council Career Path 2015Документ1 страницаEC Council Career Path 2015Atul MahajanОценок пока нет

- EC Council Career Path 2015 PDFДокумент1 страницаEC Council Career Path 2015 PDFadyanganefiОценок пока нет

- Deloitte - Anaplan-CoE-whitepaperДокумент11 страницDeloitte - Anaplan-CoE-whitepapersnowboardhollandОценок пока нет

- Periodic TableДокумент2 страницыPeriodic Tablejustine galonОценок пока нет

- Paper 1 by KVS MadaanДокумент45 страницPaper 1 by KVS MadaanUJJWAL100% (1)

- Ugc Net Set Commerce Paper - 2 & 3Документ282 страницыUgc Net Set Commerce Paper - 2 & 3UJJWALОценок пока нет

- Unit-6 Complete Book LBДокумент140 страницUnit-6 Complete Book LBUJJWALОценок пока нет

- Unit-9 Complete Book LBДокумент135 страницUnit-9 Complete Book LBUJJWALОценок пока нет

- University Grants Commission Net Bureau: Net Syllabus Subject: ManagementДокумент6 страницUniversity Grants Commission Net Bureau: Net Syllabus Subject: ManagementRanbir SinghОценок пока нет

- Unit-7 Complete Book LBДокумент95 страницUnit-7 Complete Book LBUJJWAL100% (1)

- Panchshil Domestic Bill-JuneДокумент60 страницPanchshil Domestic Bill-JuneUJJWALОценок пока нет

- Ugc-Net Result June, 2019: National Testing Agency (Nta)Документ1 страницаUgc-Net Result June, 2019: National Testing Agency (Nta)UJJWALОценок пока нет

- University Grants Commission Net Bureau: Syllabus SubjectДокумент4 страницыUniversity Grants Commission Net Bureau: Syllabus Subjectmnb11augОценок пока нет

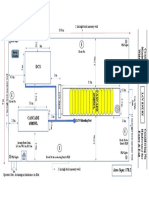

- Auto Corner CNG DWG PDFДокумент1 страницаAuto Corner CNG DWG PDFUJJWALОценок пока нет

- A Government of India Undertaking) Administrative Building, Chembur, Mumbai-400 074Документ45 страницA Government of India Undertaking) Administrative Building, Chembur, Mumbai-400 074Nitin KeshavОценок пока нет

- Us Clears Non Fta ExportsДокумент6 страницUs Clears Non Fta ExportsUJJWALОценок пока нет

- Financial Modeling Using Excel Mergers and Acquisitions: WWW - Yerite.co - inДокумент43 страницыFinancial Modeling Using Excel Mergers and Acquisitions: WWW - Yerite.co - inUJJWALОценок пока нет

- 19.8 M 2.1m High Brick Masonry Wall: FLP Light FLP Light Earth PitДокумент1 страница19.8 M 2.1m High Brick Masonry Wall: FLP Light FLP Light Earth PitUJJWALОценок пока нет

- Domestic Gas Prices, Some LNG Price Formulas & RR Committee Proposed Price FormulaДокумент29 страницDomestic Gas Prices, Some LNG Price Formulas & RR Committee Proposed Price FormulaUJJWALОценок пока нет

- Tariff Calculating Model For Natural Gas Transport PDFДокумент7 страницTariff Calculating Model For Natural Gas Transport PDFUJJWALОценок пока нет

- Service With A Smile Actual Minimum BillДокумент3 страницыService With A Smile Actual Minimum BillUJJWALОценок пока нет

- 7 Effective Ways of Website DesignДокумент9 страниц7 Effective Ways of Website DesignUJJWALОценок пока нет

- LCNG Vs CNG in USDДокумент9 страницLCNG Vs CNG in USDUJJWALОценок пока нет

- Gas Pooling ReportДокумент73 страницыGas Pooling ReportP VinayakamОценок пока нет

- Global - LNG - New - Pricing - Ahead - Ernst & YoungДокумент20 страницGlobal - LNG - New - Pricing - Ahead - Ernst & YoungUJJWALОценок пока нет

- Financing LNG Projects - Excellent Presentation Goldman SachДокумент11 страницFinancing LNG Projects - Excellent Presentation Goldman SachUJJWALОценок пока нет

- Financing LNG Projects - Excellent Presentation Goldman SachДокумент11 страницFinancing LNG Projects - Excellent Presentation Goldman SachUJJWALОценок пока нет

- Effectiveness of Ambush Marketing: Ujjwal RaoДокумент7 страницEffectiveness of Ambush Marketing: Ujjwal RaoUJJWALОценок пока нет

- LNG Versus CNG Versus HSDДокумент7 страницLNG Versus CNG Versus HSDUJJWALОценок пока нет

- MWH MW Produced in An Hour ( ) MW Capacity of Power Plant To Produce Power 24 Hours A Day Assuming 100% Efficiency ( )Документ2 страницыMWH MW Produced in An Hour ( ) MW Capacity of Power Plant To Produce Power 24 Hours A Day Assuming 100% Efficiency ( )UJJWALОценок пока нет

- Basics of CGD For MBA Oil - Gas StudentsДокумент53 страницыBasics of CGD For MBA Oil - Gas StudentsUJJWALОценок пока нет

- Conversion Table: Fuel MT/ KL Kcal / MT Equivalent Volume of NG GCV (SCM/MT)Документ4 страницыConversion Table: Fuel MT/ KL Kcal / MT Equivalent Volume of NG GCV (SCM/MT)UJJWALОценок пока нет

- Supermini200 (Hi-Res Book) Brochure en Ver1 00Документ4 страницыSupermini200 (Hi-Res Book) Brochure en Ver1 00PauloValdiviesoОценок пока нет

- Lecture 5: Triangulation Adjustment Triangulation: in This Lecture We Focus On The Second MethodДокумент5 страницLecture 5: Triangulation Adjustment Triangulation: in This Lecture We Focus On The Second MethodXogr BargarayОценок пока нет

- Crusher 4Документ39 страницCrusher 4kediliterapiОценок пока нет

- ROXAS FARM SCHOOL Trifold BrochureДокумент2 страницыROXAS FARM SCHOOL Trifold BrochureJude IledanОценок пока нет

- Sorting Algorithms in Fortran: Dr. Ugur GUVENДокумент10 страницSorting Algorithms in Fortran: Dr. Ugur GUVENDHWANIT MISEОценок пока нет

- IPT .Quarter 2 (Grade 7-Mathematics, English &TLE)Документ2 страницыIPT .Quarter 2 (Grade 7-Mathematics, English &TLE)ARRIANE JOY TOLEDOОценок пока нет

- Amplificadores Automotivos PyramidДокумент13 страницAmplificadores Automotivos Pyramidedusf1000Оценок пока нет

- Rise of Al JazeeraДокумент1 страницаRise of Al Jazeeraইlish ProductionsОценок пока нет

- Sbi Afi 2012Документ48 страницSbi Afi 2012Moneylife FoundationОценок пока нет

- Trend Trading StocksДокумент64 страницыTrend Trading Stockssasi717100% (1)

- JHS Integrated Science Preamble, Jan 2012 - FinalДокумент15 страницJHS Integrated Science Preamble, Jan 2012 - Finalfrank adamsОценок пока нет

- COSO DefinEDДокумент21 страницаCOSO DefinEDRefdy AnugrahОценок пока нет

- Kobelco CK1100G Spec BookДокумент38 страницKobelco CK1100G Spec BookEjeantengОценок пока нет

- Maryam Ejaz Sec-A Marketing Assignment (CHP #15)Документ3 страницыMaryam Ejaz Sec-A Marketing Assignment (CHP #15)MaryamОценок пока нет

- AR Financial StatementsДокумент281 страницаAR Financial StatementsISHA AGGARWALОценок пока нет

- Geography Paper 1Документ7 страницGeography Paper 1Sudhir TewatiaОценок пока нет

- Appendicitis Case StudyДокумент6 страницAppendicitis Case StudyKimxi Chiu LimОценок пока нет

- Architecture of Neural NWДокумент79 страницArchitecture of Neural NWapi-3798769Оценок пока нет

- Sample Spec For AWWA HDPE Pipe Fittings 6.02revДокумент6 страницSample Spec For AWWA HDPE Pipe Fittings 6.02revmg4myОценок пока нет

- EHR StandardsIndia - August 2013-32630521Документ54 страницыEHR StandardsIndia - August 2013-32630521kartiksinhОценок пока нет

- Full Download Human Biology 11th Edition Starr Solutions ManualДокумент35 страницFull Download Human Biology 11th Edition Starr Solutions Manualsheathe.zebrinny.53vubg100% (41)

- Norma Geral Astm Bronze Alumínio - b150b150m.19198Документ7 страницNorma Geral Astm Bronze Alumínio - b150b150m.19198EduardoОценок пока нет

- Why Do Kashmiris Need Self-Determination?: UncategorizedДокумент16 страницWhy Do Kashmiris Need Self-Determination?: UncategorizedFarooq SiddiqiОценок пока нет

- Thom22e ch03 FinalДокумент44 страницыThom22e ch03 FinalDionisius AlvianОценок пока нет

- Loch ChildrenДокумент4 страницыLoch ChildrenLauro De Jesus FernandesОценок пока нет

- Keira Knightley: Jump To Navigation Jump To SearchДокумент12 страницKeira Knightley: Jump To Navigation Jump To SearchCrina LupuОценок пока нет

- TEFL Entrance ExamДокумент3 страницыTEFL Entrance ExammerekОценок пока нет

- Theben Timer SUL 181DДокумент2 страницыTheben Timer SUL 181DFerdiОценок пока нет

- Pe8 Mod5Документ16 страницPe8 Mod5Cryzel MuniОценок пока нет

- QLD Plan Draft Review Raw DataДокумент242 страницыQLD Plan Draft Review Raw DataRohit Jain100% (1)