Академический Документы

Профессиональный Документы

Культура Документы

Condino, K. - Income Taxation (Tax 41) Synthesis

Загружено:

Kent CondinoАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Condino, K. - Income Taxation (Tax 41) Synthesis

Загружено:

Kent CondinoАвторское право:

Доступные форматы

Marcy’s Corporation Income Taxation Synthesis

Marcy’s Corporation is a privately owned company, more specifically a close corporation. The shares are

held by a select few individuals, particularly, the 5 incorporators are family members. Because of that, they don’t face

compensation issues. The company is taxed as a C corporation, thus their income is subject to double taxation. In the

interview conducted to the owners’, they stated that the company pays their taxes promptly and at the right amount

since most of their customers, and the bulk of their operations, are centered on local government units at Bukidnon.

In such circumstances, they cannot and would not try diminish their sales and income since their transactions with the

government are recorded thoroughly. The company outsources their bookkeeping and files their tax through eFiling

and Payment System (eFPS). They also pay their taxes quarterly, and the remaining at the end of calendar year. They

have an estimated total asset of ₱20 million and a total liability of ₱5 million.

When the owners were interviewed on their opinion on the recent tax reform, particularly the TRAIN Act,

they said that although they pay more taxes now, they appreciate the new Act since it gave more business opportunities

for them. It is also worthy to note that all of the construction projects they handle are initiated and funded by the local

government units. Although the company is not licensed themselves to handle construction projects, through a

contract, they use the name of M. Montesclaros Enterprises, Inc. to enable them to handle such projects, which is

allowed by law. They only needed to pay a royalty of 5 percent to use MM Enterprises’ name. Marcy’s Corporation

benefited from the Act by the increase in construction projects they handle, since the new Act gave rise to more

building and road construction projects in Bukidnon and other nearby provinces. They also stated that the TRAIN Act

was a more reasonable tax scheme compared to the previous National Internal Revenue Code (NIRC) since the new

brackets for taxable income benefited those that are in the lower brackets.

The company has minimum wage and output-based employees, the latter comprises the majority of their

workers. They also have regular employees, and gave them benefits such as Social Security System, PhilHealth, Pag-

IBIG, Christmas bonus, 13th month pay and even an annual trip overseas to their managers and key employees. They

have also provided retirement benefits to more than 50 people along the years. Although Marcy’s is known for their

custom made shirts, uniforms and other type of clothes, it only comprises 20 percent of their income, the vast majority

is on construction projects and the sliver remaining is on retail. They also sell electronics and other order-based items.

The last part of the interview was about whether Marcy’s Corporation has ever had an issue regarding tax

compliance, and they said “No, since even if we want to try doing something shady, we really aren’t able to. Most of

our income is already withheld at source by the government”. They stated that they pay an annual tax of approximately

₱1.2 million, and since they pay such a huge amount considering their operations, they are labelled tax responsible by

the government. Engr. Jose V. Calderon, Jr. even stated that tax authorities sometimes visit the company to investigate

in rare occasions, but it always result to a “clean” and proper tax compliance. Lastly, when asked if they were one of

the largest tax payers in Valencia, they hurriedly denied such claim and stated that MM Corporation is by far the

biggest tax contributor in Valencia and their tax due is huge compared to Marcy’s Corporation.

Kent P. Condino

Income Taxation (Tax 41)

Synthesis

December 3, 2018

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Facts of CheerleadingДокумент1 страницаFacts of CheerleadingKent CondinoОценок пока нет

- g10 Music 3rd Page 2Документ1 страницаg10 Music 3rd Page 2Kent CondinoОценок пока нет

- A Software System Development Life Cycle Model For ImprovedДокумент22 страницыA Software System Development Life Cycle Model For ImprovedPutri KrismayanthiОценок пока нет

- Accy 102 Theory of Cash and ReceivablesДокумент11 страницAccy 102 Theory of Cash and ReceivablesKent CondinoОценок пока нет

- Student Organization ConsultationДокумент11 страницStudent Organization ConsultationKent CondinoОценок пока нет

- Gross Estate ProblemsДокумент17 страницGross Estate ProblemsLloyd Sonica100% (1)

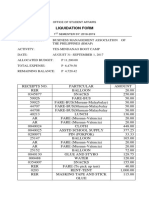

- Liquidation Form: Office of Student AffairsДокумент3 страницыLiquidation Form: Office of Student AffairsKent CondinoОценок пока нет

- Chapter 11: The General Ledger and Financial Reporting CycleДокумент29 страницChapter 11: The General Ledger and Financial Reporting CycleKent CondinoОценок пока нет

- Reviewers and ScheduleДокумент1 страницаReviewers and ScheduleKent CondinoОценок пока нет

- It Systems of Fixed Assets Processe1Документ5 страницIt Systems of Fixed Assets Processe1Kent CondinoОценок пока нет

- It Systems of Fixed Assets Processe1Документ5 страницIt Systems of Fixed Assets Processe1Kent CondinoОценок пока нет

- Gross Estate ProblemsДокумент17 страницGross Estate ProblemsLloyd Sonica100% (1)

- Chapter 1 and 2Документ16 страницChapter 1 and 2Kent CondinoОценок пока нет

- Chapter VДокумент4 страницыChapter VKent CondinoОценок пока нет

- Chapter IДокумент4 страницыChapter IKent CondinoОценок пока нет

- References CdewqДокумент1 страницаReferences CdewqKent CondinoОценок пока нет

- Ethnoveterinary Medicine in SpainДокумент11 страницEthnoveterinary Medicine in SpainKent CondinoОценок пока нет

- Cash and Cash Equivalents Audit Procedures CONDINOДокумент11 страницCash and Cash Equivalents Audit Procedures CONDINOKent CondinoОценок пока нет

- Vetsci00118 0006Документ1 страницаVetsci00118 0006Kent CondinoОценок пока нет

- Appraisal of Ethno-Veterinary PracticesДокумент7 страницAppraisal of Ethno-Veterinary PracticesKent CondinoОценок пока нет

- Ethnobotanical Study... EthiopiaДокумент10 страницEthnobotanical Study... EthiopiaKent CondinoОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Internal Controls CHAPTERДокумент107 страницInternal Controls CHAPTEReskedar eyachewОценок пока нет

- Safety Shoes PolicyДокумент1 страницаSafety Shoes PolicyMarlon BernardoОценок пока нет

- Financial Performance of NLC Ltd: A StudyДокумент67 страницFinancial Performance of NLC Ltd: A StudyAnanth MandiОценок пока нет

- Marketing Management Set 21Документ6 страницMarketing Management Set 21SUNIL SONAWANEОценок пока нет

- 0B Implemenation GuideДокумент71 страница0B Implemenation GuideSHAURYA TIWARIОценок пока нет

- KPIs Customs 2021Документ193 страницыKPIs Customs 2021Syed Hadi Hussain ShahОценок пока нет

- Petition For Issuance of Letter of AdministrationДокумент4 страницыPetition For Issuance of Letter of AdministrationMa. Danice Angela Balde-BarcomaОценок пока нет

- Business Plan For Vending Machine in Ethiopia 2013 E.CДокумент28 страницBusiness Plan For Vending Machine in Ethiopia 2013 E.CBirukee Man100% (3)

- New Product DevelopmentДокумент11 страницNew Product DevelopmentPunit BadalОценок пока нет

- Case Study On Kalayani Group: Name: Yash Srivastava Enroll No: 08917001716 Bba B Sem. ViДокумент8 страницCase Study On Kalayani Group: Name: Yash Srivastava Enroll No: 08917001716 Bba B Sem. ViTitiksha GuhaОценок пока нет

- Walmart HRPДокумент2 страницыWalmart HRPROHIT CHUGHОценок пока нет

- Telecom Industry AnalysisДокумент23 страницыTelecom Industry AnalysisSachin Gupta100% (9)

- Project Rubrics EconomicsДокумент2 страницыProject Rubrics EconomicsYummy Chum23Оценок пока нет

- Practitioners Guide Corporate LawДокумент72 страницыPractitioners Guide Corporate LawoussОценок пока нет

- Final Cadbury Project 1Документ66 страницFinal Cadbury Project 1Purva Srivastava70% (10)

- Leadership Styles Leadership Styles Leadership StylesДокумент1 страницаLeadership Styles Leadership Styles Leadership StylesDIY TaskerОценок пока нет

- Career Paths Accounting SB-33Документ1 страницаCareer Paths Accounting SB-33YanetОценок пока нет

- Final AccountДокумент10 страницFinal AccountSaket AgarwalОценок пока нет

- Hafsa Bookstore Business Plan 1Документ3 страницыHafsa Bookstore Business Plan 1Abdi100% (1)

- Week 2 - Recruitment SourcesДокумент47 страницWeek 2 - Recruitment Sourcesyousuf AhmedОценок пока нет

- ThebankerДокумент11 страницThebankerVraciu PetruОценок пока нет

- Shrdha Chungade SAP - SD - LES - GTM - MDG - 6 Years Exp ConsultantДокумент6 страницShrdha Chungade SAP - SD - LES - GTM - MDG - 6 Years Exp Consultantarpangupta007Оценок пока нет

- Vedanta Consulting Private Limited Business ProfileДокумент15 страницVedanta Consulting Private Limited Business ProfileIsfh 67Оценок пока нет

- Epro Order Guide Draft San DiegoДокумент31 страницаEpro Order Guide Draft San DiegoEmergePeoriaОценок пока нет

- Issues and Challenges of Indian Aviation Industry: A Case StudyДокумент7 страницIssues and Challenges of Indian Aviation Industry: A Case StudyJayant KumarОценок пока нет

- Strategic Fit Should Come from Highest LevelsДокумент8 страницStrategic Fit Should Come from Highest LevelsNhi Nguyễn Thị NgânОценок пока нет

- Hilton 11e Chap009PPTДокумент52 страницыHilton 11e Chap009PPTNgô Khánh HòaОценок пока нет

- Assignment of HRM 370Документ25 страницAssignment of HRM 370tahseenthedevil100% (1)

- Ek AkuntansiДокумент74 страницыEk AkuntansiEsa SulyОценок пока нет

- BondsДокумент12 страницBondsGelyn Cruz100% (1)