Академический Документы

Профессиональный Документы

Культура Документы

Credit One 2

Загружено:

BryanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Credit One 2

Загружено:

BryanАвторское право:

Доступные форматы

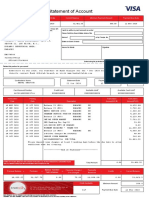

4447962354961959

WILMINGTON TRUST BANK CREDIT CARD STATEMENT

Account Number 4170-xxxx-xxxx-2673

December 16, 2017 to January 15, 2018

SUMMARY OF ACCOUNT ACTIVITY PAYMENT INFORMATION

Previous Balance $232.61 New Balance $579.00

Payments - $0.00 Past Due Amount $25.00

Other Credits - $0.21 Amount Due This Period $54.00

Purchases + $311.11 Minimum Payment Due $79.00

Cash Advances + $0.00 Payment Due Date 11/11/17

Fees Charged + $25.00 Late Payment Warning:

Interest Charged + $10.49 If we do not receive your minimum payment by the date listed above,

you may have to pay a late fee up to $35.

New Balance $579.00

Minimum Payment Warning:

Credit Limit $550.00 If you make only the minimum payment each period, you will pay more

Available Credit $0.00 in interest and it will take you longer to pay off your balance.

Statement Closing Date 10/15/17

Days in Billing Cycle 30 For example:

If you make no You will pay off the And you will

QUESTIONS? additional charges balance shown on end up paying

Call Customer Service or Report using this card and the statement in an estimated

a Lost or Stolen Credit Card 1-800-982-4620 each month you pay... about... total of...

Outside the U.S. Call 1-302-636-8500

Only the minimum

Please send billing inquiries and correspondence to: payment 3 years $768.00

1100 North Market St., 10th Floor

Wilmington, DE 19890 If you would like a location for credit counseling services,

call 1-866-515-5720.

TRANSACTIONS

Reference Number Trans Date Post Date Description of Transaction or Credit Amount

247893085KWPV6QAD 12/16 12/16 THE BUCKLE #249 BEACON NY 212.53

24445008900T2AR9M 12/21 12/21 DISCOUNT-TIRE-CO MIG-29 BEACON NY 40.00

24164058DB019YYY2 12/25 12/25 EXXONMOBIL 99405789 BEACON NY 34.00

24445008E2X9F7XG6 12/26 12/26 MEIJER #217 Q01 BEACON NY 19.07

F5727008E000FR 12/27 12/27 CREDIT ONE REWARD CREDIT -0.21

WILMINGTON DE

01/14 01/14 CREDIT PROTECT 1 866 236 1622 5.51

Fees

01/14 01/14 LATE FEE 25.00

TOTAL FEES FOR THIS PERIOD 25.00

Interest Charged

01/14 01/14 Interest Charge on Purchases 10.49

01/14 01/14 Interest Charge on Cash Advances 0.00

TOTAL INTEREST FOR THIS PERIOD 10.49

2017 Totals Year-to-Date

Total fees charged in 2017 $134.95

Total interest charged in 2017 $36.19

YOUR ACCOUNT IS PAST DUE. IT IS NOT TOO LATE TO

PROTECT YOUR CREDIT RATING! PLEASE PAY THE

MINIMUM AMOUNT DUE NOW OR CALL (888) 729-6274.

.

If your account is past due you could get help.

You have Credit Protection - Request benefits today.

It can help make payments if you get laid off or become

disabled, and there is a loss of life benefit, too.

Call 1-866-803-1746 to request benefits today!

INTEREST CHARGE CALCULATION

Your Annual Percentage Rate (APR) is the annual interest rate on your account.

Balance Subject to

Type of Balance Annual Percentage Rate (APR) Interest Rate Interest Charge

Purchases 24.90%(v) $505.56 $10.49

Cash Advances 24.90%(v) $0.00 $0.00

(v) = Variable Rate

5385 JBH 001 7 15 180114 0 X PAGE 1 of 1 2 0 5727 9620 A125 O1EO5385

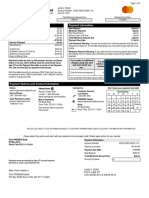

Please return this portion with your payment, and write your account number on your check, made payable to CREDIT ONE BANK.

PAY YOUR BILL ONLINE at CreditOneBank.com

Account Number: 4170 xxxx xxxx 2673

New Balance: $579.00

Minimum Payment Due: $79.00

Payment Due Date: 01/21/18

For address, telephone and email changes,

please complete the reverse side.

Or, update your contact information online

at www.WilmingtonTrust.com AMOUNT ENCLOSED: $ .

AATAFAATTDDAATAADTTFAADADFAFFATDTFTDDDFATDFTDFTTADTATDTATDADFADTT

Wilmington Trust Bank, N.A JESSICA WRIGHT

1100 N Market Street HOME PUN FOOD LTD.

Wilmington, DE 19890 223 MAIN STREET

TDDDAFAFADDTDFFTATFFFFTFAAAFDFAFTDFFDTTFFFAFFFDFFFTFTFFDFDDDTTAAA BEACON NY 12508

0000000 0057900 0005400 4447962354961959 8

PAYMENTS: When you provide a check as payment, you authorize us either to use information from your check to make a one-time electronic fund transfer from your

bank account or to process the payment as a check transaction. If a check we process in paper form is returned to us by your bank unpaid, we may re-present the

returned check electronically. Your payment, if accompanied by a valid credit card account number, regardless of the method of receipt, will be credited to your credit

card account, as of the date of receipt, if the payment is received by 5:00 p.m. Pacific Time. Credit One Bank will not be responsible for processing delays or failure to

process the payment to your credit card account if the payment does not contain your credit card account number or is not accompanied by a payment coupon.

PAYING INTEREST: We will begin charging interest on purchases and cash advances on the posting date.

HOW WE WILL CALCULATE YOUR BALANCE: We use a method called “average daily balance (including new purchases).”

BALANCE SUBJECT TO INTEREST RATE: Periodic Interest Charges will be assessed from the date the purchase, cash advance, fee or charge is posted to your

Account until the date it is paid in full, and will be calculated by applying the monthly periodic rate to the “average daily balance” of your Account. To get the

“average daily balance” we take the balance of your Account each day, add any new purchases, cash advances, fees, and charges and subtract any payments or

credits and unpaid periodic Interest Charges. This gives us the daily balance. Then we add up all the daily balances for the billing cycle, and divide the total by the

number of days in the billing cycle. This gives us the “average daily balance.” Periodic Interest Charges will be assessed on all “average daily balances” until paid in

full. All purchases, cash advances, fees or charges accrue interest charges starting on the date of posting, even if the new balance from your previous statement

was paid in full or even if that new balance was zero. A minimum Interest Charge of $1.00 will be imposed for any billing cycle in which an Interest Charge is due.

ANNUAL MEMBERSHIP FEE NOTICE: This Notice applies to your Account if the Annual Fee is assessed annually. Your Account is subject to an Annual

Membership Fee (“Annual Fee”). Your Account statement for the month of annual renewal will show the amount of the Annual Fee applicable to your Account. The

following disclosures apply to your renewal Account: There is no grace period for purchases and cash advances. Your Annual Percentage Rate (“APR”) may vary. The

current APR for Purchases and Cash Advances applicable to your Account are shown on the front of your statement under the APR heading. For each billing

cycle, the APR is determined by adding 20.65% to the U.S. Prime Rate appearing in the “Money Rates” section of any edition of The Wall Street Journal published

on the 25th day of each month. The new rate will be applied to all balances on the Account. The APR will never be greater than 29.90% (corresponding monthly

periodic rate of 2.4916%). We use the average daily balance (including new purchases) method of computing the balance for purchases. A minimum Interest

Charge of $1.00 will be imposed for any billing cycle in which an Interest Charge is due. See your Cardholder Agreement for additional information regarding your

Account and additional fees and charges that may be assessed.

The Annual Fee will continue to be billed to your Account annually for the coming year unless you terminate credit availability on your Account and pay the outstanding

balance in full. If you choose to terminate credit availability and avoid paying the Annual Fee, you must contact us by telephone at (877) 825-3242 or give us written

notice to close your Account, sent to the address for inquiries shown on the first page of your statement. Your notice must reach us no later than 30-days from when

your statement is mailed or delivered on which the Annual Fee is imposed. Closed accounts are subject to the Annual Fee as long as an outstanding balance remains

on the Account.

If your Annual Fee is billed to your Account monthly, this Notice does not apply to your Account. We will send you an Annual Membership Fee Notice at least annually.

What To Do If You Think You Find A Mistake On Your Statement

If you think there is an error on your statement, write to us at: Wilmington Trust Bank, 1100 North Market St., 10th Floor, Wilmington, DE 19890.

In your letter, give us the following information:

• Account information: Your name and account number.

• Dollar amount: The dollar amount of the suspected error.

• Description of problem: If you think there is an error on your bill, describe what you believe is wrong and why you believe it is a mistake.

You must contact us within 60 days after the error appeared on your statement.

You must notify us of any potential errors in writing. You may call us, but if you do we are not required to investigate any potential errors and you may have to pay the

amount in question.

While we investigate whether or not there has been an error, the following are true:

• We cannot try to collect the amount in question, or report you as delinquent on that amount.

• The charge in question may remain on your statement, and we may continue to charge you interest on that amount. But, if we determine that we made a

mistake, you will not have to pay the amount in question or any interest or other fees related to that amount.

• While you do not have to pay the amount in question, you are responsible for the remainder of your balance.

• We can apply any unpaid amount against your credit limit.

Your Rights If You Are Dissatisfied With Your Credit Card Purchases

If you are dissatisfied with the goods or services that you have purchased with your credit card, and you have tried in good faith to correct the problem with the

merchant, you may have the right not to pay the remaining amount due on the purchase. To use this right, all of the following must be true:

1. The purchase must have been made in your home state or within 100 miles of your current mailing address, and the purchase price must have been more than

$50. (Note: Neither of these are necessary if your purchase was based on an advertisement we mailed to you, or if we own the company that sold you the goods

or services.)

2. You must have used your credit card for the purchase. Purchases made with cash advances from an ATM or with a check that accesses your credit card

account do not qualify.

3. You must not yet have fully paid for the purchase.

If all of the criteria above are met and you are still dissatisfied with the purchase, contact us in writing at:

Wilmington Trust Bank. N.A., 1100 North Market St., 10th Floor, Wilmington, DE 19890.

While we investigate, the same rules apply to the disputed amount as discussed above. After we finish our investigation, we will tell you our decision. At that

point, if we think you owe an amount and you do not pay we may report you as delinquent.

O1EO5385 - 1 - 02/04/2016

Update your contact information online at www.WilmingtonTrust.com or fill in your address, telephone,

and/or email changes below:

Mailing Address

Address Line 2

City State Zip

Primary Phone Number† Secondary Phone Number†

( ) ( )

Email Address* †

@

† I authorize Wilmington Trust Bank and its agents to contact me at any phone number I provide at any time (including

cellular/wireless telephone

* We may use your email address to contact you about your Account. C55-00004

Вам также может понравиться

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeОт EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeОценок пока нет

- Please Return This Portion With Your Payment, and Write Your Account Number On Your Check, Made Payable To CREDIT ONE BANKДокумент2 страницыPlease Return This Portion With Your Payment, and Write Your Account Number On Your Check, Made Payable To CREDIT ONE BANKOliver KlozeoffОценок пока нет

- VISA Classic: Getting Yourself StartedДокумент3 страницыVISA Classic: Getting Yourself Startedkarely jackson lopez100% (1)

- Sam Cook Statement Page 01Документ1 страницаSam Cook Statement Page 01Mark Williams0% (1)

- Payment Information Summary of Account Activity: SeptemberДокумент3 страницыPayment Information Summary of Account Activity: SeptemberSarah BledsoeОценок пока нет

- January 08 PDFДокумент3 страницыJanuary 08 PDFGrant EwingОценок пока нет

- 05-26-2016Документ6 страниц05-26-2016Mike CarraggiОценок пока нет

- 2020-06-05 PDFДокумент6 страниц2020-06-05 PDFAli west NabОценок пока нет

- Discover Statement 20201116 8572 PDFДокумент4 страницыDiscover Statement 20201116 8572 PDFOtto. Kroupa50% (2)

- Statement Feb 2018Документ6 страницStatement Feb 2018MicahОценок пока нет

- YearEndSummary PDFДокумент10 страницYearEndSummary PDFAnonymous Pq2iqJk2bОценок пока нет

- Statement 011417 PDFДокумент3 страницыStatement 011417 PDFKathleen MendegorinОценок пока нет

- StatementImage 3Документ2 страницыStatementImage 3kayode0% (1)

- Statement Jan 2010Документ8 страницStatement Jan 2010Bryan HowardОценок пока нет

- Amex STMTДокумент1 страницаAmex STMTMark GalantyОценок пока нет

- Brenn Ferguson Amex Statement May 2015Документ3 страницыBrenn Ferguson Amex Statement May 2015lilalp100% (1)

- Chase Bank Account Statement 2021Документ3 страницыChase Bank Account Statement 2021quannbui950% (1)

- Statement - 12 29 2022Документ4 страницыStatement - 12 29 2022ytprem agu100% (1)

- Statement 042023 0603Документ4 страницыStatement 042023 0603s8hynpcq5z0% (1)

- MB Financial Corporation: 1010 Grand Boulevard Kansas City, MO 64106Документ1 страницаMB Financial Corporation: 1010 Grand Boulevard Kansas City, MO 64106Jonathan Seagull Livingston100% (3)

- Trader TemplateДокумент4 страницыTrader TemplateAndre ParnellОценок пока нет

- January 14, 2021Документ4 страницыJanuary 14, 2021D PeakeОценок пока нет

- STMNT 112013 9773Документ3 страницыSTMNT 112013 9773redbird77100% (1)

- Statements 0322Документ4 страницыStatements 0322Chris H. DabrovОценок пока нет

- Statement September 2019Документ6 страницStatement September 2019Mike Schmoronoff100% (1)

- WJ o JWJWJWJДокумент3 страницыWJ o JWJWJWJsjlermanОценок пока нет

- Bmo 8.1.13 PDFДокумент7 страницBmo 8.1.13 PDFChad Thayer VОценок пока нет

- December 2012 Statement PDFДокумент4 страницыDecember 2012 Statement PDFDeborahDaniels1Оценок пока нет

- November 07, 2016 PDFДокумент8 страницNovember 07, 2016 PDFChristine HogueОценок пока нет

- Chase BillДокумент4 страницыChase BillYu ShilohОценок пока нет

- Statement Jan, 2021Документ4 страницыStatement Jan, 2021Marco Antonio Martinez Estrada0% (2)

- November 06, 2018 PDFДокумент4 страницыNovember 06, 2018 PDFJoan HulburtОценок пока нет

- Maria Ialongo 84-23 Manton Street Apt 3E Briarwood Ny 11435-1813Документ4 страницыMaria Ialongo 84-23 Manton Street Apt 3E Briarwood Ny 11435-1813Keiver jimenezОценок пока нет

- 01-13-2017 PDFДокумент3 страницы01-13-2017 PDFAnonymous xxpU7OaОценок пока нет

- ListДокумент4 страницыListrobert100% (2)

- PDFДокумент6 страницPDFTimothy MeadОценок пока нет

- American Express - BS 2019Документ1 страницаAmerican Express - BS 2019Max PatelОценок пока нет

- Stop: 3118/04 1620 Dodge ST Omaha, NE 68197: Spiro G Sakellis 2563 123RD ST FLUSHING, NY 11354-1040Документ4 страницыStop: 3118/04 1620 Dodge ST Omaha, NE 68197: Spiro G Sakellis 2563 123RD ST FLUSHING, NY 11354-1040Viktoria DenisenkoОценок пока нет

- CreditCardStatement2801868 - 2085 - 27-Oct-20Документ1 страницаCreditCardStatement2801868 - 2085 - 27-Oct-20Abdul AleemОценок пока нет

- StatementДокумент4 страницыStatementtochi efienokwuОценок пока нет

- Equity Home: Karen Li Daniel Lee 2615 S. Union Ave. Apt 2F Chicago Il 60616-2534Документ5 страницEquity Home: Karen Li Daniel Lee 2615 S. Union Ave. Apt 2F Chicago Il 60616-2534Test000001Оценок пока нет

- Account Summary Payment Information: New Balance $135.86Документ6 страницAccount Summary Payment Information: New Balance $135.86thinh thanhОценок пока нет

- Your Consolidated Statement: Contact UsДокумент5 страницYour Consolidated Statement: Contact UsSAM50% (2)

- PNC StatementДокумент2 страницыPNC Statementwenqiang wangОценок пока нет

- RBC Visa Classic: Low Rate OptionДокумент4 страницыRBC Visa Classic: Low Rate OptionThe VaultОценок пока нет

- Statement 092022 4571Документ4 страницыStatement 092022 4571Charles GoodwinОценок пока нет

- Account Number: 4830710160: Bmo Harris Bank N.A. 94140 P.O. BOX 94033 Palatine, IL 60094-4033Документ3 страницыAccount Number: 4830710160: Bmo Harris Bank N.A. 94140 P.O. BOX 94033 Palatine, IL 60094-4033olaОценок пока нет

- Account Summary Payment InformationДокумент3 страницыAccount Summary Payment InformationJohn Bean100% (1)

- MoneyLion StatementДокумент2 страницыMoneyLion Statementfarhan khanОценок пока нет

- VARO Bank StatementДокумент1 страницаVARO Bank StatementaliОценок пока нет

- Apple Card Statement - December 2020Документ4 страницыApple Card Statement - December 2020SebastianGarciaVasquezОценок пока нет

- 7-2019 AmexДокумент5 страниц7-2019 Amexal_crespoОценок пока нет

- Statement Jul 2023Документ4 страницыStatement Jul 2023suckre100% (1)

- US Bank Business Statement Mbcvirtual ScaledДокумент1 страницаUS Bank Business Statement Mbcvirtual ScaledTanushОценок пока нет

- Synchrony Bank Billing Statement - Mar-Apr 2023Документ1 страницаSynchrony Bank Billing Statement - Mar-Apr 2023Bush JeffОценок пока нет

- Statement Dec 2011Документ2 страницыStatement Dec 2011Iris KhanashatОценок пока нет

- Bank Statement Template DownloadДокумент2 страницыBank Statement Template DownloadRapid FinanceОценок пока нет

- Manual ManualДокумент2 страницыManual ManualBobОценок пока нет

- FpbccstaytementeditableДокумент3 страницыFpbccstaytementeditableJamesОценок пока нет

- DLicense & CC ScanДокумент2 страницыDLicense & CC ScanBryanОценок пока нет

- TruWest Bank StatmementДокумент3 страницыTruWest Bank StatmementBryanОценок пока нет

- Nov BIl PGRДокумент2 страницыNov BIl PGRBryanОценок пока нет

- Chase Credit Statement Dec 18Документ3 страницыChase Credit Statement Dec 18Bryan83% (6)

- Cox 2Документ4 страницыCox 2Bryan100% (1)

- X bILL xFINITYДокумент6 страницX bILL xFINITYBryan67% (6)

- Your Student Loan Account Details: For This Month's Billing CycleДокумент3 страницыYour Student Loan Account Details: For This Month's Billing CycleBryanОценок пока нет

- Member Statement: Kenneth J Smith 229 Country Club RD Holland Mi 49423 178125Документ4 страницыMember Statement: Kenneth J Smith 229 Country Club RD Holland Mi 49423 178125BryanОценок пока нет

- Chase Bank Everyday Checking: Important Account InformationДокумент4 страницыChase Bank Everyday Checking: Important Account InformationSAM100% (1)

- Presentation On F&G Retail in IndiaДокумент81 страницаPresentation On F&G Retail in Indiamigpatel7970100% (1)

- Understanding The Letter of Credit Process: What Every Exporter Needs To KnowДокумент34 страницыUnderstanding The Letter of Credit Process: What Every Exporter Needs To KnowMuhammadSohailОценок пока нет

- Suggestions For Health Care PolicyДокумент1 страницаSuggestions For Health Care PolicyMushtaq AhmadОценок пока нет

- HomeДокумент4 страницыHomeRotoОценок пока нет

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент7 страницStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceM ADITYA REDDYОценок пока нет

- 1 Jul 2015-Master Circular On Customer Service - UCBs PDFДокумент56 страниц1 Jul 2015-Master Circular On Customer Service - UCBs PDFDisability Rights AllianceОценок пока нет

- SCM DaburДокумент21 страницаSCM Daburanshvaidhya0% (1)

- Account Statement1669732776482 CopyДокумент4 страницыAccount Statement1669732776482 CopyShiv GautamОценок пока нет

- Ride Details Bill Details: Thanks For Travelling With Us, NavneetДокумент3 страницыRide Details Bill Details: Thanks For Travelling With Us, NavneetnavneetОценок пока нет

- Gar 29Документ2 страницыGar 29smvpdy0% (1)

- AccountingДокумент5 страницAccountingAl Shane Lara CabreraОценок пока нет

- B1 Income From Salary / Pension (Ensure To Fill SCH TDS1) 1Документ3 страницыB1 Income From Salary / Pension (Ensure To Fill SCH TDS1) 1santoshkumarОценок пока нет

- Capital Gains TaxДокумент5 страницCapital Gains TaxJAYAR MENDZОценок пока нет

- Value Added Tax PracticeДокумент7 страницValue Added Tax PracticeSelene DimlaОценок пока нет

- Getting Paid Math 2.3.9.A1 PDFДокумент3 страницыGetting Paid Math 2.3.9.A1 PDFLyndsey BridgersОценок пока нет

- Warehousing Logistics Storage Services Lucknow by WEДокумент3 страницыWarehousing Logistics Storage Services Lucknow by WEGurjeet SinghОценок пока нет

- Other Percentage Tax Summary of Other Percentage Tax Rates: Coverage Taxable Base Tax RateДокумент18 страницOther Percentage Tax Summary of Other Percentage Tax Rates: Coverage Taxable Base Tax RateZaaavnn VannnnnОценок пока нет

- Uucms - Karnataka.gov - in ExamGeneral PrintExamApplicationДокумент1 страницаUucms - Karnataka.gov - in ExamGeneral PrintExamApplicationrmanjunatha227Оценок пока нет

- Form No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GДокумент10 страницForm No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GsamaadhuОценок пока нет

- Use CaseДокумент4 страницыUse CasemeriiОценок пока нет

- Republic of Philippines Court of Tax Appeals Quezon: Davao City Water District, NoДокумент21 страницаRepublic of Philippines Court of Tax Appeals Quezon: Davao City Water District, NoEdrese AguirreОценок пока нет

- Tiderc Drac (Credit Card)Документ74 страницыTiderc Drac (Credit Card)Abhijeet KulshreshthaОценок пока нет

- CoverPage DigitalДокумент1 страницаCoverPage Digitalsandeep1996dwivediОценок пока нет

- PNB Ze-Lo Mastercard - App Form OnePager - Jan2020Документ13 страницPNB Ze-Lo Mastercard - App Form OnePager - Jan2020LeonardОценок пока нет

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Документ1 страницаTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)RoxdОценок пока нет

- Bank Accounting in SAPДокумент7 страницBank Accounting in SAPmakmur abadiОценок пока нет

- HDFC Mukesh Statement Jan 2017Документ2 страницыHDFC Mukesh Statement Jan 2017MEEN SОценок пока нет

- Presentation 1 of 3pl and 4plДокумент34 страницыPresentation 1 of 3pl and 4plGajendra Behera100% (1)

- Uttaranchal University Dehradun Fee Structure B.tech (Lateral Entry) 2021-22Документ1 страницаUttaranchal University Dehradun Fee Structure B.tech (Lateral Entry) 2021-22محمد إحسنОценок пока нет