Академический Документы

Профессиональный Документы

Культура Документы

RODAS

Загружено:

Ako Si Paula MonghitАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

RODAS

Загружено:

Ako Si Paula MonghitАвторское право:

Доступные форматы

32-A.

1 Incentive plan for regular fishpond or prawn farmworkers or

fishpond or prawn farm worker’s organization

32.7 Transitory period prior to turnover of land to beneficiaries Within 6 months from the effectivity of RA 7881. Execute an

incentive plan.

Under the incentive plan, seven point five percent of their net

A transitory period, the length of which shall be determined by profit before tax from the operation of the fishpond or prawn

the DAR, shall be established in order to forestall any disruption in the farms.

normal operation of lands to be turned over to the farmworker-

benefeciaries. Shall be subject to to periodic audit or inspection by certified

public accountants chosen by the workers.

Shall not apply to agricultural lands subsequently converted to

fishpond or prawn farms, provided the size of the land

converted does not exceed the retention limit of the

landowner.

32.3 Employers covered

(1) Any enterprise owning or operating agricultural lands under

32.2 Gross Sales defined lease, management contract, production venture or other

similar arrangements, agricultural land;

Means the total annual revenue from the sale of all agricultural

products, in their raw or or original state, derived from the land or farm (2) Multinational corporations engaged in agricultural activities;

owned, operated under lease, management, production, grower or and

service contract, or the similar arrangement by an agricultural

(3) Commercial farms devoted to commercial livestock, poultry and

enterprise.

swine raising, aquaculture including saltbeds, fishponds, fruit

farms, orchards, vegetable and cut-flower farms, and cacao,

coffee and rubber plantations

32.6 Manner of sharing of gross sales and net profit

32.4 Employees Covered

(a) When the individuals or entities owning or operating under

All farmworkers of covered employers, wether classified as regular, lease or management contract, agricultural lands realize gross

seasonal, technical or other farmworker, but excluding managerial and sales in excess of 5 million per annum:

supervisory employees of covered employers, are included in the

i. They shall distribute 3 % of the gross sales from the production

mandated Production and Profit Sharing. Provided, that any

of such lands as compensation to regular and other

farmworker who renders service, regardless of duration, within a

farmworkers over and above the compensation they currently

covered period shall be entitled to this benefit. Provided, further, that

receive and

in the absence of any Presidential Agrarian Reform Council (PARC)

determination of a specific award limit, the farmer-beneficiary shall not ii. They shall distribute 1% of the gross sales of the entity to the

own more than three (3) hectares of agricultural land. managerial, supervisory and technical group in place at the time

of the effectivity of the CARL; and

(b) When such individuals or entities realizes a profit, they shall

distribute additional ten percent (10%) of the net profit after tax to said

regular and other farm workers.

SECTION 32. Production-SharingPending

final land transfer, individuals or entities owning, or operating under

If within two (2) years from the approval of this Act, the land or stock lease or management contract, agricultural lands are hereby mandated

transfer envisioned above is not made or realized or the plan for such to execute a production-sharing plan with their farm workers or

stock distribution approved by the PARC within the same period, the farmworkers' reorganization, if any, whereby three percent (3%) of the

agricultural land of the corporate owners or corporation shall be subject gross sales from the production of such lands are distributed within

to the compulsory coverage of this Act. sixty (60) days of the end of the fiscal year as compensation to regular

and other farmworkers in such lands over and above the compensation

they currently receive: Provided, That these individuals or entities

realize gross sales in excess of five million pesos per annum unless the

DAR, upon proper application, determines a lower ceiling

In the event that the individual or entity realizes a profit, an additional

ten percent (10%) of the net profit after tax shall be distributed to said

During this transitory period, at least one percent (1%) of the gross

regular and other farmworkers within ninety (90) days of the end of the

sales of the entity shall be distributed to the managerial, supervisory

fiscal year.

and technical group in place at the time of the effectivity of this Act, as

compensation for such transitory managerial and technical functions as

it will perform, pursuant to an agreement that the farmworker-

To forestall any disruption in the normal operation of lands to

beneficiaries and the managerial, supervisory and technical group may

be turned over to the farmworker-beneficiaries mentioned above, a

conclude, subject to the approval of the DAR.

transitory period, the length of which shall be determined by the DAR,

shall be established.

Upon certification by the DAR, corporations owning agricultural lands

may give their qualified beneficiaries the right to purchase such

proportion of the capital stock of the corporation that the agricultural

land, actually devoted to agricultural activities, bears in relation to the Corporations or associations which voluntarily divest a proportion of

company's total assets, under such terms and conditions as may be their capital stock, equity or participation in favor of their workers or

agreed upon by them. other qualified beneficiaries under this section shall be deemed to have

complied with the provisions of the Act: Provided, That the following

In no case shall the compensation received by the workers at conditions are complied with:

the time the shares of stocks are distributed be reduced. The same

principle shall be applied to associations, with respect to their equity or

participation.

a) In order to safeguard the right of beneficiaries who own shares

of stocks to dividends and other financial benefits, the books of

the corporation or association shall be subject to periodic audit

c)Any shares acquired by such workers and beneficiaries shall have the

by certified public accountants chosen by the beneficiaries;

same rights and features as all other shares.

b) Irrespective of the value of their equity in the corporation or

d) Any transfer of shares of stocks by the original beneficiaries shall be

association, the beneficiaries shall be assured of at least one (1)

void ab initio unless said transaction is in favor of a qualified and

representative in the board of directors, or in a management or

registered beneficiary within the same corporation.

executive committee, if one exists, of the corporation or association;

and

30.2 Homelot defined

SECTION 30. Homelots and Farmlots for Members of Cooperatives.

Refers to a lot suitable for dwelling with an area of not more than three

The individual members of the cooperatives or corporations mentioned

percent (3%) of the area of the land-holding provided that it does not

in the preceding section shall be provided with homelots and small

exceed one thousand (1000) square meters and that it shall be located

farmlots for their family use, to be taken from the land owned by the

at a convenient and suitable place within the land of the landholder to

cooperative or corporation.

be designed by the latter, where the tenant shall construct his dwelling.

30.3 Where homelot is situated in retained area

SECTION 31. Corporate Landowners.

An ARB may be awarded the homelot he actually occupies if It is subject

Corporate landowners may voluntarily transfer ownership over their

of land distribution under CARP, provided said homelot does not form

agricultural landholdings to the Republic of the Philippines pursuant to

part of the retained area of the land owner

Section 20 hereof or to qualified beneficiaries, under such terms and

conditions, consistent with this Act, as they may agree upon, subject to

confirmation by the DAR.

A tenant-beneficiary who is awarded a farmlot but has his

homelot within the retained area of the landowner

The landowner may opt to request the farmworker-beneficiary

not to remove the dwelling or other improvements for the former’s

own use.

28.6 Crops not yet harvestable deemed as plantings or sowings in SECTION 29. Farms Owned or Operated by Corporations or Other

good faith Business Associations.

Crops which are not yet harvestable and introduced by the former In general, lands shall be distributed directly to the individual worker-

landowner prior to the latter’s receipt of the corresponding notice or beneficiaries.

advice are considered plantings or sowings in good faith

In case it is not economically feasible and sound to divide the land,

The right to harvest Belong to the CLOA-title holders

then it shall be owned collectively by the workers' cooperative

The planter or sower entitled to reimbursement for the cost or association which will deal with the corporation or business

of plantings or sowings association.

Payment thereof shall only be made after the CLOA-title Until a new agreement is entered into by and between the

holders obtained the proceed from the initial harvest workers' cooperative or association and the corporation or

business association, any agreement existing at the time this

Act takes effect between the former and the previous

landowner shall be respected by both the worker’s cooperative

or association and the corporation or business association.

29.1 Collective Ownership allowed under CARL

Collective ownership is permitted in two (2) provisions of the CARL.

Section 29 allows workers cooperatives or associations to collectively 29.3 Total Area to be awarded to co-owners, cooperative or collective

own the land organization

Section 31 allows corporations or associations to own agricultural land Shall not exceed the total number of its members multiplied by the

with the farmers becoming stock-holders or members award limit of three (3) hectares, except in meritorious cases as

determined by PARC.

Cooperatives can be registered with the Cooperative Development

Authority (CDA) and acquire legal personality of their own.

Corporations are juridical persons under the Corporation Code of the

Philippines or Batas Pambansa Bilang 68

SECTION 28. Standing Crops at the Time of Acquisition 28.1 Standing crop

The landowner shall retain his share of any standing crops unharvested refers to harvestable agricultural produce or a portion thereof normally

at the time the DAR shall take possession of the land under Section 16 harvested for such particular crop growing on land at the time the DAR

of the Act, and shall be given a reasonable time to harvest the same. takes possession thereof

28.2 Payment to landowner completes acquisition process 28.4 Taking of Possession Construed

The payment to the landowner as evidenced by the Certification of Refers to the explicit act/s of the DAR, through an ocular inspection or

Deposit (COD) issued by the Land Bank of the Philippines (LBP) pursuant any other acts by which the landowner is informed of DAR’s taking actual

to Sec. 16 and 24 of the CARL signals the completion of the acquisition and physical possession of a certain agricultural land acquired under CARP

process over a specific landholding as evidenced by a COD issued by the LBP pursuant to sec. 16 (e) and 24 of

the CARL

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- 2021 San Beda Red Book Remedial Law-UnlockedДокумент390 страниц2021 San Beda Red Book Remedial Law-UnlockedPaolo OngsiakoОценок пока нет

- Taxation Law - Reviewer (Aban)Документ127 страницTaxation Law - Reviewer (Aban)Kat Pichay33% (6)

- 11 People vs. HernandezДокумент1 страница11 People vs. HernandezAko Si Paula MonghitОценок пока нет

- Case Digest Labor Standards6Документ11 страницCase Digest Labor Standards6Ako Si Paula MonghitОценок пока нет

- Arbitration Agreement - MonghitДокумент5 страницArbitration Agreement - MonghitGian Paula Monghit100% (1)

- 05 Neypes v. Court of AppealsДокумент1 страница05 Neypes v. Court of AppealsCharmila Siplon100% (1)

- RDO No. 110 - General Santos City South Cotabato (All Muns)Документ344 страницыRDO No. 110 - General Santos City South Cotabato (All Muns)Albert Degino0% (1)

- 11 Congo v. Belgium - GalangДокумент5 страниц11 Congo v. Belgium - GalangjustinegalangОценок пока нет

- Finman Case 7Документ4 страницыFinman Case 7Jastine Sosa0% (2)

- Ra 10884Документ4 страницыRa 10884Kevin BonaobraОценок пока нет

- Up V DizonДокумент3 страницыUp V DizonMyle Ysobel BayaniОценок пока нет

- Deed of Absolute ValueДокумент1 страницаDeed of Absolute ValuePOgz CalОценок пока нет

- DLL Mathematics 2 q2 w3Документ10 страницDLL Mathematics 2 q2 w3Ako Si Paula Monghit100% (1)

- 3.01 - Republic V CA & Naguit - Digest by FattДокумент1 страница3.01 - Republic V CA & Naguit - Digest by FattKate GaroОценок пока нет

- Case # 13 Gonzales vs. Aguinaldo - Full CaseДокумент5 страницCase # 13 Gonzales vs. Aguinaldo - Full CaseAko Si Paula MonghitОценок пока нет

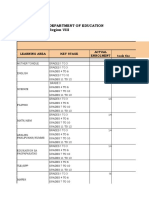

- Egra - Arata: Enroment (PRE) Enroment (POST)Документ4 страницыEgra - Arata: Enroment (PRE) Enroment (POST)Ako Si Paula MonghitОценок пока нет

- Emma Monghit-Corrected-Template-By-Regional-Focal-PersonДокумент14 страницEmma Monghit-Corrected-Template-By-Regional-Focal-PersonAko Si Paula MonghitОценок пока нет

- Emma Monghit-Corrected-Template-By-Regional-Focal-PersonДокумент14 страницEmma Monghit-Corrected-Template-By-Regional-Focal-PersonAko Si Paula MonghitОценок пока нет

- Emma Monghit - Mean-ScoreДокумент9 страницEmma Monghit - Mean-ScoreAko Si Paula MonghitОценок пока нет

- Mean Score: First Quarter, SY 2020 - 2021Документ9 страницMean Score: First Quarter, SY 2020 - 2021Ako Si Paula MonghitОценок пока нет

- Agra Sec.28-32Документ9 страницAgra Sec.28-32Ako Si Paula MonghitОценок пока нет

- Set 5Документ21 страницаSet 5Ako Si Paula MonghitОценок пока нет

- Pnacb 895Документ156 страницPnacb 895luchador86Оценок пока нет

- C.F. Sharp Crew Management, Inc. vs. Espanol, JR., 533 SCRA 424, September 14, 2007Документ6 страницC.F. Sharp Crew Management, Inc. vs. Espanol, JR., 533 SCRA 424, September 14, 2007Ako Si Paula MonghitОценок пока нет

- Dec Environmental Administrative Penalty Rules 2009 10 05 PDFДокумент7 страницDec Environmental Administrative Penalty Rules 2009 10 05 PDFAko Si Paula MonghitОценок пока нет

- 2 Combined Axial and Bending StressДокумент5 страниц2 Combined Axial and Bending StressAko Si Paula MonghitОценок пока нет

- DLL All Subjects 2 q2 w3 d2Документ9 страницDLL All Subjects 2 q2 w3 d2Ako Si Paula MonghitОценок пока нет

- DLL All Subjects 2 q1 w7 d1Документ7 страницDLL All Subjects 2 q1 w7 d1Ako Si Paula MonghitОценок пока нет

- A Landslide in Cebu Province in The Philippines Are Dozens of People Have Been Buried Alive and Atleast 22 Have Died After A Landslide After Swallow Two Villages in The PhillipinesДокумент1 страницаA Landslide in Cebu Province in The Philippines Are Dozens of People Have Been Buried Alive and Atleast 22 Have Died After A Landslide After Swallow Two Villages in The PhillipinesAko Si Paula MonghitОценок пока нет

- LawДокумент93 страницыLawAko Si Paula MonghitОценок пока нет

- DLL - All Subjects 2 - Q3 - W1 - D1-Nov.2Документ7 страницDLL - All Subjects 2 - Q3 - W1 - D1-Nov.2Ako Si Paula MonghitОценок пока нет

- Special Second Division: Coon of Tax AppealsДокумент15 страницSpecial Second Division: Coon of Tax AppealsAko Si Paula MonghitОценок пока нет

- GRADES 1 To 12 Daily Lesson Log: ESP A.P English MTB Math Filipino MAPEH (Health)Документ7 страницGRADES 1 To 12 Daily Lesson Log: ESP A.P English MTB Math Filipino MAPEH (Health)Ako Si Paula MonghitОценок пока нет

- DLL All Subjects 2 q2 w3 d4Документ9 страницDLL All Subjects 2 q2 w3 d4Ako Si Paula MonghitОценок пока нет

- Dec Environmental Administrative Penalty Rules 2009 10 05 PDFДокумент7 страницDec Environmental Administrative Penalty Rules 2009 10 05 PDFAko Si Paula MonghitОценок пока нет

- Course Outline LL2016 PDFДокумент4 страницыCourse Outline LL2016 PDFAko Si Paula MonghitОценок пока нет

- Dec Environmental Administrative Penalty Rules 2009 10 05 PDFДокумент7 страницDec Environmental Administrative Penalty Rules 2009 10 05 PDFAko Si Paula MonghitОценок пока нет

- Dec Environmental Administrative Penalty Rules 2009 10 05 PDFДокумент7 страницDec Environmental Administrative Penalty Rules 2009 10 05 PDFAko Si Paula MonghitОценок пока нет

- Dec Environmental Administrative Penalty Rules 2009 10 05 PDFДокумент7 страницDec Environmental Administrative Penalty Rules 2009 10 05 PDFAko Si Paula MonghitОценок пока нет

- 03-22-2022 - 0001 - Universal Affidavit of Fact and Writ of Removal of Original Allodially Titled Sovereign Property From UNITED STATES Foreign Tax RegistryДокумент3 страницы03-22-2022 - 0001 - Universal Affidavit of Fact and Writ of Removal of Original Allodially Titled Sovereign Property From UNITED STATES Foreign Tax Registryal malik ben beyОценок пока нет

- 04.paterok v. Bureau of CustomsДокумент7 страниц04.paterok v. Bureau of CustomsKrizel BianoОценок пока нет

- 32.1 Annexures To Ngobeni Letter - RedactedДокумент32 страницы32.1 Annexures To Ngobeni Letter - RedactedKrash KingОценок пока нет

- RetuyaДокумент5 страницRetuyaBig BoysОценок пока нет

- LIMITED: Original Power of AttorneyДокумент10 страницLIMITED: Original Power of Attorneyroman romanОценок пока нет

- China Report English Edition July 2023Документ68 страницChina Report English Edition July 2023Evando PereiraОценок пока нет

- SP 066Документ1 страницаSP 066Nguyen Hong HaОценок пока нет

- Memorndum UNLAWfUL DETAINERДокумент4 страницыMemorndum UNLAWfUL DETAINERGerald RojasОценок пока нет

- The Kerala Land Conservancy Act, 1957 PDFДокумент18 страницThe Kerala Land Conservancy Act, 1957 PDFneet1Оценок пока нет

- 02whole 5 PDFДокумент252 страницы02whole 5 PDFNikunj KhediaОценок пока нет

- 2018 19MDModelAssessmentGuidelinesДокумент44 страницы2018 19MDModelAssessmentGuidelinesEd Praetorian100% (1)

- Bailment & Pledge-FinalДокумент11 страницBailment & Pledge-FinalAbhishek JainОценок пока нет

- Cost Insurance Freight PresentationДокумент11 страницCost Insurance Freight PresentationGumisiriza BrintonОценок пока нет

- Annex 3Документ1 страницаAnnex 3Amir M. VillasОценок пока нет

- Consolidated Full Text CasesДокумент214 страницConsolidated Full Text CasesNicole BlancheОценок пока нет

- Rep. Lee Zeldin, Nancy Marks, Dpty. Comptroller Louis Necroto, Vincent Trimarco & The American Patriot Heroes Fund (AMPAT)Документ36 страницRep. Lee Zeldin, Nancy Marks, Dpty. Comptroller Louis Necroto, Vincent Trimarco & The American Patriot Heroes Fund (AMPAT)Jacquelyn Gavron100% (1)

- Affidavit (Antonio)Документ1 страницаAffidavit (Antonio)Anonymous VgZb91pLОценок пока нет

- Personal Loan AgreementДокумент2 страницыPersonal Loan AgreementFebb RoseОценок пока нет

- People Vs BulawanДокумент2 страницыPeople Vs BulawanBruce WayneОценок пока нет

- Islamic Personal LawДокумент5 страницIslamic Personal Lawhira bibiОценок пока нет

- Correction Hand-OutsДокумент12 страницCorrection Hand-OutsCristy Jane Martinez GuillermoОценок пока нет