Академический Документы

Профессиональный Документы

Культура Документы

Equity Valuation: REDS-Research Equity Database System Page 1 of 2

Загружено:

srijokoОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Equity Valuation: REDS-Research Equity Database System Page 1 of 2

Загружено:

srijokoАвторское право:

Доступные форматы

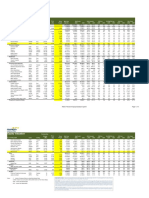

Equity Valuation Outstanding

Shares Price Price Mkt Cap Net Profit EPS Growth PER (x) EV/EBITDA (x) P/BV (x) Div.Yield ROE PCF EBITDA Growth Net Gearing

as of 07 December 2018 Code Rating (Mn) (Rp) Target (Rp Bn) 2018 2019 2018 2019 2018 2019 2018 2019 2018 2019 2018 2019 2018 2019 2018 2019 2018 2019 2018 2019

Mandiri Universe 4,452,385.3 256,567.9 284,247.6 9% 11% 17.3 15.6 13.6 12.9 2.7 2.4 2.6% 2.6% 16.0% 16.2% 18.1 17.0 9.6% 5.7% 14.3% 13.1%

Financials 1,483,179.9 95,328.8 111,927.4 13% 17% 15.6 13.3 2.3 2.0 2.2% 2.1% 15.4% 16.3% N/A N/A 0.0% 0.0%

BCA BBCA Neutral 24,655 25,950 24,500 639,797.5 25,348.4 28,937.8 9% 14% 25.2 22.1 N.A. N.A. 4.3 3.8 1.6% 1.0% 18.2% 18.2% N.A. N.A. N.A. N.A. N.A. N.A.

BNI BBNI Neutral 18,649 8,575 8,000 159,912.2 15,670.9 17,417.8 15% 11% 10.2 9.2 N.A. N.A. 1.5 1.4 3.0% 3.0% 15.6% 15.8% N.A. N.A. N.A. N.A. N.A. N.A.

BRI BBRI Buy 123,299 3,620 4,100 446,340.6 32,840.7 39,952.8 13% 22% 13.6 11.2 N.A. N.A. 2.4 2.1 2.9% 3.3% 18.8% 20.5% N.A. N.A. N.A. N.A. N.A. N.A.

BTN BBTN Buy 10,590 2,740 3,250 29,016.6 3,299.9 4,087.8 9% 24% 8.8 7.1 N.A. N.A. 1.2 1.0 2.1% 2.3% 14.4% 15.7% N.A. N.A. N.A. N.A. N.A. N.A.

Danamon BDMN Neutral 9,585 7,375 8,300 70,686.4 4,049.7 5,803.6 10% 43% 17.5 12.2 N.A. N.A. 1.7 1.5 1.6% 1.7% 10.1% 13.3% N.A. N.A. N.A. N.A. N.A. N.A.

Bank BJB BJBR Neutral 9,696 2,010 1,540 19,489.5 1,638.9 1,488.7 35% -9% 11.9 13.1 N.A. N.A. 1.6 1.6 4.5% 4.6% 15.0% 12.3% N.A. N.A. N.A. N.A. N.A. N.A.

Bank Jatim BJTM Neutral 14,918 705 655 10,517.0 1,232.5 1,275.3 6% 3% 8.5 8.2 N.A. N.A. 1.3 1.2 6.3% 6.4% 15.2% 14.7% N.A. N.A. N.A. N.A. N.A. N.A.

CIMB Niaga BNGA Buy 25,132 885 1,220 22,241.5 3,544.7 3,873.3 19% 9% 6.3 5.7 N.A. N.A. 0.6 0.5 2.7% 3.2% 9.3% 9.5% N.A. N.A. N.A. N.A. N.A. N.A.

BNLI BNLI Neutral 28,016 476 465 13,348.3 640.0 1,081.4 -19% 69% 20.9 12.3 N.A. N.A. 0.6 0.6 0.0% 0.0% 2.9% 4.8% N.A. N.A. N.A. N.A. N.A. N.A.

BTPN BTPN Neutral 5,840 3,480 4,000 20,324.2 2,104.6 2,426.0 72.4% 15.3% 9.7 8.4 N.A. N.A. 1.1 1.0 2.8% 3.6% 12.2% 12.8% N.A. N.A. N.A. N.A. N.A. N.A.

Panin PNBN Buy 24,088 1,200 1,500 28,905.2 2,677.7 2,914.0 11.0% 8.8% 10.8 9.9 N.A. N.A. 0.8 0.7 0.0% 0.0% 7.6% 7.6% N.A. N.A. N.A. N.A. N.A. N.A.

BTPS BTPS Buy 7,704 1,710 2,250 13,173.3 933.8 1,223.5 39.3% 31.0% 14.1 10.8 N.A. N.A. 3.4 2.6 0.0% 0.0% 30.2% 27.0% N.A. N.A. N.A. N.A. N.A. N.A.

BFI Finance BFIN Buy 15,967 630 1,000 9,427.6 1,346.8 1,445.4 13.4% 7.3% 7.0 6.5 N.A. N.A. 1.7 1.5 7.6% 7.9% 25.8% 24.5% N.A. N.A. N.A. N.A. N.A. N.A.

Construction & materials 255,035.7 16,416.7 15,031.6 9.9% -8.4% 15.5 17.0 10.2 10.2 1.9 1.7 3.0% 1.6% 12.6% 10.7% 19.9 10.9 14.8% 14.5% 73.8% 99.0%

Indocement INTP Neutral 3,681 20,700 15,000 76,201.5 851.8 1,035.7 -54.2% 21.6% 89.5 73.6 36.3 32.5 3.3 3.2 3.4% 0.4% 3.6% 4.5% 38.5 33.9 -38.4% 10.1% -28.9% -33.6%

Semen Indonesia SMGR Buy 5,932 11,875 10,500 70,436.8 2,662.6 1,768.2 32.2% -33.6% 26.5 39.8 12.3 12.2 2.3 2.2 2.6% 1.1% 8.9% 5.7% 16.3 19.0 22.3% 33.5% 14.8% 93.2%

Arwana Citramulia ARNA Buy 7,341 416 610 3,054.0 253.6 329.4 30.5% 29.9% 12.0 9.3 6.4 4.9 2.4 2.1 2.5% 3.2% 21.9% 24.2% 9.0 6.9 23.5% 25.8% 0.7% -5.8%

Adhi Karya ADHI Buy 3,561 1,625 2,600 5,786.4 791.4 686.1 53.6% -13.3% 7.3 8.4 7.1 11.0 0.9 0.8 1.8% 2.7% 12.7% 10.0% -1.4 -1.0 53.3% -1.3% 117.1% 207.3%

Pembangunan Perumahan PTPP Buy 6,200 1,935 3,600 11,996.8 1,648.5 1,806.8 25.2% 9.6% 7.3 6.6 4.5 4.3 1.0 0.9 2.2% 2.7% 14.2% 13.9% 34.2 11.5 23.7% 15.9% 23.2% 32.7%

Wijaya Karya WIKA Buy 8,960 1,590 2,100 14,246.7 1,505.5 1,797.6 25.2% 19.4% 9.5 7.9 5.9 6.2 1.0 0.9 2.1% 2.5% 11.4% 12.3% -7.5 17.7 32.3% 11.7% 39.0% 60.9%

Waskita Karya WSKT Buy 13,381 1,845 2,800 24,687.9 4,709.3 3,766.6 21.3% -20.0% 5.2 6.6 10.9 9.3 1.4 1.2 3.8% 3.1% 29.6% 19.5% -2.6 1.5 5.4% 17.3% 348.8% 269.0%

Wijaya Karya Beton WTON Buy 8,715 384 630 3,346.7 429.2 472.6 27.3% 10.1% 7.8 7.1 4.9 4.2 1.1 1.0 3.0% 3.8% 15.1% 14.9% 4.8 3.9 22.4% 6.0% 29.9% 13.2%

Waskita Beton WSBP Buy 26,361 356 500 9,384.6 1,096.3 1,125.6 9.2% 2.7% 8.6 8.3 6.3 4.5 1.2 1.1 8.0% 5.8% 14.7% 14.2% -56.5 1.9 26.9% 1.1% 79.3% 20.9%

Total Bangun Persada TOTL Buy 3,410 565 880 1,926.7 286.2 317.7 12.8% 11.0% 6.7 6.1 3.3 2.7 1.6 1.4 7.4% 8.2% 25.2% 24.7% 8.7 4.8 14.9% 10.1% -49.7% -55.5%

Acset Indonusa ACST Buy 700 1,660 3,800 1,162.0 301.2 342.3 83.6% 13.6% 3.9 3.4 1.4 2.0 0.7 0.7 10.4% 11.8% 20.2% 20.3% 0.9 27.8 83.6% -13.4% -8.6% 3.6%

Jasa Marga JSMR Buy 7,258 4,520 5,600 32,805.6 1,881.3 1,583.0 -14.5% -15.9% 17.4 20.7 10.1 12.6 2.0 1.9 1.3% 1.1% 11.9% 9.3% 1.7 -16.5 19.2% 6.9% 139.4% 219.3%

Consumer staples 1,248,631.2 41,164.1 46,511.9 3.1% 13.0% 30.3 26.8 19.2 17.1 7.4 6.7 2.3% 2.3% 25.4% 26.3% 27.1 24.6 4.2% 11.7% 8.0% 2.0%

Indofood CBP ICBP Buy 11,662 9,700 10,550 113,120.5 4,262.8 4,512.4 12.3% 5.9% 26.5 25.1 16.8 16.0 5.2 4.7 1.7% 1.9% 20.5% 19.5% 21.4 20.5 6.8% 4.2% -29.2% -30.9%

Indofood INDF Buy 8,781 6,700 9,950 58,825.7 3,844.3 4,004.9 -7.8% 4.2% 15.3 14.7 7.5 7.3 1.8 1.7 3.5% 3.3% 12.0% 11.8% 7.8 10.9 3.5% 3.6% 25.8% 23.0%

Mayora MYOR Neutral 22,359 2,510 2,550 56,121.1 1,652.8 1,882.0 3.7% 13.9% 34.0 29.8 19.0 15.3 6.8 5.8 1.0% 1.0% 21.4% 21.0% 16.7 24.4 -0.6% 22.8% 6.1% -2.4%

Unilever UNVR Neutral 7,630 44,000 40,000 335,720.0 7,095.5 7,775.0 1.3% 9.6% 47.3 43.2 32.7 29.8 67.2 59.2 2.2% 2.1% 139.6% 145.8% 42.8 38.7 2.4% 9.5% 66.8% 59.7%

Gudang Garam GGRM Buy 1,924 83,825 94,050 161,286.7 8,109.9 9,609.0 4.6% 18.5% 19.9 16.8 13.1 11.2 3.4 2.9 1.8% 1.4% 18.1% 18.8% 27.4 18.6 5.7% 15.1% 40.4% 29.6%

HM. Sampoerna HMSP Buy 116,318 3,730 4,000 433,866.4 13,117.8 15,337.4 3.5% 16.9% 33.1 28.3 24.5 20.9 12.5 11.6 2.9% 3.0% 38.1% 42.5% 34.6 26.2 4.1% 16.7% -21.2% -29.8%

Kalbe Farma KLBF Neutral 46,875 1,635 1,450 76,640.8 2,448.1 2,630.8 1.9% 7.5% 31.3 29.1 19.9 18.4 5.2 4.7 1.4% 1.5% 17.5% 17.0% 26.2 26.5 3.2% 7.3% -22.3% -23.7%

Sido Muncul SIDO Buy 15,000 870 950 13,050.0 633.0 760.5 18.6% 20.1% 20.6 17.2 14.8 12.3 4.2 3.9 3.4% 4.1% 21.1% 23.6% 22.7 17.8 20.6% 21.0% -27.5% -25.2%

Healthcare 37,006.7 824.9 870.9 -5.3% 5.6% 44.9 42.5 15.6 13.9 3.4 3.2 0.1% 0.2% 7.7% 7.7% 21.3 19.9 11.6% 14.2% 1.8% 6.4%

Mitra Keluarga MIKA Neutral 14,551 1,495 1,500 21,753.4 641.3 658.4 -5.7% 2.7% 33.9 33.0 24.2 23.2 7.4 6.6 0.0% 0.0% 19.3% 21.2% 26.7 27.4 -1.4% 5.2% -12.2% -8.2%

Siloam Hospital SILO Buy 1,625 3,770 4,300 6,126.3 27.7 39.0 -70.4% 40.6% 221.1 157.2 6.7 5.5 1.0 1.0 0.0% 0.0% 0.4% 0.6% 7.7 8.8 21.4% 21.4% -3.4% -1.9%

Hermina HEAL Buy 2,973 3,070 4,200 9,127.1 155.9 173.6 59.8% 11.4% 58.6 52.6 16.1 14.3 5.2 4.8 0.6% 0.9% 14.0% 9.5% 69.8 24.6 20.3% 16.6% 73.4% 60.2%

Consumer discretionary 440,198.4 29,149.4 31,075.0 16.0% 6.6% 15.1 14.2 10.4 10.3 2.6 2.3 2.8% 3.2% 18.0% 17.3% 11.1 13.0 29.8% -1.0% 21.9% 12.1%

Ace Hardware Indonesia ACES Buy 17,150 1,555 1,700 26,668.3 969.9 1,113.3 24.7% 14.8% 27.5 24.0 21.5 18.3 6.4 5.4 1.2% 1.5% 25.2% 24.6% 34.0 22.3 26.0% 14.2% -31.8% -42.3%

Matahari Department Store LPPF Buy 2,918 4,920 7,600 14,356.2 1,973.2 2,118.1 3.5% 7.3% 7.3 6.8 4.4 3.9 4.8 3.9 9.3% 9.6% 74.5% 63.5% 6.2 5.7 3.6% 7.1% -81.2% -88.7%

Mitra Adiperkasa MAPI Buy 16,600 830 1,100 13,778.0 718.5 815.0 114.7% 13.4% 19.2 16.9 7.3 7.1 3.0 2.7 0.4% 0.8% 16.7% 16.7% 18.7 13.1 25.4% 2.4% 57.5% 47.5%

Matahari Putra Prima MPPA Sell 5,378 171 250 919.6 (278.4) (334.9) -29.3% -20.3% -3.3 -2.7 11.1 15.3 0.5 0.5 -7.0% -9.1% -13.3% -18.0% 4.4 8.8 -16.0% -7.3% 33.1% 61.6%

Ramayana RALS Buy 7,096 1,355 1,700 9,615.1 510.8 558.0 25.6% 9.2% 18.8 17.2 12.4 11.2 2.6 2.4 2.5% 3.2% 14.1% 14.4% 14.3 12.1 29.1% 6.9% -27.4% -32.6%

Astra International ASII Buy 40,484 8,225 8,800 332,977.2 22,004.0 23,181.5 16.5% 5.4% 15.1 14.4 11.1 11.3 2.4 2.2 2.6% 3.0% 16.9% 16.1% 10.8 13.9 38.2% -3.4% 26.5% 16.1%

Surya Citra Media SCMA Buy 14,622 1,900 2,100 27,780.6 1,499.8 1,603.5 12.6% 6.9% 18.5 17.3 12.9 12.2 6.6 6.1 4.3% 4.6% 37.0% 36.8% 18.3 17.2 9.0% 5.1% -9.3% -15.4%

Media Nusantara Citra MNCN Buy 13,047 745 1,250 9,552.6 1,396.7 1,575.6 -2.2% 12.8% 6.8 6.1 4.3 4.1 1.0 0.9 5.8% 6.6% 15.1% 15.8% 4.0 5.1 0.1% 1.4% 31.2% 21.5%

MNC Studios MSIN Buy 5,202 352 600 1,831.1 194.5 245.7 60.1% 26.3% 9.4 7.5 4.9 4.1 1.5 1.3 5.3% 6.7% 23.3% 18.6% 17.3 6.3 93.4% 16.5% -35.6% -26.2%

Sarimelati Kencana PZZA Buy 3,022 900 1,400 2,719.7 160.4 199.1 13.5% 24.2% 17.0 13.7 7.0 6.5 2.4 2.1 0.0% 0.0% 21.2% 16.2% 10.3 7.9 13.2% 16.1% -16.1% 6.2%

Commodities 318,434.1 32,783.0 32,519.8 25.6% -1.0% 9.6 9.7 4.4 4.2 1.4 1.3 4.5% 4.1% 15.1% 13.8% 7.4 6.9 19.4% -1.9% -17.4% -23.6%

Astra Agro Lestari AALI Buy 1,925 11,450 14,200 22,037.8 1,558.2 1,817.2 -22.5% 16.6% 14.1 12.1 5.7 4.7 1.2 1.1 3.6% 2.8% 8.4% 9.3% 5.9 6.7 -11.7% 13.7% -6.3% -13.1%

London Sumatera Plantations LSIP Buy 6,823 1,190 1,450 8,119.3 583.4 649.9 -23.6% 11.4% 13.9 12.5 6.8 4.5 1.0 0.9 3.8% 2.9% 7.1% 7.6% 7.7 7.8 -39.8% 46.1% -30.6% -31.5%

Sawit Sumbermas Sarana SSMS Neutral 9,525 1,220 1,300 11,620.5 911.2 1,157.5 15.8% 27.0% 12.8 10.0 5.1 4.2 2.5 2.1 2.0% 2.4% 20.8% 22.5% 10.9 8.0 39.5% 16.6% -46.7% -45.8%

Eagle High Plantations BWPT IJ Neutral 31,525 167 195 5,264.7 (224.7) (67.5) -20.9% 70.0% -23.4 -78.0 10.9 8.0 0.9 0.9 0.0% 0.0% -3.7% -1.1% 14.8 5.7 15.8% 27.7% 119.0% 109.5%

REDS- Research Equity Database System Page 1 of 2

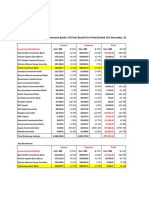

Equity Valuation Outstanding

Shares Price Price Mkt Cap Net Profit EPS Growth PER (x) EV/EBITDA (x) P/BV (x) Div.Yield ROE PCF EBITDA Growth Net Gearing

as of 07 December 2018 Code Rating (Mn) (Rp) Target (Rp Bn) 2018 2019 2018 2019 2018 2019 2018 2019 2018 2019 2018 2019 2018 2019 2018 2019 2018 2019 2018 2019

United Tractors UNTR Buy 3,730 29,375 43,750 109,572.7 11,877.1 11,664.9 54.8% -1.8% 9.2 9.4 4.9 4.6 2.0 1.8 3.3% 3.2% 24.0% 20.2% 18.0 8.0 35.8% -1.3% -33.0% -40.6%

Adaro (USD) ADRO Neutral 31,986 1,300 2,100 41,581.8 451.8 405.5 -6.5% -10.2% 6.3 7.0 2.4 2.5 0.8 0.7 6.2% 5.5% 12.5% 10.5% 3.4 3.9 1.0% -10.5% -11.3% -19.2%

Harum Energy (USD) HRUM Neutral 2,661 1,495 2,000 3,839.2 35.5 32.0 -19.6% -9.9% 7.4 8.2 0.5 0.3 0.8 0.8 7.4% 6.7% 10.9% 9.5% 6.9 6.4 -22.4% -11.6% -99.0% ######

Indo Tambangraya Megah (USD) ITMG Buy 1,108 20,425 33,400 22,397.2 261.2 225.4 3.3% -13.7% 5.9 6.8 2.3 2.6 1.5 1.5 14.5% 12.5% 26.4% 22.1% 4.6 5.5 -0.6% -13.6% -54.8% -54.1%

Bukit Asam PTBA Neutral 11,523 3,990 5,000 45,974.8 5,080.0 4,342.0 13.5% -14.5% 8.3 9.7 5.7 6.4 3.0 2.7 5.5% 4.7% 35.1% 26.8% 5.6 9.2 14.3% -14.3% -31.3% -37.1%

Antam ANTM IJ Buy 24,031 725 1,300 17,422.3 1,022.7 1,473.2 649.2% 44.1% 17.0 11.8 7.5 6.3 0.9 0.9 2.1% 3.0% 5.4% 7.5% 12.4 7.4 114.1% 17.8% 25.2% 22.0%

Vale Indonesia (USD) INCO IJ Buy 9,936 3,080 5,000 30,603.9 69.8 123.5 N/M 76.9% 29.9 17.0 7.4 5.6 1.1 1.1 1.0% 1.8% 3.8% 6.5% 7.1 10.4 95.3% 28.1% -18.0% -20.3%

Property & Industrial Estate 116,619.8 9,139.7 10,560.8 -23.6% 15.5% 12.8 11.0 9.5 9.2 1.3 1.2 1.1% 1.4% 10.4% 10.9% 11.4 13.7 -4.6% 5.8% 29.8% 29.2%

Alam Sutera Realty ASRI Neutral 19,649 348 265 6,838.0 1,199.2 1,687.8 -13.1% 40.7% 5.7 4.1 6.2 5.6 0.7 0.6 0.0% 2.0% 13.3% 16.4% 4.1 3.9 9.9% 8.5% 78.5% 67.2%

Bumi Serpong Damai BSDE Buy 19,247 1,345 1,460 25,886.8 2,136.4 2,508.2 -56.6% 17.4% 12.1 10.3 9.6 9.8 0.9 0.9 0.0% 0.0% 8.1% 8.7% 22.9 33.8 -33.5% 0.9% 26.1% 27.5%

Ciputra Development CTRA Buy 18,560 1,085 1,430 20,137.9 940.1 1,017.5 5.1% 8.2% 21.4 19.8 12.3 11.4 1.4 1.3 0.9% 0.7% 6.8% 7.0% 12.1 12.9 19.2% 8.6% 32.1% 30.5%

Jaya Real Property JRPT Buy 13,750 590 970 8,112.5 1,094.4 1,130.2 -1.7% 3.3% 7.4 7.2 5.9 5.9 1.2 1.1 3.8% 5.3% 17.9% 16.5% 5.7 7.3 6.0% 5.7% -19.4% -9.9%

Pakuwon Jati PWON Buy 48,160 635 625 30,581.3 2,014.8 2,334.7 7.6% 15.9% 15.2 13.1 10.3 9.7 2.5 2.2 0.9% 0.9% 18.0% 17.9% 17.2 22.1 7.7% 7.6% 15.5% 13.9%

Summarecon Agung SMRA Buy 14,427 860 950 12,407.0 306.4 325.7 -15.4% 6.3% 40.5 38.1 12.3 12.2 1.8 1.8 0.6% 0.6% 4.6% 4.7% 16.6 26.4 3.8% 2.2% 100.2% 97.0%

Puradelta Lestari DMAS Neutral 48,198 147 140 7,085.1 748.4 797.3 14.0% 6.5% 9.5 8.9 8.0 7.7 1.0 0.9 5.3% 5.6% 10.4% 10.5% 5.9 9.3 8.8% 6.2% -15.7% -13.2%

Bekasi Fajar BEST Buy 9,647 199 310 1,919.8 512.5 559.9 6.0% 9.3% 3.7 3.4 4.4 4.2 0.5 0.4 5.4% 5.9% 12.7% 12.5% 3.4 3.4 15.6% 8.7% 28.9% 29.1%

Mega Manunggal MMLP Buy 6,889 530 700 3,651.2 187.6 199.7 -32.0% 6.4% 19.5 18.3 26.0 22.5 0.9 0.9 0.0% 0.0% 4.8% 4.9% 62.8 24.4 48.4% 26.3% 18.0% 21.6%

Telco 457,935.6 26,863.8 30,035.1 -7.6% 11.8% 17.0 15.2 5.7 5.4 3.0 2.8 3.9% 4.4% 18.2% 19.2% 5.8 5.5 2.0% 6.6% 55.4% 49.6%

EXCEL EXCL Buy 10,688 1,960 3,800 20,948.4 797.3 1,346.0 112.5% 68.8% 26.3 15.6 4.0 3.6 0.9 0.9 0.0% 1.1% 3.6% 5.9% 2.9 2.6 11.6% 9.9% 75.5% 67.7%

Telkom TLKM Buy 99,062 3,670 4,200 363,558.3 21,413.9 23,643.1 -3.3% 10.4% 17.0 15.4 6.0 5.6 3.7 3.4 4.1% 4.6% 22.3% 23.0% 6.4 6.0 2.6% 6.9% 16.7% 13.5%

Indosat ISAT Neutral 5,434 1,945 4,000 10,569.0 446.3 451.1 (0.6) 0.0 23.7 23.4 2.8 2.7 0.8 0.7 0.0 2.3% 3.2% 3.2% 1.2 1.2 -0.117 0.0175 1.4404 1.3748

Link Net LINK Buy 3,043 4,870 6,800 14,404.8 1,143.7 1,295.7 15.1% 13.3% 12.6 11.1 6.2 5.5 2.9 2.5 4.0% 4.5% 24.1% 24.2% 8.0 7.1 12.6% 12.2% -12.0% -13.1%

Tower Bersama TBIG Neutral 4,531 3,960 5,350 17,591.2 805.0 883.9 -65.9% 9.8% 21.9 19.9 10.3 9.7 5.6 5.4 4.3% 4.3% 25.8% 27.5% 11.4 11.7 8.3% 7.8% 678.4% 686.0%

Sarana Menara TOWR Buy 51,015 605 750 30,863.8 2,257.5 2,415.5 7.5% 7.0% 13.7 12.8 8.1 7.7 3.9 3.5 4.9% 4.9% 30.2% 29.0% 9.5 8.9 4.9% 3.5% 110.1% 89.2%

Chemical 30,767.4 1,608.6 2,000.1 -5.3% 24.3% 19.1 15.4 6.0 5.3 1.8 1.6 0.0% 0.0% 9.0% 10.8% 6.5 6.8 -4.7% 21.0% -7.3% -0.9%

Aneka Gas AGII Buy 3,067 610 770 1,870.7 97.2 110.0 13.6% 13.2% 19.2 17.0 7.0 6.3 0.6 0.6 0.0% 0.0% 3.1% 3.4% 17.0 6.8 3.7% 7.2% 71.0% 64.4%

Barito Pacific (USD) BRPT Neutral 13,960 2,070 2,640 28,896.8 103.3 129.5 -13.0% 25.4% 19.1 15.3 5.9 5.2 2.0 1.8 0.0% 0.0% 10.0% 12.2% 6.1 6.7 -12.1% 22.5% -23.7% -14.6%

Airlines 6,211.4 494.1 528.2 -28.6% 6.9% 12.6 11.8 8.3 8.7 1.3 1.2 2.4% 2.6% 10.9% 10.7% -21.2 12.3 -4.8% 9.7% 51.1% 73.9%

GMF AeroAsia (USD) GMFI Buy 28,234 220 320 6,211.4 33.8 36.2 -33.7% 7.2% 12.6 11.8 8.3 8.7 1.3 1.2 2.4% 2.6% 10.6% 10.6% -20.8 12.2 -11.6% 9.9% 51.1% 73.9%

Oil and Gas 51,634.4 2,316.5 2,627.3 65.6% 13.4% 22.3 19.7 6.1 6.2 1.1 1.1 1.2% 1.8% 5.0% 5.5% 6.2 6.6 8.0% -5.7% 30.4% 22.6%

Perusahaan Gas Negara (USD) PGAS Buy 24,240 2,130 3,150 51,634.4 158.3 179.9 53.8% 13.7% 22.3 19.7 6.1 6.2 1.1 1.0 1.2% 1.8% 4.9% 5.4% 6.1 6.5 0.3% -5.4% 30.4% 22.6%

Transportation 6,730.6 478.3 559.6 12.6% 17.0% 14.1 12.0 5.8 5.1 1.3 1.2 2.1% 2.5% 9.5% 10.4% 6.4 5.9 -2.9% 11.7% 0.1% -1.1%

Blue Bird BIRD Buy 2,502 2,690 3,700 6,730.6 478.3 559.6 12.6% 17.0% 14.1 12.0 5.8 5.1 1.3 1.2 2.1% 2.5% 9.5% 10.4% 6.4 5.9 -2.9% 11.7% 0.1% -1.1%

Note : - *) means Company Data is using Bloomberg Data

- (USD) means Account under USD (USD Cents for Per Share Data)

- n/a means Not Available

- N/M means Not Meaningful

- N.A. means Not Applicable

REDS- Research Equity Database System Page 2 of 2

Вам также может понравиться

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioОт EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioОценок пока нет

- Matriks Valuasi Saham 21 Juli 2020Документ2 страницыMatriks Valuasi Saham 21 Juli 2020jnn sОценок пока нет

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Документ2 страницыEquity Valuation: REDS-Research Equity Database System Page 1 of 2Kadek ArdianaОценок пока нет

- Matriks Valuasi Saham 18 May 2020Документ2 страницыMatriks Valuasi Saham 18 May 2020hendarwinОценок пока нет

- Matriks Valuasi Saham 22 Juni 2020 PDFДокумент2 страницыMatriks Valuasi Saham 22 Juni 2020 PDFbala gamerОценок пока нет

- Equity Valuation: REDS-Research Equity Database System Page 1 of 2Документ2 страницыEquity Valuation: REDS-Research Equity Database System Page 1 of 2WidiasNastitiОценок пока нет

- Equity Valuation: REDS-Research Equity Database System Page 1 of 6Документ6 страницEquity Valuation: REDS-Research Equity Database System Page 1 of 6Kadek ArdianaОценок пока нет

- Perkembangan Ekspor Dan Impor Indonesia September 2018Документ2 страницыPerkembangan Ekspor Dan Impor Indonesia September 2018januar baharuliОценок пока нет

- Matriks Valuasi Saham Syariah 23112020Документ2 страницыMatriks Valuasi Saham Syariah 23112020Naikerretaapi Sempit'aОценок пока нет

- Matriks Valuasi Saham Sharia 18 May 2020Документ1 страницаMatriks Valuasi Saham Sharia 18 May 2020hendarwinОценок пока нет

- Matriks Valuasi Saham Sharia 11 May 2020Документ4 страницыMatriks Valuasi Saham Sharia 11 May 2020hendarwinОценок пока нет

- Matrix Valuasi Saham Syariah 1 Mar 21Документ1 страницаMatrix Valuasi Saham Syariah 1 Mar 21haji atinОценок пока нет

- Doddy Bicara InvestasiДокумент34 страницыDoddy Bicara InvestasiAmri RijalОценок пока нет

- Harga Wajar DBIДокумент40 страницHarga Wajar DBISeptiawanОценок пока нет

- Figure 35: Comparison Between JSMR's Growth Profile and Valuation Vs Regional PlayersДокумент1 страницаFigure 35: Comparison Between JSMR's Growth Profile and Valuation Vs Regional PlayersEno CasmiОценок пока нет

- Doddy Bicara InvestasiДокумент38 страницDoddy Bicara InvestasiNur Cholik Widyan SaОценок пока нет

- Danamon No More: DBS GroupДокумент6 страницDanamon No More: DBS GroupphuawlОценок пока нет

- Ambuja Cements: NeutralДокумент8 страницAmbuja Cements: Neutral张迪Оценок пока нет

- Corporate Accounting ExcelДокумент6 страницCorporate Accounting ExcelshrishtiОценок пока нет

- Top 17 Stocks BuyДокумент13 страницTop 17 Stocks BuySushilОценок пока нет

- KOPI ALK TM 11 v1.0Документ12 страницKOPI ALK TM 11 v1.0Wbok ZapztwvОценок пока нет

- Kenyan Brokerage & Investment Banking Financial Results 2009Документ83 страницыKenyan Brokerage & Investment Banking Financial Results 2009moneyedkenyaОценок пока нет

- Update Harga: Real-Time: QualityДокумент40 страницUpdate Harga: Real-Time: Qualitymatumbaman 212Оценок пока нет

- Business Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualДокумент19 страницBusiness Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualStephanieParkerexbf100% (43)

- Manappuram Finance Investor PresentationДокумент43 страницыManappuram Finance Investor PresentationabmahendruОценок пока нет

- Almarai Company: Consolidated Income StatementДокумент11 страницAlmarai Company: Consolidated Income Statementabdulla mohammadОценок пока нет

- Report 2022Документ338 страницReport 2022Yerrolla MadhuravaniОценок пока нет

- IAPM AssignmentsДокумент29 страницIAPM AssignmentsMUKESH KUMARОценок пока нет

- UPS1Документ6 страницUPS1Joana BarbaronaОценок пока нет

- Beginner EBay DCFДокумент14 страницBeginner EBay DCFQazi Mohd TahaОценок пока нет

- Update Harga: Real-Time: QualityДокумент44 страницыUpdate Harga: Real-Time: QualityNul AsashiОценок пока нет

- Business Valuation - ROTIДокумент21 страницаBusiness Valuation - ROTITEDY TEDYОценок пока нет

- Training and DevelopmentДокумент12 страницTraining and Developmentprashanth AtleeОценок пока нет

- Casa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqДокумент3 страницыCasa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqErica ZulianaОценок пока нет

- Bronch AdДокумент23 страницыBronch AdAbdelrahman NazmiОценок пока нет

- Submission v2Документ32 страницыSubmission v2MUKESH KUMARОценок пока нет

- HanssonДокумент11 страницHanssonJust Some EditsОценок пока нет

- Britannia IndustriesДокумент12 страницBritannia Industriesmundadaharsh1Оценок пока нет

- Name of The Company Last Financial Year First Projected Year CurrencyДокумент15 страницName of The Company Last Financial Year First Projected Year CurrencygabegwОценок пока нет

- 2022.07.24 - DCF Tutorial Answer KeyДокумент18 страниц2022.07.24 - DCF Tutorial Answer KeySrikanth ReddyОценок пока нет

- 2019 Q4 Financial Statement ENДокумент17 страниц2019 Q4 Financial Statement ENPinkky GithaОценок пока нет

- Roches ExcelДокумент4 страницыRoches ExcelJaydeep SheteОценок пока нет

- Tarea Heritage Doll CompanyДокумент6 страницTarea Heritage Doll CompanyFelipe HidalgoОценок пока нет

- The West Africa Companies: (Quar Terly)Документ16 страницThe West Africa Companies: (Quar Terly)addyОценок пока нет

- Purchases / Average Payables Revenue / Average Total AssetsДокумент7 страницPurchases / Average Payables Revenue / Average Total AssetstannuОценок пока нет

- Nifty50 Q2 FY18 Quarterly EstimatesДокумент8 страницNifty50 Q2 FY18 Quarterly Estimatessrinivas NОценок пока нет

- 3 Statement Model - Blank TemplateДокумент3 страницы3 Statement Model - Blank Templated11210175Оценок пока нет

- Reporte Copeme Imf Mar2023Документ52 страницыReporte Copeme Imf Mar2023Jesús Del Prado MattosОценок пока нет

- ANBIMA Ranking RF - Hibridos - 1121Документ46 страницANBIMA Ranking RF - Hibridos - 1121RoseAna CordelОценок пока нет

- Axiata Data Financials 4Q21bДокумент11 страницAxiata Data Financials 4Q21bhimu_050918Оценок пока нет

- Annual Report Laporan Tahunan: PT Gudang Garam TBKДокумент132 страницыAnnual Report Laporan Tahunan: PT Gudang Garam TBKAnnisa Rosie NirmalaОценок пока нет

- 2021 Statistics Bulletin - Public FinanceДокумент16 страниц2021 Statistics Bulletin - Public FinanceIbeh CosmasОценок пока нет

- Analisa Agen No RepeatДокумент1 страницаAnalisa Agen No Repeatirfan edisonОценок пока нет

- Amazon DCF: Ticker Implied Share Price Date Current Share PriceДокумент4 страницыAmazon DCF: Ticker Implied Share Price Date Current Share PriceFrancesco GliraОценок пока нет

- DCF TLKM Full Year 2020Документ4 страницыDCF TLKM Full Year 2020i wayan suputraОценок пока нет

- XLS EngДокумент4 страницыXLS EngShubhangi JainОценок пока нет

- Sapm AssignmentДокумент4 страницыSapm Assignment401-030 B. Harika bcom regОценок пока нет

- Estimari Dividende 2019 22.11.2019Документ4 страницыEstimari Dividende 2019 22.11.2019Bogdan BoicuОценок пока нет

- FIN254 ExcelTeam DynamicДокумент20 страницFIN254 ExcelTeam Dynamicfarah zarinОценок пока нет

- Gildan Model BearДокумент57 страницGildan Model BearNaman PriyadarshiОценок пока нет