Академический Документы

Профессиональный Документы

Культура Документы

QAFD Project Solver

Загружено:

UJJWAL0 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров5 страницQfad

Авторское право

© © All Rights Reserved

Доступные форматы

XLSX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документQfad

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров5 страницQAFD Project Solver

Загружено:

UJJWALQfad

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

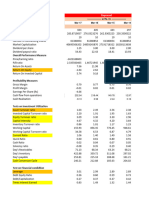

Company Market Cap Debt Maturity Time Risk Free Rate

Escorts 6648.66 7011.3 1 0.07

Page Industries 36807.79 758.91 1 0.07

Amtek India 26639.65 18879.01 1 0.07

Eicher 62150.51 1054.3 1 0.07

Kajaria 15555.57 2737.9 1 0.07

Bosch 41090 2034.8 1 0.07

Britannia 57778.78 6039.6 1 0.07

United Breweries 200326.56 11056.5 1 0.07

Merton

Merton Model

Model --Company

Company Asset

Asset Valuation

Valuation

Std Deviation Value of Company Assets % Difference

0.383 13659.96 -3.47%

0.348 37566.7 -0.14%

0.367 45518.66 -2.80%

0.943 63204.81 -0.11%

0.718 18293.47 -1.02%

0.439 43124.8 -0.32%

0.497 63818.38 -0.64%

0.69 211383.06 -0.35%

l --Company

Company Asset

Asset Valuation

Valuation

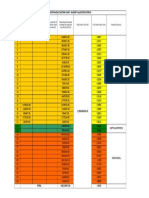

Based on Calculation

Value of the Company Assets Volatility of Company Assets

13185.89 0.19

37515.39 0.34

44242.30 0.22

63133.53 0.93

18107.55 0.62

42987.23 0.42

63410.07 0.45

210635.56 0.66

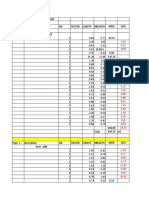

Select Company Eicher

Equity 3000000.00

Debt 10000000.00

Time 1.00

Stock Volatility 0.80

Risk Free Rate 0.05

V0 Value of the Company 12395387.19

σv Volatility of Company Assets 0.21

Equation 1 0.00

Equation 2 0.00

Minimize Function 0.00

Вам также может понравиться

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesОт EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesРейтинг: 5 из 5 звезд5/5 (3)

- Economics of LNG Fuel Bus Vs CNG Bus Vs Diesel BusДокумент7 страницEconomics of LNG Fuel Bus Vs CNG Bus Vs Diesel BusUJJWALОценок пока нет

- Financial Modeling Using Excel Mergers and Acquisitions: WWW - Yerite.co - inДокумент43 страницыFinancial Modeling Using Excel Mergers and Acquisitions: WWW - Yerite.co - inUJJWALОценок пока нет

- Return On Capital (ROC), Return On Invested Capital (ROIC) and Return On Equity (ROE) Measurement and ImplicationsДокумент69 страницReturn On Capital (ROC), Return On Invested Capital (ROIC) and Return On Equity (ROE) Measurement and Implicationsbauh100% (1)

- Labour Legislation: Labour Laws in IndiaДокумент95 страницLabour Legislation: Labour Laws in IndiaUJJWAL100% (1)

- CamScanner Document ScansДокумент45 страницCamScanner Document ScansUJJWALОценок пока нет

- Ugc Net Set Commerce Paper - 2 & 3Документ282 страницыUgc Net Set Commerce Paper - 2 & 3UJJWALОценок пока нет

- Financing Complex LNG ProjectsДокумент11 страницFinancing Complex LNG ProjectsUJJWALОценок пока нет

- Financing Complex LNG ProjectsДокумент11 страницFinancing Complex LNG ProjectsUJJWALОценок пока нет

- CSX's Two-Tiered Bid for Conrail AДокумент4 страницыCSX's Two-Tiered Bid for Conrail ARaman Gupta100% (1)

- Fundamentals of Capital MarketДокумент24 страницыFundamentals of Capital MarketBharat TailorОценок пока нет

- ET Wealth Apr 6 - 12 2020Документ23 страницыET Wealth Apr 6 - 12 2020Rony GeorgeОценок пока нет

- Panchshil Domestic Bill-JuneДокумент60 страницPanchshil Domestic Bill-JuneUJJWALОценок пока нет

- Financial Ratios FormulaДокумент2 страницыFinancial Ratios FormulaAlthea AcidreОценок пока нет

- Finance - Balance Sheet - Mahanagar Telephone Nigam Ltd (Rs in CrДокумент26 страницFinance - Balance Sheet - Mahanagar Telephone Nigam Ltd (Rs in CrDaman Deep Singh ArnejaОценок пока нет

- 1N4001 diode voltage and current measurementsДокумент4 страницы1N4001 diode voltage and current measurementsAngie Mendoza VargasОценок пока нет

- Ben Graham 22 Sep 2020 1115Документ5 страницBen Graham 22 Sep 2020 1115Debashish Priyanka SinhaОценок пока нет

- PruebaДокумент5 страницPruebaRicardo GPОценок пока нет

- Flow Through Pipes: ID-411, Hydraulic Machinery and Pipe Flow, 3 (2-1) Worksheet#8Документ4 страницыFlow Through Pipes: ID-411, Hydraulic Machinery and Pipe Flow, 3 (2-1) Worksheet#8M AliОценок пока нет

- BetasДокумент1 страницаBetaslu acoriОценок пока нет

- BetasДокумент7 страницBetasWendy FernándezОценок пока нет

- Balance Sheet of ITC: - in Rs. Cr.Документ13 страницBalance Sheet of ITC: - in Rs. Cr.Satyanarayana BodaОценок пока нет

- Financial Analysis 2 - ScribdДокумент6 страницFinancial Analysis 2 - ScribdSanjay KumarОценок пока нет

- Exploratory Factor Analysis Results for 10 ItemsДокумент2 страницыExploratory Factor Analysis Results for 10 ItemsJose Achicahuala MamaniОценок пока нет

- Starbucks Corp Quick Ratio Over TimeДокумент2 страницыStarbucks Corp Quick Ratio Over TimeTimОценок пока нет

- TVS Motor CompanyДокумент4 страницыTVS Motor CompanyRassal ShajiОценок пока нет

- NSDL Payment Bank by YunikShopДокумент4 страницыNSDL Payment Bank by YunikShoprahul dev varunОценок пока нет

- Graph of Refractive Index Against Composition of EthanolДокумент11 страницGraph of Refractive Index Against Composition of EthanolchaitanyaОценок пока нет

- Ms (%) Ed (Kcal/Kg) PC (%) Proteina Animapd (%) FC (%) Ee (%)Документ20 страницMs (%) Ed (Kcal/Kg) PC (%) Proteina Animapd (%) FC (%) Ee (%)JUAN FERNANDO SEGURA CASTROОценок пока нет

- Cairns India Private LimitedДокумент25 страницCairns India Private LimitedSuruchi GoyalОценок пока нет

- Aviziero - Lista de Plata - Asociatia de Proprietari A4Документ1 страницаAviziero - Lista de Plata - Asociatia de Proprietari A4AlexОценок пока нет

- Ratio Analysis: Net FA TA Cash Shareholder FundsДокумент2 страницыRatio Analysis: Net FA TA Cash Shareholder Fundsashwini_goyalОценок пока нет

- Formula&chartДокумент5 страницFormula&chartAb BarieОценок пока нет

- Rising Net Cash Flow and Cash From Operating Activity Aug 10Документ3 страницыRising Net Cash Flow and Cash From Operating Activity Aug 10KabirОценок пока нет

- 3% PRI Final SheetДокумент3 страницы3% PRI Final SheetAmit KumarОценок пока нет

- Mesh To Micron Conversion Chart Ecologix SystemsДокумент3 страницыMesh To Micron Conversion Chart Ecologix SystemsPitipong SunkhongОценок пока нет

- Money Manargement Trading: Compound Di Nex SheetДокумент10 страницMoney Manargement Trading: Compound Di Nex SheetSaepMulyanaОценок пока нет

- Take Home AssignmentДокумент2 страницыTake Home AssignmentPravanjan AumcapОценок пока нет

- Ambee Pharma Square Pharma Aci Beacon IBNSINA Marico Pharm Aid Orion Infusion Beximc o Pharma GSKДокумент2 страницыAmbee Pharma Square Pharma Aci Beacon IBNSINA Marico Pharm Aid Orion Infusion Beximc o Pharma GSKRiazboniОценок пока нет

- Mesh Size PDFДокумент1 страницаMesh Size PDFuntoroОценок пока нет

- Corporate Valuation DeonДокумент9 страницCorporate Valuation Deondeonlopes057Оценок пока нет

- Mesh Size PDFДокумент1 страницаMesh Size PDFuntoroОценок пока нет

- Continuous Casting Plant - Budget Allocation StatusДокумент1 страницаContinuous Casting Plant - Budget Allocation StatusAbhi 7Оценок пока нет

- Market 11 Aug 2014 3.30 PMДокумент2 страницыMarket 11 Aug 2014 3.30 PMasifОценок пока нет

- Water UtilitiesДокумент2 страницыWater Utilitiesapi-3773892Оценок пока нет

- Fractionation Rules of Thumb for Chemical EngineersДокумент30 страницFractionation Rules of Thumb for Chemical EngineersDestileria POPLAR CAPITAL S.A.Оценок пока нет

- Deepshikha 1116 CFДокумент4 страницыDeepshikha 1116 CFDeepshikha DasguptaОценок пока нет

- Beckman Coulter LS - Sampel 20 - 01 - 03Документ2 страницыBeckman Coulter LS - Sampel 20 - 01 - 03EriskaAgustinОценок пока нет

- Mar-19 Mar-18 Mar-17: Fixed Assets 1718.63 1317.69 1006.11Документ17 страницMar-19 Mar-18 Mar-17: Fixed Assets 1718.63 1317.69 1006.11PoorvaОценок пока нет

- Remedium LifeДокумент10 страницRemedium Lifeprajwal17803Оценок пока нет

- Brand Loyalty Data Logistic RegressionДокумент4 страницыBrand Loyalty Data Logistic Regressionritesh choudhuryОценок пока нет

- Attribute Coeffs S.E. Wald Z P-ValueДокумент8 страницAttribute Coeffs S.E. Wald Z P-Valuesarthak mendirattaОценок пока нет

- Grupo Hogares Ingreso % Acumulado de Hogares % Acumulado Del IngresoДокумент6 страницGrupo Hogares Ingreso % Acumulado de Hogares % Acumulado Del IngresoLIZETH KATHERIN MONROY MACIASОценок пока нет

- Solucion A Problemas de DiseñoДокумент9 страницSolucion A Problemas de DiseñoPeke SasaОценок пока нет

- Pitch Conversions Threads Per Inch TPI Pitch in Inches and Pitch in MM For Taps and DiesДокумент3 страницыPitch Conversions Threads Per Inch TPI Pitch in Inches and Pitch in MM For Taps and DiesChetan HinganeОценок пока нет

- Lab Fisica 2 9.0Документ9 страницLab Fisica 2 9.0Fredy Santiago Aristizabal GalvisОценок пока нет

- INDIAN ENERGY ANALYSISДокумент18 страницINDIAN ENERGY ANALYSISRasulОценок пока нет

- Intraday Setups BUY Trades: Watchlist and Trade Setups For Intraday Trading in Stocks (Based On 4H Timeframe)Документ11 страницIntraday Setups BUY Trades: Watchlist and Trade Setups For Intraday Trading in Stocks (Based On 4H Timeframe)rajnОценок пока нет

- AviagenBrief VentilationRates 2018 ENДокумент2 страницыAviagenBrief VentilationRates 2018 ENPOULTRY CHANNELОценок пока нет

- Risk, Price and Valuations of Jet Airways (India) LTDДокумент1 страницаRisk, Price and Valuations of Jet Airways (India) LTDShubhamSoodОценок пока нет

- SourcesДокумент1 страницаSourcesManish KaushalОценок пока нет

- Tablas Del Vertedero Rectangula Con ContraccionesДокумент4 страницыTablas Del Vertedero Rectangula Con ContraccionesAngel FerrrОценок пока нет

- Analysis of hydraulic data and drag coefficient calculationДокумент4 страницыAnalysis of hydraulic data and drag coefficient calculationAngel FerrrОценок пока нет

- Balance Sheet of DR Reddys Laboratories: - in Rs. Cr.Документ14 страницBalance Sheet of DR Reddys Laboratories: - in Rs. Cr.Anand MalashettiОценок пока нет

- Asian Paints: BSE: 500820 - NSE: ASIANPAINT - ISIN: INE021A01018 - Paints/VarnishesДокумент6 страницAsian Paints: BSE: 500820 - NSE: ASIANPAINT - ISIN: INE021A01018 - Paints/Varnishesopenid_ovmLEUQfОценок пока нет

- BetasДокумент7 страницBetasJulio Cesar ChavezОценок пока нет

- Steam Qulity Out Versus Pressure Thermal Efficiency Versus PressureДокумент2 страницыSteam Qulity Out Versus Pressure Thermal Efficiency Versus PressureebrahimОценок пока нет

- 050 Current-Limits-Of-Wire-DownloadДокумент1 страница050 Current-Limits-Of-Wire-Downloadanup chauhanОценок пока нет

- HDFC by IshanДокумент14 страницHDFC by IshanIshan MalikОценок пока нет

- Cases ABC Luciano DecourtДокумент27 страницCases ABC Luciano DecourtEric BarcelosОценок пока нет

- Total: Rezultate Economico Financiare/haДокумент25 страницTotal: Rezultate Economico Financiare/haRodion SoareОценок пока нет

- Measurement Sheet Log No 357Документ5 страницMeasurement Sheet Log No 357ejazОценок пока нет

- Kuntal Shah WatchlistДокумент2 страницыKuntal Shah WatchlistDhrumil ShahОценок пока нет

- Unit-9 Complete Book LBДокумент135 страницUnit-9 Complete Book LBUJJWALОценок пока нет

- Unit-6 Complete Book LBДокумент140 страницUnit-6 Complete Book LBUJJWALОценок пока нет

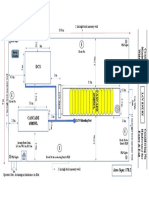

- Auto Corner CNG DWG PDFДокумент1 страницаAuto Corner CNG DWG PDFUJJWALОценок пока нет

- UGC NET Teaching & Research Aptitude SyllabusДокумент4 страницыUGC NET Teaching & Research Aptitude Syllabusmnb11augОценок пока нет

- 19.8 M 2.1m High Brick Masonry Wall: FLP Light FLP Light Earth PitДокумент1 страница19.8 M 2.1m High Brick Masonry Wall: FLP Light FLP Light Earth PitUJJWALОценок пока нет

- University Grants Commission Net Bureau: Net Syllabus Subject: ManagementДокумент6 страницUniversity Grants Commission Net Bureau: Net Syllabus Subject: ManagementRanbir SinghОценок пока нет

- A Government of India Undertaking) Administrative Building, Chembur, Mumbai-400 074Документ45 страницA Government of India Undertaking) Administrative Building, Chembur, Mumbai-400 074Nitin KeshavОценок пока нет

- UGC-NET June 2019 NTA ScoreДокумент1 страницаUGC-NET June 2019 NTA ScoreUJJWALОценок пока нет

- Tariff Calculating Model For Natural Gas Transport PDFДокумент7 страницTariff Calculating Model For Natural Gas Transport PDFUJJWALОценок пока нет

- MR Raza's gas bill detailsДокумент3 страницыMR Raza's gas bill detailsUJJWALОценок пока нет

- Domestic Gas Prices, Some LNG Price Formulas & RR Committee Proposed Price FormulaДокумент29 страницDomestic Gas Prices, Some LNG Price Formulas & RR Committee Proposed Price FormulaUJJWALОценок пока нет

- 7 Effective Ways of Website DesignДокумент9 страниц7 Effective Ways of Website DesignUJJWALОценок пока нет

- Us Clears Non Fta ExportsДокумент6 страницUs Clears Non Fta ExportsUJJWALОценок пока нет

- EFFECTIVENESS OF AMBUSH MARKETINGДокумент7 страницEFFECTIVENESS OF AMBUSH MARKETINGUJJWALОценок пока нет

- LCNG Vs CNG in USDДокумент9 страницLCNG Vs CNG in USDUJJWALОценок пока нет

- Global - LNG - New - Pricing - Ahead - Ernst & YoungДокумент20 страницGlobal - LNG - New - Pricing - Ahead - Ernst & YoungUJJWALОценок пока нет

- Gas Pooling ReportДокумент73 страницыGas Pooling ReportP VinayakamОценок пока нет

- Basics of CGD For MBA Oil - Gas StudentsДокумент53 страницыBasics of CGD For MBA Oil - Gas StudentsUJJWALОценок пока нет

- MWH MW Produced in An Hour ( ) MW Capacity of Power Plant To Produce Power 24 Hours A Day Assuming 100% Efficiency ( )Документ2 страницыMWH MW Produced in An Hour ( ) MW Capacity of Power Plant To Produce Power 24 Hours A Day Assuming 100% Efficiency ( )UJJWALОценок пока нет

- Conversion table for fuel types and their energy values in SCM of natural gasДокумент4 страницыConversion table for fuel types and their energy values in SCM of natural gasUJJWALОценок пока нет

- Chapter 12 - Market Microstructure and StrategiesДокумент17 страницChapter 12 - Market Microstructure and StrategiesJenniferОценок пока нет

- Inflation AccountingДокумент32 страницыInflation Accountingmanchana100% (9)

- Answwr of Quiz 5 (MBA)Документ2 страницыAnswwr of Quiz 5 (MBA)Wael_Barakat_3179Оценок пока нет

- Partnership Liquidation and AccountingДокумент4 страницыPartnership Liquidation and Accountingnadea06_20679973Оценок пока нет

- Stock Market CrashДокумент16 страницStock Market Crashapi-4616219590% (1)

- Petrobras of Brazil and The CostДокумент3 страницыPetrobras of Brazil and The CostIoana PunctОценок пока нет

- PL J22 Financial ManagementДокумент10 страницPL J22 Financial ManagementscottОценок пока нет

- Ipsas 2 Notes 2021Документ9 страницIpsas 2 Notes 2021Wilson Mugenyi KasendwaОценок пока нет

- Financial Analysis Tools & StatementsДокумент20 страницFinancial Analysis Tools & StatementszewdieОценок пока нет

- TCCT 1 Chapter6Документ50 страницTCCT 1 Chapter6Thảo NhưОценок пока нет

- 2-5int 2002 Jun QДокумент10 страниц2-5int 2002 Jun Qapi-3728790Оценок пока нет

- Financial and Managerial AccountingДокумент1 страницаFinancial and Managerial Accountingcons theОценок пока нет

- Prob1 Afar QuizДокумент7 страницProb1 Afar Quizryan rosalesОценок пока нет

- Case 11 Financial ForecastingДокумент9 страницCase 11 Financial ForecastingFD ReynosoОценок пока нет

- VINAMILK VALUATION REPORTДокумент24 страницыVINAMILK VALUATION REPORTThúy HằngОценок пока нет

- Faculty Accountancy 2022 Session 2 - Degree Maf551Документ7 страницFaculty Accountancy 2022 Session 2 - Degree Maf551afrina shazleenОценок пока нет

- ADVANCED CORPORATE FINANCE Repaper 3rd TermДокумент6 страницADVANCED CORPORATE FINANCE Repaper 3rd TermdixitBhavak DixitОценок пока нет

- Solved Shonda Owns 1 000 of The 1 500 Shares Outstanding in RookДокумент1 страницаSolved Shonda Owns 1 000 of The 1 500 Shares Outstanding in RookAnbu jaromiaОценок пока нет

- Prospectus MBAДокумент20 страницProspectus MBABabasab Patil (Karrisatte)100% (1)

- S P 500 Top 50 Etf Fund of Fund - PPT For PDFДокумент31 страницаS P 500 Top 50 Etf Fund of Fund - PPT For PDFस्वास्थ्य संतुलनОценок пока нет

- Bfc3170 Management of Financial Intermediaries: Off-Balance-Sheet RiskДокумент32 страницыBfc3170 Management of Financial Intermediaries: Off-Balance-Sheet RiskRajОценок пока нет

- University of 20 August 1955 Skikda Faculty of Economics, Commerce and Management Sciences Section: Master 1 Finance (2 Term) English ModuleДокумент12 страницUniversity of 20 August 1955 Skikda Faculty of Economics, Commerce and Management Sciences Section: Master 1 Finance (2 Term) English ModuleKęnza DjeОценок пока нет

- Preliminary Placement Document2018 PDFДокумент624 страницыPreliminary Placement Document2018 PDFAnonymous NFkdXNОценок пока нет

- Presentation of Financial Statements (IAS 1)Документ30 страницPresentation of Financial Statements (IAS 1)Ashura ShaibОценок пока нет

- Borsa Istanbul Indices and Trading RulesДокумент32 страницыBorsa Istanbul Indices and Trading RulesBengisu TekeliogluОценок пока нет