Академический Документы

Профессиональный Документы

Культура Документы

GST Council Meet: Here's What Will Become Cheaper For You: Finance Minister

Загружено:

Andy YongОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

GST Council Meet: Here's What Will Become Cheaper For You: Finance Minister

Загружено:

Andy YongАвторское право:

Доступные форматы

GST Council meet: Here's what will become cheaper for you - The Ec... https://economictimes.indiatimes.com/news/economy/policy/gst-counc...

Business News › News › Economy › Policy Search for News, Stock Quotes & NAV's

DID YOU KNOW? SPONSORED ★★★★★ NAV RETURNS

04:05 PM | 21 DEC CLOSED Invest Now

Unleash the power of SIP - Motilal Oswal Focused 25 Fund Direct-Growth

PORTFOLIO

₹22.19 3Y 11.15%

MARKET STATS Invest in Mutual funds 10,754 31,197.00

Class: Equity Category: Large Cap

*Regulatory Disclaimers .

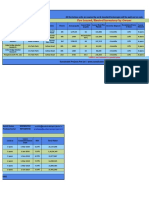

GST Council meet: Here's what will become cheaper for you

BY ET ONLINE | UPDATED: DEC 22, 2018, 11.44 PM IST Post a Comment

NEW DELHI: Finance Minister Arun Jaitley on Saturday said that six items have been

removed from the 28 per cent tax bracket under the Goods and Services Tax (GST)

regime.

There were 34 items in the 28 per cent tax bracket which included luxury and 'sin goods'

till now. However, the GST Council in its meeting on Saturday decided to take out 6 items

from this list. Today's GST rate reduction will have an overall impact on revenue of Rs

5500 crore, said Jaitley.

New return filing system will be started on trial basis from April 1, to be implemented

mandatorily by July 1. Due date for GST Annual Return and Audit Report extended till

Fitment panel recommendations have been

30th June 2019. considered in today's meet, said Arun Jaitley

Finance Minister, Arun Jaitley said that the recommendations by the fitment panel have

Related

been considered in today's meet.

GST rate cuts: The complete list of what all

becomes cheap and what not

Big Change:

The end of Five-Year Plans: All you need to know

Here are the key points:

* 28 items have been kept in 28 per cent slabs, which are mainly luxury and sin products. Rates have been reduced for 22 items under

the 28 per cent slab.

* GST rate on special flights for pilgrims lowered for economy at 5 percent and business class at 12 percent.

* The GST Council has also decided to slash tax rate on parts and accessories for the carriages for disabled persons from 28 per cent

to 5 per cent.

* The Council has decided that 5 per cent would be levied on renewable energy devices and parts for their manufacture.

1 of 4 23/12/2018, 10:13 AM

Вам также может понравиться

- A Comprehensive Assessment of Tax Capacity in Southeast AsiaОт EverandA Comprehensive Assessment of Tax Capacity in Southeast AsiaОценок пока нет

- Shodhsancharbulletinjanuarytomarch2020g P DangДокумент12 страницShodhsancharbulletinjanuarytomarch2020g P Dangakhileshyadav3794186Оценок пока нет

- Research On An Impact of Goods and Service Tax (GST) On Indian EconomyДокумент4 страницыResearch On An Impact of Goods and Service Tax (GST) On Indian EconomyEditor IJTSRDОценок пока нет

- The Impact of GST On Manufacturing Sector in India: Vol 11, Issue 7, July/ 2020 ISSN NO: 0377-9254Документ6 страницThe Impact of GST On Manufacturing Sector in India: Vol 11, Issue 7, July/ 2020 ISSN NO: 0377-9254Rohit MuleyОценок пока нет

- Moving Towards A World-Class GST: Vijay Kelkar Arvind Datar Rahul RenavikarДокумент13 страницMoving Towards A World-Class GST: Vijay Kelkar Arvind Datar Rahul Renavikarmsharma22Оценок пока нет

- Impact of Goods and Service Tax (GST) On Manufacturing SectorДокумент8 страницImpact of Goods and Service Tax (GST) On Manufacturing SectorVarinder Pal SinghОценок пока нет

- IJPUB1801089Документ5 страницIJPUB1801089ba7443789Оценок пока нет

- Study of Experience and Level of Satisfaction of Businessmen After Implementation of Goods and Service Tax (GST)Документ7 страницStudy of Experience and Level of Satisfaction of Businessmen After Implementation of Goods and Service Tax (GST)International Journal of Innovative Science and Research TechnologyОценок пока нет

- Handbook On GST On Service SectorДокумент276 страницHandbook On GST On Service SectorABC 123100% (1)

- Demonetisation and GSTДокумент4 страницыDemonetisation and GSTJitendra DubeyОценок пока нет

- GST Year in ReviewДокумент6 страницGST Year in Reviewcharu shankarОценок пока нет

- Continuous Evaluation Project Taxation Law II 18B176Документ15 страницContinuous Evaluation Project Taxation Law II 18B176un academyОценок пока нет

- Project Dse-3 6TH Semester (S04517com067)Документ43 страницыProject Dse-3 6TH Semester (S04517com067)RajeshОценок пока нет

- Ijirt158842 PaperДокумент4 страницыIjirt158842 PaperVaishnavi SainiОценок пока нет

- Impact of GST On Various Sectors 1Документ200 страницImpact of GST On Various Sectors 1bijuprasad0% (1)

- Economics RP Kartik Goel BBA LLBДокумент21 страницаEconomics RP Kartik Goel BBA LLBBADDAM PARICHAYA REDDYОценок пока нет

- GSTДокумент9 страницGSTVidhi VermaОценок пока нет

- I JM Te Journal Full PaperДокумент9 страницI JM Te Journal Full PaperSiddharth DixitОценок пока нет

- GST and Its Impact On Various Sector: September 2017Документ6 страницGST and Its Impact On Various Sector: September 2017deepak kumar gochhayatОценок пока нет

- GST Refund Under Tax Laws: An Analysis: Hidayatullah National Law University Raipur (C.G.)Документ20 страницGST Refund Under Tax Laws: An Analysis: Hidayatullah National Law University Raipur (C.G.)Atul VermaОценок пока нет

- 5yr of GSTДокумент8 страниц5yr of GSTSuraj PawarОценок пока нет

- DR Shyam Salunkhe GSTДокумент21 страницаDR Shyam Salunkhe GSTankurchauhan9304Оценок пока нет

- 2098 Main ProjectДокумент71 страница2098 Main ProjectPRACHI ShindeОценок пока нет

- Goods and Services Tax (GST) in India - An Overview and ImpactДокумент3 страницыGoods and Services Tax (GST) in India - An Overview and Impactsamar sagarОценок пока нет

- Impact of GST On Indian Economy: Keywords: GST, Consumer, Producer, Centre, StateДокумент4 страницыImpact of GST On Indian Economy: Keywords: GST, Consumer, Producer, Centre, StateSonam KumariОценок пока нет

- Impact of Goods and Service Taxes (GST) in Various SectorsДокумент7 страницImpact of Goods and Service Taxes (GST) in Various SectorsEswari GkОценок пока нет

- IndiaДокумент17 страницIndiaAkshay ArwadeОценок пока нет

- Demo Proj 4Документ31 страницаDemo Proj 4ONLY SONGS PRESENTSОценок пока нет

- Economics RP Kartik Goel BBA - LLBДокумент21 страницаEconomics RP Kartik Goel BBA - LLBKartikОценок пока нет

- India Tax Insights (October-December 2014)Документ48 страницIndia Tax Insights (October-December 2014)Eli ThomasОценок пока нет

- 22.22 Gst: C M & I (िुनौ यां) : Mrunal's Economy Pillar#2A: Budget → Revenue Part → Tax-Receipts → Page 146Документ3 страницы22.22 Gst: C M & I (िुनौ यां) : Mrunal's Economy Pillar#2A: Budget → Revenue Part → Tax-Receipts → Page 146Washim Alam50CОценок пока нет

- Implementation of Goods and Services Tax (GST)Документ11 страницImplementation of Goods and Services Tax (GST)NATIONAL ATTENDENCEОценок пока нет

- Finance ProjectДокумент33 страницыFinance Projectsarah IsharatОценок пока нет

- GstreturnandtallyДокумент49 страницGstreturnandtallyManikant VОценок пока нет

- Gstreturnandtally 240201101504 8032c8caДокумент49 страницGstreturnandtally 240201101504 8032c8cagangotrikaviriОценок пока нет

- Goods and Service Tax AND Its Impact On Indian EconomyДокумент26 страницGoods and Service Tax AND Its Impact On Indian EconomyPawan JaiswalОценок пока нет

- 'SWOT' Analysis On Goods and Services Tax (GST) in IndiaДокумент4 страницы'SWOT' Analysis On Goods and Services Tax (GST) in IndiaInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Impact F GST in Indian EconomyДокумент20 страницImpact F GST in Indian EconomyAKHIL H KRISHNANОценок пока нет

- GST - PUBLIC FINANCE GE by Pratham SinghДокумент7 страницGST - PUBLIC FINANCE GE by Pratham Singhsejalsahni3108Оценок пока нет

- GST - Is It A Win-Win Situation For All?: The Author Is Executive Partner in Lakshmikumaran & Sridharan, New DelhiДокумент3 страницыGST - Is It A Win-Win Situation For All?: The Author Is Executive Partner in Lakshmikumaran & Sridharan, New DelhiajitОценок пока нет

- I. Introduc OnДокумент6 страницI. Introduc OnGeet DharmaniОценок пока нет

- GST Rates 2017, GST Rate in India (Item Wise GST Rate List in PDFДокумент18 страницGST Rates 2017, GST Rate in India (Item Wise GST Rate List in PDFSubhrajyoti SarkarОценок пока нет

- The Impact of GST On IndiaДокумент8 страницThe Impact of GST On Indiasahil khanОценок пока нет

- Ilovepdf MergedДокумент68 страницIlovepdf Mergedjitendra kumarОценок пока нет

- GST Final PaperДокумент5 страницGST Final PaperIjcams PublicationОценок пока нет

- Chapter-1: Introduction 1. Introduction of The Topic: Savitribai Phule Pune University, PuneДокумент33 страницыChapter-1: Introduction 1. Introduction of The Topic: Savitribai Phule Pune University, PuneSawan PatelОценок пока нет

- Goods and Services Tax Media and Entertainment SectorДокумент28 страницGoods and Services Tax Media and Entertainment SectorSanjog100% (1)

- GST Housing Sector Affordable HousingДокумент3 страницыGST Housing Sector Affordable HousingschaktenОценок пока нет

- Basic Concepts and Features of Goods and Service Tax in IndiaДокумент3 страницыBasic Concepts and Features of Goods and Service Tax in Indiamansi nandeОценок пока нет

- Insights Into Yojana: August 2017: Goods and Services Tax (GST)Документ14 страницInsights Into Yojana: August 2017: Goods and Services Tax (GST)Abhishek SinghОценок пока нет

- Implementation of GST in India - 1Документ54 страницыImplementation of GST in India - 1rishubhОценок пока нет

- Media and Entertainment Sector Impact of Goods and Services Tax (GST)Документ33 страницыMedia and Entertainment Sector Impact of Goods and Services Tax (GST)Ishwar Meena100% (1)

- Vision 360 Edition 6 1614142642Документ43 страницыVision 360 Edition 6 1614142642Swapnil PatilОценок пока нет

- Impact of GST in Foreign Trade ProjectДокумент7 страницImpact of GST in Foreign Trade ProjectkiranОценок пока нет

- Impact of GSTДокумент6 страницImpact of GSTASHUTOSHОценок пока нет

- 88 1 407 2 10 20170909 PDFДокумент13 страниц88 1 407 2 10 20170909 PDFJazz JuniorОценок пока нет

- Goods and Services Tax: Benefits and Its Impact On Indian EconomyДокумент7 страницGoods and Services Tax: Benefits and Its Impact On Indian EconomyBADDAM PARICHAYA REDDYОценок пока нет

- Impact of GST On Manufacturers, Distributors and RetailersДокумент6 страницImpact of GST On Manufacturers, Distributors and Retailershemant rajОценок пока нет

- Real Fish in The Net Gains: 13 July 2017 Narrated: Yogesh Mishra, MBA (E) 2017-19Документ1 страницаReal Fish in The Net Gains: 13 July 2017 Narrated: Yogesh Mishra, MBA (E) 2017-19alkjghОценок пока нет

- The Impact of GST On Construction Industry: June 2019Документ12 страницThe Impact of GST On Construction Industry: June 2019AVS YASHWINОценок пока нет

- Book Summary - Deep Work by Cal Newport - Sam Thomas DaviesДокумент23 страницыBook Summary - Deep Work by Cal Newport - Sam Thomas DaviesAndy YongОценок пока нет

- Monthly Salary Threshold For Employment Pass Applicants To Be Increased To $4,500 - MOMДокумент5 страницMonthly Salary Threshold For Employment Pass Applicants To Be Increased To $4,500 - MOMAndy YongОценок пока нет

- Book Summary - Managing Oneself by Peter Drucker PDFДокумент11 страницBook Summary - Managing Oneself by Peter Drucker PDFAndy YongОценок пока нет

- 8 Warning Signs COVID-19 Is in Your BloodДокумент7 страниц8 Warning Signs COVID-19 Is in Your BloodAndy YongОценок пока нет

- Book Summary - Managing Oneself by Peter Drucker PDFДокумент11 страницBook Summary - Managing Oneself by Peter Drucker PDFAndy YongОценок пока нет

- Top Sales Secret Is This - Email AlchemistДокумент2 страницыTop Sales Secret Is This - Email AlchemistAndy YongОценок пока нет

- B2B Marketing Attribution: An Introductor y Guide To Attribution For Revenue - Driven B2B MarketersДокумент43 страницыB2B Marketing Attribution: An Introductor y Guide To Attribution For Revenue - Driven B2B MarketersAndy YongОценок пока нет

- China, U.S. and Power GamesДокумент6 страницChina, U.S. and Power GamesAndy YongОценок пока нет

- Persuasion For Crisis MKTingДокумент8 страницPersuasion For Crisis MKTingAndy YongОценок пока нет

- Forex Reserves Surge To All-Time High of $493.48 Billion - The Economic TimesДокумент1 страницаForex Reserves Surge To All-Time High of $493.48 Billion - The Economic TimesAndy YongОценок пока нет

- UAE To Offer Long-Term Visa For Educated ForeignersДокумент4 страницыUAE To Offer Long-Term Visa For Educated ForeignersAndy YongОценок пока нет

- Oil's Collapse Is A Geopolitical Reset in DisguiseДокумент11 страницOil's Collapse Is A Geopolitical Reset in DisguiseAndy YongОценок пока нет

- ICICI Bank Regulatory ScrutinyДокумент3 страницыICICI Bank Regulatory ScrutinyAndy YongОценок пока нет

- Entertainmnt Addiction Destroys YouДокумент7 страницEntertainmnt Addiction Destroys YouAndy YongОценок пока нет

- Owning Car in India...Документ14 страницOwning Car in India...Andy YongОценок пока нет

- How To Overcome Perfection With Speedy RevisionsДокумент36 страницHow To Overcome Perfection With Speedy RevisionsAndy YongОценок пока нет

- When - by Dan Pink - Book SummaryДокумент11 страницWhen - by Dan Pink - Book SummaryAndy Yong50% (2)

- Valuasi Saham MppaДокумент29 страницValuasi Saham MppaGaos FakhryОценок пока нет

- Bankin and Fin Law Relationship Between Bank and Its CustomersДокумент6 страницBankin and Fin Law Relationship Between Bank and Its CustomersPersephone WestОценок пока нет

- UBS HandbookДокумент152 страницыUBS HandbookcarecaОценок пока нет

- rf1 - PhilhealthДокумент6 страницrf1 - PhilhealthAngelica Radoc SansanОценок пока нет

- Full Download Corporate Financial Accounting 13th Edition Warren Solutions ManualДокумент35 страницFull Download Corporate Financial Accounting 13th Edition Warren Solutions Manualmasonh7dswebb100% (37)

- AF2108 Week 1-4 StudentДокумент6 страницAF2108 Week 1-4 Studentw.leeОценок пока нет

- Full Pack Pfcea New ProceduresДокумент27 страницFull Pack Pfcea New Proceduresdirector@bancofinancieroprivadoОценок пока нет

- Sustainable Pre Leased 06122019Документ2 страницыSustainable Pre Leased 06122019vaibhav vermaОценок пока нет

- 1BRNEA2022002Документ64 страницы1BRNEA2022002Nguyễn Xuân ThượngОценок пока нет

- Letters of Credit NotesДокумент3 страницыLetters of Credit NotesattorneyОценок пока нет

- Exter's Pyramid, by Paul MylchreestДокумент10 страницExter's Pyramid, by Paul MylchreestTFMetalsОценок пока нет

- Accounting Standard 1Документ27 страницAccounting Standard 1Sid2875% (4)

- Chapter 8 The Credit SystemДокумент20 страницChapter 8 The Credit SystemJonavel Torres MacionОценок пока нет

- Residential Rental Application: Applicant InformationДокумент3 страницыResidential Rental Application: Applicant Informationapi-115282286Оценок пока нет

- Frauds-in-Indian-Banking SectorДокумент61 страницаFrauds-in-Indian-Banking SectorPranav ViraОценок пока нет

- Module 1 - ACCT 4005Документ29 страницModule 1 - ACCT 4005yahye ahmedОценок пока нет

- Form16 2022 2023Документ8 страницForm16 2022 2023arun poojariОценок пока нет

- Annual Report 2019 PDFДокумент188 страницAnnual Report 2019 PDFowen.rijantoОценок пока нет

- MRK - Fall 2019 - HRM630 - 1 - MC180203268Документ2 страницыMRK - Fall 2019 - HRM630 - 1 - MC180203268Z SulemanОценок пока нет

- Summary of "Contemporary Strategy"Документ12 страницSummary of "Contemporary Strategy"MostakОценок пока нет

- Reading Practice TestДокумент23 страницыReading Practice Teststephen vaiОценок пока нет

- Preventing Sickkness and Rehabilitation of Business UnitsДокумент46 страницPreventing Sickkness and Rehabilitation of Business Unitsmurugesh_mbahit100% (13)

- Markell Fall-1Документ37 страницMarkell Fall-1Ma FajardoОценок пока нет

- Lehman Examiner's Report, Vol. 4Документ493 страницыLehman Examiner's Report, Vol. 4DealBookОценок пока нет

- Financial Statement Theory Notes PDFДокумент6 страницFinancial Statement Theory Notes PDFAejaz MohamedОценок пока нет

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент2 страницыStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceEklavya GuptaОценок пока нет

- CFO Job Description DRAFTДокумент3 страницыCFO Job Description DRAFTpatrickОценок пока нет

- Grace-AST Module 4Документ2 страницыGrace-AST Module 4Devine Grace A. MaghinayОценок пока нет

- Revenue Memorandum Circular No. 09-06: January 25, 2006Документ5 страницRevenue Memorandum Circular No. 09-06: January 25, 2006dom0202Оценок пока нет

- Selection Among AlternativesДокумент24 страницыSelection Among AlternativesDave DespabiladerasОценок пока нет

- Clean Mama's Guide to a Healthy Home: The Simple, Room-by-Room Plan for a Natural HomeОт EverandClean Mama's Guide to a Healthy Home: The Simple, Room-by-Room Plan for a Natural HomeРейтинг: 5 из 5 звезд5/5 (2)

- Summary of Goodbye, Things: The New Japanese Minimalism by Fumio SasakiОт EverandSummary of Goodbye, Things: The New Japanese Minimalism by Fumio SasakiРейтинг: 4.5 из 5 звезд4.5/5 (5)

- The Martha Manual: How to Do (Almost) EverythingОт EverandThe Martha Manual: How to Do (Almost) EverythingРейтинг: 4 из 5 звезд4/5 (11)

- The Gentle Art of Swedish Death Cleaning: How to Free Yourself and Your Family from a Lifetime of ClutterОт EverandThe Gentle Art of Swedish Death Cleaning: How to Free Yourself and Your Family from a Lifetime of ClutterРейтинг: 4 из 5 звезд4/5 (467)

- The Life-Changing Magic of Tidying Up: The Japanese Art of Decluttering and OrganizingОт EverandThe Life-Changing Magic of Tidying Up: The Japanese Art of Decluttering and OrganizingРейтинг: 4 из 5 звезд4/5 (2997)

- Decluttering at the Speed of Life: Winning Your Never-Ending Battle with StuffОт EverandDecluttering at the Speed of Life: Winning Your Never-Ending Battle with StuffРейтинг: 4.5 из 5 звезд4.5/5 (578)

- Declutter Like a Mother: A Guilt-Free, No-Stress Way to Transform Your Home and Your LifeОт EverandDeclutter Like a Mother: A Guilt-Free, No-Stress Way to Transform Your Home and Your LifeРейтинг: 4.5 из 5 звезд4.5/5 (164)

- How to Keep House While Drowning: A Gentle Approach to Cleaning and OrganizingОт EverandHow to Keep House While Drowning: A Gentle Approach to Cleaning and OrganizingРейтинг: 4.5 из 5 звезд4.5/5 (847)

- Success at Home with ADHD.: Practical Organization Strategies to Make Your Life Easier.От EverandSuccess at Home with ADHD.: Practical Organization Strategies to Make Your Life Easier.Рейтинг: 4 из 5 звезд4/5 (17)

- It's All Too Much: An Easy Plan for Living a Richer Life with Less StuffОт EverandIt's All Too Much: An Easy Plan for Living a Richer Life with Less StuffРейтинг: 4 из 5 звезд4/5 (232)

- Build Your Own Sheds & Outdoor Projects Manual, Fifth Edition: Over 200 Plans InsideОт EverandBuild Your Own Sheds & Outdoor Projects Manual, Fifth Edition: Over 200 Plans InsideРейтинг: 5 из 5 звезд5/5 (1)

- The Joy of Less: A Minimalist Guide to Declutter, Organize, and SimplifyОт EverandThe Joy of Less: A Minimalist Guide to Declutter, Organize, and SimplifyРейтинг: 4 из 5 звезд4/5 (278)

- Summary of KC Davis's How to Keep House While DrowningОт EverandSummary of KC Davis's How to Keep House While DrowningРейтинг: 5 из 5 звезд5/5 (1)

- How to Keep House While Drowning: A Gentle Approach to Cleaning and OrganizingОт EverandHow to Keep House While Drowning: A Gentle Approach to Cleaning and OrganizingРейтинг: 4.5 из 5 звезд4.5/5 (79)

- Let It Go: Downsizing Your Way to a Richer, Happier LifeОт EverandLet It Go: Downsizing Your Way to a Richer, Happier LifeРейтинг: 4.5 из 5 звезд4.5/5 (67)

- The Buy Nothing, Get Everything Plan: Discover the Joy of Spending Less, Sharing More, and Living GenerouslyОт EverandThe Buy Nothing, Get Everything Plan: Discover the Joy of Spending Less, Sharing More, and Living GenerouslyРейтинг: 4 из 5 звезд4/5 (40)

- How to Manage Your Home Without Losing Your Mind: Dealing with Your House's Dirty Little SecretsОт EverandHow to Manage Your Home Without Losing Your Mind: Dealing with Your House's Dirty Little SecretsРейтинг: 5 из 5 звезд5/5 (339)

- Carpentry Made Easy - The Science and Art of Framing - With Specific Instructions for Building Balloon Frames, Barn Frames, Mill Frames, Warehouses, Church SpiresОт EverandCarpentry Made Easy - The Science and Art of Framing - With Specific Instructions for Building Balloon Frames, Barn Frames, Mill Frames, Warehouses, Church SpiresРейтинг: 1 из 5 звезд1/5 (2)

- Building Outdoor Furniture: Classic Deck, Patio & Garden Projects That Will Last a LifetimeОт EverandBuilding Outdoor Furniture: Classic Deck, Patio & Garden Projects That Will Last a LifetimeОценок пока нет

- Martha Stewart's Organizing: The Manual for Bringing Order to Your Life, Home & RoutinesОт EverandMartha Stewart's Organizing: The Manual for Bringing Order to Your Life, Home & RoutinesРейтинг: 4 из 5 звезд4/5 (11)

- Mini Farming: Self-Sufficiency on 1/4 AcreОт EverandMini Farming: Self-Sufficiency on 1/4 AcreРейтинг: 4.5 из 5 звезд4.5/5 (6)

- Kintsugi Wellness: The Japanese Art of Nourishing Mind, Body, and SpiritОт EverandKintsugi Wellness: The Japanese Art of Nourishing Mind, Body, and SpiritРейтинг: 4.5 из 5 звезд4.5/5 (3)

- How to Build a House: A Practical, Common-Sense Guide to Residential ConstructionОт EverandHow to Build a House: A Practical, Common-Sense Guide to Residential ConstructionРейтинг: 4 из 5 звезд4/5 (5)