Академический Документы

Профессиональный Документы

Культура Документы

RBI Guide Joint

Загружено:

THAVENDRA KUMARОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

RBI Guide Joint

Загружено:

THAVENDRA KUMARАвторское право:

Доступные форматы

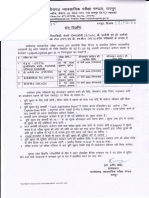

प्रेस प्रकाशनी PRESS RELEASE

भारतीय �रज़वर् ब�क

RESERVE BANK OF INDIA

संचार �वभाग, क�द्र�य कायार्लय, एस.बी.एस.मागर्, मुंबई-400001

_____________________________________________________________________________________________________________________

0 : www.rbi.org.in/hindi

वेबसाइट

DEPARTMENT OF COMMUNICATION, Central Office, S.B.S.Marg, Mumbai-400001 Website : www.rbi.org.in

फोन/Phone: 022 2261 0835 फैक्स/Fax: 91 22 22660358 इ-मेल email: helpdoc@rbi.org.in

October 06, 2017

Sovereign Gold Bond Scheme 2017-18– Series-III

Government of India, in consultation with the Reserve Bank of India, has

decided to issue Sovereign Gold Bonds 2017-18 – Series-III. Applications for the

bond will be accepted from October 09, 2017 to December 27, 2017. The Bonds will

be issued on the succeeding Monday after each subscription period. The Bonds will

be sold through banks, Stock Holding Corporation of India Limited (SHCIL),

designated post offices and recognised stock exchanges viz., National Stock

Exchange of India Limited and Bombay Stock Exchange. The features of the Bond

are given below:

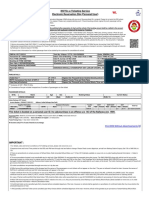

Sl. No. Item Details

1 Product name Sovereign Gold Bond 2017-18 – Series-III

2 Issuance To be issued by Reserve Bank India on behalf of the

Government of India.

3 Eligibility The Bonds will be restricted for sale to resident Indian

entities including individuals, HUFs, Trusts, Universities

and Charitable Institutions.

4 Denomination The Bonds will be denominated in multiples of gram(s) of

gold with a basic unit of 1 gram.

5 Tenor The tenor of the Bond will be for a period of 8 years with

exit option from 5th year to be exercised on the interest

payment dates.

6 Minimum size Minimum permissible investment will be 1 gram of gold.

7 Maximum limit The maximum limit of subscribed shall be 4 KG for

individual, 4 Kg for HUF and 20 Kg for trusts and similar

entities per fiscal (April-March) notified by the Government

from time to time. A self-declaration to this effect will be

obtained. The annual ceiling will include bonds

subscribed under different tranches during initial issuance

by Government and those purchased from the Secondary

Market.

8 Joint holder In case of joint holding, the investment limit of 4 KG will be

applied to the first applicant only.

9 Issue price Price of Bond will be fixed in Indian Rupees on the basis

of simple average of closing price of gold of 999 purity

published by the India Bullion and Jewellers Association

Limited for the last 3 business days of the week preceding

the subscription period. The issue price of the Gold

Bonds will be ` 50 per gram less for those who

subscribe online and pay through digital mode.

2

10 Payment Payment for the Bonds will be through cash payment (upto

option a maximum of ` 20,000) or demand draft or cheque or

electronic banking.

11 Issuance form The Gold Bonds will be issued as Government of India

Stocks under GS Act, 2006. The investors will be issued a

Holding Certificate for the same. The Bonds are eligible for

conversion into demat form.

12 Redemption The redemption price will be in Indian Rupees based on

price simple average of closing price of gold of 999 purity of

previous 3 business days published by IBJA.

13 Sales channel Bonds will be sold through banks, Stock Holding

Corporation of India Limited (SHCIL), designated post

offices as may be notified and recognised stock

exchanges viz., National Stock Exchange of India Limited

and Bombay Stock Exchange, either directly or through

agents.

14 Interest rate The investors will be compensated at a fixed rate of 2.50

per cent per annum payable semi-annually on the nominal

value.

15 Collateral Bonds can be used as collateral for loans. The loan-to-

value (LTV) ratio is to be set equal to ordinary gold loan

mandated by the Reserve Bank from time to time.

16 KYC Know-your-customer (KYC) norms will be the same as

Documentation that for purchase of physical gold. KYC documents such

as Voter ID, Aadhaar card/PAN or TAN /Passport will be

required.

17 Tax treatment The interest on Gold Bonds shall be taxable as per the

provision of Income Tax Act, 1961 (43 of 1961). The

capital gains tax arising on redemption of SGB to an

individual has been exempted. The indexation benefits will

be provided to long term capital gains arising to any

person on transfer of bond

18 Tradability Bonds will be tradable on stock exchanges within a

fortnight of the issuance on a date as notified by the RBI.

19 SLR eligibility The Bonds will be eligible for Statutory Liquidity Ratio

purposes.

20 Commission Commission for distribution of the bond shall be paid at

the rate of 1% of the total subscription received by the

receiving offices and receiving offices shall share at least

50% of the commission so received with the agents or sub

agents for the business procured through them.

Ajit Prasad

Press Release : 2017-2018/957 Assistant Adviser

Вам также может понравиться

- RBI Guidelines PDFДокумент2 страницыRBI Guidelines PDFpadmgovi23Оценок пока нет

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2От EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2Оценок пока нет

- RBI announces Sovereign Gold Bond Scheme 2017-18 – Series IIIДокумент2 страницыRBI announces Sovereign Gold Bond Scheme 2017-18 – Series IIIKrishna AdhinarayanОценок пока нет

- Sovereign Gold Bond Scheme 2017-18 - Series IДокумент2 страницыSovereign Gold Bond Scheme 2017-18 - Series IAnonymous UserОценок пока нет

- Press Release - Issuance of Calendar of Sovereign Gold Bond Scheme For H2 of 2022-23Документ2 страницыPress Release - Issuance of Calendar of Sovereign Gold Bond Scheme For H2 of 2022-23kpb hindujОценок пока нет

- Beepedia Weekly Current Affairs (Beepedia) 9th-15th December 2023Документ45 страницBeepedia Weekly Current Affairs (Beepedia) 9th-15th December 2023BRAJ MOHAN KUIRYОценок пока нет

- SGB Scheme 2020-21 CalendarДокумент3 страницыSGB Scheme 2020-21 Calendarkranti kiran kandimallaОценок пока нет

- RBI GuidelinesДокумент2 страницыRBI GuidelinesK B TempОценок пока нет

- Sovereign Gold Bond Scheme (SGB)Документ2 страницыSovereign Gold Bond Scheme (SGB)kptripathi1405Оценок пока нет

- Sovereign Gold Bond 8Документ3 страницыSovereign Gold Bond 8sriniОценок пока нет

- RBI Weekly BeePedia Issues Sovereign Gold BondsДокумент36 страницRBI Weekly BeePedia Issues Sovereign Gold BondsAparajita AhujaОценок пока нет

- FAQs On Sovereign Gold Bond SCHEME Annx1Документ6 страницFAQs On Sovereign Gold Bond SCHEME Annx1Alok Kr MishraОценок пока нет

- Sovereign Gold Bonds (SGBS) - 2016 - Tranche - Iii Issue: Retail ResearchДокумент3 страницыSovereign Gold Bonds (SGBS) - 2016 - Tranche - Iii Issue: Retail ResearchDinesh ChoudharyОценок пока нет

- Draft Outline of The Sovereign Gold Bond Scheme (For Discussion Purposes Only)Документ3 страницыDraft Outline of The Sovereign Gold Bond Scheme (For Discussion Purposes Only)Anonymous nQtCpIqooОценок пока нет

- DM Cia 1aДокумент20 страницDM Cia 1aSahana SadanandОценок пока нет

- Retail InvestorДокумент4 страницыRetail InvestorPrasenjit VighneОценок пока нет

- RBI NotesДокумент443 страницыRBI NotesManish MishraОценок пока нет

- SGB FAQsДокумент6 страницSGB FAQskumararjan365Оценок пока нет

- Frequently Asked Questions (Faqs) Sovereign Gold Bond SchemeДокумент5 страницFrequently Asked Questions (Faqs) Sovereign Gold Bond SchemeVikramОценок пока нет

- Sovereign Gold Bond: August 2020Документ7 страницSovereign Gold Bond: August 2020Chintan SardaОценок пока нет

- Unit 4 - Govt. BondsДокумент14 страницUnit 4 - Govt. Bondsshubh duttОценок пока нет

- BOND VALUATION - kelompok 5 update v2 (1)Документ67 страницBOND VALUATION - kelompok 5 update v2 (1)Remano GitzkyОценок пока нет

- BOND VALUATION - Kelompok 5 UpdateДокумент67 страницBOND VALUATION - Kelompok 5 UpdateRemano GitzkyОценок пока нет

- 6670Документ134 страницы6670sandymadhu712715114024Оценок пока нет

- FAQs Sovereign Gold Bond Scheme Tranche IVДокумент5 страницFAQs Sovereign Gold Bond Scheme Tranche IVSaiОценок пока нет

- Branch Manager Central Bank of India - BranchДокумент4 страницыBranch Manager Central Bank of India - BranchikmОценок пока нет

- Sbi ReportДокумент8 страницSbi ReportKUMARAGURU PONRAJОценок пока нет

- Term Sheet 1. Name of The Instrument: Rivate Lacement Emorandum For Private Circulation OnlyДокумент20 страницTerm Sheet 1. Name of The Instrument: Rivate Lacement Emorandum For Private Circulation OnlyBalamurugan SankaravelОценок пока нет

- All RBI Circulars December 2023 (Part-1)Документ31 страницаAll RBI Circulars December 2023 (Part-1)vinay hedaooОценок пока нет

- Sovereign Gold Bond - by AdarshДокумент21 страницаSovereign Gold Bond - by AdarshAadarsh ChaudharyОценок пока нет

- Certificate of DepositДокумент14 страницCertificate of DepositASHISH BHATОценок пока нет

- Frequently Asked Questions - 2017Документ4 страницыFrequently Asked Questions - 2017GautamDuttaОценок пока нет

- Daily Current Affairs: 7 November 2023Документ18 страницDaily Current Affairs: 7 November 2023vivek dwivediОценок пока нет

- Frequently Asked Questions: Sovereign Gold Bond Scheme 2015Документ5 страницFrequently Asked Questions: Sovereign Gold Bond Scheme 2015JaireddyОценок пока нет

- Commercial Paper DeckДокумент15 страницCommercial Paper Decknaveen penugondaОценок пока нет

- Frequently Asked Questions (FAQs) Sovereign Gold Bond (SGB) Scheme - 10092017 PDFДокумент4 страницыFrequently Asked Questions (FAQs) Sovereign Gold Bond (SGB) Scheme - 10092017 PDFkamleshОценок пока нет

- ECB Practical ApproachДокумент4 страницыECB Practical ApproachCryosave100% (1)

- Analysis & Effects of Sovereign Gold Bonds: Priya BhandariДокумент7 страницAnalysis & Effects of Sovereign Gold Bonds: Priya BhandariPriyanshuОценок пока нет

- Understanding the Debt MarketДокумент17 страницUnderstanding the Debt MarketPushkaraj SaveОценок пока нет

- Loan Against Securities MeaningДокумент6 страницLoan Against Securities MeaningPratik LahotiОценок пока нет

- Monthly - Digest - December - 2022 ByjusДокумент38 страницMonthly - Digest - December - 2022 ByjusGayathri SukumaranОценок пока нет

- Sovereign Gold Bond - Product Features and FAQ'sДокумент3 страницыSovereign Gold Bond - Product Features and FAQ'ssanjithchowdaryОценок пока нет

- SEBI Guidelines on Money Market InstrumentsДокумент43 страницыSEBI Guidelines on Money Market Instrumentsdevesh chaudharyОценок пока нет

- 5 - Fiev - B - Group ProjectДокумент5 страниц5 - Fiev - B - Group ProjectAswath ChandrasekarОценок пока нет

- Indian Economy 09 - Daily Class Notes - (Sankalp (UPSC 2024) )Документ8 страницIndian Economy 09 - Daily Class Notes - (Sankalp (UPSC 2024) )Nittin BhagatОценок пока нет

- Issue of DebenturesДокумент28 страницIssue of DebenturesFalguni Mathews100% (1)

- SGB Circular Tranche2Документ4 страницыSGB Circular Tranche2ishan619Оценок пока нет

- Drishtee Diaries 2020Документ21 страницаDrishtee Diaries 2020Smriti ShahОценок пока нет

- THOUFIKA SUMMER INTERNSHIP REPORT SДокумент4 страницыTHOUFIKA SUMMER INTERNSHIP REPORT SKUMARAGURU PONRAJОценок пока нет

- KUMARAДокумент8 страницKUMARAKUMARAGURU PONRAJОценок пока нет

- 6 B Treasury InstrumentsДокумент10 страниц6 B Treasury InstrumentsRavi kumarОценок пока нет

- May 2023 BoltДокумент131 страницаMay 2023 BoltSuman SharmaОценок пока нет

- Floating Rate Savings BondsДокумент2 страницыFloating Rate Savings BondsTarique SiddiqueОценок пока нет

- CMR(Money Market Instruments): Commercial Papers, Certificates of Deposits, Treasury Bills, Participatory Notes, Banker's Acceptance & T-BondsДокумент12 страницCMR(Money Market Instruments): Commercial Papers, Certificates of Deposits, Treasury Bills, Participatory Notes, Banker's Acceptance & T-BondsRicha NandyОценок пока нет

- Group 5 SGBs TaxationДокумент20 страницGroup 5 SGBs Taxationpampa.mannaОценок пока нет

- Power FinanceДокумент7 страницPower FinanceMrigank MauliОценок пока нет

- Power FinanceДокумент7 страницPower FinanceMrigank MauliОценок пока нет

- RBI Urged to Raise Customer Balance Limit for Payments Banks to ₹5 LakhДокумент1 страницаRBI Urged to Raise Customer Balance Limit for Payments Banks to ₹5 Lakhshriya rajanОценок пока нет

- Ic Equivalent ListДокумент5 страницIc Equivalent ListTHAVENDRA KUMARОценок пока нет

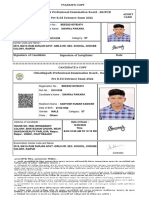

- BDED22103782474Документ1 страницаBDED22103782474THAVENDRA KUMARОценок пока нет

- Ie Rules-1956Документ191 страницаIe Rules-1956Murali MohanОценок пока нет

- Dividend-History 12Документ2 страницыDividend-History 12THAVENDRA KUMARОценок пока нет

- Provisional Marksheet MAR.-APR. 2022: Shaheed Nandkumar Patel Vishwavidyalaya, RaigarhДокумент1 страницаProvisional Marksheet MAR.-APR. 2022: Shaheed Nandkumar Patel Vishwavidyalaya, RaigarhTHAVENDRA KUMARОценок пока нет

- Scan Doc by CamScannerДокумент1 страницаScan Doc by CamScannerTHAVENDRA KUMARОценок пока нет

- Electricity Bill TGHHДокумент1 страницаElectricity Bill TGHHTHAVENDRA KUMARОценок пока нет

- RF - FormДокумент3 страницыRF - FormTHAVENDRA KUMARОценок пока нет

- (May 2022) Dahua Hdcvi MopДокумент1 страница(May 2022) Dahua Hdcvi MopTHAVENDRA KUMARОценок пока нет

- Rac 12 PDFДокумент116 страницRac 12 PDFTHAVENDRA KUMARОценок пока нет

- Listcontract3 2062019175016 SEIntimation Reg34 301Документ381 страницаListcontract3 2062019175016 SEIntimation Reg34 301NOUSHAD KОценок пока нет

- Cnss FW Logs CurrentДокумент1 страницаCnss FW Logs CurrentTHAVENDRA KUMARОценок пока нет

- Eoa PDFДокумент45 страницEoa PDFduki banaОценок пока нет

- PRESS NOTEificatmnДокумент1 страницаPRESS NOTEificatmnTHAVENDRA KUMARОценок пока нет

- FCI - Zone Wise Managers Recruitment 2019 - Notification PDFДокумент44 страницыFCI - Zone Wise Managers Recruitment 2019 - Notification PDFVed Prakash ChoudharyОценок пока нет

- InvicceДокумент1 страницаInvicceTHAVENDRA KUMARОценок пока нет

- Admit CardДокумент1 страницаAdmit CardTHAVENDRA KUMARОценок пока нет

- Dinesh D TicketДокумент3 страницыDinesh D TicketTHAVENDRA KUMARОценок пока нет

- Symbols PDFДокумент2 страницыSymbols PDFKuttappa I GОценок пока нет

- LED LIGHT TENDERДокумент1 страницаLED LIGHT TENDERTHAVENDRA KUMARОценок пока нет

- CurrentRatings PDFДокумент0 страницCurrentRatings PDFVirajitha MaddumabandaraОценок пока нет

- Bijli BillДокумент1 страницаBijli BillTHAVENDRA KUMARОценок пока нет

- Cable Catalogue-2016 PDFДокумент64 страницыCable Catalogue-2016 PDFSuman Mandal100% (1)

- Nit 1266 PDFДокумент1 страницаNit 1266 PDFTHAVENDRA KUMARОценок пока нет

- INTERNET STANDARDSДокумент18 страницINTERNET STANDARDSDawn HaneyОценок пока нет

- Nit T 51Документ1 страницаNit T 51THAVENDRA KUMARОценок пока нет

- Delta V Course 7009-12Документ16 страницDelta V Course 7009-12Freddy TorresОценок пока нет

- CurrentRatings PDFДокумент0 страницCurrentRatings PDFVirajitha MaddumabandaraОценок пока нет

- Symbols PDFДокумент2 страницыSymbols PDFKuttappa I GОценок пока нет

- Pay-In-Slip: Electrical/Mechanical/ Electronics/ Instrumentation - E2 Grade For Shift Operation of Thermal Power PlantДокумент1 страницаPay-In-Slip: Electrical/Mechanical/ Electronics/ Instrumentation - E2 Grade For Shift Operation of Thermal Power PlantSIDDHANTОценок пока нет

- Venture Capital: Presented by Suhail Rajani Yogesh Varnekar Paulami ChetnaДокумент17 страницVenture Capital: Presented by Suhail Rajani Yogesh Varnekar Paulami Chetnapragadish_nОценок пока нет

- Kerala Govt Raises House Building Loan Limit to Rs. 25 LakhДокумент2 страницыKerala Govt Raises House Building Loan Limit to Rs. 25 LakhnarenczОценок пока нет

- Retail Lending Policy 2010-11Документ25 страницRetail Lending Policy 2010-11Bhandup YadavОценок пока нет

- Basel NormsДокумент23 страницыBasel NormsPranu PranuОценок пока нет

- 09304079.pdf New Foreign PDFДокумент44 страницы09304079.pdf New Foreign PDFJannatul FerdousОценок пока нет

- Visa NetДокумент22 страницыVisa NetPahul WaliaОценок пока нет

- 4th Qtr Accounting Project AnalysisДокумент11 страниц4th Qtr Accounting Project AnalysisRaffy EmataОценок пока нет

- JNTU Kakinada 89 Alumni Reunion InviteДокумент4 страницыJNTU Kakinada 89 Alumni Reunion InvitesamirpalliОценок пока нет

- 1Документ1 страница1Pulkit KhedwalОценок пока нет

- Payroll: 1. What Is Oracle Payroll?Документ8 страницPayroll: 1. What Is Oracle Payroll?balasukОценок пока нет

- Correspondent bank liability under letters of creditДокумент1 страницаCorrespondent bank liability under letters of creditkathreenmonjeОценок пока нет

- DSK BANK Presentation 2007Документ13 страницDSK BANK Presentation 2007Stefania SimonaОценок пока нет

- Wolters Kluwer-OneSumX-Basel IV Vs Basel III InfographicДокумент1 страницаWolters Kluwer-OneSumX-Basel IV Vs Basel III InfographicAlkОценок пока нет

- Module 2 Math of InvestmentДокумент17 страницModule 2 Math of InvestmentvlythevergreenОценок пока нет

- Business ServicesДокумент11 страницBusiness ServicesBhoomi KachhiaОценок пока нет

- Cab Report Mid SipДокумент74 страницыCab Report Mid SipSawarmal ChoudharyОценок пока нет

- Banking Sector Overview: Definitions, Regulation, FunctionsДокумент39 страницBanking Sector Overview: Definitions, Regulation, FunctionsDieu NguyenОценок пока нет

- Forward Contracts Prohibitions On PDFДокумент23 страницыForward Contracts Prohibitions On PDFIqbal PramaditaОценок пока нет

- Manual Google SitesДокумент28 страницManual Google SitesAntonio DelgadoОценок пока нет

- Wise Transaction Invoice Transfer 814368287 1721868089 TRДокумент2 страницыWise Transaction Invoice Transfer 814368287 1721868089 TRhmobgpxwhlugnvplokОценок пока нет

- Specimen Copy For M.Tech Admission Interview Call LetterДокумент3 страницыSpecimen Copy For M.Tech Admission Interview Call LetterApeksha KoreОценок пока нет

- TE040 Test Script APДокумент28 страницTE040 Test Script APphoganОценок пока нет

- Amadeus Qatar EMD User Guide: Issuing, Reissuing, Canceling EMDsДокумент177 страницAmadeus Qatar EMD User Guide: Issuing, Reissuing, Canceling EMDsdlogic0% (1)

- 03 08 12 Motion To Consolidate Memorandum of Points and AuthoritiesДокумент10 страниц03 08 12 Motion To Consolidate Memorandum of Points and AuthoritiesR. Castaneda100% (2)

- Peter Brandt - BestDressed2016Документ24 страницыPeter Brandt - BestDressed2016ghafarkhaniОценок пока нет

- Financial InclusionДокумент6 страницFinancial InclusionsignОценок пока нет

- Money and CreditДокумент7 страницMoney and CreditSunil Sharma100% (1)

- Payment Bank Impact On Digital BankingДокумент78 страницPayment Bank Impact On Digital BankingSudharshan Reddy P0% (1)

- Interest Free BankingДокумент19 страницInterest Free BankingSameer ShafqatОценок пока нет

- Study of Non Performing Assets in Bank of Maharashtra.Документ74 страницыStudy of Non Performing Assets in Bank of Maharashtra.Arun Savukar60% (10)