Академический Документы

Профессиональный Документы

Культура Документы

Recommendation of Advisory Committee

Загружено:

madhumay23Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Recommendation of Advisory Committee

Загружено:

madhumay23Авторское право:

Доступные форматы

18

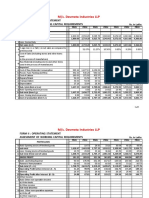

2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18

Liabilities

Capital (` in crore) 635 635 635 671 684 747 747 776 797 892

Reserves & Surplus (` in crore) 57,313 65,314 64,351 83,280 98,200 1,17,536 1,27,692 1,43,498 1,87,489 2,18,236

Deposits (` in crore) 7,42,073 8,04,116 9,33,933 10,43,647 12,02,740 13,94,409 15,76,793 17,30,722 20,44,751 27,06,344

Borrowings (` in crore) 53,713 1,03,012 1,19,569 1,27,006 1,69,183 1,83,131 2,05,150 3,23,345 3,17,694 3,62,142

other’s (` in crore) 1,10,698 80,337 1,05,248 80,915 95,404 96,927 1,37,698 1,59,276 1,55,235 1,67,138

Total(` in crore) 9,64,432 10,53,414 12,23,736 13,35,519 15,66,211 17,92,748 20,48,080 23,57,617 27,05,966 34,54,752

Assets

Investments (` in crore) 2,75,954 2,85,790 2,95,601 3,12,198 3,50,878 3,98,800 4,81,759 5,75,652 7,65,990 10,60,987

Advances (` in crore) 5,42,503 6,31,914 7,56,719 8,67,579 10,45,617 12,09,829 13,00,026 14,63,700 15,71,078 19,34,880

Financial Highlights:

10 years at a Glance

other Assets (` in crore) 1,45,975 1,35,710 1,71,416 1,55,742 1,69,716 1,84,119 2,66,295 3,18,265 3,68,898 4,58,885

Total (` in crore) 9,64,432 10,53,414 12,23,736 13,35,519 15,66,211 17,92,748 20,48,080 23,57,617 27,05,966 34,54,752

Net Interest Income (` in crore) 20,873 23,671 32,526 43,291 44,329 49,282 55,015 57,195 61,860 74,854

Provisions for NPA (` in crore) 2,475 5,148 8,792 11,546 11,368 14,224 17,908 26,984 32,247 70,680

operating Result (` in crore) 17,915 18,321 25,336 31,574 31,082 32,109 39,537 43,258 50,848 59,511

Net Profit Before Taxes (` in crore) 14,181 13,926 14,954 18,483 19,951 16,174 19,314 13,774 14,855 -15,528

Net Profit (` in crore) 9121 9,166 8,265 11,707 14,105 10,891 13,102 9,951 10,484 -6,547

Return on Average Assets (%) 1.04 0.88 0.71 0.88 0.97 0.65 0.68 0.46 0.41 -0.19

Return on equity (%) 15.07 14.04 12.84 14.36 15.94 10.49 11.17 7.74 7.25 -3.78

expenses to Income (%) (operating 46.62 52.59 47.6 45.23 48.51 52.67 49.04 49.13 47.75 50.18

expenses to total Net Income)

Profit Per employee (` in 000) 474 446 385 531 645 485 602 470 511 -243

earnings Per Share (`)* 143.77 144.37 130.16 184.31 210.06 156.76 17.55 12.98 13.43 -7.67

Dividend Per Share (`)* 29 30 30 35 41.5 30 3.5 2.60 2.60 Nil

SBI Share (Price on NSE) (`)* 1,067.10 2,078.20 2,765.30 2,096.35 2,072.75 1,917.70 267.05 194.25 293.40 249.90

Dividend Pay out Ratio % (`) 20.19 20.78 23.05 20.06 20.12 20.56 20.21 20.28 20.11 NA

Capital Adequacy Ratio (%)

(` in crore) 85,393 90,975 98,530 1,16,325 1,29,362 1,45,845 1,54,491 1,81,800 2,06,685 2,34,056

Basel-II (%) 14.25 13.39 11.98 13.86 12.92 12.96 12.79 13.94 13.56 12.74

(` in crore) 56,257 64,177 63,901 82,125 94,947 1,12,333 1,22,025 1,35,757 1,56,506 1,84,146

Tier I (%) 9.38 9.45 7.77 9.79 9.49 9.98 10.1 10.41 10.27 10.02

(` in crore) 29,136 26,798 34,629 34,200 34,415 33,512 32,466 46,043 50,179 49,910

Tier II (%) 4.87 3.94 4.21 4.07 3.43 2.98 2.69 3.53 3.29 2.72

(` in crore) N.A N.A N.A N.A N.A 1,40,151 1,46,519 1,75,903 2,04,731 2,38,154

Basel-III (%) 12.44 12 13.12 13.11 12.60

(` in crore) N.A N.A N.A N.A N.A 1,09,547 1,17,157 1,33,035 1,61,644 1,95,820

Tier I (%) 9.72 9.6 9.92 10.35 10.36

(` in crore) N.A N.A N.A N.A N.A 30,604 29,362 42,868 43,087 42,334

Tier II (%) 2.72 2.4 3.20 2.76 2.24

Net NPA to Net Advances (%) 1.79 1.72 1.63 1.82 2.1 2.57 2.12 3.81 3.71 5.73

Number of Domestic Branches 11,448 12,496 13,542 14,097 14,816 15,869 16,333 16,784 17,170 22,414

Number of Foreign Branches /offices 92 142 156 173 186 190 191 198 195 206

Financial Highlights: 10 years at a Glance

nd

*The face value of shares of the Bank was split from `10 per share to `1 per share - wef. 22 November, 2014. The data is on `1 per share from 2014-15

onwards and `10 per share for remaining previous year.

Вам также может понравиться

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosОт EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosОценок пока нет

- Business Valuation Model ExcelДокумент20 страницBusiness Valuation Model ExcelWagane DioufОценок пока нет

- Putting Intelligent Insights To WorkДокумент12 страницPutting Intelligent Insights To WorkDeloitte Analytics100% (1)

- Profit and loss analysis of 5 yearsДокумент5 страницProfit and loss analysis of 5 yearspratikОценок пока нет

- Trading SardinesДокумент6 страницTrading Sardinessim tykesОценок пока нет

- Balance Sheet: Hindalco IndustriesДокумент20 страницBalance Sheet: Hindalco Industriesparinay202Оценок пока нет

- Teuer Furniture A Case Solution PPT (Group-04)Документ13 страницTeuer Furniture A Case Solution PPT (Group-04)sachin100% (4)

- Case IДокумент20 страницCase ICherry KanjanapornsinОценок пока нет

- DR Lal Path Labs Financial Model - Ayushi JainДокумент45 страницDR Lal Path Labs Financial Model - Ayushi JainTanya SinghОценок пока нет

- Graduate and Intern Opportunities at Top Advisory Firm EvercoreДокумент14 страницGraduate and Intern Opportunities at Top Advisory Firm Evercoreheedi0Оценок пока нет

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosОт EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosОценок пока нет

- Non-Disclosure Real Estate Deal Fee PactДокумент7 страницNon-Disclosure Real Estate Deal Fee PactabhitagsОценок пока нет

- Sam Altman's Advice on Why You Should Start a Startup and Tips for SuccessДокумент56 страницSam Altman's Advice on Why You Should Start a Startup and Tips for SuccesscanyoubarrettОценок пока нет

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioОт EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioОценок пока нет

- New Heritage Doll Company Financial AnalysisДокумент31 страницаNew Heritage Doll Company Financial AnalysisSoundarya AbiramiОценок пока нет

- Finacial Management Full NotesДокумент114 страницFinacial Management Full NotesBhaskaran BalamuraliОценок пока нет

- Annual Report 2023Документ1 страницаAnnual Report 2023missionupscias2016Оценок пока нет

- Annual Accounts 2021Документ11 страницAnnual Accounts 2021Shehzad QureshiОценок пока нет

- We Are Not Above Nature, We Are A Part of NatureДокумент216 страницWe Are Not Above Nature, We Are A Part of NaturePRIYADARSHI GOURAVОценок пока нет

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksДокумент32 страницыThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5Оценок пока нет

- Bhai Bhai SpinningДокумент18 страницBhai Bhai SpinningSharifMahmudОценок пока нет

- Caterpillar IndicadoresДокумент24 страницыCaterpillar IndicadoresChris Fernandes De Matos BarbosaОценок пока нет

- Tata MotorsДокумент5 страницTata Motorsinsurana73Оценок пока нет

- Key Operating and Financial Data 2017 For Website Final 20.3.2018Документ2 страницыKey Operating and Financial Data 2017 For Website Final 20.3.2018MubeenОценок пока нет

- New Microsoft Word DocumentДокумент2 страницыNew Microsoft Word Documentনীল আকাশОценок пока нет

- Y-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesДокумент45 страницY-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesSHIKHA CHAUHANОценок пока нет

- UltraTech Financial Statement - Ratio AnalysisДокумент11 страницUltraTech Financial Statement - Ratio AnalysisYen HoangОценок пока нет

- OVL English Annual Report 19-20-24!11!2020Документ394 страницыOVL English Annual Report 19-20-24!11!2020hitstonecoldОценок пока нет

- Coca-Cola Co Financials at a Glance (2008-2017Документ6 страницCoca-Cola Co Financials at a Glance (2008-2017SibghaОценок пока нет

- Horizontal Balance SheetДокумент2 страницыHorizontal Balance Sheetkathir_petroОценок пока нет

- PV OIl Financial Spreadsheet AnalysisДокумент32 страницыPV OIl Financial Spreadsheet AnalysisNguyễn Minh ThànhОценок пока нет

- Asian Paints (Autosaved) 2Документ32 767 страницAsian Paints (Autosaved) 2niteshjaiswal8240Оценок пока нет

- Final ExamДокумент10 страницFinal ExamMustafa Azeem MunnaОценок пока нет

- Balance Sheet RsДокумент5 страницBalance Sheet RsBinesh BashirОценок пока нет

- Performance AGlanceДокумент1 страницаPerformance AGlanceHarshal SawaleОценок пока нет

- Devmeta Project Report CmaДокумент9 страницDevmeta Project Report CmaharshОценок пока нет

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreДокумент12 страницMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhОценок пока нет

- AkzoNobel Last Five YearsДокумент2 страницыAkzoNobel Last Five YearsNawair IshfaqОценок пока нет

- MGM China Holdings Ltd (2282 HK) - Multiples OverviewДокумент148 страницMGM China Holdings Ltd (2282 HK) - Multiples OverviewDaniel HernàndezОценок пока нет

- Part D.2-Vertical AnalysisДокумент32 страницыPart D.2-Vertical AnalysisQuendrick Surban100% (1)

- EVA ExampleДокумент27 страницEVA Examplewelcome2jungleОценок пока нет

- AOFSДокумент15 страницAOFS1abd1212abdОценок пока нет

- Shoppers Stop Financial Model - 24july2021Документ23 страницыShoppers Stop Financial Model - 24july2021ELIF KOTADIYAОценок пока нет

- Growth, Profitability, and Financial Ratios For Citra Marga Nusaphala Persada TBK (CMNP) FromДокумент1 страницаGrowth, Profitability, and Financial Ratios For Citra Marga Nusaphala Persada TBK (CMNP) FromadjipramОценок пока нет

- Project Report PDFДокумент13 страницProject Report PDFMan KumaОценок пока нет

- Booking Holdings Inc. (BKNG) 24 Years of Financial Statements Roic - AiДокумент3 страницыBooking Holdings Inc. (BKNG) 24 Years of Financial Statements Roic - AiNicolas GomezОценок пока нет

- DR Lal Path Labs Financial Model - Ayushi JainДокумент39 страницDR Lal Path Labs Financial Model - Ayushi JainDeepak NechlaniОценок пока нет

- Income Statement, Balance Sheet, Cash Flow Analysis 2016-2021Документ9 страницIncome Statement, Balance Sheet, Cash Flow Analysis 2016-2021Shahrukh1994007Оценок пока нет

- Performance of Infosys For The Third Quarter Ended December 31Документ33 страницыPerformance of Infosys For The Third Quarter Ended December 31ubmba06Оценок пока нет

- 3 Statement Financial Analysis TemplateДокумент14 страниц3 Statement Financial Analysis TemplateCười Vê LờОценок пока нет

- Kohinoor Chemical Company LTD.: Horizontal AnalysisДокумент19 страницKohinoor Chemical Company LTD.: Horizontal AnalysisShehreen ArnaОценок пока нет

- GR I Crew XV 2018 TcsДокумент79 страницGR I Crew XV 2018 TcsMUKESH KUMARОценок пока нет

- DCF 2 CompletedДокумент4 страницыDCF 2 CompletedPragathi T NОценок пока нет

- Income Statement FINALДокумент2 страницыIncome Statement FINALLenard TaberdoОценок пока нет

- Annextures Balance Sheet of Larsen & Toubro From The Year 2011 To The Year 2015Документ3 страницыAnnextures Balance Sheet of Larsen & Toubro From The Year 2011 To The Year 2015vandv printsОценок пока нет

- Nations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118Документ19 страницNations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118haffaОценок пока нет

- Financial HighlightsДокумент4 страницыFinancial HighlightsmomОценок пока нет

- INEOS StyrolutДокумент6 страницINEOS StyrolutPositive ThinkerОценок пока нет

- FINM 7044 Group Assignment 终Документ4 страницыFINM 7044 Group Assignment 终jimmmmОценок пока нет

- Financial HighlightsДокумент3 страницыFinancial HighlightsSalman SaeedОценок пока нет

- CDP Preparation Template Form 3c.1Документ6 страницCDP Preparation Template Form 3c.1Princess Hayria B. PiangОценок пока нет

- 2021-22Документ3 страницы2021-2241 lavanya NairОценок пока нет

- EVA ExampleДокумент14 страницEVA ExampleKhouseyn IslamovОценок пока нет

- Company Financial Analysis and Ratio Comparison Over 5 YearsДокумент6 страницCompany Financial Analysis and Ratio Comparison Over 5 YearsAanchal MahajanОценок пока нет

- PHILEX - V and H AnalysisДокумент8 страницPHILEX - V and H AnalysisHilario, Jana Rizzette C.Оценок пока нет

- VerticalДокумент2 страницыVerticalPatricia PeñaОценок пока нет

- United Tractors TBK.: Balance Sheet Dec-06 DEC 2007 DEC 2008Документ26 страницUnited Tractors TBK.: Balance Sheet Dec-06 DEC 2007 DEC 2008sariОценок пока нет

- MainMenuEnglishLevel-2 FAQ PDFДокумент19 страницMainMenuEnglishLevel-2 FAQ PDFmadhumay23Оценок пока нет

- SSC CGL Tier II Study Schedule PDFДокумент5 страницSSC CGL Tier II Study Schedule PDFAtul ChoudharyОценок пока нет

- 3 2014-Estt - Res.-06062014Документ2 страницы3 2014-Estt - Res.-06062014Vicky GautamОценок пока нет

- Prescription & Its PartsДокумент8 страницPrescription & Its Partsmadhumay23100% (1)

- Accounting For Partnership - UnaДокумент13 страницAccounting For Partnership - UnaJastine Beltran - PerezОценок пока нет

- Presentation V3 - FCAДокумент16 страницPresentation V3 - FCAJulian OwinoОценок пока нет

- Hypo Week 9Документ2 страницыHypo Week 9Jari JungОценок пока нет

- Synopsis of Financial Analysis of Indian Overseas BankДокумент8 страницSynopsis of Financial Analysis of Indian Overseas BankAmit MishraОценок пока нет

- Stéphane Giraud EGIS France PPPДокумент31 страницаStéphane Giraud EGIS France PPPvikasОценок пока нет

- VAT NotesДокумент31 страницаVAT NotesAbinas Parida60% (5)

- Ratio Analysis IfficoДокумент75 страницRatio Analysis IfficosuryakantshrotriyaОценок пока нет

- David Collis Strategy Course OutlineДокумент32 страницыDavid Collis Strategy Course OutlineKumarVelivelaОценок пока нет

- ACWI Equal Weighted FactsheetДокумент2 страницыACWI Equal Weighted FactsheetRoberto PerezОценок пока нет

- Title: Instructions For UseДокумент31 страницаTitle: Instructions For UseYosart AdiОценок пока нет

- Task (3.4) Calculate RatiosДокумент7 страницTask (3.4) Calculate RatiosAnonymous xOqiXnW9Оценок пока нет

- ACT312 Quiz1 Online-1 PDFДокумент6 страницACT312 Quiz1 Online-1 PDFCharlie Harris0% (1)

- Technology AnnualДокумент84 страницыTechnology AnnualSecurities Lending TimesОценок пока нет

- Meezan Bank Report FinalДокумент61 страницаMeezan Bank Report FinalMuhammad JamilОценок пока нет

- Boi ProjectДокумент66 страницBoi Projectnitin0010Оценок пока нет

- Asian PaintsДокумент19 страницAsian PaintsAmrita KaurОценок пока нет

- Axis Reinsurance Oveview - FinalДокумент10 страницAxis Reinsurance Oveview - Finalapi-252940667Оценок пока нет

- ADM 2350A Formula SheetДокумент12 страницADM 2350A Formula SheetJoeОценок пока нет

- Inggris Chapter 2Документ4 страницыInggris Chapter 2Alam MahardikaОценок пока нет

- 12th Economics Chapter 5 & 6Документ38 страниц12th Economics Chapter 5 & 6anupsorenОценок пока нет

- APTДокумент7 страницAPTStefanОценок пока нет

- Capital Structure MSCIДокумент10 страницCapital Structure MSCIinam ullahОценок пока нет

- Kotak Assured Income PlanДокумент9 страницKotak Assured Income Plandinesh2u85Оценок пока нет