Академический Документы

Профессиональный Документы

Культура Документы

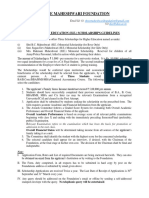

Declaration of Income For Fee Remission For The Academic Year 2018-19

Загружено:

kunal sinha0 оценок0% нашли этот документ полезным (0 голосов)

13 просмотров2 страницыThe document is a declaration of income form for a student applying for fee remission at the Indian Institute of Technology (Banaras Hindu University), Varanasi. It requires signatures and income information from the student's parents or guardian. The form collects information such as annual family income, occupation, tax filing status, permanent account number, and Aadhar number. Signers must declare that the information provided is true and understand penalties for false declarations, including withdrawal of fee remission or legal action.

Исходное описание:

Form e

Оригинальное название

form-e

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThe document is a declaration of income form for a student applying for fee remission at the Indian Institute of Technology (Banaras Hindu University), Varanasi. It requires signatures and income information from the student's parents or guardian. The form collects information such as annual family income, occupation, tax filing status, permanent account number, and Aadhar number. Signers must declare that the information provided is true and understand penalties for false declarations, including withdrawal of fee remission or legal action.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

13 просмотров2 страницыDeclaration of Income For Fee Remission For The Academic Year 2018-19

Загружено:

kunal sinhaThe document is a declaration of income form for a student applying for fee remission at the Indian Institute of Technology (Banaras Hindu University), Varanasi. It requires signatures and income information from the student's parents or guardian. The form collects information such as annual family income, occupation, tax filing status, permanent account number, and Aadhar number. Signers must declare that the information provided is true and understand penalties for false declarations, including withdrawal of fee remission or legal action.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

Form-E

INDIAN INSTITUTE OF TECHNOLOGY (BANARAS HINDU UNIVERSITY), VARANASI

DECLARATION OF INCOME FOR FEE REMISSION FOR THE ACADEMIC YEAR 2018-19

(This form needs to be completed and signed by all living parent(s). If any one parent is not alive, the word ‘Late’ may be prefixed to that

parent’s name in the concerned field marked * below. In case parents are not alive, guardian may fill the form in concerned field. Student

concerned is also required to sign and date both pages of this form. Declaration, that is incomplete or unsigned or without required

self-certified enclosures may not be accepted.)

We/I, ______________________________________________________ [father*] and __________________

___________________ [mother*]/ __________________________________________ [guardian (in case

parents are not alive)] of ___________________________________________ (name of the student)

who is admitted in _______________________________________________ at IIT(BHU), Varanasi, do

hereby declare that our/my annual income from all sources during the financial year ended 31.03.2018

was Rs. ________________ (in figures) Rs. _______________________________________ (in words).

We/I further declare that the above information given by us/me is true to the best of our/my

knowledge and if it is found at any stage that the information given by us/me is false, the fee

remission sanctioned could be withdrawn and/or recovered from me and/or legal action as

deemed fit taken against us/me and/or our/my son/daughter/ward.

Father’s signature with date Mother’s signature with date Guardian’s signature with date

(In case parents are not alive)

Father’s declaration –

I ___________________________________________ (father) further declare that:

a) I am self employed and have the following business/profession _______________________

______________ operating from _____________________________________________________

_____________________________________________________ (complete address).

b) I am employed as _________________ (designation) with _______________________________

_________ (name of employer) which is a government/public/private organization and my

workplace address is _____________________________________________________________.

(Please enclose self-certified copy of latest Form-16 issued by your employer.)

c) I am not/am an income tax payee. (Please enclose self-certified copy of Income Tax Return Acknowledgement for

the financial year ended on 31.03.2018 received from the Income Tax Department. In case the same is not available on the date of

submission of this form, the fee remission shall only be provisionally allowed and subject to confirmation on receipt of the above

document before 30th September 2018.)

d) My Permanent Account Number (PAN) issued by the Income Tax Department is __________

(Please enclose self-certified photocopy of your PAN card)/ I do not have any PAN number.

e) My Aadhar number is _____________________ (Please enclose self-certified photocopy of your Aadhar card)/ I

do not have any Aadhar number.

f) The above information given by me is true to the best of my knowledge and if it is found at any stage that the

information given by me is false, the fee remission sanctioned could be withdrawn and/or recovered from me

and/or legal action, as deemed fit, may be taken against me and/or my ward.

Date: ________________ Signature of Father

Page 1 of 2

Student’s signature with date

Mother’s declaration –

I ___________________________________________ (mother) further declare that:

a) I am self employed and have the following business/profession _______________________

______________ operating from _____________________________________________________

_____________________________________________________ (complete address).

b) I am employed as _________________ (designation) with _______________________________

_________ (name of employer) which is a government/public/private organization and my

workplace address is _____________________________________________________________.

(Please enclose self-certified copy of latest Form-16 issued by your employer.)

c) I am not/am an income tax payee. (Please enclose self-certified copy of Income Tax Return Acknowledgement for

the financial year ended on 31.03.2018 received from the Income Tax Department. In case the same is not available on the date of

submission of this form, the fee remission shall only be provisionally allowed and subject to confirmation on receipt of the above

document before 30th September 2018.)

d) My Permanent Account Number (PAN) issued by the Income Tax Department is __________

(Please enclose self-certified photocopy of your PAN card)/ I do not have any PAN number.

e) My Aadhar number is _____________________ (Please enclose self-certified photocopy of your Aadhar card)/ I

do not have any Aadhar number.

f) The above information given by me is true to the best of my knowledge and if it is found at any stage that the

information given by me is false, the fee remission sanctioned could be withdrawn and/or recovered from me

and/or legal action, as deemed fit, may be taken against me and/or my ward.

Date: ________________ Signature of Mother

Guardian’s declaration (In case parents are not alive) –

I ___________________________________________ (guardian) further declare that:

a) I am self employed and have the following business/profession _______________________

______________ operating from _____________________________________________________

_____________________________________________________ (complete address).

b) I am employed as _________________ (designation) with _______________________________

_________ (name of employer) which is a government/public/private organization and my

workplace address is _____________________________________________________________.

(Please enclose self-certified copy of latest Form-16 issued by your employer.)

c) I am not/am an income tax payee. (Please enclose self-certified copy of Income Tax Return Acknowledgement for

the financial year ended on 31.03.2017 received from the Income Tax Department. In case the same is not available on the date of

submission of this form, the fee remission shall only be provisionally allowed and subject to confirmation on receipt of the above

document before 30th September 2017.)

d) My Permanent Account Number (PAN) issued by the Income Tax Department is __________

(Please enclose self-certified photocopy of your PAN card)/ I do not have any PAN number.

e) My Aadhar number is _____________________ (Please enclose self-certified photocopy of your Aadhar card)/ I

do not have any Aadhar number.

f) The above information given by me is true to the best of my knowledge and if it is found at any stage that the

information given by me is false, the fee remission sanctioned could be withdrawn and/or recovered from me

and/or legal action, as deemed fit, may be taken against me and/or my ward.

Date: ________________ Signature of Guardian

I, ____________________________________ (student) declare that I have Aadhar no. _______________

(Please enclose self-certified photocopy of your Aadhar card)/ I do not have any Aadhar number.

Date: ________________ Signature of Student

Page 2 of 2

Student’s signature with date

Вам также может понравиться

- Private Mergers and Acquisitions Due Diligence Checklist: Preliminary Questions and OrganizationДокумент10 страницPrivate Mergers and Acquisitions Due Diligence Checklist: Preliminary Questions and OrganizationMeo U Luc LacОценок пока нет

- Template Parent Consent FormДокумент1 страницаTemplate Parent Consent FormPalksed TopОценок пока нет

- Fire Officer Exam FormДокумент6 страницFire Officer Exam FormJuan Luis Lusong100% (4)

- Bidding Process For Procurement Process and DPWHPDFДокумент9 страницBidding Process For Procurement Process and DPWHPDFGerardoОценок пока нет

- Employment VerificationДокумент2 страницыEmployment VerificationthehomemachineОценок пока нет

- Immunization RecordДокумент1 страницаImmunization RecordJordan Simmons ThomasОценок пока нет

- Tresspass To Land As A Civil TortДокумент4 страницыTresspass To Land As A Civil TortFaith WanderaОценок пока нет

- Revision ChecklistДокумент24 страницыRevision Checklistaditya agarwalОценок пока нет

- Crochet Polaroid Case: Bear & RabbitДокумент8 страницCrochet Polaroid Case: Bear & RabbitSusi Susi100% (1)

- Tutorial 3Документ2 страницыTutorial 3YiKai TanОценок пока нет

- Aristotle PDFДокумент6 страницAristotle PDFAnonymous p5jZCn100% (1)

- HEAVYLIFT MANILA V CAДокумент2 страницыHEAVYLIFT MANILA V CAbelly08100% (1)

- Asia Banking Vs Javier (GR No. 19051, April 1923)Документ2 страницыAsia Banking Vs Javier (GR No. 19051, April 1923)Thoughts and More ThoughtsОценок пока нет

- Oracle 1z0 1053 22Документ8 страницOracle 1z0 1053 22sapnag29Оценок пока нет

- Laws of Malaysia: Offenders Compulsory Attendance Act 1954Документ12 страницLaws of Malaysia: Offenders Compulsory Attendance Act 1954Syafiq SulaimanОценок пока нет

- Concepcion vs. CAДокумент2 страницыConcepcion vs. CASteinerОценок пока нет

- D I F R S 2019-20: Eclaration OF Ncome FOR EE Emission OF THE EssionДокумент2 страницыD I F R S 2019-20: Eclaration OF Ncome FOR EE Emission OF THE EssionShubham Kumar 5-Yr IDD Materials Sci., & Tech., IIT (BHU) VaranasiОценок пока нет

- Declaration of The StudentДокумент4 страницыDeclaration of The StudentMokibul IslamОценок пока нет

- Annex D - Affidavit On Inability To Pay Assessed DelinquenciesДокумент1 страницаAnnex D - Affidavit On Inability To Pay Assessed DelinquenciesAtty TanglaoОценок пока нет

- Application For Conditional Admission PhiLSATДокумент2 страницыApplication For Conditional Admission PhiLSATAllan Ydia33% (3)

- Scholarship and Study Grant Application Form: Personal DetailsДокумент2 страницыScholarship and Study Grant Application Form: Personal DetailsSharon NgОценок пока нет

- Momas ScholarshipДокумент4 страницыMomas ScholarshipBabu PPОценок пока нет

- Annexure - A: (If Yes Give Details)Документ5 страницAnnexure - A: (If Yes Give Details)anon_667514752Оценок пока нет

- Simple Bio Data FormДокумент3 страницыSimple Bio Data FormJan Michael LagonОценок пока нет

- Application Form For Endowment Scholarship PDFДокумент4 страницыApplication Form For Endowment Scholarship PDFnompk100% (10)

- Self Declaration FormДокумент4 страницыSelf Declaration FormAslam KtОценок пока нет

- Dube Trade Port Application FormДокумент7 страницDube Trade Port Application FormNcediswaОценок пока нет

- SC Affidavit PDFДокумент1 страницаSC Affidavit PDFAmit SolankiОценок пока нет

- ECVSP12Документ4 страницыECVSP12ballОценок пока нет

- Application Form For Higher Education (HE) ScholarshipsДокумент6 страницApplication Form For Higher Education (HE) ScholarshipsSomendra KumarОценок пока нет

- Notice For - Income Documents - 2020-21Документ5 страницNotice For - Income Documents - 2020-21Anshul ModiОценок пока нет

- QARZ E Hasana FormДокумент6 страницQARZ E Hasana FormtoobaОценок пока нет

- Bachelor of Fine Arts (B.F.A.) 4 Years (8 Semesters) Girls) : (BoysДокумент4 страницыBachelor of Fine Arts (B.F.A.) 4 Years (8 Semesters) Girls) : (BoysPrakashОценок пока нет

- Admission Form Nri Nris Pio Oci 2023Документ3 страницыAdmission Form Nri Nris Pio Oci 2023zahirak345Оценок пока нет

- Format For Up-Gradation of Choice of Institute in The Second Round of CounsellingДокумент8 страницFormat For Up-Gradation of Choice of Institute in The Second Round of CounsellingAnupam YadavОценок пока нет

- Offline Application For Monthly Stipend New - 0Документ3 страницыOffline Application For Monthly Stipend New - 0vignesh50% (2)

- State of Georgia Rental Assistance Program Income Documentation Waiver FormДокумент2 страницыState of Georgia Rental Assistance Program Income Documentation Waiver FormSandra BenjaminОценок пока нет

- LoanformДокумент4 страницыLoanformShreyans ShahОценок пока нет

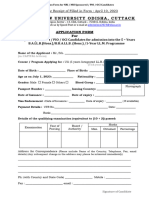

- Admission FormДокумент3 страницыAdmission FormknlsinhaОценок пока нет

- AFFIDAVIT Cum Undrtaking For Semester FeeДокумент1 страницаAFFIDAVIT Cum Undrtaking For Semester FeetarunОценок пока нет

- Kas Secondary Bursary FormДокумент4 страницыKas Secondary Bursary FormSam RuhiОценок пока нет

- AsdsДокумент3 страницыAsdsshah kumailОценок пока нет

- Undertaking 2024 2025Документ1 страницаUndertaking 2024 2025Leoni FrancОценок пока нет

- AffidavitДокумент1 страницаAffidavitVanessa OlarteОценок пока нет

- Application Form For Higher Education (HE) ScholarshipsДокумент5 страницApplication Form For Higher Education (HE) Scholarshipskrish.22123Оценок пока нет

- Registration Forms - Diploma - New Students - 2018-FinalДокумент5 страницRegistration Forms - Diploma - New Students - 2018-FinalNelson KiweluОценок пока нет

- Volunteer ApplicationДокумент2 страницыVolunteer Applicationapi-300537713Оценок пока нет

- Financial Grant Application Form New Students AUSДокумент6 страницFinancial Grant Application Form New Students AUSFarah JebrilОценок пока нет

- Revenue Department, Govt. of NCT of Delhi Application Form For Other Backward ClassesДокумент5 страницRevenue Department, Govt. of NCT of Delhi Application Form For Other Backward ClassesSurinder VermaОценок пока нет

- Revenue Department, Govt. of NCT of Delhi Application Form For Income CertificateДокумент4 страницыRevenue Department, Govt. of NCT of Delhi Application Form For Income CertificateGaurav RathaurОценок пока нет

- Application Form For Debit Card: Details of Primary Account NumberДокумент2 страницыApplication Form For Debit Card: Details of Primary Account NumberÑiTish PatelОценок пока нет

- Children Education AllianceДокумент3 страницыChildren Education AllianceJb JordanОценок пока нет

- National Highway AuthorityДокумент1 страницаNational Highway AuthorityirfangujarОценок пока нет

- Template of Income Certificates - NUSTДокумент3 страницыTemplate of Income Certificates - NUSTAdil AzeemОценок пока нет

- Consent FormДокумент1 страницаConsent Formjaypifermin09Оценок пока нет

- Consent Form - 04252022 1Документ1 страницаConsent Form - 04252022 1DondonОценок пока нет

- Letter of Commitment For Re-Enrollment: For Students Currently Enrolled at NmisДокумент1 страницаLetter of Commitment For Re-Enrollment: For Students Currently Enrolled at NmisEllenor Del RosarioОценок пока нет

- SCuEkVx3 Application-Form PDFДокумент2 страницыSCuEkVx3 Application-Form PDFAlexis Stefannie RubionОценок пока нет

- LKG Application Form 2017 18Документ2 страницыLKG Application Form 2017 18Sitar VedarajuОценок пока нет

- Employment Verification Form: The Department of Early Education and Care Subsidized Child CareДокумент6 страницEmployment Verification Form: The Department of Early Education and Care Subsidized Child CareJessica PotratzОценок пока нет

- Anjuman Wazifa Appl FormДокумент2 страницыAnjuman Wazifa Appl FormAarish Hassan75% (8)

- Annexure - IIДокумент3 страницыAnnexure - IIHarshad BhavarОценок пока нет

- Affidavit of UndertakingДокумент1 страницаAffidavit of UndertakingAryan Ceasar ManglapusОценок пока нет

- Sic 01843Документ1 страницаSic 01843DENVERОценок пока нет

- Nomination Form AttestationДокумент2 страницыNomination Form AttestationRamil MorenoОценок пока нет

- Pensioner Life Certificate 2016 A4 FormatДокумент1 страницаPensioner Life Certificate 2016 A4 FormatNihar KОценок пока нет

- AFFIDAVITДокумент1 страницаAFFIDAVITshiv4jiОценок пока нет

- RevisedДокумент3 страницыRevisedSilverfangОценок пока нет

- Affidavit LaptopДокумент1 страницаAffidavit LaptopWahab JafriОценок пока нет

- SHS VP - Consent FormДокумент1 страницаSHS VP - Consent FormNilda AdadОценок пока нет

- SHS VP - Consent FormДокумент1 страницаSHS VP - Consent FormDanielle Nicole MarquezОценок пока нет

- B.S.A. Public School Begusarai Summative Assessment:-Ii (2020-21)Документ2 страницыB.S.A. Public School Begusarai Summative Assessment:-Ii (2020-21)kunal sinhaОценок пока нет

- Numerical Heat Transfer: An International Journal of Computation and MethodologyДокумент21 страницаNumerical Heat Transfer: An International Journal of Computation and Methodologykunal sinhaОценок пока нет

- Vortex Oscillations Around A Hemisphere-Cylinder Body With A High Fineness RatioДокумент20 страницVortex Oscillations Around A Hemisphere-Cylinder Body With A High Fineness Ratiokunal sinhaОценок пока нет

- Microsoft Word - Advertisment No. 01 - 2021 - FiremanДокумент12 страницMicrosoft Word - Advertisment No. 01 - 2021 - Firemankunal sinhaОценок пока нет

- d66952 PDFДокумент48 страницd66952 PDFkunal sinhaОценок пока нет

- O A T A O Oatao: To Link To This Article: DOI:10.1017/jfm.2012.288Документ40 страницO A T A O Oatao: To Link To This Article: DOI:10.1017/jfm.2012.288kunal sinhaОценок пока нет

- Nuclear Engineering and Technology: A Simple Parameterization For The Rising Velocity of Bubbles in A Liquid PoolДокумент8 страницNuclear Engineering and Technology: A Simple Parameterization For The Rising Velocity of Bubbles in A Liquid Poolkunal sinhaОценок пока нет

- Course Structure Idd Math ComputingДокумент92 страницыCourse Structure Idd Math Computingkunal sinhaОценок пока нет

- Chemical Engineering Science: M. Gumulya, R.P. Utikar, G.M. Evans, J.B. Joshi, V. PareekДокумент10 страницChemical Engineering Science: M. Gumulya, R.P. Utikar, G.M. Evans, J.B. Joshi, V. Pareekkunal sinhaОценок пока нет

- Guidelines For Ug Project (Vi and Vii Sem Btech & Idd) : (Friday)Документ2 страницыGuidelines For Ug Project (Vi and Vii Sem Btech & Idd) : (Friday)kunal sinhaОценок пока нет

- Subject Wise ListДокумент37 страницSubject Wise Listkunal sinhaОценок пока нет

- 46 National Conference On Fluid Mechanics and Fluid Power December 9-11, 2019 PSG College of Technology, CoimbatoreДокумент4 страницы46 National Conference On Fluid Mechanics and Fluid Power December 9-11, 2019 PSG College of Technology, Coimbatorekunal sinhaОценок пока нет

- Science 7Документ2 страницыScience 7kunal sinhaОценок пока нет

- Indian Institute of Technology (BHU), Varanasi Department of Mathematical Sciences Numerical Techniques (MA-201) Tutorial-1Документ1 страницаIndian Institute of Technology (BHU), Varanasi Department of Mathematical Sciences Numerical Techniques (MA-201) Tutorial-1kunal sinhaОценок пока нет

- Untitled DocumentДокумент2 страницыUntitled Documentkunal sinhaОценок пока нет

- Cgpa Conversion 2010Документ3 страницыCgpa Conversion 2010Mustafa KamaalОценок пока нет

- Form ID 1A Copy 2Документ3 страницыForm ID 1A Copy 2Paul CОценок пока нет

- Intellectual CapitalДокумент3 страницыIntellectual CapitalMd Mehedi HasanОценок пока нет

- Floredel Detailed Lesson Plan (Ma'Am Dio.)Документ6 страницFloredel Detailed Lesson Plan (Ma'Am Dio.)Floredel BenozaОценок пока нет

- 10000018182Документ665 страниц10000018182Chapter 11 DocketsОценок пока нет

- Module 1Документ11 страницModule 1Karelle MalasagaОценок пока нет

- Think Equity Think QGLP 2018 - Applicaton FormДокумент18 страницThink Equity Think QGLP 2018 - Applicaton FormSHIVAM CHUGHОценок пока нет

- HT2336I001604951Документ4 страницыHT2336I001604951Venki YarlagaddaОценок пока нет

- MSI BidДокумент7 страницMSI BidAshwin MОценок пока нет

- BPI Payment ProcedureДокумент2 страницыBPI Payment ProcedureSarina Asuncion Gutierrez100% (1)

- JWB Thesis 05 04 2006Документ70 страницJWB Thesis 05 04 2006Street Vendor ProjectОценок пока нет

- Nego Long Quiz 12 With Basis Midterms MCQДокумент6 страницNego Long Quiz 12 With Basis Midterms MCQClephanie BuaquiñaОценок пока нет

- Leonilo Sanchez Alias Nilo, Appellant, vs. People of The Philippines and Court of AppealsДокумент6 страницLeonilo Sanchez Alias Nilo, Appellant, vs. People of The Philippines and Court of AppealsRap BaguioОценок пока нет

- Complaint About A California Judge, Court Commissioner or RefereeДокумент1 страницаComplaint About A California Judge, Court Commissioner or RefereeSteven MorrisОценок пока нет

- April11.2014 Dspeaker Feliciano Belmonte, Jr.'s Statement On The Divorce Bill and Possible Abortion BillДокумент1 страницаApril11.2014 Dspeaker Feliciano Belmonte, Jr.'s Statement On The Divorce Bill and Possible Abortion Billpribhor2Оценок пока нет

- Booking Details Fares and Payment: E-Ticket and Tax Invoice - ExpressДокумент2 страницыBooking Details Fares and Payment: E-Ticket and Tax Invoice - ExpressWidodo MuisОценок пока нет

- MAHFUZ BIN HASHIM V KOPERASI PEKEBUN KECIL DAERAH SEGAMAT & ORSДокумент22 страницыMAHFUZ BIN HASHIM V KOPERASI PEKEBUN KECIL DAERAH SEGAMAT & ORSNUR SYUHADA FADILAHОценок пока нет

- GR 199539 2023Документ28 страницGR 199539 2023Gela TemporalОценок пока нет