Академический Документы

Профессиональный Документы

Культура Документы

Mayoral Candidates' Revenue Proposals

Загружено:

Mitch ArmentroutОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Mayoral Candidates' Revenue Proposals

Загружено:

Mitch ArmentroutАвторское право:

Доступные форматы

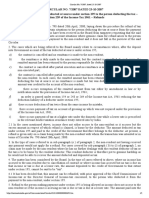

WHERE SHOULD CHICAGO FIND THE MONEY TO PAY ITS BILLS?

As we noted in a questionnaire to the candidates for mayor of Chicago, our city faces an enormous financial challenge. Chicago is on the hook for $42 billion in unfunded pension liabilities, which

works out to $35,000 for every household. In our questionnaire, we listed eight commonly proposed sources of new revenue. We asked the candidates to take a stand, for or against, on each one. And

we asked for other ideas. Here, below, is a summation of their stand on those eight specific sources of new revenue. Plus a few other ideas.

A Chicago casino Legalized and A La Salle A commuter tax A property tax A municipal sales A real estate Legalized A top alternative

taxed recreational Street tax increase tax increase transfer tax and taxed video source of new

marijuana gambling revenue

Dorothy Supports Supports, after a Supports Opposes “Undecided.” Would Opposes. Favors Supports Supports A “head tax” on

study of the impact request a review by sales tax holidays to employers, based

Brown of legalization in a Citizen Budget boost retail sales on their number of

other states Review Commission employees

Gery Supports Supports Opposes Opposes Opposes Opposes Supports Supports A legal tax of inter-

Chico net sales, such as

with Amazon stores

Bill Open to the idea Favors No. “Not viable” “Studying” the Not in first year. Low on list, but not Open to the idea Open to idea if Restore Chicago’s

issue Then an equal cut in ruled out only for high-priced Chicago gets a fair share of state

Daley expenses for every properties fairer share of income taxes

dollar increase. revenue from state

Amara States no position Supports, earmarking States no position Opposes States no position Should “explore” Supports States no position A public bank

Enyia funds for violence pre- such a tax on con-

vention and neighbor- sumer services

hood reinvestment

Bob Supports. Should Supports. “This Opposes. Not Supports Opposes. “There will Opposes Opposes Supports Reform property

have had one “long train has left the “realistic” be no property tax tax assessment

Fioretti ago.” station.” increases in a Fioretti system

administration.”

La Shawn Supports Supports An “intriguing pos- Opposes as a Favors “careful, grad- Opposes. The high Opposes Supports Graduated state

Ford sibility” burden on “working uated tax increases” sales tax “drives income tax

families” that “uplift” people residents away.”

from poverty

Jerry Supports, if publicly Supports. Target Opposes because “Perhaps.” Opposes Opposes Favors, possibly Supports A passenger

Joyce owned and all revenue funds to paying of “the importance” Needs study for higher end facility charge at

used to pay down un- down pension of the financial commercial Chicago airports

funded pension liability liability exchanges properties

John Supports, if Opposes Opposes Opposes Opposes Opposes Opposes Opposes None noted

city-owned and

Kozlar -operated

Lori Supports, but minority- Supports Open to it, but must not Opposes Not until “broken Open to it, but must Favors a graduated Not opposed A progressive state

Lightfoot and women-owned “drive businesses from property tax system look at “progressive form of this tax income tax

businesses on S. and W. Chicago or create a dis- is fixed” forms of revenue”

Sides must be involved incentive for businesses first

at every stage to invest in our city.”

Garry Supports along Supports States no position States no position Would use surplus States no position States no position Supports None noted

McCarthy with taxes on video TIF funds on, in

gambling and part, a $400 million

marijuana property tax cut

Susana “Could be a critical Supports Opposes Opposes “Should always be a Opposes. “Hits low- Supports if targeted Supports at O’Hare A progressive state

Mendoza source of revenue” last resort” income families the to downtown proper- and possibly Midway income tax

hardest” ties that can “afford airports

a minimal increase”

Toni Supports, if “substan- Favors States no position “Not good public States no position States no position Favors for proper- States no position A graduated state

Preckwinkle tial share” of women, policy” ties sold for more income tax

minorities involved as than $1 million

contractors, employees

Paul Supports Supports Opposes Opposes Favors capping in- Opposes Opposes Favors Restore “the illegal

Vallas creases to the rate diversion of corpo-

of inflation or 5%, rate personal prop-

whichever is less erty tax revenue.”

Willie Supports, if Supports. For the States no position States no position States no position States no position States no position States no position Reopen Meigs Field

Wilson city-owned revenue, and it

could lead to less

crime

Вам также может понравиться

- Jussie Smollet Case Files 3/3Документ158 страницJussie Smollet Case Files 3/3John DodgeОценок пока нет

- CPS AraДокумент41 страницаCPS AraMitch ArmentroutОценок пока нет

- Chicago Daily News, July 21, 1969Документ42 страницыChicago Daily News, July 21, 1969Mitch ArmentroutОценок пока нет

- Jussie Smollett Case Files 1/3Документ26 страницJussie Smollett Case Files 1/3John DodgeОценок пока нет

- CPS High School Applications FAQДокумент7 страницCPS High School Applications FAQMitch ArmentroutОценок пока нет

- Chicago Public Schools 2019-2010 CalendarДокумент1 страницаChicago Public Schools 2019-2010 CalendarMitch Armentrout60% (5)

- CPS OIG Update April 24, 2019Документ20 страницCPS OIG Update April 24, 2019Mitch ArmentroutОценок пока нет

- R. Kelly ProfferДокумент4 страницыR. Kelly ProfferMitch Armentrout100% (1)

- A.J. Freund DCFS TimelineДокумент4 страницыA.J. Freund DCFS TimelineJohn DodgeОценок пока нет

- OIG Sex Abuse UpdateДокумент20 страницOIG Sex Abuse UpdateMitch ArmentroutОценок пока нет

- CPS 5-Year VisionДокумент24 страницыCPS 5-Year VisionMitch ArmentroutОценок пока нет

- Chicago Public Schools FY18 Annual Financial ReportДокумент239 страницChicago Public Schools FY18 Annual Financial ReportMitch ArmentroutОценок пока нет

- Appeals Court DecisionДокумент17 страницAppeals Court DecisionMitch ArmentroutОценок пока нет

- OSP Sex Abuse UpdateДокумент12 страницOSP Sex Abuse UpdateMitch ArmentroutОценок пока нет

- Lori Lightfoot Education PolicyДокумент13 страницLori Lightfoot Education PolicyMitch ArmentroutОценок пока нет

- Program of Services For Fallen Chicago Police Officer Eduardo MarmolejoДокумент2 страницыProgram of Services For Fallen Chicago Police Officer Eduardo MarmolejoWGN Web DeskОценок пока нет

- Audit ResultsДокумент11 страницAudit ResultsMitch ArmentroutОценок пока нет

- Harry Mark Petrakis Marks 73rd Anniversary With Diana PetrakisДокумент6 страницHarry Mark Petrakis Marks 73rd Anniversary With Diana PetrakisMitch ArmentroutОценок пока нет

- Gov. Bruce Rauner 2019 Clemency/commutation GrantsДокумент4 страницыGov. Bruce Rauner 2019 Clemency/commutation GrantsMitch Armentrout100% (1)

- CPS IG Report - Fiscal Year 2018Документ124 страницыCPS IG Report - Fiscal Year 2018Mitch ArmentroutОценок пока нет

- CFD Internal Affairs Report On Juan LopezДокумент19 страницCFD Internal Affairs Report On Juan LopezWGN Web DeskОценок пока нет

- Cupich Letter To Resurrection Parishioners, StaffДокумент1 страницаCupich Letter To Resurrection Parishioners, StaffMitch ArmentroutОценок пока нет

- PA Grand Jury ReportДокумент887 страницPA Grand Jury ReportStephen LoiaconiОценок пока нет

- Tom Dart Defamation LawsuitДокумент20 страницTom Dart Defamation LawsuitMitch ArmentroutОценок пока нет

- Steven Addison Fraud ChargesДокумент3 страницыSteven Addison Fraud ChargesMitch ArmentroutОценок пока нет

- Mel Reynolds Letter 8-14Документ8 страницMel Reynolds Letter 8-14Mitch ArmentroutОценок пока нет

- Cardinal Blase Cupich Response To Pennsylvania Priest Sex Abuse ReportДокумент4 страницыCardinal Blase Cupich Response To Pennsylvania Priest Sex Abuse ReportTodd FeurerОценок пока нет

- Papadopoulos Sentencing MemoДокумент10 страницPapadopoulos Sentencing MemoMitch ArmentroutОценок пока нет

- Lago Wine Bar LawsuitДокумент48 страницLago Wine Bar LawsuitCrainsChicagoBusinessОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- (Name of Registered Business Entity) Annual Tax Incentives Report-Income-Based Tax Incentives For Calendar/Fiscal YearДокумент5 страниц(Name of Registered Business Entity) Annual Tax Incentives Report-Income-Based Tax Incentives For Calendar/Fiscal YearRoui Jean VillarОценок пока нет

- Raui Machinery StoreДокумент1 страницаRaui Machinery StoresunitachanchaliyaОценок пока нет

- Circular No. 7 - 2007, Dated 23-10-2007Документ2 страницыCircular No. 7 - 2007, Dated 23-10-2007god gov9950Оценок пока нет

- Autocop (XS)Документ41 страницаAutocop (XS)LoveSahilSharmaОценок пока нет

- NIRC Vs TRAIN ComparisonДокумент3 страницыNIRC Vs TRAIN ComparisonAngeli PaulineОценок пока нет

- VAT Return Form for ZRMR TRADE INTERNATIONALДокумент6 страницVAT Return Form for ZRMR TRADE INTERNATIONALMac TanzinОценок пока нет

- Invoice INV-0038Документ1 страницаInvoice INV-0038Rabbie LeguizОценок пока нет

- Tax Reform For Acceleration and Inclusion LawДокумент28 страницTax Reform For Acceleration and Inclusion LawGloriosa SzeОценок пока нет

- Tax Law 11102018 PDFДокумент754 страницыTax Law 11102018 PDFHarshit BhardwajОценок пока нет

- RMC 25-2011 SummaryДокумент2 страницыRMC 25-2011 SummaryCinОценок пока нет

- PNOC vs. CAДокумент2 страницыPNOC vs. CACaliОценок пока нет

- Tax Bulletin Highlights June 2018Документ24 страницыTax Bulletin Highlights June 2018RhenfacelManlegroОценок пока нет

- FORM VI (See Rule 14 (2) )Документ2 страницыFORM VI (See Rule 14 (2) )Venkataramana NippaniОценок пока нет

- MH 2223 90443 PDFДокумент6 страницMH 2223 90443 PDFHarsh PatelОценок пока нет

- 2023 True and Full ValuesДокумент1 страница2023 True and Full ValuesinforumdocsОценок пока нет

- Stocktaking Study of PFM Diagnostic Instruments: Volume II - Annexes Final Draft November 2010Документ53 страницыStocktaking Study of PFM Diagnostic Instruments: Volume II - Annexes Final Draft November 2010JahnaviBudurОценок пока нет

- PayslipДокумент2 страницыPayslipbrij18Оценок пока нет

- KAMM Notes Taxation Bar 2021Документ115 страницKAMM Notes Taxation Bar 2021Bai MonadinОценок пока нет

- Affidavit Non-Filing Income TaxДокумент1 страницаAffidavit Non-Filing Income TaxMarkОценок пока нет

- Comparative & Common Size StatementДокумент2 страницыComparative & Common Size StatementTaaran ReddyОценок пока нет

- Residential Status and Incidence of Tax On Income Under Income Tax ActДокумент6 страницResidential Status and Incidence of Tax On Income Under Income Tax ActhaseefaОценок пока нет

- GST (Good and Service TaxДокумент3 страницыGST (Good and Service TaxvkОценок пока нет

- Bir Form 2307Документ8 страницBir Form 2307Alex CalannoОценок пока нет

- Contoh Pengisian Form KPIДокумент1 страницаContoh Pengisian Form KPItri narwantoОценок пока нет

- Chair BillДокумент1 страницаChair BillRakesh S RОценок пока нет

- Payslip For The Month of Apr 2021: NoteДокумент1 страницаPayslip For The Month of Apr 2021: NoteBaranishankarОценок пока нет

- 11-2022-23-02-001 (2) Agra BillДокумент1 страница11-2022-23-02-001 (2) Agra BillMeenakshi VermaОценок пока нет

- Book of Accounts and RegistriesДокумент7 страницBook of Accounts and RegistriesRonalyn Torino ParacuelesОценок пока нет

- GST FAQ MalДокумент278 страницGST FAQ MalNarayanan PrajobОценок пока нет

- Heriot-Watt University Dubai Campus: ReceiptДокумент2 страницыHeriot-Watt University Dubai Campus: ReceiptMuhammadnasidiОценок пока нет