Академический Документы

Профессиональный Документы

Культура Документы

Administration 3-19

Загружено:

AtiaTahiraИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Administration 3-19

Загружено:

AtiaTahiraАвторское право:

Доступные форматы

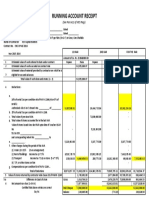

Section 3-19 Page 1 of 2

Taxation 1

Sections

Sec.-3: Income-tax authorities: [mj-10]

There shall be the following classes of income tax authorities for the purposes of this Ordinance,

namely:-

1) The National Board of Revenue,

2) Directors-General of Inspection (Taxes),

3) Commissioner of Taxes (Appeals),

4) Commissioner of Taxes (Large Tax-payer Unit),

5) Directors General (Training),

6) Directors General, Central Intelligences Cell;

7) Commissioner of Taxes;

8) Additional Commissioner of Taxes;

9) Joint Commissioner of Taxes;

10) Deputy Commissioner of Taxes;

11) Tax Recovery Officer;

12) Assistant Commissioner of Taxes;

13) Extra Assistant Commissioner of Taxes; and

14) Inspectors of Taxes.

Sec.-11: Establishment of Appellate Tribunal:

(1) For the purpose of exercising the functions of the Appellate Tribunal under this ordinance,

the Government shall establish a Taxes Appellate Tribunal consisting of a president and such

other members as the government may, from time to time, appoint.

(3) A person shall not be as a member of the Taxes Appellate Tribunal unless-

(i) he was or is a member of the Board; or

(ii) he was a Commissioner of Taxes; or

(iii) he is a Commissioner of Taxes; or

(iv) he is a CA and practiced professionally for a period not less than eight years; or

(v) he is a CMA and practiced professionally for a period not less than eight years; or

(vi) he is an ITP and practiced professionally for a period not less than twenty years; or

(vii) he is a professional legislative expert having not less than eight year experience in

the process of drafting and making financial and tax law; or

(viii) he is an advocate and practiced professionally for not less than ten years in any

income tax office; or

(ix) he is or has been a District Judge.

(4) The Government shall appoint one of the members of the Appellate Tribunal to be the

president thereof, who is a member of the board or holds the current charge of a member of the

Board.

Sec.-16: Charge of Income Tax:

(1) Income tax chargeable for each assessment year at any rate or rates as provided by an act

of Parliament.

(2) Tax to be deducted at source, paid or collected in advance in accordance with the

provisions under the ITO-1984.

(3) The rates specified in the 2nd Schedule in respect of

(i) A non resident person, not being a company.

(ii) Any income classifiable under the head “Capital Gain”.

(iii) Any income by way of “Winning” referred to section 19(13)

Sec-16B: Charges of additional tax:

* If a publicly trades company (other than bank or insurance) does not issue, declare or

distribute dividend or bonus share equivalent to at least 15% of its paid up capital within 6

months following its income year, it will be charged 5% additional tax on undistributed

profit in addition to tax payable under ITO-1984.

* Here undistributed profit includes free reserve.

Md. Sayduzzaman Tuhin, S.F.Ahmed & Co. Mob:-01552-639307, E-mail:tuhinsf@yahoo.com

Section 3-19 Page 2 of 2

Sec.-16C: Charges of excess profit tax:

* If a banking company operating under “Banking Companies Act-1991” shows a profit

exceeding 50% of the aggregate sum of capital and reserve, the bank shall pay @15% of such

excess amount. Such tax payable in addition to tax payable under ITO.

Sec.-16E: Charges of tax on sales of share in a premium over face value:

Notwithstanding anything contained in any other provision of this Ordinance or any other law,

where a company raises its share capital through book building or public offering or right

offering or placement or preference share or in any other way at a value in excess of face value,

the company shall be charged, in addition to tax payable under this ordinance, tax at the rate of

three percent on the difference between the value at which the share is sold and its face value.

Sec.-17: Scope of total income:

(1) The total income of any income year of any person includes-

(a) in relation to any person who is a resident, all income,

(i) is received or deemed to be received In Bangladesh; or

(ii) accrues or arises, or deemed to accrue or arise to him in Bangladesh; or

(iii) accrue or arise to him outside Bangladesh; and

(b) in relation to any person who is a non-resident, all income,

(i) is received or deemed to be received In Bangladesh; or

(ii) accrues or arises, or deemed to accrue or arise to him in Bangladesh; or

(2) Where any amount consisting of the whole or a part of any income of a person has been

included in his total income, it shall not be included again in his total income received by him in

Bangladesh in another year.

Sec.-18: Income Deem to Accrue or Arise in Bangladesh:

The following income shall be deemed to accrue or arise in Bangladesh, namely:

(1) any income which fall under the head ‘salary’, wherever paid if-

(a) it is earned in Bangladesh; or

(b) it is paid by the Government:

(2) any income accruing or arising, whether directly or indirectly, through or from-

(a) any business connection in Bangladesh;

(b) any property, asset, right or other source of income in Bangladesh; or

(c) transfer of capital assets in Bangladesh;

(3) Any dividend paid outside Bangladesh by a Bangladeshi company;

(4) any income by way of interest payable-

(a) by the government; or

(b) by a person who is a resident, except outside Bangladesh; or

(c) by a person who is a non-resident, by such person in Bangladesh.

(5) any income by way of fees for technical service payable-

(a) by the government; or

(b) by a person who is a resident, except outside Bangladesh; or

(c) by a person who is a non-resident, by such person in Bangladesh.

(6) any income by way of royalty payable-

(a) by the government; or

(b) by a person who is a resident, except outside Bangladesh; or

(c) by a person who is a non-resident, by such person in Bangladesh.

Sec.-19C: Special tax treatment in respect of investment in the purchase of bond under

Bangladesh Infrastructure Finance Fund:

Notwithstanding anything contained in any other provision of this Ordinance, no

question as to the source of any sum invested by any person in the purchase of bond issued or

caused to be issued under Bangladesh Infrastructure Finance Fund during the period between the

first day of July, 2010 and thirtieth day June, 2012 (both day inclusive), shall be raised if the

assessee pays, before the filing of return of income for the relevant income year, tax at the rate

of ten percent (10%) on such sum invested.

Md. Sayduzzaman Tuhin, S.F.Ahmed & Co. Mob:-01552-639307, E-mail:tuhinsf@yahoo.com

Вам также может понравиться

- Taxation Reviewer 1Документ110 страницTaxation Reviewer 1bigbully23Оценок пока нет

- Tax Law ReviewДокумент8 страницTax Law ReviewIon FashОценок пока нет

- Income Tax Set 01 2020Документ6 страницIncome Tax Set 01 2020Taaha JanОценок пока нет

- Ito 1984 2019 Final VersionДокумент153 страницыIto 1984 2019 Final VersionJusefОценок пока нет

- IT-03 Incomes Exempt From TaxДокумент18 страницIT-03 Incomes Exempt From TaxAkshat GoyalОценок пока нет

- 2012 Bar Examinations On TaxationДокумент19 страниц2012 Bar Examinations On Taxationjamaica_maglinteОценок пока нет

- Income Tax Ordinance.Документ14 страницIncome Tax Ordinance.Zaeem FarooquiОценок пока нет

- Md. Jehad Uddin Deputy Secretary Financial Institutions Division Ministry of FinanceДокумент75 страницMd. Jehad Uddin Deputy Secretary Financial Institutions Division Ministry of FinanceKhadeeza ShammeeОценок пока нет

- Tax On Corporation - NotesДокумент9 страницTax On Corporation - NotesMervidelleОценок пока нет

- Misc Sections For Exams March 2022Документ11 страницMisc Sections For Exams March 2022Daniyal AhmedОценок пока нет

- Income Tax: V SemesterДокумент17 страницIncome Tax: V SemesterAnzum anzumОценок пока нет

- Train Law ReportДокумент29 страницTrain Law Reportmarjorie blanco100% (1)

- Income Taxation Midterm ExamДокумент8 страницIncome Taxation Midterm ExamJean Diane JoveloОценок пока нет

- Income TAX CalculationДокумент33 страницыIncome TAX CalculationTaharat Ahmed ChowdhuryОценок пока нет

- Income Tax Ordinance.Документ14 страницIncome Tax Ordinance.Zaeem FarooquiОценок пока нет

- 01 Law1993Документ17 страниц01 Law1993GgoudОценок пока нет

- Business Profit Tax Act FinalДокумент34 страницыBusiness Profit Tax Act FinalsamaanОценок пока нет

- Module-1: Basic Concepts and DefinitionsДокумент35 страницModule-1: Basic Concepts and Definitions2VX20BA091Оценок пока нет

- Taxation Management (Planning) : I:Some Model QuestionsДокумент9 страницTaxation Management (Planning) : I:Some Model QuestionsRajesh WariseОценок пока нет

- CA Final Direct Tax Quick Revision of Assessment of Various 9DB7WBXYДокумент16 страницCA Final Direct Tax Quick Revision of Assessment of Various 9DB7WBXYRocka FellaОценок пока нет

- TaxLawRev1 UpdatedДокумент277 страницTaxLawRev1 UpdatedKaira TanhuecoОценок пока нет

- Taxation and Fiscal RegulationsДокумент9 страницTaxation and Fiscal RegulationsAparna SinghОценок пока нет

- Chapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Документ19 страницChapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Anita Solano BoholОценок пока нет

- Chapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Документ19 страницChapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Anita Solano BoholОценок пока нет

- Lecture 3 - Income Taxation (Corporate)Документ8 страницLecture 3 - Income Taxation (Corporate)Lovenia Magpatoc50% (2)

- Tax Treatment of InvestmentsДокумент7 страницTax Treatment of InvestmentsbnmallickОценок пока нет

- Income TaxДокумент6 страницIncome TaxDISHANОценок пока нет

- 6,6 Taxation of Income of PersonsДокумент29 страниц6,6 Taxation of Income of Personsjoseph mbuguaОценок пока нет

- Domestic Corporations Not Subject To MCITДокумент3 страницыDomestic Corporations Not Subject To MCITMeghan Kaye LiwenОценок пока нет

- WHT New 2020Документ7 страницWHT New 2020MadurikaОценок пока нет

- Revenue Regulations No. 07-10 - Implementing The Tax Privileges Provisions of Republic Act No. 9994 (Expanded Senior Citizens Act of 2010)Документ13 страницRevenue Regulations No. 07-10 - Implementing The Tax Privileges Provisions of Republic Act No. 9994 (Expanded Senior Citizens Act of 2010)Cuayo JuicoОценок пока нет

- Ranjan Sir Lecture - Details - UnlockedДокумент77 страницRanjan Sir Lecture - Details - UnlockedTumpakuri67% (6)

- Tax ReviewerДокумент17 страницTax ReviewerSab CardОценок пока нет

- CH 6Документ95 страницCH 6mulu melakОценок пока нет

- FINANCE No PDFДокумент36 страницFINANCE No PDFFiroj ShaikhОценок пока нет

- Knowledge Sharing & Update of VAT & Tax, Fin Act 2016 FinalДокумент35 страницKnowledge Sharing & Update of VAT & Tax, Fin Act 2016 FinalTeamAudit Runner GroupОценок пока нет

- TaxationДокумент26 страницTaxationaamenaОценок пока нет

- Preferential TaxationДокумент9 страницPreferential TaxationMОценок пока нет

- Exemptions & Tax Incentives (Act 896) - Power Point PresentationДокумент50 страницExemptions & Tax Incentives (Act 896) - Power Point PresentationGabrielОценок пока нет

- Taxation in BangladeshДокумент18 страницTaxation in BangladeshJames BlackОценок пока нет

- 1 Basics IcaiДокумент36 страниц1 Basics IcaiArif GokakОценок пока нет

- Kinds of Income TaxesДокумент9 страницKinds of Income TaxesRon RamosОценок пока нет

- Changes To Finance ActДокумент2 страницыChanges To Finance ActSam Jnr AnthonyОценок пока нет

- 2012 TaxДокумент20 страниц2012 TaxvenickeeОценок пока нет

- Income Tax On CorporationДокумент4 страницыIncome Tax On CorporationNikolai DanielovichОценок пока нет

- Revenue Regulations No 2-1998Документ72 страницыRevenue Regulations No 2-1998RELLYОценок пока нет

- RR No. 11-2018 SummaryДокумент6 страницRR No. 11-2018 SummaryCaliОценок пока нет

- IncomeTax Law and Practice-SBAX1022Документ124 страницыIncomeTax Law and Practice-SBAX1022Kaushal DidwaniaОценок пока нет

- Classification of Taxes: A. Domestic CorporationДокумент5 страницClassification of Taxes: A. Domestic CorporationWenjunОценок пока нет

- Union Budget 2013-14 - Highlights of Direct Tax ProposalsДокумент5 страницUnion Budget 2013-14 - Highlights of Direct Tax Proposalsankit403Оценок пока нет

- Chapter Ii - General P RinciplesДокумент19 страницChapter Ii - General P RincipleskkkОценок пока нет

- Revenue Etc For Income TaxationДокумент286 страницRevenue Etc For Income TaxationpurplebasketОценок пока нет

- Taxation - IIДокумент28 страницTaxation - IIShakhawatОценок пока нет

- Limitation:: Types of Levy Imposed by The Government in Various Sector: Objective of The StudyДокумент12 страницLimitation:: Types of Levy Imposed by The Government in Various Sector: Objective of The StudyRayan KarimОценок пока нет

- Income Tax Law and PracticesДокумент148 страницIncome Tax Law and PracticesUjjwal KandhaweОценок пока нет

- 2.4 Tax On Income - Tax On CorporationsДокумент15 страниц2.4 Tax On Income - Tax On CorporationsfelixacctОценок пока нет

- Rates of Tax:-: Individual/HUF/AOP/Artificial Juridical PersonДокумент8 страницRates of Tax:-: Individual/HUF/AOP/Artificial Juridical PersonKiran KumarОценок пока нет

- Adamson Central Bar Operations: Taxation Law Section 28 (5) (B), NIRCДокумент2 страницыAdamson Central Bar Operations: Taxation Law Section 28 (5) (B), NIRCBasmuthОценок пока нет

- Taxation Midterm ReviewerДокумент5 страницTaxation Midterm ReviewerMaria RochelleОценок пока нет

- Audit Practice Manual For ICABДокумент223 страницыAudit Practice Manual For ICABhridimamalik80% (5)

- CH 1. Introduction To AssuranceДокумент45 страницCH 1. Introduction To AssuranceAtiaTahiraОценок пока нет

- Bannor Dinguli HSC Bengali 1st Paper MCQ Question With AnswerДокумент1 страницаBannor Dinguli HSC Bengali 1st Paper MCQ Question With AnswerAtiaTahiraОценок пока нет

- Dynamic Asset Allocation Strategy-2Документ19 страницDynamic Asset Allocation Strategy-2AtiaTahiraОценок пока нет

- Taxation Theory QuestionsДокумент7 страницTaxation Theory QuestionsAtiaTahiraОценок пока нет

- Defination 2 (1-67)Документ4 страницыDefination 2 (1-67)AtiaTahiraОценок пока нет

- Tax Holiday 46A-46BДокумент3 страницыTax Holiday 46A-46BAtiaTahiraОценок пока нет

- University of Dhaka: Assignment OnДокумент1 страницаUniversity of Dhaka: Assignment OnAtiaTahiraОценок пока нет

- CaseДокумент21 страницаCaseAtiaTahira100% (1)

- Readme SpssДокумент1 страницаReadme SpssodinsideОценок пока нет

- Financial Performance Evaluation of Some Selected Jordanian Commercial BanksДокумент14 страницFinancial Performance Evaluation of Some Selected Jordanian Commercial BanksAtiaTahiraОценок пока нет

- 6.2. MethodologyДокумент12 страниц6.2. MethodologyAtiaTahiraОценок пока нет

- Demand Estimation WorksheetДокумент12 страницDemand Estimation WorksheetAbdul Rasyid RomadhoniОценок пока нет

- Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Документ11 страницEvsjv 'K M Ru: Iwr÷Vw© Bs WW G-1AtiaTahiraОценок пока нет

- 0efd540ca24e3b7470a3673d1307d5adДокумент93 страницы0efd540ca24e3b7470a3673d1307d5adAtiaTahiraОценок пока нет

- PoДокумент42 страницыPoAtiaTahiraОценок пока нет

- Green Office Guide: National Finance LimitedДокумент5 страницGreen Office Guide: National Finance LimitedAtiaTahiraОценок пока нет

- Raroc NewДокумент2 страницыRaroc NewAtiaTahiraОценок пока нет

- PriceДокумент391 страницаPriceAtiaTahiraОценок пока нет

- Stresstestingnbfi 120712Документ40 страницStresstestingnbfi 120712barnaОценок пока нет

- PDFДокумент40 страницPDFZied HediОценок пока нет

- Consolidated Balance Sheet As at 31 December 2014: Dutch Bangla Bank LimitedДокумент5 страницConsolidated Balance Sheet As at 31 December 2014: Dutch Bangla Bank LimitedAtiaTahiraОценок пока нет

- A Report On Audit Planning of ACI LIMITEDДокумент33 страницыA Report On Audit Planning of ACI LIMITEDAtiaTahiraОценок пока нет

- Commercial Bank Management AssignmentДокумент3 страницыCommercial Bank Management AssignmentAtiaTahiraОценок пока нет

- Investing For BeginnersДокумент71 страницаInvesting For Beginnersccie100% (8)

- Engagement LetterДокумент13 страницEngagement LetterAtiaTahiraОценок пока нет

- The Role of Finance In: Economic Growth & DevelopmentДокумент16 страницThe Role of Finance In: Economic Growth & DevelopmentAtiaTahiraОценок пока нет

- Developing An Effective Business Model: Bruce R. Barringer R. Duane IrelandДокумент28 страницDeveloping An Effective Business Model: Bruce R. Barringer R. Duane IrelandMutiara TechnologyОценок пока нет

- Concept of Finance Types of Finance Functions of Finance Forms of Businesses Goals of The Corporation Agency Relationship Financial MarketsДокумент23 страницыConcept of Finance Types of Finance Functions of Finance Forms of Businesses Goals of The Corporation Agency Relationship Financial MarketsAtiaTahiraОценок пока нет

- Income Tax On Individuals Part 2Документ22 страницыIncome Tax On Individuals Part 2mmhОценок пока нет

- Chapt 11+Income+Tax+ +individuals2013fДокумент13 страницChapt 11+Income+Tax+ +individuals2013fiamjan_10180% (15)

- Deductions From Gross IncomeДокумент2 страницыDeductions From Gross IncomeSetty HakeemaОценок пока нет

- Nutriarc: Tax InvoiceДокумент1 страницаNutriarc: Tax InvoiceARC FitnessОценок пока нет

- Tax Invoice: Excitel Broadband Pvt. LTDДокумент1 страницаTax Invoice: Excitel Broadband Pvt. LTDMittal GalaxyОценок пока нет

- Big Deal Vs SmallДокумент2 страницыBig Deal Vs Smallspectrum_48Оценок пока нет

- InvoiceДокумент3 страницыInvoicemukeshОценок пока нет

- GST Update 18.11.2017Документ39 страницGST Update 18.11.2017sridharanОценок пока нет

- Form 24Q4Документ6 страницForm 24Q4Anonymous Nmwl1wwFuОценок пока нет

- U.S. Individual Income Tax Return: Filing StatusДокумент2 страницыU.S. Individual Income Tax Return: Filing StatusAndyTomas100% (1)

- Amgen IS Analysis PDFДокумент2 страницыAmgen IS Analysis PDFNiОценок пока нет

- Income Taxation 2021 Rex Banggawan Answers Multiple Choice-Theory: General ConceptsДокумент6 страницIncome Taxation 2021 Rex Banggawan Answers Multiple Choice-Theory: General ConceptsJustine UngabОценок пока нет

- CIR Vs Inter PublicДокумент3 страницыCIR Vs Inter PublicArrianne ObiasОценок пока нет

- Capital Gains Tax Computation: Exempt AssetsДокумент15 страницCapital Gains Tax Computation: Exempt AssetsGayathri SudheerОценок пока нет

- HMRC Specialist Investigations Offshore Coordination Unit Letter, Oct. 2013Документ6 страницHMRC Specialist Investigations Offshore Coordination Unit Letter, Oct. 2013punktlichОценок пока нет

- RINL - Visakhapatnam Steel Plant: Customer Inquiry #Документ2 страницыRINL - Visakhapatnam Steel Plant: Customer Inquiry #Sasi Kanth GОценок пока нет

- COVID Relief Funds ApplicationДокумент10 страницCOVID Relief Funds ApplicationMichael JohnsonОценок пока нет

- Ditc CTE RQST To BIR 2Документ2 страницыDitc CTE RQST To BIR 2reyna cruzadaОценок пока нет

- Income Taxation - Class Standing - Docx-2Документ1 страницаIncome Taxation - Class Standing - Docx-2Shannon ElizaldeОценок пока нет

- TaxДокумент7 страницTaxSaloni Jain 1820343Оценок пока нет

- 16 DTF RarДокумент1 страница16 DTF RarTariq MahmoodОценок пока нет

- Nov-21 Pay SlipSF0061089Документ1 страницаNov-21 Pay SlipSF0061089Pravalika SiliveriОценок пока нет

- TED Accountant - Sales and Expenses 102023Документ10 страницTED Accountant - Sales and Expenses 102023jonjonОценок пока нет

- Chapter 1 HomeworkДокумент3 страницыChapter 1 HomeworkEmily ClevelandОценок пока нет

- Kotak Mahindra Bank Limited Payslip For The Month of AUGUST - 2010Документ1 страницаKotak Mahindra Bank Limited Payslip For The Month of AUGUST - 2010Bharat Shahane33% (3)

- Draf T: Form Gstr-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesДокумент4 страницыDraf T: Form Gstr-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesShivchandraОценок пока нет

- Bir Form 2550Q Summary Alphalist of Withholding Taxes (Sawt)Документ2 страницыBir Form 2550Q Summary Alphalist of Withholding Taxes (Sawt)Renz Christopher TangcaОценок пока нет

- Acc 324 Week 6 - 1Документ3 страницыAcc 324 Week 6 - 1Accounting GuyОценок пока нет

- Fiscal Policy - Instruments and ObjectivesДокумент9 страницFiscal Policy - Instruments and Objectivesnital2612Оценок пока нет

- Income Tax - MidtermДокумент9 страницIncome Tax - MidtermThe Second OneОценок пока нет