Академический Документы

Профессиональный Документы

Культура Документы

CTC Breakup

Загружено:

balu0 оценок0% нашли этот документ полезным (0 голосов)

388 просмотров2 страницыCTC break up format

Авторское право

© © All Rights Reserved

Доступные форматы

XLS, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документCTC break up format

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

388 просмотров2 страницыCTC Breakup

Загружено:

baluCTC break up format

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

Employee Income and Deductions Break-up

Personal details:

Employee Code:

Name: ###

Designation: Manager

Employee Grade: 2

Date of joining: Department: ###

Basic and Other Allowances Details:

Cash Flow Head Monthly Yearly Mode of payment

Basic Salary 4375.05 52500.60

House Rent Allowance 2187.53 26250.30

Conveyance Allowance 800.00 9600.00 Monthly

Washing Allowance 200.00 2400.00

Personal Pay 19546.00 234552.00

Monthly / Yearly Gross (a) 27108.58 325302.90

Deductions

PF Contribution (Employer) 525.00 6300.00

ESIC Contribution (Employer) 0.00 0.00

Total (b) 525.00 6300.00

Incentives

Leave Travel Allowance (LTA) 365 4,375

Mid point variable performance bonus 875 10,500 Yearly

Total ( c ) 1,240 14,875

Standard Deductions

PF Contribution (Employee) 525 6300.00

ESIC Contribution (Employee) - 0.00

Monthly

PT 200 2400.00

Net Salary 26,384 316602.90

Benefits

Gratuity @ 4.81% of basic salary 210 2,525

Group Medical Insurance and Personal

83 1,000

Accident Cover Policy - Premium

CL Accomodation - 0.00

Total ( d ) 294 3,525

Cost To Company (CTC)

Monthly Rs. 29167.00 Yearly Rs. 350000.00

Perks

Medical Expenses Reimbursement 1,250 15,000

Monthly

Uniform reimbursement 2,500 30,000

componants:

Telephone reimbursement - -

Petrol Reimbursement - - *Will not be included

in the Salary slip.

Food Coupons 1,000 12,000

Books & periodicals reimbursement 1,500 18,000 *Will be paid after and

as per valid bill

Company cell phone 2,000 24,000

submission only.

Total (E) 8,250 99,000

Received and Accepted

Authorized Signatory 0.00

Date: Date:

Вам также может понравиться

- CTC Structure FEB20Документ2 страницыCTC Structure FEB20Wall Street Forex (WSFx)Оценок пока нет

- Salary Calculation SheetДокумент2 страницыSalary Calculation SheetaruunstalinОценок пока нет

- Increment Letter FormatДокумент2 страницыIncrement Letter FormatPavankumar KarnamОценок пока нет

- Appointment Salary BreakupДокумент1 страницаAppointment Salary BreakupPhani KumarОценок пока нет

- Form T: Wages Slip/Leave CardДокумент2 страницыForm T: Wages Slip/Leave CardMuhammad AfzaalОценок пока нет

- Premlata Appointment LetterДокумент7 страницPremlata Appointment LetterRobin JhaaОценок пока нет

- HR 101 Employee Set Up Form PDFДокумент5 страницHR 101 Employee Set Up Form PDFLexОценок пока нет

- CTC - Salary CalculatorДокумент4 страницыCTC - Salary Calculatorboopathi.nОценок пока нет

- Contractual Letter-AMIT RAINAДокумент4 страницыContractual Letter-AMIT RAINAamit rainaОценок пока нет

- Salary Breakup SheetДокумент6 страницSalary Breakup SheetvirgoprasathОценок пока нет

- Salary Breakup Calculator ExcelДокумент3 страницыSalary Breakup Calculator ExcelBabita KumariОценок пока нет

- Sadhana Infotech #335, 19th Main, Rajaji Nagar, 1st Block, Bangalore-560010Документ1 страницаSadhana Infotech #335, 19th Main, Rajaji Nagar, 1st Block, Bangalore-560010Shreekant SkОценок пока нет

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryДокумент2 страницыSalary Calculation Yearly & Monthly Break Up of Gross Salarymoh300Оценок пока нет

- EPF CalenderДокумент1 страницаEPF CalenderAmitav TalukdarОценок пока нет

- No Dues FormДокумент2 страницыNo Dues FormSourabh Sharma100% (1)

- Auto CTC Salary CalculatorДокумент1 страницаAuto CTC Salary CalculatorSathvika SaaraОценок пока нет

- Salary Breakup (Salary Structure)Документ3 страницыSalary Breakup (Salary Structure)Srikanth Reddy KomatlaОценок пока нет

- Salary StructureДокумент4 страницыSalary StructureniranjanaОценок пока нет

- 2020 HQ Holidays CircularДокумент1 страница2020 HQ Holidays CircularSumanth Gundeti0% (1)

- YTD Statement-1326013854886Документ108 страницYTD Statement-1326013854886deepson800Оценок пока нет

- SubhashДокумент1 страницаSubhashsubhash221103Оценок пока нет

- Old Vs New Tax Rates Regime (6 Cases)Документ6 страницOld Vs New Tax Rates Regime (6 Cases)Jigeesha BhargaviОценок пока нет

- Neha Soni - Pune - Offer of EmploymentДокумент10 страницNeha Soni - Pune - Offer of EmploymentRahul JagdaleОценок пока нет

- Leave StructureДокумент8 страницLeave StructureJignesh V. KhimsuriyaОценок пока нет

- Pre Joining Formalities Campus Medical FormДокумент18 страницPre Joining Formalities Campus Medical Formrafii_babu1988Оценок пока нет

- CTC Break-Up PDFДокумент5 страницCTC Break-Up PDFJatinder SadhanaОценок пока нет

- Experience CertificateДокумент3 страницыExperience Certificatevmuruganandham50% (2)

- Compliance ChecklistДокумент66 страницCompliance ChecklistHemant AmbekarОценок пока нет

- Employee Joining FormДокумент2 страницыEmployee Joining FormSwapnashree Das100% (1)

- Terms of Employment 2018Документ11 страницTerms of Employment 2018Dinesh Yadav100% (2)

- Salary Slip FinalДокумент1 страницаSalary Slip FinalSarita NayakОценок пока нет

- Jitendra Raghuwanshi - ATCS Offer Letter - 7th February 2020Документ4 страницыJitendra Raghuwanshi - ATCS Offer Letter - 7th February 2020Sonam BhardwajОценок пока нет

- Compensation LetterДокумент6 страницCompensation LetterRashmikant RautОценок пока нет

- Form12BB R539 Proof Submission Form PDFДокумент4 страницыForm12BB R539 Proof Submission Form PDFSiva ThotaОценок пока нет

- FBP To-Be Process - April 1 India ReleaseДокумент24 страницыFBP To-Be Process - April 1 India Releaseraghava_cseОценок пока нет

- Offer LetterДокумент4 страницыOffer LetterManish ShringiОценок пока нет

- Joining Kit All FormsДокумент13 страницJoining Kit All FormsgopamaheshwariОценок пока нет

- Appointment LetterДокумент4 страницыAppointment LetterPushpa BairwaОценок пока нет

- Dell International Services India PVT LTDДокумент1 страницаDell International Services India PVT LTDpankaj_kolekar33333Оценок пока нет

- FAQs On Sodexo Meal PassДокумент7 страницFAQs On Sodexo Meal PassPooja TripathiОценок пока нет

- Appointment Letter Sanjay DeshpandeДокумент8 страницAppointment Letter Sanjay Deshpandesurya pratap singhОценок пока нет

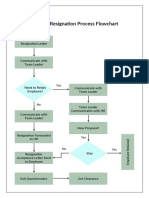

- 9 - HR Resignation Process FlowchartДокумент1 страница9 - HR Resignation Process FlowchartDazzy KumariОценок пока нет

- Releaving LetterДокумент6 страницReleaving LetterJyoti KaleОценок пока нет

- Bosch Letter 1Документ3 страницыBosch Letter 1PaulОценок пока нет

- Offer LetternullДокумент6 страницOffer Letternullaal.majeed14Оценок пока нет

- Attendance Policy PDFДокумент9 страницAttendance Policy PDFVaibhavSawantОценок пока нет

- Genius Joining Kit-1Документ8 страницGenius Joining Kit-1Aditya RajОценок пока нет

- Salary Breakup Calculator Excel 1Документ2 страницыSalary Breakup Calculator Excel 1Rajinder KumarОценок пока нет

- Interview Letter Tata 2Документ3 страницыInterview Letter Tata 2Ghazala JamalОценок пока нет

- Umesh Kumar-Offer LetterДокумент2 страницыUmesh Kumar-Offer LetterUMESH KUMARОценок пока нет

- Sample Salary - 10lacДокумент1 страницаSample Salary - 10lacManpreet Kour100% (1)

- Review Letter - Oct 19 - Chandan TatiДокумент2 страницыReview Letter - Oct 19 - Chandan Tatimadali sivareddyОценок пока нет

- DT20195075631 OlДокумент9 страницDT20195075631 Olnehavep274Оценок пока нет

- HR M Annual Policies 201516Документ64 страницыHR M Annual Policies 201516Shereen AbbangöОценок пока нет

- Master CTC Calculator & Salary Hike CalculatorДокумент6 страницMaster CTC Calculator & Salary Hike Calculatorvirag_shahsОценок пока нет

- Divya Yerrabolu Experience LetterДокумент3 страницыDivya Yerrabolu Experience LetterMuthu KrishnaОценок пока нет

- Salary AnnexureДокумент1 страницаSalary Annexuredpnair50% (4)

- Excel Payroll AdministrationДокумент12 страницExcel Payroll AdministrationBen AsamoahОценок пока нет

- Payslip Aug 2019 PDFДокумент1 страницаPayslip Aug 2019 PDFAbhishek MitraОценок пока нет

- Payslip India May - 2023Документ2 страницыPayslip India May - 2023RAJESH DОценок пока нет

- Aadhar Amendment Bill, 2019Документ20 страницAadhar Amendment Bill, 2019baluОценок пока нет

- Security OfficeДокумент1 страницаSecurity OfficebaluОценок пока нет

- Garlands, Coconut & Sweet For The Month of February' 2019 Date Coconut. Rs. Sweet - Rs. Total Rs. Garlands For Admin. Rs. Garlands For Acc - RsДокумент4 страницыGarlands, Coconut & Sweet For The Month of February' 2019 Date Coconut. Rs. Sweet - Rs. Total Rs. Garlands For Admin. Rs. Garlands For Acc - RsbaluОценок пока нет

- Cheklist For Employers Statutory Deposits & Returns January Sr. Date and Month Act Name of The Statutory ReturnДокумент11 страницCheklist For Employers Statutory Deposits & Returns January Sr. Date and Month Act Name of The Statutory ReturnbaluОценок пока нет

- GSTДокумент1 страницаGSTbaluОценок пока нет

- 1 Min GameДокумент2 страницы1 Min GamebaluОценок пока нет

- Shiva PuranamДокумент840 страницShiva PuranambaluОценок пока нет

- Corporate GovernanceДокумент3 страницыCorporate GovernancebaluОценок пока нет

- 1 Min GameДокумент2 страницы1 Min GamebaluОценок пока нет

- Human Resource Information System (HRIS) : Shweta, Saurabh, Ritesh & ShabbeerДокумент31 страницаHuman Resource Information System (HRIS) : Shweta, Saurabh, Ritesh & ShabbeerbaluОценок пока нет

- Changed PGHRJCTДокумент71 страницаChanged PGHRJCTNishant SharmaОценок пока нет

- Benefits at Meesho - 2024Документ41 страницаBenefits at Meesho - 2024abhisheksingh15461546Оценок пока нет

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentДокумент1 страницаF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1Оценок пока нет

- Letter-3 To Chairman From PFRDA PDFДокумент2 страницыLetter-3 To Chairman From PFRDA PDFsantoshkumarОценок пока нет

- Promotion and Reward Policy of An OrganizationДокумент14 страницPromotion and Reward Policy of An OrganizationChaitanya DachepallyОценок пока нет

- Colleg of Businees and Economics Department of CooperativesДокумент39 страницColleg of Businees and Economics Department of CooperativesAytenew AbebeОценок пока нет

- Omnibus Rules Implementing The Labor Code - Book 3Документ43 страницыOmnibus Rules Implementing The Labor Code - Book 3chitru_chichruОценок пока нет

- s27 Cases in Holistic Risk ManagemДокумент85 страницs27 Cases in Holistic Risk ManagemToulouse18Оценок пока нет

- GHJДокумент6 страницGHJJilyan SiobalОценок пока нет

- Final Computaion For Government OfficeДокумент24 страницыFinal Computaion For Government OfficeGagan Deep PathakОценок пока нет

- U.S. President's Study of American Work-Life Balance (March 2010)Документ35 страницU.S. President's Study of American Work-Life Balance (March 2010)Chicago Tribune100% (1)

- HDFC Bank Tax Saving GuideДокумент21 страницаHDFC Bank Tax Saving GuideShubangi ReddyОценок пока нет

- Labor Law CasesДокумент108 страницLabor Law CasesMatt Chua100% (1)

- Statutory Benifits in HCLДокумент63 страницыStatutory Benifits in HCLBhupendra SinghОценок пока нет

- Leave FormДокумент5 страницLeave FormnielОценок пока нет

- File 6 Unit С Work and motivationДокумент10 страницFile 6 Unit С Work and motivationРодион ЛучнойОценок пока нет

- Income Tax Planning Individual AssesseeДокумент26 страницIncome Tax Planning Individual AssesseeDharmesh DeshmukhОценок пока нет

- Syllabus (Part 1, Income Tax) - SPITДокумент11 страницSyllabus (Part 1, Income Tax) - SPITJulio Palma Gil BucoyОценок пока нет

- Company Weekly Excel Timesheet Template Multiple EmployeesДокумент11 страницCompany Weekly Excel Timesheet Template Multiple EmployeesngomaОценок пока нет

- Projrct Report Compensation BenchmarkingДокумент37 страницProjrct Report Compensation BenchmarkingPoornima GargОценок пока нет

- 7 Payment of Bonus Act, 1Документ25 страниц7 Payment of Bonus Act, 1DeepakОценок пока нет

- Components of CompensationДокумент6 страницComponents of Compensationsimply_cooolОценок пока нет

- A Study On Fringe Benefits Provided by The Salem Co-Operative Sugar Mills LTD., MohanurДокумент68 страницA Study On Fringe Benefits Provided by The Salem Co-Operative Sugar Mills LTD., MohanurParthiban Ak88% (8)

- Company Name Employee Provident Fund Calculator (EPF)Документ2 страницыCompany Name Employee Provident Fund Calculator (EPF)Roosy RoosyОценок пока нет

- A Project Report On Direct TaxДокумент53 страницыA Project Report On Direct Taxrani26oct84% (44)

- Kenya Tax CardДокумент2 страницыKenya Tax Cardwebryan2kОценок пока нет

- TRAIN Final PubSem April 4 PDFДокумент98 страницTRAIN Final PubSem April 4 PDFYuri SheenОценок пока нет

- Incentives and Fringe BenefitsДокумент4 страницыIncentives and Fringe BenefitsPankaj2cОценок пока нет

- RR 2-98Документ85 страницRR 2-98restless11Оценок пока нет

- Laya, Jr. vs. CA (Jan 2018)Документ5 страницLaya, Jr. vs. CA (Jan 2018)Sam Leynes100% (4)